TIDMVSA

RNS Number : 0046L

VSA Capital Group PLC

09 September 2021

DATE: 9 September 2021

VSA Capital Group plc

("VSA", the "Company" or together with its subsidiaries the

"Group")

Admission to Trading on the AQSE Growth Market

VSA Capital Group plc, an international investment banking and

broking firm, with offices in London and Shanghai, is pleased to

announce that its entire issued share capital of 19,428,966

ordinary shares of 1p ("Ordinary Shares") will commence trading on

the Access segment of the Aquis Stock Exchange Growth Market ("AQSE

Growth Market") at 8 am (UK time) today ("Admission"). The Ordinary

Shares will trade under the ticker VSA and ISIN number

GB00BMXR4K91.

Alfred Henry Corporate Finance Limited is acting as the Aquis

Stock Exchange Corporate Adviser to the Company.

Subscription

Subject to Admission, the Company has raised gross proceeds of

GBP252,560 (the "Subscription") through the issue of 1,202,666

Ordinary Shares ("Subscription Shares") to a limited number of

qualifying investors, at a price of 21p per share (the

"Subscription Price").

Andrew Monk, CEO of VSA, said: "It is an exciting day for any

company to start trading on a London stock market and at VSA we are

delighted to be listing on Aquis, the growth market for companies

listing in London. We hope many of our future clients follow our

path and enjoy the same success. VSA is listing as it is now in a

position to take the next steps in its growth trajectory and become

a much more significant player in the capital markets."

Company Information

VSA is an international investment banking and broking firm,

with offices in London and Shanghai, providing corporate finance,

advisory and capital markets services to private and public

companies. VSA's focus is on providing an independent,

solutions-driven service to clients across multiple sectors with a

particular focus on natural resources, transitional energy,

alternative energy, technology, media and telecoms (TMT) and the

consumer and leisure sectors.

VSA acts as retained adviser or broker to listed or quoted

companies on various exchanges, and many of its clients are

capitalised at over GBP100m.

VSA's longstanding focus on the natural resources sector has

resulted in long-lasting and deep relationships across the world

particularly in Asia and Africa as well as a strong understanding

of the cultural nuances associated with doing business in each.

This sector focus has meant that VSA has been an early mover in the

transitional energy space and has leading expertise in executing

capital markets strategies across the full battery storage supply

chain.

VSA also owns minority stakes in Benjiami Limited ("Benjiami") a

cryptocurrency and blockchain focused investment house, Pure

Reports Limited ("Pure Reports") a research, consulting, and

advisory business to companies engaged in blockchain activities and

Shanghai Mining Club Limited ("Shanghai Mining Club") a forum to

connect western mining companies with the broader Chinese

investment community.

As well as VSA's permanent presence in Shanghai it has joint

venture partnerships with Faida Investment Bank Limited ("Faida") a

leading investment bank regulated by the Capital Markets Authority

in Kenya and with Moshe Capital Pty Ltd ("Moshe Capital") an

advisory and investment firm, regulated by the Financial Services

Board in South Africa, that advises and invests in African

companies.

Details of Directors

The full names of the Directors of the Company and positions are

as follows:

Andrew Anthony Monk, Executive Director and Chief Executive

Officer

Andrew's stockbroking career spans over 36 years. In that time,

he has built up strong relationships with many major global

institutions and has a conducted a wealth of financial transactions

in a wide range of sectors.

He is the current Chief Executive Officer of VSA Capital

Limited. He began his career at Stock Beech in Bristol in 1984,

moving to Scott Goff Layton (which became Smith New Court, Merrill

Lynch and now Bank of America). He subsequently joined Schroder

Securities and then ABN AMRO Hoare Govett for 11 years before

founding Oriel Securities as Joint Chief Executive Officer and is a

former Chief Executive Officer of Blue Oar Securities plc.

His current directorships include non-executive director of

Anglo African Agriculture plc, an African producer and supplier of

agricultural products, executive director of Benjiami, a crypto

investment bank and executive chairman of Shanghai Mining Club

Limited. Andrew graduated with a degree in Chemistry from Oriel

College, Oxford. He holds the FCA Controlled Functions SMF1 and

SMF3.

Andrew Joseph Raca, Executive Director and Head of Corporate

Finance

Andrew has over 30 years' experience in a broad range of

corporate finance advisory, fundraising and equity capital markets

activities. He joined Andrew Monk at VSA Capital Limited in 2011,

having worked previously together when he was Head of Corporate

Finance at Blue Oar Securities plc.

He started his career in corporate finance and banking at

Barclays de Zoete Wedd and then worked in his family's

manufacturing and logistics businesses with operations in Central

and Eastern Europe. Subsequently he went on to hold senior

positions in Corporate Finance at Albert E Sharp Securities, Arthur

Andersen, Ernst & Young (where he became Head of the regional

Capital Markets Advisory practice), Arden Partners, Libertas

Capital, Blue Oar Securities and Shore Capital. Andrew is a

director of Shanghai Mining Club Limited. Andrew graduated with a

degree in Politics from the University of Bristol. He holds the FCA

Controlled Function SMF3.

Marcia Manarin, Executive Director, Company Secretary and

Finance Director

Marcia started her career in the financial industry working for

Bradesco in Sao Paulo, Brazil and relocated to London in 2001.

Since arriving in the United Kingdom, Marcia qualified as a

chartered accountant in 2008 (CIMA) and has worked in senior roles

in both Finance and Operations within both energy and financial

services sectors, including Tristone Capital (Macquarie Group) and

FirstEnergy/GMP Capital (acquired by Stifel in Dec/2019).

Marcia graduated with a degree from Faculdades Integradas

Alcântara Machado - Faculdades de Artes Alcântara Machado. Marcia

holds the FCA Controlled Functions SMF3, SMF16 and SMF17.

Mark David Crawford Steeves, Independent Non-Executive

Chairman

Mark began his business career as a shipbroker, before becoming

joint owner of a marine consultancy and ship management company,

which was sold to Aminex plc. Following the sale, he ran Aminex's

procurement and oil eld service business, Amossco Ltd. In 2002, he

joined HSBC Insurance Brokers as a Business Development Director,

eventually becoming Head of Energy, then, Head of Africa, before

HSBC sold its insurance subsidiary in March 2010.

Mark then established Samphire & Associates Ltd, a

consultancy and advisory services business focused on African

related businesses. He served on the board Britain Nigeria Business

Council (2007 to 2009), the Business Council for Africa (2009 to

2015), Resolution Insurance (2014 to 2015), Phoenix Africa

Development Co Ltd (2010 to 2019) and Leon Africa (2012 to 2016).

Mark has also been a mentor for the Women-Led Business Programme

run by Femmes Africa Solidarité and, until 2020, served on the

advisory board of Moshe Capital, a South African Broad-Based Black

Economic Empowerment woman owned advisory and investment firm. Mark

holds the FCA Controlled Function SMF9.

Ruiwen (Andy) Chen, Independent Non-Executive Director

Andy has over 10 years' experience as a project consultant to

small and growing public companies. He has considerable experience

in a number of sectors, and advising on corporate governance for

quoted companies. In 2018, Andy founded VFund (Jersey), an

alternative investment fund specializing in Scotch whisky

investment. VFund is regulated by the Jersey Financial Services

Commission (JFSC). In addition, VFund has set up a private whisky

experience centre in London. Over the years, Andy has introduced a

number of cross-border investments from Asia to the UK. He worked

as a financial analyst for IBM UK in his early career and is

currently a director of several companies. Andy gained a master's

degree in Management with Marketing from the University of

Bath.

Sector Classification:

The Company will be classified as a financial services company

on the Aquis Exchange Growth Market.

Registered office and principal place of business:

The Company's head office and primary place of business is

located at New Liverpool House, 15-17 Eldon Street, London EC2M

7LD.

Company website:

www.vsacapital.com

Admission Document

The Company's admission document is available to view on its

website www.vsacapital.com

This announcement, together with any documents incorporated by

reference, shall be deemed to constitute an admission document for

the purposes of the AQSE Growth Market Rules for Issuers - Access.

It has not been approved or reviewed by the Aquis Stock Exchange or

the Financial Conduct Authority.

For more information, please contact:

VSA Capital +44(0)20 3005 5000

Andrew Monk, CEO

Andrew Raca, Head of Corporate Finance

Marcia Manarin, Finance Director

+44 (0)20 3772

Alfred Henry - AQSE Corporate Adviser 0021

Jon Issacs www.alfredhenry.com

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NEXSSFFFWEFSELU

(END) Dow Jones Newswires

September 09, 2021 02:00 ET (06:00 GMT)

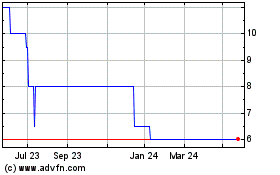

VSA Capital (AQSE:VSA)

Historical Stock Chart

From Dec 2024 to Jan 2025

VSA Capital (AQSE:VSA)

Historical Stock Chart

From Jan 2024 to Jan 2025