false

0001708599

0001708599

2023-11-14

2023-11-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (date of earliest event reported): November 14, 2023

AgeX

Therapeutics, Inc.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

1-38519 |

|

82-1436829 |

| (State or other jurisdiction |

|

(Commission |

|

(IRS Employer |

| of incorporation) |

|

File Number) |

|

Identification No.) |

1101

Marina Village Parkway, Suite 201

Alameda,

California 94501

(Address

of principal executive offices)

(510)

671-8370

(Registrant’s

telephone number, including area code)

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol |

|

Name

of exchange on which registered |

| Common Stock, par value

$0.0001 per share |

|

AGE |

|

NYSE American |

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Any

statements that are not historical fact (including, but not limited to statements that contain words such as “may,” “will,”

“believes,” “plans,” “intends,” “anticipates,” “expects,” “estimates”)

should also be considered to be forward-looking statements. Additional factors that could cause actual results to differ materially from

the results anticipated in these forward-looking statements are contained in AgeX’s periodic reports filed with the Securities

and Exchange Commission (the “SEC”) under the heading “Risk Factors” and other filings that AgeX may make with

the SEC. Undue reliance should not be placed on these forward-looking statements which speak only as of the date they are made, and the

facts and assumptions underlying these statements may change. Except as required by law, AgeX disclaims any intent or obligation to update

these forward-looking statements.

References

in this Report to “AgeX,” “we” or “us” refer to AgeX Therapeutics, Inc.

Item

2.02 - Results of Operations and Financial Condition.

On

November 14, 2023, AgeX issued a press release announcing its financial results for the quarter and nine months ended September 30, 2023.

A copy of the press release is furnished as Exhibit 99.1 to this report.

The

information in this Item 2.02 and in the press release furnished as Exhibit 99.1 to this current report shall not be deemed to be “filed”

for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and is not to be incorporated

by reference into any filing of the registrant under the Securities Act of 1933, as amended, or the Exchange Act, whether made before

or after the date hereof, regardless of any general incorporation language in any such filing, except as shall be expressly set forth

by specific reference in such a filing.

Item

9.01 – Financial Statements and Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

AGEX THERAPEUTICS, INC. |

| |

|

|

| Date: November 14, 2023 |

By: |

/s/ Andrea

E. Park |

| |

|

Chief Financial Officer |

Exhibit

99.1

AgeX

Therapeutics Reports Third Quarter 2023 Financial Results

ALAMEDA,

Calif.—(BUSINESS WIRE)—November 14, 2023—AgeX Therapeutics, Inc. (“AgeX”; NYSE American: AGE), a biotechnology

company developing therapeutics for human aging and regeneration, reported its financial and operating results for the quarter and nine

months ended September 30, 2023.

Third

Quarter and Recent Highlights

| ● | $36

Million of Indebtedness Converted into Preferred Stock |

| ● | Signed

Agreement and Plan of Merger and Reorganization to Acquire Serina Therapeutics, Inc. |

| ● | Obtained

$4.4 million addition to line of credit from Juvenescence Limited |

Liquidity

and Capital Resources

Issuance

of Preferred Stock to Eliminate $36 Million of Indebtedness

During

July 2023, AgeX and Juvenescence Limited entered into an Exchange Agreement pursuant to which AgeX issued shares of Series A Preferred

Stock and Series B Preferred Stock to Juvenescence in exchange for the extinguishment of a total of $36 million of indebtedness under

a loan agreement and certain promissory notes. The shares of Preferred Stock are convertible into shares of common stock and do not bear

dividends but rank senior of AgeX common stock with respect to any distributions to stockholders arising from a liquidation of AgeX or

a reorganization, merger, consolidation, or sale of assets that is deemed a liquidation under the terms of the Preferred Stock.

Increase

in Line of Credit

On

October 31, 2023, AgeX made a final draw of loan funds available under a line of credit from Juvenescence Limited. On November 9,

2023, AgeX and Juvenescence entered into an amendment of the secured, convertible promissory note for the line of credit that increases

the amount of the line of credit by $4,400,000, subject to Juvenescence’s discretion to approve and fund each of AgeX’s future

loan draws. AgeX also entered into an additional Pledge Agreement to add shares of a subsidiary to the collateral under a Security Agreement

in favor of Juvenescence, and three of AgeX’s subsidiaries entered into a Guaranty Agreement and Joinder Agreement pursuant to

which they each agreed to guaranty AgeX’s obligations to Juvenescence pursuant to the amended promissory note, and to grant Juvenescence

a security interest in their respective assets pursuant to the Security Agreement to secure their obligations to Juvenescence.

Balance

Sheet Information

Cash,

cash equivalents, and restricted cash totaled $0.4 million as of September 30, 2023.

Amendment

to Preferred Stock and Elimination of Stockholders Deficit

During

July 2023, AgeX and Juvenescence Limited entered into an Exchange Agreement pursuant to which AgeX issued shares of Series A Preferred

Stock and Series B Preferred Stock to Juvenescence in exchange for the extinguishment of a total of $36 million of indebtedness. On November

7, 2023, certain terms of the AgeX Series A Preferred Stock and Series B Preferred Stock were amended (i) to clarify that certain change

of control or disposition of asset transactions would be treated as a deemed liquidation if the applicable transaction is approved by

the Board of Directors or stockholders of AgeX, and (ii) to provide that in case of such a deemed liquidation transaction holders of

Preferred Stock would receive the same type of consideration as that distributed or paid to holders of AgeX common stock. This amendment

permits the classification of the Series A Preferred Stock and Series B Preferred Stock as permanent equity, rather than as temporary

or mezzanine equity, under Accounting Standards Codification 480, Distinguishing Liability from Equity. A pro-forma condensed

consolidated balance sheet is provided, following the GAAP financial statements for the third quarter, as an illustration of the Preferred

Stock classified as permanent equity, eliminating the stockholders deficit.

Third

Quarter 2023 Operating Results

Operating

expenses: Operating expenses for the three months ended September 30, 2023 were $2.4 million, as compared to $1.6 million for the

same period of 2022.

Research

and development expenses for the three months ended September 30, 2023 were approximately $0.2 million, consistent with the same period

of 2022.

General

and administrative expenses increased by $0.8 million to $2.2 million as compared to $1.4 million during the same period of 2022. The

net increase is largely attributable to professional fees for legal services, consulting expenses incurred in connection with due diligence,

and other expenses related to the proposed merger between AgeX and Serina Therapeutics Inc.

Other

expense, net: Net other expense for the three months ended September 30, 2023 is primarily comprised of $3.2 million

amortization of deferred debt issuance costs to interest expense, write off of deferred debt cost upon $36 million debt exchanged

for Preferred Stock in July 2023 offset by $0.2 million interest income primarily earned from a $10 million loan extended to Serina

in March 2023.

Net

loss attributable to AgeX: The net loss attributable to AgeX for the three months ended September 30, 2023 was $5.4 million, or ($0.14)

per share (basic and diluted) compared to $2.4 million, or ($0.06) per share (basic and diluted), for 2022. The increase in net loss

per share year over year is primarily due to certain non-recurring expenses related to the proposed merger with Serina, and a write off

of deferred debt costs upon the exchange of $36 million of indebtedness for Preferred Stock during July 2023.

Going

Concern Considerations

As

required under Accounting Standards Update 2014-15, Presentation of Financial Statements-Going Concern (ASC 205-40), AgeX evaluates

whether conditions and/or events raise substantial doubt about its ability to meet its future financial obligations as they become due

within one year after the date its financial statements are issued. Based on AgeX’s most recent projected cash flows, AgeX believes

that its cash and cash equivalents and available sources of debt and equity capital including the loan facilities provided by Juvenescence

to advance up to an additional $4.4 million to AgeX as of November 13, 2023 would not be sufficient to satisfy AgeX’s anticipated

operating and other funding requirements for the twelve months following the filing of AgeX’s Quarterly Report on Form 10-Q for

the three and nine months ended September 30, 2023. These factors raise substantial doubt regarding the ability of AgeX to continue as

a going concern.

About

AgeX Therapeutics

AgeX

Therapeutics, Inc. (NYSE American: AGE) is focused on developing and commercializing innovative therapeutics to treat human diseases

to increase healthspan and combat the effects of aging. For more information, please visit www.agexinc.com or connect with the company

on Twitter, LinkedIn, Facebook, and YouTube.

Forward-Looking

Statements

Certain

statements contained in this release are “forward-looking statements” within the meaning of the Private Securities Litigation

Reform Act of 1995. Any statements that are not historical fact including, but not limited to statements that contain words such as “will,”

“believes,” “plans,” “anticipates,” “expects,” “estimates” should also be

considered forward-looking statements. Forward-looking statements involve risks and uncertainties. Actual results may differ materially

from the results anticipated in these forward-looking statements and as such should be evaluated together with the many uncertainties

that affect the business of AgeX Therapeutics, Inc. and its subsidiaries, particularly those mentioned in the cautionary statements found

in more detail in the “Risk Factors” section of AgeX’s most recent Annual Report on Form 10-K, most recent Quarterly

Report on Form 10-Q,and other reports filed with the Securities and Exchange Commission (copies of which may be obtained at www.sec.gov).

Subsequent events and developments may cause these forward-looking statements to change. AgeX specifically disclaims any obligation or

intention to update or revise these forward-looking statements as a result of changed events or circumstances that occur after the date

of this release, except as required by applicable law.

Contact

for AgeX:

Andrea

E. Park

apark@agexinc.com

(510)

671-8620

AGEX

THERAPEUTICS, INC. AND SUBSIDIARIES

CONDENSED

CONSOLIDATED BALANCE SHEETS

(in

thousands, except par value amounts)

(unaudited)

| | |

September 30, 2023 | | |

December 31, 2022 | |

| ASSETS | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 397 | | |

$ | 645 | |

| Accounts and grants receivable, net | |

| 67 | | |

| 4 | |

| Related party receivables, net | |

| 4 | | |

| - | |

| Prepaid expenses and other current assets | |

| 673 | | |

| 1,804 | |

| Total current assets | |

| 1,141 | | |

| 2,453 | |

| | |

| | | |

| | |

| Restricted cash | |

| 50 | | |

| 50 | |

| Intangible assets, net | |

| 640 | | |

| 738 | |

| Convertible note receivable | |

| 10,379 | | |

| - | |

| TOTAL ASSETS | |

$ | 12,210 | | |

$ | 3,241 | |

| | |

| | | |

| | |

| LIABILITIES, CONVERTIBLE PREFERRED STOCK AND STOCKHOLDERS’ DEFICIT | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable and accrued liabilities | |

$ | 1,671 | | |

$ | 1,034 | |

| Loans due to Juvenescence, net of debt issuance costs, current portion | |

| 1,526 | | |

| 7,646 | |

| Related party payables, net | |

| - | | |

| 141 | |

| Warrant liability | |

| - | | |

| 180 | |

| Insurance premium liability and other current liabilities | |

| 7 | | |

| 1,077 | |

| Total current liabilities | |

| 3,204 | | |

| 10,078 | |

| | |

| | | |

| | |

| Loans due to Juvenescence, net of debt issuance costs, net of current portion | |

| 693 | | |

| 10,478 | |

| TOTAL LIABILITIES | |

| 3,897 | | |

| 20,556 | |

| | |

| | | |

| | |

| Commitments and contingencies | |

| | | |

| | |

| | |

| | | |

| | |

| Series A preferred stock; no par value; stated value $100 per share; 212 and nil shares issued and outstanding, respectively | |

| 21,135 | | |

| - | |

| Series B preferred stock; no par value; stated value $100 per share; 148 and nil shares issued and outstanding, respectively | |

| 14,823 | | |

| - | |

| | |

| | | |

| | |

| Stockholders’ deficit: | |

| | | |

| | |

| Preferred stock, $0.0001 par value, 5,000 shares authorized | |

| - | | |

| - | |

| Common stock, $0.0001 par value, 200,000 shares authorized; and 37,951 and 37,949 shares issued and outstanding, respectively | |

| 4 | | |

| 4 | |

| Additional paid-in capital | |

| 100,017 | | |

| 98,994 | |

| Accumulated deficit | |

| (127,557 | ) | |

| (116,210 | ) |

| Total AgeX Therapeutics, Inc. stockholders’ deficit | |

| (27,536 | ) | |

| (17,212 | ) |

| Noncontrolling interest | |

| (109 | ) | |

| (103 | ) |

| Total stockholders’ deficit | |

| (27,645 | ) | |

| (17,315 | ) |

| TOTAL LIABILITIES, CONVERTIBLE PREFERRED STOCK AND STOCKHOLDERS’ DEFICIT | |

$ | 12,210 | | |

$ | 3,241 | |

AGEX

THERAPEUTICS, INC. AND SUBSIDIARIES

CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS

(in

thousands, except per share data)

(unaudited)

| | |

Three Months Ended September 30, | | |

Nine Months Ended September 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| REVENUES | |

| | | |

| | | |

| | | |

| | |

| Grant revenues | |

$ | 21 | | |

$ | - | | |

$ | 21 | | |

$ | - | |

| Other revenues | |

| 46 | | |

| 9 | | |

| 65 | | |

| 26 | |

| Total revenues | |

| 67 | | |

| 9 | | |

| 86 | | |

| 26 | |

| Cost of sales | |

| (33 | ) | |

| (5 | ) | |

| (39 | ) | |

| (12 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Gross profit | |

| 34 | | |

| 4 | | |

| 47 | | |

| 14 | |

| | |

| | | |

| | | |

| | | |

| | |

| OPERATING EXPENSES | |

| | | |

| | | |

| | | |

| | |

| Research and development | |

| 218 | | |

| 162 | | |

| 552 | | |

| 817 | |

| General and administrative | |

| 2,172 | | |

| 1,392 | | |

| 5,895 | | |

| 4,390 | |

| Total operating expenses | |

| 2,390 | | |

| 1,554 | | |

| 6,447 | | |

| 5,207 | |

| | |

| | | |

| | | |

| | | |

| | |

| Loss from operations | |

| (2,356 | ) | |

| (1,550 | ) | |

| (6,400 | ) | |

| (5,193 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| OTHER EXPENSE, NET: | |

| | | |

| | | |

| | | |

| | |

| Interest expense, net | |

| (3,036 | ) | |

| (923 | ) | |

| (4,928 | ) | |

| (2,357 | ) |

| Change in fair value of warrants | |

| - | | |

| 35 | | |

| (35 | ) | |

| (220 | ) |

| Other income, net | |

| 3 | | |

| 2 | | |

| 10 | | |

| 9 | |

| Total other expense, net | |

| (3,033 | ) | |

| (886 | ) | |

| (4,953 | ) | |

| (2,568 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| NET LOSS | |

| (5,389 | ) | |

| (2,436 | ) | |

| (11,353 | ) | |

| (7,761 | ) |

| Net (income) loss attributable to noncontrolling interest | |

| (12 | ) | |

| 1 | | |

| 6 | | |

| 2 | |

| | |

| | | |

| | | |

| | | |

| | |

| NET LOSS ATTRIBUTABLE TO AGEX | |

$ | (5,401 | ) | |

$ | (2,435 | ) | |

$ | (11,347 | ) | |

$ | (7,759 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| NET LOSS PER COMMON SHARE: | |

| | | |

| | | |

| | | |

| | |

| BASIC AND DILUTED | |

$ | (0.14 | ) | |

$ | (0.06 | ) | |

$ | (0.30 | ) | |

$ | (0.20 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| WEIGHTED AVERAGE NUMBER OF COMMON SHARES OUTSTANDING: | |

| | | |

| | | |

| | | |

| | |

| BASIC AND DILUTED | |

| 37,951 | | |

| 37,946 | | |

| 37,951 | | |

| 37,944 | |

AGEX

THERAPEUTICS, INC. AND SUBSIDIARIES

CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS

(in

thousands)

(unaudited)

| | |

Nine Months Ended September 30, | |

| | |

2023 | | |

2022 | |

| OPERATING ACTIVITIES: | |

| | | |

| | |

| Net loss attributable to AgeX | |

$ | (11,347 | ) | |

$ | (7,759 | ) |

| Net loss attributable to noncontrolling interest | |

| (6 | ) | |

| (2 | ) |

| Adjustments to reconcile net loss attributable to AgeX to net cash used in operating activities: | |

| | | |

| | |

| Change in fair value of warrants | |

| 35 | | |

| 220 | |

| Amortization of intangible assets | |

| 98 | | |

| 99 | |

| Amortization of debt issuance costs | |

| 5,170 | | |

| 2,221 | |

| Stock-based compensation | |

| 145 | | |

| 646 | |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| Accounts and grants receivable | |

| (63 | ) | |

| 24 | |

| Prepaid expenses and other current assets | |

| 1,131 | | |

| 906 | |

| Interest on convertible note receivable | |

| (379 | ) | |

| - | |

| Accounts payable and accrued liabilities | |

| 571 | | |

| (98 | ) |

| Related party payables, net | |

| (33 | ) | |

| 110 | |

| Insurance premium liability | |

| (1,075 | ) | |

| (983 | ) |

| Other current liabilities | |

| 5 | | |

| (2 | ) |

| Net cash used in operating activities | |

| (5,748 | ) | |

| (4,618 | ) |

| | |

| | | |

| | |

| INVESTING ACTIVITIES: | |

| | | |

| | |

| Cash advanced on convertible note receivable | |

| (10,000 | ) | |

| - | |

| Net cash used in investing activities | |

| (10,000 | ) | |

| - | |

| | |

| | | |

| | |

| FINANCING ACTIVITIES: | |

| | | |

| | |

| Drawdown on loan facilities from Juvenescence | |

| 15,500 | | |

| 4,500 | |

| Net cash provided by financing activities | |

| 15,500 | | |

| 4,500 | |

| | |

| | | |

| | |

| NET CHANGE IN CASH, CASH EQUIVALENTS AND RESTRICTED CASH | |

| (248 | ) | |

| (118 | ) |

| | |

| | | |

| | |

| CASH, CASH EQUIVALENTS AND RESTRICTED CASH: | |

| | | |

| | |

| At beginning of the period | |

| 695 | | |

| 634 | |

| At end of the period | |

$ | 447 | | |

$ | 516 | |

Non-GAAP Financial Measures

This earnings release includes stockholders equity(deficit) prepared in accordance with accounting principles generally accepted in the United States (GAAP) and includes certain historical non-GAAP adjustments to the balance sheet. In particular, AgeX has provided a non-GAAP pro forma presentation of Series A Preferred Stock and Series B Preferred Stock classified as permanent equity, eliminating the stockholders deficit, based on a post-September 30, 2023 amendment to the liquidation provisions of the Preferred Stock. Non-GAAP financial measures are not meant to be considered in isolation or as a substitute for comparable financial measures prepared in accordance with GAAP. However, AgeX believes the non-GAAP presentation of stockholders equity, when viewed in conjunction with our GAAP presentation, is helpful in understanding AgeX’s current capital structure.

AGEX

THERAPEUTICS, INC. AND SUBSIDIARIES

CONDENSED

CONSOLIDATED PRO FORMA BALANCE SHEET

(in

thousands, except par value amounts)

(unaudited)

| | |

September 30, 2023 | | |

Adjustment | | |

Adjusted Balance | |

| | |

| | |

| | |

| |

| ASSETS | |

| | | |

| | | |

| | |

| Current assets: | |

| | | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 397 | | |

$ | - | | |

$ | 397 | |

| Accounts and grants receivable, net | |

| 67 | | |

| - | | |

| 67 | |

| Related party receivables, net | |

| 4 | | |

| - | | |

| 4 | |

| Prepaid expenses and other current assets | |

| 673 | | |

| - | | |

| 673 | |

| Total current assets | |

| 1,141 | | |

| - | | |

| 1,141 | |

| | |

| | | |

| | | |

| | |

| Restricted cash | |

| 50 | | |

| - | | |

| 50 | |

| Intangible assets, net | |

| 640 | | |

| - | | |

| 640 | |

| Convertible note receivable | |

| 10,379 | | |

| - | | |

| 10,379 | |

| TOTAL ASSETS | |

$ | 12,210 | | |

$ | - | | |

$ | 12,210 | |

| | |

| | | |

| | | |

| | |

| LIABILITIES, CONVERTIBLE PREFERRED STOCK AND STOCKHOLDERS’ EQUITY (DEFICIT) | |

| | | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | | |

| | |

| Accounts payable and accrued liabilities | |

$ | 1,671 | | |

$ | - | | |

$ | 1,671 | |

| Loan due to Juvenescence, net of debt issuance costs, current portion | |

| 1,526 | | |

| - | | |

| 1,526 | |

| Insurance premium liability and other current liabilities | |

| 7 | | |

| - | | |

| 7 | |

| Total current liabilities | |

| 3,204 | | |

| - | | |

| 3,204 | |

| | |

| | | |

| | | |

| | |

| Loan due to Juvenescence, net of debt issuance costs, net of current portion | |

| 693 | | |

| - | | |

| 693 | |

| TOTAL LIABILITIES | |

| 3,897 | | |

| - | | |

| 3,897 | |

| | |

| | | |

| | | |

| | |

| Commitments and contingencies | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | |

| Series A preferred stock; no par value; stated value $100 per share; 212 and nil shares issued and outstanding, respectively | |

| 21,135 | | |

| (21,135 | ) | |

| - | |

| Series B preferred stock; no par value; stated value $100 per share; 148 and nil shares issued and outstanding, respectively | |

| 14,823 | | |

| (14,823 | ) | |

| - | |

| | |

| | | |

| | | |

| | |

| Stockholders’ equity (deficit): | |

| | | |

| | | |

| | |

| Preferred stock, $0.0001 par value, 5,000 shares authorized; and | |

| | | |

| | | |

| | |

| Series A Preferred stock - 212 and nil shares issued and outstanding, respectively | |

| - | | |

| - | | |

| - | |

| Series B Preferred stock - 148 and nil shares issued and outstanding, respectively | |

| - | | |

| - | | |

| - | |

| Common stock, $0.0001 par value, 200,000 shares authorized; and 37,951 and 37,949 shares issued and outstanding, respectively | |

| 4 | | |

| - | | |

| 4 | |

| Additional paid-in capital | |

| 100,017 | | |

| 35,958 | | |

| 135,975 | |

| Accumulated deficit | |

| (127,557 | ) | |

| - | | |

| (127,557 | ) |

| Total AgeX Therapeutics, Inc. stockholders’ equity (deficit) | |

| (27,536 | ) | |

| 35,958 | | |

| 8,422 | |

| Noncontrolling interest | |

| (109 | ) | |

| - | | |

| (109 | ) |

| Total stockholders’ equity (deficit) | |

| (27,645 | ) | |

| 35,958 | | |

| 8,313 | |

| TOTAL LIABILITIES, CONVERTIBLE PREFERRED STOCK AND STOCKHOLDERS’ EQUITY (DEFICIT) | |

$ | 12,210 | | |

$ | - | | |

$ | 12,210 | |

v3.23.3

Cover

|

Nov. 14, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 14, 2023

|

| Entity File Number |

1-38519

|

| Entity Registrant Name |

AgeX

Therapeutics, Inc.

|

| Entity Central Index Key |

0001708599

|

| Entity Tax Identification Number |

82-1436829

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

1101

Marina Village Parkway

|

| Entity Address, Address Line Two |

Suite 201

|

| Entity Address, City or Town |

Alameda

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94501

|

| City Area Code |

(510)

|

| Local Phone Number |

671-8370

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value

$0.0001 per share

|

| Trading Symbol |

AGE

|

| Security Exchange Name |

NYSEAMER

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

true

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

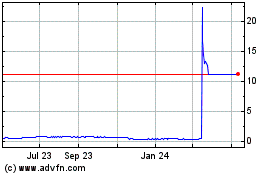

AgeX Therapeutics (AMEX:AGE)

Historical Stock Chart

From Nov 2024 to Dec 2024

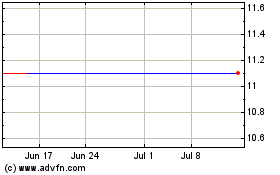

AgeX Therapeutics (AMEX:AGE)

Historical Stock Chart

From Dec 2023 to Dec 2024