RBS Asian Operations A Good Fit For ANZ Bank - Macquarie Research

March 24 2009 - 2:46AM

Dow Jones News

Australia and New Zealand Banking Group Ltd. (ANZ) could get an

instant boost to its footprint in Asia by buying Royal Bank of

Scotland's Asian operations, which could represent an attractive

and low cost option for growth, Macquarie Research analysts said

Tuesday.

Melbourne-based ANZ has made no secret of its ambitions to

expand in Asia, where it aims to become a "super-regional" lender,

and while an ANZ spokeswoman declined to comment on speculation it

could bid for RBS Asian operations, she said it will assess

strategic opportunities as they arise.

RBS has hired Morgan Stanley to advise it on the potential sale

of its retail and commercial banking businesses in Asia, which

operate in eight countries around the region, including the key

markets of India, China and Hong Kong. The businesses could fetch

up to A$2.5 billion, Macquarie estimates.

ANZ has hired Credit Suisse to advise it on options according to

local media reports, and most analysts expect it will take a close

look at RBS' information memorandum, which was sent out to

potential buyers late last week, according to people familiar with

the situation.

ANZ - Australia's fourth largest bank - aims to become one of

the four biggest players in both India and China in coming years,

and Chief Executive Mike Smith wants to generate 20% of the bank's

earnings from the region by 2012.

Smith, a veteran banker in Asia who joined ANZ from HSBC in

2007, said last month that the gyrations in global banking sector

hadn't deterred the Australian lender's ambitions.

It's an ambitious - and some say high risk - strategy, but one

that differentiates ANZ from its Australian rivals, who have

refocussed their attention on the domestic market.

"We view ANZ's likely interest in the RBS Asian assets as

positive for shareholders as the deal would represent a low-cost

expansion of ANZ's existing Asian business, with positive balance

sheet implications," Macquarie said.

While ill-timed acquisitions have been behind the fall of some

of the world's biggest banks, including RBS, Macquarie believes the

assets up for grabs are well funded from a capital and liquidity

perspective, thanks in part to a strong deposit franchise. That

could help boost both ANZ's capital and funding positions - a big

selling point in this environment.

And while interest in the RBS Asian operations is likely to be

keen, with talk that multinationals HSBC and Standard and Chartered

are interested along with some of the Chinese banks, Macquarie sees

a better fit and stronger strategic imperative for ANZ than most

likely rival bidders.

"The geographic mix of business shows very little overlap with

ANZ's existing operations, and in fact is probably complementary to

ANZ's wholesale banking operations in Asia," Macquarie said.

"This stacks up well relative to other potential bidders -

namely Standard Chartered - where we believe there is far greater

overlap between the businesses," Macquarie said.

The assets for sale generated around GBP781 million of income

during the 2008 financial year, a 12.4% improvement on the prior

year, according to Macquarie's estimates.

ANZ would probably have to sell shares to investors to raise

cash to buy any assets. Macquarie expects a share placement would

have to be at a 10% discount to market price, which would mean

further dilution for shareholders. But it's worth noting a deal has

been expected for some time, and taking RBS assets would remove

that overhang from ANZ's share price, Macquarie's analysts

said.

RBS hasn't indicated a timeframe for any divestments, and

Macquarie isn't expecting any major developments in the near

term.

"Details of a potential deal are not likely to emerge for some

time given the sale process has only recently begun and

documentation is likely to be hot off the press," Macquarie

said.

It's also worth noting that Smith has stressed he's not in a

hurry to do any deals and he won't be overpaying for growth.

-By Lyndal McFarland, Dow Jones Newswires; 61-3-9292-2093; lyndal.mcfarland@dowjones.com

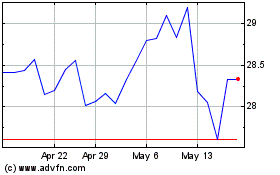

Australia And New Zealan... (ASX:ANZ)

Historical Stock Chart

From Jul 2024 to Aug 2024

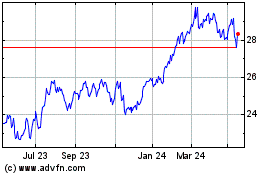

Australia And New Zealan... (ASX:ANZ)

Historical Stock Chart

From Aug 2023 to Aug 2024