Brady Dougan Gets Back in the Game With $3 Billion Investment

November 22 2016 - 6:00PM

Dow Jones News

Former Credit Suisse Group AG Chief Executive Brady Dougan plans

to launch a merchant bank in early 2017 and has lined up a $3

billion investment to seed the venture, according to people

familiar with the matter.

Mr. Dougan's firm will be backed by Scepter Partners, a

syndicate of Middle Eastern ultrawealthy families and state

investment funds. The business, which is slated to launch next

spring, will aim to make investments across a number of industries

while providing investment-banking and trading services, the people

said.

While the contours of Mr. Dougan's plans are still taking shape,

the concept is broader than many of the boutique firms other senior

Wall Street executives have opened as they embarked on the next

stage of their careers. Many of them have stuck to peddling merger

advice and other businesses that require little financial

risk-taking.

Mr. Dougan, 57 years old, is going a different route. At the new

firm, whose name has yet to be determined, Mr. Dougan could use the

funds provided by Scepter to trade with clients and potentially for

its own account, as well as underwrite capital raisings, the people

said. Added debt could give the new business billions of dollars

more to put to work beyond Scepter's $3 billion investment. The

entity is expected to draw additional investors, including Mr.

Dougan himself, the people said.

A former equities trader, Mr. Dougan began his tenure as Credit

Suisse's CEO just before the financial crisis. On his watch, the

firm was lauded for steering clear of many of the major headaches

that hit other banks, but he later left as the firm struggled with

poor performance.

At the new firm, Mr. Dougan aims to compete with Wall Street

firms in core, capital-intensive businesses. His ambitions reflect

challenges facing big banks and the opportunities for upstarts.

That his money comes from sovereign-wealth funds also shows that

these investors, which have long used traditional banks and

private-equity firms as intermediaries to financial activities,

want to flex their muscles in new ways.

While the new venture's total capital is a fraction of the

balance sheets held by big Wall Street firms, those banks are

required by U.S. regulators to hold extra capital cushions against

their trades. Housing certain businesses in a firm that is outside

of the Federal Reserve's oversight could make them more profitable

or allow them to charge less for the same services than big banks

do, analysts and bankers have said.

Advances in software and data have also emboldened a generation

of startup executives to use technology to break into parts of the

financial-services industry dominated by big banks and brokers. Mr.

Dougan's new firm is exploring ways to bring those methods to

investment banking, a place on Wall Street relatively unchanged by

technology, according to people familiar with the firm's plans.

Talks between Mr. Dougan and Bermuda-based Scepter began about

six months ago, people familiar with the plans said. Scepter in

2015 spun out from BMB Group, a financial firm based in Brunei, and

its board includes several members of the Pacific nation's ruling

family.

Scepter has about $15 billion in discretionary funds and is

backed by a network of ultrawealthy families and government funds

valued at more than $100 billion, according to its website. It is

focused on natural resources and infrastructure, and last year made

an unsuccessful takeover bid for Australian oil-and-gas producer

Santos Ltd.

Mr. Dougan will launch his firm with more funding, at least

initially, than many of the merchant banks that have opened since

the financial crisis.

More than a dozen Wall Street executives have struck out on

their own in recent years, aiming to peel away business from their

former employers. Among the best known were Morgan Stanley's Paul

Taubman , Goldman Sachs Group Inc.'s Byron Trott and Barclays PLC's

Robert Diamond and Hugh "Skip" McGee.

Mr. Dougan, a soft-spoken Illinois native known for running

marathons, was credited at Credit Suisse with bringing in

institutional investors, including sovereign-wealth funds, to help

strengthen the bank's balance sheet. Mr. Dougan used those

relationships to expand Credit Suisse's wealth-management franchise

into the Middle East through a joint venture with Qatar's state

investment fund.

But Mr. Dougan also oversaw the bank as it addressed questions

about its role in helping Americans evade taxes, leading to a $2.6

billion settlement and a guilty plea for the bank. Its share price

stagnated and it came under pressure from investors to cut its

investment-banking business.

Mr. Dougan's successor, Tidjane Thiam, has moved to aggressively

shrink the firm's investment-banking activities. Credit Suisse's

share price is down roughly 50% since Mr. Dougan stepped down in

the spring of 2015.

Anupreeta Das contributed to this article.

Write to Liz Hoffman at liz.hoffman@wsj.com and Justin Baer at

justin.baer@wsj.com

(END) Dow Jones Newswires

November 22, 2016 17:45 ET (22:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

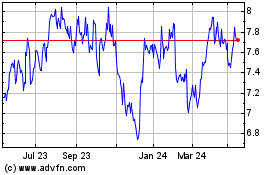

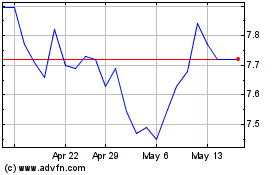

Santos (ASX:STO)

Historical Stock Chart

From Dec 2024 to Jan 2025

Santos (ASX:STO)

Historical Stock Chart

From Jan 2024 to Jan 2025