FALSE000009016800000901682022-03-232022-03-23

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) – November 8, 2023

SIFCO Industries, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| | | | |

Ohio | | 1-5978 | | 34-0553950 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| |

970 East 64th Street, Cleveland Ohio | | 44103 |

(Address of principal executive offices) | | (ZIP Code) |

Registrant’s telephone number, including area code: (216) 881-8600

N.A.

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Shares | | SIF | | NYSE American |

| | | | | |

| Item 1.01 | Entry into Material Definitive Agreements. |

On November 8, 2023, SIFCO Industries, Inc. (the “Company”) and certain of its subsidiaries (collectively, the “borrowers”) entered into the Eighth Amendment (the “Eighth Amendment”) to the Credit Agreement (as previously amended, the “Credit Agreement”), with JPMorgan Chase Bank, N.A., a national banking association (the “Lender”). Capitalized terms used but not otherwise defined herein shall have the meanings ascribed to them in the Credit Agreement.

The Eighth Amendment amends the Credit Agreement to, among other things, (i) reduces the Reserves under the Borrowing Base in the Credit Agreement to $1,500,000, or such lesser amount, if any, as may be agreed upon in writing by the Lender in its sole discretion.

The foregoing descriptions of the Eighth Amendment to the Credit Agreement do not purport to be complete and are qualified in their entirety by reference to the full text of the Eighth Amendment, attached to this Form 8-K as Exhibit 10.1, and incorporated herein by reference.

| | | | | |

| Item 2.03 | Creation of a Direct Financial Obligation or an Obligation under an Off Balance Sheet Arrangements of the Registrant. |

The disclosure in Item 1.01 and Exhibit 10.1 of this report are incorporated herein by reference.

| | | | | |

Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

104 Cover Page Interactive Data File (embedded within the Inline XBRL document).

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | |

| | SIFCO Industries, Inc. |

| | (Registrant) |

| |

Date: November 13, 2023 | | |

| | /s/ Thomas R. Kubera |

| | Thomas R. Kubera |

| | Chief Financial Officer |

| | (Principal Financial Officer) |

EIGHTH AMENDMENT TO CREDIT AGREEMENT

THIS EIGHTH AMENDMENT TO CREDIT AGREEMENT, dated as of November 8, 2023 (this "Amendment"), is by and among SIFCO Industries, Inc., an Ohio corporation (“SIFCO”), and Quality Aluminum Forge, LLC, an Ohio limited liability company (“Quality Forge” and, together with SIFCO, collectively, the “Borrowers” and each, individually, a “Borrower”), any other Loan Parties party hereto, and JPMorgan Chase Bank, N.A., a national banking association (the “Lender”).

RECITALS

A. The Borrowers, any other Loan Parties party thereto, and the Lender are parties to a Credit Agreement dated as of August 8, 2018 (as amended and as it may be further amended or modified from time to time, the “Credit Agreement”).

B. The Borrowers and any other Loan Parties desire to amend the Credit Agreement, and the Lender is willing to do so in accordance with the terms hereof.

TERMS

In consideration of the premises and of the mutual agreements herein contained, the parties agree as follows:

ARTICLE 1. AMENDMENTS. Upon fulfillment of the conditions set forth in Article IV hereof, the Credit Agreement shall be amended effective as of the date hereof as follows:

2.1 The definition of “Borrowing Base” in the Borrowing Base Schedule is hereby amended and restated as follows:

“Borrowing Base” means, at any time, the sum of (a) 85% of Eligible Accounts at such time, plus (b) the lesser of (i) 70% of Eligible Inventory, valued at the lower of cost or market value, determined on a first-in-first-out basis, at such time and (ii) the product of 85% multiplied by the NOLV Percentage identified in the most recent inventory appraisal ordered by the Lender multiplied by Eligible Inventory, valued at the lower of cost or market value, determined on a first-in-first-out basis, at such time, minus (c) Reserves of $1,500,000, or such lesser amount, if any, as may be agreed upon in writing by the Lender in its sole discretion (which may be by email from the Lender), plus (d) the PP&E Component. The Lender may, in its Permitted Discretion, reduce the advance rates set forth above or reduce one or more of the other elements used in computing the Borrowing Base.

ARTICLE II. REPRESENTATIONS. Each Loan Party represents and warrants to the Lender that:

2.1 This Amendment has been duly executed and delivered by such Loan Party and constitutes a legal, valid and binding obligation of such Loan Party, enforceable in accordance with its terms, subject to applicable bankruptcy, insolvency, reorganization, moratorium or other laws affecting creditors' rights generally and subject to general principles of equity, regardless of whether considered in a proceeding in equity or at law.

2.2 After giving effect to this Amendment, the representations and warranties contained in Article III of the Credit Agreement and in the other Loan Documents are true in all material respects on and as of the date hereof with the same force and effect as if made on and as of the date hereof (it being understood and agreed that any representation or warranty which by its terms is made as of a specified date shall be required to be true and correct in all material respects only as of such specified date, and that any representation or warranty which is subject to any materiality qualifier shall be required to be true and correct in all respects).

2.3 After giving effect to this Amendment, no Default exists or has occurred and is continuing, and no Default will be caused after giving effect to this Amendment.

2.4 All certifications, representations and other statements made in each Borrower’s Officer’s Certificate dated as of August 8, 2018 and delivered to Lender are true on and as of the date hereof with the same force and effect as if made on and as of the date hereof and all resolutions and other statements referenced therein are in full force and effect, have not been rescinded and authorize the execution, delivery and performance of this Amendment.

ARTICLE III. CONDITIONS OF EFFECTIVENESS. This Amendment shall become effective as of the date hereof when each of the following conditions is satisfied:

3.1 The Loan Parties and the Lender shall have signed this Amendment.

ARTICLE IV. MISCELLANEOUS.

4.1 References in the Credit Agreement or in any other Loan Document to the Credit Agreement shall be deemed to be references to the Credit Agreement as amended hereby, as amended previously and as further amended from time to time.

4.2 Except as expressly amended hereby, the Loan Parties agree that the Credit Agreement and all other Loan Documents are ratified and confirmed, as amended hereby, and shall remain in full force and effect in accordance with their terms and that they have no set off, counterclaim, defense or other claim or dispute with respect to any of the foregoing. The amendment contained herein shall not be construed as a waiver or amendment of any other provision of the Credit Agreement or the other Loan Documents or for any purpose except as expressly set forth herein.

4.3 Capitalized terms used but not defined herein shall have the respective meanings ascribed thereto in the Credit Agreement. This Amendment is a Loan Document. This Amendment may be signed upon any number of counterparts with the same effect as if the signatures thereto and hereto were upon the same instrument. Among other provisions of the Credit Agreement, this Amendment is subject to Sections 8.06, 8.09 and 8.10 of the Credit Agreement.

IN WITNESS WHEREOF, the parties signing this Amendment have caused this Amendment to be executed and delivered as of the day and year first above written.

BORROWERS:

SIFCO INDUSTRIES, INC.

By:___/s/___________________________________

Name: Tom Kubera

Title: Chief Financial Officer

QUALITY ALUMINUM FORGE, LLC

By:___/s/___________________________________

Name: Tom Kubera

Title: Treasurer

SIFCO Eighth Amendment Signature Page

LENDER:

JPMORGAN CHASE BANK, N.A.

By:___/s/___________________________________

Name: Karson Malecky

Title: Authorized Officer

SIFCO Eighth Amendment Signature Page

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

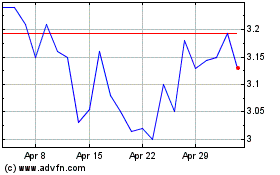

Sifco Industries (AMEX:SIF)

Historical Stock Chart

From Apr 2024 to May 2024

Sifco Industries (AMEX:SIF)

Historical Stock Chart

From May 2023 to May 2024