Platinum Group Metals Announces Share Consolidation

November 20 2018 - 4:10PM

Platinum Group Metals Ltd. (PTM-TSX; PLG-NYSE

American) (“Platinum Group” or the “Company”) today announced a

consolidation of its common shares on the basis of one new share

for ten old shares (1:10), effective at 9:00 a.m. (New York time)

on December 13, 2018 (the “Effective Time”). The Company’s

consolidated common shares are expected to begin trading on the

Toronto Stock Exchange (“TSX”) and NYSE American when the markets

open on December 17, 2018. The purpose of the consolidation

is to increase the Company’s common share price to be in compliance

with the NYSE American’s low selling price requirement.

Shareholder feedback has been that the Company

should maintain its listing on the NYSE American.

Details

Each ten (10) common shares issued and

outstanding at the Effective Time will be consolidated into one

common share. The share consolidation will affect all of the

Company’s common shares outstanding at the Effective Time. As

a result of the share consolidation, the number of issued and

outstanding common shares will be reduced from 291,259,110 to

29,125,911 (subject to fractional treatment). Each

shareholder’s percentage ownership in the Company and proportional

voting power remained unchanged after the share consolidation,

except for minor changes and adjustments resulting from the

treatment of fractional shares.

The new CUSIP number for the post-consolidation

common shares will be 72765Q882 and the new ISIN number will be

CA72765Q8829.

No fractional shares will be issued as a result

of the share consolidation. Fractional interests of 0.5 or

greater will be rounded up to the nearest whole number of shares

and fractional interests of less than 0.5 will be rounded down to

the nearest whole number of shares, in accordance with the Business

Corporations Act (British Columbia). Registered shareholders

of the Company will receive a letter of transmittal from the

Company's transfer agent, Computershare Investor Services Inc., as

soon as practicable after the effective date of the share

consolidation. The letter of transmittal will enable

registered shareholders to exchange their old share certificates

representing pre-consolidation common shares for post-consolidation

common shares. Until surrendered, each share certificate

representing pre-consolidation common shares will represent the

number of whole post consolidation common shares to which the

holder is entitled as a result of the consolidation.

Shareholders who hold their common shares in

brokerage accounts or in “street name” are not required to take any

action to effect the exchange of their common shares.

The number of common shares on a

post-consolidated basis underlying the issued and outstanding

warrants of the Company, including the warrants listed and posted

for trading on the TSX under the symbol “PTM.WT.U”, and the

exercise price thereof will be adjusted in accordance with the

applicable warrant indenture or warrant certificate. As well,

the number of common shares on a post-consolidated basis that may

be issuable upon the conversion of convertible senior subordinated

notes (the “Notes”) originally issued by the Company on June 30,

2017 and maturing on July 1, 2022 will be adjusted in accordance

with the indenture governing the Notes.

Regulatory Requirements

The listing of the consolidated common shares on

the NYSE American and the TSX is subject to the prior approval of

the NYSE American and the final approval of the TSX,

respectively.

About Platinum Group Metals

Ltd.

Platinum Group, based in Johannesburg, South

Africa and Vancouver, Canada, is focused on the advancement of the

large scale, near surface, palladium dominant Waterberg Project in

South Africa. Partners at Waterberg include Impala Platinum

Holdings Ltd., the Japan Oil, Gas and Metals National Corporation

and Mnombo Wethu Consultants (Pty) Ltd., a South African

empowerment company.

On behalf of the Board of Platinum Group Metals Ltd. R.

Michael Jones President & CEO

For further information contact: R. Michael Jones, President

& CEO or Kris Begic, VP, Corporate Development Platinum Group

Metals Ltd., Vancouver Tel: (604) 899-5450 / Toll Free: (866)

899-5450 www.platinumgroupmetals.net

Disclosure

The Toronto Stock Exchange and the NYSE American

LLC have not reviewed and do not accept responsibility for the

accuracy or adequacy of this news release, which has been prepared

by management.

This press release contains forward-looking

information within the meaning of Canadian securities laws and

forward-looking statements within the meaning of U.S. securities

laws (collectively “forward-looking statements”). Forward-looking

statements are typically identified by words such as: believe,

expect, anticipate, intend, estimate, plans, postulate and similar

expressions, or are those, which, by their nature, refer to future

events. All statements that are not statements of historical fact

are forward-looking statements. Forward-looking statements in this

press release include statements about the approval of the TSX and

the NYSE American for the trading of the consolidated common

shares, the timing of the expected commencement of trading of the

consolidated common shares on the TSX and NYSE American, the

satisfaction of the minimum share price requirement of the NYSE

American, the expected number of common shares outstanding after

the consolidation and the anticipated effect of the treatment of

fractional shares on the percentage ownership in the Company and

proportional voting power. Although the Company believes the

forward-looking statements in this press release are reasonable, it

can give no assurance that the expectations and assumptions in such

statements will prove to be correct. The Company cautions investors

that any forward-looking statements by the Company are not

guarantees of future results or performance, and that actual

results may differ materially from those in forward-looking

statements as a result of various factors, including, but not

limited to, the announcement or implementation of the share

consolidation may adversely affect the market price of the common

shares; the NYSE American may not approve the listing of the

consolidated common shares or may delist the common shares prior to

commencement of trading of the post consolidation shares if the

Company cannot satisfy NYSE American requirements, including

minimum share price requirements; the commencement of trading of

the consolidated common shares on either or both of the TSX and the

NYSE American may be delayed; the liquidity and market price of the

common shares and the Company’s ability to raise capital may be

adversely affected if the Company is unable to maintain its listing

on the NYSE American; the Company’s capital requirements may exceed

its current expectations and other risk factors described in the

Company’s Form 20-F annual report, annual information form and

other filings with the Securities and Exchange Commission and

Canadian securities regulators, which may be viewed at www.sec.gov

and www.sedar.com, respectively.

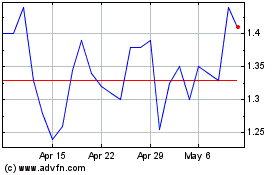

Platinum Group Metals (AMEX:PLG)

Historical Stock Chart

From Mar 2024 to Apr 2024

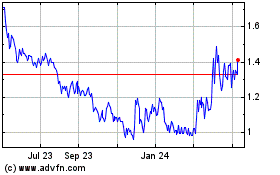

Platinum Group Metals (AMEX:PLG)

Historical Stock Chart

From Apr 2023 to Apr 2024