Current Report Filing (8-k)

March 07 2019 - 6:16AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (date of earliest event reported):

March 1, 2019

AgeX

Therapeutics, Inc.

(Exact

name of registrant as specified in its charter)

|

Delaware

|

|

1-38519

|

|

82-1436829

|

|

(State

or other jurisdiction

of

incorporation)

|

|

(Commission

File

Number)

|

|

(IRS

Employer

Identification

No.)

|

1010

Atlantic Avenue

Suite

102

Alameda,

California 94501

(Address

of principal executive offices)

(510)

871-4190

(Registrant’s

telephone number, including area code)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

|

☐

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

☐

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933

(§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this

chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Forward-Looking

Statements

Any

statements that are not historical fact (including, but not limited to statements that contain words such as “may,”

“will,” “believes,” “plans,” “intends,” “anticipates,” “expects,”

“estimates”) should also be considered to be forward-looking statements. Additional factors that could cause actual

results to differ materially from the results anticipated in these forward-looking statements are contained in AgeX’s periodic

reports filed with the SEC under the heading “Risk Factors” and other filings that AgeX may make with the Securities

and Exchange Commission. Undue reliance should not be placed on these forward-looking statements which speak only as of the date

they are made, and the facts and assumptions underlying these statements may change. Except as required by law, AgeX disclaims

any intent or obligation to update these forward-looking statements.

References

in this Report to “AgeX,” “we” or “us” refer to AgeX Therapeutics, Inc.

Section

1 - Registrant’s Business and Operations

Item

1.01 - Entry into a Material Definitive Agreement.

Effective

March 1, 2019, we entered into a compensation agreement with our Chief Financial Officer Russell Skibsted pursuant to which we

have agreed to provide him the compensation described in Item 5.02 of this Report, which is incorporated into this Item 1.01 by

reference

Section

5 - Corporate Governance and Management

Item

5.02 - Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements

of Certain Officers

We have entered into a Compensation Agreement

with our Chief Financial Officer Russell Skibsted pursuant to which we have agreed to pay Mr. Skibsted a one-time retention payment

of $18,465.38, and then $1,500 per week for one day of services per week. Services in excess of one day per week shall be compensated

at the rate of $175 per hour. Mr. Skibsted will not participate in our employee retirement, health insurance, vacation, sick leave

or other employee benefit plans.

Previously, Mr. Skibsted also served as the

Chief Financial Officer of our former parent company BioTime, Inc. and was compensated by BioTime and participated in BioTime employee

benefit plans. We did not compensate Mr. Skibsted directly for his services as our Chief Financial Officer but instead reimbursed

BioTime for a portion of Mr. Skibsted’s BioTime compensation allocable to services performed for us under our Shared Facilities

and Services Agreement with BioTime.

The foregoing description of the terms of Mr.

Skibsted’s Compensation Agreement is a summary only and does not purport to be complete. A copy of Mr. Skibsted’s Compensation

Agreement will be filed as an exhibit to our Quarterly Report on Form 10-Q for the three months ending March 31, 2019.

Item

8.01 – Other Events

Pursuant

to a Warrant Agreement, dated February 28, 2018, AgeX has set 5:00 p.m. New York time on March 18, 2019 as the expiration date

of AgeX’s outstanding common stock purchase warrants (“Warrants”). The Warrants entitle Warrant holders to purchase

shares of AgeX common stock at a price of $2.50 per share until the expiration date. A total of 2,000,000 Warrants are issued

and outstanding.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

AGEX THERAPEUTICS, INC.

|

|

|

|

|

|

Date: March 7, 2019

|

By:

|

/s/ Russell Skibsted

|

|

|

|

Chief Financial Officer

|

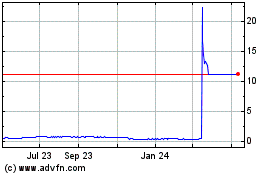

AgeX Therapeutics (AMEX:AGE)

Historical Stock Chart

From Mar 2024 to Apr 2024

AgeX Therapeutics (AMEX:AGE)

Historical Stock Chart

From Apr 2023 to Apr 2024