—National, Annualized Home Price

Appreciation Slows for Second Straight Month, Falling by Almost a

Full Percentage Point—

First American Data & Analytics, a leading national

provider of property-centric information, risk management and

valuation solutions and a division of First American Financial

Corporation (NYSE: FAF), today released its February 2024 Home

Price Index (HPI) report. The report tracks home price changes

less than four weeks behind real time at the national, state and

metropolitan (Core-Based Statistical Area) levels and includes

metropolitan price tiers that segment sale transactions into

starter, mid and luxury tiers. The full report can be found

here.

Houston-The Woodlands-Sugar Land HPI

In the Houston-The Woodlands-Sugar Land CBSA, home prices

increased by 5 percent in February compared with a year ago and

increased 0.9 percent compared with January 2024. See below for

price-tier data.

February National House Price Index Highlights

The First American Data & Analytics’ non-seasonally adjusted

(NSA) HPI showed that nationally in February1 2024:

- House prices increased 0.7 percent between January 2024 and

February 2024.

- House prices increased 6.3 percent between February 2023 and

February 2024, the slowest annual pace since October 2023.

- House prices are now 50 percent higher compared to pre-pandemic

levels (February 2020).

- House price growth reported in last month’s HPI for December

2023 to January 2024 was revised up 0.1 percentage points, from 0.3

percent to 0.4 percent.

“After reaching a recent peak in December, annualized home price

appreciation slowed for the second consecutive month, bringing more

clarity to the trajectory for price appreciation in 2024. In

February, our preliminary estimate of annualized appreciation

dropped by almost a full percentage point,” said Mark Fleming,

chief economist at First American. “The last time there was a

slow-down of this magnitude was in early 2023 when the Fed was

aggressively raising interest rates. While the supply of homes for

sale is slowly increasing as the spring selling season approaches,

persistent inflation is keeping mortgage rates elevated. The

relative increase in homes for sale is a welcome sign for

prospective home buyers and seems to be helping to normalize house

price appreciation, an added benefit heading into the spring

home-buying season.”

Year-Over-Year Price-Tier Data for the Houston-The

Woodlands-Sugar Land Metro Area: February 2023 to February

2024

The First American Data & Analytics HPI segments home price

changes at the metropolitan level into three price tiers based on

local market sales data: starter tier, which represents home sales

prices at the bottom third of the market price distribution;

mid-tier, which represents home sales prices in the middle third of

the market price distribution; and the luxury tier, which

represents home sales prices in the top third of the market price

distribution.

CBSA

Starter

Mid-Tier

Luxury

Houston-The Woodlands-Sugar Land, TX

5.8%

5.0%

4.9%

“Nationally, starter-home price appreciation remains strong as

first-time home buyers hunt for homes to buy from current starter

homeowners, who are the most sensitive to the rate lock-in effect

and unable or unwilling to list their home for sale to fuel a

move-up purchase. The lack of mid-tier move-up demand is

significantly weakening price appreciation in the mid-market," said

Fleming. “Mid-tier prices for the markets we track are mostly flat

compared with a year ago and down by more than 3 percent in Warren,

Mich. and Nassau County, N.Y."

February 2024 House Price State2 Highlights

- The five most populous states experienced the following

year-over-year growth in the HPI:

Pennsylvania (+7.9 percent), New York (+5.3 percent), Florida (+4.9

percent), Texas (+4.8 percent), and California (+4.7 percent).

- There were no states with a year-over-year decrease in the HPI.

- Full 50-state HPI data is available here.

Visit the First American Economic Center for more research on

housing market dynamics.

Next Release

The next release of the First American Data & Analytics

House Price Index will take place the week of April 15, 2024.

First American Data & Analytics HPI Methodology

The First American Data & Analytics HPI report measures

single-family home prices, including distressed sales, with indices

updated monthly beginning in 1980 through the month of the current

report. HPI data is provided at the national, state and CBSA levels

and includes preliminary index estimates for the month prior to the

report (i.e. the preliminary result of July transactions is

reported in August). The most recent index results are subject to

revision as data from more transactions become available.

The HPI uses a repeat-sales methodology, which measures prices

changes for the same property over time using more than 46 million

paired transactions to generate the indices. In non-disclosure

states, the HPI utilizes a combination of public sales records, MLS

sold and active listings, and appraisal data to estimate house

prices. This comprehensive approach is particularly effective in

areas where there is limited availability of accurate sale prices,

such as non-disclosure states. Property type, price and location

data are used to create more refined market segment indices. Real

Estate-Owned transactions are not included.

Disclaimer

Opinions, estimates, forecasts and other views contained in this

page are those of First American’s Chief Economist, do not

necessarily represent the views of First American or its

management, should not be construed as indicating First American’s

business prospects or expected results, and are subject to change

without notice. Although the First American Economics team attempts

to provide reliable, useful information, it does not guarantee that

the information is accurate, current or suitable for any particular

purpose. © 2024 by First American. Information from this page may

be used with proper attribution.

About First American Data & Analytics

First American Data & Analytics, a division of First

American Financial Corporation, is a national provider of

property-centric information, risk management and valuation

solutions. First American maintains and curates the industry’s

largest property and ownership dataset that includes more than 8

billion document images. Its major platforms and products include:

DataTree®, FraudGuard®, RegsData®, First American TaxSource™ and

ACI®. Find out more about how First American Data & Analytics

powers the real estate, mortgage and title settlement services

industries with advanced decisioning solutions at

www.FirstAmDNA.com.

About First American

First American Financial Corporation (NYSE: FAF) is a

premier provider of title, settlement and risk solutions for real

estate transactions. With its combination of financial strength and

stability built over more than 130 years, innovative proprietary

technologies, and unmatched data assets, the company is leading the

digital transformation of its industry. First American also

provides data products to the title industry and other third

parties; valuation products and services; mortgage subservicing;

home warranty products; banking, trust and wealth management

services; and other related products and services. With total

revenue of $6.0 billion in 2023, the company offers its products

and services directly and through its agents throughout the United

States and abroad. In 2023, First American was named one of the 100

Best Companies to Work For by Great Place to Work® and Fortune

Magazine for the eighth consecutive year and was named one of the

100 Best Workplaces for Innovators by Fast Company. More

information about the company can be found at www.firstam.com.

1 The most recent index results are subject to revision as data

from more transactions become available.

2 The HPI for non-disclosure states and markets that fall within

non-disclosures states are not included in this month’s HPI

report.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240319520494/en/

Media Contact: Marcus Ginnaty Corporate Communications

First American Financial Corporation (714) 250-3298

Investor Contact: Craig Barberio Investor Relations First

American Financial Corporation (714) 250-5214

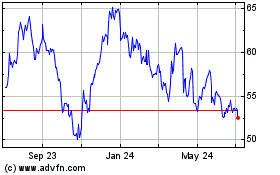

First American (NYSE:FAF)

Historical Stock Chart

From Mar 2024 to Apr 2024

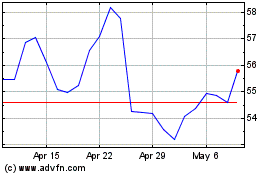

First American (NYSE:FAF)

Historical Stock Chart

From Apr 2023 to Apr 2024