Trio-Tech International (NYSE MKT: TRT) today announced

financial results for the fourth quarter and fiscal year ended June

30, 2019.

Fourth Quarter Results

Overall revenue for the fourth quarter of fiscal 2019 decreased

1% to $10,625,000 from $10,760,000 for the fourth quarter of fiscal

2018. While manufacturing revenue increased 17% to $4,803,000

compared to $4,116,000 last year, reflecting increased demand in

the Company’s Singapore operations, and distribution revenue

increased 11% to $1,864,000 from $1,678,000, lower demand in

Trio-Tech’s Malaysia and Tianjin, China operations led to a 20%

decrease in testing services revenue to $3,941,000 from $4,937,000

last year.

The decline in overall revenue, coupled with a change in product

mix, reduced gross margin to $2,468,000 for the fourth quarter of

fiscal 2019 from $2,851,000 for last year’s fourth quarter. As a

percentage of revenue, gross margin declined to 23% compared to 27%

of revenue for the same quarter last fiscal year.

Income from operations was $321,000 for the fourth quarter of

fiscal 2019 compared to $709,000 for the fourth quarter of fiscal

2018.

Net income for the fourth quarter of fiscal 2019 was $449,000,

or $0.12 per diluted share. This compares to net income for the

fourth quarter of fiscal 2018 $675,000, or $0.17 per diluted

share.

Shareholders' equity at June 30, 2019 was $24,861,000, or $6.77

per outstanding share, compared to $23,501,000, or $6.61 per

outstanding share, at June 30, 2018. There were 3,673,055 common

shares outstanding at June 30, 2019.

CEO Comments

S.W. Yong, Trio-Tech's CEO, said, “Despite the decrease in

Trio-Tech’s fiscal 2019 revenue, we achieved a 31% increase in net

income to $1,545,000, or $0.41 per diluted share, compared to

$1,184,000, or $0.31 per diluted in fiscal 2018. Net income

benefitted from a one-off gain on the sale of properties in our

Chongqing real-estate operation and lower tax expenses for fiscal

2019. We remain convinced of the quality of our business and our

opportunities for long term growth despite the headwinds created by

the ongoing trade tension between the United States and China.

"We are encouraged by the sharp increase in fourth quarter

revenue in our manufacturing and distribution segments, compared to

the fourth quarter of fiscal 2018. We continued to invest in the

business in fiscal 2019, including increased capital expenditures

to address opportunities for growth in specific markets. We also

were able to present Trio-Tech’s world-class capabilities in

introductory and follow-up meetings with our counterparts at

several potentially large new accounts, an effort we believe will

benefit the Company over time."

Fiscal 2019 Results

For the fiscal year ended June 30, 2019, revenue decreased 7% to

$39,198,000 compared to $42,361,000 in fiscal 2018. Manufacturing

revenue decreased 7% to $14,889,000 from $15,978,000, and testing

services revenue decreased 14% to $16,760,000 from $19,391,000 for

fiscal 2018. Distribution revenue increased 9% to $7,451,000 from

$6,853,000 for fiscal 2018.

Gross margin for fiscal 2019 decreased to $9,001,000, or 23% of

revenue, compared to $10,638,000, or 25% of revenue, for fiscal

2018.

Income from operations decreased 64% to $794,000 for fiscal 2019

compared to $2,188,000 for fiscal 2018.

Net income for fiscal 2019 was $1,545,000, or $0.41 per diluted

share. This compares to net income for fiscal 2018 of $1,184,000,

or $0.31 per diluted share.

Net income for fiscal 2019 benefited from $615,000 in other

income, which included a gain of $685,000 on the sale of

properties. In comparison, other income contributed a gain of

$102,000 for fiscal 2018. Net income for fiscal 2018 also was

affected by a one-time, non-cash income tax expense of $900,000

related to the 2017 United States Tax Cuts and Jobs Act. As of

December 31, 2018, the Company’s accounting for the Tax Act was

complete. The provision for income taxes for the year ended June

30, 2019 includes a $145,000 decrease from the completion of our

provisional accounting for the effects of the Tax Act under SAB

118. The decrease is associated with the one-time mandatory

repatriation tax related to certain post-1986 earnings and profits

that were deferred from U.S. taxation by the Company’s foreign

subsidiaries. The US federal income tax return was filed during Q4,

which included the $755,000 one-time repatriation tax as well as

utilization of net operating losses and tax credits amounting to

$192,000 which was not finalized until the filing of return.

About Trio‑Tech

Established in 1958 and headquartered in Van Nuys, California,

Trio-Tech International is a diversified business group with

interests in semiconductor testing services, manufacturing and

distribution of semiconductor testing equipment, and real estate.

Further information about Trio-Tech's semiconductor products and

services can be obtained from the Company's Web site at

www.triotech.com, www.universalfareast.com, and

www.ttsolar.com.

Forward Looking Statements

This press release contains statements that are forward looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995 and may contain forward looking statements

within the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended, and assumptions regarding future activities and results of

operations of the Company. In light of the "safe harbor" provisions

of the Private Securities Litigation Reform Act of 1995, the

following factors, among others, could cause actual results to

differ materially from those reflected in any forward looking

statements made by or on behalf of the Company: market acceptance

of Company products and services; changing business conditions or

technologies and volatility in the semiconductor industry, which

could affect demand for the Company's products and services; the

impact of competition; problems with technology; product

development schedules; delivery schedules; changes in military or

commercial testing specifications which could affect the market for

the Company's products and services; difficulties in profitably

integrating acquired businesses, if any, into the Company; risks

associated with conducting business internationally and especially

in Asia, including currency fluctuations and devaluation, currency

restrictions, local laws and restrictions and possible social,

political and economic instability; changes in U.S. and global

financial and equity markets, including market disruptions and

significant interest rate fluctuations; and other economic,

financial and regulatory factors beyond the Company's control.

Other than statements of historical fact, all statements made in

this Quarterly Report are forward looking, including, but not

limited to, statements regarding industry prospects, future results

of operations or financial position, and statements of our intent,

belief and current expectations about our strategic direction,

prospective and future financial results and condition. In some

cases, you can identify forward looking statements by the use of

terminology such as "may," "will," "expects," "plans,"

"anticipates," "estimates," "potential," "believes," "can impact,"

"continue," or the negative thereof or other comparable

terminology. Forward looking statements involve risks and

uncertainties that are inherently difficult to predict, which could

cause actual outcomes and results to differ materially from our

expectations, forecasts and assumptions.

TRIO‑TECH INTERNATIONAL AND

SUBSIDIARIES

CONSOLIDATED STATEMENTS OF

OPERATIONS AND COMPREHENSIVE INCOME

AUDITED (IN THOUSANDS, EXCEPT

EARNINGS PER SHARE)

Three Months Ended

Twelve Months Ended

June 30,

June 30,

Revenue

2019

2018

2019

2018

Manufacturing

$

4,803

$

4,116

$

14,889

$

15,978

Testing services

3,941

4,937

16,760

19,391

Distribution

1,864

1,678

7,451

6,853

Real estate

17

29

98

139

10,625

10,760

39,198

42,361

Cost of Sales

Cost of manufactured products sold

3,587

2,967

11,393

12,213

Cost of testing services rendered

2,851

3,442

12,202

13,323

Cost of distribution

1,674

1,470

6,505

6,068

Cost of real estate

45

30

97

119

8,157

7,909

30,197

31,723

Gross Margin

2,468

2,851

9,001

10,638

Operating Expenses:

General and administrative

1,826

1,911

7,049

7,250

Selling

246

214

826

826

Research and development

75

74

345

451

Gain on disposal of property, plant and

equipment

--

(57

)

(13

)

(77

)

Total operating expenses

2,147

2,142

8,207

8,450

Income from Operations

321

709

794

2,188

Other (Expenses) Income

Interest expense

(69

)

(59

)

(319

)

(233

)

Other income, net

29

24

249

335

Gain on sale of properties

--

--

685

--

Total other (Expenses) Income

(40

)

(35

)

615

102

Income from Continuing Operations before

Income Taxes

281

674

1,409

2,290

Income Tax Benefit (Expense)

201

48

42

(987

)

Income from Continuing Operations before

Non-controlling Interest, net of tax

482

722

1,451

1,303

Loss from discontinued operations, net of

tax

(1

)

(2

)

(3

)

(13

)

NET INCOME

481

720

1,448

1,290

Less: Net income (loss) attributable to

the non-controlling interest

32

45

(97

)

106

Net Income attributable to Trio-Tech

International

449

675

1,545

1,184

Net Income Attributable to Trio-Tech

International:

Income from continuing operations, net of

tax

451

677

1,548

1,197

Loss from discontinued operations, net of

tax

(2

)

(2

)

(3

)

(13

)

Net Income Attributable to Trio-Tech

International

449

$

675

1,545

$

1,184

Basic Earnings per Share - Continuing

Operations

$

0.12

$

0.19

$

0.42

$

0.34

Basic Loss per Share - Discontinued

Operations

--

(0.01

)

--

(0.01

)

Basic Earnings per Share

$

0.12

$

0.18

$

0.42

$

0.33

Diluted Earnings per Share – Continuing

Operations

$

0.12

$

0.18

$

0.41

$

0.32

Diluted Loss per Share – Discontinued

Operations

--

(0.01

)

--

(0.01

)

Diluted Earnings per Share

$

0.12

$

0.17

$

0.41

$

0.31

Weighted Average Shares Outstanding -

Basic

3,673

3,553

3,673

3,553

Weighted Average Shares Outstanding -

Diluted

3,681

3,714

3,762

3,771

TRIO‑TECH INTERNATIONAL AND

SUBSIDIARIES

CONSOLIDATED STATEMENTS OF

OPERATIONS AND COMPREHENSIVE INCOME

AUDITED (IN THOUSANDS, EXCEPT

EARNINGS PER SHARE)

Three Months Ended

Twelve Months Ended

June 30,

June 30,

2019

2019

2019

2018

Comprehensive Income Attributable to

Trio-Tech International Common Shareholders:

Net income

$

481

$

720

$

1,448

$

1,290

Foreign currency translation, net of

tax

(231

)

(1,081

)

(420

)

728

Comprehensive Income (Loss)

250

(361

)

1,028

2,018

Less: Comprehensive (Loss) Income

attributable to non-controlling interests

(11

)

30

(202

)

285

Comprehensive Income (Loss) Attributable

to Trio-Tech International

$

261

$

(391

)

$

1,230

$

1,733

TRIO‑TECH INTERNATIONAL AND

SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE

SHEETS

(IN THOUSANDS, EXCEPT NUMBER OF

SHARES)

June 30,

2019

2018

ASSETS

(Audited)

CURRENT ASSETS:

Cash and cash equivalents

$

4,863

$

6,539

Short-term deposits

4,144

653

Trade accounts receivable, net

7,113

7,747

Other receivables

817

881

Inventories, net

2,427

2,930

Prepaid expenses and other current

assets

287

208

Assets held for sale

89

91

Total current assets

19,740

19,049

Deferred tax assets

390

400

Investment properties, net

782

1,146

Property, plant and equipment, net

12,159

11,935

Other assets

1,750

2,249

Restricted term deposits

1,706

1,695

Total non-current assets

16,787

17,425

TOTAL ASSETS

$

36,527

$

36,474

LIABILITIES AND SHAREHOLDERS’

EQUITY

CURRENT LIABILITIES:

Lines of credit

$

187

$

2,043

Accounts payable

3,272

3,704

Accrued expenses

3,486

3,172

Income taxes payable

417

285

Current portion of bank loans payable

488

367

Current portion of capital leases

283

250

Total current liabilities

8,133

9,821

Bank loans payable, net of current

portion

2,292

1,437

Capital leases, net of current portion

442

524

Deferred tax liabilities

327

327

Income taxes payable

439

828

Other non-current liabilities

33

36

Total non-current liabilities

3,533

3,152

TOTAL LIABILITIES

11,666

12,973

EQUITY

TRIO-TECH INTERNATIONAL'S SHAREHOLDERS'

EQUITY:

Common stock, no par value, 15,000,000

shares authorized; 3,673,055 and 3,553,055 issued and outstanding

at June 30, 2019 and June 30, 2018, respectively

11,424

11,023

Paid-in capital

3,305

3,249

Accumulated retained earnings

7,070

5,525

Accumulated other comprehensive

gain-translation adjustments

1,867

2,182

Total Trio-Tech International

shareholders' equity

23,666

21,979

Non-controlling interest

1,195

1,522

TOTAL EQUITY

24,861

23,501

TOTAL LIABILITIES AND EQUITY

$

36,527

$

36,474

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190923005655/en/

Company Contact: A. Charles Wilson Chairman (818)

787-7000

Investor Contact: Berkman Associates (310) 477-3118

info@BerkmanAssociates.com

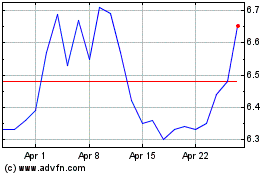

Trio Tech (AMEX:TRT)

Historical Stock Chart

From Mar 2024 to Apr 2024

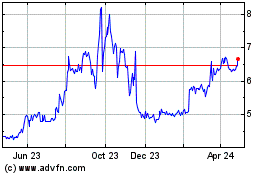

Trio Tech (AMEX:TRT)

Historical Stock Chart

From Apr 2023 to Apr 2024