GigaCloud Technology Inc (Nasdaq: GCT) (“GigaCloud” or the

“Company”), a pioneer of global end-to-end B2B ecommerce solutions

for large parcel merchandise, today announced its unaudited

financial results for the quarter and the fiscal year ended

December 31, 2023.

Fourth Quarter

2023 Financial Highlights

- Total revenues were

$244.7 million in the fourth quarter of 2023, an increase of 94.8%

from $125.6 million in the fourth quarter of 2022.

- Gross profit was

$69.8 million in the fourth quarter of 2023, an increase of

161.4% from $26.7 million in the fourth quarter of 2022.

Gross margin increased to 28.5% in the fourth

quarter of 2023 from 21.2% in the fourth quarter of 2022.

- Net income was

$35.6 million in the fourth quarter of 2023, an increase of

184.8% from $12.5 million in the fourth quarter of 2022.

Net income margin increased to 14.5% in the fourth

quarter of 2023 from 9.9% in the fourth quarter of 2022.

- Cash was

$183.3 million and restricted cash was

$0.9 million as of December 31, 2023, compared to

$143.5 million and $1.5 million as of December 31,

2022, respectively.

- Adjusted

EBITDA1 was $43.8 million in the

fourth quarter of 2023, an increase of 188.2% from

$15.2 million in the fourth quarter of 2022.

Full year 2023

Financial Highlights

- Total revenues were

$703.8 million for the full year of 2023, an increase of 43.6% from

$490.1 million for the full year of 2022.

- Gross profit was

$188.6 million for the full year of 2023, an increase of 127.0%

from $83.1 million for the full year of 2022. Gross

margin increase from 17.0% in 2022 to 26.8% in 2023.

- Net income was $94.1

million for the full year of 2023, an increase of 292.1% from $24.0

million for the full year of 2022. Net income

margin increased to 13.4% for the full year of 2023 from

4.9% for the full year of 2022.

- Adjusted EBITDA1 was

$118.3 million for the full year of 2023, an increase of 183.0%

from $41.8 million for the full year of 2022.

Operational Highlights

- GigaCloud Marketplace

GMV2 was $794.4 million in the 12 months ended

December 31, 2023, an increase of 53.3% from

$518.2 million in the 12 months ended December 31,

2022.

- Active 3P sellers3

were 815 in the 12 months ended December 31, 2023, an increase

of 45.5% from 560 in the 12 months ended December 31,

2022.

- Active buyers4 were

5,010 in the 12 months ended December 31, 2023, an increase of

20.5% from 4,156 in the 12 months ended December 31,

2022.

- Spend per active

buyer5 was $158,569 in the 12 months ended

December 31, 2023, an increase of 27.2% from $124,692 in the

12 months ended December 31, 2022.

- 3P seller GigaCloud Marketplace

GMV6 was $426.3 million in the 12 months ended

December 31, 2023, an increase of 65.4% from

$257.7 million in the 12 months ended December 31, 2022.

3P seller GigaCloud Marketplace GMV represented 53.7% of total

GigaCloud Marketplace GMV in the 12 months ended December 31,

2023.

“The fourth quarter saw our highest quarterly revenue in the

company history, up almost 95% year-over-year, representing an

inflection point in the size and scale of GigaCloud,” said Larry

Wu, Founder, Chairman, and Chief Executive Officer of GigaCloud.

“The integration of Noble House and Wondersign marks as a

significant step forward in our global expansion. This move

elevates our presence across diverse geographies, broadens our

product portfolio with premium SKUs, integrates innovative

technology, and expands our business network. Together, these

efforts, coupled with our organic growth, propel us towards a new

era of industry leadership. We combine our supplier fulfilled

retailing business model, which streamlines every step of the

supply chain journey, with ongoing research and development focused

on leveraging advanced algorithms to further optimize our robust

cloud infrastructure. This strategic combination empowers us to

deliver an exceptional B2B selling and sourcing experience for all

marketplace participants. Moving forward, we are confident in our

ability to create a sustainable, more efficient global supply chain

for large parcel merchandise.”

Fourth Quarter 2023 Financial Results

Revenues

Total revenues were $244.7 million in the fourth quarter of

2023, increased by 94.8% from $125.6 million in the fourth

quarter of 2022. The increase was primarily due to an increase in

market demand for large parcel merchandise, leading to increases in

our GigaCloud Marketplace GMV, sales volume and number of sellers

and buyers.

- Service revenue from GigaCloud 3P was

$69.3 million in the fourth quarter of 2023, increased by

92.0% from $36.1 million in the fourth quarter of 2022. The

increase was primarily due to an increase in revenue from last-mile

delivery services by 69.1% from $21.7 million in the fourth

quarter of 2022 to $36.7 million in the fourth quarter of

2023, an increase in revenue from ocean transportation services by

81.0% from $4.2 million in the fourth quarter of 2022 to

$7.6 million in the fourth quarter of 2023, an increase in

revenue from packaging service by 122.2% from $2.7 million in the

fourth quarter of 2022 to $6.0 million in the fourth quarter of

2023, and an increase in revenue from warehouse services by 43.4%

from $5.3 million in the fourth quarter of 2022 to

$7.6 million in the fourth quarter of 2023.

- Product revenue from GigaCloud 1P was

$88.3 million in the fourth quarter of 2023, increased by

50.9% from $58.5 million in the fourth quarter of 2022. The

increase was primarily due to increases in the number of buyers and

spend per active buyer.

- Product revenue from off-platform

ecommerce was $87.0 million in the fourth quarter of 2023,

increased by 179.7% from $31.1 million in the fourth quarter

of 2022. The increase was primarily due to increases in the number

of sales channels and the sales in certain third-party off-platform

ecommerce.

Cost of Revenues

Cost of revenues was $174.9 million in the fourth quarter

of 2023, increased by 76.8% from $98.9 million in the fourth

quarter of 2022.

- Cost of services increased by 91.6%

from $29.9 million in the fourth quarter of 2022 to

$57.3 million in the fourth quarter of 2023, primarily due to

an increase in delivery cost by 98.3% from $22.9 million in

the fourth quarter of 2022 to $45.4 million in the fourth

quarter of 2023 consistent with the increase in our sales, an

increase in rental cost by 65.1% from $4.3 million in the fourth

quarter of 2022 to $7.1 million in the fourth quarter of 2023 as we

increased the number of warehouses to 33 globally in the fourth

quarter of 2023, and an increase in staff cost by 115.4% from

$1.3 million in the fourth quarter of 2022 to

$2.8 million in the fourth quarter of 2023 as the Company is

expanding.

- Cost of product sales increased by

70.4% from $69.0 million in the fourth quarter of 2022 to

$117.6 million in the fourth quarter of 2023, primarily due to

an increase in product cost by 67.5% from $52.3 million in the

fourth quarter of 2022 to $87.6 million in the fourth quarter of

2023 consistent with the increase in our sales, an increase in

rental cost by 184.2% from $3.8 million in the fourth quarter of

2022 to $10.8 million in the fourth quarter of 2023 as we increased

the number of warehouses to 33 globally in the fourth quarter of

2023, and an increase in delivery costs by 20.4% from

$9.8 million in the fourth quarter of 2022 to

$11.8 million in the fourth quarter of 2023.

Gross Profit and Gross Margin

Gross profit was $69.8 million in the fourth quarter of

2023, increased by 161.4% from $26.7 million in the fourth

quarter of 2022. Gross margin increased to 28.5% in the fourth

quarter of 2023 from 21.2% in the fourth quarter of 2022.

Operating Expenses

Total operating expenses were $32.7 million in the fourth

quarter of 2023, increased by 181.9% from $11.6 million in the

fourth quarter of 2022.

- Selling and marketing expenses were

$14.0 million in the fourth quarter of 2023, increased by

122.2% from $6.3 million in the fourth quarter of 2022. The

increase was primarily due to an increase in platform service fee

we incurred to certain third-party ecommerce websites by 173.9%

from $2.3 million in the fourth quarter of 2022 to

$6.3 million in the fourth quarter of 2023, an increase in

staff cost related to selling and marketing personnel by 50.0% from

$3.4 million in the fourth quarter of 2022 to

$5.1 million in the fourth quarter of 2023, and an increase in

advertising and promotion expense by 340.0% from $0.5 million in

the fourth quarter of 2022 to $2.2 million in the fourth quarter of

2023.

- General and administrative expenses

were $13.1 million in the fourth quarter of 2023, increased by

235.9% from $3.9 million in the fourth quarter of 2022. The

increase was primarily due to an increase in staff cost by 178.3%

from $2.3 million in the fourth quarter of 2022 to

$6.4 million in the fourth quarter of 2023, an increase in

professional service expense by 311.1% from $0.9 million in the

fourth quarter of 2022 to $3.7 million in the fourth quarter of

2023 as the Company engaged professional services for its financial

and legal advisors in the fourth quarter of 2023.

- Research and development expenses were

$2.3 million in the fourth quarter of 2023, increased by 64.3%

from $1.4 million in the fourth quarter of 2022, primarily due to

the Company's dedication in expanding our research and development

efforts. We increased the number of research and development

projects and the number of employees to perform research and

development function in the fourth quarter of 2023 compared to the

fourth quarter of 2022.

Operating Income

Operating income was $37.1 million in the fourth quarter of

2023, increased by 145.7% from $15.1 million in the fourth

quarter of 2022.

Income Tax Expenses

Income tax expenses were $7.3 million in the fourth quarter

of 2023, increased by 204.2% from $2.4 million in the fourth

quarter of 2022.

Net Income

Net income was $35.6 million in the fourth quarter of 2023,

an increase of 184.8% from $12.5 million in the fourth quarter

of 2022. Net income margin increased to 14.5% in the fourth quarter

of 2023 from 9.9% in the fourth quarter of 2022.

Basic and Diluted Earnings per Share

Basic and diluted earnings per share were $0.87 in the fourth

quarter of 2023, compared to $0.31 in the fourth quarter of

2022.

Adjusted EBITDA

Adjusted EBITDA7 was $43.8 million in the fourth quarter of

2023, increased by 188.2% from $15.2 million in the fourth

quarter of 2022.

___________________________________1 Adjusted EBITDA

is a non-GAAP financial measure. For more information on the

non-GAAP financial measure, please see the section of “Non-GAAP

Financial Measure” and the table captioned “Unaudited

Reconciliation of Adjusted EBITDA” set forth at the end of this

press release.2 GigaCloud Marketplace GMV means the

total gross merchandise value of transactions ordered through our

GigaCloud Marketplace including GigaCloud 3P and GigaCloud 1P,

before any deductions of value added tax, goods and services tax,

shipping charges paid by buyers to sellers and any refunds.3

Active 3P sellers means sellers who have sold a product in

GigaCloud Marketplace within the last 12-month period, irrespective

of cancellations or returns.4 Active buyers means

buyers who have purchased a product in the GigaCloud Marketplace

within the last 12-month period, irrespective of cancellations or

returns.5 Spend per active buyer is calculated by

dividing the total GigaCloud Marketplace GMV within the

last 12-month period by the number of active buyers as of

such date.6 3P seller GigaCloud Marketplace GMV means

the total gross merchandise value of transactions sold through our

GigaCloud Marketplace by 3P sellers, before any deductions of value

added tax, goods and services tax, shipping charges paid by buyers

to sellers and any refunds.7 Adjusted EBITDA is a

non-GAAP financial measure. For more information on the non-GAAP

financial measure, please see the section of “Non-GAAP Financial

Measure” and the table captioned “Unaudited Reconciliation of

Adjusted EBITDA” set forth at the end of this press release.

Balance Sheet

As of December 31, 2023, the Company had cash of

$183.3 million and restricted cash of $0.9 million,

compared to $143.5 million and $1.5 million as of

December 31, 2022, respectively.

Cash Flow

Net cash provided by operating activities was

$133.5 million in the year ended December 31, 2023,

compared to net cash provided by operating activities of

$49.7 million in the year ended December 31, 2022,

primarily attributable to net income of $94.1 million in the

year ended December 31, 2023, adjusted primarily by

prepayments and other assets, accrued expenses and other current

liabilities, income tax payable, inventories, accounts payable, and

accounts receivable.

Net cash used in investing activities was $90.5 million in the

year ended December 31, 2023 compared to $0.7 million in

the year ended December 31, 2022, consisting primarily of

acquisitions, with the cash payment of $86.6 million in the year

ended December 31, 2023.

Net cash used in financing activities was $4.0 million in

the year ended December 31, 2023, compared to net cash

provided by financing activities of $31.9 million in the year

ended December 31, 2022, consisting primarily of repayment of

finance lease obligations of $2.2 million in the year ended

December 31, 2023 and payment of share repurchase of $1.6

million in the year ended December 31, 2023.

Acquisitions

In October 2023, we completed the acquisition of Noble House

Home Furnishings LLC, or Noble House, a leading B2B distributor of

indoor and outdoor home furnishings, for an aggregate consideration

of approximately $77.6 million. The Noble House acquisition was

funded using cash on hand from operations. The acquisition added

valuable assets, including but not limited to, inventory,

warehouses leases, intangible assets including technology assets,

and other assets which can be further utilized and to supplement

our B2B ecommerce ecosystem.

The acquisition of Noble House added six warehouses with

approximately 2.4 million square feet to our warehousing network in

the U.S., and one warehouse with approximately 0.1 million square

feet in Canada. We also increased the number of product SKUs,

particularly in outdoor furnishings, to our GigaCloud Marketplace

through this acquisition. We plan to utilize Noble House’s

footprint in India to broaden our suppliers base, and in Canada to

expand the end markets that we serve, attract more sellers and

buyers on our Marketplace. We believe the Noble House acquisition

would contribute additional sales channels and business

relationships to further complement our B2B ecommerce

ecosystem.

In November 2023, we completed the acquisition of a 100% equity

interest of Apexis, Inc., a Florida corporation dba Wondersign, or

Wondersign, for an aggregate purchase price of approximately $10.0

million. The Wondersign acquisition was funded using cash on hand

from operations. Wondersign is a cloud-based interactive digital

signage and e-catalog management SaaS company headquartered in

Tampa, Florida with access to thousands of storefronts across the

United States through its customers. Wondersign develops and

maintains “Catalog Kiosk,” a leading digital catalog software that

allows retailers to display an endless aisle of products and better

connect with today’s omni-channel shoppers. We believe that the

acquisition of Wondersign would help us achieve our goal in making

GigaCloud Marketplace a customer-facing and seamless platform,

providing a user-friendly experience for both platform participants

and retail store customers.

Noble House contributes product revenues to our GigaCloud 1P and

off-platform ecommerce revenue streams, while Wondersign

contributes service revenues through its catalog subscription

services, and product revenues through the sales of its Catalog

Kiosk displays.

The financial impact from the acquisitions of Noble House and

Wondersign was reflected in our financial results in the fourth

quarter of 2023. The operating impact from these acquisitions has

not been reflected in the operating metrics in our GigaCloud

Marketplace in the fourth quarter of 2023.

Warehouse Fire

On March 9, 2024, one of the Company’s warehouses in Japan

suffered damages due to a warehouse fire. While the Company is

still evaluating the impact caused by the warehouse fire, the

Company estimated approximately $1.8 million in damages with

respect to the cost of its inventory held at the warehouse. The

Company has insurance coverage associated with the damages to the

inventory and warehouse equipment. Furthermore, the Company has a

total of four warehouses in Japan and the Company has shifted our

warehousing operations in Japan to the other three warehouses to

minimize any disruptions to the Company’s operations in Japan.

Share Repurchase Program

The Company established a share repurchase program in June 2023

under which the Company may purchase up to $25.0 million of its

Class A ordinary shares, par value $0.05, over a 12-month period.

From the launch of the share repurchase program on June 14, 2023 to

December 31, 2023, the Company in aggregate purchased

approximately 215,000 Class A ordinary shares in the open market at

a total consideration of approximately $1.6 million pursuant to the

share repurchase program. During our fourth fiscal quarter of 2023,

we did not repurchase any Class A ordinary shares.

Business Outlook

The Company expects its total revenues to be between

$230 million and $240 million in the first quarter of

2024. This forecast reflects the Company’s current and preliminary

views on the market and operational conditions, which are subject

to change and cannot be predicted with reasonable accuracy as of

the date hereof.

Conference Call

The Company will host an earnings conference call to discuss its

financial results at 8:30 am U.S. Eastern Time (8:30 pm

Beijing/Hong Kong Time) on March 18, 2024.

For participants who wish to join the call, please access the

link provided below to complete the online registration

process.

Registration

Link: https://register.vevent.com/register/BI81d3392a6ff646c69fe25f848272517b

Upon registration, participants will receive the dial-in number

and unique PIN, which can be used to join the conference call. If

participants register and forget their PIN or lose their

registration confirmation email, they may simply re-register and

receive a new PIN. All participants are encouraged to dial in 15

minutes prior to the start time.

A live and archived webcast of the conference call will be

accessible on the Company’s investor relations website at:

https://investors.gigacloudtech.com/.

About GigaCloud Technology Inc

GigaCloud Technology Inc is a pioneer of global end-to-end B2B

ecommerce solutions for large parcel merchandise. The Company’s B2B

ecommerce platform, which it refers to as the “GigaCloud

Marketplace,” integrates everything from discovery, payments and

logistics tools into one easy-to-use platform. The Company’s global

marketplace seamlessly connects manufacturers, primarily in Asia,

with resellers, primarily in the U.S., Asia and Europe, to execute

cross-border transactions with confidence, speed and efficiency.

The Company offers a truly comprehensive solution that transports

products from the manufacturer’s warehouse to the end customer’s

doorstep, all at one fixed price. The Company first launched its

marketplace in January 2019 by focusing on the global furniture

market and has since expanded into additional categories such as

home appliances and fitness equipment. For more information, please

visit the Company’s website:

https://investors.gigacloudtech.com/.

Non-GAAP Financial Measures

The Company uses Adjusted EBITDA, which is net income excluding

interest, income taxes and depreciation, further adjusted to

exclude share-based compensation expense, a non-GAAP financial

measure, to understand and evaluate its core operating performance.

Non-GAAP financial measures, which may differ from similarly titled

measures used by other companies, are presented to enhance

investors’ overall understanding of our financial performance and

should not be considered a substitute for, or superior to, the

financial information prepared and presented in accordance with

U.S. GAAP.

For more information on the non-GAAP financial measures, please

see the table captioned “Unaudited Reconciliation of Adjusted

EBITDA” set forth at the end of this press release.

Forward-Looking Statements

This press release contains “forward-looking statements”.

Forward-looking statements reflect our current view about future

events. These forward-looking statements involve known and unknown

risks and uncertainties and are based on the Company’s current

expectations and projections about future events that the Company

believes may affect its financial condition, results of operations,

business strategy and financial needs. Investors can identify these

forward-looking statements by words or phrases such as “may,”

“will,” “could,” “expect,” “anticipate,” “aim,” “estimate,”

“intend,” “plan,” “believe,” “is/are likely to,” “propose,”

“potential,” “continue” or similar expressions. The Company

undertakes no obligation to update or revise publicly any

forward-looking statements to reflect subsequent occurring events

or circumstances, or changes in its expectations, except as may be

required by law. Although the Company believes that the

expectations expressed in these forward-looking statements are

reasonable, it cannot assure you that such expectations will turn

out to be correct, and the Company cautions investors that actual

results may differ materially from the anticipated results and

encourages investors to review other factors that may affect its

future results in the Company’s registration statement and other

filings with the SEC.

For investor and media inquiries, please

contact:

GigaCloud Technology Inc

Investor Relations Email: ir@gigacloudtech.com

ICR Inc.

Ryan Gardella Email: GigacloudIR@icrinc.com

|

|

|

GigaCloud Technology Inc UNAUDITED

CONDENSED CONSOLIDATED BALANCE SHEETS(In thousands

except for share data and per share data) |

|

|

| |

December 31, |

|

December 31, |

|

|

|

2022 |

|

|

|

2023 |

|

| ASSETS |

|

|

|

| Current

assets |

|

|

|

| Cash |

$ |

143,531 |

|

|

$ |

183,283 |

|

| Restricted cash |

|

1,545 |

|

|

|

885 |

|

| Accounts receivable, net |

|

27,142 |

|

|

|

58,876 |

|

| Inventories |

|

78,338 |

|

|

|

125,615 |

|

| Prepayments and other current

assets |

|

7,566 |

|

|

|

17,516 |

|

| Total current

assets |

|

258,122 |

|

|

|

386,175 |

|

| Non-current

assets |

|

|

|

| Operating lease right-of-use

assets |

|

144,168 |

|

|

|

398,922 |

|

| Property and equipment,

net |

|

13,053 |

|

|

|

24,614 |

|

| Intangible assets, net |

|

— |

|

|

|

8,367 |

|

| Goodwill |

|

— |

|

|

|

12,586 |

|

| Deferred tax assets |

|

75 |

|

|

|

1,440 |

|

| Other non-current assets |

|

3,182 |

|

|

|

8,173 |

|

| Total non-current

assets |

|

160,478 |

|

|

|

454,102 |

|

| Total

assets |

$ |

418,600 |

|

|

$ |

840,277 |

|

| LIABILITIES AND

SHAREHOLDERS’ EQUITY |

|

|

|

| Current

liabilities |

|

|

|

| Current portion of long-term

borrowings |

$ |

207 |

|

|

$ |

— |

|

| Accounts payable (including

accounts payable of VIEs without recourse to the Company of $4,185

and $8,200 as of December 31, 2022 and December 31, 2023,

respectively) |

|

31,573 |

|

|

|

63,125 |

|

| Contract liabilities

(including contract liabilities of VIEs without recourse to the

Company of $385 and $736 as of December 31, 2022 and December 31,

2023, respectively) |

|

2,001 |

|

|

|

5,537 |

|

| Current operating lease

liabilities (including current operating lease liabilities of VIEs

without recourse to the Company of $1,864 and $1,305 as of December

31, 2022 and December 31, 2023, respectively) |

|

27,653 |

|

|

|

57,949 |

|

| Income tax payable (including

income tax payable of VIEs without recourse to the Company of $280

and $3,644 as of December 31, 2022 and December 31, 2023,

respectively) |

|

4,142 |

|

|

|

15,212 |

|

| Accrued expenses and other

current liabilities (including accrued expenses and other current

liabilities of VIEs without recourse to the Company of $442 and

$2,774 as of December 31, 2022 and December 31, 2023,

respectively) |

|

37,062 |

|

|

|

57,319 |

|

| Total current

liabilities |

|

102,638 |

|

|

|

199,142 |

|

| Non-current

liabilities |

|

|

|

| Operating lease liabilities,

non-current (including operating lease liabilities, non-current of

VIEs without recourse to the Company of $3,322 and $553 as of

December 31, 2022 and December 31, 2023, respectively) |

|

116,564 |

|

|

|

343,511 |

|

| Deferred tax liabilities |

|

472 |

|

|

|

3,795 |

|

| Finance lease obligations,

non-current |

|

867 |

|

|

|

111 |

|

| Non-current income tax

payable |

|

2,894 |

|

|

|

3,302 |

|

| Total non-current

liabilities |

|

120,797 |

|

|

|

350,719 |

|

| Total

liabilities |

$ |

223,435 |

|

|

$ |

549,861 |

|

| Commitments and

contingencies |

|

|

|

| Shareholders’

equity |

|

|

|

| Treasury shares, at cost

(4,624,039 and 294,029 shares held as of December 31, 2022 and

December 31, 2023, respectively) |

$ |

(231 |

) |

|

$ |

(1,594 |

) |

| Subscription receivable from

ordinary shares |

|

(81 |

) |

|

|

— |

|

| Class A ordinary shares ($0.05

par value, 50,673,268 shares authorized, 31,357,814 and 31,738,632

shares issued as of December 31, 2022 and December 31, 2023,

respectively, 31,357,814 and 31,455,148 shares outstanding as of

December 31, 2022 and December 31, 2023, respectively) |

|

1,568 |

|

|

|

1,584 |

|

| Class B ordinary shares ($0.05

par value, 9,326,732 shares authorized, issued and outstanding as

of both December 31, 2022 and December 31, 2023) |

|

466 |

|

|

|

466 |

|

| Additional paid-in

capital |

|

109,049 |

|

|

|

111,736 |

|

| Accumulated other

comprehensive income |

|

804 |

|

|

|

526 |

|

| Retained earnings |

|

83,590 |

|

|

|

177,698 |

|

| Total shareholders’

equity |

|

195,165 |

|

|

|

290,416 |

|

| Total liabilities and

shareholders’ equity |

$ |

418,600 |

|

|

$ |

840,277 |

|

|

|

|

GigaCloud Technology Inc UNAUDITED

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE

INCOME(In thousands except for share data and per

share data) |

|

|

| |

Three months ended December 31 |

|

Year ended December 31, |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

| Revenues |

|

|

|

|

|

|

|

| Service revenues |

$ |

36,069 |

|

|

$ |

69,336 |

|

|

$ |

140,628 |

|

|

$ |

199,184 |

|

| Product revenues |

|

89,535 |

|

|

|

175,401 |

|

|

|

349,443 |

|

|

|

504,647 |

|

| Total

revenues |

|

125,604 |

|

|

|

244,737 |

|

|

|

490,071 |

|

|

|

703,831 |

|

| Cost of

revenues |

|

|

|

|

|

|

|

| Services |

|

29,927 |

|

|

|

57,291 |

|

|

|

120,102 |

|

|

|

161,215 |

|

| Product sales |

|

69,003 |

|

|

|

117,609 |

|

|

|

286,855 |

|

|

|

353,983 |

|

| Total cost of

revenues |

|

98,930 |

|

|

|

174,900 |

|

|

|

406,957 |

|

|

|

515,198 |

|

|

Gross profit |

|

26,674 |

|

|

|

69,837 |

|

|

|

83,114 |

|

|

|

188,633 |

|

| Operating

expenses |

|

|

|

|

|

|

|

| Selling and marketing

expenses |

|

6,256 |

|

|

|

14,004 |

|

|

|

24,038 |

|

|

|

41,386 |

|

| General and administrative

expenses |

|

3,931 |

|

|

|

13,130 |

|

|

|

22,627 |

|

|

|

30,008 |

|

| Research and development

expenses |

|

1,426 |

|

|

|

2,344 |

|

|

|

1,426 |

|

|

|

3,925 |

|

| Losses on disposal of property

and equipment |

|

— |

|

|

|

3,236 |

|

|

|

— |

|

|

|

3,236 |

|

| Total operating

expenses |

|

11,613 |

|

|

|

32,714 |

|

|

|

48,091 |

|

|

|

78,555 |

|

|

Operating income |

|

15,061 |

|

|

|

37,123 |

|

|

|

35,023 |

|

|

|

110,078 |

|

| Interest expense |

|

(129 |

) |

|

|

(108 |

) |

|

|

(568 |

) |

|

|

(1,240 |

) |

| Interest income |

|

254 |

|

|

|

1,293 |

|

|

|

472 |

|

|

|

3,304 |

|

| Foreign currency exchange

gains (losses), net |

|

(1,024 |

) |

|

|

4,239 |

|

|

|

(4,854 |

) |

|

|

2,086 |

|

| Government grants |

|

1,085 |

|

|

|

438 |

|

|

|

1,085 |

|

|

|

911 |

|

| Others, net |

|

(396 |

) |

|

|

(137 |

) |

|

|

6 |

|

|

|

(144 |

) |

|

Income before income taxes |

|

14,851 |

|

|

|

42,848 |

|

|

|

31,164 |

|

|

|

114,995 |

|

| Income tax expense |

|

(2,375 |

) |

|

|

(7,273 |

) |

|

|

(7,192 |

) |

|

|

(20,887 |

) |

| Net

income |

$ |

12,476 |

|

|

$ |

35,575 |

|

|

$ |

23,972 |

|

|

$ |

94,108 |

|

| Accretion of Redeemable

Convertible Preferred Shares |

|

— |

|

|

|

— |

|

|

|

(941 |

) |

|

|

— |

|

| Net income

attributable to ordinary shareholders |

|

12,476 |

|

|

|

35,575 |

|

|

|

23,031 |

|

|

|

94,108 |

|

| Foreign currency translation

adjustment, net of nil income taxes |

|

3,440 |

|

|

|

232 |

|

|

|

969 |

|

|

|

(278 |

) |

| Total other

comprehensive income (loss) |

|

3,440 |

|

|

|

232 |

|

|

|

969 |

|

|

|

(278 |

) |

| Comprehensive

Income |

|

15,916 |

|

|

|

35,807 |

|

|

|

24,941 |

|

|

|

93,830 |

|

| Net income per

ordinary share |

|

|

|

|

|

|

|

|

—Basic |

$ |

0.31 |

|

|

$ |

0.87 |

|

|

$ |

0.60 |

|

|

$ |

2.31 |

|

|

—Diluted |

$ |

0.31 |

|

|

$ |

0.87 |

|

|

$ |

0.60 |

|

|

$ |

2.30 |

|

| Weighted average

number of ordinary shares outstanding used in computing net income

per ordinary share |

|

|

|

|

|

|

|

|

—Basic |

|

40,692,080 |

|

|

|

40,770,882 |

|

|

|

24,412,314 |

|

|

|

40,788,448 |

|

|

—Diluted |

|

40,692,080 |

|

|

|

40,901,772 |

|

|

|

24,412,314 |

|

|

|

40,922,590 |

|

|

|

|

GigaCloud Technology Inc UNAUDITED

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands) |

|

|

| |

Year ended December 31, |

|

|

|

2022 |

|

|

|

2023 |

|

| Cash flows from

operating activities: |

|

|

|

| Net

income |

$ |

23,972 |

|

|

$ |

94,108 |

|

| Adjustments to reconcile net

income to net cash provided by operating activities: |

|

|

|

|

Allowance for doubtful accounts |

|

86 |

|

|

|

263 |

|

|

Inventory write-down |

|

318 |

|

|

|

671 |

|

|

Deferred tax |

|

183 |

|

|

|

398 |

|

|

Share-based compensation |

|

9,196 |

|

|

|

2,503 |

|

|

Depreciation and amortization |

|

1,386 |

|

|

|

2,873 |

|

|

Loss from disposal of property and equipment |

|

4 |

|

|

|

3,236 |

|

|

Operating lease |

|

2,389 |

|

|

|

2,485 |

|

|

Unrealized foreign currency exchange gains (losses) |

|

2,126 |

|

|

|

(972 |

) |

|

Interest expense of capital leases (ASC 840) |

|

— |

|

|

|

— |

|

| Changes in operating assets

and liabilities, net of businesses acquired: |

|

|

|

|

Accounts receivable |

|

(9,161 |

) |

|

|

(5,058 |

) |

|

Inventories |

|

2,785 |

|

|

|

(9,882 |

) |

|

Prepayments and other assets |

|

(1,384 |

) |

|

|

(9,249 |

) |

|

Accounts payable |

|

6,619 |

|

|

|

19,392 |

|

|

Contract liabilities |

|

(1,689 |

) |

|

|

1,473 |

|

|

Income tax payable |

|

(1,530 |

) |

|

|

10,977 |

|

|

Accrued expenses and other current liabilities |

|

14,356 |

|

|

|

20,234 |

|

| Net cash provided by

operating activities |

|

49,656 |

|

|

|

133,452 |

|

| Cash flows from

investing activities: |

|

|

|

|

Cash paid for purchase of property and equipment |

|

(709 |

) |

|

|

(4,380 |

) |

|

Cash received from disposal of property and equipment |

|

— |

|

|

|

462 |

|

|

Acquisitions, net of cash acquired |

|

— |

|

|

|

(86,629 |

) |

| Net cash used in

investing activities |

$ |

(709 |

) |

|

$ |

(90,547 |

) |

| Cash flows from

financing activities: |

|

|

|

|

Repayment of finance lease obligations |

$ |

(3,624 |

) |

|

$ |

(2,212 |

) |

|

Repayment of bank loans |

|

(312 |

) |

|

|

(197 |

) |

|

Payment of share repurchase |

|

— |

|

|

|

(1,594 |

) |

|

Proceeds from prepaid consideration of restricted shares |

|

1,578 |

|

|

|

— |

|

|

Proceeds from initial public offering, net of IPO costs |

|

34,245 |

|

|

|

— |

|

| Net cash provided by

(used in) financing activities |

|

31,887 |

|

|

|

(4,003 |

) |

| Effect of foreign currency

exchange rate changes on cash and restricted cash |

|

380 |

|

|

|

190 |

|

| Net increase in cash

and restricted cash |

|

81,214 |

|

|

|

39,092 |

|

| Cash and restricted cash at

the beginning of the year |

|

63,862 |

|

|

|

145,076 |

|

| Cash and restricted

cash at the end of the year |

|

145,076 |

|

|

|

184,168 |

|

| Supplemental

disclosure of cash flow information |

|

|

|

| Cash paid for interest

expense |

|

568 |

|

|

|

1,240 |

|

| Cash paid for income

taxes |

|

8,539 |

|

|

|

9,512 |

|

| Non-cash investing and

financing activities: |

|

|

|

| Purchase of property and

equipment under finance leases |

|

2,719 |

|

|

|

— |

|

| Share based awards

attributable to the IPO where no cash payment is required |

|

807 |

|

|

|

— |

|

| Reversal of subscription

receivable from ordinary shares |

|

— |

|

|

|

312 |

|

| Fair value of assets acquired

by acquisition |

|

— |

|

|

|

273,086 |

|

| Cash paid for business

combinations and asset purchases |

|

— |

|

|

|

87,568 |

|

| Liabilities assumed by

acquisition |

$ |

— |

|

|

$ |

(185,518 |

) |

|

|

|

GigaCloud Technology IncUNAUDITED

RECONCILIATION OF ADJUSTED EBITDA(In

thousands) |

|

|

| |

Three Months EndedDecember

31, |

|

Years Ended December 31, |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

| Net

Income |

$ |

12,476 |

|

|

$ |

35,575 |

|

|

$ |

23,972 |

|

|

$ |

94,108 |

|

| Add: Income tax expense |

|

2,375 |

|

|

|

7,273 |

|

|

|

7,192 |

|

|

|

20,887 |

|

| Add: Interest expense |

|

129 |

|

|

|

108 |

|

|

|

568 |

|

|

|

1,240 |

|

| Less: Interest income |

|

(254 |

) |

|

|

(1,293 |

) |

|

|

(472 |

) |

|

|

(3,304 |

) |

| Add: Depreciation and

amortization |

|

349 |

|

|

|

1,723 |

|

|

|

1,386 |

|

|

|

2,873 |

|

| Add: Share-based compensation

expenses |

|

110 |

|

|

|

429 |

|

|

|

9,196 |

|

|

|

2,503 |

|

| Adjusted

EBITDA |

$ |

15,185 |

|

|

$ |

43,815 |

|

|

$ |

41,842 |

|

|

$ |

118,307 |

|

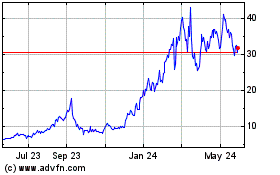

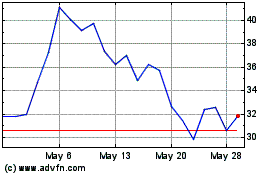

GigaCloud Technology (NASDAQ:GCT)

Historical Stock Chart

From Apr 2024 to May 2024

GigaCloud Technology (NASDAQ:GCT)

Historical Stock Chart

From May 2023 to May 2024