Comstock Mining Inc. (the “Company”) (NYSE American: LODE)

announced today that the Third Judicial District Court of the State

of Nevada, at a hearing held yesterday, ruled in favor of the

Company and Lyon County on the one remaining Due Process rights

claim associated with the Lyon County Board of Commissioners Master

Plan amendment and zone change associated with certain mineralized

properties within the Company’s Dayton Resource Area, just south of

the Company’s Lucerne properties and near Silver City,

Nevada.

The District Court found that the Comstock Residents Association

(the “CRA”), having been afforded the full opportunity to conduct

any and all discovery, failed to establish that the Lyon County

Board of Commissioners had denied the organization its due process

rights and reaffirmed prior favorable rulings.

The District Court’s ruling concludes that the Lyon County Board

of Commissioners satisfied constitutional due process requirements

and that the Commissioners were entitled to vote on the

applications filed by the Company, properly voted to approve the

Company’s requested Master Plan and zoning changes, denying the

CRA’s claims and reaffirming the propriety of the land use changes.

Corrado De Gasperis, Executive Chairman and CEO of the Company

stated, “This ruling was anticipated and deeply rewarding to hear

directly from Judge Robert Estes. Lyon County holds itself to

the highest standards of governance and transparent public process,

a critical component of our democratic processes, and this ruling

reaffirms the standard of excellence and transparency that we must

all hold ourselves to. We look forward to advancing the

community planning process with Silver City and Lyon County and

advancing the exploration, development and permitting of our

properties for their highest and best uses.”

This favorable, definitive ruling, along with the previous

favorable rulings and all other recent events, will be updated into

and included in the Company’s Financial Statements to be filed on

Form 10-Q with the Securities and Exchange Commission today or

before May 20, 2019. The Company’s unaudited financial

statements, as of and for the three months ended March 31, 2019,

have been included in an attachment to this release, for

convenience.

About Comstock Mining Inc.

Comstock Mining Inc. is a Nevada-based, gold and silver mining

company with extensive, contiguous property in the Comstock

District and is an emerging leader in sustainable, responsible

mining. The Company began acquiring properties in the Comstock

District in 2003. Since then, the Company has consolidated a

significant portion of the Comstock District, amassed the single

largest known repository of historical and current geological data

on the Comstock region, secured permits, built an infrastructure

and completed its first phase of production. The Company continues

evaluating and acquiring properties inside and outside the district

expanding its footprint and exploring all of our existing and

prospective opportunities for further exploration, development and

mining. The near-term goal of our business plan is to maximize

intrinsic stockholder value realized, per share, by continuing to

acquire mineralized and potentially mineralized properties,

exploring, developing and validating qualified resources and

reserves (proven and probable) that enable the commercial

development of our operations through extended, long-lived mine

plans and developments that are economically feasible and socially

responsible. Forward-Looking Statements

This press release and any related calls or discussions may

include forward-looking statements within the meaning of Section

27A of the Securities Act of 1933, as amended, and Section 21E of

the Securities Exchange Act of 1934, as amended. All statements,

other than statements of historical facts, are forward-looking

statements. The words “believe,” “expect,” “anticipate,”

“estimate,” “project,” “plan,” “should,” “intend,” “may,” “will,”

“would,” “potential” and similar expressions identify

forward-looking statements, but are not the exclusive means of

doing so. Forward-looking statements include statements about

matters such as: future industry market conditions; future

explorations or acquisitions; future changes in our exploration

activities; future prices and sales of, and demand for, our

products; land entitlements and uses; production capacity and

operations; operating and overhead costs; future capital

expenditures and their impact on us; operational and management

changes (including changes in the board of directors); changes in

business strategies, planning and tactics; future employment and

contributions of personnel, including consultants; future land

sales investments, acquisitions, joint ventures, strategic

alliances, business combinations, operational, tax, financial and

restructuring initiatives; including the nature and timing and

accounting for restructuring charges, derivative liabilities and

the impact thereof; contingencies; environmental compliance and

changes in the regulatory environment; offerings, limitations on

sales or offering of equity or debt securities; including asset

sales and the redemption of the debenture and associated costs;

future working capital, costs, revenues, business opportunities,

debt levels, cash flows, margins, earnings and growth. These

statements are based on assumptions and assessments made by our

management in light of their experience and their perception of

historical and current trends, current conditions, possible future

developments and other factors they believe to be appropriate.

Forward-looking statements are not guarantees, representations or

warranties and are subject to risks and uncertainties, many of

which are unforeseeable and beyond our control and could cause

actual results, developments and business decisions to differ

materially from those contemplated by such forward-looking

statements. Some of those risks and uncertainties include the

risk factors set forth in this report and our Annual Report on Form

10-K for the fiscal year ended December 31, 2017, and the

following: adverse effects of climate changes or natural disasters;

global economic and capital market uncertainties; the speculative

nature of gold or mineral exploration, including risks of

diminishing quantities or grades of qualified resources;

operational or technical difficulties in connection with

exploration or mining activities; contests over our title to

properties; potential dilution to our stockholders from our stock

issuances, recapitalization and balance sheet restructuring

activities; potential inability to comply with applicable

government regulations or law; adoption of or changes in

legislation or regulations adversely affecting our businesses;

permitting constraints or delays; business opportunities that may

be presented to, or pursued by, us; acquisitions, joint ventures,

strategic alliances, business combinations, asset sales, and

investments that we may be party to in the future; changes in the

United States or other monetary or fiscal policies or regulations;

interruptions in our production capabilities due to capital

constraints; equipment failures; fluctuation of prices for gold or

certain other commodities (such as silver, zinc, cyanide, water,

diesel fuel and electricity); changes in generally accepted

accounting principles; adverse effects of terrorism and

geopolitical events; potential inability to implement our business

strategies; potential inability to grow revenues; potential

inability to attract and retain key personnel; interruptions in

delivery of critical supplies, equipment and raw materials due to

credit or other limitations imposed by vendors; assertion of

claims, lawsuits and proceedings against us; potential inability to

satisfy debt and lease obligations; potential inability to maintain

an effective system of internal controls over financial reporting;

potential inability or failure to timely file periodic reports with

the SEC; potential inability to list our securities on any

securities exchange or market; inability to maintain the listing of

our securities; and work stoppages or other labor difficulties.

Occurrence of such events or circumstances could have a material

adverse effect on our business, financial condition, results of

operations or cash flows or the market price of our securities. All

subsequent written and oral forward-looking statements by or

attributable to us or persons acting on our behalf are expressly

qualified in their entirety by these factors. Except as may be

required by securities or other law, we undertake no obligation to

publicly update or revise any forward-looking statements, whether

as a result of new information, future events, or otherwise.

Neither this press release nor any related calls or discussions

constitutes an offer to sell or the solicitation of an offer to buy

the Debenture or any other securities of the Company. Contact

information: Comstock Mining, Inc. P.O. Box 1118 Virginia City, NV

89440 ComstockMining.com Corrado De Gasperis Executive Chairman

& CEO Tel (775) 847-4755 degasperis@comstockmining.com Zach

Spencer Director of External Relations Tel (775) 847-5272

ext.151questions@comstockmining.com

COMSTOCK MINING INC. AND

SUBSIDIARIESCONDENSED CONSOLIDATED BALANCE

SHEETS(UNAUDITED)

| |

March 31, 2019 |

|

December 31, 2018 |

| ASSETS |

|

|

|

| |

|

|

|

| CURRENT ASSETS: |

|

|

|

|

Cash and cash equivalents |

$ |

310,596 |

|

|

$ |

488,657 |

|

|

Assets held for sale, Net (Note 2) |

6,902,600 |

|

|

5,363,403 |

|

|

Prepaid expenses and other current assets (Note 3) |

2,874,842 |

|

|

2,712,202 |

|

|

Total current assets |

10,088,038 |

|

|

8,564,262 |

|

| |

|

|

|

| MINERAL RIGHTS AND PROPERTIES,

Net |

5,690,884 |

|

|

7,205,081 |

|

| PROPERTIES, PLANT AND

EQUIPMENT, Net (Note 4) |

9,148,087 |

|

|

9,742,120 |

|

| RECLAMATION BOND DEPOSIT |

2,655,972 |

|

|

2,622,544 |

|

| RETIREMENT OBLIGATION ASSET

(Note 5) |

186,335 |

|

|

203,274 |

|

| OTHER ASSETS |

385,791 |

|

|

274,444 |

|

| |

|

|

|

| TOTAL ASSETS |

$ |

28,155,107 |

|

|

$ |

28,611,725 |

|

| |

|

|

|

| LIABILITIES AND

STOCKHOLDERS’ EQUITY |

|

|

|

| |

|

|

|

| CURRENT LIABILITIES: |

|

|

|

|

Accounts payable |

$ |

458,719 |

|

|

$ |

405,146 |

|

|

Accrued expenses and other liabilities (Note 6) |

3,103,137 |

|

|

1,674,733 |

|

|

Long-term debt– current portion (Note 7) |

314,303 |

|

|

309,843 |

|

|

Total current liabilities |

3,876,159 |

|

|

2,389,722 |

|

| |

|

|

|

| LONG-TERM LIABILITIES: |

|

|

|

|

Long-term debt (Note 7) |

7,981,123 |

|

|

8,857,870 |

|

|

Long-term reclamation liability (Note 8) |

7,446,801 |

|

|

7,441,091 |

|

|

Other liabilities |

572,719 |

|

|

538,140 |

|

|

Total long-term liabilities |

16,000,643 |

|

|

16,837,101 |

|

| |

|

|

|

| Total liabilities |

19,876,802 |

|

|

19,226,823 |

|

| |

|

|

|

| COMMITMENTS AND CONTINGENCIES

(Note 10) |

|

|

|

| |

|

|

|

| STOCKHOLDERS’ EQUITY: |

|

|

|

|

Preferred Stock, $.000666 par value, 50,000,000 shares authorized;

no shares issued |

— |

|

|

— |

|

|

Common stock, $.000666 par value, 790,000,000 shares authorized,

80,790,273 and 75,338,273 shares issued and outstanding at

March 31, 2019, and December 31, 2018, respectively |

53,806 |

|

|

50,175 |

|

|

Additional paid-in capital |

242,144,734 |

|

|

241,419,897 |

|

|

Accumulated deficit |

(233,920,235 |

) |

|

(232,085,170 |

) |

| |

|

|

|

| Total stockholders’

equity |

8,278,305 |

|

|

9,384,902 |

|

| |

|

|

|

| TOTAL LIABILITIES AND

STOCKHOLDERS’ EQUITY |

$ |

28,155,107 |

|

|

$ |

28,611,725 |

|

COMSTOCK MINING INC. AND

SUBSIDIARIESCONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS(UNAUDITED)

| |

Three Months Ended March 31, |

| |

2019 |

|

2018 |

| REVENUES |

|

|

|

| Revenue - mining |

$ |

— |

|

|

$ |

— |

|

| Revenue - real estate |

37,598 |

|

|

22,850 |

|

|

Total revenues |

37,598 |

|

|

22,850 |

|

| |

|

|

|

| COSTS AND

EXPENSES |

|

|

|

| Costs applicable to mining

revenue |

505,393 |

|

|

728,904 |

|

| Real estate operating

costs |

10,424 |

|

|

7,091 |

|

| Exploration and mine

development |

225,867 |

|

|

209,538 |

|

| Mine claims and costs |

150,954 |

|

|

180,231 |

|

| Environmental and

reclamation |

53,451 |

|

|

58,068 |

|

| General and

administrative |

660,366 |

|

|

726,620 |

|

|

Total costs and expenses |

1,606,455 |

|

|

1,910,452 |

|

| |

|

|

|

| LOSS FROM OPERATIONS |

(1,568,857 |

) |

|

(1,887,602 |

) |

| |

|

|

|

| OTHER INCOME (EXPENSE) |

|

|

|

|

Interest expense |

(461,137 |

) |

|

(383,340 |

) |

|

Other income (expense) |

194,929 |

|

|

(213,961 |

) |

|

Total other income (expense), net |

(266,208 |

) |

|

(597,301 |

) |

| |

|

|

|

| NET LOSS |

$ |

(1,835,065 |

) |

|

$ |

(2,484,903 |

) |

| |

|

|

|

| Net loss per common share –

basic and diluted |

$ |

(0.02 |

) |

|

$ |

(0.05 |

) |

| |

|

|

|

| Weighted average common shares

outstanding — basic and diluted |

79,080,429 |

|

|

49,863,424 |

|

COMSTOCK MINING INC. AND

SUBSIDIARIESCONDENSED CONSOLIDATED STATEMENTS OF

CASH FLOWS(UNAUDITED)

| |

Three Months Ended March 31, |

| |

2019 |

|

2018 |

| OPERATING

ACTIVITIES: |

|

|

|

| Net loss |

$ |

(1,835,065 |

) |

|

$ |

(2,484,903 |

) |

| Adjustments to reconcile net

loss to net cash used in operating activities: |

|

|

|

| Depreciation, amortization,

and depletion |

586,921 |

|

|

826,928 |

|

| Accretion of reclamation

liability |

5,710 |

|

|

4,876 |

|

| Gain on sale of properties,

plant, and equipment |

— |

|

|

(26,000 |

) |

| Amortization of debt discounts

and issuance costs |

71,623 |

|

|

102,492 |

|

| Net loss on early retirement

of long-term debt |

151,531 |

|

|

2,621 |

|

| Payment-in-kind interest

expense |

470,246 |

|

|

— |

|

| Change in make-whole liability

with Pelen, LLC |

(135,162 |

) |

|

216,147 |

|

| Changes in operating assets

and liabilities: |

|

|

|

|

Prepaid expenses and other assets |

24,934 |

|

|

25,001 |

|

|

Accounts payable |

53,573 |

|

|

3,543 |

|

|

Accrued expenses and other liabilities |

(286,855 |

) |

|

230,368 |

|

| NET CASH USED IN OPERATING

ACTIVITIES |

(892,544 |

) |

|

(1,098,927 |

) |

| INVESTING

ACTIVITIES: |

|

|

|

| Proceeds from principal

payment on note receivable |

130 |

|

|

119 |

|

| Proceeds from sale of mineral

rights and properties, plant, and equipment |

— |

|

|

26,000 |

|

| Proceeds from deposits on

Membership Interest Purchase Agreement |

1,950,000 |

|

|

— |

|

| Purchase of mineral rights and

properties, plant and equipment |

(365,000 |

) |

|

— |

|

| Change in reclamation bond

deposit |

(33,428 |

) |

|

— |

|

| NET CASH PROVIDED BY INVESTING

ACTIVITIES |

1,551,702 |

|

|

26,119 |

|

| FINANCING

ACTIVITIES: |

|

|

|

| Principal payments on

long-term debt |

(1,565,687 |

) |

|

(99,005 |

) |

| Proceeds from the issuance of

common stock |

813,561 |

|

|

1,185,452 |

|

| Common stock issuance

costs |

(85,093 |

) |

|

(52,568 |

) |

| NET CASH (USED IN) PROVIDED BY

FINANCING ACTIVITIES |

(837,219 |

) |

|

1,033,879 |

|

| (DECREASE) IN CASH AND CASH

EQUIVALENTS |

(178,061 |

) |

|

(38,929 |

) |

| CASH AND CASH EQUIVALENTS,

BEGINNING OF PERIOD |

488,657 |

|

|

2,066,718 |

|

| CASH AND CASH EQUIVALENTS, END

OF PERIOD |

$ |

310,596 |

|

|

$ |

2,027,789 |

|

| |

|

|

|

| SUPPLEMENTAL CASH FLOW

INFORMATION: |

|

|

|

| Cash paid for interest |

$ |

34,460 |

|

|

$ |

17,509 |

|

| |

|

|

|

| Supplemental

disclosure of non-cash investing and financing

activities: |

|

|

|

| Common Stock Issuance

Costs |

$ |

— |

|

|

$ |

200,000 |

|

| Issuance of common stock (in

advance) to purchase membership interest |

$ |

— |

|

|

$ |

585,000 |

|

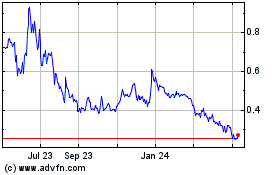

Comstock (AMEX:LODE)

Historical Stock Chart

From Aug 2024 to Sep 2024

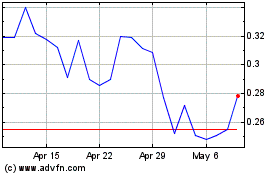

Comstock (AMEX:LODE)

Historical Stock Chart

From Sep 2023 to Sep 2024