0000875355false--12-31FY2023truefalsefalse0.010.0157140001797000174300000009.600.000000677000P5Y00008753552023-01-012023-12-310000875355ldwy:AcquisitionOfBloomiaBVMemberus-gaap:SubsequentEventMember2024-02-012024-02-220000875355ldwy:CreditAgreementMemberus-gaap:SubsequentEventMember2024-06-300000875355ldwy:CreditAgreementMember2023-01-012023-12-310000875355ldwy:CreditAgreementMember2023-12-310000875355ldwy:AcquisitionOfBloomiaBVMember2023-12-310000875355ldwy:AcquisitionOfBloomiaBVMember2023-01-012023-12-310000875355us-gaap:RepurchaseAgreementsMember2023-01-012023-12-310000875355us-gaap:RepurchaseAgreementsMembersrt:BoardOfDirectorsChairmanMember2023-08-280000875355us-gaap:StateAndLocalJurisdictionMember2023-12-310000875355us-gaap:DomesticCountryMember2023-12-3100008753552020-12-310000875355us-gaap:EmployeeStockMember2023-12-310000875355us-gaap:EmployeeStockMember2022-01-012022-12-310000875355us-gaap:EmployeeStockMember2023-01-012023-12-310000875355us-gaap:RestrictedStockUnitsRSUMember2022-08-012022-08-310000875355us-gaap:RestrictedStockUnitsRSUMember2023-12-310000875355ldwy:ExercisePriceRangeOneMember2023-01-012023-12-310000875355ldwy:ExercisePriceRangeOneMember2023-12-310000875355ldwy:OtherMember2023-01-012023-12-310000875355ldwy:OtherMember2022-01-012022-12-310000875355ldwy:CorporateHeadquartersMember2023-01-012023-12-3100008753552022-01-012022-09-300000875355ldwy:NewsAmericaMember2022-01-012022-09-300000875355ldwy:NewsAmericaMember2022-07-0100008753552023-08-0300008753552024-02-012024-02-220000875355srt:MaximumMemberus-gaap:LeaseholdImprovementsMember2023-01-012023-12-310000875355srt:MinimumMemberus-gaap:LeaseholdImprovementsMember2023-01-012023-12-310000875355srt:MaximumMemberldwy:ComputerEquipmentAndSoftwareMember2023-01-012023-12-310000875355srt:MinimumMemberldwy:ComputerEquipmentAndSoftwareMember2023-01-012023-12-310000875355srt:MaximumMemberus-gaap:FurnitureAndFixturesMember2023-01-012023-12-310000875355srt:MinimumMemberus-gaap:FurnitureAndFixturesMember2023-01-012023-12-310000875355us-gaap:RetainedEarningsMember2023-12-310000875355us-gaap:AdditionalPaidInCapitalMember2023-12-310000875355us-gaap:CommonStockMember2023-12-310000875355us-gaap:RetainedEarningsMember2023-01-012023-12-310000875355us-gaap:AdditionalPaidInCapitalMember2023-01-012023-12-310000875355us-gaap:CommonStockMember2023-01-012023-12-310000875355us-gaap:RetainedEarningsMember2022-12-310000875355us-gaap:AdditionalPaidInCapitalMember2022-12-310000875355us-gaap:CommonStockMember2022-12-310000875355us-gaap:RetainedEarningsMember2022-01-012022-12-310000875355us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310000875355us-gaap:CommonStockMember2022-01-012022-12-3100008753552021-12-310000875355us-gaap:RetainedEarningsMember2021-12-310000875355us-gaap:AdditionalPaidInCapitalMember2021-12-310000875355us-gaap:CommonStockMember2021-12-3100008753552022-01-012022-12-3100008753552022-12-3100008753552023-12-3100008753552024-03-2700008753552023-06-30iso4217:USDxbrli:sharesiso4217:USDxbrli:sharesxbrli:pure

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2023 | | Commission File Number 001-13471 |

LENDWAY, INC. |

(Exact name of registrant as specified in its charter) |

Delaware | | 41-1656308 |

(State or other jurisdiction of incorporation or organization) | | (IRS Employer Identification No.) |

5000 West 36th Street, Suite 220, Minneapolis, MN 55416 |

(Address of principal executive offices; zip code) |

(763) 392-6200 |

(Registrant’s telephone number, including area code) |

Insignia Systems, Inc.; 212 Third Avenue N, Suite 356, Minneapolis, MN 55401 |

(Former name, former address and former fiscal year, if changed since last report) |

Securities Registered Pursuant to Section 12(b) of the Act:

Title of each class | | Trading Symbol | | Name of each exchange on which registered |

Common Stock, $0.01 par value | | LDWY | | The Nasdaq Stock Market LLC |

Securities Registered Pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☐ | Accelerated filer | ☐ |

Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant as of the last business day of the registrant’s most recently completed second fiscal quarter (June 30, 2023) was approximately $4,692,000 based upon the price of the registrant’s Common Stock on such date.

Number of shares outstanding of Common Stock, $0.01 par value, as of March 27, 2024 was 1,742,599.

DOCUMENTS INCORPORATED BY REFERENCE:

Portions of the registrant’s definitive proxy statement for its 2024 Annual Meeting of Stockholders are incorporated by reference into Part III of this Annual Report on Form 10-K where indicated. Such proxy statement will be filed with the U.S. Securities and Exchange Commission within 120 days after the end of the fiscal year to which this report relates.

TABLE OF CONTENTS

PART I.

Item 1. Business

General

This Annual Report on Form 10-K is being filed by the registrant, Lendway, Inc. (“Lendway,” “we,” “us,” “our” and the “Company”), a Delaware corporation. Effective August 4, 2023, we changed our name from “Insignia Systems, Inc.” and reincorporated from Minnesota to Delaware. As part of the name change, our common stock now trades under the symbol “LDWY” on The Nasdaq Stock Market LLC.

The Company has evolved into a specialty agricultural (“ag”) and finance company focused on making and managing its ag investments in the United States (“U.S.”) and internationally. The Company is the majority owner of Bloomia B.V. and its affiliated entities, representing a significant producer of fresh cut tulips (“stems”) in the U.S. The Company also fully owns and operates FarmlandCredit.com, a non-bank lending business that seeks to purchase existing loans and/or originate and fund new loans domestically. During the past twelve months, the Company took three major steps in its evolution.

The Company is building a scalable non-bank lending business (“Lending Business”) to purchase existing loans or originate and fund new loans, all of which will be secured by collateral. Initially, we intend to focus on loans secured by real estate, primarily for agricultural purposes. We expect to expand our product offerings over time as we identify needs and opportunities in the marketplace for loans generally. Our plan, therefore, is to build a portfolio of well-secured loans, with a portion of the credit risk being participated to third parties in most cases, to maintain a low net loss experience and to charge fully compensatory rates and fees.

On August 3, 2023, the Company completed the sale of certain assets and certain liabilities relating to the Company’s legacy business of providing in-store advertising solutions to brands, retailers, shopper marketing agencies and brokerages (the “In-Store Marketing Business”) for a price of $3.5 million, subject to escrows and a post-closing adjustment.

The operations of the In-Store Marketing Business are presented as discontinued operations beginning with the Quarterly Report on Form 10-Q for the three months ended September 30, 2023, the quarter in which the sale of the In-Store Marketing Business met the criteria as discontinued operations. All previous periods presented have been restated to present the In-Store Marketing Business as discontinued operations. See Note 2 to the Consolidated Financial Statements appearing in Part II, Item 8, of this Annual Report on Form 10-K for a further description of the impact of the sale of the In-Store Marketing Business on the consolidated financial statements.

On February 22, 2024, the Company acquired Bloomia B.V. (“Bloomia”) for a price of $47.5 million financed with Company cash, a new credit facility and promissory notes payable to the sellers. Bloomia is one of the largest producers of fresh cut tulips in the United States, nurturing over 75 million stems annually. Bloomia purchases tulip bulbs, hydroponically grows tulips from the bulbs, and sells the stems to retail stores. The Company’s primary focus in the near-term will be on the Bloomia business.

Our internet address is www.lendway.com. We make all reports we file with the Securities and Exchange Commission (“SEC”), including our annual reports on Form 10-K; quarterly reports on Form 10-Q; current reports on Form 8-K; and amendments to those reports, if any, available free of charge on its website, as soon as reasonably practicable after electronically filing such materials with, or furnishing them to the SEC. Our website is not incorporated by reference into this Annual Report on Form 10-K. Copies of reports can also be obtained free of charge by requesting them from Lendway, Inc. Our mailing address is 5000 West 36th Street, Suite 220, Minneapolis, MN 55416; telephone 763-392-6200.

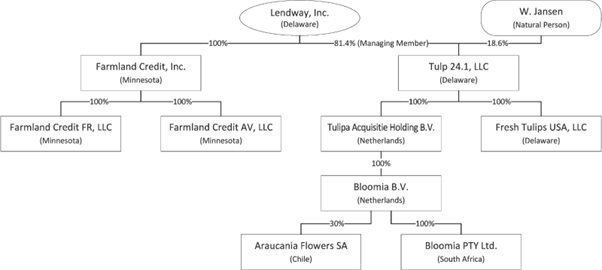

Recent Acquisitions

On February 22, 2024, we completed the acquisition of Bloomia B.V., a private company with limited liability (besloten vennootschap met beperkte aansprakelijkheid) incorporated under the laws of the Netherlands (“Bloomia”). The Acquisition was completed through Tulp 24.1, LLC, a Delaware limited liability company ( “Tulp 24.1”) and Tulipa Acquisitie Holding B.V., a private company with limited liability (besloten vennootschap met beperkte aansprakelijkheid) incorporated under the laws of the Netherlands and a wholly owned subsidiary of Tulp 24.1 ( “Tulipa”, together with Tulp 24.1, the “Purchasers”), pursuant to an Agreement for the Sale and Purchase of Shares (the “Purchase Agreement”) by and among Tulp 24.1, Tulipa, Botman Bloembollen B.V. (“Botman”), W.F. Jansen, who has continued to serve as chief executive officer of Bloomia (“Jansen”), and H.J. Strengers (“Strengers”, together with Botman and Jansen, the “Sellers”) and Lendway, as the Guarantor. Following the Acquisition, Tulp 24.1 became the holder of 100% of the ownership interests of Bloomia. As a result of the acquisition, Lendway holds an 81.4% ownership interest in Tulp 24.1 and Jansen owns the remaining 18.6% ownership interest.

We acquired Bloomia for $47.5 million. The acquisition price was paid with $9.2 million of the Company’s cash, $22.8 million of proceeds from a new credit agreement, and promissory notes payable to the sellers totaling $15.5 million.

We entered into a revolving credit and term loan agreement (the “Credit Agreement”), together with Tulp 24.1 as the borrower. Under the terms of the Credit Agreement, Tulp 24.1 had an $18.0 million term loan funded. The Credit Agreement also contains a $6.0 million revolving credit facility, which may be used by Tulp 24.1 for general business purposes and working capital. The Credit Agreement contains ongoing affirmative and negative covenants that Tulp 24.1 is required to comply with. The Company provided an unsecured guaranty of the obligations of Tulp 24.1 under the Credit Agreement.

The Company acquired Farmland Credit, Inc., a Minnesota corporation (“FCI”), and FCI’s subsidiaries, Farmland Credit FR, LLC and Farmland Credit AV, LLC for a nominal amount from a related party, Air T, Inc., a member of the group that holds 38.9% of Lendway’s outstanding shares. This transaction was part of starting the non-bank lending business discussed below.

The following summarizes the current entity structure of the Company:

Segments

With the February 2024 acquisition of Bloomia, we operate in two industry segments:

| · | Specialty Ag, consisting of the Bloomia business |

| | |

| · | Non-bank Lending, consisting of the Lending Business |

Specialty Ag

Our Specialty Ag segment consists of Bloomia’s operations. Bloomia was founded in the Netherlands and has grown to become a leader in the fresh cut tulip industry in the U.S. Bloomia nurtured over 75 million stems annually in 2023 and 2022. Bloomia operates from three strategically positioned locations in the United States, the Netherlands and South Africa, and also has a 30% interest in a greenhouse business in Chile.

Bloomia operates greenhouses to hydroponically grow tulips at its United States and South Africa locations. Bloomia has invested in automation in its U.S. greenhouse in recent years that has increased production efficiency. Bloomia has historically sourced tulip bulbs from producers in the Netherlands, Chile, and New Zealand, which provides for year-round supply. Bulbs from the Southern Hemisphere are generally used from the end of August to early December, with the Northern Hemisphere produced bulbs used the remainder of the year.

Bloomia has established business relationships with prominent retailers. A small number of mass-market retailers in the U.S. have historically accounted for more than 99% of Bloomia’s total annual sales. Revenues are mainly generated on the East Coast, leaving potential for growth on the West Coast. Bloomia aims to offer premium tulip stems, the result of sourcing larger bulbs, that have a longer shelf life than imported stems. Growing bulbs domestically also allows for higher margins because the freight costs for importing bulbs by sea have been substantially less than the costs associated with importing stems by air.

In the Netherlands, Bloomia’s office facilitates the sourcing of bulbs, conditioning to prepare bulbs for planting, and shipping of bulbs to its United States and South Africa facilities.

In South Africa, Bloomia’s wholly owned subsidiary operates a greenhouse that has produced an average of approximately 3.5 million tulip stems per year over the last five years. The facility is capable of growing tulips hydroponically year-round.

In Chile, Bloomia has a minority ownership interest in Araucania Flowers S.A. (“Araucania”). The operation grows tulips hydroponically year-round. Its growing and production complex consists of about 8,600 square feet of greenhouse, 7,000 cubic feet of cold storage, and more than 2,400 square feet of processing space. Araucania traditionally sells to retailers located in Chile, Bolivia, and Peru.

Customers

Bloomia has well established customer relationships. In the U.S., Bloomia sells stems to some of the largest mass-market retailers. During 2023, Bloomia had approximately 15 customers in the U.S. Of those customers, three individually represented greater than 10% of Bloomia’s revenue, accounting for 37.7%, 16.2%, and 10.4% of its U.S. revenue during the 12 months ended December 31, 2023.

Industry

The estimated market for cut flowers in the United States for 2023 is approximately $8 billion, of which approximately 80% is imported and around 20% is produced within the U.S. Of overall cut flowers sales, approximately 15% is represented by tulip stems. Bloomia believes it has a market share of approximately 20% of the cut tulips grown in the U.S. Barriers to entry are considered high due to the need for high volumes and efficient operations to generate significant profitability.

Seasonality

In the U.S., the tulip industry has historically been highly seasonal due to peak demand between January to May, supported by the Valentine’s Day, Easter, and Mother’s Day holidays, and also because of the tulip bulbs’ growing season in traditional sourcing areas. The tulip market is growing outside of the peak season, as demand increases for other events such as birthdays and weddings. As one of only a few tulip producers in the U.S. with sourcing of bulbs from the Southern Hemisphere, we believe Bloomia is well positioned to fill this growing demand.

Competition

Bloomia competes with both local (U.S.) producers and foreign producers who import cut tulips, primarily from the Netherlands. Bloomia has carved out a strong competitive position amongst U.S. growers by developing unique infrastructure through the combination of hydroponics and an integrated supply chain. Growing tulips in a greenhouse using hydroponics enables year-round production and requires less water and nutrients to grow the stems, and results in tulips that are better quality and have a longer shelf life. By sourcing tulip bulbs from both the Netherlands and the Southern Hemisphere, Bloomia is able to offer quality fresh cut tulips year-round, meeting unmet demand.

Supply Chain

The supply chain steps for U.S. operations are detailed below:

Step 1: Procure bulbs: Purchase bulbs from established suppliers in the Netherlands or Southern Hemisphere.

Step 2: Buffer storage: Bulbs kept in cooled storage in the Netherlands.

Step 3: Shipping to U.S.: Bulbs are shipped via ocean containers.

Step 4: Rooting: Bulbs are prepared for growing.

Step 5: Growing: Bulbs are moved into the greenhouse.

Step 6: Harvesting: Tulips are cut and wrapped.

Step 7: Storage: Stems are stored in a cooled warehouse to prevent spoilage.

Step 8: Transport: Stems are transported to retailer’s distribution centers.

Step 9: Sales: Consumer sales at mass-market retailers.

During 2023 Bloomia sourced bulbs to grow around 75 million stems. The Netherlands has around 1,500 bulb suppliers, who jointly export over 2.5 billion tulip bulbs each year. Over the past five years, Bloomia has sourced from the 10 largest producers, 20 medium-sized producers, as well as from smaller producers.

The Netherlands’ large-scale production of tulip bulbs has created an efficient marketplace for Bloomia to source bulbs. The large majority of Bloomia’s contracts for purchase of bulbs from growers in the Netherlands are short term; however, Bloomia has a long history with most of its suppliers. Bulb contracts obligate Bloomia only to buy an agreed upon volume of bulbs; bulb price is established through market pricing.

To help facilitate year-round growing, Bloomia has routinely sourced bulbs from Chile and more recently began sourcing bulbs from New Zealand. Chile and New Zealand are currently the only countries in the Southern Hemisphere with bulb production at volume. By sourcing bulbs from around the world, Bloomia has bulbs that are ready for planting year-round, limiting its reliance on importing stems. Year-round production results in Bloomia being less exposed to higher logistics costs that result from importing stems.

Bloomia has also made investments to automate its greenhouse. The automation of the greenhouse allows Bloomia to:

| · | scale production faster if needed to meet demand; |

| | |

| · | increase greenhouse efficiency resulting in higher margins, and; |

| | |

| · | reduce its dependence on seasonal labor. |

Bloomia and its customers conduct regular purchase planning meetings, enabling Bloomia to fine-tune its planning for delivery volume and timing. Bloomia is also a member of three trade associations; providing import/export logistics support, marketing support, and support for conducting business with wholesalers.

Non-Bank Lending Segment

We are building a scalable Lending Business to purchase existing loans or originate and fund new loans, all of which will be secured by collateral (individually or collectively, “Secured Loans”). In April 2023, we launched our Lending Business, through the hiring of a Senior Vice President of Lending with over 20 years of experience in credit and lending.

Initially, we intend to focus on loans secured by real estate, primarily for agricultural purposes. We expect to expand our product offerings over time as we identify needs and opportunities in the marketplace for loans generally. Our plan, therefore, is to build a portfolio of well-secured loans, with a portion of the credit risk being participated to third parties in most cases, to maintain a low net loss experience and to charge fully compensatory rates and fees.

We are building our strategy and long-term growth initiatives through development of customized niche products to support identified customer needs and opportunities in the marketplace, and effective funding structures to maximize returns.

Competition

We face competition from other entities that originate, purchase, securitize, or provide financing for Secured Loans. These entities include commercial and investment banks, insurance companies, Farm Credit System institutions, and financial funds.

We plan to compete through development of niche products and effective fundings structures, while controlling overhead costs. The relative competitiveness and our ability to grow loan volume will be affected by many factors, including demand for the lending products we offer, availability of capital, and liquidity and cost of funds from third-party funding sources.

Activity to Date

The Company met with a number of prospects for loan originations and/or purchases since the start of the lending business. Deals were negotiated, but ultimately did not close. With the Company’s decision to allocate capital to the Bloomia acquisition, capital available for the lending business will be significantly constrained in the near term. Accordingly, we anticipate minimal revenue and operating losses from the lending business during the remainder of 2024.

Intellectual Property: Patents and Trademarks

Bloomia holds a trademark on its name and logo. Certain employees are required to enter into nondisclosure and invention assignment agreements. Customers, vendors and other third parties also must agree to nondisclosure restrictions to prevent unauthorized disclosure of the Company’s trade secrets or other confidential or proprietary information.

Environmental Matters

We believe our operations follow all applicable environmental regulations within the jurisdictions in which we operate. The costs and effects of compliance with these regulations have not been and are not expected to become material.

Importers of cut flowers air ship stems to the U.S., while Bloomia ships bulbs via sea containers. Bloomia’s business model (shipping bulbs for local production) lowers its carbon footprint compared to importers of cut flowers. Hydroponic farming method is free of pesticides, requires less water and has fewer diseases, and requires substantially fewer import shipments.

Governmental Regulation

The Company and its subsidiaries are subject to regulation by various governmental agencies. Bloomia has an import permit from the USDA for shipments of tulip bulbs. For import of bulbs from the Netherlands to the U.S., Bloomia participates in a pre-clearance program with the USDA where the climate-controlled tulip bulb shipments are inspected in the Netherlands, and the containers are sealed in the Netherlands. While there is a process for random inspection by the USDA once the shipment arrives on U.S. shores, receiving of the shipment is generally expedited. Chile has a similar process through the USDA. The European Union regulations may impact aspects of the growing of tulip bulbs in the Netherlands. Farmland Credit FR, LLC has a money broker’s license in North Dakota.

Employee and Human Capital Resources

As of March 1, 2024, the Company and its subsidiaries had 156 employees, of which 5 were part-time employees. None of the employees are represented by labor unions. During 2023, approximately 50% of our hourly workers were hired for seasonal support during January through the end of May. As of March 1, 2024, 54 employees were seasonal. We employ temporary foreign agricultural workers (H2A employees).

We regard our relationship with our employees as favorable. Our human capital resources objectives include, as applicable, identifying, recruiting, retaining, incenting, and integrating our employees. Our human capital department also requests quarterly feedback through surveys and focus groups to continuously improve the workplace and employee relations. As it relates to our employees:

Oversight and Management

Our executive officers are tasked with leading our organization and managing employment-related matters, including recruiting, hiring, onboarding, training, compensation planning, talent management and development. We are committed to providing team members with the training and resources necessary to continually strengthen their skills both inside and outside the workplace. In 2023, Bloomia added to its Human Capital and Human Resources team, to take on initiatives such as employee wellness programs and continuing education.

Our executive team is responsible for periodically reviewing team member programs and initiatives, including healthcare and other benefits, as well as our management development and succession planning practices. Management periodically reports to the Board regarding our human capital measures and results that guide how we attract, retain, and develop a workforce to enable our business strategies.

Workplace Safety and Health

A vital part of our business is providing our workforce with a safe, healthy, and sustainable working environment. We focus on implementing change through workforce observation and feedback channels to recognize risk and continuously improve our processes. Our team continues to also focus on improving our educational materials for employees to be informed of the best safety practices based on OSHA guidelines and workplace observations.

Item 1A. Risk Factors

Our business is subject to many risks. The following are significant factors known to us that could materially adversely affect our business, reputation, operating results, industry, financial position, or future financial performance.

RISKS RELATING TO OUR BUSINESS AND OPERATIONS

We face competition and cannot guarantee our continued ability to compete effectively.

Our Bloomia business competes against other providers of cut tulips and other participants in the broader cut floral industry. Competition is based on, among other things, price, quality, product perception and ability to fulfill orders, particularly during seasonal peaks. We face direct competition from other growers as well as indirect competition through retailers who are supplied by our competitors, including on-line flower delivery websites. If competitors succeed in diverting business from our current customers or capturing a greater share of the overall market for cut tulips or cut flowers generally, Bloomia’s revenues and related operations would be adversely affected, potentially materially.

Our revenue is highly concentrated among a small number of customers.

During calendar 2023, three customers accounted for approximately 64.3% of Bloomia’s revenue. Although those customers have a history of purchasing fresh-cut tulips from Bloomia, there are no long-term purchase commitments. If one or more of Bloomia’s traditional customers significantly reduces or ceases purchasing fresh-cut tulips from Bloomia, then Bloomia could experience a significant decrease in revenue. Bloomia has historically had a high retention rate, with the majority of our significant customers having business relationships in excess of five years.

We may be unable to prevent our competitors from benefiting from the expertise of our former executives.

In connection with the acquisition of Bloomia, we entered into non-compete agreements with its former owners. These agreements prohibit the former owners from competing with Bloomia’s business for a three-year period from the February 22, 2024 acquisition date. We may be unable to enforce these agreements under the laws of the jurisdictions in which our business operates and it may be difficult for us to restrict our competitors from benefiting from the expertise that our former owners developed while working for us. If we cannot demonstrate that such interests will be harmed, we may be unable to prevent our competitors from benefiting from the expertise of our former owners and our ability to remain competitive may be diminished.

RISKS RELATING TO ECONOMY AND MARKET CONDITIONS

We are subject to changes in interest rates.

The majority of our debt carries floating interest rates and is subject to interest rate fluctuations. Borrowings under the Credit Agreement bear interest at a rate per annum equal to Term SOFR for an interest period of one month plus 3.0%. Changes in interest rates are caused by a number of factors beyond our control. If the SOFR interest rate increases significantly, our interest expense and cash paid for interest will increase, and our ability to obtain additional financing may decrease, which may materially adversely affect our operations.

Our net sales and earnings have been and could continue to be adversely affected by economic conditions and outlook in the markets in which we conduct business.

Adverse economic conditions and outlook in the U.S. and in other countries in which we conduct business, such as South Africa and South America, have previously and could in the future impact our net sales and earnings. These adverse economic conditions could include, but are not limited to, business closures, slowdowns, suspensions or delays of production and commercial activity; recessionary conditions; slow or negative economic growth rates; reduced consumer spending levels; increased or prolonged high unemployment rates; higher costs, longer lead times, and reduced availability of commodities, components, parts, and accessories, including as a result of transportation-related costs, inflation, changing prices, foreign currency fluctuations, tariffs, and/or duties; inflationary or deflationary pressures; reduced infrastructure spending; the impact of U.S. federal debt, state debt, and sovereign debt defaults and austerity measures by certain European countries; reduced credit availability or unfavorable credit terms for our distributors, dealers, and end-user customers; higher short-term, mortgage, and other interest rates; government shutdowns; and general economic and political conditions and expectations. Fresh cut tulips are something of a discretionary purchase and consumers may reduce purchases of tulips in slower economic times. In the past, some of these factors have caused and may continue to cause customers to reduce spending and delay or forego purchases of our products, which has had an adverse effect on our net sales and earnings.

STRATEGIC RISKS

Our company’s results are highly dependent on Bloomia’s success.

Although we intend to continue to develop our non-bank lending business, we have committed a substantial portion of our capital to the acquisition and growth of Bloomia’s business. With this lack of diversification, for at least the near term, our cash flow and ability to service our debt is highly dependent on the performance of the Bloomia business. Risks inherent in the Bloomia business are discussed in this section.

Failure to successfully manage the recently acquired Bloomia business and other future acquisitions could adversely affect our business.

As part of our strategy to develop our specialty ag and finance strategy, we recently acquired Bloomia, and may make additional acquisitions in the future. We cannot be certain that the businesses we acquire will become profitable or remain so. Our management and integration of the operations of acquired businesses requires significant efforts, including the coordination of information technologies and finance. These efforts result in additional expenses and involve significant amounts of management’s time that cannot then be dedicated to other projects. Factors that will affect the success of our acquisitions include:

| · | the presence or absence of adequate internal controls and/or significant fraud in the financial systems of acquired companies, |

| | |

| · | our ability or inability to integrate information technology systems of acquired companies in a secure and reliable manner, |

| | |

| · | any decrease in customer loyalty and product orders caused by dissatisfaction with the Company’s product lines and sales and marketing practices, including price increases, |

| | |

| · | our ability to retain key employees, and |

| | |

| · | ability to generate adequate cash flow to service the debt incurred for the acquisitions. |

These effects, individually or in the aggregate, could cause a deterioration of our credit and result in increased borrowing costs and interest expense.

We may not generate enough cash or secure enough capital to execute our business plans.

As we develop and grow our businesses, we may be required to finance this process through equity offerings or additional debt financings. To the extent that we raise additional capital through the sale of equity or debt financing, the ownership interest of our stockholders would be diluted, and the terms of those securities may include liquidation or other preferences that adversely affect the rights of our stockholders. Debt financing and preferred equity financing, if available, may involve agreements that include additional covenants limiting or restricting our ability to take specific actions, such as incurring additional debt, making capital expenditures or declaring dividends. Additional capital may not be available when needed, on reasonable terms, or at all, and our ability to raise additional capital may be adversely impacted by potential worsening global economic conditions and the recent disruptions to and volatility in the credit and financial markets in the U.S. and worldwide. If we are unable to raise additional funds when needed we may not be able to grow our businesses, or complete transactions related to our strategy.

OPERATIONAL RISKS

Restrictions in the Credit Agreement, could adversely affect the Bloomia business, financial condition, and results of operations.

The obligations under the Credit Agreement are secured by substantially all of the personal property assets of Tulp 24.1 and its subsidiaries. The Company provided an unsecured guaranty of the obligations of Tulp 24.1 under the Credit Agreement.

The Credit Agreement contains customary affirmative and negative covenants, including covenants that restrict the ability of Tulp 24.1 and its subsidiaries to incur additional indebtedness, dispose of significant assets, make distributions or pay dividends to the Company, make certain investments, including any acquisitions other than permitted acquisitions, make certain payments, enter into sale and leaseback transactions or grant liens on its assets, subject to certain limitations.

The provisions of the Company’s credit agreement or other debt instruments may restrict its ability to obtain additional financing and pursue attractive business opportunities and its flexibility in planning for, and reacting to, changes in business conditions. In addition, a failure to comply with the provisions of the Company’s credit agreement, any future credit facility or other debt instruments could result in a default or an event of default that could enable its lenders or other debt holders to declare the outstanding principal of that debt, together with accrued and unpaid interest, to be immediately due and payable. If the payment obligations of Tulp 24.1 or the Company under the Credit Agreement are accelerated, its assets may be insufficient to repay such debt in full. These factors could have a material adverse effect on the Company’s business, financial condition and results of operations.

The Credit Agreement restricts Tulp 24.1’s ability to make distributions to Lendway.

Under terms of the Credit Agreement, the Bloomia business is permitted to pay a management fee of $60,000 monthly to Lendway, but generally is not permitted to make distributions to its members, including Lendway. This may constrain cash available to Lendway for corporate expenses and expenses of the Lending Business. This constraint significantly limits the capital available for the Lending Business, for which we anticipate minimal revenue and losses during the remainder of 2024. The restriction on distributions will also limit our ability to fund additional strategic acquisitions using capital we have contributed to the Bloomia business.

The Company’s success depends on its key personnel.

The Company’s business results depend largely upon the continued contributions of our CEO Randy Uglem, as it relates to the Lending Business, and Bloomia’s CEO Werner Jansen as it relates to the tulip business. If Mr. Uglem or Mr. Jansen no longer serves in (or serves in some lesser capacity than) their current roles, or if the Company loses other members of our management team, we may not be able to successfully execute on our business strategy and our business, financial condition and results of operations, as well as the market price of its securities, could be adversely affected.

If we fail to establish and maintain effective internal control over financial reporting, then we may not be able to accurately or timely report our financial condition or results of operations, which may adversely affect our business and the market price of our common stock.

Company management is responsible for establishing and maintaining effective internal controls designed to provide reasonable assurance regarding the achievement of objectives relating to operations, reporting, and compliance. Any internal control system, no matter how well designed and operated, can only provide reasonable, not absolute, assurance that the objectives of the control system are met. Further, the design of a control system must reflect the fact that there are resource constraints, and the benefits of controls must be considered relative to their costs. Given the limited current number of employees, this resource constraint causes challenges in effectively providing appropriate segregation of duties. Because of the inherent limitations in all internal control systems, internal control over business processes and financial reporting may not prevent or detect fraud or misstatements.

We are required, pursuant to Section 404 of the Sarbanes Oxley Act (SOX), to furnish a report by management on, among other things, the effectiveness of our internal control over financial reporting. This assessment includes disclosure of any material weaknesses identified by our management in our internal control over financial reporting. As a smaller reporting company, the Company is not required to have an attestation from its external auditor on the effectiveness of its internal control over financial reporting and disclosure controls and procedures. With regards to its February 2024 acquisition of Bloomia, the Company intends to elect the provision under SOX to exclude the evaluation of internal control over financial reporting and disclosure controls and procedures for Bloomia for a one-year period after the acquisition date.

We cannot assure you that the measures we have taken to date, and actions we may take in the future, will prevent or avoid potential future material weaknesses. If we are unable to maintain effective internal control over financial reporting, the accuracy and timing of our financial reporting may be adversely affected, investors could lose confidence in the accuracy and completeness of our financial reports, the market price of our common stock could decline, we could be subject to sanctions or investigations by the Nasdaq Stock Market, the SEC or other regulatory authorities, and our ability to access the capital markets could be limited.

Bloomia’s international operations involve additional market and operational risks, and failure to manage these risks may adversely affect our business and operating results.

We operate in several countries throughout the world including South Africa, Chile and the Netherlands. Accordingly, we face significant operational risks from doing business internationally, including:

| · | fluctuations in foreign currency exchange rates; |

| · | potentially adverse tax consequences; |

| · | difficulties in staffing and managing foreign operations; |

| · | laws and business practices favoring local competition; |

| · | compliance with a wide variety of complex foreign laws, treaties and regulations; |

| · | tariffs, trade barriers and other regulatory or contractual limitations on their ability to sell or develop their products in certain foreign markets; and |

| · | being subject to the laws, regulations and the court systems of many jurisdictions. |

Our failure to manage the market and operational risks associated with our international operations effectively could limit the future growth of our business and adversely affect our operating results.

Exchange rate fluctuations between the U.S. dollar and the Euro and other non-U.S. currencies may negatively affect the earnings of our operations.

We report our financial results and most of our revenues are recorded in U.S. dollars. However, most of our tulip bulb costs as well as a portion of our general and administrative expenses, are incurred in euros. As a result, we are exposed to exchange rate risks that may adversely affect our financial results. For example, if the euro appreciates against the U.S. dollar, then the U.S. dollar cost of our operations in the Netherlands would increase and our results of operations would be adversely affected.

From time to time, we engage in currency hedging activities. These measures, however, may not adequately protect us from material adverse effects due to the fluctuations in the relative values of the U.S. dollar and the euro and other foreign currencies in which we transact business, and may result in a financial loss.

Failure to comply with the U.S. Foreign Corrupt Practices Act or other applicable anti-corruption legislation could result in fines, criminal penalties and an adverse effect on our business.

We are committed to doing business in accordance with applicable anti-corruption laws. We are subject, however, to the risk that our affiliated entities or our affiliates’ respective officers, directors, employees and agents may take action determined to be in violation of such anti-corruption laws, including the U.S. Foreign Corrupt Practices Act of 1977 and similar anti-bribery laws in non-U.S. jurisdictions, as well as trade sanctions administered by the Office of Foreign Assets Control and the U.S. Department of Commerce. Any such violation could result in substantial fines, sanctions, civil and/or criminal penalties, curtailment of operations in certain jurisdictions, and might adversely affect our results of operations. In addition, actual or alleged violations could damage our reputation and ability to do business.

Compliance with employment laws may adversely affect Bloomia’s business.

With the acquisition of Bloomia, we significantly increased the size and scope of our workforce. Various federal and state labor laws govern the relationship with Bloomia’s employees in the United States and impact operating costs. These laws include:

| · | employee classification as exempt or non-exempt for overtime and other purposes; |

| · | minimum wage requirements; |

| · | unemployment tax rates; |

| · | workers’ compensation rates; |

| · | immigration status; |

| · | mandatory health benefits; |

| · | paid leaves of absence, including paid sick leave; |

| · | tax reporting; and |

| · | other wage and benefit requirements. |

Although Bloomia verifies the employment eligibility status of its employees, some of its employees may, without Bloomia’s knowledge, be unauthorized workers. Unauthorized workers are subject to deportation and may subject Bloomia to fines or penalties, and if any of Bloomia’s workers are found to be unauthorized, Bloomia could experience adverse publicity that negatively impacts its brand and may make it more difficult to hire and keep qualified employees. Termination of a significant number of employees who were unauthorized employees may disrupt Bloomia’s operations, cause temporary increases in its labor costs as it trains new employees and result in additional adverse publicity. Bloomia could also become subject to fines, penalties and other costs related to claims that it did not fully comply with all recordkeeping obligations of federal and state immigration compliance laws. Failure to fully comply with one or more of these requirements could have a material adverse effect on the Company’s business, financial condition and results of operations.

Through Bloomia, we are subject to risks inherent in the operation of an agricultural business.

Our business involves agricultural products with the procuring of tulip bulbs and the growing of tulips. Such business is subject to the risks inherent in the agricultural business, such as insects, plant diseases, government regulations regarding bulb production and similar agricultural risks. We can reduce, but cannot eliminate, the impacts of adverse weather conditions because the significant majority of our tulips are grown in a hydroponic greenhouse.

Tulip bulbs, like any plant, are subject to quality issues and disease, and we could have significant inventory loss or production delays resulting from low quality tulips. In June of 2023 Bloomia wrote off $900,000 of tulip bulb inventory due to the bulbs not meeting Bloomia’s quality standards. The bulbs were sourced during the off-season which we believe contributed to the quality issues and subsequent write-off. Additionally, although we coordinate with recurring customers to plan production based on anticipated demand and projections, we may have to write down inventory or recognize a material impairment if our production significantly exceeds customer demand.

Accordingly, any of these factors may have a material adverse effect on our inventory and any future production of tulips and a corresponding adverse effect on our results of operations.

Energy and water price increases could adversely impact our profit margins.

Bloomia’s hydroponic greenhouse cultivation process uses significant energy and water. Certain factors which may impact the availability of energy and water are out of Bloomia’s control including, but not limited to, disruptions resulting from weather, economic conditions, and interruption of energy supply. Significant increases in the cost or access of energy and water, and the failure to fully pass any such increased prices and costs through to our customers or to modify our activities to mitigate the impact, would have an adverse effect on our production results and operating income.

Inclement weather and other disruptions to the transportation network could adversely impact our distribution system and demand for our products.

Bloomia’s operations rely on dependable and efficient transportation services, the disruption of which could result in difficulties supplying materials to Bloomia’s facilities and impair Bloomia’s ability to deliver products to its retail customers in a timely manner. Specifically, our ability to receive shipments of tulip bulbs from Bloomia’s Netherlands or Chilean facilities on a timely basis and to provide efficient distribution of our stems to our retail customers are integral components of our overall business strategy. The volumes handled by, and operating challenges at, ocean ports have at times been volatile and can delay the receipt of tulip bulbs or cause the cost of shipping goods to be more expensive. Additionally, the availability and reliability of truck transportation has been negatively impacted by a number of factors, including limited availability of qualified drivers and equipment and limitations on drivers’ hours of service. Impairment in our ability to receive timely shipments of tulip bulbs or distribute stems to our retail customers may affect our ability to both maintain core products in inventory and deliver products to customers on a timely basis, which may in turn adversely affect our consolidated results of operations.

TECHNOLOGY AND CYBERSECURITY RISKS

We rely on our management information systems for inventory management, distribution, and other key functions. If our information systems fail to adequately perform these functions, or if we experience an interruption in their operation, our business and operating results could be adversely affected.

The efficient operation of our business is dependent on our management information systems, both internal and outsourced. We rely on our management information systems to, among other things, effectively manage our accounting and financial functions, including maintaining our internal controls, and to manage our procurement, greenhouse, distribution and sales processes. The failure of our management information systems to perform properly could disrupt our business, which may result in decreased sales, increased overhead costs, excess or obsolete inventory, causing our business and operating results to suffer. We also have automated processes in our greenhouse operations, which could be adversely impacted by interruptions in their operations. Although we take steps to secure our management information systems and automated processes, including our computer systems, intranet and internet sites, email and other telecommunications and data networks, the security measures we have implemented may not be effective and our systems may be vulnerable to theft, loss, damage and interruption from a number of potential sources and events, including unauthorized access or security breaches, natural or man-made disasters, cyber-attacks, computer viruses, power loss, or other disruptive events. Our reputation, brand, and financial condition could be adversely affected if, as a result of a significant cyber event or otherwise, our operations are disrupted or shutdown; our confidential, proprietary information is stolen or disclosed; we incur costs or are required to pay fines in connection with stolen customer, employee, or other confidential information; we must dedicate significant resources to system repairs or increase cyber security protection; or we otherwise incur significant litigation or other costs.

RISKS RELATED TO AN INVESTMENT IN OUR COMPANY

Our Results of Operations Have Been and May Be Subject to Significant Fluctuations.

Our quarterly and annual operating results have fluctuated in the past and may vary in the future due to a wide variety of factors including:

| · | our ability to successfully operate the acquired Bloomia business at the levels of revenue and cash flow planned; |

| · | inability to close loans; |

| · | changes in interest rates; and |

| · | the impact of other strategic activities. |

Due to these factors, our quarterly and annual net sales, expenses and results of operations could vary significantly in the future, and this could adversely affect the market price of our common stock.

Investment in Our Stock Could Result in Fluctuating Returns.

During 2023, the sale prices of our common stock as reported by The Nasdaq Stock Market ranged from a low of $4.05 to a high of $9.67. We believe factors such as the fluctuations in our quarterly and annual operating results described above, the market’s acceptance of our services and products, the performance of our business relative to market expectations, the results of our acquired Bloomia business, as well as limited daily trading volume of our stock and general volatility in the securities markets, could cause the market price of our common stock to fluctuate substantially. In addition, the stock markets have experienced price and volume fluctuations, resulting in changes in the market prices of the stock of many companies, which may not have been directly related to the operating performance of those companies.

We may need to raise additional capital, which might not be available or might be available only on terms unfavorable to us or our investors.

In order to continue to operate and grow our businesses, we will likely need to raise additional capital beyond this current financing round by offering shares of our common or preferred stock and/or other classes of equity. All of these would result in dilution to our existing investors, plus they may include additional rights or terms that may be unfavorable to our existing investor base. We cannot assure you that the necessary funds will be available on a timely basis, on favorable terms, or at all, or that such funds, if raised, would be sufficient. The level and timing of future expenditure will depend on a number of factors, many of which are outside our control. If we are not able to obtain additional capital on acceptable terms, or at all, we may be forced to curtail or abandon our growth plans, which could adversely impact the Company, its business, development, financial condition, operating results or prospects.

We may be required to recognize impairment charges that could materially affect our results of operations.

We assess our intangible assets, and our other long-lived assets as and when required by GAAP to determine whether they are impaired. If they are impaired, we will record appropriate impairment charges. It is possible that we may be required to record significant impairment charges in the future and, if we do so, our results of operations could be materially adversely affected.

Certain significant stockholders of our company may exert a degree of control in a manner that conflicts with the interests of other stockholders.

Current significant holders of shares may have interests that are different than or adverse to our other stockholders. Based on public filings with the SEC, we believe that our largest stockholders and its affiliates hold approximately 38.9% of our issued and outstanding common shares. Based on this share ownership and the simple majority vote of shares present in person or by proxy that is sufficient for the approval of most actions at any stockholders meeting, those stockholders may be able to exercise a certain degree of control over certain matters requiring stockholders’ approval. Those matters include the election of directors, amendment of our articles of association and approval of significant corporate transactions, subject to rules requiring the approval of a special majority among non-interested stockholders in certain situations. This control could have the effect of delaying or preventing a change of control of our Company or changes in management and will make the approval of certain transactions difficult without the support of those significant stockholders, including transactions in which a non-significant stockholder might otherwise receive a premium for its shares over the then-current market price.

We could be deemed to have been a “shell company” after completion of the August 2023 asset sale and, as such, we and our stockholders could be restricted in reliance on certain rules or forms.

We have been focused on the successful startup and growth of our Lending Business since before the sale of assets relating to our former In-Store Marketing Business. Following the recent acquisition of the Bloomia business we have also been focused on managing Bloomia’s operations and growth. We do not believe that the Company, even after completion of the sale of the In-Store Marketing Business was a “shell company” as described under Rule 405 promulgated under the Securities Act and Rule 12b-2 promulgated under the Exchange Act, which is a company that has: no or nominal operations; and either (a) no or nominal assets; (b) assets consisting solely of cash and cash equivalents; or (c) assets consisting of any amount of cash and cash equivalents and nominal other assets.

However, a designation as a “shell company” could result in the application of Rule 144(i), which would limit the availability of the exemption from registration provided in Rule 144 for certain shares of Company common stock and could result in certain persons affiliated with the Company being deemed “statutory underwriters under Rule 145(c). Some of the presently outstanding shares of our common stock are “restricted securities” as defined under Rule 144 promulgated under the Securities Act and may only be sold pursuant to an effective registration statement or an exemption from registration, if available. Pursuant to Rule 144, if we were designated a “shell company” as defined in Rule 405 of the Securities Act and Rule 12b-2 of the Exchange Act, one year would be required to elapse from the time, we ceased to be a “shell company” and filed a Form 8-K addressing Item 5.06 with such information as may be required in a Form 10 Registration Statement with the SEC, before our restricted stockholders could resell their holdings in reliance on Rule 144. The Form 10 information or disclosure is equivalent to the information that a company would be required to file if it were registering a class of securities on Form 10 under the Exchange Act. Under amended Rule 144, restricted or unrestricted securities that were initially issued by a reporting or non-reporting shell company, or a company that was at any time previously a reporting or non-reporting shell company, can only be resold in reliance on Rule 144 if the following conditions are met:

| · | The issuer of the securities that was formerly a shell company has ceased to be a shell company; |

| · | The issuer of the securities has filed all reports and material required to be filed under Section 13 or 15(d) of the Exchange Act, as applicable, during the preceding twelve months (or shorter period that the issuer was required to file such reports and materials), other than Form 8-K reports; and |

| · | At least one year has elapsed from the time the issuer filed the current Form 10 type information with the SEC reflecting its status as an entity that is not a shell company. |

We have never been classified as a “shell company” under rules promulgated under the Securities Act or the Exchange Act. However, in the event we were to be so designated, we may have to retroactively adjust our reporting or accounting for affected periods.

Item 1B. Unresolved Staff Comments

Smaller reporting companies are not required to provide disclosure pursuant to this Item.

Item 1C. Cybersecurity

Lendway’s cyber environment at December 31, 2023 consisted primarily of outsourced information technology (“IT”) operations. The outsourced provider has a cybersecurity framework which includes multiple products implemented to ensure the security of Lendway’s environment. Annual internal and external vulnerability scans are also completed to ensure we mitigate any risks proactively. The Company’s internal operations are PC based and the PCs have up to date security software. Regular phishing exercises are conducted, and employee awareness training is conducted annually by our outsourced provider.

Our full Board of Directors and our Audit Committee provide oversight of our risk management program, which includes cybersecurity. The Audit Committee, as part of its charter to review the Company’s practices with respect to risk assessment and risk management, receives updates on internal control, including those relating to IT general controls and cybersecurity.

With the acquisition of Bloomia on February 22, 2024, the Company will include the IT environment of Bloomia in its cybersecurity processes and oversight at the corporate and board level. Bloomia’s cybersecurity is managed by a third party vendor.

As of the date of this report, we did not identify any cybersecurity threats that have materially affected or are reasonably likely to materially affect our business strategy, results of operations, or financial condition. However, despite our efforts, we cannot eliminate all risks from cybersecurity threats, or provide assurances that we have not experienced an undetected cybersecurity incident.

Item 2. Properties

We believe that our facilities are adequate and suitable for the purposes they serve, including absorption of reasonable growth. We believe that we carry customary levels of insurance covering the replacement of damaged property.

The Company leases 1,700 square feet for its corporate headquarters in Minneapolis, Minnesota through September 30, 2025. Fresh Tulips USA, LLC leases a 360,000 square foot greenhouse facility in King George, Virginia through 2028. In the Netherlands, Bloomia leases a 107,000 square foot office and warehouse space through 2027. In South Africa, Bloomia operates a 21,000 square foot greenhouse located in Rawsonville (near Cape Town) through 2028.

Item 3. Legal Proceedings

The Company is party to legal actions, proceedings, and claims in the ordinary course of business. The outcome of these matters is not expected to have a material effect on the Company’s financial position or results of operations.

Item 4. Mine Safety Disclosures

Not applicable.

PART II.

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Market Information and Holders

The Company’s common stock is listed on the Nasdaq Capital Market under the symbol LDWY.

As of March 27, 2024, our common stock was held by approximately 115 holders of record.

Dividends

The Company has not historically paid dividends, other than two one-time special dividends declared in 2011 and 2016. The Board of Directors periodically evaluates our ability to pay dividends in light of our financial condition and business plans.

Share Repurchases

On August 28, 2023, we announced that our Board of Directors had approved a stock repurchase authorization providing for the repurchase of up to 400,000 shares of the Company’s common stock. We may purchase shares of our common stock from time to time in open market transactions at prevailing market prices, in privately negotiated transaction, or by other means in accordance with federal securities laws. Open market repurchases may be effected pursuant to Rule 10b5-1 trading plans. The repurchase authorization does not obligate the Company to acquire any particular amount of its common stock or to acquire shares on any particular timetable and may be suspended or discontinued at any time at the Company’s discretion.

Repurchase activity for the twelve months ended December 31, 2023, was as follows:

Period | | Total number of shares purchased | | | Average price paid per share | | | Total number of shares purchased as part of publicly announced plans or programs | | | Approximate dollar value of shares purchased under the plans or programs | | | Maximum Number of Shares that May Yet Be Purchased under the Plans or Programs | |

October 1 - 31, 2023 | | | 5,546 | | | $ | 5.09 | | | | 5,546 | | | $ | 27,864 | | | | 319,109 | |

November 1 - 30, 2023 | | | 3,137 | | | | 4.99 | | | | 3,137 | | | | 16,267 | | | | 315,972 | |

December 1 - 31, 2023 | | | - | | | | - | | | | - | | | | - | | | | 315,972 | |

| | | 8,683 | | | | | | | | 8,683 | | | $ | 44,131 | | | | | |

Item 6. [Reserved]

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion should be read in conjunction with the financial statements and the related notes included in this Annual Report on Form 10-K. This report contains forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those in such forward-looking statements as a result of many factors, including those discussed in “Cautionary Statement Regarding Forward-Looking Statements” and elsewhere in this report.

Overview

The Company has evolved into a specialty agricultural and finance company focused on making and managing its agricultural investments in the United States and internationally. During the past twelve months, the Company took three major steps in this evolution.

In April 2023, the Company launched its lending business, through the hiring of a Senior Vice President of Lending with over 20 years of experience in credit and lending. The Company is seeking to build a scalable non-bank lending business to purchase existing loans or originate and fund new loans, all of which will be secured by collateral.

On August 3, 2023, the Company completed the sale of its In-Store Marketing Business. The operations of the In-Store Marketing Business are presented as discontinued operations. All prior periods presented have been restated to present the In-Store Marketing Business as discontinued operations. Related to change in strategy of the Company, on August 4, 2023, we changed our name from “Insignia Systems, Inc.” and reincorporated from Minnesota to Delaware. As part of the name change, our common stock now trades under the symbol “LDWY” on The Nasdaq Stock Market LLC.

Bloomia Business

On February 22, 2024, the Company acquired majority ownership in Bloomia B.V. and its subsidiaries (“Bloomia”). Bloomia produces and sells fresh cut tulips.

Bloomia purchases tulip bulbs, hydroponically grows tulips from the bulbs, and sells the stems to retail stores. Bloomia is a leading producer of fresh cut tulips in the United States, nurturing over 75 million stems annually. Net sales (unaudited) of Bloomia for the twelve months ended December 31, 2023 and 2022 were approximately $45 million and $43 million, respectively. Bloomia was founded in the Netherlands and is now strategically positioned in the United States, Netherlands, South Africa and Chile. Bloomia has relationships with prominent U.S. mass market retailers.

The Company acquired Bloomia for $47.5 million. The acquisition resulted in significantly leveraging the Company’s balance sheet. The acquisition price was paid with $9.2 million of the Company’s cash, $22.8 million of proceeds from a new credit facility, and notes payable of $15.5 million to the sellers. The new credit facility contains financial covenants that the Company is required to meet. See description of the credit facility below.

Non-Bank Lending Business

While the Company’s primary near-term focus will be on the Bloomia business, the Company plans to continue building a scalable non-bank lending business (our “Lending Business”) to purchase existing loans or originate and fund new loans, all of which will be secured by collateral (individually or collectively, the “Secured Loans”). In April 2023, we launched our Lending Business, through the hiring of Randy Uglem as Senior Vice President of Lending, now CEO, with over 20 years of experience in credit and lending.

Initially, we intend to focus on loans secured by real estate, primarily for agricultural purposes. We expect to expand our product offerings over time as we identify needs and opportunities in the marketplace for loans generally. Our plan, therefore, is to build a portfolio of well-secured loans, with a portion of the credit risk being participated to third parties in most cases, to maintain a low net loss experience and to charge fully compensatory rates and fees. We are building our strategy and long-term growth initiatives through development of customized niche products to support identified customer needs and opportunities in the marketplace, and effective funding structures to maximize returns.

The Company met with a number of prospects for loan originations and/or purchases since the start of the lending business. Deals were negotiated, but ultimately did not close. With the Company’s decision to allocate capital to the Bloomia acquisition, capital available for the lending business will be significantly constrained in the near term. Accordingly, we anticipate minimal revenue and operating losses from the lending business during the remainder of 2024.

Sale of In-Store Marketing Business

On August 3, 2023, we completed the sale of our former In-Store Marketing Business for a sale price of $3.5 million to TIMIBO LLC, an affiliate of Park Printing, Inc. (the “Buyer”), under an Asset Purchase Agreement dated May 24, 2023 (the “Purchase Agreement”). The Company retained accounts receivable, as well as all cash, cash equivalents and marketable securities. The cash consideration for the sale was subject to a post-closing adjustment that depended on the net balance of (i) cash received by the Company for programs that remained unexecuted as of August 3, 2023, minus (ii) the payments made by the Company to vendors for unexecuted programs. The final purchase adjustment for the net balance was to reduce the cash consideration by $1.5 million, with the Company retaining an equal amount of cash that had been received for unexecuted programs. Under the Purchase Agreement, $200,000 was escrowed for a twelve-month period for any future claims, as defined in the Purchase Agreement by the Buyer against the Company.

We also incurred transaction-related severance and other separation benefits in connection with the termination of certain of our officers and employees of approximately $1,416,000, $490,000 of which was attributed to the sale of the In-Store Marketing Business, as well as retention award payouts totaling $343,000 and employee bonuses totaling $164,000, each of which were recorded as expense. The sum of transaction-related severance, retention awards and bonuses were $1,923,000, of which $974,000 was recorded in continuing operations and $949,000 was recorded in discontinued operations in 2023.

Results of Operations

The following table sets forth, for the periods indicated, certain items from our continuing operations in our consolidated statements of operations and the percentage change year-over-year. The Company had no revenue from continuing operations subsequent to the sale of the In-Store Marketing Business.

| | Year Ended December 31, | | | Increase (decrease) from 2022 to 2023 | |

| | 2023 | | | 2022 | | | Amount | | | Percent | |

Operating expenses: | | | | | | | | | | | | |

Sales and marketing | | $ | 196,000 | | | $ | - | | | $ | 196,000 | | | | 100.0 | % |

General and administrative | | | 3,323,000 | | | | 2,442,000 | | | | 881,000 | | | | 36.1 | % |

Total operating expenses | | | 3,519,000 | | | | 2,442,000 | | | | 1,077,000 | | | | 44.1 | % |

Operating loss | | | (3,519,000 | ) | | | (2,442,000 | ) | | | (1,077,000 | ) | | | 44.1 | % |

Interest income | | | 518,000 | | | | 154,000 | | | | 364,000 | | | | 236.4 | % |

Loss from continuing operations before income taxes | | | (3,001,000 | ) | | | (2,288,000 | ) | | | (713,000 | ) | | | 31.2 | % |

Income tax expense | | | 20,000 | | | | 6,000 | | | | 14,000 | | | | 233.3 | % |

Net loss from continuing operations | | | (3,021,000 | ) | | | (2,294,000 | ) | | | (727,000 | ) | | | 31.7 | % |

Income from discontinued operations, net of tax | | | 2,474,000 | | | | 12,340,000 | | | | (9,866,000 | ) | | | -80.0 | % |

Gain from sale of discontinued operations, net of tax | | | 2,961,000 | | | | - | | | | 2,961,000 | | | | 100.0 | % |

Net income | | $ | 2,414,000 | | | $ | 10,046,000 | | | $ | (7,632,000 | ) | | | -76.0 | % |

Year Ended December 31, 2023 Compared to Year Ended December 31, 2022

Operating Expenses

Sales and Marketing. Sales and marketing expenses for the year ended December 31, 2023 were $196,000, consisting of a portion of our CEO’s compensation, as well as travel and entertainment, website and public relations costs. There was no comparable expense for the year ended December 31, 2022.

General and Administrative. General and administrative expenses for the year ended December 31, 2023 increased 36.1% to $3,323,000, compared to $2,442,000 for the year ended December 31, 2022. The increase was primarily due to transaction-related severance and other separation benefits amounting to $926,000 in connection with the termination of Kristine Glancy, our previous CEO, in addition to the comparison of reduced expense in 2022 from the Director Deferred Compensation Plan due to a reduction in our share price during the year ended December 31, 2022.

Interest Income. Interest income for the year ended December 31, 2023 was $518,000 compared to interest income of $154,000 for the year ended December 31, 2022. Interest income in 2023 increased over 2022 primarily due to higher invested balances in short-term treasury bills and interest-bearing savings, and the higher interest rates available on the investments. The higher invested balances were primarily due to the net proceeds from litigation of $12 million received in July 2022, proceeds related to the sale of the In-Store Marketing Business, and collection of accounts receivable.

Income Taxes. For the year ended December 31, 2023, the Company recorded income tax expense on continuing operations of $20,000, compared to income tax expense on continuing operations of $6,000 for the year ended December 31, 2022. The effective tax rate on continuing operations was (0.7)% and (0.3)% for the years ended December 31, 2023 and 2022, respectively. The primary differences between the Company’s 2023 and 2022 effective tax rates and the statutory federal rates include state taxes and an increase in the Company’s valuation allowance against its deferred assets. The effective tax rate fluctuates between periods based on the level of permanent differences and other discrete items relative to the level of pre-tax income or loss for the period.

Net Loss from Continuing Operations. For the reasons stated above, net loss from continuing operations for the year ended December 31, 2023 was $3,021,000, compared to loss of $2,294,000 for the year ended December 31, 2022.

Income from Discontinued Operations, Net of Tax and Gain from Sale of Discontinued Operations, Net of Tax. Income from discontinued operations, net of tax, was $2,474,000 for the year ended December 31, 2023 compared to $12,340,000 for the year ended December 31, 2022. In 2022, the Company recorded a pre-tax gain of $12 million as a gain on litigation settlement. For the year ended December 31, 2023, the Company recorded a gain from the sale of discontinued operations before tax of $3,044,000 from the sale of its In-Store Marketing Business. Information on the sale of the In-Store Marketing Business and statement of operations details of the discontinued operations are included in Note 2 to the Consolidated Financial Statements in Item 8 of this Annual Report on Form 10-K.

Liquidity and Capital Resources

We have historically financed our operations with proceeds from stock sales and sales of our services and products, subject to occasional supplemental proceeds from the settlement of litigation. The sale of the In-Store Marketing Business on August 3, 2023 generated approximately $1.6 million in cash, directly from the buyer. On December 31, 2023, working capital (current assets less current liabilities) was $15,525,000, compared to $13,379,000 at December 31, 2022. During the year ended December 31, 2023, cash, cash equivalents and restricted cash increased $1,553,000 from $14,524,000 at December 31, 2022, to $16,077,000 at December 31, 2023.

Operating Activities. Net cash used in continuing operating activities during the year ended December 31, 2023 was $2,905,000. Net income of $2,414,000, less income from discontinued operations of $2,474,000, less gain from the sale of discontinued operations of $2,961,000 resulted in net cash used in continuing operations before adjustments and changes in operating assets and liabilities of $65,000. Non-cash adjustments for depreciation and stock-based compensation during the year ended December 31, 2023 was $51,000. The largest component of the change in operating assets and liabilities was accrued liabilities, which increased $376,000 from December 31, 2022. The increase was primarily due to $330,000 of severance related payments that remained to be paid to the Company’s prior CEO, Ms. Glancy.

Investing Activities. Net cash provided by investing activities from continuing operations during the year ended December 31, 2023 was $1,532,000, which was due to the proceeds from the sale of our In-Store Marketing Business.