TIDMVSA

RNS Number : 8074D

VSA Capital Group PLC

26 June 2023

DATE: 26 June 2023

VSA Capital Group plc

("VSA", the "Company" or together with its subsidiaries the

"Group")

Audited results for the year ended 31 March 2023

VSA Capital Group plc (Aquis: VSA), the international investment

banking and broking firm is pleased to announce its audited results

for the year ended 31 March 2023.

Highlights

-- Turnover of GBP4.36m (previous year GBP3.61m), underlying

profit of GBP0.61m (previous year GBP0.40m)

-- Cash at year end GBP1.27m (previous year GBP2.01m)

-- NAV GBP4.372m (previous year GBP4.162m)

-- Retained Corporate Clients of VSA Capital Limited 24 (2022: 24)

Another busy year of progress despite difficult market

conditions.

We have continued to build on our core sectors of Natural

Resources and Transitional Energy and made solid progress into the

Leisure and Consumer Brands sectors and into Technology and

Software, eMobility and eCommerce.

Andrew Monk, CEO of VSA Capital Group plc said:

"This is a solid result in difficult markets. We continue to

advise and raise funds for companies listed on AIM and the Main

Market of the London Stock Exchange and have established a strong

position as an adviser and broker to companies on the Aquis Stock

Exchange. Our expanding activities into M&A and strategic

advisory work positions us well for the future. We are cautiously

optimistic about the prospects for VSA Capital in the current

year."

For more information, please contact:

VSA Capital Group plc +44(0)20 3005 5000

Andrew Monk, CEO

Andrew Raca, Head of Corporate Finance

Marcia Manarin, Finance Director

+44 (0)20 3772

Alfred Henry - AQSE Corporate Adviser 0021

N ick Michaels www.alfredhenry.com

M aya K. Wassink

Chairman's Statement

I am pleased to present the audited Annual Report and Accounts

for VSA Capital Group plc, which is the holding company of the

regulated investment banking and broking firm, VSA Capital

Limited.

As last year, the results include another tranche of

amortisation of GBP330,770 resulting from a simple restructuring

that we undertook on 31 March 2021 and this is expected to repeat

for another three years. Once the intangible assets are fully

amortised, which we currently anticipate will be in March 2026, our

profits will no longer be affected by the amortisation charge on

this asset.

In his report our CEO Andrew Monk describes certain very

challenging aspects of the market, of which we should all take

note. Nevertheless, and especially in such difficult circumstances,

the board is pleased with the outcome for the year which reflects

further growth and progress for the Group.

Whilst our optimism for the current year remains cautious,

reflecting challenging conditions, we are confident as a board that

the Group's strategy is robust to continue to build shareholder

value.

I pay tribute to my fellow Directors and staff within the Group

and also to our clients who trust us as their advisers, as they

themselves work to build value for their shareholders in such

difficult global conditions.

Mark Steeves

Chairman

CEO'S Report

Principal Activity

The principal activities of the Group are the provision of

corporate finance advisory, stockbroking, fundraising and research

services to both private and public companies.

Review of the Business

On 31 March 2021, in preparation for the IPO of the Company on

the Aquis Growth Market, VSA Capital Group plc acquired VSA Capital

Limited in a reverse takeover and its results are therefore

consolidated into these Group accounts for the second time in the

financial statements for the year ended 31 March 2023.

Review of the Year

I am pleased to report a good underlying performance for our

year ended 31 March 2023 as the last 12 months have been

exceptionally difficult for all players in the equity markets. We

achieved a turnover of GBP4.36m (2022: GBP3.61m) and an underlying

profit of GBP0.61m (2022: GBP0.40m).

As explained previously, we regard our underlying profit (profit

before tax adding back amortisation) as most pertinent as it is

considered by many as a better reflection of how much money is

being generated. As the amortisation of intangible assets is a

non-cash item, we exclude this when calculating our underlying

profit. Cash has decreased this year to GBP1.273m (March 2022:

GBP2.010m) as the substantial fee for the 'Silverwood Transaction'

has been received in equity. We will look to monetise that position

at the appropriate time. Because it is a listed company, we have to

reflect it by marking to market, regardless of how we think it may

perform. Like many of our peer group, we own equity positions in

many of our clients, and in this past turbulent year they gave a

substantial negative return, which we have to reflect in our Group

Statement of Comprehensive Income. However, we hope will regain

ground in the current year. Even so our NAV increased by 5% to

GBP4.372m (from GBP4.162m in March 2022), even after the material

amortisation charge.

Our retained clients remained static at 24, although the outlook

for the sectors we are involved in looks very promising. Whilst we

would have liked to have won a few more clients and will look to do

so going forward, I am happy that we have good quality clients

which is more important than just the overall number.

Sector Focus

We remain focussed on our core sector expertise of Natural

Resources, Transitional Energy, Technology and Consumer/Leisure as

we believe these are good sectors for long term growth, although in

2022/23 they proved very challenging. We seek to add value to our

corporate clients and provide them with innovative solutions to

their corporate, strategic and financing needs.

Mining as a sector has seen a lack of investment now for about

15 to 20 years. Production across the industry is slowing as demand

picks up and so this will result in many commodities facing a

'squeeze' at some stage in the future. Pretty much all experts

agree on this, but stock markets are not responding - although

inevitably, they must. We are big supporters of Cornish mining but

the development of the Southwest region has been slowed by the

issues surrounding Tungsten West's Hemerdon mine getting back into

production. The Ukraine war and rising costs had a huge impact but

as the war continues, the demand for Tungsten (a key part of

military ammunition) will increase, and there is a very limited

supply outside of China. We have seen good progress made in our

Transitional Energy activities, with a particular emphasis on

energy storage, and electric mobility. In Technology and Software,

we have recruited new members of the team to strengthen our

offering and indications are that this will prove to be an

important area of growth for us. In Consumer Brands we completed

the acquisition of approximately 20% of Lush Cosmetics for

Silverwood Brands plc for approximately GBP216m. This was a complex

transaction, and also novel in that it was not technically an RTO

under the Aquis Growth Market Rules. As far as we and Silverwood

are concerned, the transaction is completed, although we note that

as there is an acrimonious relationship between Lush and Silverwood

which we hope will abate with the passage of time. There may be

speculation as to any further activity. We have recruited an

additional research analyst to help our coverage of the

Consumer/Brands sector in general.

Transitional Energy as an industry is becoming very strong. The

stock market, however, has become impatient with the pace of

change. This trend is very similar to the Technology sector back in

2000, when we had the Dot Com crash, but at that time the good

companies made good progress, and some became hugely successful. We

expect to see a similar pattern developing in Transitional

Energy.

Equity Capital Markets

Pension funds have been reducing their exposure to equities now

for 20 years but in the last 12 months the 'de-equitisation' of the

UK has become extreme and now exposure to equities by pension funds

has fallen from about 40% to probably less than 4%. This is

untenable for our industry and also untenable for the UK Economy as

it deprives UK companies of capital to grow. We are approaching the

stage where either the UK gives up on quoted equities or there is a

change of stance by the Government to make equities more attractive

and the accounting less penal for pension funds. If the latter does

occur, then one can be very optimistic, but it certainly cannot be

taken for granted and this is why at VSA we continue to tread

carefully and keep a tight cost base.

The Aquis Stock Exchange is an important part of our growth

strategy as we believe it will be an important and successful

challenger stock exchange in the UK. It was not an easy year for

Aquis, as many retail platforms are still very slow at offering an

electronic service to their customers, but we believe that as

demand continues to grow, that they will realise that if they do

put in electronic dealing their customers will leave them. We dual

listed two companies on the Aquis Growth Market; Guanajuato Silver

(from Canada) and Cooks Coffee (from New Zealand). The support for

Aquis stocks was further clearly seen by our incredibly successful

Aquis Showcase day and the running of the "Britain's Got Aquis"

competition. We will be hosting this again this year at the end of

November and expect it to be bigger, better and even more

exciting.

We continue to support our corporate clients on AIM and the Main

Market of the London Stock Exchange in terms of financial advice,

the provision of equity research and fundraisings. We look forward

with great interest as to what opportunities will arise as the

review of the Main Market takes shape.

International Reach

We have always had a very international approach at VSA,

although as we reported last year, we have been unable to really do

much with our Shanghai office. Our strategy has always been to

support western companies develop their China strategy, whilst also

advising on transactions involving Chinese investment or expertise.

Despite the difficult geopolitical situation, currently I am

hopeful that this year we will be back in China and able to

complete transactions as one cannot ignore that it is the second

largest economy in the World, and vital to the mining industry. At

the same time though, we have been developing more links into the

USA and continue to build our relationships in Africa and other

parts of the World. In Africa we are working well with our partners

in Kenya, Faida Investment Bank, and we have very recently entered

into a strategic alliance with Bravura Holdings in South Africa. We

have always been proud of the fact that we are not just reliant on

London as many of our competitors are. This has also proven useful

as we develop our M&A activities.

We are always looking for opportunities at VSA to create

shareholder value, which is not easy in an industry which has been

in decline. The fact that we have become stronger over the past 5

years, whilst our peer group has weakened, suggests that if the

industry does see a recovery, we will be well placed to take

advantage of it. We have historically tried many times to become a

Nominated Adviser on AIM, as without this ability it has been

harder to grow. Unfortunately, we were unsuccessful. The London

Stock Exchange has historically made it very difficult to acquire a

Nomad firm unless you are already a Nomad. In this last financial

year, we saw that potentially being a Nomad is a poison pill due to

the fact that you cannot be acquired. We saw with Arden Partners

that this caused the value of the business to be effectively zero

when Ince acquired it as it was then passed to Zeus Capital for a

net zero consideration. The number of Nomad firms has shrunk to a

current level of 26 compared to over 70 firms 10 years ago. We

believe there may be change as it does appear there will be a

shake-up of the rules and approach to the 3 different markets of

AIM, the Standard Listing and the Premium listing. We view this as

good news and an opportunity for firms with high quality people and

capabilities to be more active on the LSE. We have seen the merger

of Finncap and Cenkos, and we would expect more mergers to take

place. Numis is not merging with Deutsche Bank, but is being

acquired as part of consolidation in the sector, and we believe

further acquisitions will take place, as bigger banks that felt

London was no longer on their radar after Brexit, reconsider as

there has not been the anticipated outflow of business across the

Channel.

Most of the UK domestic brokers were formed or grew rapidly

around the 2000's as many entrepreneurial brokers in their 40's

wanted to get away from the rigid structures of big banks. These

entrepreneurs are now in their 60's, but one issue they face is

that the younger generation now in their 40's no longer want to run

or own their own broking business, as they are just not nearly as

attractive due to weaker economics and vastly increased regulation.

This again is likely to lead to more consolidation or

acquisitions.

Outlook

Last year I said we were cautiously optimistic despite the

worsening conditions for global markets that are unlikely to

improve for some time. I was right on both points. We expect to

report a loss at the interim stage. This is due to our year end

being March and as the three quietest months in our industry -

April, July and August - all fall in our first half. Nevertheless

this year, I am slightly more cautious but remain optimistic as we

head towards 2024 as we have a good client base and are engaged on

a broad range of strategic advisory, M&A and fundraising

mandates. Our Position in Transitional Energy is also attracting a

lot of attention particularly in the USA and Asia and we expect

some major developments in the future.

We can but hope that a clearer global picture emerges which has

been clouded in the last three years by Covid, the Ukraine war,

global political tension, inflation at record levels, an energy

crisis, and interest rates going up substantially. Let's hope that

not much more will be thrown at us! Whatever happens, we are in

good shape with a great team.

Andrew Monk

CEO

Key performance indicators

Reported (accounting) profit

Year ended 31 March 2023 Underlying Profits

GBP611,531 comprising GBP280,761 profit on ordinary activities

before taxation plus amortisation of GBP330,770 (2022:

GBP399,144)

Cash at 31 March 2023

GBP1.27m (2022: GBP2.01m)

Retained Corporate Clients at 31 March 2023

24 clients of VSA Capital Limited (2022: 24)

GROUP STATEMENT OF COMPREHENSIVE INCOME

FOR THE YEARED 31 MARCH 2023

Notes 2023 2022

------------ ------------

GBP GBP

Turnover 2 4,358,875 3,605,562

Cost of sales (166,179) (175,761)

------------ ------------

Gross profit 4,192,696 3,429,801

Other operating income 39,000 34,750

Administrative expenses (3,090,564) (2,954,406)

------------ ------------

Operating Profit 1,141,132 510,145

Finance (expenses)/income 4 (721) 736

Gains/(losses) on investments 4 (859,650) (442,507)

Profit on ordinary activities before taxation 280,761 68,374

Tax on Profit on ordinary activities 5 (33,218) (26,482)

------------ ------------

Profit for the year 247,543 41,892

Other Comprehensive Income - -

------------ ------------

Total Comprehensive Income 247,543 41,892

============ ============

EARNINGS PER SHARE - PROFIT AFTER TAX Notes pence pence

------ ------

Basic 7 1.3 0.2

Diluted 7 0.8 0.1

The statement of comprehensive income has been prepared on the

basis that all operations in the year ended 31 March 2023 are

continuing operations.

There were no discontinued operations during the current

financial year.

GROUP AND COMPANY BALANCE SHEET

FOR THE YEARED 31 MARCH 2023

2023 2022 2023 2022

Notes Group Group Company Company

ASSETS GBP GBP GBP GBP

---------- ---------- ---------- ----------

Non-current assets

Property, plant & equipment

- owned 77,515 107,764 - -

Property, plant & equipment

- right of use 468,900 645,253 - -

Intangible assets 992,311 1,323,081 - -

Investment in subsidiaries - - 3,873,996 3,873,996

---------- ---------- ---------- ----------

Total non-current assets 1,538,726 2,076,098 3,873,996 3,873,996

Current assets

Investments 2,141,416 691,769 6,322 12,716

Trade and other receivables 381,464 536,932 49,041 1,532

Cash and cash equivalents 6 1,273,122 2,010,003 267,292 339,625

---------- ---------- ---------- ----------

Total current assets 3,796,002 3,238,704 322,655 353,873

TOTAL ASSETS 5,334,728 5,314,802 4,196,651 4,227,869

---------- ---------- ---------- ----------

EQUITY AND LIABILITIES

Share capital 3,523,547 3,523,547 3,523,547 3,523,547

Share premium 418,057 418,057 418,057 418,057

Share-based payments

reserve 13,892 51,585 13,892 51,585

Accumulated profits/(losses) 416,637 169,094 214,159 218,990

---------- ---------- ---------- ----------

Total equity 4,372,133 4,162,283 4,169,655 4,212,179

LIABILITIES

Current liabilities

Trade and other payables 529,199 557,408 26,996 15,690

Finance liabilities

- borrowings 216,566 107,623 - -

---------- ---------- ---------- ----------

Total current liabilities 745,765 665,031 26,996 15,690

Non-current liabilities

Finance liabilities

- borrowings 216,830 487,488 - -

TOTAL EQUITY AND LIABILITIES 5,334,728 5,314,802 4,196,651 4,227,869

---------- ---------- ---------- ----------

The financial statements were approved by the Board of Directors

on 26 June 2023 and were signed on its behalf by:

Andrew Monk Andrew Raca

Director Director

GROUP STATEMENT OF CHANGES IN EQUITY

FOR THE YEARED 31 MARCH 2023

Share Share Share Retained Total

Capital Premium based Earnings

payments

reserve

GBP GBP GBP GBP GBP

------------ --------- ----------- ---------- ------------

At 1 April 2022 3,645,260 177,524 25,786 127,202 3,975,772

Total comprehensive income - - - 41,892 41,892

Share issue 12,027 240,533 - - 252,560

Company purchase of own

shares into Treasury (133,740) - - - (133,740)

Movement in share based

premium reserve - - 25,799 - 25,799

At 1 April 2023 3,523,547 418,057 51,585 169,094 4,162,283

Total Comprehensive Income - - - 247,543 247,543

Movement in share based

premium reserve - - (37,692) - (37,693)

At 31 March 2023 3,523,547 418,057 13,892 416,637 4,372,133

------------ --------- ----------- ---------- ------------

GROUP AND COMPANY CASHFLOW STATEMENT

FOR THE YEARED 31 MARCH 2023

2023 2022 2023 2022

Group Group Company Company

Notes GBP GBP GBP GBP

------------ ---------- --------- ----------

Net cash generated/(used)

in operating activities

Profit / (loss) before income

tax 280,761 68,374 (4,831) (158,212)

Tax paid - (19,740) - -

Depreciation and amortisation 540,043 521,947 - -

Loss / (gain) on current asset

investments 859,650 438,628 6,394 9,403

Sales settled by shares (2,277,074) - - -

(Increase)/decrease in trade

/ other receivables 107,468 (301,565) (47,509) 112

Increase / (decrease) in trade

/ other payables (13,427) (504,770) 11,306 15,252

Change in share based payments

reserve (37,693) 25,799 (37,693) 25,799

------------ ---------- --------- ----------

NET CASH (GENERATED)/USED IN

OPERATING ACTIVITIES (540,272) 228,673 (72,333) (107,646)

------------ ---------- --------- ----------

Net cash generated from/(used

in) investing activities

Proceeds from disposal of plant, - 212,808 - -

property and equipment

Purchases of plant, property

and equipment (2,671) (252,540) - -

Proceeds from other investing

activities 280,215 210,262 - 57,015

Other investments - additions (312,437) (177,167) - (3,377)

Dividends received - - - 250,000

------------ ---------- --------- ----------

NET CASH (GENERATED)/USED IN

INVESTING ACTIVITIES (34,893) (6,637) - 303,638

------------ ---------- --------- ----------

Cash flows from financing

activities

Share capital issue - 252,560 - 252,560

Purchase of shares into treasury - (133,740) - (133,740)

Finance lease repayments (161,716) (194,638) - -

------------ ---------- --------- ----------

NET CASH GENERATED/(USED) FROM

FINANCING ACTIVITIES (161,716) (75,818) - 118,820

------------ ---------- --------- ----------

NET INCREASE/(DECREASE) IN

CASH AND CASH EQUIVALENTS (736,881) 146,218 (72,333) 314,812

Cash and cash equivalents at

beginning of period 2,010,003 1,863,785 339,625 24,813

CASH AND CASH EQUIVALENTS AT OF PERIOD 6 1,273,122 2,010,003 267,292 339,625

------------ ---------- --------- ----------

A prior year adjustment has been made to the cash flow statement

to reflect the fact that the tangible fixed asset purchases were

not all in cash. The adjustment was to reduce the purchase of

tangible fixed assets by GBP595,111 to GBP252,540 and the finance

lease liability reducing by the same amount to GBP194,638.

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEARED 31 MARCH 2023

1 Statutory Information

VSA Capital Group plc is a public limited company limited by

shares, is listed on the Aquis Stock Exchange, is incorporated in

the UK and registered in England and Wales (Company Number

04918684). The Company's registered and head office is at Park

House, 16-18 Finsbury Circus, London, United Kingdom, EC2M 7EB.

2 Revenue

Segmental reporting

Group Revenue of GBP4,358,875 (2022: GBP3,605,562)

comprises:

Corporate Finance fees of GBP3,455,272 (2022: GBP2,797,340);

Broking fees of GBP711,950 (2022: GBP578,069);

Bond trading of GBP85,212 (2022: GBP85,462),

Research fees of GBP102,083 (2022: GBP138,750); and,

Other income of GBP4,358 (2022: GBP5,941).

3 Employees and Directors (Group)

31/3/23 31/3/22

GBP GBP

---------- ----------

Wages and salaries 1,738,138 1,763,882

Social security costs 223,792 217,903

Other pension costs 32,526 33,926

---------- ----------

1,994,456 2,015,711

---------- ----------

The average number of employees during the year was as

follows:

31/3/23 31/3/22

-------- --------

Directors 5 5

Corporate finance 6 6

Research and sales 7 9

Account and administration 3 2

-------- --------

21 22

-------- --------

4 Net finance costs

Finance income: deposit account 2023: GBP1,936 2022: GBP736

interest

----------------- --------------------

Financial Income 2023: GBP1,936 2022: GBP736

Finance costs: finance lease interest 2023: ( 2022: (GBP13,282)

GBP1,035)

Finance costs: other interest 2023: (1,622) 2022: GBPNIL

----------------- --------------------

Financial Expenses 2023: (2,657) 2022: (13,282)

Total 2023: (GBP721) 2022: (GBP12,546)

-------------------------------------- ----------------- --------------------

5 Taxation

Analysis of the tax charge

Corporation tax is payable on investment income.

Factors affecting the tax charge

The tax assessed for the year is lower than the standard rate of

corporation tax in the UK. The difference is explained below:

2023 2022

GBP GBP

---------- ---------

Profit on ordinary activities before

tax 280,761 68,374

Profit on ordinary activities multiplied

by the

standard rate of corporation tax

in the UK of 19% (2022: 19%) 53,345 12,991

Effects of:

Tax losses utilised (75,768) (12,991)

Tax paid on Investment Income 8,338 26,482

Other adjustments 47,303 -

Tax Charge 33,218 26,482

---------- ---------

Due to the uncertainty of the timing of taxable profits for the

Company in the future, a deferred tax asset in respect of the tax

losses has not been included in the accounts. Tax losses of GBP2.7m

(2022: GBP2.9m) have been carried forward as at 31 March 2023. The

rate of corporation tax is set to rise to 25% in 2023.

6 Cash

Group Group Company Company

2023 2022 2023 2022

GBP GBP GBP GBP

------------ ------------ ---------- ----------

Cash at bank 1,273,122 2,010,003 267,292 339,625

------------ ------------ ---------- ----------

7 Profit & Loss Per Share

As at 31 As at 31

March 2022 March 2022

Audited Audited

------------ ------------

Basic

Profit/ (Loss) for the period attributable

to owners of the Company (GBP) 247,543 41,892

Weighted average number of shares: 19,428,966 19,428,966

Basic earnings/(loss) per share (pence): 1.3 0.2

------------ ------------

Diluted

Profit/ (Loss) for the period attributable

to owners of the Company (GBP) 247,543 41,892

Weighted average number of shares: 30,944,566 30,279,466

Diluted earnings/(loss) per share

(pence): 0.8 0.1

------------ ------------

The basic and diluted earnings per share were determined by

dividing the profit or loss attributable to the equity

holders of the Company by the weighted average number of shares

outstanding during the periods.

8 Annual Report and Accounts

Copies of the 2023 Report and Accounts will be posted to

shareholders shortly. Copies will also be available from the

Company's registered office and from the Company's website

www.vsacapital.com

The statutory accounts for the year ended 31 March 2023 will be

delivered to the Registrar of Companies in due course.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NEXFXLLLXQLZBBF

(END) Dow Jones Newswires

June 26, 2023 02:00 ET (06:00 GMT)

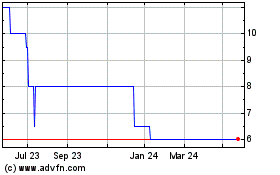

VSA Capital (AQSE:VSA)

Historical Stock Chart

From Dec 2024 to Jan 2025

VSA Capital (AQSE:VSA)

Historical Stock Chart

From Jan 2024 to Jan 2025