TIDMFSJ

RNS Number : 9080K

Fisher (James) & Sons plc

07 September 2021

7 September 2021

James Fisher and Sons plc

Half year results for the six months ended 30 June 2021

James Fisher and Sons plc (FSJ.L) ('James Fisher', 'the Group'),

the leading marine service provider, announces its unaudited

results for the six months ended 30 June 2021 ('the period').

H1 2021 H1 2020 % change

Revenue GBP233.7m GBP258.1m (9.5)%

Underlying operating profit margin 5.7% 7.6% (190)bps

Return on capital employed 5.4% 6.6% (120)bps

Underlying operating profit * GBP13.3m GBP19.5m (31.8)%

Underlying profit before tax * GBP9.2m GBP15.1m (39.1)%

Underlying diluted earnings per share ** 12.8p 23.6p (45.8)%

Statutory operating profit GBP12.2m GBP11.5m 6.1%

Statutory profit before tax GBP8.1m GBP7.1m 14.1%

Statutory diluted earnings per share 26.8p 9.9p 170.7%

Interim dividend per share Nil 8.0p -

* excludes separately disclosed items of GBP1.1m loss (2020:

GBP8.0m loss) (note 5)

** excludes separately disclosed items of GBP7.1m (2020: GBP6.9m

loss) (note 5)

Highlights:

-- First half results in line with the Board's expectations

against the backdrop of end markets that remain impacted by

Covid-19

-- Q2 performance showed a marked improvement over Q1

-- Strengthening order books, particularly in decommissioning

and offshore wind, following high tender wins in H1

-- New strategy to deliver sustainable profitable growth announced in June 2021

-- Sale of the Paladin dive support vessel completed in the period for $17.3m

-- GBP130m of revolving credit facilities renewed for three-year

term, providing access to facilities of GBP287.5m in total and

GBP247.5m through to at least 2024

Commenting on the results, Chief Executive Officer, Eoghan

O'Lionaird, said:

"Our first half result was in line with the Board's

expectations, with Q2 showing a marked improvement over Q1. The

Group is expecting performance to improve during the second half of

the year as our end markets recover from the disruption caused by

the effects of the global pandemic.

However, we experienced weaker than anticipated trading in

Fendercare and lower short-cycle order intake at JFD during the

important summer period and this, combined with project suspensions

in Mozambique, lead the Board to now expect underlying operating

profit for 2021 to be around the same level as that achieved in

2020.

Looking beyond 2021, forward-looking order books in our

long-cycle businesses are strengthening following high levels of

tendering activity and contract wins year-to-date which gives the

Board confidence in the Group's future prospects.

James Fisher's new strategy to deliver sustainable profitable

growth is progressing well. The Group is focused on capitalising on

its leading market positions within the marine, energy and defence

markets and is well placed to benefit from the market recovery and

meet its mid-term financial targets."

For further information:

Chief Executive

Officer

James Fisher and Eoghan O'Lionaird Chief Financial

Sons plc Duncan Kennedy Officer 020 7614 9508

Richard Mountain

FTI Consulting Susanne Yule 0203 727 1340

--------------------------------------- --------------

Notes:

1. James Fisher uses alternative performance measures (APMs) as

key financial indicators to assess the underlying performance of

the business. APMs are used by management as they are considered to

better reflect business performance and provide useful additional

information. APMs include underlying operating profit, underlying

profit before tax, underlying diluted earnings per share,

underlying return on capital employed and cash conversion. An

explanation of APMs is set out in note 3 in these half year

results.

2. Certain statements contained in this announcement constitute forward-looking statements. Forward-looking statements involve risks, uncertainties and other factors which may cause the actual results, performance or achievements of James Fisher to be materially different from future results, performance or achievements expressed or implied by such statements. Such risks, uncertainties and other factors include exchange rates, general economic conditions and the business environment.

Review of the six months ended 30 June 2021

Overview

The Group's performance in the first half of 2021 was in line

with the Board's expectations with Q2 showing a marked improvement

on Q1 across the Group. The end-markets in which we operate are

recovering as the world continues to manage the global pandemic. We

have seen encouraging levels of tendering in the offshore wind and

decommissioning markets in particular, for projects starting later

in 2021 and into 2022 and beyond, and Group tender wins in the

first half were at a record level within Marine Contracting.

Strategic progress

The Group announced its new strategy to deliver sustainable

profitable growth at a Capital Markets Event held on 29 June 2021.

The new strategy aims to refocus the Group and reinforce its

competitive advantages in attractive niches within the Energy,

Defence and Marine markets and to deliver stronger sustainable

returns.

A full portfolio review has been undertaken and the Group is

committed to addressing underperforming assets and businesses and

accelerating investments into the energy transition. To that end

the Paladin dive support vessel, against which a significant

impairment charge was taken last year, was sold for $17.3m during

the period. The Group is in discussions with regard to the

potential sale of the Swordfish dive support vessel, which has the

benefit of a long-term framework agreement for its use with a major

contractor.

Good progress has been made within the rapidly growing global

renewables sector, with the Group winning a number of offshore wind

projects in France and the UK, including St. Brieuc and Fecamp off

the French coast and the Sofia wind farm in the Dogger Bank. The

Group has also seen increased usage of its 'bubble curtains'

product offering, which uses compressed air to create a wall of

bubbles around noisy subsea works, protecting local wildlife and

reducing the environmental impact of such activity. The Group's

decommissioning activities, supporting the safe and

environmentally-friendly deconstruction of oil wells, is also

seeing growing momentum in an area of growing global demand.

Over the last 18 months the Group has created a solid platform

from which James Fisher will benefit as our markets continue to

recover, and the Board remains confident of meeting its mid-term

financial targets of underlying operating profit margin in excess

of 10% and return on capital employed in excess of 15%.

Financial performance

Revenue in the first half of 2021, at GBP233.7m, was 9.5% below

H1 2020 and 7.2% below at constant currency. Performance in Q1 2021

was particularly affected by the return of the UK to a Covid-driven

lockdown. Revenue in Q2 was 14% higher than Q1 and showed a

much-reduced variance to prior year (Q2 2021: 3% adverse to Q2

2020; Q1 2021: 16% adverse to Q1 2020).

At a divisional level, Specialist Technical and Offshore Oil

both provided constant currency revenue growth compared to H1 2020

and Tankships is now trading broadly in line with 2020 following an

improved performance in Q2. Marine Support experienced a more

challenging half year, with ship-to-ship transfers significantly

below the record performance achieved in H1 2020. This division was

also affected by the suspension of projects in Mozambique following

an insurgency in the region.

Statutory operating profit of GBP12.2m was GBP0.7m ahead of

prior year, with a significant reduction in separately disclosed

items (2021: GBP1.1m loss; 2020: GBP8.0m loss). Within separately

disclosed items in H1 2021 the Group recognised a profit on sale of

the Paladin dive support vessel of GBP0.3m (2020: nil) offset by

amortisation of acquired intangible assets of GBP1.4m (2020:

GBP1.5m). Included in 2020 were impairment charges, restructuring

costs and acquisition costs of GBP6.5m (2021: nil).

Underlying operating profit excludes separately disclosed items,

and at GBP13.3m was GBP6.2m below prior year. In line with the

improvement in revenue, Q2 showed a much-improved profit

performance compared to Q1. Underlying operating profit margin was

5.7% for the period compared to 7.6% in H1 2020, reflecting the

reduced overall levels of profit. Encouragingly, the Group achieved

an underlying operating profit margin of 9% in Q2 2021.

Statutory profit before tax, profit after tax and earnings per

share all showed improvement over 2020. Statutory profit before tax

increased by 14% to GBP8.1m. Statutory profit after tax increased

by GBP8.5m, which included a benefit of GBP7.9m arising on the

recognition of a deferred tax asset. This is shown as a separately

disclosed item. Statutory earnings per share increased to 26.8

pence per share, up 170%, also reflecting the separately disclosed

deferred tax asset recognition.

Dividends

The Board is committed to reintroducing a sustainable and

progressive dividend policy at the appropriate time. Given our

markets are still recovering from Covid-19 and taking into account

our current absolute levels of net debt and the resulting leverage

ratio, the Board has not declared an interim dividend for 2021

(2020: 8.0 pence per share).

Environmental, Social and Governance

The Group continued to prioritise the health and safety of its

employees in the period. Additional Covid-19 safety measures have

remained in place throughout the first half, including

quarantining, regular testing of employees at all sites and the

continuation of social distancing and hygiene measures. The safety

of our staff was of primary concern when terrorist attacks hit

Mozambique during the period and we were pleased to evacuate

everyone safely.

Through its stakeholder strategy, the Group continues to

recognise the importance of the contribution that employees,

customers and suppliers, the environment and local communities all

make towards supporting shareholder value. The first draft of the

formal sustainability strategy will be published with the Annual

Report. To date we have completed an initial materiality assessment

and revamped the Sustainability Committee.

As a group of businesses that is closely affiliated with the

energy transition, the environmental elements of the sustainability

strategy will be prominent, underpinned by robust social and

governance processes and commitments. We continue to work towards

meaningful environmental targets through our commitment to the

Science Based Targets Initiative, while improving our reporting for

the Carbon Disclosure Project and have joined the Council for

Inclusive Capitalism.

James Fisher continues to focus on diversity and inclusion. In

the first half of 2021, women represented 29% of our Board

membership and 33% of our Executive Committee.

Liquidity

Underlying net borrowings at 30 June 2021 was GBP178.7m, showing

a marginal increase of GBP3.7m compared to 31 December 2020

(GBP175.0m). On an IFRS16 basis, including the Group's operating

lease liabilities, net debt has increased from GBP198.1m at 31

December 2020 to GBP211.0m at 30 June 2021.

Revolving credit facilities totalling GBP130m have been

refinanced in the period on a three year term, with options to

extend by up to two years. In aggregate, the Group has GBP287.5m of

committed facilities, of which GBP247.5m is now secured through to

at least 2024.

At 30 June 2021, the Group had headroom against its committed

revolving credit facilities of GBP117.0m (2020: GBP115.6m). The

ratio of net debt (including bonds and guarantees) to Ebitda was

2.9 times (31 December 2020: 2.8 times; 30 June 2020: 2.5 times).

The covenant requirement at 30 June 2021 was 3.75 times, which

reduces to 3.5 times at 31 December 2021.

Board changes

The Group has seen two changes to the Board during the period.

Angus Cockburn replaced Malcolm Paul as Chairman and Duncan Kennedy

joined as Chief Financial Officer, replacing Stuart Kilpatrick. The

Board would like to express its sincere thanks to both Malcolm and

Stuart for their outstanding contributions to the Group's strategy

and growth over the course of the last decade.

Outlook

The Group is expecting performance to improve during the second

half of the year as our end markets recover from the disruption

caused by the effects of the global pandemic.

However, we experienced weaker than anticipated trading in

Fendercare and lower short-cycle order intake at JFD during the

important summer period and this, combined with project suspensions

in Mozambique, lead the Board to now expect underlying operating

profit for 2021 to be around the same level as that achieved in

2020.

Looking beyond 2021, forward-looking order books in our

long-cycle businesses are strengthening following high levels of

tendering activity and contract wins year-to-date which gives the

Board confidence in the Group's future prospects.

James Fisher's new strategy to deliver sustainable profitable

growth is progressing well. The Group is focused on capitalising on

its leading market positions within the marine, energy and defence

markets and is well placed to benefit from the market recovery and

meet its mid-term financial targets.

Business review

Marine Support

H1 2021 H1 2020 change

Revenue (GBPm) 97.7 122.5 (20.2)%

Underlying operating profit (GBPm) 2.1 4.8 (56.3)%

Underlying operating margin 2.1% 3.9%

Return on capital employed 3.7% 4.4%

Revenue was 20% below prior year at GBP97.7m. The GBP24.8m

revenue shortfall resulted in a GBP2.7m reduction in underlying

operating profit to GBP2.1m (2020: GBP4.8m).

The Marine Support division has seen mixed results across its

businesses. The ship-to-ship transfer market has seen volumes well

below prior year, and although we believe that Fendercare has

maintained its market share, H1 revenues were 39% below the record

performance in H1 2020, when significant volatility in the oil

price led to the highest volumes of ship-to-ship transfers that the

business had ever experienced. The market recovery in ship-to-ship

transfers during 2021 has been slow and revenues in July and August

remained lower than anticipated.

The Marine Contracting and Digital & Data Services

businesses are broadly in line with last year, although the

suspension of projects in Mozambique due to an insurgency in the

local area has adversely affected performance. We expect to

continue to benefit from this contract when the suspension is

lifted on the major LNG project. In the meantime, there are

on-going dispute resolution discussions with our clients to seek

recovery of amounts contractually due for work completed to date,

and this could provide some variability to 2021 performance.

There have been a number of contract wins in the period in the

renewables space, which is showing encouraging growth and continued

high levels of tenders. EDS, the provider of specialist high

voltage cabling and related services, delivered strong revenue and

profit growth in the period and has a strong order book for 2022

and beyond.

Specialist Technical

H1 2021 H1 2020 change

Revenue (GBPm) 67.8 65.7 3.2%

Underlying operating profit (GBPm) 5.6 7.5 (25.3)%

Underlying operating margin 8.3% 11.4%

Return on capital employed 11.2% 13.4%

Revenue increased by 3.2% in the period to GBP67.8m (2020:

GBP65.7m). JFD, our defence and diving equipment provider, is

approaching significant milestones in a number of major projects,

including the final milestone on the 500m saturation diving system

and the delivery of a submarine rescue vessel. Recent contract wins

include a GBP20m, four-year contract with the UK Ministry of

Defence to provide life support services for the Astute class of

submarines. The business has a sales pipeline in excess of GBP400m

across both its long and short cycle business lines. However, order

intake in the diving equipment and services sector has been weaker

than anticipated over recent months as customers continue to delay

spending decisions as a result of Covid-19.

JFN, our nuclear decommissioning business, has remained

resilient. It has progressed all of its major projects including

the on-going decommissioning work at Sellafield where it recently

secured two new contracts. One being a multi-million pound project

for the mechanical and electrical design and commissioning of the

New Civil Nuclear Constabulary Operational Unit at Sellafield and

the other being the renewal of its contract for the provision and

management of ROVs targeted at the clean-up of legacy ponds on

site. These legacy ponds provide some of the most complex

decommissioning challenges in the world.

Underlying operating profit was GBP1.9m below H1 2020 at

GBP5.6m, principally a result of an increase in project-based

equipment revenues within the JFN projects, which carry lower

margins.

Offshore Oil

H1 2021 H1 2020 change

Revenue (GBPm) 39.6 40.0 (1.0)%

Underlying operating profit (GBPm) 5.3 5.4 (1.8)%

Underlying operating margin 13.4% 13.1%

Return on capital employed 9.2% 8.6%

The Offshore Oil division performed well in the period, with

revenue of GBP39.6m broadly in line with 2020 and 4% higher at

constant currency. This reflects strong growth in both our Scantech

and Fisher Offshore businesses, partially offset by RMSpumptools,

where the comparator period in 2020 saw the completion of a number

of projects that had been started prior to Covid-19 disruptions.

The RMSpumptools order book going into the second half is robust

and in line with that of 2020 and ordering activity early in H2 has

provided the business with confidence for the second half.

The Scantech businesses saw strong demand for their air

compressors, principally because of increased usage in the

generation of 'bubble curtains', which reduce subsea noise around

construction and protect marine life. Such measures are legal

requirements in most jurisdictions around the world and represent

an exciting mid-term growth opportunity for the Group. The combined

forward order books of the Scantech businesses, at approximately

GBP16m, are more than 40% higher than at this point in 2020.

Fisher Offshore saw a continuation of the strong demand for its

specialist cutting tools, which are used in the decommissioning of

existing oil platforms and wells, tendering for GBP31m of business

in the period, which compares to GBP26m for the whole of 2020. The

Group further strengthened its customer offering with the purchase

of Subsea Engenuity during the period for a consideration of up to

GBP0.75m. Subsea Engenuity's innovative technology significantly

reduces risk in well abandonment operations and is expected to be

launched commercially in early 2022.

Tankships

H1 2021 H1 2020 change

Revenue (GBPm) 28.6 29.9 (4.3)%

Underlying operating profit (GBPm) 2.1 3.6 (41.7)%

Underlying operating margin 7.3% 12.0%

Return on capital employed 20.1% 24.3%

The Tankships division saw challenging trading conditions in Q1

as the UK was placed back into lockdown. Following the gradual

easing of restrictions in Q2, we saw an improvement in demand and

revenue ended the period only 4% below 2020 at GBP28.6m. Volumes

are now approaching pre-pandemic levels.

Underlying operating profit was GBP1.5m below 2020 at GBP2.1m

for the period, which reflects both the largely fixed cost nature

of the business and an increase in operating costs due to Covid

quarantining and enhanced safety measures put in place as we

continue to prioritise the safety and wellbeing of our staff.

Cashflow and borrowings

Underlying net borrowings at 30 June 2021 was GBP178.7m, showing

a marginal increase of GBP3.7m compared to 31 December 2020

(GBP175.0m). On an IFRS16 basis, including the Group's operating

lease liabilities, net debt increased from GBP198.1m at 31 December

2020 to GBP211.0m at 30 June 2021.

As anticipated, the Group saw a working capital outflow during

the period. A number of projects across the Group have not yet met

invoicing milestones, resulting in an increase in accrued income of

GBP17.1m in the period. Debtor days, at 87, showed some improvement

over H1 2020 and creditor days are in line at 97 (30 June 2020:

98).

Capital expenditure was much reduced at GBP6.5m (2020: GBP11.8m)

as the business continues to prioritise its capital investments.

The sale of the Paladin was completed in the period and proceeds of

$17.3m (GBP12.6m) were received prior to the period end.

Acquisition spend was lower at GBP0.4m (2020: GBP4.5m).

Tax and interest payments were broadly in line with prior year

at GBP7.6m (2020: GBP8.8m).

At 30 June 2021 the Group had headroom against its committed

revolving credit facilities of GBP117.0m (2020: GBP115.6m). The

ratio of net debt (including bonds and guarantees) to Ebitda was

2.9 times (31 December 2020: 2.8 times; 30 June 2020: 2.5 times).

The covenant requirement at 30 June 2021 was 3.75 times, which

reduces to 3.5 times at 31 December 2021.

Balance sheet

Non-current assets reduced from GBP389.6m at 31 December to

GBP369.7m at 30 June 2021, due principally to a reduction in

tangible fixed assets of GBP31.5m offset by an increase in

right-of-use assets of GBP8.3m.

Current assets increased from GBP302.5m at 31 December 2020

(restated - see note 12) to GBP313.3m at 30 June 2021. This

reflects an increase in receivables of GBP20.8m, principally in

accrued income as major long-term contracts work towards invoicing

milestones in the second half of the year. In addition, GBP15.2m

assets held for sale have been recognised at 30 June 2021 (refer to

note 13 for details), offset by lower cash at bank and in hand

balances (see note 12).

Current and non-current liabilities decreased by GBP21.0m in the

period, from GBP456.2m at 31 December 2020 (restated - see note 12)

to GBP435.2m at 30 June 2021. The principal movement is a decrease

in bank overdrafts (refer note 12), offset by an increase of

GBP8.2m in lease liabilities, which broadly matches against the

increase in right-of-use assets of GBP8.3m.

Risks and uncertainties

The principal risks and uncertainties which may have the largest

impact on performance in the second half of the year are the same

as disclosed in the 2020 Annual Report and Accounts on pages 43-48.

The principal risks set out in the 2020 Annual Report and Accounts

were:

-- Operational - project delivery, recruitment and retention of

key staff, health, safety and environment, contractual risk, cyber

security and pandemic risk;

-- Strategic - climate change, operating in emerging markets; and

-- Financial - foreign currency and interest rates.

The Board considers that the principal risks and uncertainties

set out in the 2020 Annual Report and Accounts remain the same.

Directors' Responsibilities

We confirm that to the best of our knowledge:

(a) The condensed set of financial statements has been prepared

in accordance with IAS 34 'Interim Financial Reporting' as adopted

by the European Union.

(b) The interim management report includes a fair review of the

information required by:

a. DTR 4.2.7R of the 'Disclosure and Transparency Rules', being

an indication of important events that have occurred during the

first six months of the financial year and their impact on the

condensed set of financial statements; and a description of the

principal risks and uncertainties for the remaining six months of

the year; and

b. DTR 4.2.8R of the 'Disclosure and Transparency Rules', being

related party transactions that have taken place in the first six

months of the current financial year and that have materially

affected the financial position or performance of the entity during

the period; and any changes in the related party transactions

described in the last annual report that could do so.

Approved by the Board of Directors and signed on its behalf

by:

E P O'Lionaird D Kennedy

Chief Executive Officer Chief Financial Officer

6 September 2021

CONDENSED CONSOLIDATED INCOME STATEMENT

for the six months ended 30 June 2021

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2021 2020 2020

Note GBPm GBPm GBPm

Revenue 4 233.7 258.1 518.2

Cost of sales (177.6) (187.2) (423.8)

----------- ----------- -------------

Gross profit 56.1 70.9 94.4

Administrative expenses (44.9) (60.1) (139.5)

Share of post-tax results of joint ventures 1.0 0.7 1.6

----------- ----------- -------------

Operating profit/(loss) 4 12.2 11.5 (43.5)

Analysis of operating profit:

Underlying operating profit 13.3 19.5 40.5

Separately disclosed items (1.1) (8.0) (84.0)

Net finance expense 6 (4.1) (4.4) (9.0)

----------- ----------- -------------

Profit/(loss) before taxation 8.1 7.1 (52.5)

Analysis of profit before tax:

Underlying profit before taxation 9.2 15.1 31.5

Separately disclosed items 5 (1.1) (8.0) (84.0)

Income tax 7 5.5 (2.0) (4.8)

Profit/(loss) for the period 13.6 5.1 (57.3)

=========== =========== =============

Attributable to:

Owners of the Company 13.5 5.0 (57.5)

Non-controlling interests 0.1 0.1 0.2

13.6 5.1 (57.3)

=========== =========== =============

Earnings/(loss) per share pence pence pence

Basic 8 26.8 9.9 (114.2)

Diluted 8 26.8 9.9 (114.2)

Underlying earnings per share

Basic 8 12.8 23.6 48.0

Diluted 8 12.8 23.6 47.9

CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

for the six months ended 30 June 2021

Six months Six months

ended ended Year ended

30 June 30 June 31 December

2021 2020 2020

Note GBPm GBPm GBPm

Profit/(loss) for the period 13.6 5.1 (57.3)

Items that will not be reclassified to the

income statement

Actuarial gain/(loss) in defined benefit

pension schemes 10 2.8 (0.4) (9.3)

Tax on items that will not be reclassified - 0.1 1.1

-------- ----------- ------------

2.8 (0.3) (8.2)

Items that may be reclassified subsequently to

the income statement

Exchange differences on foreign currency

net investments (2.3) 1.8 (7.8)

Effective portion of changes in fair value

of cash flow hedges (1.2) (3.6) 0.6

Effective portion of changes in fair value of

cash flow hedges in joint ventures 0.1 (0.3) (0.2)

Net change in fair value of cash flow hedges transferred

to income statement (0.6) 0.6 (0.1)

Deferred tax on items that may be reclassified 0.1 0.7 1.1

-------- ----------- ------------

(3.9) (0.8) (6.4)

Total comprehensive income for the period 12.5 4.0 (71.9)

======== =========== ============

Attributable to:

Owners of the Company 12.4 3.9 (72.0)

Non-controlling interests 0.1 0.1 0.1

12.5 4.0 (71.9)

======== =========== ============

CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

at 30 June 2021

30 June 30 June 31 December

2021 2020 2020

Note GBPm GBPm GBPm

Non-current assets restated* restated*

Goodwill 11 165.8 182.8 166.5

Other intangible assets 18.2 25.6 20.1

Property, plant and equipment 126.7 208.2 158.2

Right-of-use assets 39.0 24.4 30.7

Investment in joint ventures 7.7 8.9 7.5

Other investments 1.4 1.4 1.4

Deferred tax assets 10.9 5.6 5.2

369.7 456.9 389.6

-------- ---------- ------------

Current assets

Inventories 51.5 52.3 46.6

Trade and other receivables 183.6 201.2 162.8

Assets held for sale 13 15.2 - -

Cash and cash equivalents 12 63.0 70.1 93.1

313.3 323.6 302.5

-------- ---------- ------------

Current liabilities

Trade and other payables (142.3) (173.6) (140.1)

Provisions for liabilities and charges (0.6) (0.9) -

Liabilities associated with assets held

for sale 13 (1.7) - -

Current tax (4.8) (7.1) (7.6)

Borrowings (51.2) (57.5) (79.8)

Lease liabilities (8.9) (8.4) (7.2)

(209.5) (247.5) (234.7)

-------- ---------- ------------

Net current assets 103.8 76.1 67.8

Total assets less current liabilities 473.5 533.0 457.4

-------- ---------- ------------

Non-current liabilities

Other payables (3.3) (3.7) (3.6)

Provisions (1.4) - (1.6)

Retirement benefit obligations 10 (6.6) (5.2) (10.3)

Cumulative preference shares (0.1) (0.1) (0.1)

Borrowings (182.0) (182.8) (178.8)

Lease liabilities (31.8) (19.8) (25.3)

Deferred tax liabilities (0.5) (5.2) (1.8)

(225.7) (216.8) (221.5)

-------- ---------- ------------

Net assets 247.8 316.2 235.9

======== ========== ============

Equity

Called up share capital 12.6 12.6 12.6

Share premium 26.8 26.6 26.7

Treasury shares (0.6) (0.3) (0.2)

Other reserves (20.5) (11.0) (16.5)

Retained earnings 228.7 287.4 212.6

-------- ---------- ------------

Equity attributable to owners of the Company 247.0 315.3 235.2

Non-controlling interests 0.8 0.9 0.7

Total equity 247.8 316.2 235.9

======== ========== ============

* cash and cash equivalents and borrowings (current) have been

restated for the 2020 comparative periods to reflect a gross up of

cash at bank and in hand and overdraft balances (see note 12).

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

for the six months ended 30 June 2021

Share Share Retained Other Treasury Shareholders' Non-controlling Total

capital premium earnings reserves shares equity interests equity

GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

At 1 January 2021 12.6 26.7 212.6 (16.5) (0.2) 235.2 0.7 235.9

Profit for the

year - - 13.5 - - 13.5 0.1 13.6

Other

comprehensive

income - - 2.8 (3.9) - (1.1) - (1.1)

Contributions by

and distributions

to owners:

Remeasurement of

non-controlling

interest

put option - - - (0.1) - (0.1) - (0.1)

Share based

payments - - 0.3 - - 0.3 - 0.3

Tax effect of

share

based payments - - 0.1 - - 0.1 - 0.1

Purchase of

shares

by ESOT - - - - (0.5) (0.5) - (0.5)

Notional purchase

of own shares - - (0.5) - - (0.5) - (0.5)

Arising on the

issue

of shares - 0.1 - - - 0.1 - 0.1

Transfer - - (0.1) - 0.1 - - -

-----

At 30 June 2021 12.6 26.8 228.7 (20.5) (0.6) 247.0 0.8 247.8

====== ====== ======= ======= ========== ========= =============== =======

Share Share Retained Other Treasury Shareholders' Non- controlling Total

capital premium earnings reserves shares equity interests equity

GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

At 1 January 2020 12.6 26.5 284.7 (10.6) - 313.2 0.8 314.0

Profit for the

year - - 5.0 - - 5.0 0.1 5.1

Other

comprehensive

income - - (0.8) (0.3) - (1.1) - (1.1)

Contributions by

and distributions

to owners:

Remeasurement of

non-controlling

interest

put option - - - (0.1) - (0.1) - (0.1)

Share based

payments - - 0.2 - - 0.2 - 0.2

Tax effect of

share

based payments - - (0.3) - - (0.3) - (0.3)

Purchase of

shares

by ESOT - - - - (0.9) (0.9) - (0.9)

Notional purchase

of own shares - - (0.8) - - (0.8) - (0.8)

Arising on the

issue

of shares - 0.1 - - - 0.1 - 0.1

Transfer - - (0.6) - 0.6 - - -

At 30 June 2020 12.6 26.6 287.4 (11.0) (0.3) 315.3 0.9 316.2

====== ====== ======= ======= ========== ========= =============== =======

Other reserve

movements

Translation Hedging Put option

reserve reserve liability Total

Other reserves GBPm GBPm GBPm GBPm

At 1 January 2020 (7.8) (0.2) (2.6) (10.6)

Other

comprehensive

income (6.5) 0.7 - (5.8)

Remeasurement of non-controlling interest

put option - - (0.1) (0.1)

---------- --------- --------------- -------

At 31 December

2020 (14.3) 0.5 (2.7) (16.5)

Other

comprehensive

income (2.3) (1.6) - (3.9)

Remeasurement of non-controlling interest

put option - - (0.1) (0.1)

At 30 June 2021 (16.6) (1.1) (2.8) (20.5)

========== ========= =============== =======

CONDENSED CONSOLIDATED CASH FLOW STATEMENT

for the six months ended 30 June 2021

Six months Six months

ended ended Year ended

30 June 30 June 31 December

2021 2020 2020

restated*

Note GBPm GBPm GBPm

Profit/(loss) before tax for the period 8.1 7.1 (52.5)

Adjustments to reconcile profit/(loss) before

tax to net cash flows

Depreciation and amortisation 21.1 23.3 48.0

Separately disclosed items (excluding amortisation) (0.3) 6.5 81.1

Other non cash items 3.0 6.0 7.1

(Increase)/decrease in inventories (5.3) (3.4) 2.0

(Increase)/decrease in trade and other receivables (24.8) 14.5 30.9

Increase/(decrease) in trade and other payables 2.8 13.6 (13.4)

Defined benefit pension cash contributions

less service cost (1.0) (1.2) (4.8)

----------- ----------- ------------

Cash generated from operations 3.6 66.4 98.4

Cash outflow from separately disclosed items - (1.1) (3.9)

Income tax payments (4.5) (5.2) (7.9)

----------- ----------- ------------

Cash flow (used in)/from operating activities (0.9) 60.1 86.6

Investing activities

Dividends from joint venture undertakings 0.7 0.6 1.8

Proceeds from the disposal of a subsidiary - - 1.3

Proceeds from the disposal of property,

plant and equipment 14.3 0.6 2.6

Finance income 0.2 0.1 0.3

Acquisition of subsidiaries, net of cash

acquired (0.4) (4.0) (7.9)

Investment in joint ventures and other investments - (0.5) (0.5)

Acquisition of property, plant and equipment (6.5) (11.8) (17.5)

Development expenditure (0.8) (1.5) (2.9)

Cash flows from/(used in) investing activities 7.5 (16.5) (22.8)

Financing activities

Proceeds from the issue of share capital 0.1 0.1 0.2

Finance costs (3.3) (3.7) (7.0)

Purchase of own shares by Employee Share

Ownership Trust (0.5) (0.9) (0.9)

Notional purchase of own shares for LTIP

vesting (0.5) (0.8) (1.0)

Capital element of lease repayments (6.6) (6.2) (13.0)

Proceeds from borrowings 10.5 43.9 34.3

Repayment of borrowings (7.9) (70.1) (64.5)

Dividends paid - - (4.0)

Dividend paid to non-controlling interest - - (0.2)

----------- ----------- ------------

Cash flows used in financing activities (8.2) (37.7) (56.1)

Net decrease in cash and cash equivalents (1.6) 5.9 7.7

Cash and cash equivalents at beginning of

period 13.5 7.5 7.5

Net foreign exchange differences - (0.6) (1.7)

Cash and cash equivalents at end of period 12 11.9 12.8 13.5

=========== =========== ============

* Cash and cash equivalents restated for the period ended 30 June 2020.

NOTES TO THE CONDENSED CONSOLIDATED HALF YEAR STATEMENTS

1 Basis of preparation

James Fisher and Sons Plc (the Company) is a public limited

company registered and domiciled in England and Wales and listed on

the London Stock Exchange. The condensed consolidated half year

financial statements of the Company for the six months ended 30

June 2021 comprise the Company and its subsidiaries (together

referred to as the Group) and the Group's interests in jointly

controlled entities.

Statement of compliance

The condensed consolidated financial statements, which have been

reviewed and not audited, have been prepared in accordance with

International Financial Reporting Standard (IFRS) IAS 34 "Interim

Financial Reporting" as adopted by the European Union (EU). As

required by the Disclosure and Transparency Rules of the Financial

Services Authority, the condensed consolidated set of financial

statements has been prepared applying the accounting policies and

presentation that were applied in the preparation of the Group's

published consolidated financial statements for the year ended 31

December 2020 with the exceptions described below. They do not

include all of the information required for full annual financial

statements, and should be read in conjunction with the consolidated

financial statements of the Group for the year ended 31 December

2020.

The comparative figures for the financial year ended 31 December

2020 are not the Group's statutory accounts for that financial

year. Those accounts which were prepared under International

Financial Reporting Standards (IFRS) as adopted by the EU (adopted

IFRS), have been reported on by the Group's auditors and delivered

to the Registrar of Companies. The report of the auditors was (i)

unqualified, (ii) did not include a reference to any matters to

which the auditors drew attention by way of emphasis without

qualifying their report and (iii) did not contain a statement under

section 498 (2) or (3) of the Companies Act 2006.

The consolidated financial statements of the Group for the year

ended 31 December 2020 are available upon request from the

Company's registered office at Fisher House, PO Box 4,

Barrow-in-Furness, Cumbria LA14 1HR or at www.james-fisher.co.uk

.

The half year financial information is presented in Sterling and

all values are rounded to the nearest million pounds (GBPm) except

where otherwise indicated.

Going concern

In light of the Covid-19 global pandemic experienced in 2020 and

subsequent uncertainty, the Group has undertaken a detailed

viability review and taken appropriate mitigating actions to

protect the business and liquidity. Operations have been impacted

by travel restrictions, supply chain logistics and actions to

protect employees to ensure safe working conditions. The Group's

quick response to Covid-19 has mitigated some of the impact on

financial performance, however the potential impact of a post

pandemic recession gives on-going risk to future financial

performance. Liquidity is monitored through daily balance

reporting, quarterly forecasting and monthly cashflow

forecasting.

The Directors base case forecast reflected financial performance

in the year ended 31 December 2020 and the associated impacts of

Covid-19. A number of severe but plausible downside scenarios were

calculated compared to the base case forecast of profit and cash

flow to assess headroom and covenants against facilities for the

going concern assessment period of the next 12 months from the date

of this report. Against these negative scenarios, which reduced

operating profit by GBP10m in 2021 and GBP20m in 2022, adjusted

projections showed no breach of covenants. Additional sensitivities

which reduced cash receipts by GBP10m in 2021 and GBP20m in 2022

and delayed project delivery reducing profit by GBP10m in 2021 and

GBP20m in 2022 and deferring debtor collection by GBP3m in 2021 and

by GBP6m in 2022 were also run separately in combination with the

severe but plausible downside and adjusted projections showed no

breach of covenants and headroom against committed facilities

throughout the 12 month going concern assessment period. Further

controllable mitigating actions could also be taken in such

scenarios should it be required, including reducing capital

expenditure, reducing dividend payments and not carrying out any

acquisitions.

The Directors are of the opinion that the Group has sufficient

financial resources to continue trading for at least 12 months from

the date of this report. Accordingly, the Directors believe it

remains appropriate to prepare the interim condensed financial

statements on a going concern basis.

The Group meets its day to day working capital requirements

through operating cash flows with borrowings in place to fund

acquisitions and capital expenditure. The Group had GBP117.0m of

undrawn committed facilities at 30 June 2021 (2020: GBP115.6m).

During September, revolving credit facilities totalling GBP130m

have been refinanced on a three year term with options to extend by

up to two years.

Significant accounting policies

The accounting policies applied by the Group in these condensed

consolidated financial statements are the same as those applied by

the Group in its consolidated financial statements as at and for

the year ended 31 December 2020.

2 Accounting estimates and judgements

The preparation of half year financial statements requires

management to make judgements, estimates and assumptions that

affect the application of accounting policies and the reported

amounts of assets and liabilities, income and expense. Actual

results may differ materially from these estimates.

The significant judgements made by management in applying the

Group's accounting policies and the key sources of estimation

uncertainty were the same as those applied to the consolidated

financial statements as at and for the year ended 31 December

2020.

3 Alternative performance measures

The Group presents a number of alternative (non-Generally

Accepted Accounting Practice (non-GAAP)) performance measures which

are not defined within IFRS. These measures are presented to assist

investors in gaining a clear and balanced view of the underlying

operational performance of the Group and are consistent year on

year with how business performance is measured internally. The

adjustments are separately disclosed (note 5) and are usually items

that are significant in size or non-recurring in nature. The

following non-GAAP measures are referred to in the half year

results.

3.1 Underlying operating profit and underlying profit before taxation

Underlying operating profit is defined as operating profit

before acquisition related income and expense (amortisation or

impairment of acquired intangible assets, acquisition expenses,

adjustments to contingent consideration), the costs of a material

restructuring, litigation, or asset impairment and the profit or

loss relating to the sale of businesses. As acquisition related

income and expense fluctuates with activity and to provide a better

comparison to businesses that are not acquisitive, the Directors

consider that these items should be separately disclosed to give a

better understanding of operating performance. Underlying profit

before taxation is defined as underlying operating profit less net

finance expense.

2021 2020 2020

Six months Six months Year

ended ended ended

30 June 30 June 31 December

GBPm GBPm GBPm

Operating profit/(loss) 12.2 11.5 (43.5)

Separately disclosed items before

taxation 1.1 8.0 84.0

Underlying operating

profit 13.3 19.5 40.5

Net finance expense (4.1) (4.4) (9.0)

Underlying profit before taxation 9.2 15.1 31.5

=========== =========== =============

3.2 Underlying earnings per share

Underlying earnings per share (EPS) is calculated as the total

of underlying profit before tax, less income tax, but excluding the

tax impact on separately disclosed items included in the

calculation of underlying profit less profit attributable to

non-controlling interests, divided by the weighted average number

of ordinary shares in issue during the year. Underlying earnings

per share is set out in note 8.

3.3 Capital employed and Return on Capital Employed (ROCE)

Capital employed is defined as net assets less right-of-use

assets, less cash and short-term deposits and after adding back

borrowings. Average capital employed is adjusted for the timing of

businesses acquired and after adding back cumulative amortisation

of customer relationships. Segmental ROCE is defined as the

underlying operating profit, divided by average capital employed.

The key performance indicator, Group post-tax ROCE, is defined as

underlying operating profit, less notional tax, calculated by

multiplying the effective tax rate by the underlying operating

profit, divided by average capital employed.

2021 2020 2020

Six months Six months Year

ended ended ended

30 June 30 June 31 December

GBPm GBPm GBPm

Net assets 247.8 316.2 235.9

Less right-of-use

assets (39.0) (24.4) (30.7)

Plus net borrowings 211.0 198.5 198.1

Capital employed 419.8 490.3 403.3

----------- ----------- -------------

Underlying operating

profit 13.3 19.5 40.5

Notional tax at the effective

tax rate (3.9) (4.1) (9.2)

----------- ----------- -------------

9.4 15.4 31.3

Average capital employed 459.2 471.9 467.6

Return on average capital employed 5.4% 6.6% 6.7%

----------- ----------- -------------

3.4 Cash conversion

Cash conversion is defined as the ratio of operating cash flow

to underlying operating profit. Operating cash flow comprises:

2021 2020 2020

Six months Six months Year

ended ended ended

30 June 30 June 31 December

GBPm GBPm GBPm

Cash generated from operations 3.6 66.4 98.4

Dividends from joint venture

undertakings 0.7 0.6 1.8

Capital element of lease repayments (6.6) (6.2) (13.0)

Other 1.0 0.1 0.5

----------- ----------- -------------

Operating cash flow (1.3) 60.9 87.7

Underlying operating

profit 13.3 19.5 40.5

Cash conversion (10)% 312% 217%

3.5 Underlying earnings before interest, tax, depreciation and amortisation (Ebitda)

Underlying Ebitda is defined as the underlying operating profit

before interest, tax, depreciation and amortisation.

2021 2020 2020

Six months Six months Year

ended ended ended

30 June 30 June 31 December

GBPm GBPm GBPm

Underlying operating

profit 13.3 19.5 40.5

Depreciation and

amortisation 21.1 23.3 48.0

Less: Deprecation on right-of-use

assets (5.6) (5.3) (10.9)

Amortisation of acquired intangibles

(note 5) (1.4) (1.5) (2.9)

----------- ----------- -------------

Underlying

Ebitda 27.4 36.0 74.7

----------- ----------- -------------

3.6 Underlying dividend cover

Underlying dividend cover is the ratio of the underlying diluted

earnings per share to the dividend per share.

pence pence pence

Underlying earnings

per share 12.8 23.6 47.9

Dividends per share - 8.0 8.0

Underlying dividend cover (times) - 3.0 6.0

3.7 Organic constant currency

Organic constant currency growth represents absolute growth,

adjusted for current and prior year acquisitions and for constant

currency. Constant currency takes the non-sterling results of the

prior year and re-translates them at the average exchange rate of

the current year.

3.8 Underlying net borrowings

Underlying net borrowings is net borrowings as set out in note

12, excluding right-of-use operating leases. The Group's banking

arrangements are based on underlying net borrowings.

2021 2020 2020

Six months Six months

ended 30 ended 30 Year ended

June June 31 December

GBPm GBPm GBPm

Net borrowings (note 12) 211.0 198.5 198.1

Less: right-of-use operating

leases (32.3) (25.4) (23.1)

178.7 173.1 175.0

----------- ----------- -------------

4 Segmental information

Management has determined that the Group has four operating

segments reviewed by the Board; Marine Support, Specialist

Technical, Offshore Oil and Tankships. Their principal activities

are set out in the Strategic Report within the consolidated

financial statements of the Group for the year ended 31 December

2020.

The Board assesses the performance of the segments based on

underlying operating profit. The Board believes that such

information is the most relevant in evaluating the results of

certain segments relative to other entities which operate within

these industries. Inter-segmental sales are made using prices

determined on an arms-length basis. Sector assets exclude cash,

short-term deposits and corporate assets that cannot reasonably be

allocated to operating segments. Sector liabilities exclude

borrowings, retirement benefit obligations and corporate

liabilities that cannot reasonably be allocated to operating

segments.

Six months ended 30 June 2021

Marine Specialist Offshore

Support Technical Oil Tankships Corporate Total

GBPm GBPm GBPm GBPm GBPm GBPm

Revenue

Segmental revenue

reported

- point in time 81.7 22.9 39.7 - - 144.3

- over time 16.1 45.4 - 28.6 - 90.1

Inter-segmental sales (0.1) (0.5) (0.1) - - (0.7)

97.7 67.8 39.6 28.6 - 233.7

======== =========== ========= ========== ========== ========

Underlying operating

profit 2.1 5.6 5.3 2.1 (1.8) 13.3

Separately disclosed

items (0.7) - (0.4) - - (1.1)

Operating profit 1.4 5.6 4.9 2.1 (1.8) 12.2

Net finance expense (4.1)

--------

Profit before tax 8.1

Income tax 5.5

Profit for the period 13.6

========

Assets & liabilities

Segmental assets 238.1 165.7 141.2 65.9 64.4 675.3

Investment in joint

ventures 2.1 3.3 2.3 - - 7.7

-------- ----------- --------- ---------- ---------- --------

Total assets 240.2 169.0 143.5 65.9 64.4 683.0

Segmental liabilities (77.3) (62.4) (27.6) (31.7) (236.2) (435.2)

162.9 106.6 115.9 34.2 (171.8) 247.8

======== =========== ========= ========== ========== ========

Other segmental information

Capital expenditure 2.3 0.8 2.3 0.9 0.2 6.5

Depreciation and amortisation 6.7 3.4 5.8 5.1 0.1 21.1

======== =========== ========= ========== ========== ========

Six months ended 30 June 2020

Marine Specialist Offshore

Support Technical Oil Tankships Corporate Total

GBPm GBPm GBPm GBPm GBPm GBPm

Revenue

Segmental revenue

reported

- point in time 106.0 18.7 40.2 - - 164.9

- over time 16.6 47.5 - 29.9 - 94.0

Inter-segmental sales (0.1) (0.5) (0.2) - - (0.8)

122.5 65.7 40.0 29.9 - 258.1

======== =========== ========= ========== ========== ========

Underlying operating

profit reported 4.8 7.5 5.4 3.6 (1.8) 19.5

Separately disclosed

items (4.3) (1.1) (2.6) - - (8.0)

Operating profit 0.5 6.4 2.8 3.6 (1.8) 11.5

Net finance expense (4.4)

--------

Profit before tax 7.1

Income tax (2.0)

Profit for the period 5.1

========

Assets & liabilities

Segmental assets 320.7 163.5 153.4 58.6 75.4 771.6

Investment in joint

ventures 3.5 3.0 2.4 - - 8.9

-------- ----------- --------- ---------- ---------- --------

Total assets 324.2 166.5 155.8 58.6 75.4 780.5

Segmental liabilities (101.5) (55.6) (30.4) (28.8) (248.0) (464.3)

222.7 110.9 125.4 29.8 (172.6) 316.2

======== =========== ========= ========== ========== ========

Other segment information

Capital expenditure 4.9 1.3 3.2 2.4 - 11.8

Depreciation and amortisation 8.0 3.3 6.5 5.3 0.2 23.3

======== =========== ========= ========== ========== ========

Year ended 31 December 2020

Marine Specialist Offshore

Support Technical Oil Tankships Corporate Total

GBPm GBPm GBPm GBPm GBPm GBPm

Revenue

Segmental revenue

reported

- point in time 225.3 42.2 80.1 - - 347.6

- over time 24.5 89.2 - 60.4 - 174.1

Inter-segmental sales (0.4) (1.0) (2.1) - - (3.5)

249.4 130.4 78.0 60.4 - 518.2

======== =========== ========= ========== ========== ========

Underlying operating

profit/(loss) 10.1 14.0 11.2 8.0 (2.8) 40.5

Separately disclosed

items (79.6) (1.6) (2.8) - - (84.0)

-------- ----------- --------- ---------- ---------- --------

Operating (loss)/profit (69.5) 12.4 8.4 8.0 (2.8) (43.5)

Net finance expense (9.0)

--------

Loss before tax (52.5)

Income tax (4.8)

Loss for the year (57.3)

========

Assets & liabilities

Segmental assets 246.7 156.0 139.4 53.5 89.0 684.6

Investment in joint

ventures 2.1 3.0 2.4 - - 7.5

-------- ----------- --------- ---------- ---------- --------

Total assets 248.8 159.0 141.8 53.5 89.0 692.1

Segmental liabilities (90.5) (57.6) (24.9) (22.2) (261.0) (456.2)

158.3 101.4 116.9 31.3 (172.0) 235.9

======== =========== ========= ========== ========== ========

Other segment information

Capital expenditure 7.1 1.9 5.4 3.1 - 17.5

Depreciation and amortisation 17.8 6.7 12.7 10.5 0.3 48.0

======== =========== ========= ========== ========== ========

5 Separately disclosed items

Certain items are disclosed separately in the financial

statements to provide a clearer understanding of the underlying

financial performance of the Group, referred to in note 3. They are

items that are non-recurring and significant by virtue of their

size and include acquisition related income or charges, costs of

material litigation, restructure or material impairment and related

items. Separately disclosed items comprise:

2021 2020 2020

Six months Six months Year

ended ended ended

30 June 30 June 31 December

GBPm GBPm GBPm

Acquisition related income and (expense):

Costs incurred on acquiring businesses - (0.2) (1.0)

Amortisation of acquired intangibles (1.4) (1.5) (2.9)

(1.4) (1.7) (3.9)

Marine Support restructure - (1.5) (3.9)

Disposal of businesses - - (3.5)

Disposal of dive support vessel 0.3 - -

Impairment charges - (4.8) (72.7)

Separately disclosed items before

taxation (1.1) (8.0) (84.0)

----------- ----------- ------------

Taxation 8.2 1.1 2.4

Separately disclosed items after taxation 7.1 (6.9) (81.6)

=========== =========== ============

During the six months ended 30 June 2021, the Group has

recognised a gain of GBP0.3m on disposal of one of its dive support

vessels, the Paladin. The vessel had operated in the Marine Support

division. Tax on separately disclosed items includes a credit of

GBP7.9m, which represents deferred tax recognised on the timing

differences created following the impairment of dive support

vessels during the year ended 31 December 2020 and the Group's

current expectations regarding Dive Support operations.

During 2020, following the impact of Covid-19 combined with a

sharp fall in energy prices, project work with Marine Support

sharply declined and the Group commenced a material restructure of

the division. A charge of GBP1.5m was recognised at June 2020 and

GBP3.9m at December 2020 in respect of this. There has been no

equivalent charge in 2021.

6 Net finance expense

2021 2020 2020

Six months Six months

ended ended Year ended

30 June 30 June 31 December

GBPm GBPm GBPm

Finance income:

Interest receivable on short-term

deposits 0.2 0.1 0.2

Finance expense:

Interest payable on bank loans and

overdrafts (3.2) (3.4) (7.2)

Net interest on pension obligations (0.1) (0.2) (0.1)

Unwind of discount on right-of-use

lease liability (1.0) (0.8) (1.8)

Unwind of discount on contingent consideration - (0.1) (0.1)

----------- ----------- ------------

(4.3) (4.5) (9.2)

Net finance expense (4.1) (4.4) (9.0)

=========== =========== ============

7 Taxation

The Group's effective rate on profit before income tax is

(67.3)% (30 June 2020: 28.2%, 31 December 2020: 9.1%) which

includes an exceptional tax credit of GBP7.9m as detailed in note

5. The effective income tax rate on underlying profit before income

tax, based on an estimated rate for the year ending 31 December

2021, is 29.3% (30 June 2020: 20.7%, 31 December 2020: 22.8%). This

is based on the estimated effective tax rate for the year to 31

December 2021. Of the total tax charge, GBP1.3m relates to overseas

businesses (30 June 2020: GBP2.0m). Taxation on profit has been

estimated based on rates of taxation applied to the profits

forecast for the full year.

8 Earnings per share

Basic earnings per share is calculated by dividing the profit

attributable to equity holders of the Company by the weighted

average number of ordinary shares in issue during the year, after

excluding 54,571 (June 2020: 9,227, December 2020: 9,227) ordinary

shares held by the James Fisher and Sons plc Employee Share

Ownership Trust (ESOT), as treasury shares. Diluted earnings per

share are calculated by dividing the net profit attributable to

ordinary equity holders of the Company by the weighted average

number of ordinary shares that would be issued on conversion of all

the dilutive potential ordinary shares into ordinary shares.

At 30 June 2021, 515,463 options (June 2020: 139,506, December

2020: 386,317) were excluded from the diluted weighted average

number of ordinary shares calculation as their effect would be

anti-dilutive. The average market value of the Company's shares for

purposes of calculating the dilutive effect of share options was

based on quoted market prices for the period during which the

options were outstanding.

Weighted average number of shares

30 June 30 June 31 December

2021 2020 2020

Number

Number of Number of of

shares shares shares

For basic earnings per ordinary share 50,350,082 50,332,654 50,342,732

Exercise of share options and LTIPs 17,692 107,576 85,973

For diluted earnings per ordinary

share 50,367,774 50,440,230 50,428,705

=========== =========== ============

Underlying earnings per share

To provide a better understanding of the underlying performance

of the Group, underlying earnings per share on continuing

activities is reported as an alternative performance measure (note

3).

2021 2020 2020

Six months Six months

ended ended Year ended

30 June 30 June 31 December

GBPm GBPm GBPm

Profit/(loss) attributable to owners

of the Company 13.5 5.0 (57.5)

Separately disclosed items 1.1 8.0 84.0

Tax on separately disclosed items (8.2) (1.1) (2.4)

Underlying profit attributable to

owners of the Company 6.4 11.9 24.1

=========== =========== ============

Earnings per share pence pence pence

Basic earnings per share 26.8 9.9 (114.2)

Diluted earnings per share 26.8 9.9 (114.2)

Underlying basic earnings per share 12.8 23.6 48.0

Underlying diluted earnings per share 12.8 23.6 47.9

9 Interim dividend

No interim dividend is proposed in respect of the period ended

30 June 2021 (2020: 8.0p).

10 Retirement benefit obligations

Movements during the period in the Group's defined benefit

pension schemes are set out below:

2021 2020 2020

Six months Six months

ended ended Year ended

30 June 30 June 31 December

GBPm GBPm GBPm

Net obligation as at 1 January (10.3) (5.8) (5.8)

Expense recognised in the income statement (0.1) (0.2) (0.2)

Contributions paid to scheme 1.0 1.2 5.0

Remeasurement gains and losses 2.8 (0.4) (9.3)

At period end (6.6) (5.2) (10.3)

=========== =========== ============

The Group's net liabilities in respect of its pension schemes

were as follows:

2021 2020 2020

Six months Six months Year

ended ended ended

30 June 30 June 31 December

GBPm GBPm GBPm

Shore Staff (5.3) (0.3) (8.8)

Merchant Navy Officers Pension Fund (1.1) (3.2) (1.3)

Merchant Navy Ratings Pension Fund (0.2) (1.7) (0.2)

(6.6) (5.2) (10.3)

=========== =========== ============

The principal assumptions in respect of these liabilities are

disclosed in the December 2020 Annual Report. The Group has not

obtained an interim valuation for the period ended 30 June 2021. In

the first half of 2021, the Group paid contributions to defined

benefit schemes of GBP1.0m (June 2020: GBP1.2m).

11 Goodwill

Movements during the period in the Group's goodwill are set out

below:

2021 2020 2020

Six months Six months Year

ended ended ended

30 June 30 June 31 December

GBPm GBPm GBPm

At 1 January 166.5 185.5 185.5

Impairment - - (17.0)

Exchange differences (0.7) (2.7) (2.0)

At period end 165.8 182.8 166.5

=========== =========== ============

At the half year, the results of the impairment tests carried

out in respect of the year ended 31 December 2020, were

reconsidered based on the Group's trading performance and revised

outlooks.

The recoverable amount of the cash generating units (CGU's) has

been assessed based on value in use calculations using cash

projections based on 5-year strategic plans which take into account

the impact of climate change and are approved by the Board. For all

CGU's a terminal value of cash flows beyond that date have been

calculated at a growth rate in line with management's long-term

expectations for the relevant market, using a growth rate of 0.6%.

The key assumptions used in the value in use calculations include

gross margin, discount rate, inflation of overheads and payroll and

growth rates.

Sensitivity to impairment

The Directors have carried out sensitivity analysis to determine

the impact on the carrying value of goodwill.

Sensitivities carried out across all CGU's included increasing

the discount rate by 2.0% and reducing the terminal growth to zero

and reducing operating profit by 25.0%. In all of the scenarios

analysed headroom remained positive.

12 Reconciliation of net borrowings

1 January Cash Other Exchange 30 June

2021 flow non-cash movement 2021

GBPm GBPm GBPm GBPm GBPm

Cash and cash equivalents 13.5 (1.6) - - 11.9

Debt due after 1 year (178.9) (2.7) (0.5) - (182.1)

Debt due within 1 year (0.2) 0.1 - - (0.1)

---------- ------ --------- --------- ------------

(179.1) (2.6) (0.5) - (182.2)

Lease liabilities (32.5) 6.6 (15.0) 0.2 (40.7)

Net borrowings (198.1) 2.4 (15.5) 0.2 (211.0)

========== ====== ========= ========= ============

1 January Cash Other Exchange 30 June

2020 flow non-cash movement 2020

*Restated

GBPm GBPm GBPm GBPm GBPm

Cash and cash equivalents 7.5 5.9 - (0.6) 12.8

Debt due after 1 year (207.4) 26.1 (0.1) (1.5) (182.9)

Debt due within 1 year (0.3) 0.1 - - (0.2)

---------- ------ --------- --------- ------------

(207.7) 26.2 (0.1) (1.5) (183.1)

Lease liabilities (30.2) 6.2 (3.8) (0.4) (28.2)

Net borrowings (230.4) 38.3 (3.9) (2.5) (198.5)

========== ====== ========= ========= ============

1 January Cash Other Exchange 31 December

2020 flow non-cash movement 2020

GBPm GBPm GBPm GBPm GBPm

Cash and cash equivalents 7.5 7.7 - (1.7) 13.5

Debt due after 1 year (207.4) 30.1 (0.7) (0.9) (178.9)

Debt due within 1 year (0.3) 0.1 - - (0.2)

---------- ------ --------- --------- ------------

(207.7) 30.2 (0.7) (0.9) (179.1)

Lease liabilities (30.2) 13.0 (15.4) 0.1 (32.5)

Net borrowings (230.4) 50.9 (16.1) (2.5) (198.1)

========== ====== ========= ========= ============

*Cash and cash equivalents restated for the period ended 30 June

2020 to include bank overdrafts repayable on demand.

Cash and cash equivalents comprise:

2021 2020 2020

As at As at Year ended

30 June 31 December

30 June Restated Restated

GBPm GBPm GBPm

Cash at bank and in hand 63.0 70.1 93.1

Overdrafts (51.1) (57.3) (79.6)

At period end 11.9 12.8 13.5

======== ========== ============

The Group operates a notional pooling and net overdraft facility

whereby cash and overdraft balances held with the same bank have a

legal right of offset. Where there is no intention to settle

amounts net, IAS 32 requires gross balance sheet presentation to

separate overdrafts and cash balances. The Group has restated both

the cash at bank and in hand and overdraft balances for 2020 to

show these amounts gross.

This adjustment has no impact on the Group's prior year net

profit or loss, net assets or cash flow statements.

The prior periods have been restated for this adjustment as

follows:

As

Restated

2020 2020

As at As at

30 June Adjustment 30 June

GBPm GBPm GBPm

Cash at bank and in hand 20.8 49.3 70.1

Overdrafts (8.0) (49.3) (57.3)

12.8 - 12.8

======== =========== =========

As

Restated

2020 2020

Year ended Year ended

31 December Adjustment 31 December

GBPm GBPm GBPm

Cash at bank and in hand 23.9 69.2 93.1

Overdrafts (10.4) (69.2) (79.6)

13.5 - 13.5

============ =========== ============

13 Assets held for sale

In June 2021, management agreed a plan to sell the dive support

vessel known as the Swordfish within the Marine Support division

and consequently GBP10.5m relating to vessels has been reclassified

from property, plant and equipment.

In May 2021, management agreed to dispose of certain non-core

businesses within the Marine Support division. The disposal group

comprises GBP4.7m of assets and GBP1.7m of liabilities.

Both disposals are expected to complete by the end of 2021.

14 Commitments and contingencies

Capital commitments at 30 June 2021 were GBPnil (2020: GBP0.9m;

31 December: GBPnil).

Contingent liabilities

(a) In the ordinary course of the Company's business, counter

indemnities have been given to banks in respect of custom bonds,

foreign exchange commitments and bank guarantees.

(b) A Group VAT registration is operated by the Company and six

Group undertakings in respect of which the Company is jointly and

severally liable for all amounts due to HM Revenue & Customs

under the arrangement.

(c) A guarantee has been issued by the Group and Company to

charter parties in respect of obligations of a subsidiary, James

Fisher Everard Limited, in respect of charters relating to nine

vessels. The charters expire between 2021 and 2024.

(d) Subsidiaries of the Group have issued performance and

payment guarantees to third parties with a total value of GBP38.4m

(June 2020: GBP81.3m, December 2020: GBP48.2m).

(e) The Group is liable for further contributions in the future

to the MNOPF and MNRPF if additional actuarial deficits arise or if

other employers liable for contributions are not able to pay their

share. The Group and Company remains jointly and severally liable

for any future shortfall in recovery of the MNOPF deficit.

(f) The Group has given an unlimited guarantee to the Singapore

Navy in respect of the performance of First Response Marine Pte

Ltd, its Singapore joint venture, in relation to the provision of

submarine rescue and related activities.

(g) In the normal course of business, the Company and certain

subsidiaries have given parental and subsidiary guarantees in

support of loan and banking arrangements.

(h) The Company and its subsidiaries may be parties to legal

proceedings and claims which arise in the ordinary course of

business, and can be material in value. Disclosure of contingent

liabilities or appropriate provision has been made in these

accounts where, in the opinion of the Directors, liabilities may

materialise. Other than provisions made against certain receivables

and claims, described in note 33 (b) estimates of the last filed

annual report, there are no other significant provisions and no

individually significant contingent liabilities that required

specific disclosure.

15 Related parties

Excepting the change of Directors and the acquisition of Subsea

Engenuity, there were no material changes to related parties or

associated transactions from those disclosed in the Annual Report

for the year ended 31 December 2020.

Independent review report to James Fisher and Sons plc

Conclusion

We have been engaged by the company to review the condensed set

of financial statements in the half-yearly financial report for the

six months ended 30 June 2021 which comprises condensed

consolidated income statement, the condensed consolidated statement

of comprehensive income, the condensed consolidated balance sheet,

the condensed consolidated cash flow statement, the condensed

consolidated statement of changes in equity and the related

explanatory notes.

Based on our review, nothing has come to our attention that

causes us to believe that the condensed set of financial statements

in the half-yearly financial report for the six months ended 30

June 2021 is not prepared, in all material respects, in accordance

with IAS 34 Interim Financial Reporting as adopted by the EU and

the Disclosure Guidance and Transparency Rules ("the DTR") of the

UK's Financial Conduct Authority ("the UK FCA").

Scope of review

We conducted our review in accordance with International

Standard on Review Engagements (UK and Ireland) 2410 Review of

Interim Financial Information Performed by the Independent Auditor

of the Entity issued by the Auditing Practices Board for use in the

UK. A review of interim financial information consists of making

enquiries, primarily of persons responsible for financial and

accounting matters, and applying analytical and other review

procedures. We read the other information contained in the

half-yearly financial report and consider whether it contains any

apparent misstatements or material inconsistencies with the

information in the condensed set of financial statements.

A review is substantially less in scope than an audit conducted

in accordance with International Standards on Auditing (UK) and

consequently does not enable us to obtain assurance that we would

become aware of all significant matters that might be identified in

an audit. Accordingly, we do not express an audit opinion.

Directors' responsibilities

The half-yearly financial report is the responsibility of, and

has been approved by, the directors. The directors are responsible

for preparing the half-yearly financial report in accordance with

the DTR of the UK FCA.

As disclosed in note 1, the annual financial statements of the

company are prepared in accordance with International Financial

Reporting Standards as adopted by the EU. The directors are

responsible for preparing the condensed set of financial statements

included in the half-yearly financial report in accordance with IAS

34 as adopted by the EU.

The annual financial statements of the group are prepared in

accordance with International Financial Reporting Standards as

adopted by the EU. The directors are responsible for preparing the

condensed set of financial statements included in the half-yearly

financial report in accordance with IAS 34 as adopted by the

EU.

Our responsibility

Our responsibility is to express to the company a conclusion on

the condensed set of financial statements in the half-yearly

financial report based on our review.

The purpose of our review work and to whom we owe our

responsibilities

This report is made solely to the company in accordance with the

terms of our engagement to assist the company in meeting the

requirements of the DTR of the UK FCA. Our review has been

undertaken so that we might state to the company those matters we

are required to state to it in this report and for no other

purpose. To the fullest extent permitted by law, we do not accept

or assume responsibility to anyone other than the company for our

review work, for this report, or for the conclusions we have

reached.

Mike Barradell

for and on behalf of KPMG LLP

Chartered Accountants

1 St Peters Square

Manchester

M2 3AE

6 September 2021

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FLFEAADIRIIL

(END) Dow Jones Newswires

September 07, 2021 02:00 ET (06:00 GMT)

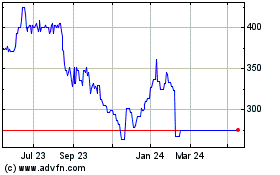

Fisher James And Sons (AQSE:FSJ.GB)

Historical Stock Chart

From Nov 2024 to Dec 2024

Fisher James And Sons (AQSE:FSJ.GB)

Historical Stock Chart

From Dec 2023 to Dec 2024