- Quarterly net income of $675 million and cash flow from

operating activities of $885 million

- Successful completion of planned turnaround activities at

Kearl, Syncrude and Strathcona refinery

- Upstream production of 363,000 gross oil-equivalent barrels per

day

- Refinery throughput of 388,000 barrels per day and capacity

utilization of 90%

- Commenced facility construction on the Strathcona Renewable

Diesel project

- Renewed annual normal course issuer bid (NCIB) to repurchase up

to 5% of outstanding common shares, with plans to accelerate

completion of the program prior to year end

- Declared third quarter dividend of 50 cents per share

IMPERIAL OIL LIMITED, TSE: IMO, NYSE American: IMO

Second quarter

Six months

millions of Canadian dollars, unless

noted

2023

2022

∆

2023

2022

∆

Net income (loss) (U.S. GAAP)

675

2,409

(1,734)

1,923

3,582

(1,659)

Net income (loss) per common share,

assuming dilution (dollars)

1.15

3.63

(2.48)

3.29

5.36

(2.07)

Capital and exploration expenditures

493

314

+179

922

610

+312

Imperial reported estimated net income in the second quarter of

$675 million, compared to net income of $1,248 million in the first

quarter of 2023, driven by lower refining margins and planned

turnaround activity. Quarterly cash flow from operating activities

was $885 million, up from $821 million used in the first quarter of

2023.

“Imperial’s results in the second quarter reflect the safe and

on-plan execution of significant turnaround activity across our

Upstream and Downstream business lines,” said Brad Corson,

Imperial's chairman, president and chief executive officer. “With

substantial turnaround activity now behind us, we anticipate strong

production in the second half of 2023."

Upstream production in the second quarter averaged 363,000 gross

oil-equivalent barrels per day. At Kearl, quarterly total gross

production averaged 217,000 barrels per day (154,000 barrels

Imperial's share), primarily impacted by planned turnaround

activity. In April, Kearl took delivery of its first-ever shipment

of renewable diesel for use in its mine fleet as part of the

company’s ongoing efforts to reduce emissions and demonstrate

suitability for use in heavy equipment applications. At Cold Lake,

quarterly gross production averaged 132,000 barrels per day,

impacted by the timing of production and steam cycles. At Syncrude,

the company's share of quarterly production averaged 66,000 gross

barrels per day, primarily impacted by its annual coker

turnaround.

In the Downstream, throughput in the quarter averaged 388,000

barrels per day with refinery capacity utilization of 90 percent,

reflecting the impact of the planned turnaround at the Strathcona

refinery. Petroleum product sales in the quarter were 475,000

barrels per day. In May, the Strathcona Renewable Diesel project

passed a significant milestone with key contractors being mobilized

to site to commence facility construction work.

“We support Canada’s vision for a lower-emission future, and I

am encouraged to see the work now underway to build Canada’s

largest renewable diesel facility,” said Corson. “The project

remains on track for a 2025 start-up and is expected to produce

more than 1 billion litres of renewable diesel annually to help

meet strong demand under Canada's Clean Fuel Regulations and reduce

reliance on costly imports,” said Corson.

During the quarter, Imperial returned $257 million to

shareholders through dividend payments and declared a third quarter

dividend of 50 cents per share. In June, Imperial renewed its

annual normal course issuer bid program, allowing the company to

repurchase up to five percent of its outstanding common shares over

a 12-month period ending June 28, 2024.

“Imperial continues to demonstrate its long-standing commitment

to returning surplus cash to shareholders and I am pleased to

announce our plan to accelerate our NCIB share repurchases with a

target of completing the program prior to year end,” said

Corson.

Second quarter highlights

- Net income of $675 million or $1.15 per share on a diluted

basis, compared to $2,409 million or $3.63 per share in the

second quarter of 2022. Lower net income is primarily driven by

lower commodity prices and increased planned turnaround

activity.

- Cash flows from operating activities of $885 million,

compared to cash flows from operating activities of $2,682 million

in the same period of 2022. Cash flows from operating activities

excluding working capital1 of $1,136 million, compared to $2,783

million in the same period of 2022.

- Capital and exploration expenditures totalled $493

million, up from $314 million in the second quarter of

2022.

- The company returned $257 million to shareholders in the

second quarter of 2023 through dividends paid.

- Renewed share repurchase program, enabling the purchase

of up to five percent of common shares outstanding, a maximum of

29,207,635 shares, during the 12-month period ending June 28, 2024.

Imperial plans to accelerate its share purchases under the NCIB

program and anticipates repurchasing all remaining allowable shares

prior to year end. Purchase plans may be modified at any time

without prior notice.

- Production averaged 363,000 gross oil-equivalent barrels per

day, compared to 413,000 gross oil-equivalent barrels per day

in the same period of 2022. Lower production is primarily driven by

the timing of planned turnaround activity at Syncrude, production

and steam cycle timing at Cold Lake and the absence of

unconventional volumes following the sale of XTO Energy Canada in

the third quarter of 2022.

- Total gross bitumen production at Kearl averaged 217,000

barrels per day (154,000 barrels Imperial's share), compared to

224,000 barrels per day (159,000 barrels Imperial's share) in the

second quarter of 2022.

- Completed construction work on key mitigation efforts to

expand the existing seepage interception system at Kearl.

Additional monitoring and assessment work will occur in the coming

months. Imperial continues to engage with local Indigenous

communities, and is providing site tours and access for independent

testing. To date, there is no indication of adverse impacts to

wildlife or fish populations in nearby river systems, or risks to

drinking water for local communities.

- First-ever delivery of renewable diesel to Kearl for use in

mine fleet as part of the company's ongoing effort to reduce

emissions and demonstrate suitability for use in heavy equipment

applications.

- Gross bitumen production at Cold Lake averaged 132,000

barrels per day, compared to 144,000 barrels per day in the

second quarter of 2022. Lower production was primarily due to

timing of production and steam cycles.

- Finished drilling and completion of all wells and received

final unit module for the Cold Lake Grand Rapids phase 1 (GRP1)

project. GRP1 will be the first solvent-assisted SAGD project

in industry and is expected to reduce greenhouse gas emissions

intensity by up to 40% compared to existing cyclic steam

stimulation technology. The project remains on track to achieve

accelerated start-up with steam injection anticipated by year end

2023.

- The company's share of gross production from Syncrude

averaged 66,000 barrels per day, compared to 81,000 barrels per

day in the second quarter of 2022, primarily driven by timing of

planned turnaround activity.

- Refinery throughput averaged 388,000 barrels per day,

compared to 412,000 barrels per day in the second quarter of 2022.

Capacity utilization was 90 percent, compared to 96 percent in the

second quarter of 2022, reflecting the impact of the planned

Strathcona turnaround in the quarter.

- Started facility construction of the Strathcona Renewable

Diesel project, with key contractors mobilizing to site. The

project is designed to produce more than one billion litres of

renewable diesel annually, primarily from locally sourced

feedstocks, and could help reduce greenhouse gas emissions by about

3 million metric tonnes per year, as determined in accordance with

Canada's Clean Fuel Regulations. Renewable diesel production

expected to start in early 2025.

- Petroleum product sales were 475,000 barrels per day,

compared to 480,000 barrels per day in the second quarter of

2022.

- Chemical net income of $71 million in the quarter, up

from $53 million in the second quarter of 2022.

- Early work continues on the foundational carbon storage hub

project for the Pathways Alliance, which is now working to

obtain a carbon sequestration agreement from the Government of

Alberta. Engineering and field work is underway to support a

regulatory application later this year. Imperial is a founding

member of the alliance, which continues to work collaboratively

with both the Federal and Alberta governments on the policy and

co-financing frameworks necessary to move the project forward.

____________________________ [1] non-GAAP

financial measure - see attachment VI for definition and

reconciliation

Recent business environment

During the first half of 2023, the price of crude oil decreased

as the global oil market saw higher inventory levels. In addition,

the Canadian WTI/WCS spread continued to recover in the second

quarter, but remains weaker than the first half of 2022. Refining

margins declined on steady supply of diesel.

Operating results Second quarter 2023 vs.

second quarter 2022

Second Quarter

millions of Canadian dollars, unless

noted

2023

2022

Net income (loss) (U.S. GAAP)

675

2,409

Net income (loss) per common share,

assuming dilution (dollars)

1.15

3.63

Upstream Net income (loss) factor analysis

millions of Canadian dollars

2022

Price

Volumes

Royalty

Other

2023

1,346

(1,340)

(300)

420

258

384

Price – Lower bitumen realizations were primarily driven by

lower marker prices and the widening WTI/WCS spread. Average

bitumen realizations decreased by $43.63 per barrel, generally in

line with WCS, and synthetic crude oil realizations decreased by

$43.75 per barrel, generally in line with WTI.

Volumes – Lower volumes were primarily driven by the timing of

planned turnaround activities at Syncrude, and production and steam

cycle timing at Cold Lake.

Royalty – Lower royalties were primarily driven by weakened

commodity prices.

Other – Includes favourable foreign exchange impacts of about

$180 million, and lower operating expenses of about $130 million,

resulting primarily from lower energy prices.

Marker prices and average realizations

Second Quarter

Canadian dollars, unless noted

2023

2022

West Texas Intermediate (US$ per

barrel)

73.56

108.52

Western Canada Select (US$ per barrel)

58.49

95.80

WTI/WCS Spread (US$ per barrel)

15.07

12.72

Bitumen (per barrel)

68.64

112.27

Synthetic crude oil (per barrel)

100.92

144.67

Average foreign exchange rate (US$)

0.74

0.78

Production

Second Quarter

thousands of barrels per day

2023

2022

Kearl (Imperial's share)

154

159

Cold Lake

132

144

Syncrude (a)

66

81

Kearl total gross production (thousands of

barrels per day)

217

224

(a)

In the second quarter of 2023, Syncrude gross production included

about 0 thousand barrels per day of bitumen and other products

(2022 - 2 thousand barrels per day) that were exported to the

operator's facilities using an existing interconnect pipeline.

Lower production at Cold Lake was primarily driven by timing of

production and steam cycles.

Lower production at Syncrude was primarily driven by the timing

of the annual coker turnaround.

Downstream Net income (loss) factor analysis

millions of Canadian dollars

2022

Margins

Other

2023

1,033

(730)

(53)

250

Margins – Lower margins primarily reflect weaker market

conditions.

Other – Includes higher turnaround impacts of about $230

million, reflecting the planned turnaround activities at Strathcona

refinery, partially offset by favourable foreign exchange impacts

of about $110 million.

Refinery utilization and petroleum product sales

Second Quarter

thousands of barrels per day, unless

noted

2023

2022

Refinery throughput

388

412

Refinery capacity utilization

(percent)

90

96

Petroleum product sales

475

480

Lower refinery throughput in the second quarter of 2023 reflects

the impact of planned turnaround activities at the Strathcona

refinery.

Chemicals Net income (loss) factor analysis

millions of Canadian dollars

2022

Margins

Other

2023

53

—

18

71

Corporate and other

Second Quarter

millions of Canadian dollars

2023

2022

Net income (loss) (U.S. GAAP)

(30)

(23)

Liquidity and capital resources

Second Quarter

millions of Canadian dollars

2023

2022

Cash flow generated from (used in):

Operating activities

885

2,682

Investing activities

(489)

(230)

Financing activities

(263)

(2,734)

Increase (decrease) in cash and cash

equivalents

133

(282)

Cash and cash equivalents at period

end

2,376

2,867

Cash flow generated from operating activities primarily reflects

lower Upstream realizations and Downstream margins.

Cash flow used in investing activities primarily reflects higher

additions to property, plant and equipment, and lower proceeds from

asset sales.

Cash flow used in financing activities primarily reflects:

Second Quarter

millions of Canadian dollars, unless

noted

2023

2022

Dividends paid

257

228

Per share dividend paid (dollars)

0.44

0.34

Share repurchases (a)

—

2,500

Number of shares purchased (millions)

(a)

—

32.5

(a)

The company did not purchase shares during

the second quarter of 2023. In the second quarter of 2022, share

repurchases were made under the company's substantial issuer bid

that commenced on May 6, 2022 and expired on June 10, 2022, and

included shares purchased from Exxon Mobil Corporation by way of a

proportionate tender to maintain its ownership percentage at

approximately 69.6 percent.

On June 27, 2023, the company announced by news release that it

had received final approval from the Toronto Stock Exchange for a

new normal course issuer bid and will continue its existing share

purchase program. The program enables the company to purchase up to

a maximum of 29,207,635 common shares during the period June 29,

2023 to June 28, 2024. This maximum includes shares purchased under

the normal course issuer bid and from Exxon Mobil Corporation

concurrent with, but outside of, the normal course issuer bid. As

in the past, Exxon Mobil Corporation has advised the company that

it intends to participate to maintain its ownership percentage at

approximately 69.6 percent. The program will end should the company

purchase the maximum allowable number of shares or on June 28,

2024. Imperial plans to accelerate its share purchases under the

normal course issuer bid program, and anticipates repurchasing all

remaining allowable shares prior to year end. Purchase plans may be

modified at any time without prior notice.

Six months 2023 vs. six months 2022

Six Months

millions of Canadian dollars, unless

noted

2023

2022

Net income (loss) (U.S. GAAP)

1,923

3,582

Net income (loss) per common share,

assuming dilution (dollars)

3.29

5.36

Upstream Net income (loss) factor analysis

millions of Canadian dollars

2022

Price

Volumes

Royalty

Other

2023

2,128

(2,340)

(170)

650

446

714

Price – Lower bitumen realizations were primarily driven by

lower marker prices and the widening WTI/WCS spread. Average

bitumen realizations decreased by $42.59 per barrel, generally in

line with WCS, and synthetic crude oil realizations decreased by

$29.68 per barrel, generally in line with WTI.

Volumes – Lower volumes were primarily driven by the timing of

planned turnaround activities at Syncrude, and production and steam

cycle timing at Cold Lake, partially offset by the absence of

extreme cold weather and reduced unplanned downtime at Kearl.

Royalty – Lower royalties were primarily driven by weakened

commodity prices.

Other – Includes favourable foreign exchange impacts of about

$330 million, and lower operating expenses of about $50

million.

Marker prices and average realizations

Six Months

Canadian dollars, unless noted

2023

2022

West Texas Intermediate (US$ per

barrel)

74.77

101.77

Western Canada Select (US$ per barrel)

54.92

88.13

WTI/WCS Spread (US$ per barrel)

19.85

13.64

Bitumen (per barrel)

58.94

101.53

Synthetic crude oil (per barrel)

101.73

131.41

Average foreign exchange rate (US$)

0.74

0.79

Production

Six Months

thousands of barrels per day

2023

2022

Kearl (Imperial's share)

169

146

Cold Lake

137

142

Syncrude (a)

71

79

Kearl total gross production (thousands of

barrels per day)

238

205

(a)

In 2023, Syncrude gross production

included about 1 thousand barrels per day of bitumen and other

products (2022 - 2 thousand barrels per day) that were exported to

the operator's facilities using an existing interconnect

pipeline.

Higher production at Kearl was primarily driven by the absence

of extreme cold weather, and reduced unplanned downtime as a result

of the successful rollout of the winterization strategy.

Downstream Net income (loss) factor analysis

millions of Canadian dollars

2022

Margins

Other

2023

1,422

(350)

48

1,120

Margins – Lower margins primarily reflect weaker market

conditions.

Other – Favourable foreign exchange impacts of about $190

million and improved volumes of about $110 million, partially

offset by higher turnaround impacts of about $250 million,

reflecting the planned turnaround activities at Strathcona

refinery.

Refinery utilization and petroleum product sales

Six Months

thousands of barrels per day, unless

noted

2023

2022

Refinery throughput

403

406

Refinery capacity utilization

(percent)

93

95

Petroleum product sales

465

464

Lower refinery throughput in 2023 reflects the impact of planned

turnaround activities at the Strathcona refinery.

Chemicals Net income (loss) factor analysis

millions of Canadian dollars

2022

Margins

Other

2023

109

10

5

124

Corporate and other

Six Months

millions of Canadian dollars

2023

2022

Net income (loss) (U.S. GAAP)

(35)

(77)

Liquidity and capital resources

Six Months

millions of Canadian dollars

2023

2022

Cash flow generated from (used in):

Operating activities

64

4,596

Investing activities

(903)

(509)

Financing activities

(534)

(3,373)

Increase (decrease) in cash and cash

equivalents

(1,373)

714

Cash flow generated from operating activities primarily reflects

unfavourable working capital impacts, including an income tax

catch-up payment of $2.1 billion, as well as lower Upstream

realizations and Downstream margins.

Cash flow used in investing activities primarily reflects higher

additions to property, plant and equipment, and lower proceeds from

asset sales.

Cash flow used in financing activities primarily reflects:

Six Months

millions of Canadian dollars, unless

noted

2023

2022

Dividends paid

523

413

Per share dividend paid (dollars)

0.88

0.61

Share repurchases (a)

—

2,949

Number of shares purchased (millions)

(a)

—

41.4

(a)

The company did not purchase shares during

the six months ended June 30, 2023. In the six months ended June

30, 2022, share repurchases were made under the company's normal

course issuer bid program and substantial issuer bid that commenced

on May 6, 2022 and expired on June 10, 2022. Includes shares

purchased from Exxon Mobil Corporation concurrent with, but outside

of, the normal course issuer bid, and by way of a proportionate

tender under the company's substantial issuer bid.

Key financial and operating data follow.

Forward-looking statements

Statements of future events or conditions in this report,

including projections, targets, expectations, estimates, and

business plans are forward-looking statements. Similarly,

discussion of emission-reduction future plans to drive towards

net-zero emissions are dependent on future market factors, such as

continued technological progress and policy support, and represent

forward-looking statements. Forward-looking statements can be

identified by words such as believe, anticipate, intend, propose,

plan, goal, seek, estimate, expect, future, continue, likely, may,

should, will and similar references to future periods.

Forward-looking statements in this report include, but are not

limited to, references to the company’s long-standing commitment to

returning surplus cash to shareholders, including purchases under

the normal course issuer bid and plans to accelerate completion

prior to year end; anticipating strong production and throughput in

the second half of 2023; the company’s ongoing efforts to reduce

emissions in its operations, including the impact of the use of

renewable diesel at Kearl and demonstrating suitability for use in

heavy equipment applications; the company’s Strathcona renewable

diesel project, including timing, expected production, strong

demand, the ability to reduce reliance on costly imports, and the

reduction to greenhouse gas emissions; additional monitoring and

assessment activities at Kearl related to seepage and engagement

with local indigenous communities; the impact and timing of the

Cold Lake Grand Rapids phase 1 project, including reductions to

greenhouse gas emissions intensity; and progress of the Pathways

Alliance carbon storage hub, including obtaining a sequestration

agreement and timing of a regulatory application.

Forward-looking statements are based on the company's current

expectations, estimates, projections and assumptions at the time

the statements are made. Actual future financial and operating

results, including expectations and assumptions concerning demand

growth and energy source, supply and mix; production rates, growth

and mix across various assets; project plans, timing, costs,

technical evaluations and capacities and the company’s ability to

effectively execute on these plans and operate its assets,

including the Strathcona renewable diesel project; for shareholder

returns, assumptions such as cash flow forecasts, financing sources

and capital structure, participation of the company’s majority

shareholder and the results of periodic and ongoing evaluation of

alternate uses of capital; the adoption and impact of new

facilities or technologies on reductions to GHG emissions

intensity, including but not limited to Strathcona renewable

diesel, carbon capture and storage including in connection with

hydrogen for the renewable diesel project, and any changes in the

scope, terms, or costs of such projects; for renewable diesel, the

availability and cost of locally-sourced and grown feedstock and

the supply of renewable diesel to British Columbia in connection

with its low-carbon fuel legislation; the amount and timing of

emissions reductions, including the impact of lower carbon fuels;

that any required support from policymakers and other stakeholders

for various new technologies such as carbon capture and storage

will be provided; performance of third party service providers;

receipt of regulatory approvals in a timely manner; refinery

utilization; applicable laws and government policies, including

with respect to climate change, GHG emissions reductions and low

carbon fuels; the ability to offset any ongoing inflationary

pressures; capital and environmental expenditures; and commodity

prices, foreign exchange rates and general market conditions could

differ materially depending on a number of factors.

These factors include global, regional or local changes in

supply and demand for oil, natural gas, and petroleum and

petrochemical products and resulting price, differential and margin

impacts, including foreign government action with respect to supply

levels and prices, the impact of COVID-19 on demand and the

occurrence of wars; availability and allocation of capital; the

receipt, in a timely manner, of regulatory and third-party

approvals, including for new technologies that will help the

company meet its lower emissions goals; the results of research

programs and new technologies, the ability to bring new

technologies to commercial scale on a cost-competitive basis, and

the competitiveness of alternative energy and other emission

reduction technologies; failure or delay of supportive policy and

market development for the adoption of emerging lower emission

energy technologies and other technologies that support emissions

reductions; political or regulatory events, including changes in

law or government policy, environmental regulation including

climate change and greenhouse gas regulation, and actions in

response to COVID-19; unanticipated technical or operational

difficulties; project management and schedules and timely

completion of projects; availability and performance of third-party

service providers; environmental risks inherent in oil and gas

exploration and production activities; management effectiveness and

disaster response preparedness; operational hazards and risks;

cybersecurity incidents, including increased reliance on remote

working arrangements; currency exchange rates; general economic

conditions; and other factors discussed in Item 1A risk factors and

Item 7 management’s discussion and analysis of financial condition

and results of operations of Imperial Oil Limited’s most recent

annual report on Form 10-K and subsequent interim reports.

Forward-looking statements are not guarantees of future

performance and involve a number of risks and uncertainties, some

that are similar to other oil and gas companies and some that are

unique to Imperial Oil Limited. Imperial’s actual results may

differ materially from those expressed or implied by its

forward-looking statements and readers are cautioned not to place

undue reliance on them. Imperial undertakes no obligation to update

any forward-looking statements contained herein, except as required

by applicable law.

Forward-looking and other statements regarding Imperial's

environmental, social and other sustainability efforts and

aspirations are not an indication that these statements are

necessarily material to investors or requiring disclosure in the

company's filings with securities regulators. In addition,

historical, current and forward-looking environmental, social and

sustainability-related statements may be based on standards for

measuring progress that are still developing, internal controls and

processes that continue to evolve, and assumptions that are subject

to change in the future, including future rule-making. Individual

projects or opportunities may advance based on a number of factors,

including availability of supportive policy, technology for

cost-effective abatement, company planning process, and alignment

with our partners and other stakeholders.

In this release all dollar amounts are expressed in Canadian

dollars unless otherwise stated. This release should be read in

conjunction with Imperial’s most recent Form 10-K. Note that

numbers may not add due to rounding.

The term “project” as used in this release can refer to a

variety of different activities and does not necessarily have the

same meaning as in any government payment transparency reports.

Attachment I

Second Quarter

Six Months

millions of Canadian dollars, unless

noted

2023

2022

2023

2022

Net income (loss) (U.S. GAAP)

Total revenues and other income

11,819

17,307

23,940

29,993

Total expenses

10,935

14,141

21,411

25,293

Income (loss) before income taxes

884

3,166

2,529

4,700

Income taxes

209

757

606

1,118

Net income (loss)

675

2,409

1,923

3,582

Net income (loss) per common share

(dollars)

1.16

3.63

3.29

5.37

Net income (loss) per common share -

assuming dilution (dollars)

1.15

3.63

3.29

5.36

Other financial data

Gain (loss) on asset sales, after tax

10

3

18

19

Total assets at June 30

42,126

44,892

Total debt at June 30

4,144

5,166

Shareholders' equity at June 30

23,828

21,979

Capital employed at June 30

27,995

27,162

Dividends declared on common stock

Total

292

227

549

455

Per common share (dollars)

0.50

0.34

0.94

0.68

Millions of common shares outstanding

At June 30

584.2

636.7

Average - assuming dilution

585.3

664.4

585.3

668.1

Attachment II

Second Quarter

Six Months

millions of Canadian dollars

2023

2022

2023

2022

Total cash and cash equivalents at

period end

2,376

2,867

2,376

2,867

Operating activities

Net income (loss)

675

2,409

1,923

3,582

Adjustments for non-cash items:

Depreciation and depletion

453

451

943

877

(Gain) loss on asset sales

(13)

(4)

(22)

(24)

Deferred income taxes and other

(15)

(149)

(71)

(480)

Changes in operating assets and

liabilities

(251)

(101)

(2,626)

594

All other items - net

36

76

(83)

47

Cash flows from (used in) operating

activities

885

2,682

64

4,596

Investing activities

Additions to property, plant and

equipment

(499)

(333)

(928)

(637)

Proceeds from asset sales

9

102

23

126

Loans to equity companies - net

1

1

2

2

Cash flows from (used in) investing

activities

(489)

(230)

(903)

(509)

Cash flows from (used in) financing

activities

(263)

(2,734)

(534)

(3,373)

Attachment III

Second Quarter

Six Months

millions of Canadian dollars

2023

2022

2023

2022

Net income (loss) (U.S. GAAP)

Upstream

384

1,346

714

2,128

Downstream

250

1,033

1,120

1,422

Chemical

71

53

124

109

Corporate and other

(30)

(23)

(35)

(77)

Net income (loss)

675

2,409

1,923

3,582

Revenues and other income

Upstream

3,590

5,949

7,290

10,483

Downstream

12,735

18,785

26,217

32,830

Chemical

437

563

870

1,034

Eliminations / Corporate and other

(4,943)

(7,990)

(10,437)

(14,354)

Revenues and other income

11,819

17,307

23,940

29,993

Purchases of crude oil and

products

Upstream

1,432

2,357

2,975

4,247

Downstream

11,133

16,261

22,329

28,773

Chemical

263

401

537

716

Eliminations

(4,972)

(7,998)

(10,507)

(14,365)

Purchases of crude oil and products

7,856

11,021

15,334

19,371

Production and manufacturing

Upstream

1,256

1,423

2,543

2,672

Downstream

475

418

886

774

Chemical

54

67

112

121

Eliminations

—

—

—

—

Production and manufacturing

1,785

1,908

3,541

3,567

Selling and general

Upstream

—

—

—

—

Downstream

160

153

317

300

Chemical

22

22

48

45

Eliminations / Corporate and other

24

16

27

71

Selling and general

206

191

392

416

Capital and exploration

expenditures

Upstream

303

233

624

455

Downstream

152

69

226

137

Chemical

5

2

9

3

Corporate and other

33

10

63

15

Capital and exploration expenditures

493

314

922

610

Exploration expenses charged to Upstream

income included above

1

1

2

3

Attachment IV

Operating statistics

Second Quarter

Six Months

2023

2022

2023

2022

Gross crude oil and natural gas liquids

(NGL) production

(thousands of barrels per day)

Kearl

154

159

169

146

Cold Lake

132

144

137

142

Syncrude (a)

66

81

71

79

Conventional

5

11

5

11

Total crude oil production

357

395

382

378

NGLs available for sale

—

2

—

1

Total crude oil and NGL production

357

397

382

379

Gross natural gas production

(millions of cubic feet per day)

35

98

36

105

Gross oil-equivalent production

(b)

363

413

388

397

(thousands of oil-equivalent barrels per

day)

Net crude oil and NGL production

(thousands of barrels per day)

Kearl

144

145

157

134

Cold Lake

105

101

112

104

Syncrude (a)

61

63

65

61

Conventional

5

10

5

11

Total crude oil production

315

319

339

310

NGLs available for sale

—

1

—

1

Total crude oil and NGL production

315

320

339

311

Net natural gas production

(millions of cubic feet per day)

32

95

36

98

Net oil-equivalent production

(b)

320

336

345

327

(thousands of oil-equivalent barrels per

day)

Kearl blend sales (thousands of

barrels per day)

211

221

236

205

Cold Lake blend sales (thousands of

barrels per day)

174

191

182

189

NGL sales (thousands of barrels per

day)

—

2

—

1

Average realizations (Canadian

dollars)

Bitumen (per barrel)

68.64

112.27

58.94

101.53

Synthetic crude oil (per barrel)

100.92

144.67

101.73

131.41

Conventional crude oil (per barrel)

64.33

115.80

64.65

106.99

NGL (per barrel)

—

69.19

—

66.98

Natural gas (per thousand cubic feet)

2.36

6.81

2.73

5.98

Refinery throughput (thousands of

barrels per day)

388

412

403

406

Refinery capacity utilization

(percent)

90

96

93

95

Petroleum product sales (thousands

of barrels per day)

Gasolines

231

229

222

219

Heating, diesel and jet fuels

176

179

180

176

Lube oils and other products

42

49

42

49

Heavy fuel oils

26

23

21

20

Net petroleum products sales

475

480

465

464

Petrochemical sales (thousands of

tonnes)

220

222

438

432

(a)

Syncrude gross and net production included

bitumen and other products that were exported to the operator’s

facilities using an existing interconnect pipeline.

Gross bitumen and other products production

(thousands of barrels per day)

-

2

1

3

Net bitumen and other products production (thousands

of barrels per day)

-

2

1

3

(b)

Gas converted to oil-equivalent at six

million cubic feet per one thousand barrels.

Attachment V

Net income (loss) per

Net income (loss) (U.S. GAAP)

common share - diluted (a)

millions of Canadian dollars

Canadian dollars

2019

First Quarter

293

0.38

Second Quarter

1,212

1.57

Third Quarter

424

0.56

Fourth Quarter

271

0.36

Year

2,200

2.88

2020

First Quarter

(188)

(0.25)

Second Quarter

(526)

(0.72)

Third Quarter

3

—

Fourth Quarter

(1,146)

(1.56)

Year

(1,857)

(2.53)

2021

First Quarter

392

0.53

Second Quarter

366

0.50

Third Quarter

908

1.29

Fourth Quarter

813

1.18

Year

2,479

3.48

2022

First Quarter

1,173

1.75

Second Quarter

2,409

3.63

Third Quarter

2,031

3.24

Fourth Quarter

1,727

2.86

Year

7,340

11.44

2023

First Quarter

1,248

2.13

Second Quarter

675

1.15

Year

1,923

3.29

(a)

Computed using the average number of

shares outstanding during each period. The sum of the quarters

presented may not add to the year total.

Attachment VI

Non-GAAP financial measures and other specified financial

measures Certain measures included in this document are not

prescribed by U.S. Generally Accepted Accounting Principles (GAAP).

These measures constitute “non-GAAP financial measures” under

Securities and Exchange Commission Regulation G and Item 10(e) of

Regulation S-K, and “specified financial measures” under National

Instrument 52-112 Non-GAAP and Other Financial Measures Disclosure

of the Canadian Securities Administrators.

Reconciliation of these non-GAAP financial measures to the most

comparable GAAP measure, and other information required by these

regulations, have been provided. Non-GAAP financial measures and

specified financial measures are not standardized financial

measures under GAAP and do not have a standardized definition. As

such, these measures may not be directly comparable to measures

presented by other companies, and should not be considered a

substitute for GAAP financial measures.

Cash flows from (used in) operating activities excluding

working capital Cash flows from (used in) operating activities

excluding working capital is a non-GAAP financial measure that is

the total cash flows from operating activities less the changes in

operating assets and liabilities in the period. The most directly

comparable financial measure that is disclosed in the financial

statements is "Cash flows from (used in) operating activities"

within the company’s Consolidated statement of cash flows.

Management believes it is useful for investors to consider these

numbers in comparing the underlying performance of the company’s

business across periods when there are significant period-to-period

differences in the amount of changes in working capital. Changes in

working capital is equal to “Changes in operating assets and

liabilities” as disclosed in the company’s Consolidated statement

of cash flows and in Attachment II of this document. This measure

assesses the cash flows at an operating level, and as such, does

not include proceeds from asset sales as defined in Cash flows from

operating activities and asset sales in the Frequently Used Terms

section of the company’s annual Form 10-K.

Reconciliation of cash flows from (used in) operating

activities excluding working capital

Second Quarter

Six Months

millions of Canadian dollars

2023

2022

2023

2022

From Imperial's Consolidated statement

of cash flows

Cash flows from (used in) operating

activities

885

2,682

64

4,596

Less changes in working capital

Changes in operating assets and

liabilities

(251)

(101)

(2,626)

594

Cash flows from (used in) operating

activities excl. working capital

1,136

2,783

2,690

4,002

Free cash flow

Free cash flow is a non-GAAP financial measure that is cash

flows from operating activities less additions to property, plant

and equipment and equity company investments plus proceeds from

asset sales. The most directly comparable financial measure that is

disclosed in the financial statements is "Cash flows from (used in)

operating activities" within the company’s Consolidated statement

of cash flows. This measure is used to evaluate cash available for

financing activities (including but not limited to dividends and

share purchases) after investment in the business.

Reconciliation of free cash flow

Second Quarter

Six Months

millions of Canadian dollars

2023

2022

2023

2022

From Imperial's Consolidated statement

of cash flows

Cash flows from (used in) operating

activities

885

2,682

64

4,596

Cash flows from (used in) investing

activities

Additions to property, plant and

equipment

(499)

(333)

(928)

(637)

Proceeds from asset sales

9

102

23

126

Loans to equity companies - net

1

1

2

2

Free cash flow

396

2,452

(839)

4,087

Net income (loss) excluding identified items Net income

(loss) excluding identified items is a non-GAAP financial measure

that is total net income (loss) excluding individually significant

non-operational events with an absolute corporate total earnings

impact of at least $100 million in a given quarter. The net income

(loss) impact of an identified item for an individual segment in a

given quarter may be less than $100 million when the item impacts

several segments or several periods. The most directly comparable

financial measure that is disclosed in the financial statements is

"Net income (loss)" within the company’s Consolidated statement of

income. Management uses these figures to improve comparability of

the underlying business across multiple periods by isolating and

removing significant non-operational events from business results.

The company believes this view provides investors increased

transparency into business results and trends, and provides

investors with a view of the business as seen through the eyes of

management. Net income (loss) excluding identified items is not

meant to be viewed in isolation or as a substitute for net income

(loss) as prepared in accordance with U.S. GAAP. All identified

items are presented on an after-tax basis.

Reconciliation of net income (loss) excluding identified

items There were no identified items in the second quarter or

year-to-date 2023 and 2022.

Cash operating costs (cash costs) Cash operating costs is

a non-GAAP financial measure that consists of total expenses, less

purchases of crude oil and products, federal excise taxes and fuel

charge, financing, and costs that are non-cash in nature, including

depreciation and depletion, and non-service pension and

postretirement benefit. The components of cash operating costs

include "Production and manufacturing", "Selling and general" and

"Exploration" from the company’s Consolidated statement of income,

and as disclosed in Attachment III of this document. The sum of

these income statement lines serve as an indication of cash

operating costs and does not reflect the total cash expenditures of

the company. The most directly comparable financial measure that is

disclosed in the financial statements is "Total expenses" within

the company’s Consolidated statement of income. This measure is

useful for investors to understand the company’s efforts to

optimize cash through disciplined expense management.

Reconciliation of cash operating costs

Second Quarter

Six Months

millions of Canadian dollars

2023

2022

2023

2022

From Imperial's Consolidated statement

of income

Total expenses

10,935

14,141

21,411

25,293

Less:

Purchases of crude oil and products

7,856

11,021

15,334

19,371

Federal excise taxes and fuel charge

598

553

1,127

1,032

Depreciation and depletion

453

451

943

877

Non-service pension and postretirement

benefit

20

5

40

9

Financing

16

11

32

18

Cash operating costs

1,992

2,100

3,935

3,986

Components of cash operating costs

Second Quarter

Six Months

millions of Canadian dollars

2023

2022

2023

2022

From Imperial's Consolidated statement

of income

Production and manufacturing

1,785

1,908

3,541

3,567

Selling and general

206

191

392

416

Exploration

1

1

2

3

Cash operating costs

1,992

2,100

3,935

3,986

Segment contributions to total cash operating costs

Second Quarter

Six Months

millions of Canadian dollars

2023

2022

2023

2022

Upstream

1,257

1,424

2,545

2,675

Downstream

635

571

1,203

1,074

Chemicals

76

89

160

166

Corporate / Eliminations

24

16

27

71

Cash operating costs

1,992

2,100

3,935

3,986

Unit cash operating cost (unit cash costs)

Unit cash operating costs is a non-GAAP ratio. Unit cash

operating costs (unit cash costs) is calculated by dividing cash

operating costs by total gross oil-equivalent production, and is

calculated for the Upstream segment, as well as the major Upstream

assets. Cash operating costs is a non-GAAP financial measure and is

disclosed and reconciled above. This measure is useful for

investors to understand the expense management efforts of the

company’s major assets as a component of the overall Upstream

segment. Unit cash operating cost, as used by management, does not

directly align with the definition of “Average unit production

costs” as set out by the U.S. Securities and Exchange Commission

(SEC), and disclosed in the company’s SEC Form 10-K.

Components of unit cash operating cost

Second Quarter

2023

2022

millions of Canadian dollars

Upstream (a)

Kearl

Cold Lake

Syncrude

Upstream (a)

Kearl

Cold Lake

Syncrude

Production and manufacturing

1,256

526

282

412

1,423

578

396

380

Selling and general

—

—

—

—

—

—

—

—

Exploration

1

—

—

—

1

—

—

—

Cash operating costs

1,257

526

282

412

1,424

578

396

380

Gross oil-equivalent production

363

154

132

66

413

159

144

81

(thousands of barrels per day)

Unit cash operating cost

($/oeb)

38.05

37.53

23.48

68.60

37.89

39.95

30.22

51.55

USD converted at the quarterly average

forex

28.16

27.77

17.38

50.76

29.55

31.16

23.57

40.21

2023 US$0.74; 2022 US$0.78

Six Months

2023

2022

millions of Canadian dollars

Upstream (a)

Kearl

Cold Lake

Syncrude

Upstream (a)

Kearl

Cold Lake

Syncrude

Production and manufacturing

2,543

1,084

584

811

2,672

1,099

718

728

Selling and general

—

—

—

—

—

—

—

—

Exploration

2

—

—

—

3

—

—

—

Cash operating costs

2,545

1,084

584

811

2,675

1,099

718

728

Gross oil-equivalent production

388

169

137

71

397

146

142

79

(thousands of barrels per day)

Unit cash operating cost

($/oeb)

36.24

35.44

23.55

63.11

37.23

41.59

27.94

50.91

USD converted at the YTD average forex

26.82

26.23

17.43

46.70

29.41

32.86

22.07

40.22

2023 US$0.74; 2022 US$0.79

(a)

Upstream includes Imperial's share of

Kearl, Cold Lake, Syncrude and other.

After more than a century, Imperial continues

to be an industry leader in applying technology and innovation to

responsibly develop Canada’s energy resources. As Canada’s largest

petroleum refiner, a major producer of crude oil, a key

petrochemical producer and a leading fuels marketer from coast to

coast, our company remains committed to high standards across all

areas of our business.

Source: Imperial

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230728803568/en/

Investor relations (587) 476-4743

Media relations (587) 476-7010

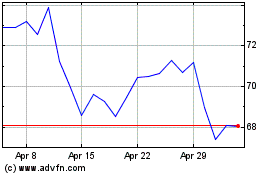

Imperial Oil (AMEX:IMO)

Historical Stock Chart

From May 2024 to Jun 2024

Imperial Oil (AMEX:IMO)

Historical Stock Chart

From Jun 2023 to Jun 2024