Northill Capital Agrees to Buy Westpac's Infrastructure-Assets Unit

November 02 2017 - 11:43PM

Dow Jones News

By Robb M. Stewart

MELBOURNE, Australia--U.K. asset manager Northill Capital is

buying Westpac Banking Corp.'s (WBC.AU) Hastings Management unit,

an investment manager with US$11 billion invested in global

infrastructure from toll roads to airports and ports.

The acquisition is Northill's first foray into Australia. It is

a bet on investor appetite for backing infrastructure projects

world-wide as governments spin off existing assets and spend on new

roads, electricity grids and ports in an effort to drive economic

growth.

On Friday, Northill said it agreed to buy majority control of

Hastings. The Australian business's management team will retaining

an equity stake. Financial terms weren't disclosed, although a

person familiar with the negotiations valued the deal at between

150 million and 160 million Australian dollars (US$116 million to

US$123 million).

Hastings invests on behalf of institutional investors in a

infrastructure equity and debt. It has interests in owners of

airports including Melbourne Airport, seaports such as Port of

Newcastle in eastern Australia and Northern Ireland gas

distribution company Phoenix Natural Gas.

In February, Hastings bought the outstanding 50% stake in

British utility South East Water on behalf of clients including

investors within Canada's Desjardins Group. A month later, it

secured a debt-investment agreement with Development Bank of Japan

Inc. and its DBJ Asset Management Co. arm to target investments in

member nations of the Organisation for Economic Cooperation and

Development.

"Infrastructure is an attractive asset class...most pension

funds are underinvested in infrastructure," Jonathan Little,

founding partner at Northill, told The Wall Street Journal.

Westpac had been seeking to exit Hastings for some time. It

failed to clinch a deal to sell Hastings to Charter Hall Group;

exclusive talks with the Australian property investor broke down in

August. Hastings accounts for only a small slice of the bank's

overall earnings and the exit isn't considered material.

Countries around the world are making bold plans for

infrastructure investment. As a candidate, President Donald Trump

promised a US$1 trillion infrastructure-spending package, which has

encouraged investors to target related funds. Australian federal

and state authorities have been selling billions of dollars worth

of ports, roads and electricity assets in recent years to help fund

investment plans, drawing bids from global pension and

sovereign-wealth funds interested in well-regulated and reliable

revenue generators.

Northill's Mr. Little said his company had been interested in

infrastructure and in Hastings for some time, attracted by the

opportunity to develop the business.

The immediate priority for Northill will be to consolidate the

business but it would then be prepared to inject capital for growth

in opportunities in Europe, the U.K. and possibly the U.S., Mr.

Little said.

Northill invests in asset managers, providing seed capital to

start-ups and funds to replace existing shareholders in established

businesses. Founded in 2010 by Mr. Little, a former BNY Mellon

Asset Management vice chairman, with the financial backing of the

Bertarelli family, it has assets under management of about US$48

billion. The Bertarellis, heirs to Swiss biotech company Serono SA,

which was sold to Merck in 2006, are among Europe's richest

families.

The firm's strategy is to take majority interests in firms, with

the support of management. It is expected that Hastings management

will, in time, target a collective stake of between 15% and 20%,

Mr. Little said.

Founded in Melbourne in 1994, Hastings has offices in Sydney,

London, New York, Singapore and Seoul. Westpac bought 51% of the

company in 2002 and the remaining 49% in late 2005. In September,

the fund manager named board member Terry Winder, a former Westpac

executive, as its chief executive.

Write to Robb M. Stewart at robb.stewart@wsj.com

(END) Dow Jones Newswires

November 02, 2017 23:28 ET (03:28 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

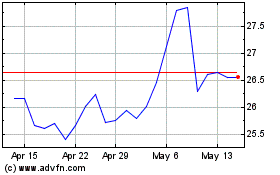

Westpac Banking (ASX:WBC)

Historical Stock Chart

From Oct 2024 to Nov 2024

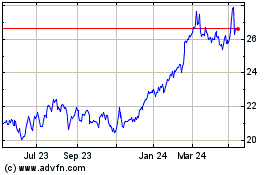

Westpac Banking (ASX:WBC)

Historical Stock Chart

From Nov 2023 to Nov 2024