false

0001682220

0001682220

2024-08-20

2024-08-20

0001682220

us-gaap:CommonStockMember

2024-08-20

2024-08-20

0001682220

sach:Notes6.875PercentDue2024Member

2024-08-20

2024-08-20

0001682220

sach:Notes7.75percentDue2025Member

2024-08-20

2024-08-20

0001682220

sach:Notes6.00percentDue2026Member

2024-08-20

2024-08-20

0001682220

sach:Notes6.00percentDue2027Member

2024-08-20

2024-08-20

0001682220

sach:Notes7.125PercentDue2027Member

2024-08-20

2024-08-20

0001682220

sach:Notes8.00percentDue2027Member

2024-08-20

2024-08-20

0001682220

us-gaap:SeriesAPreferredStockMember

2024-08-20

2024-08-20

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

August 20, 2024

SACHEM

CAPITAL CORP.

(Exact name of Registrant as specified in its

charter)

| New

York |

|

001-37997 |

|

81-3467779 |

(State

or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer

Identification No.) |

| 568 East

Main Street, Branford,

Connecticut |

|

06405 |

| (Address

of Principal Executive Office) |

|

(Zip

Code) |

Registrant's

telephone number, including area code (203)

433-4736

| (Former

Name or Former Address, if Changed Since Last Report) |

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

Ticker

symbol(s) |

Name

of each exchange on which registered |

| Common

Shares, par value $.001 per share |

SACH |

NYSE American LLC |

| 6.875%

Notes due 2024 |

SACC |

NYSE American LLC |

| 7.75%

notes due 2025 |

SCCC |

NYSE American LLC |

| 6.00%

notes due 2026 |

SCCD |

NYSE American LLC |

| 6.00%

notes due 2027 |

SCCE |

NYSE American LLC |

| 7.125%

notes due 2027 |

SCCF |

NYSE American LLC |

| 8.00%

notes due 2027 |

SCCG |

NYSE American LLC |

| 7.75%

Series A Cumulative Redeemable Preferred Stock, Liquidation Preference $25.00 per share |

SACHPRA |

NYSE

American LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter)

Emerging growth company

¨

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 1.01. | Entry into a Material Definitive Agreement. |

On August 20, 2024, Sachem Capital Corp. (the “Company”)

entered into a cooperation agreement (the “Cooperation Agreement”) with Blackwells

Capital LLC, Blackwells Onshore I LLC and Jason Aintabi (together with their respective affiliates, “Blackwells”).

Pursuant to the Cooperation Agreement, the board of directors of the Company (the “Board”)

appointed Jeffery C. Walraven to serve on the Board, with a term expiring at the 2024 annual meeting of shareholders (the “2024

Annual Meeting”), and agreed to nominate, support and recommend Mr. Walraven for election at the 2024 Annual Meeting. Effective

upon execution of the Cooperation Agreement, Blackwells withdrew a notice of intent that it submitted to the Company to nominate candidates

for election to the Board at the 2024 Annual Meeting.

The Cooperation Agreement further provides, among

other things, that until the Termination Date (as defined below), (i) Blackwells will be subject to customary standstill restrictions,

including, among others, with respect to proxy solicitations and extraordinary transactions; (ii) each party will not disparage or sue

the other party, subject to certain exceptions; (iii) Blackwells will vote all common shares of the Company beneficially owned by Blackwells

in accordance with the Board’s recommendations with respect to all proposals submitted to shareholders at each annual or special

meeting of shareholders of the Company, subject to certain exceptions; and (iv) the Company will reimburse certain of Blackwells’

out-of-pocket costs and expenses, provided that such reimbursement will not exceed $150,000 in the aggregate.

The Cooperation Agreement will remain in effect

until terminated in accordance with its terms. Unless otherwise mutually agreed to in writing, either party can terminate the Cooperation

Agreement with five business days’ notice following the date that is 30 days prior to the earlier of (i) the deadline under the

Company’s bylaws for the nomination of director candidates for election to the Board at the 2032 annual meeting of shareholders

and (ii) the deadline for shareholder nominations of director candidates under Rule 14a-19 under the Securities Exchange Act of 1934,

as amended, with respect to the 2032 annual meeting of shareholders (the “Termination Date”).

The foregoing description does not purport to be

complete and is qualified in its entirety by reference to the Cooperation Agreement, a copy of which is attached hereto as Exhibit 10.1

and is incorporated herein by reference.

| Item 5.02. | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of

Certain Officers. |

On

August 21, 2024, the Board appointed Jeffery C. Walraven to the Board with a term expiring at the 2024 Annual Meeting. Mr. Walraven’s

appointment filled the vacant fifth seat on the Board resulting from the resignation of Jeffrey Villano from the Board in 2019.

Jeffery C. Walraven, age 55, brings to the Board

experience in public company accounting, corporate capital markets and background in the real estate industry. Mr. Walraven is Co-Founder

and Chief Operating Officer of Freehold Properties, Inc., a real estate investment trust (REIT) focused on specialty industrial and retail

real estate, since its formation in May 2019. In addition, he has served as an independent director and member of the audit committee

of Broad Street Realty, Inc. (OTCQX: BRST), a real estate company that owns, operates, develops, and redevelops primarily essential grocery-anchored

shopping centers and mixed-use properties, since September 2023. From January 2014 to May 2019, Mr. Walraven served as Executive Vice

President and Chief Financial Officer of MedEquities Realty Trust, Inc. (formerly NYSE: MRT), a REIT specializing in healthcare properties.

From July 2007 to June 2014, Mr. Walraven served as an assurance partner of BDO USA, LLP, an international accounting firm, and was appointed

Managing Partner of BDO USA’s Memphis office in January 2013. Mr. Walraven is formerly a certified public accountant and graduated

from Bob Jones University with a B.S. in Financial Management and from Clemson University with a Masters of Professional Accountancy.

Except for the arrangements disclosed herein, there

is no arrangement or understanding between the Company and Mr. Walraven pursuant to which he was appointed to the Board, and there have

been no related party transactions between the Company and Mr. Walraven that would be reportable under Item 404(a) of Regulation S-K.

Mr. Walraven will receive compensation consistent with the Company’s compensation program for non-employee directors.

The disclosure set forth in Item 1.01 above is

hereby incorporated herein by reference.

| Item 7.01. | Regulation FD Disclosure. |

A copy of a press release announcing the appointment

of Mr. Walraven is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits

In accordance with General Instruction B.2 of Form

8-K, the information in this Current Report on Form 8-K, furnished pursuant to Item 7.01, including Exhibit 99.1, shall not be deemed

to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

or otherwise subject to the liability of that section, and shall not be incorporated by reference into any registration statement or other

document filed under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference

in such filing.

* * * * *

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Sachem Capital Corp. |

| |

|

|

| Dated: August 26, 2024 |

By: |

/s/ John L. Villano |

| |

|

John L. Villano, CPA |

| |

|

President and Chief Executive Officer |

Exhibit 10.1

COOPERATION AGREEMENT

This COOPERATION AGREEMENT

(this “Agreement”) is made and entered into as of August 20, 2024, by and between Sachem Capital Corp., a New

York corporation (the “Company”), and Blackwells Capital LLC, Blackwells Onshore I LLC and Jason Aintabi (together

with their respective Affiliates, “Blackwells”). The Company and Blackwells are each herein referred to as a “party”

and collectively, the “parties.” Capitalized terms used herein shall have the meanings set forth in Section 14

of this Agreement.

WHEREAS, on July 9,

2024, Blackwells Onshore I LLC submitted to the Company notice of Blackwells’ intent to nominate four candidates (the “Nomination

Notice”) for election to the Board of Directors of the Company (the “Board”) at the Company’s 2024

Annual Meeting of Shareholders (the “2024 Annual Meeting”); and

WHEREAS, the Company and

Blackwells have determined to come to an agreement with respect to the withdrawal of the Nomination Notice and certain other matters,

as provided in this Agreement.

NOW,

THEREFORE, in consideration of the foregoing premises and the mutual covenants and agreements contained herein, and for other

good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties, intending to be legally bound

hereby, agree as follows:

| 1. | Board

Composition and Related Matters. |

(a) Blackwells

hereby (i) irrevocably withdraws, with this Agreement constituting sufficient and conclusive evidence of such withdrawal, the Nomination

Notice as well as Blackwells’ director nominations and any related materials or notices submitted to the Company in connection

therewith or related thereto with respect to the 2024 Annual Meeting (collectively, the “Blackwells Shareholder Matters”),

and (ii) agrees to abstain from taking further action to pursue the Blackwells Shareholder Matters or any other action related to

the 2024 Annual Meeting (other than in accordance with this Agreement.)

(b) Simultaneously

with the execution of this Agreement, the Company shall take all necessary actions to appoint Jeffery Charles Walraven to the Board as

a director, with a term expiring at the 2024 Annual Meeting or until his earlier death, disability, resignation, disqualification, or

removal. The Company shall take all necessary actions to (i) nominate Mr. Walraven for election to the Board at the 2024 Annual

Meeting, (ii) include Mr. Walraven in the Company’s proxy statement and proxy card for the 2024 Annual Meeting, (iii) solicit

proxies for the election of Mr. Walraven in respect of the 2024 Annual Meeting in a manner no less rigorous and favorable than the

manner in which it solicits proxies for the election of the Company’s other director nominees, and (iv) support and recommend

for the election of Mr. Walraven in respect of the 2024 Annual Meeting in the same manner as it supports and recommends for the

election of the Company’s other director nominees.

2. Voting

Commitment. Until the Termination Date, Blackwells shall, and shall cause its Representatives

to appear in person or by proxy at each Shareholder Meeting (including the 2024 Annual Meeting) and to vote, or deliver consents or consent

revocations with respect to, all of the Company’s common shares, par value $0.001 per share (the “Common Shares”),

beneficially owned by Blackwells and over which Blackwells has voting power, in accordance with the Board’s recommendations with

respect to all proposals submitted to shareholders at each such Shareholder Meeting, in each case as the Board’s recommendation

is set forth in the applicable definitive proxy statement, consent solicitation statement or revocation solicitation statement filed

by the Company in respect of such Shareholder Meeting. Notwithstanding the foregoing, (i) in the event that Institutional Shareholder

Services, Inc. (“ISS”) issues voting recommendations that differ from the voting recommendation of the Board

with respect to any proposal submitted to the shareholders at any Shareholder Meeting (other than proposals to elect or remove directors),

Blackwells shall be permitted to vote, or deliver consents or consent revocations with respect to, all or a portion of the Common Shares

it beneficially owns and over which Blackwells has voting power, respectively, at such Shareholder Meeting in accordance with ISS recommendations;

and (ii) Blackwells shall be permitted to vote in its sole discretion on any proposal of the Company in respect of any Extraordinary

Transaction that is subject to a vote of the Company’s shareholders. Blackwells shall use commercially reasonable efforts (including

by calling back any loaned out shares) to ensure that Blackwells has voting power for each share beneficially owned by it on the record

date for and through each Shareholder Meeting. For the avoidance of doubt, if ISS is silent regarding any Company proposal, Blackwells

shall vote only in accordance with the Board’s recommendation.

3. Standstill.

Prior to the Termination Date, except as otherwise provided in this Agreement, without the prior

written consent of the Board, Blackwells shall not, and shall cause each of its Affiliates and Associates not to, in each case, directly

or indirectly, in whole or in part, in any manner:

(a) acquire,

offer or seek to acquire, agree to acquire or acquire rights to acquire (except by way of stock dividends or other distributions or offerings

made available to holders of voting securities of the Company generally on a pro rata basis or pursuant to an Extraordinary Transaction

approved by the Board), directly or indirectly, whether by purchase, tender or exchange offer, through the acquisition of control of

another person, by joining a group, through swap or hedging transactions or otherwise, any voting securities of the Company (other than

through a broad-based market basket or index fund) or any voting rights decoupled from the underlying voting securities which would result

in Blackwells’ beneficially owning or constructively owning (as defined in Sections 856(h) and 544(a) of the Internal

Revenue Code of 1986, as amended), in the aggregate, more than four and ninety-nine hundredths percent (4.99%) of the then-outstanding

Common Shares;

(b) sell,

assign, or otherwise transfer or dispose of Common Shares, or any rights decoupled from such shares, beneficially owned by them, other

than in open market sale transactions where the identity of the purchaser is not known or in underwritten widely-dispersed public offerings,

to any Third Party that, to Blackwells’ knowledge (after reasonable due inquiry in connection with a private, non-open market transaction),

would result in such Third Party’s, together with its Affiliates and Associates, beneficially owning or constructively owning (as

defined in Sections 856(h) and 544(a) of the Internal Revenue Code of 1986, as amended), in the aggregate, more than four and

ninety-nine hundredths percent (4.99%);

(c) (i) nominate,

recommend for nomination or give notice of an intent to nominate or recommend for nomination a person for election at any Shareholder

Meeting at which the Company’s directors are to be elected; (ii) initiate, encourage or participate in any solicitation of

proxies, consents or consent revocations in respect of any election contest or removal contest with respect to the Company’s directors;

(iii) submit, initiate, make or be a proponent of any shareholder proposal for consideration at, or bring any other business before,

any Shareholder Meeting; (iv) initiate, encourage or participate in any solicitation of proxies, consents or consent revocations

in respect of any shareholder proposal for consideration at, or other business brought before, any Shareholder Meeting; (v) call

or seek to call, or request to call, alone or in concert with others, any Shareholder Meeting, whether or not such a meeting is permitted

by the Company’s Certificate of Incorporation (as amended from time to time, the “Certificate of Incorporation”)

or the Company’s Amended and Restated Bylaws (as amended from time to time, the “Bylaws”), including any “town

hall meeting,” or initiate, encourage or participate in any shareholder action by written consent; or (vi) initiate, encourage

or participate in any “withhold” or similar campaign with respect to any proposal for consideration at, or other business

brought before, any Shareholder Meeting;

(d) form,

join or in any way participate in or with any group or agreement of any kind with respect to any voting securities of the Company, including

in connection with any election or removal contest with respect to the Company’s directors or any shareholder proposal or other

business brought before any Shareholder Meeting;

(e) deposit

any voting securities of the Company in any voting trust or subject any Company voting securities to any arrangement or agreement with

respect to the voting thereof;

(f) seek,

alone or in concert with others, to amend any provision of the Certificate of Incorporation, the Bylaws, Board committee charters, corporate

governance principles, and any similar governance-related policies or documents of the Company;

(g) demand

an inspection of the Company’s books and records;

(h) make

any proposal with respect to, or make any statement or otherwise seek to encourage, advise or assist any person in so encouraging or

advising: (i) any change in the composition, number or term of directors serving on the Board or the filling of any vacancies on

the Board, (ii) any change in the capitalization or dividend policy or share repurchase programs or practices of the Company, (iii) any

other change in the Company’s management, governance, corporate structure, business, operations, strategy, affairs or policies,

(iv) causing a class of securities of the Company to be delisted from, or to cease to be authorized to be quoted on, any securities

exchange, or (v) causing a class of equity securities of the Company to become eligible for termination of registration pursuant

to Section 12(g)(4) of the Exchange Act;

(i) publicly

disclose any vote, delivery of consents or consent revocations, or failure to deliver consents or consent revocations, as applicable,

by Blackwells against the voting recommendations of the Board in connection with a Shareholder Meeting;

(j) initiate,

make, offer, propose to effect or in any way participate, directly or indirectly, in any Extraordinary Transaction or make, directly

or indirectly, any proposal, either alone or in concert with others, to the Company or the Board that would reasonably be expected to

require a public announcement or disclosure regarding any such matter;

(k) effect

or seek to effect, offer or propose to effect, cause or participate in, or in any way assist or facilitate any other person to effect

or seek to effect, offer or propose to effect, cause or participate in, any Extraordinary Transaction;

(l) enter

into any negotiations, agreements or understandings with any Third Party with respect to any of the foregoing, or advise, assist, encourage

or seek to persuade any Third Party to take any action that is prohibited under this Section 3, or otherwise take or cause

any action inconsistent with any of the foregoing;

(m) make

or in any way advance any request or proposal that the Company or the Board amend, modify or waive any provision of this Agreement; or

(n) take

any action challenging the validity or enforceability of this Section 3 or this Agreement unless the Company is challenging

the validity or enforceability of this Agreement;

provided,

however, that (i) the restrictions in this Section 3 shall not prohibit or restrict Blackwells or its Representatives

from making (A) any factual statement to the extent required by applicable legal process, subpoena or legal requirement from any

governmental authority with competent jurisdiction over the party from whom information is sought (so long as such request did not arise

as a result of action by Blackwells or its Representatives) or (B) any private or confidential communication to or with the Board

or any officer or director of the Company or legal counsel that is not intended to, and would not reasonably be expected to, trigger

or require any public disclosure of such communications for any of the parties and (ii) the restrictions in this Section 3

shall not restrict Blackwells or its Representatives from tendering shares, receiving payment for shares or otherwise participating

in any transaction approved by the Board on the same basis as the other shareholders of the Company, subject to the other terms of this

Agreement. Blackwells shall comply with the requirements of Section 13(d) of the Exchange Act.

4. Mutual

Non-Disparagement. Prior to the Termination Date, each party hereby covenants and agrees

that it and its respective Representatives shall not, without the prior written consent of the other party, make any public statement,

including by filing or furnishing any document to the SEC, or speaking to any analyst, investor, or member of the press or other person,

in a manner that criticizes, undermines, disparages or otherwise reflects detrimentally on the other party, the other party’s Affiliates

or subsidiaries, the other party’s or its Affiliates’ or subsidiaries’ current or former directors in their capacity

as such, the other party’s or its Affiliates’ or subsidiaries’ officers or employees (including with respect to such

persons’ service at the other party, and including any current officer of a party or a party’s Affiliates or subsidiaries

who no longer serves in such capacity following the execution of this Agreement), or any of their businesses, products or services. A

statement in breach of this Section 4 shall only be deemed to be made by the Company if made by a member of the Board or

senior management team, in each case authorized to make such statement. The restrictions in this Section 4 shall not (x) apply

(i) to any compelled testimony or production of information, whether by legal process, subpoena or as part of a response to a request

for information from any governmental or regulatory authority with jurisdiction over the party from whom information is sought, in each

case, to the extent required, or (ii) to any disclosure that such party reasonably believes, after consultation with outside counsel,

to be legally required by applicable law, rules or regulations, in each case of clause (i) or (ii), solely to the extent that

such restrictions would require a violation of the applicable requirement; or (y) prohibit any party from reporting what it reasonably

believes, after consultation with outside counsel, to be violations of federal law or regulation to any governmental authority pursuant

to Section 21F of the Exchange Act or Rule 21F promulgated thereunder.

5. No

Litigation. Prior to the Termination Date, each party hereby covenants and agrees that it

shall not, and shall not permit any of its Representatives to, directly or indirectly, alone or in concert with others, encourage, threaten,

initiate or pursue, or assist any other person to encourage, threaten, initiate or pursue, any lawsuit, claim or proceeding before any

court (each, a “Legal Proceeding”) against the other party or any of its Representatives based on information known

or that should have been known by such party as of the date of this Agreement, except for (a) any Legal Proceeding initiated primarily

to remedy a breach of or to enforce this Agreement and (b) counterclaims with respect to any proceeding initiated by, or on behalf

of, one (1) party or its Affiliates against the other party or any Affiliate of such other party; provided, however,

that the foregoing shall not prevent any party or any of its Representatives from responding to oral questions, interrogatories, requests

for information or documents, subpoenas, civil investigative demands or similar processes (each, a “Legal Requirement”)

in connection with any Legal Proceeding if such Legal Proceeding has not been initiated by, on behalf of or at the direct or indirect

suggestion of such party or any of its Representatives; provided, further, that in the event any party or any of its Representatives

is subject to such Legal Requirement, such party shall give prompt written notice of such Legal Requirement to the other party (except

where such notice would be prohibited by law, other than by a contractual relationship). Each party represents and warrants that neither

it nor any assignee has filed any lawsuit against the other party.

| 6. | Public Statements; SEC Filings. |

No later than four (4) Business

Days following the date of this Agreement, the Company shall file with the SEC a Current Report on Form 8-K, setting forth a brief

description of the terms of this Agreement and appending this Agreement as an exhibit thereto (the “Form 8-K”).

The Company shall provide Blackwells with a reasonable opportunity to review and comment on such Form 8-K prior to the filing with

the SEC and consider in good faith any comments of Blackwells.

7. Affiliates

and Associates. Each party shall instruct its Affiliates and Associates to comply with the

terms of this Agreement and shall be responsible for any breach of this Agreement by any such Affiliate or Associate. A breach of this

Agreement by an Affiliate or Associate of a party, if such Affiliate or Associate is not a party to this Agreement, shall be deemed to

occur if such Affiliate or Associate engages in conduct that would constitute a breach of this Agreement if such Affiliate or Associate

was a party to the same extent as a party to this Agreement.

| 8. | Representations

and Warranties. |

(a) Blackwells

represents and warrants that it has full power and authority to execute, deliver and carry out the terms and provisions of this Agreement

and to consummate the transactions contemplated hereby, and that this Agreement has been duly and validly executed and delivered by it,

constitutes a valid and binding obligation and agreement of it and is enforceable against it in accordance with its terms. Blackwells

represents that the execution of this Agreement, the consummation of any of the transactions contemplated hereby, and the fulfillment

of the terms hereof, in each case in accordance with the terms hereof, will not conflict with, or result in a breach or violation of

the organizational documents of it as currently in effect, the execution, delivery and performance of this Agreement by it does not and

will not (i) violate or conflict with any law, rule, regulation, order, judgment or decree applicable to it or (ii) result

in any breach or violation of or constitute a default (or an event which with notice or lapse of time or both could constitute such a

breach, violation or default) under or pursuant to, or result in the loss of a material benefit under, or give any right of termination,

amendment, acceleration or cancellation of, any organizational document, agreement, contract, commitment, understanding or arrangement

to which it is a party or by which it is bound.

(b) Blackwells

represents and warrants that it has voting authority over its Common Shares, and owns no Synthetic Equity Interests or any Short Interests

in the Company.

(c) The

Company hereby represents and warrants that it has the power and authority to execute, deliver and carry out the terms and provisions

of this Agreement and to consummate the transactions contemplated hereby, and that this Agreement has been duly and validly authorized,

executed and delivered by the Company, constitutes a valid and binding obligation and agreement of the Company and is enforceable against

the Company in accordance with its terms, except as enforcement thereof may be limited by applicable bankruptcy, insolvency, reorganization,

moratorium, fraudulent conveyance or similar laws generally affecting the rights of creditors and subject to general equity principles.

The Company represents that the execution of this Agreement, the consummation of any of the transactions contemplated hereby, and the

fulfillment of the terms hereof, in each case in accordance with the terms hereof, will not conflict with, or result in a breach or violation

of the organizational documents of the Company as currently in effect, and the execution, delivery and performance of this Agreement

by the Company does not and will not violate or conflict with (i) any law, rule, regulation, order, judgment or decree applicable

to the Company or (ii) result in any breach or violation of or constitute a default (or an event which with notice or lapse of time

or both could constitute such a breach, violation or default) under or pursuant to, or result in the loss of a material benefit under,

or give any right of termination, amendment, acceleration or cancellation of, any organizational document, agreement, contract, commitment,

understanding or arrangement to which the Company is a party or by which it is bound.

(a) Unless

otherwise mutually agreed to in writing by each party, this Agreement shall remain in effect until terminated in accordance with its

terms. Either party can terminate this Agreement with five (5) Business Days’ notice following the date that is thirty (30)

days prior to the earlier of (x) the nomination deadline under the Bylaws for the nomination of director candidates for election

to the Board at the 2032 annual meeting of shareholders, if any, and (y) the deadline for shareholder nominations of director candidates

under Rule 14a-19(a) and Rule 14a-19(b) under the Exchange Act, in each case for clauses (x) and (y), with respect

to the 2032 annual meeting of shareholders (the effective date of termination, the “Termination Date”). Notwithstanding

anything to the contrary in this Agreement:

(i) the

obligations of Blackwells to the Company pursuant to Sections 1 (Board Composition and Related Matters), 2

(Voting Commitment), 3 (Standstill), 4 (Mutual Non-Disparagement), 5 (No Litigation)

and 6 (Public Statements; SEC Filings) shall terminate in the event that the Company materially breaches its obligations pursuant

to Sections 1 (Board Composition and Related Matters), 4 (Mutual Non-Disparagement) or 5 (No

Litigation), or the representations and warranties in Section 8(c) (Representations and Warranties) and such

breach (if capable of being cured) has not been cured within fifteen (15) calendar days following written notice of such breach from

Blackwells, or, if impossible to cure within fifteen (15) calendar days, the Company has not taken substantive action to correct within

fifteen (15) calendar days following written notice of such breach from Blackwells; provided, however, that the obligations

of Blackwells pursuant to Section 5 (No Litigation) shall terminate immediately in the event that the Company materially

breaches its obligations under Section 5 (No Litigation);

(ii) the

obligations of the Company to Blackwells pursuant to Sections 1 (Board Composition and Related Matters), 4

(Mutual Non-Disparagement) or 5 (No Litigation) shall terminate in the event that Blackwells materially breaches

its obligations in Sections 1 (Board Composition and Related Matters), 2 (Voting Commitment), 3

(Standstill), 4 (Mutual Non-Disparagement), 5 (No Litigation) or 6 (Public Statements; SEC

Filings), or the representations and warranties in Section 8(a)–(b) (Representations and Warranties)

and such breach (if capable of being cured) has not been cured within fifteen (15) calendar days following written notice of such breach

from the Company, or, if impossible to cure within fifteen (15) calendar days, Blackwells has not taken substantive action to correct

within fifteen (15) calendar days following written notice of such breach from the Company; provided, however, that the

obligations of the Company to Blackwells pursuant to Section 5 (No Litigation) shall terminate immediately in the

event that Blackwells materially breaches its obligations under Section 5 (No Litigation).

(b) If

this Agreement is terminated in accordance with this Section 9, this Agreement shall forthwith become null and void, but

no termination shall relieve any party from liability for any breach of this Agreement prior to such termination. Notwithstanding the

foregoing, Sections 11 (Notices), 12 (Governing Law; Jurisdiction; Jury Waiver), 13 (Specific Performance)

and 15 (Miscellaneous) shall survive the termination of this Agreement.

10. Expenses.

The Company shall reimburse Blackwells for documented out-of-pocket costs, fees and expenses

(including attorneys’ fees and other legal expenses) incurred by Blackwells in connection with its engagement with the Company

and the negotiation and execution of this Agreement; provided, however, that such reimbursement shall not exceed $150,000

in the aggregate.

11. Notices.

All notices, demands and other communications to be given or delivered under or by reason of

the provisions of this Agreement shall be in writing and shall be deemed to have been given (a) when delivered by hand, with written

confirmation of receipt; (b) upon sending if sent by electronic mail to the electronic mail addresses below, with confirmation of

receipt from the receiving party by electronic mail; (c) one (1) Business Day after being sent by a nationally recognized overnight

carrier to the addresses set forth below; or (d) when actually delivered if sent by any other method that results in delivery, with

written confirmation of receipt:

If to the Company:

Sachem Capital Corp.

568 East Main Street

Branford, Connecticut 06405

Attn: John L. Villano, Chairman of the Board,

President and Chief Executive Officer

Email: [***] |

with mandatory copies (which shall not constitute

notice) to:

Sidley Austin LLP

787 Seventh Avenue

New York, New York 10019

Attn:

Kai H.E. Liekefett

Leonard

Wood

Email: kliekefett@sidley.com

lwood@sidley.com |

| |

|

If to Blackwells or Jason Aintabi:

Blackwells Onshore I LLC

400 Park Avenue, 4th Floor

New York, New York 10022

Attention: Jason Aintabi

Email: [***] |

with mandatory copies (which shall not constitute

notice) to:

Vinson & Elkins L.L.P.

1114 Sixth Avenue, 32nd Floor

New York, New York 10036

Attn: Lawrence Elbaum

Patrick Gadson

Email: lelbaum@velaw.com

pgadson@velaw.com

|

12. Governing

Law; Jurisdiction; Jury Waiver. This Agreement, and any disputes arising out of or related

to this Agreement (whether for breach of contract, tortious conduct or otherwise) or the validity thereof, shall be governed by, and

construed in accordance with, the laws of the State of New York, without giving effect to its conflict of laws principles. The parties

agree that exclusive jurisdiction and venue for any Legal Proceeding arising out of or related to this Agreement shall exclusively lie

in the state courts of the State of New York or, if such courts do not have subject matter jurisdiction, the Federal courts of the United

States sitting in the State of New York, Borough of Manhattan, and any appellate court from any such state or Federal court. Each party

waives any objection it may now or hereafter have to the laying of venue of any such Legal Proceeding, and irrevocably submits to personal

jurisdiction in any such court in any such Legal Proceeding and hereby further irrevocably and unconditionally waives and agrees not

to plead or claim in any court that any such Legal Proceeding brought in any such court has been brought in any inconvenient forum. Each

party consents to accept service of process in any such Legal Proceeding by service of a copy thereof upon either its registered agent

in the State of New York or the Secretary of State of the State of New York, with a copy delivered to it by certified or registered mail,

postage prepaid, return receipt requested, addressed to it at the address set forth in Section 11. Nothing contained herein

shall be deemed to affect the right of any party to serve process in any manner permitted by law. EACH PARTY HEREBY IRREVOCABLY WAIVES

ANY AND ALL RIGHT TO TRIAL BY JURY IN ANY LEGAL PROCEEDING ARISING OUT OF OR RELATED TO THIS AGREEMENT.

13. Specific

Performance. Each party to this Agreement acknowledges and agrees that a non-breaching party

would be irreparably injured by an actual breach of this Agreement by another party or its Representatives and that monetary remedies

would be inadequate to protect the parties against any actual or threatened breach or continuation of any breach of this Agreement. Without

prejudice to any other rights and remedies otherwise available to the parties under this Agreement, each party shall be entitled to equitable

relief by way of injunction or otherwise and specific performance of the provisions hereof upon satisfying the requirements to obtain

such relief without the necessity of posting a bond or other security, if a party or any of its Representatives breaches or threatens

to breach any provision of this Agreement. Such remedy shall not be deemed to be the exclusive remedy for a breach of this Agreement

but shall be in addition to all other remedies available at law or equity to the non-breaching party.

14. Certain

Definitions and Interpretations. As used in this Agreement: (a) the terms “Affiliate”

and “Associate” (and any plurals thereof) have the meanings ascribed to such terms under Rule 12b-2 promulgated

by the SEC under the Exchange Act and shall include all persons or entities that after the date hereof become Affiliates or Associates

of any applicable person or entity referred to in this Agreement; provided, however, that the term “Associate” shall

refer only to Associates controlled by the Company or Blackwells, as applicable; provided, further, that, for purposes of this

Agreement, Blackwells shall not be an Affiliate or Associate of the Company and the Company shall not be an Affiliate or Associate of

Blackwells; (b) the terms “beneficial ownership,” “group,” “person,” “proxy” and

“solicitation” (and any plurals thereof) have the meanings ascribed to such terms under the Exchange Act and the rules and

regulations promulgated thereunder, provided, that the meaning of “solicitation” shall be without regard to the exclusions

set forth in Rules 14a-1(l)(2)(iv) and 14a-2 under the Exchange Act; (c) the term “Business Day” means

any day that is not a Saturday, Sunday or other day on which commercial banks in the State of New York are authorized or obligated to

be closed by applicable law; (d) the term “Exchange Act” means the Securities Exchange Act of 1934, as amended,

and the rules and regulations promulgated thereunder; (e) the term “Extraordinary Transaction” means any

tender offer, exchange offer, share exchange, merger, consolidation, acquisition, business combination, sale, recapitalization, restructuring,

or other corporate transaction with a third party that, in each case, results in a change in control of the Company or the sale of all

or substantially all of its assets; (f) the term “Representatives” means (i) a person’s Affiliates

and Associates, and (ii) its and their respective directors, officers, employees, partners, members, managers, consultants, agents

and other representatives (excluding legal, financial and other advisors engaged for advice in connection with the election contest at

the 2024 Annual Meeting) acting in a capacity on behalf of, in concert with or at the direction of such person or its Affiliates or Associates;

(g) the term “SEC” means the U.S. Securities and Exchange Commission; (h) the term “Short Interests”

means any agreement, arrangement, understanding or relationship, including any repurchase or similar so-called “stock borrowing”

agreement or arrangement, engaged in, directly or indirectly, by such person, the purpose or effect of which is to mitigate loss to,

reduce the economic risk (of ownership or otherwise) of shares of any class or series of the Company’s equity securities by, manage

the risk of share price changes for, or increase or decrease the voting power of, such person with respect to the shares of any class

or series of the Company’s equity securities, or that provides, directly or indirectly, the opportunity to profit from any decrease

in the price or value of the shares of any class or series of the Company’s equity securities; (i) the term “Shareholder

Meeting” means each annual or special meeting of shareholders of the Company, or any action by written consent of the Company’s

shareholders in lieu thereof, and any adjournment, postponement, rescheduling or continuation thereof; (j) the term “Synthetic

Equity Interests” means any derivative, swap or other transaction or series of transactions engaged in, directly or indirectly,

by such person, the purpose or effect of which is to give such person economic risk similar to ownership of equity securities of any

class or series of the Company, including due to the fact that the value of such derivative, swap or other transactions are determined

by reference to the price, value or volatility of any shares of any class or series of the Company’s equity securities, or which

derivative, swap or other transactions provide the opportunity to profit from any increase in the price or value of shares of any class

or series of the Company’s equity securities, without regard to whether (i) the derivative, swap or other transactions convey

any voting rights in such equity securities to such person; (ii) the derivative, swap or other transactions are required to be,

or are capable of being, settled through delivery of such equity securities; or (iii) such person may have entered into other transactions

that hedge or mitigate the economic effect of such derivative, swap or other transactions; and (k) the term “Third Party”

refers to any person that is not a party, a member of the Board, a director or officer of the Company, or legal counsel to any party.

In this Agreement, unless a clear contrary intention appears, (i) the word “including” (in its various forms) means

“including, without limitation;” (ii) the words “hereunder,” “hereof,” “hereto”

and words of similar import are references to this Agreement as a whole and not to any particular provision of this Agreement; (iii) the

word “or” is not exclusive; (iv) references to “Sections” in this Agreement are references to Sections of

this Agreement unless otherwise indicated; and (v) whenever the context requires, the masculine gender shall include the feminine

and neuter genders.

(a) This

Agreement contains the entire agreement between the parties and supersedes all other prior agreements and understandings, both written

and oral, between the parties with respect to the subject matter hereof.

(b) This

Agreement is solely for the benefit of the parties and is not enforceable by any other persons.

(c) This

Agreement shall not be assignable by operation of law or otherwise by a party without the consent of the other party. Any purported assignment

without such consent is void ab initio. Subject to the foregoing sentence, this Agreement shall be binding upon, inure to the

benefit of, and be enforceable by and against the permitted successors and assigns of each party.

(d) Neither

the failure nor any delay by a party in exercising any right, power or privilege under this Agreement shall operate as a waiver thereof,

nor shall any single or partial exercise thereof preclude any other or further exercise thereof or the exercise of any right, power or

privilege hereunder.

(e) If

any term, provision, covenant or restriction of this Agreement is held by a court of competent jurisdiction to be invalid, void or unenforceable,

the remainder of the terms, provisions, covenants and restrictions of this Agreement shall remain in full force and effect and shall

in no way be affected, impaired or invalidated. It is hereby stipulated and declared to be the intention of the parties that the parties

would have executed the remaining terms, provisions, covenants and restrictions without including any of such which may be hereafter

declared invalid, void or unenforceable. In addition, the parties agree to use their reasonable best efforts to agree upon and substitute

a valid and enforceable term, provision, covenant or restriction for any of such that is held invalid, void or unenforceable by a court

of competent jurisdiction.

(f) Any

amendment or modification of the terms and conditions set forth herein or any waiver of such terms and conditions must be agreed to in

a writing signed by each party.

(g) This

Agreement may be executed in one (1) or more textually identical counterparts, each of which shall be deemed an original, but all

of which together shall constitute one (1) and the same agreement. Signatures to this Agreement transmitted by facsimile transmission,

by electronic mail in “portable document format” (“.pdf”) form, or by any other electronic means intended to

preserve the original graphic and pictorial appearance of a document, shall have the same effect as physical delivery of the paper document

bearing the original signature.

(h) Each

of the parties acknowledges that it has been represented by counsel of its choice throughout all negotiations that have preceded the

execution of this Agreement, and that it has executed this Agreement with the advice of such counsel.

(i) The

headings set forth in this Agreement are for convenience of reference purposes only and shall not affect or be deemed to affect in any

way the meaning or interpretation of this Agreement or any term or provision of this Agreement.

[Signature Pages Follow]

IN WITNESS WHEREOF, each

of the parties has executed this Agreement, or caused the same to be executed by its duly authorized representative, as of the date first

above written.

| |

THE COMPANY: |

| |

|

| |

|

| |

SACHEM

CAPITAL CORP. |

| |

|

| |

By:

|

/s/

John L. Villano |

| |

John

L. Villano |

| |

Chairman

of the Board, President and Chief Executive Officer |

Signature

Page to Cooperation Agreement

| |

BLACKWELLS: |

| |

|

| |

|

| |

Blackwells Capital LLC |

| |

|

| |

|

| |

By: |

/s/

Jason Aintabi |

| |

Jason Aintabi |

| |

President &

Secretary |

| |

Blackwells Onshore I LLC |

| |

|

| |

|

| |

By: |

/s/

Jason Aintabi |

| |

Jason Aintabi |

| |

President &

Secretary |

| |

|

| |

|

| |

|

| |

/s/

Jason Aintabi |

| |

Jason Aintabi |

Signature

Page to Cooperation Agreement

Exhibit 99.1

Sachem Capital Corp. Announces Appointment of

Jeffery C. Walraven to the Board of Directors

BRANFORD, Conn. – August 26, 2024 – Sachem Capital Corp.

(the “Company” or “Sachem Capital”), announced today that its Board of Directors (the “Board”) has

appointed Jeffery C. Walraven to the Board, effective August 21, 2024. Mr. Walraven will also stand for election at the Company’s

2024 Annual Meeting of Shareholders.

“We are pleased to welcome Jeffery Walraven to our Board,”

said John L. Villano, CEO and Chairman of the Board of Sachem Capital. “Jeff’s deep experience in the real estate industry,

especially in public company leadership, accounting and capital markets, will be invaluable to Sachem Capital as we grow our business

and pursue value creation for our shareholders.”

Mr. Walraven is Co-Founder and Chief Operating Officer of Freehold

Properties, Inc., a real estate investment trust (REIT), since its formation in 2019. He has also served as an independent director and

member of the audit committee of Broad Street Realty, Inc. (OTCQX: BRST), a real estate company that owns, operates, develops, and redevelops

primarily essential grocery-anchored shopping centers and mixed-use properties, since 2023. From 2014 to 2019, Mr. Walraven served as

Executive Vice President and Chief Financial Officer of MedEquities Realty Trust, Inc. (formerly NYSE: MRT) and previously served in various

leadership roles at BDO USA, LLP, an international accounting firm, from 2007 to 2014.

“Jeff’s appointment is a meaningful step in Sachem Capital’s

efforts to refresh the Board,” added Brian Prinz, independent director and Chair of the Nominating and Corporate Governance Committee.

“Jeff’s public company accounting and corporate finance expertise as well as his leadership experience align with the qualities

we have been searching for in a new independent Board member.”

For further information, please refer to the Company’s Current

Report on Form 8-K filed with the SEC on August 26, 2024.

About Sachem Capital Corp.

Sachem Capital Corp. is a mortgage REIT that specializes in originating,

underwriting, funding, servicing, and managing a portfolio of loans secured by first mortgages on real property. It offers short-term

(i.e. three years or less) secured, nonbanking loans to real estate investors to fund their acquisition, renovation, development, rehabilitation,

or improvement of properties. The Company’s primary underwriting criteria is a conservative loan to value ratio. The properties

securing the loans are generally classified as residential or commercial real estate and, typically, are held for resale or investment.

Each loan is secured by a first mortgage lien on real estate and is personally guaranteed by the principal(s) of the borrower. The Company

also makes opportunistic real estate purchases apart from its lending activities.

Forward Looking Statements

This press release may contain forward-looking statements. All statements

other than statements of historical facts contained in this press release, including statements regarding our future results of operations

and financial position, strategy and plans, and our expectations for future operations, are forward-looking statements. Such forward-looking

statements are subject to several risks, uncertainties and assumptions as described in the Annual Report on Form 10-K for 2023 filed with

the U.S. Securities and Exchange Commission (the “SEC”) on April 1, 2024. Because of these risks, uncertainties and assumptions,

any forward-looking events and circumstances discussed in this press release may not occur. You should not rely upon forward-looking statements

as predictions of future events. Neither the Company nor any other person assumes responsibility for the accuracy and completeness of

any of these forward-looking statements. The Company disclaims any duty to update any of these forward-looking statements. All forward-looking

statements attributable to the Company are expressly qualified in their entirety by these cautionary statements as well as others made

in this press release. You should evaluate all forward-looking statements made by the Company in the context of these risks and uncertainties.

Important Additional Information and Where to Find It

The Company intends to file a proxy statement on Schedule 14A, an

accompanying proxy card, and other relevant documents with the SEC in connection with its solicitation of proxies from the

Company’s shareholders for the Company’s 2024 Annual Meeting of Shareholders. THE COMPANY’S SHAREHOLDERS ARE

STRONGLY ENCOURAGED TO READ THE COMPANY’S DEFINITIVE PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO), THE

ACCOMPANYING PROXY CARD, AND ALL OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE

BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Investors and shareholders may obtain a copy of the definitive proxy statement, an

accompanying proxy card, any amendments or supplements to the definitive proxy statement and other documents filed by the Company

with the SEC at no charge at the SEC’s website at www.sec.gov. Copies will also be available at no charge by clicking the

“SEC Filings” link in the “Investor” section of the Company’s website, http://sachemcapitalcorp.com,

or by contacting investors@sachemcapitalcorp.com as soon as reasonably practicable after such materials are electronically filed

with, or furnished to, the SEC.

Participants in the Solicitation

The Company, its directors, certain of its officers,

and other employees may be deemed to be “participants” (as defined in Section 14(a) of the Securities Exchange Act of 1934,

as amended) in the solicitation of proxies from the Company’s shareholders in connection with matters to be considered at the Company’s

2024 Annual Meeting of Shareholders.

Information about the names of the Company’s

directors and officers, their respective interests in the Company by security holdings or otherwise, and their respective compensation

is set forth in the sections entitled “Election of Directors,” “Compensation of Directors,” “Executive Compensation,”

and “Security Ownership of Certain Beneficial Owners” of the Company’s Proxy Statement on Schedule 14A in connection

with the 2023 Annual Meeting of Shareholders, filed with the SEC on August 4, 2023 (available here) and the Company’s Annual Report

on Form 10-K, filed with the SEC on April 1, 2024 (available here). To the extent the security holdings of directors and executive officers

have changed since the amounts described in these filings, such changes are set forth on Initial Statements of Beneficial Ownership on

Form 3 or Statements of Change in Ownership on Form 4 filed with the SEC, which can be found at no charge at the SEC’s

website at www.sec.gov. Updated information regarding the identity of potential participants and

their direct or indirect interests, by security holdings or otherwise, in the Company will be set forth in the Company’s Proxy Statement

on Schedule 14A for the 2024 Annual Meeting of Shareholders and other relevant documents to be filed with the SEC, if and when they become

available. These documents will be available free of charge as described above.

Investor & Media Contact:

Email: investors@sachemcapitalcorp.com

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=sach_Notes6.875PercentDue2024Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=sach_Notes7.75percentDue2025Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=sach_Notes6.00percentDue2026Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=sach_Notes6.00percentDue2027Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=sach_Notes7.125PercentDue2027Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=sach_Notes8.00percentDue2027Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesAPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

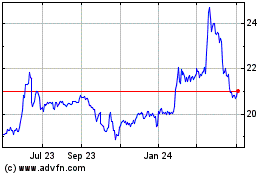

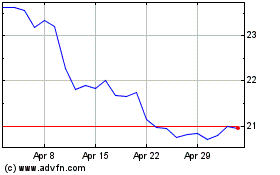

Sachem Capital (AMEX:SACH-A)

Historical Stock Chart

From Nov 2024 to Dec 2024

Sachem Capital (AMEX:SACH-A)

Historical Stock Chart

From Dec 2023 to Dec 2024