0001599407

false

0001599407

2023-08-04

2023-08-04

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

August 10, 2023 (August 4, 2023)

| 1847 Holdings LLC |

| (Exact name of registrant as specified in its charter) |

| Delaware |

|

001-41368 |

|

38-3922937 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

| 590 Madison Avenue, 21st Floor, New York, NY |

|

10022 |

| (Address of principal executive offices) |

|

(Zip Code) |

| (212) 417-9800 |

| (Registrant’s telephone number, including area code) |

| |

| (Former name or former address, if changed since last report.) |

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant

to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to

Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Shares |

|

EFSH |

|

NYSE American LLC |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging Growth Company ☐

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

Item 2.04 Triggering Events That Accelerate or Increase a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement.

As previously disclosed, on February 3, 2023,

1847 Holdings LLC (the “Company”) issued a promissory note in the principal amount of $104,000 to Mast Hill Fund, L.P. (“Mast

Hill”) and a promissory note in the principal amount of $500,000 to Leonite Fund I, LP (“Leonite”). These

promissory notes (the “February 3 Notes”) are convertible into the Company’s common shares only upon an Event

of Default (as defined in the February 3 Notes).

On August 4, 2023, the Company received notices

(the “August 4 Notices”) from Mast Hill and Leonite that an Event of Default has occurred under the February 3 Notes

for failure to make certain payments when due. Notwithstanding the foregoing, Mast Hill and Leonite agreed that they will not require

any payments in cash for the over-due amounts or accelerate the payments due under the February 3 Notes for a period of 60 days. Since

an Event of Default has occurred, Mast Hill and Leonite have the right to convert the February 3 Notes, including the over-due amounts,

into common shares at their election.

As previously disclosed, on February 9, 2023,

the Company issued a promissory note in the principal amount of $1,390,909 to Mast Hill and a promissory note in the principal amount

of $1,166,667 to Leonite. These promissory notes (the “February 9 Notes”) are convertible into the Company’s

common shares only upon an Event of Default (as defined in the February 9 Notes).

On August 9, 2023, the Company received notices

(the “August 9 Notices”) from Mast Hill and Leonite that an Event of Default has occurred under the February 9 Notes

for failure to make certain payments when due. Notwithstanding the foregoing, Mast Hill and Leonite agreed that they will not require

any payments in cash for the over-due amounts or accelerate the payments due under the February 9 Notes for a period of 60 days. Since

an Event of Default has occurred, Mast Hill and Leonite have the right to convert the February 9 Notes, including the over-due amounts,

into common shares at their election.

As previously disclosed, on February 22,

2023, the Company issued a promissory note in the principal amount of $878,000 to Mast Hill (the “February 22 Note”). The

February 22 Note is convertible into the Company’s common shares only upon an Event of Default (as defined in the February 22 Note).

On August 10, 2023, the Company received a notice (the “August

10 Notice”) from Mast Hill that an Event of Default has occurred under the February 22 Note for failure to make certain payments

when due. Notwithstanding the foregoing, Mast Hill agreed that it will not require any payments in cash for the over-due amounts or accelerate

the payments due under the February 22 Note for a period of 60 days from August 9, 2023. Since an Event of Default has occurred, Mast

Hill has the right to convert the February 22 Note, including the over-due amounts, into common shares at its election.

The

foregoing description of the August 4 Notices, the August 9 Notices and the August 10 Notice does not purport to be complete and is qualified

in its entirety by reference to the full text of those documents filed as exhibits to this report, which are incorporated herein by reference.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On August 4, 2023, upon recommendation of the

Nominating and Corporate Governance Committee, the Board of Directors of the Company (the “Board”) appointed Ms. Michele

A. Chow-Tai to the Board to fill an existing vacancy. Ms. Chow-Tai was also appointed to the Audit Committee and the Nominating and Corporate

Governance Committee. The Board determined that Ms. Chow-Tai is independent within the meaning of the rules of NYSE American. Below is

certain biographical information regarding Ms. Chow-Tai.

Ms. Chow-Tai is an experienced professional in

global banking and financial services with more than 32 years of industry expertise. For nearly seven years, she has been leading business

development initiatives, fundraising, and acquisition strategies at Fairview Capital Partners, a private equity and venture capital firm,

where she has been responsible for delivering a significant increase in the firm’s assets under management and has forged strong

relationships with major institutional investors in the US and abroad. Prior to her work in private equity, Ms. Chow-Tai spent over two

decades at leading global banks and financial services organizations, where she led multiple business initiatives, managed risk, and helped

clients navigate the complexities of global markets. Ms. Chow-Tai served as Board Chair for the City University of New York - York College

Foundation for 10 years. She is currently a Board Member of the National Association of Securities Professionals – New York Chapter,

Board Member of the NASP-NY Foundation, and the Greater New Haven Chambers of Commerce. Ms. Chow-Tai also serves on the Advisory Board

of LeaderXXchange, a purpose-driven organization that advises and promotes diversity and sustainability in governance, leadership, and

investments. Ms. Chow-Tai holds a B.S. degree from the City University of New York – York College, holds credentials in business

administration and finance and is currently pursuing a Juris Doctor degree from Mitchell Hamline School of Law.

Ms. Chow-Tai was appointed until her successor

is duly elected and qualified. There are no arrangements or understandings between Ms. Chow-Tai and any other person pursuant to which

she was selected as a director. There has been no transaction, nor is there any currently proposed transaction, between Ms. Chow-Tai and

the Company that would require disclosure under Item 404(a) of Regulation S-K.

On August 4, 2023, the Company entered into an

independent director agreement with Ms. Chow-Tai, in the Company’s standard form (the “Director Agreement”),

pursuant to which she is entitled to an annual fee of $35,000 and an annual grant of $35,000 of restricted shares, restricted share units

and/or share options, subject to Compensation Committee approval. The Company also agreed to reimburse Ms. Chow-Tai for pre-approved reasonable

business expenses incurred in good faith in connection with the performance of her duties for the Company. Such compensation shall be

subject to adjustment from time to time by the Board.

On August 4, 2023, the Company also entered into

an indemnification agreement with Ms. Chow-Tai, in the Company’s standard form (the “Indemnification Agreement”),

pursuant to which the Company agreed to indemnify Ms. Chow-Tai to the fullest extent permitted by law and agreed to advance all expenses

incurred by or on behalf of Ms. Chow-Tai in connection with any proceeding within thirty (30) days after the receipt by the Company of

a statement requesting such advance, whether prior to or after final disposition of such proceeding.

The foregoing summary of the terms and conditions

of the Director Agreement and the Indemnification Agreement does not purport to be complete and is qualified in its entirety by reference

to the full text of the form of Director Agreement and the form of Indemnification Agreement filed as exhibits to this report, which are

incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| Exhibit No. | |

Description of Exhibit |

| 10.1 | |

Promissory Note issued by 1847 Holdings LLC to Mast Hill Fund, L.P. on February 3, 2023 (incorporated by reference to Exhibit 10.4 to the Current Report on Form 8-K filed on February 9, 2023) |

| 10.2 | |

Promissory Note issued by 1847 Holdings LLC to Leonite Fund I, LP on February 3, 2023 (incorporated by reference to Exhibit 10.3 to the Current Report on Form 8-K filed on February 9, 2023) |

| 10.3 | |

Letter Agreement, dated August 4, 2023, between Mast Hill Fund, L.P. and 1847 Holdings LLC |

| 10.4 | |

Letter Agreement, dated August 4, 2023, between Leonite Fund I, LP and 1847 Holdings LLC |

| 10.5 | |

Promissory Note issued by 1847 Holdings LLC to Mast Hill Fund, L.P. on February 9, 2023 (incorporated by reference to Exhibit 10.16 to the Current Report on Form 8-K filed on February 13, 2023) |

| 10.6 | |

Promissory Note issued by 1847 Holdings LLC to Leonite Fund I, LP on February 9, 2023 (incorporated by reference to Exhibit 10.15 to the Current Report on Form 8-K filed on February 13, 2023) |

| 10.7 | |

Letter Agreement, dated August 9, 2023, between Mast Hill Fund, L.P. and 1847 Holdings LLC |

| 10.8 | |

Letter Agreement, dated August 9, 2023, between Leonite Fund I, LP and 1847 Holdings LLC |

| 10.9 | |

Promissory Note issued by 1847 Holdings LLC to Mast Hill Fund, L.P. on February 22, 2023 (incorporated by reference to Exhibit 10.2 to the Current Report on Form 8-K filed on February 28, 2023) |

| 10.10 | |

Letter Agreement, dated August 10, 2023, between Mast Hill Fund, L.P and 1847 Holdings LLC |

| 10.11 | |

Form of Independent Director Agreement between 1847 Holdings LLC and each independent director (incorporated by reference to Exhibit 10.31 to Amendment No. 1 to Registration Statement on Form S-1/A filed on January 31, 2022) |

| 10.12 | |

Form of Indemnification Agreement between 1847 Holdings LLC and each independent director (incorporated by reference to Exhibit 10.32 to Amendment No. 1 to Registration Statement on Form S-1/A filed on January 31, 2022) |

| 104 | |

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| Date: August 10, 2023 |

1847 HOLDINGS LLC |

| |

|

| |

/s/ Ellery W. Roberts |

| |

Name: |

Ellery W. Roberts |

| |

Title: |

Chief Executive Officer |

4

Exhibit 10.3

Mast Hill Fund, L.P.

48 Parker Road

Wellesley, MA 02482

August 4, 2023

1847 Holdings LLC

590 Madison Avenue, 21st Floor

New York, NY 10022

Attn: Ellery W. Roberts

Mr. Roberts:

Reference is made to that

certain Promissory Note in the principal amount of $104,000 issued by 1847 Holdings LLC (the “Company”) to Mast Hill

Fund, L.P., a Delaware limited partnership (the “Holder”) on February 3, 2023 (the “Note”). Capitalized

terms used but not defined herein shall have the meaning ascribed to them in the Note.

This letter shall serve as

notice that an Event of Default has occurred pursuant to Section 3.20 of the Note due to the Company’s failure to make certain required

payments on or prior to August 3, 2023 (the “Delinquent Payments”). Notwithstanding the foregoing, the Holder agrees

that (i) it will not require payment in cash of the Default Amount or any other fees due pursuant to Section 3.22 of the Note (or take

any collection action against the Company for payment in cash of such amounts) for a period of sixty (60) calendar days from August 4,

2023 and (ii) will waive all rights to accelerate the maturity of the Note as a result of the Delinquent Payments for a period of sixty

(60) calendar days from August 4, 2023. The parties further acknowledge that since an Event of Default has occurred, the Holder may convert

the Note (including but not limited to the Default Amount) in full in accordance with Section 1.1 of the Note.

By signing below, the parties

hereto hereby consent and agree to the terms as set forth above.

| |

Very truly yours, |

| |

|

| |

MAST HILL FUND, L.P. |

| |

|

| |

By: |

/s/

Patrick Hassani |

| |

Name: |

Patrick Hassani |

| |

Title: |

Chief Investment Officer |

| AGREED AND ACKNOWLEDGED: |

| |

|

| 1847

HOLDINGS LLC |

| |

|

| By: |

/s/

Ellery W. Roberts |

|

| Name: |

Ellery W. Roberts |

|

| Title: |

Chief Executive Officer |

|

Exhibit 10.4

Leonite Fund I, LP

1 Hillcrest Center Dr, Suite 232

Spring Valley, NY 10977

August 4, 2023

1847 Holdings LLC

590 Madison Avenue, 21st Floor

New York, NY 10022

Attn: Ellery W. Roberts

Mr. Roberts:

Reference is made to that

certain Promissory Note in the principal amount of $500,000 issued by 1847 Holdings LLC (the “Company”) to Leonite

Fund I, LP (the “Holder”) on February 3, 2023 (the “Note”). Capitalized terms used but not defined

herein shall have the meaning ascribed to them in the Note.

This letter shall serve as

notice that an Event of Default has occurred pursuant to Section 3.20 of the Note due to the Company’s failure to make certain required

payments on or prior to August 3, 2023 (the “Delinquent Payments”). Notwithstanding the foregoing, the Holder agrees

that (i) it will not require payment in cash of the Default Amount or any other fees due pursuant to Section 3.22 of the Note (or take

any collection action against the Company for payment in cash of such amounts) for a period of sixty (60) calendar days from August 4,

2023 and (ii) will waive all rights to accelerate the maturity of the Note as a result of the Delinquent Payments for a period of sixty

(60) calendar days from August 4, 2023. The parties further acknowledge that since an Event of Default has occurred, the Holder may convert

the Note (including but not limited to the Default Amount) in full in accordance with Section 1.1 of the Note.

By signing below, the parties

hereto hereby consent and agree to the terms as set forth above.

| |

Very

truly yours, |

| |

|

| |

LEONITE

FUND I, LP |

| |

By:

Leonite Advisors LLC, its Manager |

| |

|

| |

By: |

/s/

Avi Geller |

| |

Name: |

Avi

Geller |

| |

Title: |

Managing

Member |

| AGREED

AND ACKNOWLEDGED: |

|

| |

|

| 1847

HOLDINGS LLC |

|

| |

|

| By: |

/s/

Ellery W. Roberts |

|

| Name: |

Ellery

W. Roberts |

|

| Title: |

Chief

Executive Officer |

|

Exhibit 10.7

Mast

Hill Fund, L.P.

48

Parker Road

Wellesley,

MA 02482

August

10, 2023

1847

Holdings LLC

590

Madison Avenue, 21st Floor

New

York, NY 10022

Attn:

Ellery W. Roberts

Mr.

Roberts:

Reference

is made to that certain Promissory Note in the principal amount of $878,000.00 issued by 1847 Holdings LLC (the “Company”)

to Mast Hill Fund, L.P., a Delaware limited partnership (the “Holder”) on February 22, 2023 (the “Note”).

Capitalized terms used but not defined herein shall have the meaning ascribed to them in the Note.

This

letter shall serve as notice that an Event of Default has occurred pursuant to Section 3.20 of the Note due to the Company’s failure

to make certain required payments on or prior to August 9, 2023 (the “Delinquent Payments”). Notwithstanding the foregoing,

the Holder agrees that (i) it will not require payment in cash of the Default Amount or any other fees due pursuant to Section 3.22 of

the Note (or take any collection action against the Company for payment in cash of such amounts) for a period of sixty (60) calendar

days from August 9, 2023 and (ii) will waive all rights to accelerate the maturity of the Note as a result of the Delinquent Payments

for a period of sixty (60) calendar days from August 9, 2023. The parties further acknowledge that since an Event of Default has occurred,

the Holder may convert the Note (including but not limited to the Default Amount) in full in accordance with Section 1.1 of the Note.

By

signing below, the parties hereto hereby consent and agree to the terms as set forth above.

| |

Very

truly yours, |

| |

|

| |

MAST

HILL FUND, L.P. |

| |

|

|

| |

By: |

/s/

Patrick Hassani |

| |

Name: |

Patrick

Hassani |

| |

Title: |

Chief

Investment Officer |

| AGREED AND ACKNOWLEDGED: |

|

| |

|

|

| 1847 HOLDINGS LLC |

|

| |

|

|

| By: |

/s/ Ellery W. Roberts |

|

| Name: |

Ellery W. Roberts |

|

| Title: |

Chief Executive Officer |

|

Exhibit 10.8

Leonite Fund I, LP

1 Hillcrest Center Dr, Suite 232

Spring Valley, NY 10977

August 9, 2023

1847 Holdings LLC

590 Madison Avenue, 21st Floor

New York, NY 10022

Attn: Ellery W. Roberts

Mr. Roberts:

Reference is made to that

certain Promissory Note in the principal amount of $1,166,666.67 issued by 1847 Holdings LLC (the “Company”) to Leonite

Fund I, LP (the “Holder”) on February 9, 2023 (the “Note”). Capitalized terms used but not defined

herein shall have the meaning ascribed to them in the Note.

This letter shall serve as

notice that an Event of Default has occurred pursuant to Section 3.20 of the Note due to the Company’s failure to make certain required

payments on or prior to August 9, 2023 (the “Delinquent Payments”). Notwithstanding the foregoing, the Holder agrees

that (i) it will not require payment in cash of the Default Amount or any other fees due pursuant to Section 3.22 of the Note (or take

any collection action against the Company for payment in cash of such amounts) for a period of sixty (60) calendar days from August 9,

2023 and (ii) will waive all rights to accelerate the maturity of the Note as a result of the Delinquent Payments for a period of sixty

(60) calendar days from August 9, 2023. The parties further acknowledge that since an Event of Default has occurred, the Holder may convert

the Note (including but not limited to the Default Amount) in full in accordance with Section 1.1 of the Note.

By signing below, the parties

hereto hereby consent and agree to the terms as set forth above.

| |

Very

truly yours, |

| |

|

| |

LEONITE

FUND I, LP |

| |

By:

Leonite Advisors LLC, its Manager |

| |

|

| |

By: |

/s/

Avi Geller |

| |

Name: |

Avi

Geller |

| |

Title: |

Managing

Member |

| AGREED

AND ACKNOWLEDGED: |

|

| |

|

| 1847

HOLDINGS LLC |

|

| |

|

| By: |

/s/

Ellery W. Roberts |

|

| Name: |

Ellery

W. Roberts |

|

| Title: |

Chief

Executive Officer |

|

Exhibit 10.10

Mast Hill Fund, L.P.

48 Parker Road

Wellesley, MA 02482

August 9, 2023

1847 Holdings LLC

590 Madison Avenue, 21st Floor

New York, NY 10022

Attn: Ellery W. Roberts

Mr. Roberts:

Reference is made to that

certain Promissory Note in the principal amount of $1,390,908.59 issued by 1847 Holdings LLC (the “Company”) to Mast

Hill Fund, L.P., a Delaware limited partnership (the “Holder”) on February 9, 2023 (the “Note”).

Capitalized terms used but not defined herein shall have the meaning ascribed to them in the Note.

This letter shall serve as

notice that an Event of Default has occurred pursuant to Section 3.20 of the Note due to the Company’s failure to make certain required

payments on or prior to August 9, 2023 (the “Delinquent Payments”). Notwithstanding the foregoing, the Holder agrees

that (i) it will not require payment in cash of the Default Amount or any other fees due pursuant to Section 3.22 of the Note (or take

any collection action against the Company for payment in cash of such amounts) for a period of sixty (60) calendar days from August 9,

2023 and (ii) will waive all rights to accelerate the maturity of the Note as a result of the Delinquent Payments for a period of sixty

(60) calendar days from August 9, 2023. The parties further acknowledge that since an Event of Default has occurred, the Holder may convert

the Note (including but not limited to the Default Amount) in full in accordance with Section 1.1 of the Note.

By signing below, the parties

hereto hereby consent and agree to the terms as set forth above.

| |

Very truly yours, |

| |

|

| |

MAST HILL FUND, L.P. |

| |

|

| |

By: |

/s/ Patrick Hassani |

| |

Name: |

Patrick Hassani |

| |

Title: |

Chief Investment Officer |

| AGREED AND ACKNOWLEDGED: |

|

| |

|

| 1847

HOLDINGS LLC |

|

| |

|

| By: |

/s/ Ellery W. Roberts |

|

| Name: |

Ellery W. Roberts |

|

| Title: |

Chief Executive Officer |

|

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

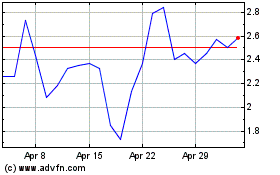

1847 (AMEX:EFSH)

Historical Stock Chart

From Apr 2024 to May 2024

1847 (AMEX:EFSH)

Historical Stock Chart

From May 2023 to May 2024