0001841156false00018411562024-03-082024-03-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): March 8, 2024 |

Paymentus Holdings, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-40429 |

45-3188251 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

11605 North Community House Road, Suite 300 |

|

Charlotte, North Carolina |

|

28277 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

(888) 440-4826 Registrant’s Telephone Number, Including Area Code: |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Class A Common Stock, par value $0.0001 per share |

|

PAY |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

2024 Executive Incentive Compensation Program

On March 8, 2024, the board of directors (the “Board”) of Paymentus Holdings, Inc. (the “Company”) adopted the Company’s 2024 Executive Incentive Compensation Plan (the “2024 Program”), which was established under the Company’s Executive Incentive Compensation Plan (“EICP”). The Board’s adoption of the 2024 Program followed the recommendation of the Compensation Committee (the “Committee”) of the Board, after a review by the Committee of the Company’s executive compensation program and related information provided by the Committee’s independent compensation consultant.

The name, position, current 2024 base salary and full-year target bonus amount of each of the Company’s executive officers participating in the 2024 Program is as follows:

|

|

|

|

Name |

Position |

2024 Base Salary |

Target Bonus as a % of 2024 Base Salary |

Dushyant Sharma |

President and Chief Executive Officer |

$360,500(1) |

192.9% |

Sanjay Kalra |

Senior Vice President and Chief Financial Officer |

$515,000(1) |

100.0% |

Jerry Portocalis |

Chief Commercial Officer |

$432,600(1) |

62.5% |

Andrew Gerber |

General Counsel and Secretary |

$351,488(1) |

61.5% |

_____________________________

(1) Represents a 3% increase over the 2023 base salary for each executive officer.

The performance components under the 2024 Program are equally weighted and consist of (i) gross revenue (“Revenue”), (ii) non-GAAP contribution profit (“CP”), (iii) Adjusted EBITDA, (iv) Adjusted EBITDA less capitalized software (“Adjusted EBITDA-LCS”), and (v) individual performance, with a performance target established for each of the four financial components for the fiscal year ending December 31, 2024. Each component under the 2024 Program may be achieved and a corresponding payout made independent of the other components, but the minimum threshold (as described below) for at least two of the four financial components must be achieved before any bonus payments will be made.

Under the 2024 Program, (i) a minimum threshold equal to 90% of the Revenue and CP targets must be met before any bonus payments will be made with respect to such components, and in the event either of the Revenue or CP targets are achieved at a level above 100% of the target for such components, the participant may receive up to an additional 10% payout with respect to such components, and (ii) a minimum threshold equal to 80% of the Adjusted EBITDA and Adjusted EBITDA-LCS targets must be met before any bonus payments will be made with respect to such components, and in the event either of the Adjusted EBITDA or Adjusted EBITDA-LCS targets are achieved at a level above 100% of the target for such components, the participant may receive up to an additional 10% payout with respect to such components. The individual performance payout will range from 0 to 120%, as determined by the Committee.

Payment of bonus amounts earned, if any, under the 2024 Program will be made following approval by the Audit Committee of the Board of the Company’s 2024 audited financial statements.

Unless otherwise determined by the Committee, participants in the 2024 Program must remain employed by the Company through the date that any bonus amount is paid in order to receive the bonus payment. The Board and the Committee, each in its sole discretion, generally retain the right to amend, supplement, supersede or cancel the 2024 Program for any reason, and reserve the right to determine whether and when to pay out any bonus amounts pursuant to or outside of the 2024 Program, regardless of the achievement of the performance targets.

The EICP under which the 2024 Program was established is filed as Exhibit 10.3 to our Annual Report on Form 10-K for the year ended December 31, 2023 and described in our Definitive Proxy Statement, dated April 21, 2023, under the heading “Executive Compensation—Non-equity Incentive Plan Compensation.”

Payouts Under 2023 Executive Incentive Compensation Program and Discretionary Bonus

Also on March 8, 2024, the Board determined that the Company’s financial results for the year ended December 31, 2023 resulted in a formula payout under the Company’s 2023 Executive Incentive Compensation Plan (the “2023 Program”) of 112.2% of the target bonus opportunity for the executive officers participating in the 2023 Program, resulting in a bonus payment of $467,500 for Mr. Kalra, $294,563 for Mr. Portocalis and $235,651 for Mr. Gerber. The 2023 Program is describe in more detail in our Current Report on Form 8-K filed with the Securities and Exchange Commission on June 5, 2023.

Although Mr. Sharma declined to participate in the 2023 Program, the Committee reserved the right to elect to pay Mr. Sharma a discretionary bonus as appropriate based on fiscal year 2023 financial performance. In recognition of the Company’s strong financial performance and the fact that all 2023 Program metrics were achieved above their respective targets, on March 8, 2024, the Board, upon recommendation of the Committee, approved payment of a discretionary bonus to Mr. Sharma in the amount of $757,350, which represented an amount equal to the formula payout amount of 112.2% of his initially approved 2023 Program target opportunity of $675,000.

|

|

|

|

|

|

|

PAYMENTUS HOLDINGS, INC. |

|

|

|

|

Date: |

March 11, 2024 |

By: |

/s/ Dushyant Sharma |

|

|

|

Dushyant Sharma

Chairman, President and Chief Executive Officer |

v3.24.0.1

Document and Entity Information

|

Mar. 08, 2024 |

| Document Information [Line Items] |

|

| Amendment Flag |

false

|

| Document Type |

8-K

|

| Document Period End Date |

Mar. 08, 2024

|

| Entity File Number |

001-40429

|

| Entity Registrant Name |

Paymentus Holdings, Inc.

|

| Entity Central Index Key |

0001841156

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

45-3188251

|

| Entity Address, Address Line One |

11605 North Community House Road

|

| Entity Address, Address Line2 |

Suite 300

|

| Entity Address, City or Town |

Charlotte

|

| Entity Address, State or Province |

NC

|

| Entity Address, Postal Zip Code |

28277

|

| City Area Code |

(888)

|

| Local Phone Number |

440-4826

|

| Title of 12(b) Security |

Class A Common Stock, par value $0.0001 per share

|

| Trading Symbol |

PAY

|

| Security Exchange Name |

NYSE

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Entity Ex Transition Period |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

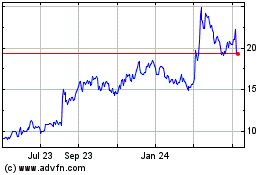

Paymentus (NYSE:PAY)

Historical Stock Chart

From Mar 2024 to Apr 2024

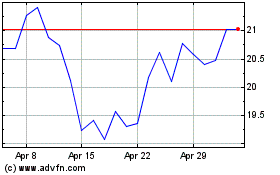

Paymentus (NYSE:PAY)

Historical Stock Chart

From Apr 2023 to Apr 2024