EVI Industries Completes Acquisition of Spynr, Inc. – Adds Commercial Laundry Marketing Firm

May 09 2022 - 11:33AM

Business Wire

EVI Industries, Inc. (NYSE American: “EVI” or the “Company”)

announced today that it simultaneously executed a definitive

agreement and completed the acquisition of New York, NY based

Spynr, Inc. (“Spynr”), EVI’s twentieth (20th) acquisition. Spynr is

a highly specialized full-service marketing agency with deep roots

in the commercial laundry industry. Spynr provides owners of

laundry businesses a variety of marketing services, including

branding, web design, digital advertising, social media services,

content development, SEO, and other related services aimed to reach

and attract customers to their laundry businesses efficiently and

effectively.

Spynr was founded by Mr. Dennis Diaz, a young and dynamic

entrepreneur with over twelve years of experience in the commercial

laundry industry. Mr. Diaz leads a team of thirteen digital

marketing professionals that together have developed, and deployed

marketing solutions specifically designed for the commercial

laundry industry.

Henry M. Nahmad, EVI’s Chairman and Chief

Executive Officer, commented: “Our customers make significant

financial investments in their laundry businesses. Given the

competitive environment, maximizing the return on their investment

also requires laundry business owners to think and deliver across

the entire marketing spectrum, from branding to web design to

digital marketing, and beyond. To that end, we seek to provide

these critical services to existing and prospective customers such

that they may achieve their return expectations. Through Spynr, we

expect to deliver the industry and our Company these necessary

marketing capabilities.”

Spynr will operate as a subsidiary of EVI under its current name

and from its present location, will continue to be led by Mr. Diaz

and all its associates, and have the full extent of EVI’s resources

with which to execute on the Company’s long-term growth strategy.

In addition, Mr. Diaz will serve as EVI’s Director of Marketing.

Given Mr. Diaz’s service as a board member of the Coin Laundry

Association and the LaundryCares Foundation, the Company believes

it strengthened its leadership team with a well-recognized and

accomplished industry professional.

EVI’s Long-Term Strategy EVI is in the early stages of a

long-term growth strategy to build an enterprise through which it

may deliver comprehensive laundry solutions to all segments of the

commercial laundry industry.

Key components of EVI’s buy-and-build strategy include:

- Identify and partner with great businesses led by influential

leaders,

- Retain the leadership team, honor the company culture and

empower them,

- Pursue aggressive growth plans and help the leadership team

achieve their goals,

- Create an ownership culture by motivating the team with

long-term equity, and

- Collaborate on new and transformative ideas to foster a spirit

of growth and innovation.

About EVI Industries EVI Industries, Inc., through its

wholly-owned subsidiaries, is a distributor that sells, leases, and

rents commercial, industrial, and vended laundry and dry cleaning

equipment and steam and hot water boilers manufactured by others,

supplies related replacement parts and accessories, designs and

plans turn-key laundry, dry cleaning, and boiler systems, and

provides installation and maintenance services to thousands of

customers, which include commercial, industrial, institutional,

government, and retail customers. These activities are conducted in

the United States, Canada, the Caribbean and Latin America.

Forward-Looking Statements

Except for the historical matters contained herein, statements in

this press release are forward- looking and are made pursuant to

the safe harbor provisions of the Private Securities Litigation

Reform Act of 1995. Forward-looking statements are subject to a

number of known and unknown risks and uncertainties that may cause

actual results, trends, performance or achievements of EVI

Industries, or industry trends and results, to differ from the

future results, trends, performance or achievements expressed or

implied by such forward-looking statements. These risks and

uncertainties include, among others, that the acquisition of Spynr

may not be accretive to EVI Industries earnings or otherwise have a

positive impact on EVI Industries operating results or financial

condition to the extent anticipated or at all, integration risks,

risks related to the business, operations and prospects of Spynr

and EVI Industries plans with respect thereto. Reference is also

made to other economic, competitive, governmental, technological

and other risks and factors discussed in EVI Industries filings

with the Securities and Exchange Commission, including, without

limitation, those disclosed in the “Risk Factors” section of EVI

Industries Annual Report on Form 10-K for the fiscal year ended

June 30, 2021, filed with the SEC on September 13, 2021, as amended

by its Annual Report on Form 10-K/A for the fiscal year ended June

30, 2021, filed with the SEC on October 28, 2021. Many of these

risks and factors are beyond EVI Industries control. In addition,

past performance and perceived trends may not be indicative of

future results. EVI Industries cautions that the foregoing factors

are not exclusive. The reader should not place undue reliance on

any forward- looking statement, which speaks only as of the date

made. EVI Industries does not undertake to, and specifically

disclaims any obligation to, update or supplement any

forward-looking statement, whether as a result of changes in

circumstances, new information, subsequent events or otherwise,

except as may be required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220509005773/en/

Henry M. Nahmad (305) 402-9300 Sloan Bohlen (203) 428-3210

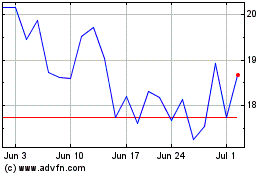

EVI Industries (AMEX:EVI)

Historical Stock Chart

From Mar 2024 to Apr 2024

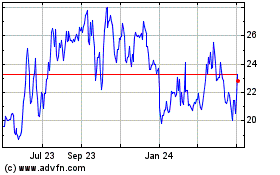

EVI Industries (AMEX:EVI)

Historical Stock Chart

From Apr 2023 to Apr 2024