Uranium Stocks Plummet On Fears Following Japan Reactor Incident

March 14 2011 - 11:08AM

Dow Jones News

Uranium stocks plummeted Monday after several Japanese reactors

overheated and may have suffered partial meltdowns as a result of a

devastating earthquake and tsunami that knocked out their cooling

systems.

Analysts said uranium equities are falling because they had been

pricing in strong growth in demand as countries across the world

plan to build new fleets of nuclear power stations to manage their

energy needs. But those growth assumptions may be overstretched if

public sentiment turns against nuclear power following Japan's

problems.

Shares of Cameco Corp. (CCJ), the world's largest publicly owned

uranium miner, dropped 17.9% to $30.68 in recent trading on the New

York Stock Exchange. Denison Mines Corp. (DNN) shares dropped

21.9%.

Uranium One Inc. (UUU.T) shares dropped 25.5% and Australia's

Bannerman Resources Ltd. (BAN.T) dropped 25.7% in recent Toronto

trading.

In the U.S., some lawmakers have already begun calling for curbs

on nuclear power development. Rep. Edward Markey (D.-Mass) issued a

statement Sunday calling for a moratorium on the construction of

new nuclear power plants in the U.S., saying that a similar nuclear

accident could happen in the U.S.

"Fingers may be pointed at the nuclear industry," Dundee Capital

Markets analyst David Talbot told clients, saying that there is a

risk that development plans in the West will be halted - although

he said that China, India and Russia, which account for about half

of the expected growth in nuclear power plants, aren't likely to

curb their building as a result of Japan's problems.

So far, the three Japanese reactors experience cooling problems

haven't released significant amounts of radiation, but the

situation is dangerous, as an explosion Monday morning in Japan

damaged a pump bringing in cooling seawater at one reactor and a

third reactor began experiencing cooling problems Monday

afternoon.

Talbot said that so far the destruction of a hydroelectric dam

and damage to an oil refinery in the country have done more damage

to the surrounding environment than the nuclear reactors, but

uranium miners are still more vulnerable to public fears about

nuclear power.

"It could take some time for the sector to stabilize as the

world realizes that the worst case scenario likely won't be

achieved," he said.

-By Edward Welsch, Dow Jones Newswires; 403-229-9095;

edward.welsch@dowjones.com

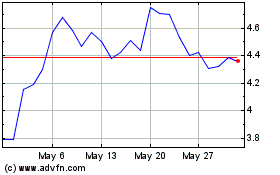

Bannerman Energy (ASX:BMN)

Historical Stock Chart

From Apr 2024 to May 2024

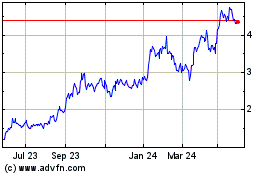

Bannerman Energy (ASX:BMN)

Historical Stock Chart

From May 2023 to May 2024