TIDMSML

RNS Number : 4601D

Strategic Minerals PLC

20 October 2022

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 ('MAR') which has

been incorporated into UK law by the European Union (Withdrawal)

Act 2018.

20 October 2022

Strategic Minerals plc

("Strategic Minerals" or the "Company")

September Quarter 2022 Magnetite Sales and Cash Balances

Strategic Minerals plc (AIM: SML; USOTC: SMCDY), a profitable

producing mineral company , is pleased to provide the following

update on the Company's cash position and ore sales at the Cobre

magnetite operation in New Mexico, USA ("Cobre") for the quarter

ended 30 September 2022.

Highlights

-- July price increases boost September quarter revenue to US$0.653m (2021: US$0.607m)

-- Annual sales to the end of September 2022 (US$2.475m) were

slightly weaker than in the previous year (US$2.85m) reflecting

lower revenues prior to agreed pricing increases

-- Elevated transportation costs continuing to restrict geographical sales expansion

-- Group cash balance of US$0.381m as at 30 September 2022

-- Discussions with both equity and debt funders for Leigh Creek Copper Mine continue

-- Tungsten and Tin named as Critical Minerals and encompassed

within the UK Government strategy, providing the potential for

government assistance in developing the Redmoor mine

Sales update: Cobre magnetite tailings operations

On 1 July 2022, prices for material from the Cobre magnetite

stockpile were increased and are now reflecting in sales revenues.

There appears to be no adverse effect on sales volumes from the

price increase.

While the extension of access to the stockpile until 31 March

2027 has provided a platform from which SMG hopes to increase

future sales revenues, the current increase in transportation costs

has moderated those expectations.

Sales comparisons on quarterly and annual periods to 30

September 2022, along with associated volume details, are shown in

the table below:

Tonnage Sales (US$'000)

----------------------------- ----------------------------

Year 3 months to 12 months to 3 months to 12 months to

Sept Sept Sept Sept

2022 9,322 37,884 653 2,475

2021 10,259 48,237 607 2,865

2020 10,987 50,875* 632 2,991*

* For comparison purposes, the US$0.75m of deposits forfeited by

CV Investments LLC, in October 2019, has been excluded.

With regards to the claim on CV Investments LLC ("CVI"), the

Receiver has not taken any action yet on the likely distribution of

assets from CVI and has yet to file their "Omnibus Motion for Order

Resolving Disputed Creditor Claims", which they indicated was the

next step in the last status report of 1 August 2022. While the

Company initially felt it would receive a meaningful payment from

the distribution, given its position as an established creditor, it

now appears that, as the assets in CVI arose from the proceeds of

crime, the Company's claim and rank may not be as strong as

originally anticipated. As previously noted, the Company is not

including funds from the Receiver in its cash flow projections.

Financials and Operations

As at 30 September 2022, the Company's cash balance was

US$0.381m (30 June 2022: US$0.430m). The marginal fall reflects

continuing activity at both the Leigh Creek and Redmoor

projects.

Leigh Creek Copper Mine ("LCCM")

After receiving final PEPR approval for the mining of copper

oxide at Paltridge North, the Company has continued discussions

with potential debt and equity funders. While copper prices have

fallen around 22% from earlier in the year (US$4-50 lb to US$3-50

lb) this has been partially offset by the fall in the A$/US$

exchange rate (0.7300 to 0.6300). Accordingly, the net drop in the

forecasted Australian dollar revenue has been only 10% from the

peak of earlier this year.

Initial preparatory work and maintenance is being undertaken

ahead of the anticipated restart of production at LCCM subject to

receipt of funding.

Cornwall Resources Limited ("CRL")

With the inclusion of Tungsten and Tin on the UK Government's

Critical Minerals list, CRL has focused attention on funding

programs associated with the UK Government's Critical Minerals

Strategy. It appears that the Redmoor project can, potentially,

benefit from Governmental funding given it:

-- Falls within the UK Government's Critical Minerals Strategy;

-- Is anticipated to result in many well-paid jobs for decades in East Cornwall; and

-- East Cornwall being an area likely to benefit from the UK Government's "Levelling Up" policy.

At present, CRL is following up on potential sources of

government funding for the Redmoor project. Current plans for

Redmoor have been built around the Company's previously disclosed

limited drill plans, although these may be rapidly expanded should

additional funding be forthcoming.

Commenting, John Peters, Managing Director of Strategic

Minerals, said:

"Sales revenue levels continue to provide operational support,

despite price increases.

"Efforts continue to secure funding for the LCCM restart but, as

yet, no binding commitments have been made.

"We are studiously preparing submissions for possible government

funding of the Redmoor mine and believe that this project aligns

well with the UK Government's plans for the Critical Minerals

sector."

For further information, please contact:

+61 (0) 414 727

Strategic Minerals plc 965

John Peters

Managing Director

Website: www.strategicminerals.net

Email: info@strategicminerals.net

Follow Strategic Minerals on:

Vox Markets: https://www.voxmarkets.co.uk/company/SML/

Twitter: @SML_Minerals

LinkedIn: https://www.linkedin.com/company/strategic-minerals-plc

+44 (0) 20 3470

SP Angel Corporate Finance LLP 0470

Nominated Adviser and Broker

Matthew Johnson

Ewan Leggat

Charlie Bouverat

Notes to Editors

Strategic Minerals plc is an AIM-quoted, profitable operating

minerals company actively developing projects tailored to materials

expected to benefit from strong demand in the future. It has an

operation in the United States of America along with development

projects in the UK and Australia. The Company is focused on

utilising its operating cash flows, along with capital raisings, to

develop high quality projects aimed at supplying the metals and

minerals likely to be highly demanded in the future.

In September 2011, Strategic Minerals acquired the distribution

rights to the Cobre magnetite tailings dam project in New Mexico,

USA, a cash-generating asset, which it brought into production in

2012 and which continues to provide a revenue stream for the

Company. This operating revenue stream is utilised to cover company

overheads and invest in development projects aimed at supplying the

metals and minerals likely to be highly demanded in the future.

In May 2016, the Company entered into an agreement with New Age

Exploration Limited and, in February 2017, acquired 50% of the

Redmoor Tin/Tungsten project in Cornwall, UK. The bulk of the funds

from the Company's investment were utilised to complete a drilling

programme that year. The drilling programme resulted in a

significant upgrade of the resource. This was followed in 2018 with

a 12-hole 2018 drilling programme has now been completed and the

resource update that resulted was announced in February 2019. In

March 2019, the Company entered into arrangements to acquire the

balance of the Redmoor Tin/Tungsten project which was settled on 24

July 2019 by way of a vendor loan which was fully repaid on 26

September 2020.

In March 2018, the Company completed the acquisition of the

Leigh Creek Copper Mine situated in the copper rich belt of South

Australia and brought the project temporarily into production in

April 2019. In July 2021, the project was granted a conditional

approval by the South Australian Government for a Program for

Environmental Protection and Rehabilitation (PEPR) in relation to

mining of its Paltridge North deposit and processing at the

Mountain of Light installation. In late September 2022, an updated

PEPR, addressing the conditions associated with the July 2021

approval, was approved.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCEASENFDLAFFA

(END) Dow Jones Newswires

October 20, 2022 02:00 ET (06:00 GMT)

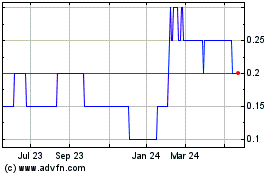

Strategic Minerals (AQSE:SML.GB)

Historical Stock Chart

From Dec 2024 to Jan 2025

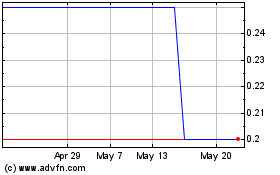

Strategic Minerals (AQSE:SML.GB)

Historical Stock Chart

From Jan 2024 to Jan 2025