Asian Shares Weaker, With All Eyes on U.S. Jobs Report

September 01 2016 - 1:30AM

Dow Jones News

Asian shares were broadly weaker Thursday as investors

cautiously await the release of U.S. jobs data on Friday that could

jolt markets out of their summer malaise.

Australia's S&P/ASX 200 was down 0.2%, South Korea's Kospi

fell 0.5%, and Japan's Nikkei Stock Average traded up 0.1%.

"There's not much action," said Tareck Horchani, deputy head of

Asian Pacific sales trading at Saxo Capital Markets Pte. "The main

thing really will be the U.S. nonfarm payrolls tomorrow. The market

is positioned for that."

Trading volumes across Asia, particularly in Japan and China,

remained well below 100-day moving averages for most of August, as

summer holiday absences and unmet expectations of monetary easing

contributed to reduced volatility and a slower trading season. The

start of the fall season and key economic data points from the U.S.

could change that, analysts said.

A recent report from payroll processor ADP, which showed that

private U.S. employers continued to hire at a solid clip in August

by adding 177,000 workers, raised hopes for a strong showing in

U.S. nonfarm payrolls, the next test of the likelihood of an

interest rate rise.

Investors remain concerned, however, that higher U.S. rates

could lead to capital outflows from Asia's emerging markets, though

analysts say that economic fundamentals in the region are still

strong.

Elsewhere, energy stocks in commodity-reliant economies were

hard hit after Brent crude, the global oil benchmark, hit a

three-week low. The U.S. Energy Information Administration said

overnight that U.S. stockpiles of crude oil and refined products

jumped by 4.5 million barrels in the week ended Aug. 26 to more

than 1.4 billion barrels.

In Australia, shares of oil producer Santos Ltd. were down 2.1%,

while Woodside Petroleum Ltd. was off 1.5% and Oil Search Ltd. fell

1.5%, dragging down the overall performance of the benchmark

index.

Among other energy-focused markets, the FTSE Bursa Malaysia

Index was last down 0.4%. Oil prices attempted to claw back gains,

but analysts say they are skeptical about sustainable areas of

price support in the heavily oversupplied market.

Earlier on Thursday, China released manufacturing data for

August, with the official purchasing managers index coming in at

50.4, versus 49.9 in July, the highest in 22 months and indicating

a slight expansion in the economy. The reading came in above the

50.0 level that indicates economic expansion.

The Caixin China manufacturing purchasing managers index, a

private gauge of nationwide factory activity, fell to 50.0 in

August from 50.6 in July but still showed an expansion, albeit at a

slower pace.

Still, the August data helped turn losses into gains in Hong

Kong, with the Hang Seng Index rising 0.2%. However, investor

excitement was lacking in mainland China, with the Shanghai

Composite Index falling 0.2% and the Shenzhen Composite Index also

down around that much.

"It seems that the market is reacting to this as can be

expected, because hopes for more policy stimulus will be lower"

following the improved data, said Daniel So, a strategist at China

Merchants Bank International.

The main driver of the Hang Seng Index on Thursday was banking

giant HSBC Holdings, which was last up 2.4%. Mainland Chinese

investors continued to pile into the blue-chip lender via the

Shanghai-Hong Kong Stock Connect platform, boosting its share

price. The upward momentum wasn't expected to last, though.

"The rally in HSBC is unsustainable," said Mr. So. He noted that

a recent move by the bank's management to start a share buyback

program, instead of gradually boosting dividends, "only shows that

the earnings outlook isn't good."

Hiroyuki Kachi contributed to this article.

Write to Ese Erheriene at ese.erheriene@wsj.com

(END) Dow Jones Newswires

September 01, 2016 01:15 ET (05:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

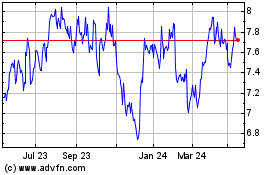

Santos (ASX:STO)

Historical Stock Chart

From Dec 2024 to Jan 2025

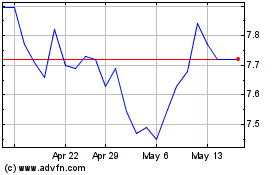

Santos (ASX:STO)

Historical Stock Chart

From Jan 2024 to Jan 2025