Interim Results

September 28 2006 - 3:54AM

UK Regulatory

RNS Number:6088J

Ormonde Mining PLC

28 September 2006

28 September 2006

Ormonde Mining plc

Interim Results for the Six Months Ended 30 June 2006

DUBLIN & LONDON: 28 September 2006 - Ormonde Mining plc ("Ormonde" or "the

Company"), the Spain-focused exploration and development company, is pleased to

announce its unaudited interim results for the six months ended 30 June 2006.

HIGHLIGHTS

* Positive pre-feasibility Scoping Study on the La Zarza copper-gold project

completed, incorporating the first JORC-compliant resource; bankable

feasibility study underway.

* Final phase of La Zarza infill drilling in progress, environmental

baseline study underway and discussions initiated with appropriate companies

for the engineering design work.

* Drilling programmes on the Salamanca Gold Project and other exploration

properties to progress during Q4; drilling at Salamanca will test the first

of several new gold-in-soil anomalies identified to-date.

* Signing of an option over a possible near-term cashflow opportunity at a

tungsten tailings project in Salamanca; sampling and survey results will

lead into a short metallurgical testwork programme.

* Fully funded for all ongoing programmes following a capital raising in May

of Euro4.47 million (#3.04 million) before expenses.

* Loss for the period of Euro235,927 (Euro201,224 for the 6 months to June 2005);

management continues to maximize in-the-ground investment and keep overheads

to a minimum.

Mike Donoghue, Chairman of Ormonde commented,

"This has been a period in which our lead project has passed a critical

milestone and is now advancing into its final evaluation. Our other projects

have been advanced to facilitate the more rigorous investigation which has now

commenced and which will be the subject of further news flow in the coming

months."

Enquiries to:

Kerr Anderson, Managing Director,

Ormonde Mining plc Tel: +353 (0)46 9073623

Fraser Gardiner, Director,

Ormonde Mining plc Mobile: +353 (0)86 3931178

Simon Rothschild,

Bankside Consultants Tel: +44 (0)20 7367 8871 Mobile: +44 (0)7703 167065

CHAIRMAN'S STATEMENT

OPERATIONAL REVIEW

Operational activity during the first six months of the year focused on a

pre-feasibility Scoping Study on the La Zarza Copper-Gold Deposit in Huelva

Province of south west Spain. This Study, completed in early September,

demonstrated positive economics for the proposed underground mining operation at

metal prices substantially lower than those presently prevailing, indicating an

Internal Rate of Return of 21%, rising to 36% with appropriate gearing. This

milestone has allowed the Company to immediately advance to the definitive

bankable study stage to be completed by mid-2007.

Drilling is continuing at La Zarza for reserve definition, following the first

JORC-compliant resource published in April. The environmental baseline study is

also progressing, and documentation to initiate permitting procedures will

shortly be submitted to the provincial authorities. A detailed programme of

metallurgical testwork to facilitate optimization of the mill processing circuit

is being planned and various other technical studies will commence shortly. We

have also initiated discussions with appropriate companies for the feasibility

study engineering design work.

Progress during the period on our gold exploration projects included the

completion of extensive soil geochemistry field programmes on our Salamanca and

Tracia licences. At Salamanca an extensive new mineralised zone was identified

with geochemical associations and style of mineralisation suggesting a bulk

tonnage gold target. Recently completed trenching at both Salamanca and Tracia

has confirmed drilling targets in both projects. Drilling will be ongoing

during Q4.

In February we signed an option over a tungsten tailings project at Salamanca,

which we are currently evaluating as a possible near-term cash generating

operation with exposure to upside in the tungsten price. Our assessment

advanced during the period with drilling, trenching and surveying of the

tailings. A gravity separation metallurgical testwork programme will commence

shortly and, assuming positive results, will lead into a simple

technical-economic evaluation of the project, including the design and costing

of a gravity tailings treatment plant.

CORPORATE DEVELOPMENTS

In May we completed a placing with both institutional and private investors of

Euro4.47 million (#3.04 million) before expenses, and our current cash position of

over Euro5 million means that the Company is fully funded to complete the bankable

feasibility at La Zarza and its ongoing drilling programmes on its various

projects.

Ormonde's operating loss for the period was Euro235,927 (Euro201,224 for the 6 months

to June 2005). Our management continues to maximize in-the-ground investment

and keep overheads to a minimum.

SUMMARY

This has been a period in which our lead project has passed a critical milestone

and is now advancing into its final evaluation. Our other projects have been

advanced to facilitate more rigorous investigation which has now commenced and

which will be the subject of further news flow in the coming months.

Michael J. Donoghue

Chairman

27 September 2006

Consolidated Profit & Loss Account

6 months ended 30 June 2006

6 months ended 6 months ended 12 months ended

30 June, 2006 30 June, 2005 31 December, 2005

Euro000's Euro000's Euro000's

Unaudited Unaudited Audited

Administrative expenses (252) (210) (451)

Operating income - - -

OPERATING LOSS (252) (210) (451)

Interest receivable 16 9 30

LOSS ON ORDINARY ACTIVITIES

BEFORE TAXATION (236) (201) (421)

Tax on loss on ordinary activities - - -

LOSS ON ORDINARY ACTIVITIES

AFTER TAXATION (236) (201) (421)

Minority Interest - -

Loss for the financial period (236) (201) (421)

Loss per share (Euro0.0015) (Euro0.0015) (Euro0.0029)

Consolidated Statement of Total Recognised Gains and Losses

6 months ended 30 June 2006

6 months ended 6 months ended 12 months ended

30 June, 2006 30 June, 2005 31 December, 2005

Euro000's Euro000's Euro000's

Unaudited Unaudited Audited

Loss for the financial period (236) (201) (421)

Currency translation differences on

foreign currency net investments - - 3

Total recognised gains and losses (236) (201) (418)

Consolidated Balance Sheet

As at 30 June 2006

30 June, 2006 30 June, 2005 31 December, 2005

Euro000's Euro000's Euro000's

Unaudited Unaudited Audited

FIXED ASSETS

Tangible assets 17 14 19

Goodwill 112 112 112

Intangible assets 4,444 2,853 3,555

4,573 2,979 3,686

CURRENT ASSETS

Debtors 360 32 571

Cash at bank and on hand 5,034 3,257 1,891

5,394 3,289 2,462

CREDITORS: (amounts falling due

within one year) (43) (120) (236)

NET CURRENT ASSETS 5,351 3,169 2,226

TOTAL ASSETS LESS CURRENT LIABILITIES 9,924 6,148 5,912

CREDITORS: (amounts falling due

after more than one year) - (3) -

NET ASSETS 9,924 6,145 5,912

CAPITAL AND RESERVES

Called-up share capital 5,864 5,474 5,484

Share premium account 14,230 10,383 10,359

Capital conversion reserve fund 29 29 29

Capital reserve 7 7 7

Foreign currency reserves - 3 3

Profit and loss account (10,208) (9,753) (9,972)

SHAREHOLDERS' FUNDS 9,922 6,143 5,910

Minority interest 2 2 2

9,924 6,145 5,912

Consolidated Cash Flow Statement

6 months ended 30 June 2006

6 months ended 6 months ended 12 months ended

30 June, 2006 30 June, 2005 31 December, 2005

Euro000's Euro000's Euro000's

Unaudited Unaudited Audited

NET CASH OUTFLOW FROM

OPERATING ACTIVITIES (258) (195) (821)

RETURNS ON INVESTMENTS AND

SERVICING OF FINANCE

Interest received 16 8 30

Interest element of finance leases - (1) -

NET CASH INFLOW FROM RETURNS ON

INVESTMENTS AND SERVICING OF FINANCE 16 7 30

CAPITAL EXPENDITURE AND

FINANCIAL INVESTMENT

Expenditure on intangible assets (889) (1,011) (1,759)

Payments to acquire tangible assets - (2) (25)

Sale of tangible fixed assets - - 18

NET CASH OUTFLOW FROM CAPITAL

EXPENDITURE AND FINANCIAL INVESTMENT (889) (1,013) (1,766)

NET CASH OUTFLOW BEFORE FINANCING (1,131) (1,201) (2,557)

FINANCING

Issue of shares net of expenses 4,274 4,018 4,004

Capital element of finance leases - (4) -

NET CASH INFLOW FROM FINANCING 4,274 4,014 4,004

INCREASE IN CASH 3,143 2,813 1,447

1. This interim statement for the 6 months ended 30 June 2006 is

unaudited and was approved by the Directors on 27 September 2006. The financial

information contained in these statements does not constitute statutory accounts

within the meaning of section 240 of the Companies Act 1985. The financial

information for the year ended 31 December 2005 has been extracted from the

statutory accounts for that year, which have been filed with the Registrar of

Companies and on which the auditors issued an unqualified report.

2. The financial information has been prepared on a consistent basis

and using the same accounting policies as the audited financial statements for

the year ended 31 December 2005 with the exception of the adoption of FRS 20 '

Share-based Payment' which was adopted with effect from 1 January 2006. FRS 20

requires the fair value of share options, granted after 7 November 2002 and not

yet vested at 1 January 2006, to employees and directors to be recognized in the

financial statements. There is no impact on the 2006 interim financial

statements or on the comparative 2005 financial statements.

3. The loss per share was calculated from the loss for the period

attributable to ordinary shareholders of Euro235,927(June 2005 = Euro201,224) divided

by the time-weighted average number of shares in issue during the period of

156,292,428 (June 2005 = 133,687,956). There is no dilutive effect of share

options on the basic loss per share.

4. No dividends were paid or proposed in respect of the six months

ended 30 June 2006.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR SEFSWASMSEIU

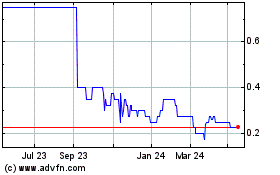

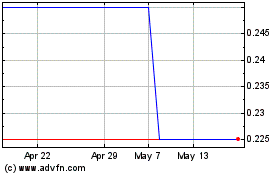

Ormonde Mining (AQSE:ORM)

Historical Stock Chart

From Jul 2024 to Aug 2024

Ormonde Mining (AQSE:ORM)

Historical Stock Chart

From Aug 2023 to Aug 2024