Current Report Filing (8-k)

January 03 2023 - 5:32PM

Edgar (US Regulatory)

0001553788

false

0001553788

2022-12-27

2022-12-27

0001553788

SBEV:CommonStock0.001ParValuePerShareMember

2022-12-27

2022-12-27

0001553788

SBEV:WarrantsToPurchaseSharesOfCommonStockMember

2022-12-27

2022-12-27

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM

8-K

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): December

27, 2022

| SPLASH BEVERAGE GROUP, INC. |

| (Exact Name of Registrant as Specified in Its Charter) |

| |

| Nevada |

| (State or Other Jurisdiction of Incorporation) |

| 001-40471 |

|

34-1720075 |

| (Commission File Number) |

|

(IRS Employer Identification No.) |

| |

1314

East Las Olas Blvd, Suite 221

Fort Lauderdale, Florida 33301 |

|

| (Address of Principal

Executive Offices) |

| |

| (954)

745-5815 |

| (Registrant’s

Telephone Number, Including Area Code) |

| |

| (Former Name or

Former Address, if Changed Since Last Report) |

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

| ☐ |

Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on

which registered |

| Common Stock, $0.001 par

value per share |

|

SBEV |

|

NYSE American LLC |

| Warrants to purchase shares

of common stock |

|

SBEV-WT |

|

NYSE American LLC |

Indicate by check mark whether the registrant is an

emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark

if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01

Entry into a Material Definitive Agreement.

Splash Beverage Group, Inc. (the

"Company") entered into a securities purchase agreements (the "Purchase Agreement") with certain accredited investors

(the "Purchasers"). Pursuant to the Purchase Agreement, the Company sold the Purchasers 12% convertible 18-month promissory

notes (the "Notes") convertible for up to 4,000,000 shares of the Company's common stock, $0.001 par value per share and warrants

exercisable into 4,000,000 shares of the Company's common stock (the "Warrants") and received aggregate gross proceeds of $4,000,000.

The Conversion Price of the Notes is $1 per share subject to adjustments as provided in the Notes.

The maturity date of the Notes (the

“Maturity Date”) is eighteen months from the issuance date of the Notes. Interest on the unpaid principal balance of the Notes

accrues at 12% per annum and subject to the conversion of the Notes accrued interest outstanding is payable in full on the Maturity date

of the Notes.

The Notes are

subject to customary events of default (“Event of Default”) including the failure to pay principal and interest when due,

bankruptcy by the Company. Upon the occurrence of an Event of Default, the unpaid portion

of the principal amount will bear simple interest from the date of the Event of Default at a rate equal to 7% per annum, for the duration

from such Event of Default until the cure of such Default or the repayment date of the entire outstanding balance of the Note.

On the Maturity

Date of the Notes, the principal and interest and any amounts due on the Notes shall automatically convert unless at least one business

date prior to such date, the Holder and/or the Company have indicated in writing that the Note shall not automatically Convert.

In any month,

the Holder will not convert more than the total of 10% of the shares issuable upon conversion of the Note and the shares issuable upon

exercise of the Warrant issued in connection with the Note.

The Warrants are exercisable on the

date of conversion of the Notes at an exercise price of $0.25 per share, subject to adjustment, and will expire 3 years from the initial

exercise date. In any month the Holder may not exercise the Warrants to acquire more than 10% of shares issuable upon exercise

of the Warrant and the shares issuable upon the conversion of the Notes.

Pursuant to the Purchase Agreement,

within one hundred twenty (120) days after the Company has received the purchase price of the Notes from the Investors the Company will

file with the U.S. Securities and Exchange Commission a registration statement registering the resale of the shares of the Company's common

stock underlying the Warrants.

The foregoing summary of the Purchase Agreement,

Note and Warrants are qualified by reference to the full text of such documents, copies of which

are filed as exhibits to this report and incorporated herein by reference.

Item 8.01 Other Information.

Effective December 30, 2022, the Company switched

transfer agents from Equiniti Shareowner Services to VStock Transfer, LLC

Item 9.01 Financial Statements and

Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: January 3, 2023

| SPLASH BEVERAGE GROUP, INC. |

|

| |

|

| /s/ Robert Nistico |

|

| Robert Nistico |

|

| Chief Executive Officer |

|

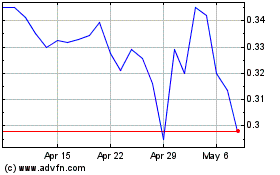

Splash Beverage (AMEX:SBEV)

Historical Stock Chart

From Mar 2024 to Apr 2024

Splash Beverage (AMEX:SBEV)

Historical Stock Chart

From Apr 2023 to Apr 2024