UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2014

Commission File Number: 001-35284

Ellomay Capital Ltd.

(Translation of registrant’s name into English)

9 Rothschild Blvd., Tel Aviv 6688112, Israel

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ____

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ____

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes o No x

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- ________

This Report on Form 6-K of Ellomay Capital Ltd. consists of the following document, which is attached hereto and incorporated by reference herein:

|

99.1

|

Press Release: “Ellomay Capital Reports Publication of Financial Results of Dorad Energy Ltd.; Ellomay Capital Indirectly Holds 7.5% of Dorad Energy Ltd.,” dated November 26, 2014.

|

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Ellomay Capital Ltd.

|

|

| |

|

|

|

|

|

By:

|

/s/ Ran Fridrich |

|

| |

|

Ran Fridrich

Chief Executive Officer and Director

|

|

Dated: November 28, 2014

3

Exhibit 99.1

Ellomay Capital Reports Publication of Financial Results of Dorad Energy Ltd.

Ellomay Capital Indirectly Holds 7.5% of Dorad Energy Ltd.

Tel-Aviv, Israel, November 26, 2014 – Ellomay Capital Ltd. (NYSE MKT: ELLO; TASE: ELOM) (“Ellomay” or the “Company”), an emerging operator in the renewable energy and energy infrastructure sector, today reported the publication in Israel of financial statements of Dorad Energy Ltd. (“Dorad”), in which Ellomay indirectly holds 7.5%.

On November 25, 2014, U. Dori Group Ltd. (the “Dori Group”), an Israeli public company that holds 60% of U. Dori Energy Infrastructures Ltd. (“Dori Energy”), published its quarterly report in Israel based on the requirements of the Israeli Securities Law, 1968. Based on applicable regulatory requirements, the quarterly report of the Dori Group includes the financial statements of Dorad. Dorad’s power plant commenced operations during May 2014, and therefore the results for the period present the first full financial quarter of operations of the power plant.

The financial results of Dori Energy and of Dorad for the quarter ended September 30, 2014 were prepared in accordance with International Financial Reporting Standards. Ellomay will include its share of these results in the financial results of Ellomay for this period, whichare currently expected to be published on or about December 31, 2014. In an effort to provide Ellomay’s shareholders with access to Dorad’s financial results (which were published in Hebrew), Ellomay hereby provides a convenience translation of the Dorad financial results.

Dorad Financial Highlights

|

|

·

|

Dorad’s unaudited revenues for the quarter ended September 30, 2014 - approximately NIS 693 million (or approximately USD 188 million, based on the exchange rate on September 30, 2014).

|

|

|

·

|

Dorad’s unaudited operating profit for the quarter ended September 30, 2014 - approximately NIS 160 million (or approximately USD 43 million, based on the exchange rate on September 30, 2014).

|

Based on the information provided by Dorad, the demand for electricity by Dorad’s customers is seasonal and is affected by, inter alia, the climate prevailing in that season. The months of the year are split into three seasons as follows: the summer season – the months of July and August; the winter season - the months of December, January and February; and intermediate seasons – (spring and autumn), the months from March to September and from September to November. There is a higher demand for electricity during the winter and summer seasons, and the average electricity consumption is higher in these seasons than in the intermediate seasons and is even characterized by peak demands due to extreme climate conditions of heat or cold. In addition, Dorad’s revenues are affected by the change in load and time tariffs - TAOZ (an electricity tariff that varies across seasons and across the day in accordance with demand hour clusters), as, on average, TAOZ tariffs are higher in the summer season than in the intermediate and winter seasons. Therefore, the results presented, which include the summer months of July and August, are not indicative of full year results.

Ran Fridrich, CEO and a board member of Ellomay commented: “We are very pleased with the results of operations of the Dorad power plant in which we currently hold 7.5% with an option to increase our holdings to approximately 9.4%. The Dorad power plant is unique due to its ability to quickly adjust its capacity and operate based on the current demand and because it assists the Israeli energy market by backing up the Israeli electricity system, in addition to the fact that it sells cheaper electricity to the Israeli Ministry of Defense, the Israeli water company (Mekorot) and to the Israeli industry in general.”

A translation of the financial results for Dorad as of and for the year ended December 31, 2013 and as of and for the three and nine month periods ended September 30, 2014 is included at the end of this press release. Ellomay does not undertake to separately report Dorad’s financial results in a separate press release in the future. Neither Ellomay nor its independent public accountants have reviewed or consulted with the Dori Group, Dori Energy or Dorad with respect to the financial results included in this press release.

About Ellomay Capital Ltd.

Ellomay is an Israeli based company whose shares are registered with the NYSE MKT, under the trading symbol “ELLO” and with the Tel Aviv Stock Exchange under the trading symbol “ELOM.” Since 2009, Ellomay Capital focuses its business in the energy and infrastructure sectors worldwide. Ellomay (formerly Nur Macroprinters Ltd.) previously was a supplier of wide format and super-wide format digital printing systems and related products worldwide, and sold this business to Hewlett-Packard Company during 2008 for more than $100 million.

To date, Ellomay has evaluated numerous opportunities and invested significant funds in the renewable, clean energy and natural resources industries in Israel, Italy and Spain, including:

|

|

·

|

Approx. 22.6MW of photovoltaic power plants in Italy and approximately 5.6MW and 85% of 2.3MW of photovoltaic power plants in Spain;

|

|

|

·

|

7.5% indirect interest, with an option to increase its holdings to 9.375%, in Dorad Energy Ltd. Israel’s largest private power plant, with production capacity of approximately 800 MW, representing about 8% of Israel’s total current electricity consumption;

|

Ellomay Capital is controlled by Mr. Shlomo Nehama, Mr. Hemi Raphael and Mr. Ran Fridrich.

Mr. Nehama is one of Israel’s prominent businessmen and the former Chairman of Israel’s leading bank, Bank Hapohalim, and Messrs. Raphael and Fridrich both have vast experience in financial and industrial businesses. These controlling shareholders, along with Ellomay’s dedicated professional management, accumulated extensive experience in recognizing suitable business opportunities worldwide. The expertise of Ellomay’s controlling shareholders and management enables the company to access the capital markets, as well as assemble global institutional investors and other potential partners. As a result, Ellomay is capable of considering significant and complex transactions, beyond its immediate financial resources.

For more information about Ellomay, visit http://www.ellomay.com.

Information Relating to Forward-Looking Statements

This press release contains forward-looking statements that involve substantial risks and uncertainties, including statements that are based on the current expectations and assumptions of the Company’s management. All statements, other than statements of historical facts, included in this press release regarding the Company’s plans and objectives, expectations and assumptions of management are forward-looking statements. The use of certain words, including the words “estimate,” “project,” “intend,” “expect,” “believe” and similar expressions are intended to identify forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. The Company may not actually achieve the plans, intentions or expectations disclosed in the forward-looking statements and you should not place undue reliance on the Company’s forward-looking statements. Various important factors could cause actual results or events to differ materially from those that may be expressed or implied by our forward-looking statements. These and other risks and uncertainties associated with the Company’s business are described in greater detail in the filings the Company makes from time to time with Securities and Exchange Commission, including its Annual Report on Form 20-F. The forward-looking statements are made as of this date and the Company does not undertake any obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise.

Contact:

Kalia Weintraub

CFO

Tel: +972 (3) 797-1111

Email: anatb@ellomay.com

Condensed Interim Statement of Financial Position

| |

|

September 30

|

|

|

September 30

|

|

|

December 31

|

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

Current assets

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

|

371,641 |

|

|

|

665 |

|

|

|

4,199 |

|

|

Accounts receivable

|

|

|

247,663 |

|

|

|

- |

|

|

|

- |

|

|

Other accounts receivables

|

|

|

20,496 |

|

|

|

23,566 |

|

|

|

36,529 |

|

|

Pledged deposit

|

|

|

68,124 |

|

|

|

94,399 |

|

|

|

78,637 |

|

|

Firm commitment

|

|

|

- |

|

|

|

19,339 |

|

|

|

5,101 |

|

|

Financial derivatives

|

|

|

4,179 |

|

|

|

- |

|

|

|

- |

|

|

Total current assets

|

|

|

712,103 |

|

|

|

137,969 |

|

|

|

124,466 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-current assets

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Prepaid expenses

|

|

|

49,426 |

|

|

|

50,166 |

|

|

|

50,165 |

|

|

Fixed assets

|

|

|

4,471,253 |

|

|

|

3,706,889 |

|

|

|

3,939,647 |

|

|

Advances to suppliers

|

|

|

- |

|

|

|

109,519 |

|

|

|

56,978 |

|

|

Intangible assets

|

|

|

8,677 |

|

|

|

6,325 |

|

|

|

7,657 |

|

|

Total non-current assets

|

|

|

4,529,356 |

|

|

|

3,872,899 |

|

|

|

4,054,447 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total assets

|

|

|

5,241,459 |

|

|

|

4,010,868 |

|

|

|

4,178,913 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Current liabilities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current maturities of loans from banks

|

|

|

311,300 |

|

|

|

133,461 |

|

|

|

145,926 |

|

|

Trade payables and other accounts payable

|

|

|

675,598 |

|

|

|

149,173 |

|

|

|

123,313 |

|

|

Financial derivatives

|

|

|

- |

|

|

|

25,613 |

|

|

|

7,894 |

|

|

Total current liabilities

|

|

|

986,898 |

|

|

|

308,247 |

|

|

|

277,133 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-current liabilities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loans from banks

|

|

|

3,063,207 |

|

|

|

2,745,783 |

|

|

|

2,918,579 |

|

|

Loans from related parties and others

|

|

|

454,644 |

|

|

|

404,559 |

|

|

|

369,212 |

|

|

Provision for dismantling and restoration

|

|

|

28,341 |

|

|

|

- |

|

|

|

- |

|

|

Deferred tax liabilities

|

|

|

17,815 |

|

|

|

- |

|

|

|

- |

|

|

Liabilities for employee benefits

|

|

|

62 |

|

|

|

79 |

|

|

|

57 |

|

|

Total non-current liabilities

|

|

|

3,564,069 |

|

|

|

3,150,421 |

|

|

|

3,287,848 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Share capital

|

|

|

11 |

|

|

|

10 |

|

|

|

11 |

|

|

Share premium

|

|

|

642,199 |

|

|

|

573,633 |

|

|

|

642,199 |

|

|

Capital reserve from activities with controlling shareholders

|

|

|

3,748 |

|

|

|

3,748 |

|

|

|

3,748 |

|

|

Retained loss

|

|

|

44,536 |

|

|

|

(25,191 |

) |

|

|

(32,026 |

) |

|

Total equity

|

|

|

690,494 |

|

|

|

552,200 |

|

|

|

613,932 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities and equity

|

|

|

5,241,459 |

|

|

|

4,010,868 |

|

|

|

4,178,913 |

|

Dorad Energy Ltd.

Condensed Interim Statement of Earnings

| |

|

For the nine months ended

|

|

|

For the three months ended

|

|

|

Year ended

|

|

| |

|

|

|

|

|

|

|

December 31

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues

|

|

|

901,178 |

|

|

|

- |

|

|

|

692,705 |

|

|

|

- |

|

|

|

- |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating costs of the power

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

plant

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Energy costs

|

|

|

196,258 |

|

|

|

- |

|

|

|

140,269 |

|

|

|

- |

|

|

|

- |

|

|

Electricity purchase and

|

|

|

394,909 |

|

|

|

- |

|

|

|

300,213 |

|

|

|

- |

|

|

|

- |

|

|

Depreciation and amortization

|

|

|

73,618 |

|

|

|

- |

|

|

|

50,029 |

|

|

|

- |

|

|

|

- |

|

|

Other operating costs

|

|

|

49,264 |

|

|

|

- |

|

|

|

35,732 |

|

|

|

- |

|

|

|

- |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total cost of power plant

|

|

|

714,049 |

|

|

|

- |

|

|

|

526,243 |

|

|

|

- |

|

|

|

- |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Profit from operating the

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

power plant

|

|

|

187,129 |

|

|

|

- |

|

|

|

166,462 |

|

|

|

- |

|

|

|

- |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

General & Administrative

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

expenses

|

|

|

(8,057 |

) |

|

|

- |

|

|

|

6,334 |

|

|

|

- |

|

|

|

- |

|

|

Other expenses

|

|

|

(5,771 |

) |

|

|

(5,000 |

) |

|

|

- |

|

|

|

(3,750 |

) |

|

|

(7,813 |

) |

| |

|

|

(13,828

|

) |

|

|

(5,000

|

) |

|

|

6,334

|

|

|

|

(3,750

|

) |

|

|

(7,813

|

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating profit (loss) for

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

the period

|

|

|

173,301 |

|

|

|

(5,000 |

) |

|

|

160,128 |

|

|

|

(3,750 |

) |

|

|

(7,813 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Financing income

|

|

|

22,415 |

|

|

|

- |

|

|

|

21,062 |

|

|

|

- |

|

|

|

- |

|

|

Financing expenses

|

|

|

(101,338 |

) |

|

|

11,858 |

|

|

|

(68,799 |

) |

|

|

2,843 |

|

|

|

(15,880 |

) |

|

Financing expenses, net

|

|

|

(78,924 |

) |

|

|

(11,858 |

) |

|

|

(47,737 |

) |

|

|

(2,843 |

) |

|

|

(15,880 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Profit (loss) before taxes on income

|

|

|

94,377 |

|

|

|

(16,858 |

) |

|

|

112,637 |

|

|

|

(6,593 |

) |

|

|

(23,693 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Taxes on income

|

|

|

17,815 |

|

|

|

- |

|

|

|

(28,637 |

) |

|

|

- |

|

|

|

- |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Profit (loss) for the period

|

|

|

76,562 |

|

|

|

(16,858 |

) |

|

|

83,752 |

|

|

|

(6,593 |

) |

|

|

(23,693 |

) |

Dorad Energy Ltd.

Condensed Interim Statement of Changes in Shareholders’ Equity

| |

|

|

|

|

|

|

|

Capital reserve

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

for activities

|

|

|

|

|

|

|

|

| |

|

Share

|

|

|

Share

|

|

|

with controlling

|

|

|

Retained

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the nine months ended

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, 2014 (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance as at

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

January 1, 2014 (Audited)

|

|

|

11 |

|

|

|

642,199 |

|

|

|

3,748 |

|

|

|

(32,026 |

) |

|

|

613,932 |

|

|

Profit for the period

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

76,562 |

|

|

|

76,562 |

|

|

Balance as at September 30,

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2014 (Unaudited)

|

|

|

11 |

|

|

|

642,199 |

|

|

|

3,748 |

|

|

|

44,536 |

|

|

|

690,494 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the nine months ended

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, 2013 (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance as at

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

January 1, 2013 (Audited)

|

|

|

6 |

|

|

|

373,731 |

|

|

|

3,748 |

|

|

|

(8,333 |

) |

|

|

369,152 |

|

|

Loss for the period

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(16,858 |

) |

|

|

(16,858 |

) |

|

Issuance of ordinary shares

|

|

|

4 |

|

|

|

199,902 |

|

|

|

- |

|

|

|

- |

|

|

|

199,906 |

|

|

Balance as at September 30,

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2013 (Unaudited)

|

|

|

10 |

|

|

|

573,633 |

|

|

|

3,748 |

|

|

|

(25,191 |

) |

|

|

552,200 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the three months ended

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, 2014 (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance as at

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

July 1, 2014 (Unaudited)

|

|

|

11 |

|

|

|

642,199 |

|

|

|

3,748 |

|

|

|

(39,216 |

) |

|

|

752 |

|

|

Profit for the period

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

83,752 |

|

|

|

83,769 |

|

|

Balance as at September 30,

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2014 (Unaudited)

|

|

|

11 |

|

|

|

642,199 |

|

|

|

3,748 |

|

|

|

44,536 |

|

|

|

690,494 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the three months ended

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, 2013 (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance as at

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

July 1, 2013 (Unaudited)

|

|

|

8 |

|

|

|

503,137 |

|

|

|

3,748 |

|

|

|

(18,598 |

) |

|

|

488,295 |

|

|

Loss for the period

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(6,593 |

) |

|

|

(6,593 |

) |

|

Issuance of shares

|

|

|

2 |

|

|

|

70,496 |

|

|

|

- |

|

|

|

- |

|

|

|

70,498 |

|

|

Balance as at September 30,

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2013 (Unaudited)

|

|

|

10 |

|

|

|

573,633 |

|

|

|

3,748 |

|

|

|

(25,191 |

) |

|

|

552,200 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the year ended

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31, 2013 (Audited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance as at

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

January 1, 2013 (Audited)

|

|

|

6 |

|

|

|

373,731 |

|

|

|

3,748 |

|

|

|

(8,333 |

) |

|

|

369,152 |

|

|

Loss for the year

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(23,693 |

) |

|

|

(23,693 |

) |

|

Issuance of ordinary shares

|

|

|

5 |

|

|

|

268,468 |

|

|

|

- |

|

|

|

- |

|

|

|

268,473 |

|

|

Balance as at December 31,

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2013 (Audited)

|

|

|

11 |

|

|

|

642,199 |

|

|

|

3,748 |

|

|

|

(32,026 |

) |

|

|

613,932 |

|

Dorad Energy Ltd.

Condensed Interim Statement of Cash Flows

| |

|

For the nine months ended

|

|

|

For the three months ended

|

|

|

Year ended

|

|

| |

|

|

|

|

|

|

|

December 31

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash flows from operating activities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Profit (loss) for the period

|

|

|

76,562 |

|

|

|

(16,858 |

) |

|

|

83,752 |

|

|

|

(6,593 |

) |

|

|

(23,693 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjustments:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization

|

|

|

73,871 |

|

|

|

- |

|

|

|

50,201 |

|

|

|

- |

|

|

|

- |

|

|

Taxes on income

|

|

|

171,815 |

|

|

|

- |

|

|

|

28,637 |

|

|

|

- |

|

|

|

- |

|

|

Compensation for customers

|

|

|

5,771 |

|

|

|

5,000 |

|

|

|

- |

|

|

|

3,750 |

|

|

|

7,813 |

|

|

Financing expenses, net

|

|

|

78,924 |

|

|

|

11,858 |

|

|

|

47,737 |

|

|

|

2,843 |

|

|

|

15,880 |

|

| |

|

|

176,381 |

|

|

|

16,858 |

|

|

|

126,576 |

|

|

|

6,593 |

|

|

|

23,693 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Change in trade receivables

|

|

|

(247,610 |

) |

|

|

- |

|

|

|

(80,297 |

) |

|

|

- |

|

|

|

- |

|

|

Change in other receivables

|

|

|

(20,265 |

) |

|

|

- |

|

|

|

(51,380 |

) |

|

|

- |

|

|

|

- |

|

|

Change in trade payables and

|

|

|

335,273 |

|

|

|

|

|

|

|

224,146 |

|

|

|

|

|

|

|

|

|

|

other accounts payable

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

- |

|

|

|

- |

|

|

Change in employee benefits, net

|

|

|

5 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

| |

|

|

67,403 |

|

|

|

- |

|

|

|

92,469 |

|

|

|

- |

|

|

|

- |

|

|

Net cash flows used in

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

operating activities

|

|

|

320,346 |

|

|

|

- |

|

|

|

302,797 |

|

|

|

- |

|

|

|

- |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net cash flows used in

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

investing activities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Payments of settlement of

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

financial derivatives

|

|

|

10,134 |

|

|

|

(57,440 |

) |

|

|

21,801 |

|

|

|

(15,807 |

) |

|

|

(83,496 |

) |

|

Repayment of pledged deposit

|

|

|

44,627 |

|

|

|

72,554 |

|

|

|

14,345 |

|

|

|

29,527 |

|

|

|

89,263 |

|

|

Investment in pledged deposit

|

|

|

(33,716 |

) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Long-term prepaid expenses

|

|

|

- |

|

|

|

(11,690 |

) |

|

|

- |

|

|

|

(11,690 |

) |

|

|

(11,690 |

) |

|

Investment in fixed assets

|

|

|

(207,469 |

) |

|

|

(623,094 |

) |

|

|

(64,700 |

) |

|

|

(245,533 |

) |

|

|

(782,557 |

) |

|

Investment in intangible assets

|

|

|

(1,705 |

) |

|

|

(2,686 |

) |

|

|

(189 |

) |

|

|

(487 |

) |

|

|

(4,018 |

) |

|

Interest received

|

|

|

155 |

|

|

|

- |

|

|

|

100 |

|

|

|

- |

|

|

|

- |

|

|

Net Cash flows used in

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

investing activities

|

|

|

(187,974 |

) |

|

|

(622,356 |

) |

|

|

(28,643 |

) |

|

|

(243,990 |

) |

|

|

(792,498 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash flows from financing

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

activities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Receipt of long-term loans

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

from related parties

|

|

|

60,491 |

|

|

|

84,953 |

|

|

|

8,606 |

|

|

|

33,593 |

|

|

|

110,806 |

|

|

Receipt of loans from banks

|

|

|

174,764 |

|

|

|

529,059 |

|

|

|

57,547 |

|

|

|

199,848 |

|

|

|

676,882 |

|

|

Interest paid

|

|

|

(922 |

) |

|

|

- |

|

|

|

(500 |

) |

|

|

- |

|

|

|

- |

|

|

Net cash flows provided by

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

financing activities

|

|

|

234,334 |

|

|

|

614,012 |

|

|

|

62,654 |

|

|

|

233,441 |

|

|

|

787,688 |

|

|

Effect of exchange rate

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

fluctuations on cash and cash

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

equivalents

|

|

|

736 |

|

|

|

- |

|

|

|

690 |

|

|

|

- |

|

|

|

- |

|

|

Net increase (decrease) in

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

cash and cash equivalents for

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

the period

|

|

|

366,706 |

|

|

|

(8,344 |

) |

|

|

339,807 |

|

|

|

(10,549 |

) |

|

|

(4,810 |

) |

|

Cash and cash equivalents at

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

beginning of period

|

|

|

4,199 |

|

|

|

9,009 |

|

|

|

31,144 |

|

|

|

11,214 |

|

|

|

9,009 |

|

|

Cash and cash equivalents at

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

end of period

|

|

|

371,641 |

|

|

|

665 |

|

|

|

371,641 |

|

|

|

665 |

|

|

|

4,199 |

|

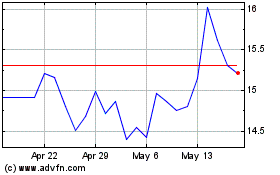

Ellomay Capital (AMEX:ELLO)

Historical Stock Chart

From Jun 2024 to Jul 2024

Ellomay Capital (AMEX:ELLO)

Historical Stock Chart

From Jul 2023 to Jul 2024