UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

REPORT

OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE

13A-16 OR 15D-16 UNDER THE SECURITIES

EXCHANGE

ACT OF 1934

For

the month of January, 2024

Commission

File Number: 001-41353

Genius

Group Limited

(Translation

of registrant’s name into English)

8

Amoy Street, #01-01

Singapore

049950

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ________.

Note:

Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report

to security holders.

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ________.

Note:

Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that

the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated,

domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on

which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to

be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the

subject of a Form 6-K submission or other Commission filing on EDGAR.

Closing

of Public Offering

On

January 17, 2024, Genius Group Limited issued a press release regarding the closing of an $8.25 million public offering. The press release

is filed herewith as Exhibit 99.1.

The

information in this Current Report on Form 6-K and Exhibit 99.1 attached hereto shall not be deemed “filed” for purposes

of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section or Sections

11 and 12(a)(2) of the Securities Act of 1933, as amended. The information contained in this Current Report and in Exhibit 99.1 to this

Current Report shall not be incorporated by reference into any filing with the SEC made by the Company, whether made before or after

the date hereof, regardless of any general incorporation language in such filing.

Exhibit

Index

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| |

GENIUS

GROUP LIMITED |

| |

|

|

| Date:

January 17, 2024 |

|

|

| |

By: |

/s/

Roger James Hamilton |

| |

Name: |

Roger

James Hamilton |

| |

Title: |

Chief

Executive Officer and Chairman

(Principal

Executive Officer) |

Exhibit

99.1

Genius

Group Announces Closing of $8.25 Million Public Offering

SINGAPORE,

January 17, 2024 – Genius Group Limited (NYSE American: GNS) (“Genius Group” or the “Company”), a leading

entrepreneur edtech and education group, today announced the closing of its previously announced public offering of 23,571,429 of the

Company’s ordinary shares, Series 2024-A warrants (“Series 2024-A Warrants”) to purchase up to 23,571,429 of the Company’s

ordinary shares and Series 2024-C warrants (“Series 2024-C Warrants”) to purchase up to 23,571,429 of the Company’s

ordinary shares, at a combined offering price of $0.35 per ordinary share and associated warrants. The Series 2024-A Warrants have an

exercise price of $0.35 per ordinary share and are immediately exercisable upon issuance for a period of five years following the date

of issuance. The Series 2024-C Warrants have an exercise price of $0.35 per ordinary share and are immediately exercisable upon issuance

for a period of 18 months following the date of issuance.

H.C.

Wainwright & Co. acted as the exclusive placement agent for the offering.

The

gross proceeds to the Company from the offering were approximately $8.25 million, before deducting the placement agent’s fees and

other offering expenses payable by the Company. Mr. Roger Hamilton, our chief executive officer and chairman of the board of directors,

converted approximately $1 million of his outstanding loan to the Company into the securities offered in the public offering at the same

terms and conditions, which amount was included in the gross proceeds from the offering. The Company intends to use the net proceeds

from the offering for general corporate purposes, including working capital, operating expenses, debt repayment and to support acquisitions.

The

securities described above were offered pursuant to a registration statement on Form F-1 (File No. 333-273841) originally filed with

the Securities and Exchange Commission (“SEC”) on August 9, 2023, as amended, and declared effective by the SEC on January

11, 2024. The offering was made only by means of a prospectus, which forms a part of the effective registration statement. Electronic

copies of the final prospectus may be obtained for free on the SEC’s website located at http://www.sec.gov and may also

be obtained by contacting H.C. Wainwright & Co., LLC at 430 Park Avenue, 3rd Floor, New York, NY 10022, by phone at (212) 856-5711

or e-mail at placements@hcwco.com.

This

press release shall not constitute an offer to sell or a solicitation of an offer to buy these securities, nor shall there be any sale

of these securities in any state or other jurisdiction in which such offer, solicitation or sale would be unlawful prior to the registration

or qualification under the securities laws of any such state or other jurisdiction.

About

Genius Group

Genius

Group is a leading entrepreneur edtech and education group, with a mission to disrupt the current education model with a student-centered,

life-long learning curriculum that prepares students with the leadership, entrepreneurial and life skills to succeed. Through its learning

platform, GeniusU, the Genius Group has a member base of 5.4 million users in 200 countries, ranging from early age to 100.

For

more information, please visit https://www.geniusgroup.net/

Forward-Looking

Statements:

Statements

made in this press release include forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements can be identified by the use of words such as “may,”

“will,” “plan,” “should,” “expect,” “anticipate,” “estimate,”

“continue,” or comparable terminology. Such forward-looking statements are inherently subject to certain risks, trends and

uncertainties, including market and other conditions, many of which the Company cannot predict with accuracy and some of which the Company

might not even anticipate and involve factors that may cause actual results to differ materially from those projected or suggested. Forward-looking

statements in this press release include, without limitation, statements pertaining to the intended use of proceeds from the offering.

Readers are cautioned not to place undue reliance on these forward-looking statements and are advised to consider the factors listed

above together with the additional factors under the heading “Risk Factors” in the Company’s Annual Reports on Form

20-F, as may be supplemented or amended by the Company’s Reports of a Foreign Private Issuer on Form 6-K and the registration statement.

The Company assumes no obligation to update or supplement forward-looking statements that become untrue because of subsequent events,

new information or otherwise, except as required by law.

Contacts

Investors:

Dave

Gentry

RedChip

Companies Inc

1-800-RED-CHIP

GNS@redchip.com

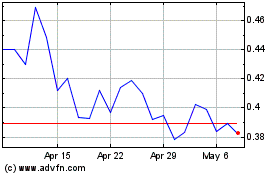

Genius (AMEX:GNS)

Historical Stock Chart

From Oct 2024 to Nov 2024

Genius (AMEX:GNS)

Historical Stock Chart

From Nov 2023 to Nov 2024