UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

Report

of Foreign Private Issuer

Pursuant

to Rule 13a-16

or 15d-16

UNDER

the Securities Exchange Act of 1934

For

the month of April 2024

Commission

File No.: 001-41824

Kolibri

Global Energy Inc.

(Translation

of registrant’s name into English)

925

Broadbeck Drive, Suite 220

Thousand

Oaks, CA 91320

(Address

of principal executive office)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F: Form 20-F ☐ Form

40-F ☒

EXHIBIT

INDEX

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| |

Kolibri Global

Energy Inc. |

| |

|

| Date:

April 24, 2024 |

By: |

/s/

Gary Johnson |

| |

Name: |

Gary Johnson |

| |

Title: |

Chief Financial Officer |

Exhibit

99.1

Notice

of Meeting

and

Management

Information Circular

with

respect to the

Annual

General Meeting of Shareholders of

Kolibri

Global Energy Inc.

to

be held on May 15, 2024

Dear

Shareholder:

You

are invited to attend the Annual General Meeting of Shareholders of Kolibri Global Energy Inc. to be held at Marina del Rey Marriott,

Marina Boardroom, 4100 Admiralty Way, Marina del Rey, California, on Wednesday, May 15, 2024 at the hour of 9:00 a.m. (local time in

Marina del Rey, California, USA).

The

business of the meeting is described in the accompanying Notice of Meeting and Management Information Circular.

Your

participation in the meeting is important regardless of the number of shares you hold. If you cannot attend the meeting, please vote

by completing, signing and dating the form of proxy or voting instruction form accompanying this notice of meeting and returning the

same within the time and in the manner set out in the form of proxy or voting instruction form.

Shareholders

can join the meeting by telephone by requesting the dial-in details to our conference line from Katie Peterson at kpeterson@kolibrienergy.com.

Please dial-in 5-10 minutes prior to the scheduled start time.

Shareholders

who dial-in to our conference line will be not able to vote through this method. We recommend that you vote by proxy or voting instruction

form in advance of the meeting.

| “/s/

David Neuhauser” |

|

“/s/

Wolf Regener” |

| DAVID

NEUHAUSER |

|

WOLF

REGENER |

| Chairman

of the Board |

|

President

& Chief Executive Officer |

KOLIBRI

GLOBAL ENERGY INC.

925

Broadbeck Drive, Suite 220

Thousand

Oaks, California 91320

NOTICE

OF ANNUAL GENERAL MEETING

NOTICE

IS HEREBY GIVEN THAT the annual general meeting of the shareholders of Kolibri Global Energy Inc. (the “Company”)

will be held at Marina del Rey Marriott, Marina Boardroom, 4100 Admiralty Way, Marina del Rey, California, on Wednesday, May 15, 2024

at the hour of 9:00 a.m. (local time in Marina del Rey, California), for the following purposes:

| 1. | to

receive and consider the report of the directors and the consolidated financial statements

of the Company together with the auditors’ report thereon for the financial year ended

December 31, 2023; |

| | |

| 2. | to

fix the number of directors at five (5); |

| | |

| 3. | to

elect directors for the ensuing year; |

| | |

| 4. | to

appoint the auditors for the ensuing year and authorize the directors to fix the remuneration

to be paid to the auditors; and |

| | |

| 5. | to

transact such further or other business as may properly come before the meeting and any adjournments

thereof. |

The

accompanying management information circular provides additional information relating to the matters to be dealt with at the meeting

and is deemed to form part of this notice of meeting.

This

year, out of an abundance of caution, to proactively deal with the unprecedented public health impact of corona virus disease, also known

as COVID-19, and to mitigate risks to the health and safety of our communities, shareholders, employees and other stakeholders, although

we plan to hold an in-person meeting, we strongly recommend that shareholders vote by proxy or voting instruction form in advance of

the meeting and DO NOT attend the meeting in person. Only the matters referred to in the accompanying Notice of Meeting will be addressed

at the meeting.

Shareholders

can join the meeting by telephone by requesting the dial-in details to our conference line from Katie Peterson at kpeterson@kolibrienergy.com.

Please dial-in 5-10 minutes prior to the scheduled start time.

Shareholders

who dial-in to our conference line will be not able to vote through this method. We recommend that you vote by proxy or voting instruction

form in advance of the meeting.

| DATED

this 8th day of April, 2024. |

|

|

| |

|

|

| |

|

By

Order of the Board of Directors of |

| |

|

Kolibri

Global Energy Inc. |

| |

|

|

| |

|

“/s/

Wolf Regener” |

| |

|

WOLF

REGENER |

| |

|

President

and Chief Executive Officer |

KOLIBRI

GLOBAL ENERGY INC.

925

Broadbeck Drive, Suite 220

Thousand Oaks, California 91320

MANAGEMENT

INFORMATION CIRCULAR

(Unless

otherwise indicated, all information is as at April 8, 2024)

The

Company is providing this information circular (the “Information Circular”) and a form of proxy in connection with

management’s solicitation of proxies for use at the annual general meeting (the “Meeting”) of the Company to

be held on Wednesday, May 15, 2024 and at any adjournments thereof. Unless the context otherwise requires, when we refer in this Information

Circular to the Company, its subsidiaries are also included. The Company will conduct its solicitation by mail and officers and employees

of the Company may, without receiving special compensation, also telephone or make other personal contact. The Company will pay the cost

of solicitation.

Unless

otherwise indicated, dollar figures in this Information Circular are in U.S. currency (“US$”). Canadian dollars are referred

to as “C$” herein.

This

year, out of an abundance of caution, to proactively deal with the unprecedented public health impact of corona virus disease, also known

as COVID-19, and to mitigate risks to the health and safety of our communities, shareholders, employees and other stakeholders, we strongly

recommend that shareholders vote by proxy or voting instruction form in advance of the Meeting and DO NOT attend the Meeting in person.

Shareholders

can join the Meeting by telephone by requesting the dial-in details to our conference line from Katie Peterson at kpeterson@kolibrienergy.com.

Please dial-in 5-10 minutes prior to the scheduled start time.

Shareholders

who dial-in to our conference line will not be able to vote through this method. We recommend that you vote by proxy or voting instruction

form in advance of the Meeting.

APPOINTMENT

OF PROXYHOLDER

The

purpose of a proxy is to designate persons who will vote the proxy on a shareholder’s behalf in accordance with the instructions

given by the shareholder in the proxy. The persons whose names are printed in the enclosed form of proxy are officers or directors of

the Company (the “Management Proxyholders”).

A

shareholder has the right to appoint a person other than a Management Proxyholder, to represent the shareholder at the Meeting by inserting

the desired person’s name in the blank space provided or by executing a proxy in a form similar to the enclosed form. A proxyholder

need not be a shareholder.

VOTING

BY PROXY

Only

registered shareholders or duly appointed proxyholders are permitted to vote at the Meeting. Common shares of the Company (“Shares”)

represented by a properly executed proxy will be voted or be withheld from voting on each matter referred to in the Notice of Meeting

in accordance with the instructions of the shareholder on any ballot that may be called for and if the shareholder specifies a choice

with respect to any matter to be acted upon, the Shares will be voted accordingly.

If

a shareholder does not specify a choice and the shareholder has appointed one of the Management Proxyholders as proxyholder, the Management

Proxyholder will vote in favour of the matters specified in the Notice of Meeting and in favour of all other matters proposed by management

at the Meeting.

The

enclosed form of proxy also gives discretionary authority to the person named therein as proxyholder with respect to amendments or variations

to matters identified in the Notice of the Meeting and with respect to other matters which may properly come before the Meeting. At

the date of this Information Circular, management of the Company knows of no such amendments, variations or other matters to come before

the Meeting.

COMPLETION

AND RETURN OF PROXY

Completed

forms of proxy must be deposited at the office of the Company’s registrar and transfer agent, Computershare Trust Company of Canada,

Proxy Department, 100 University Avenue, 8th Floor, Toronto, Ontario M5J 2Y1; or sent by fax to Computershare Trust Company of Canada,

Proxy Department at 1-866- 249-7775 within North America or (416) 263-9524 outside North America, not later than two business days, excluding

Saturdays, Sundays and holidays, prior to the time of the Meeting, unless the chairman of the Meeting elects to exercise his discretion

to accept proxies received subsequently.

NOTICE-AND-ACCESS

The

Company is not sending this Information Circular to registered or beneficial shareholders using “notice- and-access” as defined

under NI 54-101 – Communication with Beneficial Owners of Securities of a Reporting Issuer (“NI 54-101”)

of the Canadian Securities Administrators.

NON-REGISTERED

HOLDERS

Only

shareholders whose names appear on the records of the Company as the registered holders of Shares or duly appointed proxyholders are

permitted to vote at the Meeting. Most shareholders of the Company are “non-registered” shareholders because the Shares

they own are not registered in their names but instead are registered in the name of a nominee such as a brokerage firm through which

they purchased the Shares; bank, trust company, trustee or administrator of self-administered RRSPs, RRIFs, RESPs and similar plans;

or clearing agency such as The Canadian Depository for Securities Limited (a “Nominee”). If you purchased your Shares

through a broker, you are likely to be a non-registered holder.

In

accordance with securities regulatory policy, the Company has distributed copies of the Meeting materials, being the Notice of Meeting,

this Information Circular and the Proxy, to the Nominees for distribution to non-registered holders. Nominees are required to forward

the Meeting materials to non- registered holders to seek their voting instructions in advance of the Meeting. Shares held by Nominees

can only be voted in accordance with the instructions of the non-registered holder. The Nominees often have their own form of proxy,

mailing procedures and provide their own return instructions. If you wish to vote by proxy, you should carefully follow the instructions

from the Nominee in order that your Shares are voted at the Meeting.

If

you, as a non-registered holder, wish to vote at the Meeting in person, you should appoint yourself as proxyholder by writing your name

in the space provided on the request for voting instructions or proxy provided by the Nominee and return the form to the Nominee in the

envelope provided. Do not complete the voting section of the form as your vote will be taken at the Meeting.

In

accordance with the requirements of NI 54-101, the Company has elected to send the Meeting materials directly to “non-objecting

beneficial owners” (“NOBOs”). If the Company or its agent has sent these materials directly to you (instead

of through a Nominee), your name and address and information about your holdings of securities have been obtained in accordance with

applicable securities regulatory requirements from the Nominee holding on your behalf. By choosing to send these materials to you directly,

the Company (and not the Nominee holding on your behalf) has assumed responsibility for (i) delivering these materials to you and (ii)

executing your proper voting instructions. Please return your voting instructions as specified in the request for voting instructions.

The

Company intends to pay for an intermediary to deliver to “objecting beneficial owners” (or “OBOs”) the

proxy-related materials and Form 54-101F7 Request for Voting Instructions Made by Intermediary.

REVOCABILITY

OF PROXY

In

addition to revocation in any other manner permitted by law, a shareholder, his or her attorney authorized in writing or, if the shareholder

is a corporation, a corporation under its corporate seal or by an officer or attorney thereof duly authorized, may revoke a proxy by

instrument in writing, including a proxy bearing a later date. The instrument revoking the proxy must be deposited at the registered

office of the Company, at any time up to and including the last business day preceding the date of the Meeting, or any adjournments thereof,

or with the chairman of the Meeting on the day of the Meeting.

Only

registered shareholders have the right to revoke a proxy. Non-registered holders who wish to change their vote must, in sufficient time

in advance of the Meeting, arrange for their respective Nominees to revoke the proxy on their behalf.

VOTING

SHARES AND PRINCIPAL HOLDERS THEREOF

The

Company is authorized to issue an unlimited number of Shares without par value, of which 35,625,587 Shares are issued and outstanding

as of April 8, 2024, the record date for the Meeting (the “Record Date”). Persons who are registered shareholders

at the close of business on the Record Date will be entitled to receive notice of and vote at the Meeting and will be entitled to one

vote for each Share held. The Company has only one class of shares currently issued and outstanding.

To

the knowledge of the directors and executive officers of the Company, except as disclosed below, no person beneficially owns, controls

or directs, directly or indirectly, Shares carrying 10% or more of the voting rights attached to all Shares of the Company:

| Shareholder | |

Number

of Shares | | |

Percentage

of Issued Capital (%) | |

| TFG

Asset Management UK LLP | |

| 7,070,568 | (2) | |

| 19.9 | % |

| Livermore

Partners LLC(1) | |

| 5,521,071 | | |

| 15.5 | % |

| Harrington

Global Opportunities Fund Limited | |

| 4,077,050 | (3) | |

| 11.4 | % |

| (1) | The

managing director of Livermore Partners LLC is David Neuhauser, a director of the Company,

who exercises control or direction over the Shares owned by Livermore Partners LLC. |

| (2) | Based

on TFG Asset Management UK LLP’s alternative monthly report dated March 3, 2023. |

| (3) | Estimated

on a post-consolidation basis based on Harrington Global Opportunities Fund Limited’s

SEDI filings. |

BUSINESS

OF THE ANNUAL GENERAL MEETING

Receipt

of the Financial Statements and Auditors’ Report

The

consolidated financial statements of the Company for the year ended December 31, 2023 and the auditors’ report thereon will be

placed before the shareholders at the Meeting.

If

you wish to receive interim and/or annual financial statements from the Company you are encouraged to send the enclosed return card to

Computershare Investor Services Inc. at the address set forth on the return card.

Election

of Directors

The

directors of the Company are elected at each annual meeting and hold office until the next annual meeting or until their successors are

appointed.

Shareholder

approval will be sought to fix the number of directors of the Company at five (5).

The

Company has the following standing committees: Audit Committee, Compensation Committee, Corporate Governance Committee, Health, Safety

and Environmental (“HS&E”) Committee and Reserves Committee.

Management

of the Company proposes to nominate each of the following persons for election as a director. Information concerning such persons, as

furnished by the individuals, is as follows:

| Name,

Jurisdiction of Residence and Position | |

Principal

Occupation, Business or Employment | |

Previous

Service as

a Director | |

Number

of Shares beneficially owned, or controlled or directed, directly or indirectly(6) | |

David

Neuhauser(1)(2)(5) Illinois,

USA Director | |

Founder

and Managing Director of Livermore Partners LLC | |

Since

November 1,

2016 | |

| 5,521,071 | (8) |

Leslie

O’Connor(2)(3)(4)(5) Colorado,

USA Director | |

Associate

of MHA Petroleum Consultants, LLC since February 2017. Managing Partner of MHA Petroleum Consultants, LLC between May 2006 and February

2017. | |

Since

April 11, 2014 | |

| 3,859 | |

Wolf

Regener(4) California,

USA President,

CEO and Director | |

President

and CEO of the Company since May 27, 2008 | |

Since

May 25, 2010 | |

| 318,022 | (7) |

Evan

S. Templeton(2)(3)(5) New

York, USA Director | |

Managing

Director, Odinbrook Global Advisors LLC from April 2020 to present. Principal, WestOak Advisors LLC from January 2020 to present.

Managing Director, Leveraged Credit Strategy, Jefferies LLC from April 2005 to March 2019. | |

Since

July 19, 2022 | |

| 7,950 | |

Douglas

C. Urch(1)(3) Texas,

USA Director | |

Executive

Vice President and Chief Financial Officer of PetroTal Corp. since November 2019, and Chair of the Board from December 2017 to October

2019. Executive Vice President, Finance and Chief Financial Officer of Bankers Petroleum Ltd. from February 2008 to September 2018. | |

Since

October 18,

2023 | |

| 6,000 | |

| (1) | Member

of the Audit Committee. |

| (2) | Member

of the Compensation Committee. |

| (3) | Member

of the Corporate Governance Committee. |

| (4) | Member

of the HS&E Committee. |

| (5) | Member

of the Reserves Committee. |

| (6) | Shares

beneficially owned, or controlled or directed, directly or indirectly, as at the Record Date,

based upon information furnished to the Company by individual directors. |

| (7) | 188,696

Shares held through Regener Family Trust; 92,133 Shares held through W&L Regener Family

Trust; and 21,833 Shares held through Oil Guys, Inc, each of which are entities controlled

by Mr. Regener. |

| (8) | David

Neuhauser exercises control or direction over 5,521,071 Shares owned by Livermore Partners

LLC. |

Unless

otherwise instructed, the persons named as proxyholder in the enclosed form of proxy intend to vote for the fixing of the number of directors

at five (5) and for the director nominees listed herein.

No

proposed director is to be elected under any arrangement or understanding between the proposed director and any other person or company,

except the directors and executive officers of the Company acting solely in such capacity.

The

Board believes that each director should have the confidence and support of the shareholders of the Company. To this end, the Board has

unanimously adopted an Amended and Restated Majority Voting Policy and future nominees for election to the Board will be required to

confirm that they will abide by this Amended and Restated Majority Voting Policy. Readers are referred to the full text of the policy,

which is set out at Schedule “A” to this Information Circular.

To

the knowledge of the Company, except as set out below, no proposed director:

| (a) | is,

as at the date of the Information Circular, or has been, within 10 years before the date

of the Information Circular, a director, chief executive officer (“CEO”)

or chief financial officer (“CFO”) of any company (including the Company)

that: |

| (i) | was

the subject, while the proposed director was acting in the capacity as director, CEO or CFO

of such company, of a cease trade or similar order or an order that denied the relevant company

access to any exemption under securities legislation, that was in effect for a period of

more than 30 consecutive days; or |

| (ii) | was

subject to a cease trade or similar order or an order that denied the relevant company access

to any exemption under securities legislation, that was in effect for a period of more than

30 consecutive days, that was issued after the proposed director ceased to be a director,

CEO or CFO but which resulted from an event that occurred while the proposed director was

acting in the capacity as director, CEO or CFO of such company; or |

| (b) | is,

as at the date of this Information Circular, or has been within 10 years before the date

of the Information Circular, a director or executive officer of any company (including the

Company) that, while that person was acting in that capacity, or within a year of that person

ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating

to bankruptcy or insolvency or was subject to or instituted any proceedings, arrangement

or compromise with creditors or had a receiver, receiver manager or trustee appointed to

hold its assets; or |

| (c) | has,

within the 10 years before the date of this Information Circular, become bankrupt, made a

proposal under any legislation relating to bankruptcy or insolvency, or become subject to

or instituted any proceedings, arrangement or compromise with creditors, or had a receiver,

receiver manager or trustee appointed to hold the assets of the proposed director; or |

| (d) | has

been subject to any penalties or sanctions imposed by a court relating to securities legislation

or by a securities regulatory authority or has entered into a settlement agreement with a

securities regulatory authority; or |

| (e) | has

been subject to any penalties or sanctions imposed by a court or regulatory body that would

likely be considered important to a reasonable securityholder in deciding whether to vote

for a proposed director. |

Certain

directors of the Company are presently directors of other reporting issuers (see “Participation of Directors in Other Reporting

Issuers”).

On

March 19, 2024, the Company announced that because of an anticipated delay in filing its annual financial statements for the year ended

December 31, 2023, the related management’s discussion and analysis, annual information form for the year ended December 31, 2023,

and the CEO and CFO certifications relating to such filings before the April 2, 2024 deadline, the Company applied to the British Columbia

Securities Commission for the imposition of a management cease trade order. As a result, on April 3, 2024, the British Columbia Securities

Commission issued a management cease trade order against Wolf Regener and Gary Johnson. The management cease trade order prohibits Mr.

Regener and Mr. Johnson from trading in the securities of the Company until the date the management cease trade order is lifted.

Appointment

of Auditors

On

September 29, 2023, KPMG LLP resigned as auditors of the Company due to California licensing restrictions that were created upon the

Company’s filing of the 40-F registration statement with the U.S. Securities and Exchange Commission in order to be listed on the

Nasdaq Capital Market.

On

February 18, 2024, the Board, on the recommendation of the Audit Committee, approved the appointment of Marcum LLP of Houston, Texas

as auditors of the Company. A copy of the “reporting package” (as defined in National Instrument 51-102 Continuous Disclosure

Obligations) in respect of the change of auditors is attached as Schedule “B” to the Information Circular.

At

the Meeting, Shareholders will be asked to pass an ordinary resolution to appoint Marcum LLP as auditors of the Company and to authorize

the directors of the Company to fix the remuneration to be to be paid to the auditors. An ordinary resolution needs to be passed by a

simple majority of the votes cast by the Shareholders present in person or represented by proxy and entitled to vote at the Meeting.

Unless

otherwise instructed, the persons named as proxyholder in the enclosed form of proxy intend to vote for the appointment of Marcum LLP

as auditors of the Company.

EXECUTIVE

COMPENSATION AND REMUNERATION OF DIRECTORS

The

following Compensation Discussion and Analysis is intended to provide information about the Company’s philosophy, objectives and

processes regarding compensation for the executive officers of the Company. It explains how decisions regarding executive compensation

are made and the reasoning behind these decisions.

Compensation

Philosophy and Objectives of Compensation Programs

To

achieve the Company’s objectives, the Company believes it is critical to create and maintain compensation programs that attract

and retain committed, highly-qualified personnel and to motivate them to assist in the achievement of the Company’s business objectives,

by providing appropriate rewards and incentives.

The

Company’s compensation program is designed to reward performance that contributes to the achievement of the Company’s business

strategy on both a short-term and long-term basis, without unduly increasing the risks associated with the Company’s business and

its business strategy. In furtherance of the foregoing the Company strives to reward qualities that it believes help achieve its strategy

such as teamwork, individual performance in light of general economic and industry specific conditions, efforts to mitigate the business,

financial and other risks facing the Company, integrity and resourcefulness, the ability to manage the Company’s existing assets,

the ability to identify and pursue new business opportunities, responsibility and accountability, and tenure with the Company.

Risk-Management

Implications

The

Compensation Committee exercises both positive and negative discretion in relation to compensation and the allocation of ‘at-risk’

compensation (being cash bonuses and securities-based compensation), to encourage and reward performance that does not increase, and

where practical mitigates, the Company’s exposure to business and financial risks including those identified in the Company’s

Annual Information Form and Management’s Discussion and Analysis. The nature of the business and the competitive environment in

which the Company operates requires some level of risk-taking to achieve growth. The following aspects of the Company’s executive

compensation program are designed to encourage practices and activities that should enhance long-term value and sustainable growth and

limit incentives that could encourage inappropriate or excessive risk-taking:

| ● | an

annual cash bonus target, determined as a percentage of an executive’s annual salary,

that may be earned in a calendar year; |

| ● | staged

vesting over a two or three year period of stock options granted to executives with a maximum

of one-third vesting per annum; and |

| ● | staged

vesting over a three year period of restricted share units. |

The

Compensation Committee regularly considers risks associated with the Company’s compensation policies and practices. The Compensation

Committee has not identified compensation policies or practices that are reasonably likely to have a material adverse effect on the Company.

The

Company has adopted a policy prohibiting Named Executive Officers (as defined below) or directors from purchasing financial instruments

that are designed to hedge or offset a decrease in market value of equity securities of the Company granted as compensation or held,

directly or indirectly, by Named Executive Officers or directors.

Compensation

Mix

The

Company compensates its executive officers through base salary, cash bonuses, the award of stock options under the Company’s stock

option plan (the “Option Plan”) and the award of restricted share units (“RSUs”) under the Company’s

restricted share units plan (the “RSU Plan”) at levels which the Compensation Committee believes are reasonable in

light of the performance of the Company under the leadership of the executive officers. The objective of the compensation program is

to provide a combination of short, medium and long-term incentives that reward performance and also are designed to achieve retention

of high-quality executives.

The

following table provides an overview of the elements of the Company’s compensation program.

| Compensation

Element |

|

Award

Type |

|

Objective |

|

Key

Features |

| Base

Salary |

|

Salary |

|

Provides

a fixed level of regularly paid cash compensation for performing day-to-day executive level responsibilities. |

|

Recognizes

each officer’s unique value and historical contribution to the success of the

Company

in light of salary norms in the industry and the general marketplace. |

| Annual

Cash Bonuses |

|

Annual

non-equity incentive plan |

|

Motivates

executive officers to achieve key corporate objectives by rewarding the achievement of these objectives. |

|

Discretionary

cash payments recommended to the Board by the Compensation Committee based upon contribution

to the achievement of corporate objectives and individual performance. |

| Long-Term

Incentives |

|

Option-

based and share-based awards |

|

Long-term,

equity-based, incentive compensation that rewards long-term performance by allowing executive

officers to participate in the long-term appreciation of the Company’s Shares. The

Compensation Committee believes that the granting of stock options and/or RSUs is required

in order for the Company to be competitive with its peers from a total remuneration standpoint

and to encourage executive officer retention. |

|

Annual

and special incentive stock option awards granted as determined by the Board, typically based

on recommendations from the Compensation Committee. Options are granted at market price,

generally vesting over two or three years and having a term of five years.

RSUs

vest over a three-year period. |

The

Named Executive Officers are also eligible to participate in the same benefits offered to all full-time employees. The Company does not

view these benefits as a significant element of its compensation structure but does believe that they can be used in conjunction with

base salary to attract, motivate and retain individuals in a competitive environment.

Assessment

of Compensation

In

determining appropriate levels of executive compensation the Compensation Committee utilizes publicly available compensation surveys

and information contained within annual proxy circulars. The Compensation Committee also takes into account recommendations made by the

Chief Executive Officer in respect of the Named Executive Officers (other than himself). In reviewing comparative data, the Compensation

Committee does not engage in benchmarking for the purposes of establishing compensation levels relative to any predetermined point. In

the Compensation Committee’s view, external and third-party survey data provides an insight into external competitiveness, but

is not an appropriate single basis for establishing compensation levels. This is primarily due to the differences in the size, scope

and location of operations of comparable corporations and the lack of sufficient appropriate matches to provide statistical relevance.

Salary:

Base salary is intended to compensate core competences in the executive role relative to skills, experience and contribution to the

Company. Base salary provides fixed compensation determined by reference to competitive market information. The Compensation Committee

believes that salaries should be competitive and, as such, should provide the executive officers with an appropriate compensation that

reflects their level of responsibility, industry experience, individual performance and contribution to the growth of the Company. The

2023 base salaries of the Named Executive Officers of the Company disclosed in the “Summary Compensation Table”, were

established primarily on this basis.

Annual

Cash Bonuses: Bonuses are paid at the discretion of the Board on the recommendation of the Compensation Committee, based upon the

performance of the individual, achievement of corporate objectives and the individual executive’s contribution thereto. Bonuses

awarded by the Compensation Committee are intended to be competitive with the market while rewarding executive officers for meeting qualitative

goals, including delivering near-term financial and operating results, developing long-term growth prospects, improving the efficiency

and effectiveness of business operations and building a culture of teamwork focused on creating long-term shareholder value. Consistent

with the flexible nature of the annual bonus program, the Compensation Committee does not assign any specific weight to any particular

performance goal. The Board can exercise discretion to award compensation absent attainment of a pre- determined performance goal, or

to reduce or increase the size of a bonus award. To date, the Board has not exercised its discretion to award a bonus absent attainment

of applicable performance goals. The Compensation Committee considers not only the Company’s performance during the year with respect

to the qualitative goals, but also with respect to market and economic trends and forces, extraordinary internal and market-driven events,

unanticipated developments and other extenuating circumstances. In sum, the Compensation Committee analyzes the total mix of available

information on a qualitative, rather than quantitative, basis in making bonus determinations. Target bonuses for Named Executive Officers

may be exceeded if an executive officer is instrumental in the achievement of favourable milestones in addition to pre-determined objectives,

and in circumstances where an executive’s individual commitment and performance is exceptional.

Long-Term

Incentives: The allocation of stock options and RSUs, and the terms thereof, are integral components of the compensation package

of the executive officers of the Company. The Company’s Option Plan and RSU Plan are in place for the purpose of providing equity-based

compensation to its officers, employees and consultants. The Compensation Committee believes that the grant of options and RSUs to the

executive officers serve to motivate achievement of the Company’s long-term strategic objectives and the result will benefit all

shareholders of the Company. Stock options and RSUs are awarded to employees of the Company (including the directors and Named Executive

Officers) by the Board based in part upon the recommendation of the Compensation Committee, which bases its recommendations in part upon

recommendations of the Chief Executive Officer relative to the level of responsibility and contribution of the individuals toward the

Company’s goals and objectives.

To

date, stock options granted to Named Executive Officers generally vest in tranches of one-third at the time of grant (subject to any

applicable probationary period) and one-third on each of the first and second anniversary date of grant. The Compensation Committee exercises

its discretion to adjust the number of stock options and RSUs awarded based upon its assessment of individual and corporate performance

and the anticipated future hiring requirements of the Company. Also, the Compensation Committee considers the overall number of stock

options and RSUs that are outstanding relative to the number of outstanding Shares of the Company and the overall number of stock options

and RSUs held by each individual optionee relative to the number of stock options and RSUs that are available under the Option Plan and

RSU Plan in determining whether to make any new grants of stock options and RSUs and the size of such grants. The granting of specific

options and share units to Named Executive Officers are generally reviewed by the Compensation Committee for recommendation to the Board

for final approval. To date, the Compensation Committee has not recommended the grant of any RSUs to Named Executive Officers or directors

of the Company.

Performance

Analysis

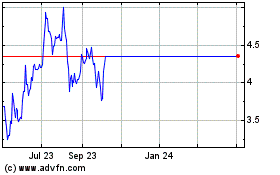

The

following graph compares the yearly change in the cumulative total shareholder return for the Company’s five most recently completed

financial years, assuming an investment of C$100 was made on January 1, 2019 in the Shares, with the cumulative total return of the S&P/TSX

Composite Index for the comparable period.

The

trend in the Company’s share price shown in the above graph corresponds approximately to the Company’s compensation to its

Named Executive Officers during the same periods.

The

Compensation Committee reviews and recommends to the Board the remuneration of the Company’s Named Executive Officers. The Compensation

Committee’s recommendations are based on a number of factors, including the Company’s performance as measured by the advancement

of business objectives, which performance is not necessarily reflected in the trading price of the Shares on the Toronto Stock Exchange

(the “TSX”). See “Compensation Discussion and Analysis” above. The trading price of the Shares

on the TSX is subject to fluctuation based on a number of factors, many of which are outside the control of the Company. These include,

but are not limited to, fluctuations and volatility in commodity prices for crude oil, natural gas and natural gas liquids, fluctuations

and volatility in foreign exchange rates, global economic conditions, changes in government, environmental policies, legislation and

royalty regimes, and other factors, some of which are disclosed and discussed under the heading “Principal Business Risks”

in the Company’s most recently filed annual and interim Management’s Discussion and Analysis and under the heading “Risk

Factors” in the most recently filed Annual Information Form of the Company, all of which are available for viewing under the Company’s

profile on SEDAR+ at www.sedarplus.ca.

Compensation

Governance

The

Company’s executive compensation program is administered by the Compensation Committee, which is currently comprised solely of

independent directors. The current members of the Compensation Committee are Evan S. Templeton, David Neuhauser and Leslie O’Connor.

Each member of the Compensation Committee is independent, as defined by applicable securities legislation, and is experienced in dealing

with compensation matters by virtue of having previously held senior executive or similar positions requiring such individuals to be

directly involved in establishing compensation philosophy and policies and in determining overall compensation of executives.

As

part of its mandate, the Compensation Committee reviews and recommends to the Board the remuneration of the Company’s senior executive

officers. The Compensation Committee is also responsible for reviewing the Company’s compensation policies and guidelines generally.

During 2023, the Compensation Committee held four (4) formal meetings and several informal meetings to address compensation matters including

matters relating to hiring decisions and option awards.

The

Compensation Committee has a written mandate that sets out the Compensation Committee’s structure, operations, and responsibilities.

Among other things, the mandate requires the Board to appoint to the Compensation Committee three or more directors who meet the independence

and experience requirements of applicable securities laws and stock exchange policies, as determined by the Board. The chair of the Compensation

Committee may be designated by the Board or, if it does not do so, the members of the Compensation Committee may elect a chair by majority

vote. Decisions at Committee meetings are decided by a majority of votes cast. The mandate also grants the Compensation Committee access

to officers, employees and information of the Company and the authority to engage independent counsel and advisors as it deems necessary

to perform its duties and responsibilities. The mandate of the Compensation Committee is described under “Corporate Governance

Practices - Compensation of Directors and the Chief Executive Officer”.

Summary

Compensation Table

The

following table (presented in accordance with National Instrument Form 51-102F6 Statement of Executive Compensation) sets forth

all annual and long-term compensation for services in all capacities to the Company for the three most recently completed financial years

of the Company in respect of the following individuals (each, a “Named Executive Officer” or “NEO”):

| (a) | each

individual who acted as CEO or CFO for all or any portion of the most recently completed

financial year, |

| | |

| (b) | each

of the three most highly compensated executive officers, or the three most highly compensated

individuals acting in a similar capacity, (other than the CEO and the CFO), whose total compensation

was, individually, more than $150,000 for the most recently completed financial year, and |

| | |

| (c) | any

individual who would have satisfied these criteria but for the fact that the individual was

neither an executive officer of the Company, nor acting in a similar capacity, at the end

of the most recently completed financial year. |

| | |

| | |

| | |

| | |

| | |

Non-Equity

Incentive Plan Compensation | | |

| | |

| | |

| |

| Name

and Principal Position | |

Year | | |

Salary

($) | | |

Share

Based Awards(1)

($) | | |

Option-

Based Awards (2)(3) ($) | | |

Annual

Incentive Plans(4)

($) | | |

Long-Term

Incentive Plans ($) | | |

Pension

Value ($) | | |

All

Other Comp- ensation(5)

($) | | |

Total

Comp- ensation

($) | |

Wolf

Regener(5) | |

| 2023 | | |

| 440,000 | | |

| Nil | | |

| Nil | | |

| Nil | | |

| Nil | | |

| Nil | | |

| Nil | | |

| 440,000 | |

| President

and Chief | |

| 2022 | | |

| 346,500 | | |

$ | 167,600 | | |

| 327,000 | | |

| 350,000 | | |

| Nil | | |

| Nil | | |

| Nil | | |

| 1,191,100 | |

| Executive

Officer | |

| 2021 | | |

| 313,000 | | |

| Nil | | |

| Nil | | |

| Nil | | |

| Nil | | |

| Nil | | |

| Nil | | |

| 313,000 | |

Gary

Johnson | |

| 2023 | | |

| 315,000 | | |

| Nil | | |

| Nil | | |

| Nil | | |

| Nil | | |

| Nil | | |

| Nil | | |

| 315,000 | |

| Chief

Financial | |

| 2022 | | |

| 273,700 | | |

$ | 68,400 | | |

| 141,700 | | |

| 185,000 | | |

| Nil | | |

| Nil | | |

| Nil | | |

| 668,800 | |

| Officer

and Vice President | |

| 2021 | | |

| 247,200 | | |

| Nil | | |

| Nil | | |

| Nil | | |

| Nil | | |

| Nil | | |

| Nil | | |

| 247,200 | |

| (1) | Represents

RSUs, with each RSU entitling the holder to acquire one Share when vested. The value of share-based

awards was determined using the Share price on the date of grant which is reported in Canadian

dollars. All amounts above are in US$, calculated using the currency rates in effect on the

date of grant. The RSUs were granted in April 2023 but were earned in 2022. |

| |

Wolf

Regener: |

In April

2023, Mr. Regener was granted 41,900 RSUs at C$5.38. |

| |

|

|

| |

Gary

Johnson: |

In April

2023, Mr. Johnson was granted 17,100 RSUs at C$5.38. |

| (2) | Represents

options to purchase Shares of the Company, with each option upon exercise entitling the holder

to acquire one Share. The grant date fair value has been calculated in accordance with Section

3870 of the CICA Handbook. The value of option-based awards was determined using the Black-Scholes

option pricing model. These options were granted, and the Company’s Share trading price

is reported in, Canadian dollars. All amounts above are in US$, calculated using the currency

rates in effect on the date of grant. |

| |

Wolf

Regener: |

Mr.

Regener was granted option awards in January 2022 and April 2023. The options granted in April 2023 were earned in 2022. The value

of the January 2022 option-based awards, using the Black-Scholes option pricing model, was 135,000 Shares at C$0.70. The options were

granted at an exercise price of C$0.80. Key additional weighted average assumptions used were: (i) the risk free interest rate, which

was 1.56%; (ii) current time to expiration of the option which was assumed to be 5 years; and (iii) the volatility for the Shares on

the TSX, which was 150%. The value of the April 2023 option-based awards, using the Black-Scholes option pricing model, was 67,700

Shares at C$5.00. The options were granted at an exercise price of C$5.23. Key additional weighted average assumptions used were: (i)

the risk free interest rate, which was 2.89%; (ii) current time to expiration of the option which was assumed to be 10 years; and (iii)

the volatility for the Shares on the TSX, which was 110%. |

| |

Gary

Johnson: |

Mr.

Johnson was granted option awards in January 2022 and April 2023. The options granted in April 2023 were earned in 2022. The value

of the January 2022 option-based awards, using the Black-Scholes option pricing model, was 70,000 Shares at C$0.70. The options were

granted at an exercise price of C$0.80. Key additional weighted average assumptions used were: (i) the risk free interest rate, which

was 1.56%; (ii) current time to expiration of the option which was assumed to be 5 years; and (iii) the volatility for the Shares on

the TSX, which was 150%. The value of the April 2023 option-based awards, using the Black-Scholes option pricing model, was 27,600

Shares at C$5.00. The options were granted at an exercise price of C$5.23. Key additional weighted average assumptions used were: (i)

the risk free interest rate, which was 2.89%; (ii) current time to expiration of the option which was assumed to be 10 years; and (iii)

the volatility for the Shares on the TSX, which was 110%. |

| (3) | The

actual value of the options granted to the Named Executive Officers will be determined based

on the market price of the Shares at the time of exercise of such options, which may be greater

or less than grant date fair value reflected in the table above. See “Outstanding

Share- Based and Option-Based Awards - Named Executive Officers”. |

| (4) | Annual

Incentive Plan amounts represent discretionary cash bonuses earned in the year noted but

paid in the following year. See “Compensation Discussion and Analysis”. |

| (5) | “Nil”

indicates perquisites and other personal benefits did not exceed C$50,000 or 10 percent of

the total of the annual salary of the Named Executive Officer during the reporting period.

“All Other Compensation” includes perquisites and other benefits including vehicle

allowance, parking, life insurance premiums and club membership fees. |

Outstanding

Share-Based Awards and Option-Based Awards - Named Executive Officers

The

following table sets forth information with respect to all outstanding stock options granted under the Option Plan and all outstanding

RSUs under the RSU Plan to the Named Executive Officers, as at December 31, 2023.

| | |

Option-Based

Awards | | |

Share-based

Awards | |

| | |

Number

of Securities Underlying Unexercised Options (#)(1) | | |

Option

Exercise Price (US$(2)/C$) | | |

Option

Expiration Date | | |

Value

of Unexercised In-the-Money Options

(US$/C$)(3) | | |

Number

of shares or units of shares that have not vested (#) | | |

Market

or payout value of share-based awards that have not vested

(US$/C$)(3) | | |

Market

or payout value of vested share- based awards not paid out or distributed

(s) | |

| Wolf

Regener | |

| 135,000 | | |

| 0.60/0.80 | | |

| January

13, 2027 | | |

| 438,100/579,200 | | |

| Nil | | |

| Nil | | |

| Nil | |

| | |

| 67,700 | | |

| 3.95/5.23 | | |

| April

12, 2033 | | |

| Nil/Nil | | |

| Nil | | |

| Nil | | |

| Nil | |

| | |

| Nil | | |

| Nil | | |

| Nil | | |

| Nil/Nil | | |

| 41,900 | | |

| 161,300/213,300 | | |

| Nil | |

| Gary

Johnson | |

| 70,000 | | |

| 0.60/0.80 | | |

| January

13, 2027 | | |

| 227,100/300,300 | | |

| Nil | | |

| Nil | | |

| Nil | |

| | |

| 27,600 | | |

| 3.95/5.23 | | |

| April

12, 2033 | | |

| Nil/Nil | | |

| Nil | | |

| Nil | | |

| Nil | |

| | |

| Nil | | |

| Nil | | |

| Nil | | |

| Nil/Nil | | |

| 17,100 | | |

| 65,800/87,000 | | |

| Nil | |

| (1) | Options

granted to Named Executive Officers are typically subject to vesting on the basis that one-third

of the number granted vest on the date of grant, a further one-third vest on the first anniversary

of the date of grant and the remaining third vest on the second anniversary of the date of

grant. |

| (2) | These

options were granted, and the Company’s Share trading price is reported, in Canadian

dollars. On December 29, 2023, the last trading day of the financial year, the exchange rate

as reported by the Bank of Canada was US$0.75613 = C$1.00. |

| (3) | Calculated

based on the closing price of the Company’s Shares of C$5.09 (US$3.85) on December

29, 2023, the last trading day of the financial year. |

Incentive

Plan Awards – Value Vested or Earned During the Year

The

following table sets forth information in respect of the value of awards under the Option Plan and the RSU Plan to the Named Executive

Officers of the Company that vested during the period ending December 31, 2023 and bonuses awarded to Named Executive Officers, for the

financial year ending December 31, 2023.

| | |

Option-Based

Awards - | | |

| | |

Non-Equity

Incentive Plan | |

| |

Value

Vested During Year (1)(2) | | |

Share-Based

Awards -Value Vested During Year | | |

Compensation-

Value Earned During Year | |

| Name | |

(US$/C$) | | |

(C$) | | |

(US$) | |

| Wolf

Regener | |

| 193,800/259,700 | | |

| N/A | | |

| Nil | |

| Gary

Johnson | |

| 100,500/134,600 | | |

| N/A | | |

| Nil | |

| (1) | This

amount is the dollar value that would have been realized if the options held by such individual

had been exercised on the vesting date(s). This amount is computed by obtaining the difference

between the market price of the underlying securities at exercise and the exercise or base

price of the options under the option-based award on the vesting date. |

| (2) | This

amount is the dollar value realized computed by multiplying the number of Shares by the market

value of the underlying shares on the vesting date. |

Additional

information regarding the significant terms of the Company’s Option Plan and the Company’s RSU Plan is provided under “Stock

Option Plan” and “RSU Plan” below.

Pension

Plan Benefits

The

Company has not established a pension plan for the benefit of its executive officers that provides for payments or benefits at, following,

or in connection with retirement.

Deferred

Compensation Plans

The

Company does not have any deferred compensation plans relating to a Named Executive Officer.

Compensation

Recovery Policy

In

November 2023, the Board approved the adoption of a compensation recovery policy (the “Compensation Recovery Policy”)

that complies with Rule 10D-1 under the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”), and related

Listing Rules of the Nasdaq Stock Market LLC (the “Nasdaq Stock Market Rules”). Under the Compensation Recovery Policy,

if the Company restates its financial results due to its material non-compliance with financial reporting requirements under applicable

securities laws, it must recover, form any current or former executive officers, certain incentive- based compensation that was received

by such executive officers during the three years preceding the date that such restatement was determined to be required. The recoverable

amount would be the amount of incentive-based compensation received in excess of the amount that would otherwise have been received had

it been determined based on the restated financial measure.

Employment

Agreements and Termination and Change of Control Benefits

Wolf

Regener is employed by the Company as President and Chief Executive Officer. His base salary for 2023 was $440,000 per annum and his

annual cash bonus that was paid in 2023 but earned in 2022 was $350,000. His employment contract provides for a severance payment upon

termination of his employment either (a) without cause, or (b) on a “Change of Control”, being an event resulting in new

persons possessing more than 50% of the voting power of the Company or any successor company, and where one of the following circumstances

occurs within twenty-four (24) months of such event: (i) he is terminated without cause; (ii) his working location is transferred to

a location more than fifty (50) miles from the Company’s current place of business in Newbury Park, California; (iii) he is demoted

to a position of lesser seniority or authority; or (iv) his base salary is reduced to an annual amount at least 25% less than his base

salary prior to the acquisition (together, the “triggering events”). Upon occurrence of either of these events, the

Company will pay Mr. Regener a severance payment in the amount of twenty-four (24) months’ pay calculated on the basis of his base

salary at the time of his termination, payable in accordance with the Company’s standard payroll schedule. The Company will also

reimburse his health care premiums for twenty-four (24) months of medical benefits. In the event of the termination of his employment

upon either of the above events, all stock options then held by him will immediately vest and will remain exercisable until the earlier

of the expiry date of the said options and the date which is twenty-four (24) months immediately following the date upon which such notice

of termination is delivered by the Company. Assuming a triggering event took place on December 31, 2023, the incremental payments, payables

and benefits that Mr. Regener would be entitled to are $880,000 plus approximately $141,700 in benefits (amount of premiums and vacation

pay). Mr. Regener would also be entitled to the amount of any bonus awarded but not then paid.

Gary

Johnson is employed by the Company as Chief Financial Officer and Vice President. His base salary in 2023 was $315,000 per annum and

his annual cash bonus that was paid in 2023 but earned in 2022 was $185,000. If Mr. Johnson’s employment agreement is terminated

without cause or upon a Change of Control (which is defined, in this instance, as an event in which a person or group acquires more than

50% of the Company’s outstanding capital stock, the sale of all or substantially all of the assets of the Company, or the removal

of more than 50% of the then incumbent directors of the Company or the election of a majority of members of the board who were not nominees

of the Company’s incumbent board at the time immediately preceding such election, and where one of the following occurs within

twelve (12) months of such event: (i) his working location is transferred to a location more than fifty (50) miles from the Company’s

current place of business in Newbury Park, California; (ii) there is a material diminution in his authorities, duties or responsibilities;

or (iii) his gross base salary is reduced by at least 10%) his employment contract entitles him, in addition to his final pay and benefits

and accrued paid time off through the last date of employment, to the following payments upon termination: a severance payment of twelve

(12) months’ pay calculated on the basis of his base salary at the time of his termination, payable in accordance with the Company’s

standard payroll schedule and reimbursement for group health coverage for twelve (12) months. In addition, under the Company’s

stock option plan, in the event of Change of Control all stock options then held will immediately vest and, in the event of a termination

without cause, all stock options will remain exercisable until the earlier of the expiry date and the date which is ninety (90) days

immediately following the date upon which such notice of termination is delivered by the Company. Assuming a termination without cause

or a Change of Control took place on December 31, 2023, the incremental payments, payables and benefits that Mr. Johnson would be entitled

to as at such date is $315,000 plus approximately $75,200 in benefits (vacation pay and medical benefits). Mr. Johnson would also be

entitled to any bonus awarded and not then paid.

The

Company’s Option Plan agreements, including those agreements with the Named Executive Officers, contain a provision that if a Change

of Control occurs, all option shares subject to outstanding options will become vested, whereupon such options may be exercised in whole

or in part subject to the approval of the TSX, if necessary.

Compensation

of Directors

For

the financial year ended December 31, 2023, the directors received the following fees: (i) a US$45,000 annual board fee to be paid to

the directors of the Company (effective June 2023), (ii) an additional US$15,000 fee for the Chair of the board of directors, and (iii)

an additional US$10,000 for the Audit Committee Chair, US$7,500 for the Compensation Committee Chair and US$5,000 fee for the Chairs

of the other committees of the board of directors, which is payable in four equal payments at the commencement of each fiscal quarter.

In addition, Special Committee members are paid US$1,500 per month for the number of months that the Special Committee is active. No

bonuses were paid by the Company to its directors for the year ended December 31, 2023.

The

following table sets forth the compensation paid to the directors who are not also NEOs for the Company’s most recently completed

financial year:

| Director

Name | |

Fees

Earned(1)

($) | | |

Share-

Based Awards

($) | | |

Option-

Based Awards(3)

($) | | |

Non-Equity

Incentive Plan Compensation

($) | |

Pension

Value

($) | | |

All

Other Compensation

($) | |

Total

($) | |

| David

Neuhauser | |

$ | 74,900 | | |

| Nil | | |

| Nil | | |

Nil | |

| Nil | | |

Nil | |

$ | 74,900 | |

| Eric

Brown | |

$ | 72,600 | | |

| Nil | | |

| Nil | | |

Nil | |

| Nil | | |

Nil | |

$ | 72,600 | |

| Leslie

O’Connor | |

$ | 51,900 | | |

| Nil | | |

| Nil | | |

Nil | |

| Nil | | |

Nil | |

$ | 51,900 | |

| Evan

S. Templeton | |

$ | 50,100 | | |

| Nil | | |

| Nil | | |

Nil | |

| Nil | | |

Nil | |

$ | 50,100 | |

| Douglas

C. Urch(2) | |

$ | 11,300 | | |

| Nil | | |

$ | 282,000 | | |

Nil | |

| Nil | | |

Nil | |

$ | 293,300 | |

| (1) | All

amounts above are in US$. Special Committee members are paid US$1,500 per month for the number

of months that the Special Committee is active. |

| (2) | Douglas

C. Urch was appointed a director of the Company on October 18, 2023. |

| (3) | Represents

options to purchase Shares of the Company, with each option upon exercise entitling the holder

to acquire one Share. The grant date fair value has been calculated in accordance with Section

3870 of the CICA Handbook. The value of option-based awards was determined using the Black-Scholes

option pricing model. These options were granted, and the Company’s Share trading price

is reported in, Canadian dollars. All amounts above are in US$, calculated using the currency

rates in effect on the date of grant. |

| |

Doug

Urch: |

In

2023, the value of option-based awards, using the Black-Scholes option pricing model, was 75,000 Shares at C$5.34. The options were

granted at an exercise price of C$6.04. Key additional weighted average assumptions used were: (i) the risk free interest rate, which

was 4.01%; (ii) current time to expiration of the option which was assumed to be 10 years; and (iii) the volatility for the Shares

on the TSX, which was 93%. |

The

compensation of Mr. Regener, who is both a director and a Named Executive Officer, is disclosed in the sections above.

Outstanding

Share-Based Awards and Option-Based Awards – Directors

The

following table sets forth information with respect to all outstanding share-based and option-based awards to directors who are not Named

Executive Officers as at December 31, 2023.

| Option-based

Awards | | |

Share-based

Awards |

| Name | |

Number

of Securities Underlying Unexercised Options (#)(1) | | |

Option

Exercise Price (US$(2)/C$) | | |

Option

Expiration Date | |

Value

of Unexercised In-the-Money Options(3) (US$(2)/C$) | | |

Number

of shares or units of shares that have not vested (#) | | |

Market

or payout value of share- based awards that have not vested(3) (US$/C$) | | |

Market

or payout value of vested share- based awards not paid out or distributed (s) |

| David

Neuhauser | |

| 95,000 | | |

| 0.60/0.80 | | |

January

13,

2027 | |

| 308,200/407,600 | | |

| Nil | | |

| Nil | | |

Nil |

| | |

| Nil | | |

| Nil | | |

Nil | |

| Nil | | |

| 11,785 | | |

| 45,400/60,000 | | |

Nil |

| Eric

Brown | |

| 75,000 | | |

| 0.60/0.80 | | |

January

13,

2027 | |

| 243,300/321,800 | | |

| Nil | | |

| Nil | | |

Nil |

| | |

| Nil | | |

| Nil | | |

Nil | |

| Nil | | |

| 11,785 | | |

| 45,400/60,000 | | |

Nil |

| Leslie

O’Connor | |

| 75,000 | | |

| 0.60/0.80 | | |

January

13,

2027 | |

| 243,300/321,800 | | |

| Nil | | |

| Nil | | |

Nil |

| | |

| Nil | | |

| Nil | | |

Nil | |

| Nil | | |

| 11,785 | | |

| 45,400/60,000 | | |

Nil |

| Evan

S. Templeton | |

| 75,000 | | |

| 1.43/1.89 | | |

July

18,

2027 | |

| 77,200/240,00 | | |

| Nil | | |

| Nil | | |

Nil |

| | |

| Nil | | |

| Nil | | |

Nil | |

| Nil | | |

| 11,785 | | |

| 45,400/60,000 | | |

Nil |

Douglas

C. Urch(4) | |

| 75,000 | | |

| 4.57/6.04 | | |

October

24, 2033 | |

| Nil/Nil | | |

| Nil | | |

| Nil | | |

Nil |

| (1) | Options

granted to directors are typically subject to vesting on the basis that one-third of the

number granted vest on the date of grant, a further one-third vest on the first anniversary

of the date of grant and the remaining third vest on the second anniversary of the date of

grant. |

| (2) | These

options were granted, and the Company’s Share trading price is reported, in Canadian

dollars. On December 29, 2023, the last trading day of the financial year, the exchange rate

as reported by the Bank of Canada was US$0.75613 = C$1.00. |

| (3) | Calculated

based on the closing price of the Company’s Shares of C$5.09 (US$3.85) on December

29, 2023, the last trading day of the financial year. |

| (4) | Douglas

C. Urch was appointed a director of the Company on October 18, 2023 |

Incentive

Plan Awards – Value Vested or Earned During the Year

The

following table sets forth information in respect of the value of awards under the Option Plan and the RSU Plan to directors that vested

during the period ending December 31, 2023 and bonuses awarded to directors, for the financial year ending December 31, 2023.

| | |

Option-Based

Awards - | | |

Share-Based

Awards - | |

Non-Equity

Incentive Plan Compensation- |

| | |

Value

Vested During Year(1)(2) | | |

Value

Vested During Year(3) | |

Value

Earned

During Year |

| Name | |

(US$/C$) | | |

(US$/C$) | |

(US$/C$) |

| David

Neuhauser | |

| 136,400/182,700 | | |

N/A | |

Nil/Nil |

| Eric

Brown | |

| 107,700/144,300 | | |

N/A | |

Nil/Nil |

| Leslie

O’Connor | |

| 107,700/144,300 | | |

N/A | |

Nil/Nil |

| Evan

S. Templeton | |

| 78,600/103,500 | | |

N/A | |

Nil/Nil |

| Douglas

C. Urch | |

| Nil/Nil | | |

N/A | |

Nil/Nil |

| (1) | This

amount is the dollar value that would have been realized if the options held by such individual

had been exercised on the vesting date(s). This amount is computed by obtaining the difference

between the market price of the underlying securities at exercise and the exercise or base

price of the options under the option-based award on the vesting date. |

| (2) | The

actual value of the options granted to the director will be determined based on the market

price of the Shares at the time of exercise of such options, which may be greater or less

than the value at the date of vesting reflected in the table above. |

| (3) | This

amount is the dollar value realized computed by multiplying the number of Shares by the market

value of the underlying shares on the vesting date. |

Stock

Ownership Policy

In

June 2023, the Board, on the recommendation of the Compensation Committee, approved a stock ownership policy (the “Stock Ownership

Policy”) which applies to any non-executive director of the Company. The Stock Ownership Policy states that the non-executive

directors should own Shares which have a fair market value equal to three (3) times the annual cash retainer paid to such director in

their capacity as a member of the Board.

The

following may be used in determining Share ownership: (i) Shares beneficially owned, or controlled or directed, directly or indirectly

(including through open market purchases or acquired and held upon vesting of the Company equity awards); (ii) Shares owned jointly or

separately by the individual’s spouse;

(iii)

Shares held in trust for the benefit of the individual, the individual’s spouse and/or children; and (iv) RSUs, whether vested

or not vested. Unexercised stock options, whether vested or not vested, do not count towards Share ownership under the Stock Ownership

Policy.

The

Stock Ownership Policy is expected to be satisfied by each non-executive director within five (5) years after such non-executive director

becoming subject to the Stock Ownership Policy.

The

Compensation Committee has the discretion to enforce the Stock Ownership Policy on a case-by-case basis. The Compensation Committee will

evaluate whether exceptions from the Stock Ownership Policy should be made in the case of any Director who, due to his or her unique

financial circumstances, would incur a hardship by complying with the Stock Ownership Policy.

The

following table outlines the Share ownership of each of the directors covered by the Stock Ownership Policy as of December 31, 2023:

| Name | |

Equity

Ownership as December 31, 2023 | | |

Total

Equity(1) (US$) | | |

Share

Ownership Requirement (US$) | | |

Meets

Share Ownership Guidelines | |

Date

to Meet Requirements By |

| |

Shares | | |

RSUs | | |

| | |

| |

|

| David

Neuhauser | |

| 5,521,071 | | |

| 11,785 | | |

$ | 21,301,500 | | |

$ | 135,000 | | |

Yes | |

June

6, 2028 |

| Eric

Brown | |

| 53,462 | | |

| 11,785 | | |

$ | 251,200 | | |

$ | 135,000 | | |

Yes | |

June

6, 2028 |

| Leslie

O’Connor | |

| 3,859 | | |

| 11,785 | | |

$ | 60,200 | | |

$ | 135,000 | | |

No | |

June

6, 2028 |

| Evan

S. Templeton | |

| 8,850 | | |

| 11,785 | | |

$ | 79,400 | | |

$ | 135,000 | | |

No | |

June

6, 2028 |

| Douglas

C. Urch | |

| 6,000 | | |

| Nil | | |

$ | 23,100 | | |

$ | 135,000 | | |

No | |

October

18,

2028 |

| (1) |

Calculated based on the closing price of the Company’s

Shares of C$5.09 (US$3.85) on December 29, 2023, the last trading day of the financial year. |

INTEREST

OF CERTAIN PERSONS IN MATTERS TO BE ACTED UPON

Except

as set out herein, no person who has been a director or executive officer of the Company at any time since the beginning of the Company’s

last financial year, no proposed nominee of management of the Company for election as a director of the Company and no associate or affiliate

of the foregoing persons, has any material interest, direct or indirect, by way of beneficial ownership or otherwise, in matters to be

acted upon at the Meeting other than the election of directors and the matters described under “Particulars Of Other Matters To

Be Acted Upon” in this Information Circular.

INTEREST

OF INFORMED PERSONS IN MATERIAL TRANSACTIONS

Management

of the Company is not aware of any material interest, direct or indirect, of any director or officer of the Company, any person or company

who beneficially owns, controls or directs, directly or indirectly, more than 10 percent of the Company’s voting securities, or

any associate or affiliate of such person in any transaction since January 1, 2023 or in any proposed transaction which in either case

has materially affected or will materially affect the Company or its subsidiaries.

MANAGEMENT

CONTRACTS

No

management functions of the Company or any subsidiaries are performed to any substantial degree by a person other than the directors

or executive officers of the Company at any time since the start of the Company’s most recent completed financial year.

INDEBTEDNESS

OF DIRECTORS AND EXECUTIVE OFFICERS

At

no time since the beginning of the year ended December 31, 2023 has there been any indebtedness of any director or officer, or any associate

of any such director or officer, to the Company or to any other entity which is, or at any time has been, the subject of a guarantee,

support agreement, letter of credit or other similar arrangement or understanding provided by the Company.

SECURITIES

AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLANS

The

following table sets forth information, as at the end of the most recently completed financial year, with respect to the Company’s

compensation plans under which equity securities are authorized for issuance.

| Plan

Category | |

Number

of Shares to be issued upon exercise of outstanding options, warrants or rights (a)(1) | | |

Weighted-average

exercise price of outstanding options,

warrants or rights (b) (US$) | | |

Number

of Shares remaining available for future issuance under equity compensation plans (excluding

securities reflected in column (a)) (2) (c) | |

| Equity

compensation plans approved by security holders | |

| 1,058,774 | | |

| 2.52 | | |

| 2,503,784 | |

| Equity

compensation plans not approved by security holders | |

| Nil | | |

| Nil | | |

| Nil | |

| Total | |

| 1,058,774 | | |

| 2.52 | | |

| 2,503,784 | |

| (1) | Incentive

stock options and RSUs are the only compensation arrangement in respect of which equity securities

of the Company are currently authorized for issuance. As of December 31, 2023, there were

no incentive warrants outstanding. |

| | |

| (2) | Represents

the number of Shares remaining available for future issuance under stock options available

for grant as of December 31, 2023 under the Option Plan. The maximum number of Shares which

may be issued pursuant to options granted under the Plan is 10% of the issued and outstanding

Shares at the time of grant. Any awards granted under the RSU Plan will reduce the number

of Shares remaining available for future issuance under the Option Plan. |

STOCK

OPTION PLAN

The

Company’s Option Plan was adopted in 2008 and approved by the shareholders on May 27, 2009. The Option Plan governs the issuance

of stock options to directors, officers, employees, management company employees (as defined in the Option Plan), and consultants and

service providers of the Company and its subsidiaries that are retained by the Company and its subsidiaries, (the “Eligible

Participants”). The purpose of the Plan is to give to Eligible Participants, as additional compensation, the opportunity to

participate in the success of the Company by granting to such individuals options, exercisable over periods of up to ten (10) years as

determined by the board of directors of the Company, to buy shares of the Company at a price not less than the market price at the time

of grant.

The

directors approved amendments to the Option Plan on May 15, 2019 to facilitate the administration of the Option Plan, including cashless