Syncrude Partner Imperial Sees Expansion Delayed Until After 2020

November 23 2011 - 5:28PM

Dow Jones News

An expansion of the Syncrude oil-sands joint venture will likely

be put on hold until after 2020, the project's operator Imperial

Oil Ltd. (IMO) said Wednesday.

"Imperial is of the view that expansion would not happen before

the end of this decade," Imperial Oil spokesman Pius Rolheiser

said.

Syncrude's largest owner with a 36.7% stake, Canadian Oil Sands

Ltd. (COS.T), has been promoting a plan since early last year to

expand the Syncrude project's crude oil production capacity from

350,000 barrels a day to about 550,000 barrels by 2020.

But the reluctance of Imperial Oil, which owns a 25% stake and

manages the project, would effectively nix those plans, as any

expansion requires approval of all the partners.

Imperial Oil made its comments on the Syncrude project Wednesday

after FirstEnergy Capital analyst Mike Dunn wrote in a research

note that he believed support for the expansion plans had waned

among Syncrude's other large partners, including Imperial Oil,

which is 70% owned by Exxon Mobil Corp. (XOM), and Suncor Energy

Inc. (SU). Dunn suggested that Imperial Oil and Suncor would be

more focused on building their own oil-sands projects - Imperial's

Kearl project and Suncor's Fort Hills and Joslyn project - for the

rest of this decade, rather than on expanding Syncrude.

Imperial's Rolheiser said that Imperial remains committed to

developing the entire resource at Syncrude, but said its "first

priority is improving and sustaining the reliability of Syncrude's

base operation."

Syncrude's production at around 300,000 barrels a day has fallen

short of its full capacity, in part due to equipment reliability

issues. Canadian Oil Sands last month cut the project's production

outlook due to extended equipment maintenance, and it said Tuesday

evening that production had been temporarily shut down due to a

malfunction of a coker.

A Suncor spokeswoman declined to comment. Canadian Oil Sands

spokeswoman Siren Fisekci said the expansion plans had been set

after a discussion with all the Syncrude partners, though she said

that Imperial's view on the project means it likely won't go

forward as initially laid out.

Syncrude's other partners include China's Sinopec Corp.

(600028.SH), Nexen Inc. (NXY) Mocal Energy Ltd. and Murphy Oil

(MUR).

FirstEnergy analyst Dunn said that pushing back the expansion

plans and focusing on improving the current project might be good

news for Canadian Oil Sands stock, as it would remove the weight of

a large capital expenditure program that wouldn't pay off for years

and relieve some investor concerns about unreliability of current

operations.

On the Toronto Stock Exchange Wednesday, Canadian Oil Sands

shares closed down less than 1% at C$19.40, while Imperial Oil

shares declined 2.8% to C$40.01 and Suncor shares closed down 4.6%

to C$29.01.

-By Edward Welsch, Dow Jones Newswires; 403-229-9095;

edward.welsch@dowjones.com

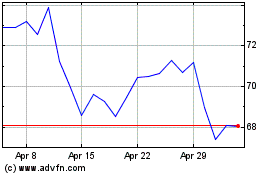

Imperial Oil (AMEX:IMO)

Historical Stock Chart

From Jun 2024 to Jul 2024

Imperial Oil (AMEX:IMO)

Historical Stock Chart

From Jul 2023 to Jul 2024