0000732026

TRIO-TECH INTERNATIONAL

false

--06-30

Q1

2025

215

209

734

679

0

0

15,000,000

15,000,000

4,250,305

4,250,305

4,250,305

4,250,305

2,000

6

15

4

0

0

6

0

7

17

1.25

1.25

2

1.25

1.25

2

http://fasb.org/us-gaap/2024#PrimeRateMember

http://fasb.org/us-gaap/2024#PrimeRateMember

2.00

2.00

4.85

4.6

2,151

2,208

3.2

3.2

3.0

3.0

3.0

3.0

0

0

0

0

10

5

5

0

0

0

0

0

0

17

1

4

false

false

false

false

100% owned by Trio-Tech International Pte. Ltd.

For periods in which the Company has reported net loss, diluted net loss per share attributable to common stockholders is the same as basic net loss per share attributable to common stockholders, because dilutive common shares are not assumed to have been issued if their effect is anti-dilutive.

00007320262024-07-012024-09-30

xbrli:shares

00007320262024-11-01

iso4217:USD

00007320262024-09-30

00007320262024-06-30

iso4217:USDxbrli:shares

0000732026trt:SemiconductorBackendSolutionsMember2024-07-012024-09-30

0000732026trt:SemiconductorBackendSolutionsMember2023-07-012023-09-30

0000732026trt:IndustrialElectronicsMember2024-07-012024-09-30

0000732026trt:IndustrialElectronicsMember2023-07-012023-09-30

0000732026us-gaap:ProductAndServiceOtherMember2024-07-012024-09-30

0000732026us-gaap:ProductAndServiceOtherMember2023-07-012023-09-30

00007320262023-07-012023-09-30

0000732026us-gaap:CommonStockMember2024-06-30

0000732026us-gaap:AdditionalPaidInCapitalMember2024-06-30

0000732026us-gaap:RetainedEarningsMember2024-06-30

0000732026us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-06-30

0000732026us-gaap:NoncontrollingInterestMember2024-06-30

0000732026us-gaap:CommonStockMember2024-07-012024-09-30

0000732026us-gaap:AdditionalPaidInCapitalMember2024-07-012024-09-30

0000732026us-gaap:RetainedEarningsMember2024-07-012024-09-30

0000732026us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-07-012024-09-30

0000732026us-gaap:NoncontrollingInterestMember2024-07-012024-09-30

0000732026us-gaap:CommonStockMember2024-09-30

0000732026us-gaap:AdditionalPaidInCapitalMember2024-09-30

0000732026us-gaap:RetainedEarningsMember2024-09-30

0000732026us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-09-30

0000732026us-gaap:NoncontrollingInterestMember2024-09-30

0000732026us-gaap:CommonStockMember2023-06-30

0000732026us-gaap:AdditionalPaidInCapitalMember2023-06-30

0000732026us-gaap:RetainedEarningsMember2023-06-30

0000732026us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-30

0000732026us-gaap:NoncontrollingInterestMember2023-06-30

00007320262023-06-30

0000732026us-gaap:CommonStockMember2023-07-012023-09-30

0000732026us-gaap:AdditionalPaidInCapitalMember2023-07-012023-09-30

0000732026us-gaap:RetainedEarningsMember2023-07-012023-09-30

0000732026us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-07-012023-09-30

0000732026us-gaap:NoncontrollingInterestMember2023-07-012023-09-30

0000732026us-gaap:CommonStockMember2023-09-30

0000732026us-gaap:AdditionalPaidInCapitalMember2023-09-30

0000732026us-gaap:RetainedEarningsMember2023-09-30

0000732026us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-09-30

0000732026us-gaap:NoncontrollingInterestMember2023-09-30

00007320262023-09-30

xbrli:pure

0000732026trt:ExpressTestCorporationDormantMember2024-09-30

0000732026trt:TrioTechReliabilityServicesDormantMember2024-09-30

0000732026trt:KtsIncorporatedDbaUniversalSystemsDormantMember2024-09-30

0000732026trt:EuropeanElectronicTestCentreDormantMember2024-09-30

0000732026trt:TrioTechInternationalPteLtdMember2024-09-30

0000732026trt:UniversalFarEastPteLtdMember2024-09-30

0000732026trt:TriotechInternationalThailandCoLtdMember2024-09-30

0000732026trt:TriotechBangkokCoLtdMember2024-09-30

0000732026trt:TriotechMalaysiaSdnBhdMember2024-09-30

0000732026trt:TriotechKualaLumpurSdnBhdMember2024-09-30

0000732026trt:PrestalEnterpriseSdnBhdMember2024-09-30

0000732026trt:TrioTechSipCoLtdMember2024-09-30

0000732026trt:TriotechChongqingCoLtdMember2024-09-30

0000732026trt:ShiInternationalPteLtdDormantMember2024-09-30

0000732026trt:PtShiIndonesiaDormantMember2024-09-30

0000732026trt:TriotechTianjinCoLtdMember2024-09-30

0000732026trt:TriotechJiangsuCoLtdMember2024-09-30

0000732026trt:TriotechTianjinCoLtdMember2024-09-30

00007320262023-07-012024-06-30

iso4217:CNY

0000732026trt:MaoYeMember2024-09-30

0000732026trt:MaoYeMember2024-06-30

0000732026trt:JiangHuaiMember2024-09-30

0000732026trt:JiangHuaiMember2024-06-30

0000732026trt:FuliMember2024-09-30

0000732026trt:FuliMember2024-06-30

0000732026trt:MaoYeMember2024-07-012024-09-30

0000732026trt:MaoYeMember2023-07-012023-09-30

0000732026trt:MaoYeMember2023-02-012023-02-01

0000732026trt:JiangHuaiMember2009-07-012010-06-30

0000732026trt:JiangHuaiMember2024-07-012024-07-31

0000732026trt:JiangHuaiMember2024-07-012024-09-30

0000732026trt:JiangHuaiMember2023-07-012023-09-30

0000732026trt:FuliMember2024-07-012024-09-30

0000732026trt:FuliMember2023-07-012023-09-30

0000732026trt:FuliMemberus-gaap:SubsequentEventMember2024-10-102024-10-10

0000732026country:CN2024-07-012024-09-30

0000732026country:CN2023-07-012023-09-30

00007320262021-04-012021-06-30

0000732026trt:TrioTechInternationalPteLtdMember2023-07-012023-09-30

0000732026trt:TrioTechInternationalPteLtdMember2024-09-30

0000732026trt:UniversalFarEastPteLtdMember2023-07-012023-09-30

0000732026trt:UniversalFarEastPteLtdMember2024-09-30

0000732026trt:TriotechMalaysiaSdnBhdMember2023-07-012023-09-30

0000732026trt:TriotechMalaysiaSdnBhdMember2024-09-30

0000732026trt:TrioTechInternationalPteLtdMembersrt:MaximumMember2022-07-012023-06-30

0000732026trt:TrioTechInternationalPteLtdMember2024-06-30

0000732026trt:UniversalFarEastPteLtdMembersrt:MaximumMember2022-07-012023-06-30

0000732026trt:UniversalFarEastPteLtdMember2024-06-30

0000732026trt:TriotechMalaysiaSdnBhdMember2022-07-012023-06-30

0000732026trt:TriotechMalaysiaSdnBhdMember2024-06-30

thunderdome:item

0000732026trt:NotesPayableToBanks1Member2024-07-012024-09-30

0000732026trt:NotesPayableToBanks1Member2023-07-012024-06-30

0000732026trt:NotesPayableToBanks1Member2024-09-30

0000732026trt:NotesPayableToBanks1Member2024-06-30

0000732026trt:NotesPayableToBanks2Member2024-09-30

0000732026trt:NotesPayableToBanks2Member2024-06-30

0000732026trt:NotesPayableToBank3Member2024-09-30

0000732026trt:NotesPayableToBank3Member2024-06-30

0000732026trt:NotesPayableToBank4Member2024-09-30

0000732026trt:NotesPayableToBank4Member2024-06-30

0000732026us-gaap:IntersegmentEliminationMember2024-07-012024-09-30

0000732026us-gaap:IntersegmentEliminationMember2023-07-012023-09-30

0000732026us-gaap:OperatingSegmentsMembertrt:SemiconductorBackendSolutionsMember2024-07-012024-09-30

0000732026us-gaap:OperatingSegmentsMembertrt:SemiconductorBackendSolutionsMember2024-09-30

0000732026us-gaap:OperatingSegmentsMembertrt:SemiconductorBackendSolutionsMember2023-07-012023-09-30

0000732026us-gaap:OperatingSegmentsMembertrt:SemiconductorBackendSolutionsMember2023-09-30

0000732026us-gaap:OperatingSegmentsMembertrt:IndustrialElectronicsMember2024-07-012024-09-30

0000732026us-gaap:OperatingSegmentsMembertrt:IndustrialElectronicsMember2024-09-30

0000732026us-gaap:OperatingSegmentsMembertrt:IndustrialElectronicsMember2023-07-012023-09-30

0000732026us-gaap:OperatingSegmentsMembertrt:IndustrialElectronicsMember2023-09-30

0000732026us-gaap:CorporateNonSegmentMember2024-07-012024-09-30

0000732026us-gaap:CorporateNonSegmentMember2024-09-30

0000732026us-gaap:CorporateNonSegmentMember2023-07-012023-09-30

0000732026us-gaap:CorporateNonSegmentMember2023-09-30

0000732026trt:FinancialAssistanceReceivedFromTheSingaporeGovernmentMember2024-07-012024-09-30

0000732026trt:FinancialAssistanceReceivedFromTheChineseGovernmentMember2024-07-012024-09-30

0000732026trt:FinancialAssistanceReceivedFromTheSingaporeGovernmentMember2023-07-012023-09-30

0000732026trt:EmployeeRetentionCreditMember2023-07-012023-09-30

utr:Y

0000732026srt:MinimumMember2024-07-012024-09-30

0000732026srt:MaximumMember2024-07-012024-09-30

0000732026srt:MinimumMember2023-07-012024-06-30

0000732026srt:MaximumMember2023-07-012024-06-30

0000732026srt:MinimumMember2023-07-012023-09-30

0000732026srt:MaximumMember2023-07-012023-09-30

0000732026trt:EmployeeStockOptionPlan2017Member2017-09-24

0000732026trt:EmployeeStockOptionPlan2017Member2021-12-012021-12-31

0000732026trt:EmployeeStockOptionPlan2017Member2021-12-31

0000732026trt:EmployeeStockOptionPlan2017Memberus-gaap:ShareBasedCompensationAwardTrancheOneMember2021-12-012021-12-31

0000732026trt:EmployeeStockOptionPlan2017Member2024-07-012024-09-30

0000732026trt:EmployeeStockOptionPlan2017Member2023-07-012023-09-30

0000732026trt:EmployeeStockOptionPlan2017Member2024-09-30

0000732026trt:EmployeeStockOptionPlan2017Member2023-09-30

0000732026trt:EmployeeStockOptionPlan2017Member2024-06-30

0000732026trt:EmployeeStockOptionPlan2017Member2023-07-012024-06-30

0000732026trt:EmployeeStockOptionPlan2017Member2023-06-30

0000732026trt:EmployeeStockOptionPlan2017Member2022-07-012023-06-30

0000732026trt:DirectorPlan2017Member2017-09-24

0000732026trt:DirectorPlan2017Member2020-09-012020-09-30

0000732026trt:DirectorPlan2017Member2020-09-30

0000732026trt:DirectorPlan2017Member2023-10-31

0000732026trt:DirectorPlan2017Member2024-07-012024-09-30

0000732026trt:DirectorPlan2017Member2023-07-012023-09-30

0000732026trt:DirectorPlan2017Member2024-09-30

0000732026trt:DirectorPlan2017Member2023-09-30

0000732026trt:DirectorPlan2017Member2024-06-30

0000732026trt:DirectorPlan2017Member2023-07-012024-06-30

0000732026trt:DirectorPlan2017Member2023-06-30

0000732026trt:DirectorPlan2017Member2022-07-012023-06-30

utr:M

0000732026srt:MinimumMember2024-09-30

0000732026srt:MaximumMember2024-09-30

0000732026us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMembertrt:CustomerAMember2024-07-012024-09-30

0000732026us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMembertrt:CustomerAMember2023-07-012023-09-30

0000732026us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMembertrt:CustomerBMember2024-07-012024-09-30

0000732026us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMembertrt:CustomerBMember2023-07-012023-09-30

0000732026us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMembertrt:CustomerCMember2024-07-012024-09-30

0000732026us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMembertrt:CustomerCMember2023-07-012023-09-30

0000732026us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMembertrt:CustomerAMember2024-07-012024-09-30

0000732026us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMembertrt:CustomerAMember2023-07-012023-09-30

0000732026us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMembertrt:CustomerBMember2024-07-012024-09-30

0000732026us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMembertrt:CustomerBMember2023-07-012023-09-30

0000732026us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMembertrt:CustomerCMember2024-07-012024-09-30

0000732026us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMembertrt:CustomerCMember2023-07-012023-09-30

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

☑ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Quarterly Period Ended September 30, 2024

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Transition Period from ___ to ___

Commission File Number 1-14523

TRIO-TECH INTERNATIONAL

(Exact name of Registrant as specified in its Charter)

| California | 95-2086631 |

| (State or other jurisdiction of | (I.R.S. Employer |

| incorporation or organization) | Identification Number) |

| | |

| Block 1008 Toa Payoh North | |

| Unit 03-09 Singapore | 318996 |

| (Address of principal executive offices) | (Zip Code) |

Registrant's Telephone Number, Including Area Code: (65) 6265 3300

Securities registered pursuant to Section 12(b) of the Act:

| | | Name of each exchange |

| Title of each class | Trading Symbol | on which registered |

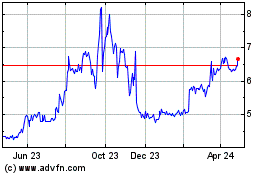

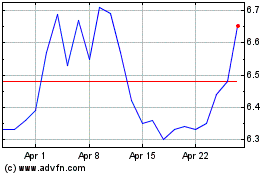

| Common Stock, no par value | TRT | NYSE American |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-‐accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and "emerging growth company" in Rule 12b-‐2 of the Exchange Act. (Check one):

| Large Accelerated Filer | ☐ | | Accelerated Filer | ☐ |

| Non-Accelerated Filer | ☒ | | Smaller reporting company | ☒ |

| | | | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of November 1, 2024, there were 4,250,305 shares of the issuer’s Common Stock, no par value, outstanding.

TRIO-TECH INTERNATIONAL

INDEX TO CONDENSED CONSOLIDATED FINANCIAL INFORMATION, OTHER INFORMATION AND SIGNATURE

| |

|

Page |

| Part I. |

Financial Information |

|

| |

|

|

| Item 1. |

Financial Statements |

1 |

| |

(a) Condensed Consolidated Balance Sheets as of September 30, 2024 (Unaudited), and June 30, 2024 |

1 |

| |

(b) Condensed Consolidated Statements of Operations and Comprehensive Income / (Loss) for the Three Months Ended September 30, 2024 (Unaudited), and September 30, 2023 (Unaudited) |

2 |

| |

(c) Condensed Consolidated Statements of Shareholders’ Equity for the Three Months Ended September 30, 2024 (Unaudited), and September 30, 2023 (Unaudited) |

4 |

| |

(d) Condensed Consolidated Statements of Cash Flows for the Three Months Ended September 30, 2024 (Unaudited), and September 30, 2023 (Unaudited) |

5 |

| |

(e) Notes to Condensed Consolidated Financial Statements (Unaudited) |

6 |

| Item 2. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

26 |

| Item 3. |

Quantitative and Qualitative Disclosures about Market Risk |

35 |

| Item 4. |

Controls and Procedures |

35 |

| |

|

|

| Part II. |

Other Information |

|

| |

|

|

| Item 1. |

Legal Proceedings |

36 |

| Item 1A. |

Risk Factors |

36 |

| Item 2. |

Unregistered Sales of Equity Securities and Use of Proceeds |

36 |

| Item 3. |

Defaults upon Senior Securities |

36 |

| Item 4. |

Mine Safety Disclosures |

36 |

| Item 5. |

Other Information |

36 |

| Item 6. |

Exhibits |

36 |

| |

|

|

| Signatures |

37 |

FORWARD-LOOKING STATEMENTS

The discussions of Trio-Tech International’s (the “Company”) business and activities set forth in this Quarterly Report on Form 10-Q (this “Quarterly Report”) and in other past and future reports and announcements by the Company may contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and assumptions regarding future activities and results of operations of the Company. In light of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, the following factors, among others, could cause actual results to differ materially from those reflected in any forward-looking statements made by or on behalf of the Company: market acceptance of Company products and services; changing business conditions or technologies and volatility in the semiconductor industry, which could affect demand for the Company’s products and services; the impact of competition; problems with technology; product development schedules; delivery schedules; changes in military or commercial testing specifications which could affect the market for the Company’s products and services; difficulties in profitably integrating acquired businesses, if any, into the Company; or the divestiture in the future of one or more business segments; risks associated with conducting business internationally and especially in Asia, including currency fluctuations and devaluation, currency restrictions, local laws and restrictions and possible social, political and economic instability; changes in U.S. and global financial and equity markets, including market disruptions and significant interest rate fluctuations; the trade tension between U.S. and China; inflation; the war in Ukraine and Russia, the war between Israel and Hamas; other economic, financial and regulatory factors beyond the Company’s control and uncertainties relating to our ability to operate our business in China; uncertainties regarding the enforcement of laws and the fact that rules and regulation in China can change quickly with little advance notice, along with the risk that the Chinese government may intervene or influence our operation at any time, or may exert more control over offerings conducted overseas and/or foreign investment in China-based issuers could result in a material change in our operations, financial performance and/or the value of our common stock, no par value (“Common Stock”), or impair our ability to raise money. Other than statements of historical fact, all statements made in this Quarterly Report are forward-looking, including, but not limited to, statements regarding industry prospects, future results of operations or financial position, and statements of our intent, belief and current expectations about our strategic direction, prospective and future financial results and condition. In some cases, you can identify forward-looking statements by the use of terminology such as “may,” “will,” “expects,” “plans,” “anticipates,” “estimates,” “potential,” “believes,” “can impact,” “continue,” or the negative thereof or other comparable terminology. Forward-looking statements involve risks and uncertainties that are inherently difficult to predict, which could cause actual outcomes and results to differ materially from our expectations, forecasts and assumptions.

Unless otherwise required by law, we undertake no obligation to update forward-looking statements to reflect subsequent events, changed circumstances, or the occurrence of unanticipated events. You are cautioned not to place undue reliance on such forward-looking statements.

PART I. FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

TRIO-TECH INTERNATIONAL AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS (IN THOUSANDS, EXCEPT NUMBER OF SHARES)

| | | September 30, | | | June 30, | |

| | | 2024 | | | 2024 | |

| | | (Unaudited) | | | | | |

| ASSETS | | | | | | | | |

| CURRENT ASSETS: | | | | | | | | |

| Cash and cash equivalents | | $ | 8,948 | | | $ | 10,035 | |

| Short-term deposits | | | 6,509 | | | | 6,497 | |

| Trade accounts receivable, less allowance for expected credit losses of $215 and $209, respectively | | | 12,094 | | | | 10,661 | |

| Other receivables | | | 655 | | | | 541 | |

| Inventories, less provision for obsolete inventories of $734 and $679, respectively | | | 2,872 | | | | 3,162 | |

| Prepaid expense and other current assets | | | 593 | | | | 536 | |

| Restricted term deposits | | | 804 | | | | 750 | |

| Total current assets | | | 32,475 | | | | 32,182 | |

| NON-CURRENT ASSETS: | | | | | | | | |

| Deferred tax assets | | | 139 | | | | 124 | |

| Investment properties, net | | | 404 | | | | 407 | |

| Property, plant and equipment, net | | | 6,273 | | | | 5,937 | |

| Operating lease right-of-use assets | | | 1,626 | | | | 1,887 | |

| Other assets | | | 125 | | | | 232 | |

| Restricted term deposits | | | 1,898 | | | | 1,771 | |

| Total non-current assets | | | 10,465 | | | | 10,358 | |

| TOTAL ASSETS | | $ | 42,940 | | | $ | 42,540 | |

| | | | | | | | | |

| LIABILITIES | | | | | | | | |

| CURRENT LIABILITIES: | | | | | | | | |

| Accounts payable | | $ | 2,375 | | | $ | 3,175 | |

| Accrued expense | | | 3,260 | | | | 3,634 | |

| Contract liabilities | | | 827 | | | | 754 | |

| Income taxes payable | | | 244 | | | | 379 | |

| Current portion of bank loans payable | | | 289 | | | | 261 | |

| Current portion of finance leases | | | 49 | | | | 57 | |

| Current portion of operating leases | | | 1,095 | | | | 1,162 | |

| Total current liabilities | | | 8,139 | | | | 9,422 | |

| NON-CURRENT LIABILITIES: | | | | | | | | |

| Bank loans payable, net of current portion | | | 634 | | | | 613 | |

| Finance leases, net of current portion | | | 24 | | | | 34 | |

| Operating leases, net of current portion | | | 531 | | | | 725 | |

| Income taxes payable, net of current portion | | | 142 | | | | 141 | |

| Other non-current liabilities | | | 30 | | | | 27 | |

| Total non-current liabilities | | | 1,361 | | | | 1,540 | |

| TOTAL LIABILITIES | | $ | 9,500 | | | $ | 10,962 | |

| | | | | | | | | |

| EQUITY | | | | | | | | |

| SHAREHOLDERS’ EQUITY: | | | | | | | | |

| Common stock, no par value, 15,000,000 shares authorized; 4,250,305 shares issued outstanding as at September 30, 2024 and June 30, 2024, respectively | | $ | 13,325 | | | $ | 13,325 | |

| Paid-in capital | | | 5,602 | | | | 5,531 | |

| Accumulated retained earnings | | | 11,577 | | | | 11,813 | |

| Accumulated other comprehensive income-translation adjustments | | | 2,548 | | | | 660 | |

| Total shareholders’ equity | | | 33,052 | | | | 31,329 | |

| Non-controlling interest | | | 388 | | | | 249 | |

| TOTAL EQUITY | | $ | 33,440 | | | $ | 31,578 | |

| TOTAL LIABILITIES AND EQUITY | | $ | 42,940 | | | $ | 42,540 | |

See notes to condensed consolidated financial statements.

TRIO-TECH INTERNATIONAL AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME / (LOSS)

UNAUDITED (IN THOUSANDS, EXCEPT EARNINGS PER SHARE)

| | | Three Months Ended | |

| | | September 30, | | | September 30, | |

| | | 2024 | | | 2023 | |

| Revenue | | | | | | | | |

| Semiconductor Back-end Solutions | | $ | 6,879 | | | $ | 7,176 | |

| Industrial Electronics | | | 2,914 | | | | 2,783 | |

| Others | | | 6 | | | | 7 | |

| | | | 9,799 | | | | 9,966 | |

| | | | | | | | | |

| Cost of Sales | | | 7,477 | | | | 7,446 | |

| | | | | | | | | |

| Gross Margin | | | 2,322 | | | | 2,520 | |

| | | | | | | | | |

| Operating Expense: | | | | | | | | |

| General and administrative | | | 1,964 | | | | 2,158 | |

| Selling | | | 150 | | | | 187 | |

| Research and development | | | 88 | | | | 85 | |

| (Gain) / Loss on disposal of property, plant and equipment | | | (13 | ) | | | 91 | |

| Total operating expense | | | 2,189 | | | | 2,521 | |

| | | | | | | | | |

| Income / (Loss) from Operations | | | 133 | | | | (1 | ) |

| | | | | | | | | |

| Other (Expense) / Income | | | | | | | | |

| Interest expense | | | (13 | ) | | | (24 | ) |

| Other (expense) / income, net | | | (365 | ) | | | 196 | |

| Government grant | | | 66 | | | | 73 | |

| Total other (expense) / income | | | (312 | ) | | | 245 | |

| | | | | | | | | |

| (Loss) / Income from Continuing Operations before Income Taxes | | | (179 | ) | | | 244 | |

| | | | | | | | | |

| Income Tax Expense | | | (51 | ) | | | (37 | ) |

| | | | | | | | | |

| (Loss) / Income from Continuing Operations before Non-controlling Interest, Net of Taxes | | | (230 | ) | | | 207 | |

| | | | | | | | | |

| Discontinued Operations | | | | | | | | |

| Loss from discontinued operations, net of tax | | | 7 | | | | - | |

| Net (Loss) / Income | | | (223 | ) | | | 207 | |

| | | | | | | | | |

| Less: Net income / (loss) attributable to non-controlling interest | | | 13 | | | | (23 | ) |

| Net (Loss) / Income Attributable to Common Shareholders | | $ | (236 | ) | | $ | 230 | |

| | | | | | | | | |

| Amounts Attributable to Common Shareholders: | | | | | | | | |

| (Loss) / Income from continuing operations, net of tax | | | (240 | ) | | | 227 | |

| Income from discontinued operations, net of tax | | | 4 | | | | 3 | |

| Net (Loss) / Income Attributable to Common Shareholders | | $ | (236 | ) | | $ | 230 | |

| | | | | | | | | |

| Basic (Loss) / Earnings per Share: | | | | | | | | |

| Basic (loss) / earnings per share from continuing operations | | $ | (0.06 | ) | | $ | 0.06 | |

| Basic earnings per share from discontinued operations | | $ | - | | | $ | - | |

| Basic (Loss) / Earnings per Share from Net (Loss) / Income | | $ | (0.06 | ) | | $ | 0.06 | |

| | | | | | | | | |

| Diluted (Loss) / Earnings per Share: | | | | | | | | |

| Diluted (loss) / earnings per share from continuing operations | | $ | (0.06 | ) | | $ | 0.05 | |

| Diluted earnings per share from discontinued operations | | $ | - | | | $ | - | |

| Diluted (Loss) / Earnings per Share from Net (Loss) / Income | | $ | (0.06 | ) | | $ | 0.05 | |

| | | | | | | | | |

| Weighted Average Number of Common Shares Outstanding | | | | | | | | |

| Basic | | | 4,250 | | | | 4,096 | |

| Dilutive effect of stock options | | | 85 | | | | 184 | |

| Number of Shares Used to Compute Earnings Per Share Diluted | | | 4,335 | | | | 4,280 | |

See notes to condensed consolidated financial statements.

TRIO-TECH INTERNATIONAL AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

UNAUDITED (IN THOUSANDS)

| | | Three Months Ended | |

| | | Sept. 30, | | | Sept. 30, | |

| | | 2024 | | | 2023 | |

| Comprehensive Income Attributable to Common Shareholders: | | | | | | | | |

| | | | | | | | | |

| Net (loss) / income | | $ | (223 | ) | | $ | 207 | |

| Foreign currency translation, net of tax | | | 2,014 | | | | (183 | ) |

| Comprehensive Income | | | 1,791 | | | | 24 | |

| Less: comprehensive income / (loss) attributable to non- controlling interest | | | 139 | | | | (2 | ) |

| Comprehensive Income Attributable to Common Shareholders | | $ | 1,652 | | | $ | 26 | |

See notes to condensed consolidated financial statements.

TRIO-TECH INTERNATIONAL AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY

UNAUDITED (IN THOUSANDS)

Three months ended September 30, 2024

| | | | | | | | | | | | | | | | | | | Accumulated | | | | | | | | | |

| | | | | | | | | | | | | | | Accumulated | | | Other | | | Non- | | | | | |

| | | Common Stock | | | Paid-in | | | Retained | | | Comprehensive | | | controlling | | | | | |

| | | Shares | | | Amount | | | Capital | | | Earnings | | | Income | | | Interest | | | Total | |

| | | | | | | $ | | | $ | | | $ | | | $ | | | $ | | | $ | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance at June 30, 2024 | | | 4,250 | | | | 13,325 | | | | 5,531 | | | | 11,813 | | | | 660 | | | | 249 | | | | 31,578 | |

| Stock option expense | | | - | | | | - | | | | 71 | | | | - | | | | - | | | | - | | | | 71 | |

| Net (loss) / income | | | - | | | | - | | | | - | | | | (236 | ) | | | - | | | | 13 | | | | (223 | ) |

| Translation adjustment | | | - | | | | - | | | | - | | | | - | | | | 1,888 | | | | 126 | | | | 2,014 | |

| Balance at September 30, 2024 | | | 4,250 | | | | 13,325 | | | | 5,602 | | | | 11,577 | | | | 2,548 | | | | 388 | | | | 33,440 | |

Three months ended September 30, 2023

| | | | | | | | | | | | | | | | | | | Accumulated | | | | | | | | | |

| | | | | | | | | | | | | | | Accumulated | | | Other | | | Non- | | | | | |

| | | Common Stock | | | Paid-in | | | Retained | | | Comprehensive | | | controlling | | | | | |

| | | Shares | | | Amount | | | Capital | | | Earnings | | | Income / (Loss) | | | Interest | | | Total | |

| | | | | | | $ | | | $ | | | $ | | | $ | | | $ | | | $ | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance at June 30, 2023 | | | 4,097 | | | | 12,819 | | | | 5,066 | | | | 10,763 | | | | 758 | | | | 165 | | | | 29,571 | |

| Stock option expenses | | | - | | | | - | | | | 60 | | | | - | | | | - | | | | - | | | | 60 | |

| Net income / (loss) | | | - | | | | - | | | | - | | | | 230 | | | | - | | | | (23 | ) | | | 207 | |

| Translation adjustment | | | - | | | | - | | | | - | | | | - | | | | (204 | ) | | | 21 | | | | (183 | ) |

| Balance at September 30, 2023 | | | 4,097 | | | | 12,819 | | | | 5,126 | | | | 10,993 | | | | 554 | | | | 163 | | | | 29,655 | |

See notes to condensed consolidated financial statements.

TRIO-TECH INTERNATIONAL AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (IN THOUSANDS)

| | | Three Months Ended | |

| | | September 30, | | | September 30, | |

| | | 2024 | | | 2023 | |

| | | (Unaudited) | | | (Unaudited) | |

| Cash Flow from Operating Activities | | | | | | | | |

| Net (loss) / income | | $ | (223 | ) | | $ | 207 | |

| Adjustments to reconcile net income to net cash flow provided by operating activities | | | | | | | | |

| Unrealized foreign exchange loss | | | 460 | | | | 81 | |

| Depreciation and amortization | | | 711 | | | | 1,471 | |

| Gain on sales of property, plant and equipment | | | - | | | | 91 | |

| Addition of provision for obsolete inventories | | | 29 | | | | 7 | |

| Stock compensation | | | 71 | | | | 60 | |

| Bad debt recovery | | | - | | | | (5 | ) |

| Accrued interest expense, net accrued interest income | | | (5 | ) | | | (49 | ) |

| Payment of interest portion of finance lease | | | (1 | ) | | | (2 | ) |

| Warranty (expense) / recovery, net | | | (7 | ) | | | 7 | |

| Reversal of income tax provision | | | (1 | ) | | | (1 | ) |

| Deferred tax expense / (benefits) | | | 5 | | | | (56 | ) |

| Repayment of operating lease | | | (363 | ) | | | (346 | ) |

| Changes in operating assets and liabilities, net of acquisition effects | | | | | | | | |

| Trade accounts receivable | | | (1,427 | ) | | | (1,158 | ) |

| Other receivables | | | (114 | ) | | | (732 | ) |

| Other assets | | | 93 | | | | (47 | ) |

| Inventories | | | 409 | | | | (1,914 | ) |

| Prepaid expense and other current assets | | | (37 | ) | | | 36 | |

| Accounts payable, accrued expense and contract liabilities | | | (1,312 | ) | | | 2,861 | |

| Income taxes payable | | | (148 | ) | | | (120 | ) |

| Other non-current liabilities | | | 3 | | | | (367 | ) |

| Net Cash (Used in) / Provided by Operating Activities | | $ | (1,857 | ) | | $ | 24 | |

| | | | | | | | | |

| Cash Flow from Investing Activities | | | | | | | | |

| Withdrawal from unrestricted term deposits, net | | | 140 | | | | 693 | |

| Additions to property, plant and equipment | | | (69 | ) | | | (77 | ) |

| Proceeds from disposal of assets held-for-sale | | | - | | | | 198 | |

| Proceeds from disposal of property, plant and equipment | | | 10 | | | | - | |

| Net Cash Provided by Investing Activities | | | 81 | | | | 814 | |

| | | | | | | | | |

| Cash Flow from Financing Activities | | | | | | | | |

| Payment on lines of credit | | | - | | | | (270 | ) |

| Payment of bank loans | | | (70 | ) | | | (116 | ) |

| Payment of finance leases | | | (23 | ) | | | (26 | ) |

| Proceeds from lines of credit | | | - | | | | 556 | |

| Net Cash (Used in) / Provided by Financing Activities | | | (93 | ) | | | 144 | |

| | | | | | | | | |

| Effect of Changes in Exchange Rate | | | 963 | | | | (231 | ) |

| | | | | | | | | |

| Net (Decrease) / Increase in Cash, Cash Equivalents, and Restricted Cash | | | (906 | ) | | | 751 | |

| Cash, Cash Equivalents, and Restricted Cash at Beginning of Period | | | 12,556 | | | | 10,038 | |

| Cash, Cash Equivalents, and Restricted Cash at End of Period | | $ | 11,650 | | | $ | 10,789 | |

| | | | | | | | | |

| Supplementary Information of Cash Flows | | | | | | | | |

| Cash paid during the period for: | | | | | | | | |

| Interest | | $ | 11 | | | $ | 20 | |

| Income taxes | | $ | 193 | | | $ | 141 | |

| | | | | | | | | |

| Reconciliation of Cash, Cash Equivalents, and Restricted Cash | | | | | | | | |

| Cash | | | 8,948 | | | | 8,333 | |

| Restricted Term-Deposits in Current Assets | | | 804 | | | | 737 | |

| Restricted Term-Deposits in Non-Current Assets | | | 1,898 | | | | 1,719 | |

| Total Cash, Cash Equivalents, and Restricted Cash Shown in Statements of Cash Flows | | $ | 11,650 | | | $ | 10,789 | |

Restricted deposits represent the amount of cash pledged to secure loans payable or trade financing granted by financial institutions, serve as collateral for public utility agreements such as electricity and water, and performance bonds related to customs duty payable. Restricted deposits are classified as current and non-current depending on whether they relate to long-term or short-term obligations. Restricted deposits of $804 as at September 30, 2024 are classified as current assets as they relate to short-term trade financing. On the other hand, restricted deposits of $1,898 as at September 30, 2024 are classified as non-current assets as they relate to long-term obligations and will become unrestricted only upon discharge of the obligations.

See notes to condensed consolidated financial statements.

TRIO-TECH INTERNATIONAL AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(IN THOUSANDS, EXCEPT EARNINGS PER SHARE AND NUMBER OF SHARES)

| 1. | ORGANIZATION AND BASIS OF PRESENTATION |

Trio-Tech International (the “Company”, or “TTI”) was incorporated in fiscal year ended June 30, 1958 under the laws of the State of California. The Company has traditionally been a provider of reliability test equipment and services to the semiconductor and other industries. The Company provides comprehensive electrical, environmental, and burn-in testing services to semiconductor manufacturers in Asia. The Company designs and manufactures an extensive range of burn-in and reliability test equipment used in the “back-end” manufacturing processes of semiconductors. The Company also designs, manufactures and distributes an extensive range of test, process and other equipment used in the manufacturing processes of customers in various industries in the consumer and industrial market. The Company also acts as a design-in reseller of a wide range of camera modules, LCD displays and touch screen panels.

In the first quarter of fiscal year ended June 30, 2025 (“Fiscal 2025”), we made changes in our business strategy in an effort to better align with our focus areas and to streamline operations. While the semiconductor industry is and will remain a major market for Trio-Tech, an important component of our strategy is to reduce our historic concentration on this industry. As a result, we have decided to organize our operating businesses based on the markets that we serve. Beginning in fiscal 2025, we report our financial performance based on our new segments, Semiconductor Back-end Solutions and Industrial Electronics.

TTI has subsidiaries in the U.S., Singapore, Malaysia, Thailand, Indonesia, Cayman Islands and China as follows:

| | | Ownership | | | Location |

| Express Test Corporation (Dormant) | | | 100 | % | | Van Nuys, California |

| Trio-Tech Reliability Services (Dormant) | | | 100 | % | | Van Nuys, California |

| KTS Incorporated, dba Universal Systems (Dormant) | | | 100 | % | | Van Nuys, California |

| European Electronic Test Centre (Dormant) | | | 100 | % | | Cayman Islands |

| Trio-Tech International Pte. Ltd. | | | 100 | % | | Singapore |

| Universal (Far East) Pte. Ltd.* | | | 100 | % | | Singapore |

| Trio-Tech International (Thailand) Co. Ltd. * | | | 100 | % | | Bangkok, Thailand |

| Trio-Tech (Bangkok) Co. Ltd. * | | | 100 | % | | Bangkok, Thailand |

| Trio-Tech (Malaysia) Sdn. Bhd. (55% owned by Trio-Tech International Pte. Ltd.) | | | 55 | % | | Penang and Selangor, Malaysia |

| Trio-Tech (Kuala Lumpur) Sdn. Bhd. (100% owned by Trio-Tech Malaysia Sdn. Bhd.) | | | 55 | % | | Selangor, Malaysia |

| Prestal Enterprise Sdn. Bhd. (76% owned by Trio-Tech International Pte. Ltd.) | | | 76 | % | | Selangor, Malaysia |

| Trio-Tech (SIP) Co., Ltd. * | | | 100 | % | | Suzhou, China |

| Trio-Tech (Chongqing) Co. Ltd. * | | | 100 | % | | Chongqing, China |

| SHI International Pte. Ltd. (Dormant) (55% owned by Trio-Tech International Pte. Ltd) | | | 55 | % | | Singapore |

| PT SHI Indonesia (Dormant) (95% owned by SHI International Pte. Ltd.) | | | 52 | % | | Batam, Indonesia |

| Trio-Tech (Tianjin) Co., Ltd. * | | | 100 | % | | Tianjin, China |

| Trio-Tech (Jiangsu) Co., Ltd. (51% owned by Trio-Tech (SIP) Co., Ltd.) | | | 51 | % | | Suzhou, China |

* 100% owned by Trio-Tech International Pte. Ltd.

The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with United States Generally Accepted Accounting Principles (“GAAP”) for interim financial information and with the instructions to Form 10-Q and Article 10 of Regulation S-X. All significant intercompany accounts and transactions have been eliminated in consolidation. The unaudited condensed consolidated financial statements are presented in U.S. dollars unless otherwise stated. The accompanying condensed consolidated financial statements do not include all the information and footnotes required by GAAP for complete financial statements. For further information, refer to the consolidated financial statements and footnotes thereto included in the Company's Annual Report for the fiscal year ended June 30, 2024 (“Fiscal 2024”). The Company’s operating results are presented based on the translation of foreign currencies using the respective quarter’s average exchange rate.

The results of operations for the three months ended September 30, 2024 are not necessarily indicative of the results that may be expected for any other interim period or for the full year ending June 30, 2025.

Use of Estimates — The preparation of consolidated financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the consolidated financial statements and the reported amounts of revenues and expense during the reporting period. Among the more significant estimates included in these consolidated financial statements are the estimated allowance for credit losses on account receivables, reserve for obsolete inventory, impairments, provision of income tax, stock options and the deferred income tax asset allowance. Actual results could materially differ from those estimates.

Significant Accounting Policies. There have been no material changes to our significant accounting policies summarized in Note 1 “Basis of Presentation and Summary of Significant Accounting Policies” to our consolidated Financial Statements included in our Annual Report on Form 10-K for Fiscal 2024.

Recasting of Certain Prior Period Information - In response to changes in our business strategy, during the first quarter of fiscal 2025, the Company’s chief operating decision maker, who is also our Chief Executive Officer, requested changes in the information that he regularly reviews for purposes of allocating resources and assessing performance. As a result, beginning in fiscal 2025, we report our financial performance based on our new segments described in Note 14 – Segment Information. We have recast certain prior period amounts to conform to the way we internally manage and monitor segment performance during fiscal 2025. This change primarily impacted Note 14 – Segment Information, with no impact on consolidated net income or cash flows.

Comparative figures - Certain amounts in the prior periods presented have been reclassified to conform to the current period financial statement presentation. These reclassifications have no effect on previously reported net income.

| 2. | NEW ACCOUNTING PRONOUNCEMENTS |

In November 2023, the FASB issued ASU 2023-07, Segment Reporting (Topic 280), Improvements to Reportable Segment Disclosures. The new guidance requires enhanced disclosures about significant segment expense. This standard update is effective for Company beginning in the fiscal year ending June 30, 2025 and interim period reports beginning in the first quarter of the fiscal year ending June 30, 2026. Early adoption is permitted on a retrospective basis. The Company is currently evaluating the impact of this ASU on segment disclosure.

In December 2023, the FASB issued ASU 2023-09, Income Taxes (Topic 740), Improvements to Income Tax Disclosures. The new guidance requires enhanced disclosures about income tax expense. This standard update is effective for Company beginning in the fiscal year ending June 30, 2026. Early adoption is permitted on a prospective basis. The Company is currently evaluating the impact of this ASU on annual income tax disclosures.

In November 2024, the FASB has released Accounting Standards Update (“ASU”) No. 2024-03, Disaggregation of Income Statement Expenses. The ASU’s purpose is to improve the disclosures about a public business entity’s expenses and address requests from investors for more detailed information about the types of expenses in commonly presented expense captions. Early adoption is permitted. This standard update is effective for Company beginning in the fiscal year ending June 30, 2029.

New pronouncements issued but not yet effective until after September 30, 2024, are not expected to have a significant effect on the Company’s consolidated financial position or results of operations.

-

7 -

| | | Sept. 30, | | | June 30, | |

| | | 2024 | | | 2024 | |

| | | (Unaudited) | | | | |

| | | | | | | | |

| Short-term deposits | | $ | 6,121 | | | $ | 6,540 | |

| Currency translation effect on short-term deposits | | | 388 | | | | (43 | ) |

| Total short-term deposits | | | 6,509 | | | | 6,497 | |

| Restricted term deposits - Current | | | 759 | | | | 750 | |

| Currency translation effect on restricted term deposits | | | 45 | | | | - | |

| Total restricted term deposits - Current | | | 804 | | | | 750 | |

| Restricted term deposits – Non-current | | | 1,773 | | | | 1,773 | |

| Currency translation effect on restricted term deposits | | | 125 | | | | (2 | ) |

| Total restricted term deposits - Non-current | | | 1,898 | | | | 1,771 | |

| Total term deposits | | $ | 9,211 | | | $ | 9,018 | |

Restricted deposits represent the amount of cash pledged to secure loans payable or trade financing granted by financial institutions, serve as collateral for public utility agreements such as electricity and water, and performance bonds related to customs duty payable. Restricted deposits are classified as current and non-current depending on whether they relate to long-term or short-term obligations. Restricted deposits of $804 as at September 30, 2024 are classified as current assets as they relate to short-term trade financing. On the other hand, restricted deposits of $1,898 as at September 30, 2024 are classified as non-current assets as they relate to long-term obligations and will become unrestricted only upon discharge of the obligations.

| 4. | TRADE ACCOUNTS RECEIVABLE AND ALLOWANCE FOR EXPECTED CREDIT LOSSES |

Accounts receivable are customer obligations due under normal trade terms. The Company performs continuing credit evaluations of its customers’ financial conditions, and although management generally does not require collateral, letters of credit may be required from the customers in certain circumstances.

The allowance for trade receivable represents management’s expected credit losses in our trade receivables as of the date of the financial statements. The allowance provides for probable losses that have been identified with specific customer relationships and for probable losses believed to be inherent in the trade receivables, but that have not been specifically identified.

The following table represents the changes in the allowance for expected credit losses:

| | | Sept. 30, | | | June 30, | |

| | | 2024 | | | 2024 | |

| | | (Unaudited) | | | | |

| | | | | | | | |

| Beginning | | $ | 209 | | | $ | 217 | |

| Additions charged to expense | | | - | | | | 12 | |

| Recovered | | | - | | | | (17 | ) |

| Currency translation effect | | | 6 | | | | (3 | ) |

| Ending | | $ | 215 | | | $ | 209 | |

| 5. | LOANS RECEIVABLE FROM PROPERTY DEVELOPMENT PROJECTS |

The following table presents Trio-Tech (Chongqing) Co. Ltd (“TTCQ”)’s loan receivables from property development projects in China as of September 30, 2024.

| | Loan Expiry | | Loan Amount | | | Loan Amount | |

| | Date | | (RMB) | | | (U.S. Dollars) | |

| Short-term loan receivables | | | | | | | | | |

| JiangHuai (Project – Yu Jin Jiang An) | May 31, 2013 | | | 2,000 | | | | 285 | |

| Less: allowance for expected credit losses | | | (2,000 | ) | | | (285 | ) |

| Net loan receivables from property development projects | | | - | | | | - | |

The short-term loan receivables amounting to renminbi (“RMB”) 2,000, or approximately $285 arose due to TTCQ entering into a Memorandum Agreement with JiangHuai Property Development Co. Ltd. (“JiangHuai”) to invest in their property development projects (Project - Yu Jin Jiang An) located in Chongqing City, China in the fiscal year ended June 30, 2011 (“Fiscal 2011”). Based on TTI’s financial policy, an allowance for expected credit losses of $285 on the investment in JiangHuai was recorded during the fiscal year ended June 30, 2014 (“Fiscal 2014”). TTCQ did not generate other income from JiangHuai for the quarter ended September 30, 2024 or for Fiscal 2024. TTCQ is in the legal process of recovering the outstanding amount of approximately $285.

-

8 -

Inventories consisted of the following:

| | | Sept. 30, | | | June 30, | |

| | | 2024 | | | 2024 | |

| | | (Unaudited) | | | | | |

| | | | | | | | | |

| Raw materials | | $ | 1,491 | | | $ | 1,668 | |

| Work in progress | | | 788 | | | | 1,048 | |

| Finished goods | | | 1,152 | | | | 1,129 | |

| Less: provision for obsolete inventories | | | (734 | ) | | | (679 | ) |

| Currency translation effect | | | 175 | | | | (4 | ) |

| | | $ | 2,872 | | | $ | 3,162 | |

The following table represents the changes in provision for obsolete inventories:

| | | Sept. 30, | | | June 30, | |

| | | 2024 | | | 2024 | |

| | | (Unaudited) | | | | | |

| | | | | | | | | |

| Beginning | | $ | 679 | | | $ | 648 | |

| Additions charged to expense | | | 29 | | | | 65 | |

| Usage – disposition | | | - | | | | (21 | ) |

| Currency translation effect | | | 26 | | | | (13 | ) |

| Ending | | $ | 734 | | | $ | 679 | |

The following table presents the Company’s investment in properties in China as of September 30, 2024. The exchange rate is based on the market rate as of September 30, 2024.

| | | Sept. 30, 2024 | | | June 30, 2024 | |

| | | (Unaudited) | | | | | |

| | | | | | | | | |

| Property I – MaoYe Property | | | | | | | | |

| Cost | | $ | 301 | | | $ | 301 | |

| Less: Accumulated depreciation | | | (230 | ) | | | (226 | ) |

| Currency translation effect | | | (19 | ) | | | (22 | ) |

| | | $ | 52 | | | | 53 | |

| | | Sept. 30, 2024 | | | June 30, 2024 | |

| | | (Unaudited) | | | | | |

| | | | | | | | | |

| Property II – JiangHuai Property | | | | | | | | |

| Cost | | $ | - | | | $ | 580 | |

| Less: Accumulated depreciation | | | - | | | | (360 | ) |

| Currency translation effect | | | - | | | | (83 | ) |

| Carrying value of relinquished asset | | $ | - | | | $ | 137 | |

| Cost of acquired asset | | | 137 | | | | - | |

| Less: Accumulated depreciation of acquired asset | | | (6 | ) | | | - | |

| Currency translation effect | | | 4 | | | | - | |

| | | $ | 135 | | | $ | 137 | |

| | | Sept. 30, 2024 | | | June 30, 2024 | |

| | | (Unaudited) | | | | | |

| | | | | | | | | |

| Property III – FuLi Property | | | | | | | | |

| Cost | | $ | 648 | | | $ | 648 | |

| Less: Accumulated Depreciation | | | (345 | ) | | | (338 | ) |

| Currency translation effect | | | (86 | ) | | | (93 | ) |

| | | $ | 217 | | | $ | 217 | |

Rental Property I – MaoYe Property

MaoYe Property generated a rental income of $6 during the three months ended September 30, 2024, and 2023.

A lease agreement was entered into on February 1, 2023 for a period of 4 years at a monthly rate of RMB15, or approximately $2. Pursuant to the agreement, monthly rental will increase by 5% after the second year.

Depreciation expense for MaoYe Property was $4 for the three months ended September 30, 2024, and 2023, respectively.

Rental Property II – JiangHuai

During the year ended June 30, 2010 (“Fiscal 2010”), TTCQ purchased eight units of commercial property in Chongqing, China, from JiangHuai for RMB 3,600, or approximately $580. The title deeds for these properties had not been received by TTCQ since the entire project had not been completed by JiangHuai. JiangHuai is currently in liquidation and the local court had appointed a Management Company to manage the liquidation process and address claims from stakeholders. To expedite the resolution, TTCQ agreed to settle the claims through an asset exchange. The court directed the Management Company to engage a third-party valuer to assess the assets involved. Based on the valuation, the court determined that TTCQ would receive title deeds for 5 shop units having a total area of 547.67 m² in exchange of the claim made for the 8 units without title deeds. In July 2024, the court concluded that the value of these 5 shop units was equivalent to the original purchase price of 8 shop units of RMB 3,600 and issued a court order to process title deeds for the 5 units in the name of TTCQ. The carrying value of the JiangHuai asset group as at June 30, 2024 was RMB 990. Applying the guidance in ASC Topic 845, Nonmonetary transactions, this transaction lacks commercial substance and hence, the JiangHuai asset group will continue to be accounted based on the carrying value of the exchanged investment properties. The title deeds have been received as September 2024.

JiangHuai Property did not generate any rental income for the three months ended September 30, 2024 and 2023.

Depreciation expense for JiangHuai was $6 for the three months ended September 30, 2024, and 2023, respectively.

Rental Property III – FuLi

FuLi Property did not generate any rental income for the three months ended September 30, 2024, as compared to $1 for the same period in Fiscal 2024.

A lease agreement was entered into October 10, 2024 for a period of 4 years at a monthly rate of RMB9, or approximately $1. Pursuant to the agreement, monthly rental will increase by 5% after the second year.

Depreciation expense for FuLi was $7 for the three months ended September 30, 2024, and 2023, respectively.

Summary

Total rental income for all investment properties in China was $6 for the three months ended September 30, 2024, as compared to $7 for the three months ended 2023, respectively.

Depreciation expense for all investment properties in China was $17 for the three months ended September 30, 2024 and 2023, respectively.

Other assets consisted of the following:

| | | Sept. 30, | | | June 30, | |

| | | 2024 | | | 2024 | |

| | | (Unaudited) | | | | | |

| Deposits for rental and utilities and others | | | 113 | | | | 234 | |

| Downpayment for Purchase of Investment Properties* | | | 1,580 | | | | 1,580 | |

| Less: Provision for Impairment | | | (1,580 | ) | | | (1,580 | ) |

| Currency translation effect | | | 12 | | | | (2 | ) |

| Total | | $ | 125 | | | $ | 232 | |

*Down payment for purchase of investment properties included downpayment relating to shop lots in Singapore Themed Resort Project in Chongqing, China. The shop lots are to be delivered to TTCQ upon completion of the construction. The initial targeted date of completion was in Fiscal 2017. However, progress has stalled because the developer is currently reorganizing assets and renegotiating with the creditors to complete the project.

During the fourth quarter of Fiscal 2021, the Company accrued an impairment charge of $1,580 related to the doubtful recovery of the down payment on property in the Singapore Themed Resort Project in Chongqing, China. The Company elected to take this non-cash impairment charge due to increased uncertainties regarding the project’s viability, given the developers’ weakening financial condition as well as uncertainties arising from the negative real-estate environment in China, implementation of control measures on real-estate lending in China and its relevant government policies.

The carrying value of the Company’s lines of credit approximates its fair value because the interest rates associated with the lines of credit are adjustable in accordance with market situations when the Company borrowed funds with similar terms and remaining maturities.

The Company’s credit rating provides it with ready and adequate access to funds in global markets.

As of September 30, 2024, the Company had certain lines of credit that are collateralized by restricted deposits.

| Entity with | | Type of | | Interest | | Credit | | | Unused | |

| Facility | | Facility | | Rate | | Limitation | | | Credit | |

| Trio-Tech International Pte. Ltd., Singapore | | Lines of Credit | | Cost of Funds Rate +1.25% | | $ | 4,141 | | | $ | 3,843 | |

| Universal (Far East) Pte. Ltd. | | Lines of Credit | | Cost of Funds Rate +1.25% | | $ | 1,953 | | | $ | 1,927 | |

| Trio-Tech Malaysia Sdn. Bhd. | | Revolving credit | | Cost of Funds Rate +2% | | $ | 364 | | | $ | 364 | |

As of June 30, 2024, the Company had certain lines of credit that are collateralized by restricted deposits.

| Entity with | | Type of | | Interest | | Credit | | | Unused | |

| Facility | | Facility | | Rate | | Limitation | | | Credit | |

| Trio-Tech International Pte. Ltd., Singapore | | Lines of Credit | | Cost of Funds Rate +1.25% | | $ | 3,907 | | | $ | 3,626 | |

| Universal (Far East) Pte. Ltd. | | Lines of Credit | | Cost of Funds Rate +1.25% | | $ | 1,843 | | | $ | 1,818 | |

| Trio-Tech Malaysia Sdn. Bhd. | | Revolving credit | | Cost of Funds Rate +2% | | $ | 318 | | | $ | 318 | |

Accrued expense consisted of the following:

| | | Sept. 30, | | | June 30, | |

| | | 2024 | | | 2024 | |

| | | (Unaudited) | | | | | |

| | | | | | | | | |

| Payroll and related costs | | $ | 1,611 | | | $ | 1,809 | |

| Commissions | | | 134 | | | | 164 | |

| Legal and audit | | | 227 | | | | 328 | |

| Sales tax | | | 54 | | | | 34 | |

| Utilities | | | 157 | | | | 231 | |

| Warranty | | | 21 | | | | 27 | |

| Accrued purchase of materials and property, plant and equipment | | | 388 | | | | 553 | |

| Provision for reinstatement | | | 380 | | | | 380 | |

| Other accrued expense | | | 119 | | | | 86 | |

| Currency translation effect | | | 169 | | | | 22 | |

| Total | | $ | 3,260 | | | $ | 3,634 | |

| 11. | ASSURANCE WARRANTY ACCRUAL |

The Company provides for the estimated costs that may be incurred under its warranty program at the time the sale is recorded. The warranty period of the products manufactured by the Company is generally one year or the warranty period agreed upon with the customer. The Company estimates the warranty costs based on the historical rates of warranty returns. The Company periodically assesses the adequacy of its recorded warranty liability and adjusts the amounts as necessary.

| | | Sept. 30, | | | June 30, | |

| | | 2024 | | | 2024 | |

| | | (Unaudited) | | | | | |

| | | | | | | | | |

| Beginning | | $ | 27 | | | $ | 24 | |

| Additions charged to cost and expense | | | - | | | | 21 | |

| Utilization | | | (7 | ) | | | (20 | ) |

| Currency translation effect | | | 1 | | | | 2 | |

| Ending | | $ | 21 | | | $ | 27 | |

Bank loans payable consisted of the following:

| | | Sept. 30, | | | June 30, | |

| | | 2024 | | | 2024 | |

| | | (Unaudited) | | | | | |

| | | | | | | | | |

| Note payable denominated in the Malaysian Ringgit for expansion plans in Malaysia, maturing in July 2028, bearing interest at the bank’s prime rate less 2.00% (4.85% and 4.6% at September 30, 2024 and June 30, 2024) per annum, with monthly payments of principal plus interest through July 2028, collateralized by the acquired building with a carrying value of $2,151 and $2,208, as at September 30, 2024 and June 30, 2024, respectively. | | $ | 638 | | | $ | 596 | |

| Financing arrangement at fixed interest rate 3.2% per annum, with monthly payments of principal plus interest through July 2025. | | | 40 | | | | 44 | |

| Financing arrangement at fixed interest rate 3.0% per annum, with monthly payments of principal plus interest through December 2026. | | | 128 | | | | 124 | |

| Financing arrangement at fixed interest rate 3.0% per annum, with monthly payments of principal plus interest through August 2027. | | | 117 | | | | 110 | |

| Total bank loans payable | | $ | 923 | | | $ | 874 | |

| | | | | | | | | |

| Current portion of bank loans payable | | | 253 | | | | 235 | |

| Currency translation effect on current portion of bank loans | | | 36 | | | | 26 | |

| Current portion of bank loans payable | | | 289 | | | | 261 | |

| Long-term portion of bank loans payable | | | 553 | | | | 591 | |

| Currency translation effect on long-term portion of bank loans | | | 81 | | | | 22 | |

| Long-term portion of bank loans payable | | $ | 634 | | | $ | 613 | |

Future minimum payments (excluding interest) as at September 30, 2024, were as follows:

| Remainder of Fiscal 2025 | | $ | 222 | |

| 2026 | | | 263 | |

| 2027 | | | 242 | |

| Thereafter | | | 196 | |

| Total obligations and commitments | | $ | 923 | |

Future minimum payments (excluding interest) as at June 30, 2024, were as follows:

| 2025 | | $ | 260 | |

| 2026 | | | 230 | |

| 2027 | | | 212 | |

| Thereafter | | | 172 | |

| Total obligations and commitments | | $ | 874 | |

| 13. |

COMMITMENTS AND CONTINGENCIES |

The Company has no capital commitments as at September 30, 2024, as compared to capital commitment of $65 as at June 30, 2024.

Deposits with banks are not fully insured by the local government or agency and are consequently exposed to risk of loss. The Company believes that the probability of bank failure, causing loss to the Company, is remote.

The Company is, from time to time, the subject of litigation claims and assessments arising out of matters occurring in its normal business operations. In the opinion of management, resolution of these matters will not have a material adverse effect on the Company’s consolidated financial statements.

ASC Topic 280, Segment Reporting, establishes standards for reporting information about operating segments. Operating segments are defined as components of a reporting entity, the operating results of which are reviewed regularly by the chief operating decision maker (“CODM”) to make decisions about resource allocation and to assess performance. Our CODM is our Chief Executive Officer.

In response to changes in our business strategy in an effort to better align with our focus areas and to streamline operations, during the first quarter of Fiscal 2025, our CODM requested changes in the information that he regularly reviews for purposes of allocating resources and assessing performance. As a result, we have updated our reporting and beginning in Fiscal 2025, we report our financial performance based on our new segments, “Semiconductor Back-end Solutions” (“SBS”) and “Industrial Electronics” (“IE”), and analyze gross profit and operating income as the measure of segment profitability. We have recast certain prior period amounts to conform to the way we internally manage and monitor segment performance during Fiscal 2025.

Our operating businesses are organized based on the nature of markets. The SBS segment comprises our core semiconductor back-end equipment manufacturing and testing operations that serve the semiconductor industry. Our value-added distribution business, along with our services and equipment manufacturing operations that serve various industries will be reported together in our IE segment. A detailed description of our operating segments as of September 30, 2024 can be found in the overview section within MD&A. A mapping of our previous presentation and the new segments is as presented below:

| ● |

Manufacturing – Manufacturing of equipment that solely serves the back-end processes of the semiconductor industry is presented under the SBS segment, and manufacturing of equipment that serves various industries is presented under the IE segment. |

| ● |

Testing Services – Testing services are presented under the SBS segment. |

| ● |

Distribution – Value-added distribution of burn-in test related equipment is presented under the SBS segment, and value-added distribution of other electronic products is presented under the IE segment. |

| ● |

Real estate – Real-estate segment relates to real estate investments made in ChongQing, China. When identifying reportable segments, management evaluates the contribution of each segment to the overall business strategy and whether the segment reported provides meaningful information to users about the Company’s performance and prospects. Revenue from the real-estate segment has been below 1% of total revenue in the past five fiscal years due to the negative real-estate environment in China. Effective in Fiscal 2025, management therefore concluded that the real-estate segment is not integral to the Company’s operations and does not intend to allocate any additional resources to this segment. As a result, this segment will cease to be a reportable segment in Fiscal 2025, and therefore will be presented under the Others segment. |

Our CODM uses total revenue, gross profit, operating income and total assets in assessing segment performance and deciding how to allocate resources. Segment operating income includes corporate allocations. Segment revenues include sales of equipment and services by our segments. Total intersegment sales were $36 and $649 in the three months ended September 30, 2024 and September 30, 2023 respectively. Certain corporate costs, including those related to legal, information technology, human resources and shared services are allocated to our segments based on their relative revenues, manpower costs and fixed assets.

The amounts related to revenue and earnings presented as Others include the results of an immaterial real estate business that ceased to be a reportable segment in Fiscal 2025 and includes certain costs incurred at the corporate-level, including the cost of our stock compensation plans not allocated to our reportable segments. Assets presented under Others segment consisted primarily of cash and cash equivalents, prepaid expenses and investment properties.

The cost of equipment, current year investment in new equipment and depreciation expense is allocated into respective reportable segments based on the primary purpose for which the equipment was acquired.

The following segment Information is unaudited for the three months ended September 30, 2024, and September 30, 2023:

Business Segment Information:

| |

Three Months |

|

|

|

|

|

Gross Profit |

|

|

Operating |

|

|

|

|

|

|

Depr. |

|

|

|

|

|

| |

Ended |

|

Net |

|

|

Income / |

|

|

Income / |

|

|

Total |

|

|

and |

|

|

Capital |

|

| |

Sept. 30, |

|

Revenue |

|

|

(Loss) |

|

|

(Loss) |

|

|

Assets |

|

|

Amort. |

|

|

Expenditures |

|

| Semiconductor Back-end Solutions |

2024 |

|

$ |

6,879 |

|

|

$ |

1,794 |

|

|

$ |

177 |

|

|

$ |

33,765 |

|

|

$ |

636 |

|

|

$ |

133 |

|

| |

2023 |

|

$ |

7,176 |

|

|

$ |

1,880 |

|

|

$ |

(40 |

) |

|

$ |

34,102 |

|

|

$ |

1,385 |

|

|

$ |

77 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Industrial Electronics |

2024 |

|

|

2,914 |

|

|

|

539 |

|

|

|

(7 |

) |

|

|

6,297 |

|

|

|

58 |

|

|

|

- |

|

| |

2023 |

|

|

2,783 |

|

|

|

650 |

|

|

|

190 |

|

|

|

8,476 |

|

|

|

68 |

|

|

|

- |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Others |

2024 |

|

|

6 |

|

|

|

(11 |

) |

|

|

(37 |

) |

|

|

2,878 |

|

|

|

17 |

|

|

|

- |

|

| |

2023 |

|

|

7 |

|

|

|

(10 |

) |

|

|

(151 |

) |

|

|

2,121 |

|

|

|

18 |

|

|

|

- |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Company |

2024 |

|

$ |

9,799 |

|

|

$ |

2,322 |

|

|

$ |

133 |

|

|

$ |

42,940 |

|

|

$ |

711 |

|

|

$ |

133 |

|

| |

2023 |

|

$ |

9,966 |

|

|

$ |

2,520 |

|

|

$ |

(1 |

) |

|

$ |

44,699 |

|

|

$ |

1,471 |

|

|

$ |

77 |

|

Management periodically evaluates the ongoing contributions of each of its business segments to its current and future revenue and prospects. As a result, it may divest one or more business segments in the future to enable management to concentrate on segments where it anticipates opportunities for future revenue growth, thereby maximizing shareholder value.

| 15. | OTHER (EXPENSE) / INCOME |

Other (expense) / income consisted of the following:

| | | Three Months Ended | |

| | | Sept. 30, | | | Sept. 30, | |

| | | 2024 | | | 2023 | |

| | | (Unaudited) | | | (Unaudited) | |

| Interest income | | $ | 101 | | | $ | 78 | |

| Other rental income | | | 38 | | | | 36 | |

| Exchange (loss) / gain | | | (506 | ) | | | 59 | |

| Other miscellaneous income | | | 2 | | | | 23 | |

| Total | | $ | (365 | ) | | $ | 196 | |

| | | Three Months Ended | |

| | | Sept. 30, | | | Sept. 30, | |

| | | 2024 | | | 2023 | |

| | | (Unaudited) | | | (Unaudited) | |

| Government grant | | $ | 66 | | | $ | 73 | |

In the three months ended September 30, 2024, the Company received government grants amounting to $66, $62 of which was an incentive from the Singapore government for local resident recruitment, and $4 related to capital expenditure subsidy received from the China government.

During the same period in Fiscal 2024, the Company received government grants amounting to $73, $16 of which was financial assistance received from the Singapore government, and the remaining $57 from the US government related to Employee Retention Credit (“ERC”).

-

14 -

The provision for income taxes has been determined based upon the tax laws and rates in the countries in which we operate. The Company is subject to income taxes in the U.S. and numerous foreign jurisdictions. Significant judgment is required in determining the provision for income taxes and income tax assets and liabilities, including evaluating uncertainties in the application of accounting principles and complex tax laws.

Due to the enactment of the Tax Cuts and Jobs Act, the Company is subject to a tax on global intangible low-taxed income (“GILTI”). GILTI is a tax on foreign income in excess of a deemed return on tangible assets of foreign corporations. Companies subject to GILTI have the option to account for the GILTI tax as a period cost if and when incurred, or to recognize deferred taxes for temporary differences including outside basis differences expected to reverse as GILTI. The Company has elected to account for GILTI as a period cost. GILTI expense was $nil and $15 for the three months ended September 30, 2024, and 2023, respectively.

The Company's income tax expense was $51 for the three months ended September 30, 2024, as compared to $37 for the same period in Fiscal 2024. Our effective tax rate (“ETR”) from continuing operations was (28.5)% and 15.2% for three months ended September 30, 2024 and September 30, 2023, respectively. The increase of income tax expenses is attributable to increase of chargeable income in our China operation which partially offset by lower GILTI tax due to lower chargeable income derived from controlled foreign corporation.

The Company accrues penalties and interest related to unrecognized tax benefits when necessary, as a component of penalties and interest expense, respectively. The Company had no unrecognized tax benefits or related accrued penalties or interest expense at September 30, 2024 and September 30, 2023, respectively.

In assessing the ability to realize the deferred tax assets, management considers whether it is more likely than not that some portion or all of the deferred tax assets will not be realized. The ultimate realization of deferred tax assets is dependent upon the generation of future taxable income during the periods in which those temporary differences become deductible. Management considers the scheduled reversal of deferred tax liabilities, projected future taxable income, and tax planning strategies in making this assessment. Based on these criteria, management believes it is more likely than not the Company will not realize all of the benefits of the federal, state, and foreign deductible differences. Accordingly, a valuation allowance has been established against portion of the deferred tax assets recorded in the U.S. and various foreign jurisdictions.

The Company generates revenue primarily from two segments: Semiconductor Back-end Solutions (SBS) and Industrial Electronics (IE). The Company accounts for a contract with a customer when there is approval and commitment from both parties, the rights of the parties are identified, payment terms are identified, the contract has commercial substance and collectability of consideration is probable. The Company’s revenues are measured based on consideration stipulated in the arrangement with each customer, net of any sales incentives and amounts collected on behalf of third parties, such as sales taxes. The revenues are recognized as separate performance obligations that are satisfied by transferring control of the product or service to the customer.

Significant Judgments

The Company’s arrangements with its customers include various combinations of products and services, which are generally capable of being distinct and accounted for as separate performance obligations. A product or service is considered distinct if it is separately identifiable from other deliverables in the arrangement and if a customer can benefit from it on its own or with other resources that are readily available to the customer.

-

15 -

The Company allocates the transaction price to each performance obligation on a relative standalone selling price basis (“SSP”). Determining the SSP for each distinct performance obligation and allocation of consideration from an arrangement to the individual performance obligations and the appropriate timing of revenue recognition are significant judgments with respect to these arrangements. The Company typically establishes the SSP based on observable prices of products or services sold separately in comparable circumstances to similar clients. The Company may estimate SSP by considering internal costs, profit objectives and pricing practices in certain circumstances.

Warranties, discounts and allowances are estimated using historical and recent data trends. The Company includes estimates in the transaction price only to the extent that a significant reversal of revenue is not probable in subsequent periods. The Company’s products and services are generally not sold with a right of return, nor has the Company experienced significant returns from or refunds to its customers.

Products

The Company derives SBS segment revenue from the sale of burn-in and reliability test equipment used in the “back-end” manufacturing processes of semiconductors. Our equipment includes burn-in systems, burn-in boards and related equipment that is used in the testing of structural integrity of integrated circuits.

Under the IE segment, the Company designs, manufactures and distributes an extensive range of test, process and other equipment used in the manufacturing processes of customers in various industries in the consumer and industrial market. The Company also acts as a design-in reseller of a wide range of camera module, LCD displays and touch screen panels.

The Company recognizes revenue at a point in time when the Company has satisfied its performance obligation by transferring control of the product to the customer. The Company uses judgment to evaluate whether the control has transferred by considering several indicators, including whether:

| ● | the Company has a present right to payment; |

| ● | the customer has legal title; |

| ● | the customer has physical possession; |

| ● | the customer has significant risk and rewards of ownership; and |