MARKET COMMENT: S&P/ASX 200 Down 1%; China Property Curbs Weigh

March 04 2013 - 4:52AM

Dow Jones News

0223 GMT [Dow Jones] Australia's S&P/ASX 200 extends

Monday's fall after China's Shanghai Composite dived 2% in early

trading following China's announcement of new measures late Friday

to curb property speculation. The measures announced by Australia's

biggest trading partner include higher downpayment and mortgage

rates in cities, where property prices have risen quickly, and a

tightening of enforcement of a 20% capital gains tax on property

transactions. Resources are continuing to lead declines, with BHP

(BHP.AU) down 3.1% after commodity prices weakened Friday and BHP

went ex-dividend Monday. Financials have reversed early gains, with

Westpac (WBC.AU), NAB (NAB.AU) and Macquarie (MQG.AU) down

0.9%-1.5%. The S&P/ASX 200 has 20-day moving average support at

5014. Key support from last week's low is at 4978.4. The index is

down 1.0% at 5033.7. (david.rogers1@wsj.com)

Contact us in Singapore. 65 64154 140; MarketTalk@dowjones.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

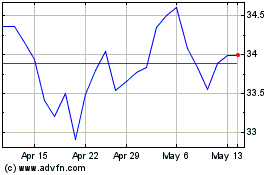

National Australia Bank (ASX:NAB)

Historical Stock Chart

From Jul 2024 to Aug 2024

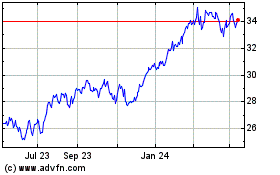

National Australia Bank (ASX:NAB)

Historical Stock Chart

From Aug 2023 to Aug 2024