Trinity Place Holdings Announces Update on Review of Strategic Alternatives

March 28 2023 - 8:40AM

Business Wire

Engages Houlihan Lokey and Ackman Ziff as

Advisors in Strategic Review Process

Trinity Place Holdings Inc. (NYSE American: TPHS) (the

“Company”) announced that it is providing an update on its ongoing

review of potential strategic alternatives. As previously

disclosed, the Company has been engaged in a process to review and

evaluate potential strategic alternatives to maximize shareholder

value. To that end the Company has engaged from time to time with

various parties who have expressed interest in the Company’s assets

and attributes, and has considered a range of potential strategic

transactions, including financing alternatives, a potential

financial restructuring or a reorganization, merger, reverse

merger, sale or other strategic transaction, with the goal of

maximizing the value of the assets and attributes of the

Company.

The Company has retained Houlihan Lokey and Ackman Ziff as its

financial advisors to assist with its evaluation of potential

strategic alternatives.

There can be no assurance that the strategic review process will

result in any strategic alternative, or any assurance as to its

outcome or timing. The Company has not set a timetable for

completion of the review process and does not intend to disclose

developments related to the process unless and until the Company

executes a definitive agreement with respect thereto, or it

otherwise determines that further disclosure is appropriate or

required.

About Trinity Place Holdings

Trinity Place Holdings Inc. is a real estate holding,

investment, development and asset management company. The Company’s

largest asset is a property located at 77 Greenwich Street in Lower

Manhattan, which is nearing completion as a mixed-use project

consisting of a 90-unit residential condominium tower, retail space

and a New York City elementary school. The Company also owns a

105-unit, 12-story multi-family property located at 237 11th Street

in Brooklyn, New York as well as a property occupied by retail

tenants in Paramus, New Jersey. In addition to its real estate

portfolio, the Company also controls a variety of intellectual

property assets, including Filene’s Basement and related

trademarks, focused on the consumer sector, a legacy of its

predecessor, Syms Corp. The Company also had approximately $268.0

million of federal net operating loss carryforwards as well as

approximately $232.9 million of state and local net operating loss

carryforwards at September 30, 2022, which can be used to reduce

its future taxable income and capital gains.

Forward Looking Statements

This press release includes forward-looking statements within

the meaning of Section 21E of the Securities Exchange Act of 1934,

as amended, and the Private Securities Litigation Reform Act of

1995. These forward-looking statements are based on current

expectations and projections about future events and are not

guarantees of future performance or results and involve risks and

uncertainties that cannot be predicted or quantified, and,

consequently, the actual performance of the Company may differ

materially from those expressed or implied by such forward-looking

statements. Such risks and uncertainties include the risk that the

Company may not identify one or more strategic alternatives or

ultimately pursue a strategic alternative, the risk that the

Company’s exploration of strategic alternatives or the public

announcement thereof may be disruptive to the Company’s business

operations or cause the Company’s stock price to fluctuate

significantly, the risk that the Company’s exploration of strategic

alternatives may be time consuming and involve the dedication of

significant resources and may require the Company to incur

significant costs and expenses, the risk that the Company’s

exploration of strategic alternatives could divert the attention of

the Company’s management and its board of directors from existing

business operations, negatively impact the Company’s ability to

attract, retain and motivate key employees, and expose the Company

to potential litigation in connection with the process of exploring

strategic alternatives or any resulting transaction, among other

risks and uncertainties, as well as the factors described in more

detail in the Company’s most recent Annual Report on Form 10-K, as

well as to its subsequent filings with the Securities and Exchange

Commission. The forward-looking statements contained herein speak

only as of the date hereof, and we assume no obligation to update

any forward-looking statements, whether as a result of new

information, subsequent events or otherwise, except as required by

law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230328005603/en/

Linda Flynn, (212) 235-2191 Linda.Flynn@tphs.com

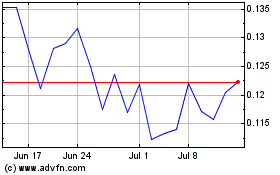

Trinity Place (AMEX:TPHS)

Historical Stock Chart

From Jul 2024 to Aug 2024

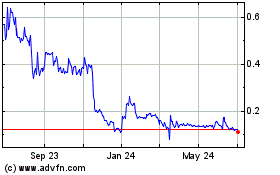

Trinity Place (AMEX:TPHS)

Historical Stock Chart

From Aug 2023 to Aug 2024