Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

September 26 2023 - 12:46PM

Edgar (US Regulatory)

Portfolio of Investments (unaudited)

As of July 31, 2023

abrdn Australia Equity Fund, Inc.

| Shares

| Description

| Industry and Percentage

of Net Assets

| Value

|

| COMMON STOCKS—105.8%

|

| AUSTRALIA—95.4%

|

|

| 289,813

| ANZ Group Holdings Ltd.

| Banks—3.9%

| $ 5,028,014

|

| 157,552

| Aristocrat Leisure Ltd.

| Hotels, Restaurants & Leisure—3.3%

| 4,172,799

|

| 54,800

| ASX Ltd.

| Capital Markets—1.8%

| 2,289,470

|

| 87,142

| AUB Group Ltd.

| Insurance—1.3%

| 1,683,331

|

| 2,089,200

| Beach Energy Ltd.

| Oil, Gas & Consumable Fuels—1.8%

| 2,278,033

|

| 493,612

| BHP Group Ltd.

| Metals & Mining—12.1%

| 15,362,127

|

| 221,300

| Charter Hall Group, REIT

| Diversified REITs—1.3%

| 1,705,728

|

| 25,210

| Cochlear Ltd.

| Health Care Equipment & Supplies—3.2%

| 4,055,591

|

| 160,240

| Commonwealth Bank of Australia

| Banks—8.9%

| 11,400,877

|

| 58,497

| CSL Ltd.

| Biotechnology—8.3%

| 10,536,254

|

| 580,525

| Endeavour Group Ltd.

| Consumer Staples Distribution & Retail—1.9%

| 2,372,801

|

| 314,006

| Goodman Group

| Industrial REITs—3.4%

| 4,341,809

|

| 571,700

| Insurance Australia Group Ltd.

| Insurance—1.8%

| 2,282,233

|

| 85,349

| James Hardie Industries PLC(a)

| Construction Materials—2.0%

| 2,501,313

|

| 43,250

| Macquarie Group Ltd.

| Capital Markets—4.0%

| 5,100,469

|

| 846,220

| Medibank Pvt Ltd.

| Insurance—1.6%

| 1,997,846

|

| 1,413,775

| Mirvac Group

| Diversified REITs—1.7%

| 2,228,533

|

| 376,600

| National Australia Bank Ltd.

| Banks—5.7%

| 7,214,168

|

| 454,000

| Northern Star Resources Ltd.

| Metals & Mining—2.8%

| 3,544,017

|

| 875,500

| Pilbara Minerals Ltd.

| Metals & Mining—2.2%

| 2,864,237

|

| 51,700

| Pro Medicus Ltd.

| Health Care Technology—1.9%

| 2,394,388

|

| 77,980

| Rio Tinto PLC

| Metals & Mining—4.0%

| 5,154,300

|

| 1,833,200

| Telstra Group Ltd.

| Diversified Telecommunication Services—4.1%

| 5,247,005

|

| 84,080

| Wesfarmers Ltd.

| Broadline Retail—2.2%

| 2,809,292

|

| 293,760

| Woodside Energy Group Ltd.

| Oil, Gas & Consumable Fuels—5.9%

| 7,571,716

|

| 212,440

| Woolworths Group Ltd.

| Consumer Staples Distribution & Retail—4.3%

| 5,516,819

|

|

| Total Australia

| 121,653,170

|

| NEW ZEALAND—8.3%

|

|

| 494,840

| Auckland International Airport Ltd.(a)

| Transportation Infrastructure—2.0%

| 2,590,199

|

| 499,400

| Mercury NZ Ltd.

| Electric Utilities—1.6%

| 2,029,454

|

| 620,400

| Spark New Zealand Ltd.

| Diversified Telecommunication Services—1.6%

| 1,997,854

|

| 48,000

| Xero Ltd.(a)

| Software—3.1%

| 3,945,667

|

|

| Total New Zealand

| 10,563,174

|

| UNITED STATES—2.1%

|

|

| 120,549

| ResMed, Inc., GDR

| Health Care Equipment & Supplies—2.1%

| 2,722,305

|

|

| Total Common Stocks

| 134,938,649

|

| SHORT-TERM INVESTMENT—0.3%

|

| UNITED STATES—0.3%

|

|

| 325,151

| State Street Institutional U.S. Government Money Market Fund, Premier Class, 5.19%(b)

| 325,151

|

|

| Total Short-Term Investment

| 325,151

|

|

| Total Investments—106.1% (cost $116,550,842)

| 135,263,800

|

|

| Liabilities in Excess of Other Assets—(6.1%)

| (7,757,143)

|

|

| Net Assets—100.0%

|

| $127,506,657

|

| (a)

| Non-income producing security.

|

| (b)

| Registered investment company advised by State Street Global Advisors. The rate shown is the 7 day yield as of July 31, 2023.

|

| GDR

| Global Depositary Receipt

|

| PLC

| Public Limited Company

|

| REIT

| Real Estate Investment Trust

|

See accompanying Notes

to Portfolio of Investments.

Notes to Portfolio of Investments

July 31, 2023 (unaudited)

1. Summary of Significant

Accounting Policies

a. Security Valuation:

The Fund values its

securities at current market value or fair value, consistent with regulatory requirements. "Fair value" is defined in the Fund's Valuation and Liquidity Procedures as the price that could be received to sell an asset

or paid to transfer a liability in an orderly transaction between willing market participants without a compulsion to transact at the measurement date. Pursuant to Rule 2a-5 under the Investment Company Act of 1940,

as amended (the "1940 Act"), the Board designated abrdn Asia as the valuation designee ("Valuation Designee") for the Fund to perform the fair value determinations relating to Fund investments for which market

quotations are not readily available.

Equity securities that are

traded on an exchange are valued at the last quoted sale price or the official close price on the principal exchange on which the security is traded at the “Valuation Time” subject to application, when

appropriate, of the valuation factors described in the paragraph below. Under normal circumstances, the Valuation Time is as of the close of regular trading on the New York Stock Exchange ("NYSE") (usually 4:00 p.m.

Eastern Time). In the absence of a sale price, the security is valued at the mean of the bid/ask price quoted at the close on the principal exchange on which the security is traded. Securities traded on NASDAQ are

valued at the NASDAQ official closing price.

Foreign equity securities that

are traded on foreign exchanges that close prior to the Valuation Time are valued by applying valuation factors to the last sale price or the mean price as noted above. Valuation factors are provided by an independent

pricing service provider. These valuation factors are used when pricing the Fund's portfolio holdings to estimate market movements between the time foreign markets close and the time the Fund values such foreign

securities. These valuation factors are based on inputs such as depositary receipts, indices, futures, sector indices/ETFs, exchange rates, and local exchange opening and closing prices of each security. When prices

with the application of valuation factors are utilized, the value assigned to the foreign securities may not be the same as quoted or published prices of the securities on their primary markets. A security that

applies a valuation factor is determined to be a Level 2 investment because the exchange-traded price has been adjusted. Valuation factors are not utilized if the independent pricing service provider is unable to

provide a valuation factor or if the valuation factor falls below a predetermined threshold; in such case, the security is determined to be a Level 1 investment.

Short-term investments are

comprised of cash and cash equivalents invested in short-term investment funds which are redeemable daily. The Fund sweeps available cash into the State Street Institutional U.S. Government Money Market Fund,

which has elected to qualify as a “government money market fund” pursuant to Rule 2a-7 under the 1940 Act, and has an objective, which is not guaranteed, to maintain a $1.00 per share NAV. Registered

investment companies are valued at their NAV as reported by such company. Generally, these investment types are categorized as Level 1 investments.

In the event that a

security’s market quotations are not readily available or are deemed unreliable (for reasons other than because the foreign exchange on which it trades closes before the Valuation Time), the security is valued

at fair value as determined by the Valuation Designee, taking into account the relevant factors and surrounding circumstances using valuation policies and procedures approved by the Board. A security that has been

fair valued by the Investment Manager may be classified as Level 2 or Level 3 depending on the nature of the inputs.

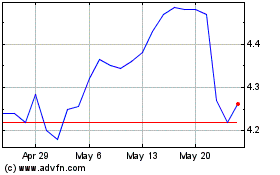

abrdn Australia Equity (AMEX:IAF)

Historical Stock Chart

From Apr 2024 to May 2024

abrdn Australia Equity (AMEX:IAF)

Historical Stock Chart

From May 2023 to May 2024