Santos to Book US$1.05 Billion Impairment Charge -- Update

August 14 2016 - 8:24PM

Dow Jones News

By Robb M. Stewart

MELBOURNE, Australia--Santos Ltd. continues to be battered by

the slump in oil and gas prices, forcing a US$1.05 billion

after-tax impairment charge against the value of its flagship

gas-export project on Australia's east coast.

The charge is likely to lead to a sharp first-half loss for the

energy company when it releases its results on Friday.

Chairman Peter Coates said the impairment reflected the

challenging environment facing the company, which had led it to

adjust long-term operating assumptions for the GLNG liquefied

natural gas operation on the coast of Queensland state.

There had been a slower ramp-up of production and an increase in

third-party gas prices feeding the plant over the course of 2016,

which meant the company had to adjust supply and pricing

assumptions.

"We are seeing the effects of ongoing constraints on capital

expenditure and a softer LNG market," said Kevin Gallagher, who

took the helm as chief executive in February after previously

leading engineering firm Clough Ltd.

The US$18.5 billion GLNG operation, which counts France's Total

SA and Malaysia's Petronas Gas Bhd. as partners, shipped its first

cargo of LNG in late 2015. It is one of three new massive LNG

plants on eastern Curtis Island that have added to a growing glut

of liquefied natural gas from Australia targeting demand for

cleaning burning fuels in Asia.

Santos has been working to restore investor confidence and

repair a balance sheet stretched by its heavy investment in energy

projects from Queensland to Papua New Guinea. Last October, the

Adelaide-based company rejected as too low a 7.14 billion (US$5.46

billion) takeover approach from Bermuda-based Scepter Partners that

had the backing of sovereign investors and wealthy members of Asian

and Gulf-based ruling families.

The company reported a net profit of A$37 million in the first

half of 2015 but was pushed to a full-year loss of A$2.7 billion

after booking A$2.8 billion in impairment charges to reflect the

fall in crude-oil prices.

Santos said the fresh impairment hit will be a "non-cash" charge

and won't affect its debt facilities.

Mr. Coates said the company continued to believe in longer-term

growth for LNG consumption and demand globally, adding GLNG would

continue to be an important part of Santos's portfolio.

Write to Robb M. Stewart at robb.stewart@wsj.com

(END) Dow Jones Newswires

August 14, 2016 20:09 ET (00:09 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

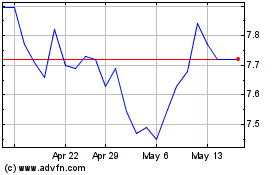

Santos (ASX:STO)

Historical Stock Chart

From Dec 2024 to Jan 2025

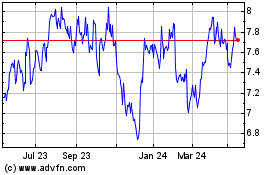

Santos (ASX:STO)

Historical Stock Chart

From Jan 2024 to Jan 2025