Asian Shares Down on Europe Financial Health Concerns

September 26 2016 - 11:30PM

Dow Jones News

Declines in financial and commodities stocks sent Asian share

markets broadly lower Tuesday, as markets eyed the first U.S.

presidential debate for hints of future economic policy.

The Nikkei Stock Average slipped 0.4%, the S&P/ASX 200 was

down 0.7%, and Korea's Kospi was down 0.1%.

Banks, insurers and other financial stocks in Japan opened

lower, following a global fall in the sector overnight as concerns

intensified over the health of Deutsche Bank AG, after its shares

slid 7.5% Monday to their lowest in decades.

At the center of concerns about Deutsche Bank, a linchpin of

Europe's financial system, is the question of whether the lender

will need to raise capital to fortify its increasingly precarious

finances, though the bank said Monday it was "fundamentally

strong."

"It's the banking sector in Europe that triggered all this

movement and selloff in equities ... then you saw [a shift to]

risk-off mode," said Tareck Horchani, deputy head of Asian Pacific

sales trading at Saxo Capital Markets Pte.

Like their European peers, Japanese financial firms are

struggling with the ultra-low interest rate environment.

Japan's Topix bank index was recently down 3.8%. Among

individual stocks, Mitsubishi UFJ Financial Group lost 3.3% and

Sumitomo Mitsui Financial Group declined 2.8%.

The release of the minutes of the Bank of Japan's most recent

meeting also provoked investor jitters, as the board's caution

about expanding the BOJ's stock-fund buying could add to

speculation that the central bank is now more hesitant to

dramatically ease policy.

More broadly, investors in Asia were keeping an eye on the first

U.S. presidential debate between Hillary Clinton and Donald Trump

that could trigger market volatility. Nonetheless, stocks in

Greater China have largely held up, bucking the region's losses and

recovering from Monday's declines.

Hong Kong's Hang Seng Index was last up 0.5%, while the Shanghai

Composite Index was up 0.1%.

Investors have also been tracking the Mexican peso, last up 1%

against the dollar, and the Canadian dollar, flat, given the

ramifications on the Mexican and Canadian economies if Mr. Trump

does well in the debate, said Chris Weston, chief market strategist

at IG Markets, in a note.

The peso's rise likely indicated that the market saw Mrs.

Clinton performing better than Mr. Trump, Mr. Weston said.

Elsewhere, a slide in oil prices pressured stocks in

commodity-reliant economies after Iran said it expects Wednesday's

meeting of the Organization of the Petroleum Exporting Countries

will be merely "consultative," and vowed to keep pumping until

output reaches pre-sanction levels.

Among stock markets with a significant focus on energy, the FTSE

Bursa Malaysia was down 0.3% and Singapore's Strait Times Index was

down 0.3%. In Australia, Woodside Petroleum shares were down 1.8%

and Santos Ltd. fell 0.8%. Brent crude, the global oil benchmark,

declined 0.6% to $47.06 a barrel in early Asian trade.

Kosaku Narioka, Jenny W. Hsu, Takashi Nakamichi and Gregor

Stuart Hunter contributed to this article.

Write to Ese Erheriene at ese.erheriene@wsj.com

(END) Dow Jones Newswires

September 26, 2016 23:15 ET (03:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

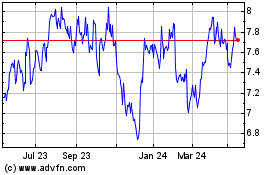

Santos (ASX:STO)

Historical Stock Chart

From Dec 2024 to Jan 2025

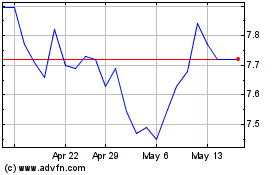

Santos (ASX:STO)

Historical Stock Chart

From Jan 2024 to Jan 2025