via NewMediaWire - American Shared Hospital Services (NYSE

American: AMS) (the "Company"), a leading provider of turnkey

technology solutions for stereotactic radiosurgery and advanced

radiation therapy equipment and services, today announced financial

results for the first quarter ended March 31, 2023.

First Quarter

2023

Highlights

- Total revenue in

the first quarter was $4,925,000, an increase of 1.6% from the

comparable period in 2022. Total proton therapy revenue

increased 13.5% period-over-period; fractions decreased 5.7%.

- Gross margin was

$1,908,000, a period-over-period decrease of 7.7%. The gross margin

percentage was 38.7% of revenue.

- Operating income

for the first quarter of 2023 was $98,000 compared to operating

income of $600,000 in the first quarter of 2022, a decrease of

83.7%.

- Net income

attributable to American Shared Hospital Services in the first

quarter was $188,000, or $0.03 per diluted share, compared to net

income of $269,000, or $0.04 per diluted share, for the same period

in the prior year.

- Adjusted EBITDA,

a non-GAAP financial measure, was $1,903,000 for the first quarter

of 2023, compared to $1,922,000 for the first quarter of 2022.

- Cash at March

31, 2023 was $13,201,000 compared to $12,453,000 at December 31,

2022.

- Appointed new

Chief Financial Officer, Robert Hiatt, a seasoned financial

executive with experience at both public and private

companies.

- Announced second order for the year

for a 5-year contract extension at an existing domestic Gamma Knife

site, that includes an upgrade from a Perfexion to the Leksell

Gamma Knife Esprit, the latest model. This follows the first order

of the year that totaled $1.3 million from a new customer.

Ray Stachowiak, Executive Chairman of AMS,

commented, “I am pleased to announce that in April, Bob Hiatt

joined our team as Chief Financial Officer. Bob is a seasoned

financial executive who has served as CFO at both public and

private companies, and I believe that he will make a significant

impact in the evolving growth of our company. In addition, we’ve

been investing for future growth and those investments are expected

to contribute further throughout the year. In the past twelve

months we’ve added our new CEO, Peter Gaccione, a very seasoned,

well known and well respected executive in our industry. We also

added Tim Keel, our Vice President of Domestic Sales and Business

Development, and Ranjit Pradham, our new in-house Customer

Advocate, to grow our current client relationships. Ernie Bates,

Vice President of International Sales and Business Development, is

flourishing in developing our international opportunities. Craig

Tagawa, our President, will continue to provide valuable

contributions in the structuring and negotiation of our future

orders. We believe that all of these investments are necessary to

advance future revenue growth, although they have currently added

to our selling expenses, as can be seen in the first quarter

results.”

“We’re excited to announce that we recently

received the approvals to install the upgraded Gamma Knife ICON in

Ecuador, as well as the approval for the new linear accelerator, or

LINAC, for our new Cancer Center joint venture in Puebla, Mexico.

Installation of this new LINAC has already begun. We expect the

start-up of both systems, and contributions to revenue, during the

third quarter of this year. We continued to generate strong

positive cash flow during the first quarter despite its challenges.

We ended the quarter with over $13 million in cash, or

approximately $2.03 per share, which underscores the financial

strength of our business,” concluded Mr. Stachowiak.

Peter Gaccione, Chief Executive Officer of AMS,

added, “From a sales and marketing perspective AMS had a good start

to the year. Our sales pipeline is now full of solid possibilities

that includes a range of advanced radiation equipment in a variety

of settings. This includes the recent expansion of our business

model to also consider the development of our own majority-owned

proton beam and radiation oncology centers in the U.S. We see an

opportunity in this area given the recent market consolidation and

AMS’ deep financial expertise.”

“Total Gamma Knife procedures were again a bit

lower in the quarter and our new customer advocate has been working

closely with the three lowest volume Gamma Knife sites in the U.S.

to address any issues. One of those discussions has already

resulted in the five-year contract extension and our second new

order of the year that we announced today. The order is for an

upgrade to the Leksell Gamma Knife Esprit, the latest model, and it

will be one of the first Esprits in the U.S. when it is installed,

which we expect will be during the fourth quarter.”

“Looking ahead, with stronger international

growth on the horizon from additional treatment capabilities,

numerous new contract possibilities working their way through the

complex sales cycles, and a strong financial position, we’re

confident that AMS is poised for new growth,” concluded Mr.

Gaccione.

Financial Results for the Three Months Ended

March

31,

2023

For the three months ended March 31, 2023,

revenue increased 1.6% to $4,925,000 compared to $4,847,000 in the

year ago period.

First quarter revenue for the Company's proton

therapy system installed at Orlando Health in Florida increased

13.5% to $2,314,000 compared to revenue for the first quarter of

2022 of $2,039,000 primarily due to higher average reimbursement

for the current period.

Total proton therapy fractions in the first

quarter were 1,536 compared to 1,628 proton therapy fractions in

the first quarter of 2022, a decrease of 5.7% or 92 fractions,

which is within the typical quarterly fluctuation

range.

Total revenue for the Company's Gamma Knife

operations decreased 7.0% to $2,611,000 for the first quarter of

2023 compared to $2,808,000 for the first quarter of

2022. Gamma Knife domestic revenue declined 8.9% to $1,915,000

and international revenue decreased 1.4% to $696,000 for the first

three months of 2023 compared to 2022. The decline in overall Gamma

Knife revenue was due to a decrease in procedures, partially offset

by an increase in average reimbursement. The increase in average

reimbursement continues to be driven by a favorable shift in payor

mix to more commercial payors.

Total Gamma Knife procedures decreased by 10.9%

to 293 for the first quarter of 2023 from 329 in the first quarter

of 2022, within the range of normal, cyclical fluctuations. Gamma

Knife domestic procedures declined 15.0% to 216 and international

procedures increased 2.7% to 77 for the first three months of 2023

compared to 2022.

Gross margin for the first quarter of 2023

decreased 7.7% to $1,908,000, or 38.7% of revenue, compared to

gross margin of $2,067,000, or 42.6% of revenue, for the first

quarter of 2022.

Selling and administrative costs increased by

16.7% to $1,539,000 for the first quarter of 2023 compared to

$1,319,000 for the same period in the prior year primarily due to

higher sales and related fees associated with new business

opportunities. Net Interest expense was $184,000 in the 2023 period

compared to $148,000 in the comparable period of last year, an

increase of 24.3%. The increase stems from an increase in the

interest rate on the Company’s variable rate debt.

Operating income for the first quarter of 2023

was $98,000 compared to operating income of $600,000 in the first

quarter of 2022, a decrease of 83.7%, reflecting higher operating

costs and selling and administrative expenses.

Income tax expense decreased 67.0% to $68,000

for the first quarter of 2023 compared to $206,000 for the same

period in the prior year. The decrease in income tax expense for

the current period was primarily due to lower earnings during the

current period and in the prior year, return-to-provision

adjustments arising from foreign tax returns, as well as permanent

domestic tax differences.Net income attributable to American Shared

Hospital Services in the first quarter of 2023 was $188,000, or

$0.03 per diluted share, compared to net income of $269,000, or

$0.04 per diluted share, for the first quarter of 2022. The

decrease was primarily due to higher interest expense, and higher

selling and administrative expense to support the Company’s pursuit

of new business opportunities. Fully diluted weighted average

common shares outstanding were 6,472,000 and 6,299,000 for the

first quarter of 2023 and 2022, respectively.

Adjusted EBITDA, a non-GAAP financial measure,

was $1,903,000 for the first quarter of 2023, compared to

$1,922,000 for the first quarter of 2022.

Balance Sheet Highlights

At March 31, 2023, cash, cash equivalents, and

restricted cash was $13,201,000 compared to $12,453,000 at December

31, 2022. American Shared Hospital Services' equity (excluding

non-controlling interests in subsidiaries) at March 31, 2023 and

December 31, 2022 was $21,909,000 or $3.54 per outstanding share

and $21,625,000, or $3.50 per outstanding share, respectively.

Conference Call and Webcast Information

AMS has scheduled a conference call to review

its financial results for today, May 12, 2023 at 9:00 a.m. PT /

12:00 p.m. ET.

To participate, please call 1 (844) 413-3972 at

least 10 minutes prior to the start of the call and ask to join the

American Shared Hospital Services call. A simultaneous Webcast of

the call may be accessed through the Company's website,

www.ashs.com, or at www.streetevents.com for institutional

investors.

A replay of the call will be available at 1

(877) 344-7529, access code 1786295 through May 19, 2023. The call

will also be available for replay on the Company’s website,

www.ashs.com, for one year.

About American Shared Hospital Services (NYSE American:

AMS)

American Shared Hospital Services (“ASHS”) is a

leading provider of creative financial and turnkey solutions to

Cancer Treatment Centers, hospitals, and large cancer networks

worldwide. The Company works closely with major global Original

Equipment Manufacturers (“OEM’s”) that provide leading edge

clinical treatment systems and software to treat cancer using

Radiation Therapy and Radiosurgery. Major products the Company is

able to provide include MR Guided Radiation Therapy Linacs,

Advanced Digital Linear Accelerators, Proton Beam Radiation Therapy

Systems, Brachytherapy systems, and through the Company’s GK

Financing partnership with Elekta, the Leksell Gamma Knife products

and services. GK Financing, a subsidiary of ASHS, is a leading

global provider of Gamma Knife radiosurgery equipment, a

non-invasive treatment for malignant and benign brain tumors,

vascular malformations, and trigeminal neuralgia (facial pain). For

more information, please visit: www.ashs.com.

Safe Harbor Statement

This press release may be deemed to contain

certain forward-looking statements with respect to the financial

condition, results of operations and future plans of American

Shared Hospital Services (including statements regarding the

expected continued growth of the Company and the expansion of the

Company’s Gamma Knife, proton therapy and MR/LINAC business, which

involve risks and uncertainties including, but not limited to, the

risks of economic and market conditions, the risks of variability

of financial results between quarters, the risks of the Gamma Knife

and proton therapy businesses, the risks of developing The

Operating Room for the 21st Century program, the risks of

changes to CMS reimbursement rates or reimbursement methodology,

the risks of the timing, financing, and operations of the Company’s

Gamma Knife, proton therapy, and MR/LINAC businesses, the risk of

expanding within or into new markets, the risk that the integration

or continued operation of acquired businesses could adversely

affect financial results and the risk that current and future

acquisitions may negatively affect the Company’s financial

position. Further information on potential factors that could

affect the financial condition, results of operations and future

plans of American Shared Hospital Services is included in the

filings of the Company with the Securities and Exchange Commission,

including the Annual Report on Form 10-K for the year ended

December 31, 2022, and the definitive Proxy Statement for the

Annual Meeting of Shareholders to be held on June 20, 2023.

Non-GAAP Financial Measure

Adjusted EBITDA, the non-GAAP measure presented

in this press release and supplementary information, is not a

measure of performance under the accounting principles generally

accepted in the United States ("GAAP"). This non-GAAP

financial measure has limitations as an analytical tool, including

that it does not have a standardized meaning. When assessing our

operating performance, this non-GAAP financial measure should not

be considered a substitute for, and investors should also consider,

income before income taxes, income from operations, net income

attributable to the Company, earnings per share and other measures

of performance as defined by GAAP as indicators of the Company's

performance or profitability.

EBITDA is a non-GAAP financial measure

representing our earnings before interest expense, income tax

expense, depreciation, and amortization. We define Adjusted EBITDA

as net income before interest expense, interest income, income tax

expense, depreciation and amortization expense, and stock-based

compensation expense.

We use this non-GAAP financial measure as a

means to evaluate period-to-period comparisons. Our management

believes that this non-GAAP financial measure provides meaningful

supplemental information regarding our performance by excluding

certain expenses and charges that may not be indicative of the

operating results of our recurring core business, such as

stock-based compensation expense. We believe that both

management and investors benefit from referring to this non-GAAP

financial measure in assessing our performance.

Contacts:

American Shared Hospital ServicesRay StachowiakExecutive

Chairmanrstachowiak@ashs.com

Investor RelationsPCG AdvisoryStephanie PrinceP: (646)

863-6341sprince@pcgadvisory.com

- Tables Follow -

|

American Shared Hospital Services |

|

|

|

|

|

|

Condensed Consolidated Statements of Income |

|

|

|

| |

|

Summary of

Operations Data |

|

| |

|

(Unaudited) |

|

| |

|

|

|

|

|

| |

|

Three months ended March 31, |

|

| |

|

|

|

|

|

|

|

|

|

2023 |

|

|

2022 |

|

|

|

Revenues |

|

$ |

4,925,000 |

|

$ |

4,847,000 |

|

|

| Costs of

revenue |

|

|

3,017,000 |

|

|

2,780,000 |

|

|

| Gross

margin |

|

|

1,908,000 |

|

|

2,067,000 |

|

|

| Selling and

administrative expense |

|

|

1,539,000 |

|

|

1,319,000 |

|

|

| Interest

expense |

|

|

271,000 |

|

|

148,000 |

|

|

| Operating

income |

|

|

98,000 |

|

|

600,000 |

|

|

| Interest and

other income |

|

|

70,000 |

|

|

- |

|

|

| Income

before income taxes |

|

|

168,000 |

|

|

600,000 |

|

|

| Income tax

expense |

|

|

68,000 |

|

|

206,000 |

|

|

| Net

income |

|

|

100,000 |

|

|

394,000 |

|

|

|

Less: Net loss (income) attributable

to non-controlling interest |

|

|

88,000 |

|

|

(125,000 |

) |

|

| Net income

attributable to American Shared Hospital Services |

|

$ |

188,000 |

|

$ |

269,000 |

|

|

| |

|

|

|

|

|

| Earnings per

common share: |

|

|

|

|

|

|

Basic |

|

$ |

0.03 |

|

$ |

0.04 |

|

|

|

Diluted |

|

$ |

0.03 |

|

$ |

0.04 |

|

|

| |

|

|

|

|

|

| Weighted

Average Shares Outstanding: |

|

|

|

|

|

|

Basic |

|

|

6,306,000 |

|

|

6,201,000 |

|

|

|

Diluted |

|

|

6,472,000 |

|

|

6,299,000 |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

American Shared Hospital Services |

|

|

|

|

|

|

Balance Sheet Data |

|

|

|

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

| |

|

Balance Sheet

Data |

|

| |

|

(Unaudited) |

|

| |

|

|

|

|

|

| |

|

3/31/2023 |

|

12/31/2022 |

|

| Cash, cash

equivalents, and restricted cash |

|

$ |

13,201,000 |

|

$ |

12,453,000 |

|

|

| Current

assets |

|

$ |

19,571,000 |

|

$ |

18,723,000 |

|

|

| Total

assets |

|

$ |

43,547,000 |

|

$ |

43,956,000 |

|

|

| |

|

|

|

|

|

| Current

liabilities |

|

$ |

5,254,000 |

|

$ |

5,175,000 |

|

|

|

Shareholders' equity, excluding non-controlling interests |

|

$ |

21,909,000 |

|

$ |

21,625,000 |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

American Shared Hospital Services |

|

|

|

|

|

Adjusted EBITDA |

|

|

|

|

|

|

|

|

|

|

|

| |

|

Reconciliation of

GAAP to Non-GAAP Adjusted Results |

|

| |

|

(Unaudited) |

|

| |

|

|

|

|

|

| |

|

Three months ended March 31, |

|

| |

|

|

2023 |

|

|

|

2022

|

|

|

Net Income |

$ |

188,000 |

|

|

$ |

269,000 |

|

| Plus

(less): |

Income tax

expense |

|

68,000 |

|

|

|

206,000 |

|

| |

Interest

expense |

|

271,000 |

|

|

|

148,000 |

|

| |

Interest

(income) |

|

(87,000 |

) |

|

|

- |

|

| |

Depreciation

and amortization expense |

|

1,367,000 |

|

|

|

1,212,000 |

|

| |

Stock-based

compensation expense |

|

96,000 |

|

|

|

87,000 |

|

|

Adjusted EBITDA |

$ |

1,903,000 |

|

|

$ |

1,922,000 |

|

| |

|

|

|

|

|

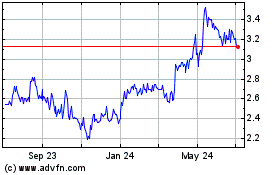

American Shared Hospital... (AMEX:AMS)

Historical Stock Chart

From Dec 2024 to Jan 2025

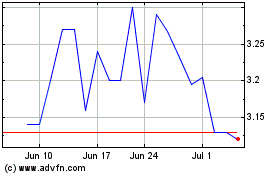

American Shared Hospital... (AMEX:AMS)

Historical Stock Chart

From Jan 2024 to Jan 2025