Additional Proxy Soliciting Materials (definitive) (defa14a)

June 29 2020 - 12:31PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C.

20549

SCHEDULE 14A

Proxy Statement

Pursuant to Section 14(a) of the Securities

Exchange Act of

1934 (Amendment No.___)

Filed by the Registrant

[X]

Filed by a Party

other than the Registrant [ ]

Check the appropriate

box:

|

[ ]

|

Preliminary Proxy Statement

|

|

[ ]

|

Confidential, for Use of the Commission Only

(as permitted by Rule 14a-6(e)(2))

|

|

[ ]

|

Definitive Proxy Statement

|

|

[X]

|

Definitive Additional Materials

|

|

[ ]

|

Soliciting Material Pursuant to Sec. 240.14a-12

|

|

CLOUGH GLOBAL

DIVIDEND AND INCOME FUND

|

|

(Name of Registrant as Specified In Its Charter)

|

Payment of Filing

Fee (Check the appropriate box):

|

[X]

|

No fee required.

|

|

[ ]

|

Fee computed on table below per Exchange Act Rules

14a-6(i)(1) and 0-11.

|

|

|

(1)

|

Title of each class of securities

to which transaction applies:

|

|

|

|

|

|

|

(2)

|

Aggregate number of securities to which transaction

applies:

|

|

|

|

|

|

|

(3)

|

Per unit price or other underlying value of transaction

computed pursuant to Exchange Act Rule 0-11(set forth the amount on which the filing fee is calculated and state how it was

determined):

|

|

|

|

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

(5)

|

Total fee paid:

|

|

|

|

|

|

[ ]

|

Fee paid previously with preliminary

materials.

|

|

|

|

|

[ ]

|

Check box if any part of the fee is offset as

provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify

the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

(1)

|

Amount

Previously Paid:

|

|

|

|

|

|

|

(2)

|

Form, Schedule

or Registration Statement No.:

|

|

|

|

|

|

|

(3)

|

Filing Party:

|

|

|

|

|

|

|

(4)

|

Date Filed:

|

|

|

|

|

Persons who are to respond to the

collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control

number.

|

Clough Global Dividend and Income Fund (NYSE MKT:

GLV)

|

PRESS RELEASE

|

|

Clough Global Equity Fund (NYSE MKT: GLQ)

|

June 29, 2020

|

|

Clough Global Opportunities Fund (NYSE MKT: GLO)

|

|

|

1290 Broadway, Suite 1000

|

|

|

Denver, CO 80203

|

|

|

Contact: Fund Services Group at 877-256-8445

|

|

Clough

Global Dividend and Income Fund, Clough Global Equity Fund

and

Clough Global Opportunities Fund

Announce

Change of Location of the Joint Annual Meeting of Shareholders

Denver,

Colorado — The Board of Trustees of the Clough Global Dividend and Income Fund, Clough Global Equity Fund and Clough

Global Opportunities Fund (each, a “Fund” and together, the “Funds”) have determined it is advisable and

in the best interests of the Fund’s shareholders to hold the July 9, 2020 Annual Meeting of Shareholders by telephone conference

call without any in-person attendance. The Funds are taking this step because of travel limitations and other concerns relating

to the coronavirus outbreak (COVID-19), including the health of shareholders and proxyholders. This press release provides instructions

for participating in the meeting.

Registration Instructions for the

Telephonic Meeting

As described in

the previously distributed proxy materials for the Meeting, any shareholder of record of the Funds as of the close of business

on May 11, 2020 is entitled to notice of, and to vote at, the Meeting or any postponement or adjournment thereof. To participate

in the Meeting, you must email shareholdermeetings@computershare.com no later than 5:00 p.m. Eastern Time on July 6, 2020 and

provide your full name and address. You will then receive an email from Computershare Fund Services containing the conference

call dial-in information and instructions for participating in the Meeting.

If you hold your

shares through an intermediary, such as a bank or broker, you must register in advance to attend the Meeting. To register, you

must submit proof of your proxy power (legal proxy) reflecting your Fund holdings along with your name and email address to Computershare

Fund Services, the Funds’ tabulator. You may forward an email from your intermediary or attach an image of your legal proxy

to shareholdermeetings@computershare.com. Requests for registration must be received no later than 5:00 p.m. Eastern Time on July

6, 2020. You will then receive an email from Computershare Fund Services containing the conference call dial-in information and

instructions for participating in the Meeting.

Whether

or not you plan to participate in the Meeting, the Funds urge shareholders to vote and submit

their proxy in advance of the meeting by one of the methods described in the proxy materials for the Annual Meeting. The proxy

card included with the proxy materials previously distributed will not be updated to reflect information provided above and may

continue to be used to vote each shareholder’s shares in connection with the Meeting.

The Clough

Global Dividend and Income Fund

The Fund is a closed-end

fund with an investment objective of providing a high level of total return. The Fund seeks to pursue this objective by applying

a fundamental research-driven investment process and will invest in equity and equity-related securities as well as fixed income

securities, including both corporate and sovereign debt, in both U.S. and non-U.S. markets. The Fund’s portfolio managers

are Chuck Clough and Rob Zdunczyk. As of May 31, 2020, the Fund had approximately $145 million in total assets. More information,

including the Fund’s dividend reinvestment plan, can be found at www.cloughglobal.com or call 877-256-8445.

The Clough

Global Equity Fund

The Fund is a closed-end

fund utilizing Clough Capital’s research-driven, thematic process, with an investment objective of providing a high level

of total return. Having a global, flexible mandate, the Fund will invest at least 80% of its net assets, including any borrowings

for investment purposes, in equity and equity-related securities in both U.S. and non-U.S. markets, and the remainder in fixed

income securities, including corporate and sovereign debt, in both U.S. and non-U.S. markets. The Fund’s portfolio managers

are Chuck Clough and Rob Zdunczyk. As of May 31, 2020, the Fund had approximately $270 million in total assets. More information,

including the Fund’s dividend reinvestment plan, can be found at www.cloughglobal.com or call 877-256-8445.

The

Clough Global Opportunities Fund

The Fund

is a closed-end fund with an investment objective of providing a high level of total return. The Fund seeks to achieve this objective

by applying a fundamental research-driven investment process and will invest in equity and equity-related securities as well as

fixed income securities, including both corporate and sovereign debt. Utilizing Clough Capital’s global research capabilities,

the Fund will invest in both U.S. and non-U.S. markets. The Fund’s portfolio managers are Chuck Clough and Rob Zdunczyk.

As of May 31, 2020, the Fund had approximately $537 million in total assets. More information, including the Fund’s dividend

reinvestment plan, can be found at www.cloughglobal.com or call 877-256-8445.

Clough Capital

Partners L.P.

Clough Capital,

a Boston-based investment advisory firm which manages approximately $1.7 billion in assets as of May 31, 2020, serves as investment

adviser to the Funds.

The Clough Global

Dividend and Income Fund, Clough Global Equity Fund and Clough Global Opportunities Fund are closed-end funds and closed-end funds

do not continuously issue shares for sale as open-end mutual funds do. Since the initial public offering, the Funds now trade

in the secondary market. Investors wishing to buy or sell shares need to place orders through an intermediary or broker. The share

price of a closed-end fund is based on the market's value.

ALPS Portfolio

Solutions Distributor, Inc., FINRA Member Firm.

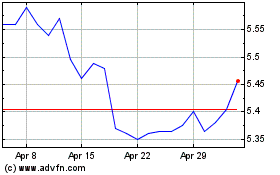

Clough Global Dividend a... (AMEX:GLV)

Historical Stock Chart

From Jun 2024 to Jul 2024

Clough Global Dividend a... (AMEX:GLV)

Historical Stock Chart

From Jul 2023 to Jul 2024