0001494650false00014946502023-07-272023-07-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________________________________________________________________________

FORM 8-K

____________________________________________________________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 8, 2024

__________________________________________________________________________________________

OPTINOSE, INC.

(Exact Name of Registrant as Specified in its Charter)

____________________________________________________________________________________________ | | | | | | | | |

| Delaware | 001-38241 | 42-1771610 |

| (State or Other Jurisdiction of Incorporation or Organization) | (Commission File No.) | (I.R.S. Employer Identification No.) |

1020 Stony Hill Road, Suite 300

Yardley, Pennsylvania 19067

(Address of principal executive offices and zip code)

(267) 364-3500

(Registrant’s telephone number, including area code)

(Former name or former address, if changed from last report)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading symbol(s) | | Name of each exchange on which registered |

| Common stock, par value $0.001 per share | | OPTN | | Nasdaq Global Select Market |

____________________________________________________________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below): | | | | | |

| |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-14(c)) |

| |

| Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). |

| |

| ☐ | Emerging growth company |

| |

| ☐ | If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. |

Item 1.01 Entry into a Material Definitive Agreement

On March 8, 2024, OptiNose, Inc. (the “Company”) entered in a Second Amendment (the “Second Amendment”) to its Amended and Restated Note Purchase Agreement dated November 21, 2022, as amended on March 5, 2024, among the Company, OptiNose US, Inc., the purchaser parties defined therein and BioPharma Credit PLC (as amended, the “A&R Note Purchase Agreement”).

Pursuant to the Second Amendment, the financial covenants requiring the Company to achieve minimum trailing twelve-month consolidated XHANCE net product sales and royalties was modified as follows (amounts in millions):

| | | | | | | | |

| | |

| Trailing Twelve-Months Ending | As Revised Pursuant to Second Amendment |

| March 31, 2024 | $70,000,000 |

| June 30, 2024 | $70,000,000 |

| September 30, 2024 | $72,500,000 |

| December 31, 2024 | $75,000,000 |

| March 31, 2025 | $80,000,000 |

| June 30, 2025 | $87,500,000 |

| September 30, 2025 | $95,000,000 |

| December 31, 2025 | $105,500,000 |

| March 31, 2026 | $120,000,000 |

| June 30, 2026 | $130,000,000 |

| September 30, 2026 | $145,000,000 |

| December 31, 2026 | $150,000,000 |

| March 31, 2027 | $155,000,000 |

| June 30, 2027 | $160,000,000 |

| | |

In addition, the “make-whole” premium payment due in connection with any principal prepayments (whether mandatory or voluntary) was modified to provide that the Company will be required to pay a make-whole premium in the amount of (i) for any prepayment occurring up to and including November 21, 2024 (which represents the 24th-month anniversary of the effective date of the A&R Note Purchase Agreement), the sum of all interest that would have accrued on the principal amount of the notes prepaid or required to be prepaid from the date of such prepayment through and including the 18th-month anniversary of such prepayment date; and (b) for any prepayment occurring after November 21, 2024 (which represents the 24th-month anniversary of the effective date of the A&R Note Purchase Agreement) but prior to May 21, 2026 (which represents the 42nd-month anniversary of the effective date of the A&R Note Purchase Agreement), the sum of all interest that would have accrued on the principal amount of the notes prepaid or required to be prepaid from the date of such prepayment through and including May 21, 2026 (which represents the 42nd-month anniversary of the effective date of the A&R Note Purchase Agreement); provided, however, that in no event shall all make-whole amounts payable by the Company exceed $24,000,000 in the aggregate.

The foregoing description of the Second Amendment does not purport to be complete and is qualified in its entirety by reference to the full text of the Second Amendment, a copy of which is filed as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits | | | | | | | | |

|

| | |

| Exhibit No. | | Description |

| 10.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| | | | | | | | |

|

| | |

| | | |

| | | OptiNose, Inc. |

| | By: /s/ Michael F. Marino |

| | | Michael F. Marino |

| | | Chief Legal Officer |

March 8, 2024

SECOND AMENDMENT

TO

NOTE PURCHASE AGREEMENT

This Second Amendment to the Note Purchase Agreement (defined below) (this “Amendment”), dated as of March 8. 2024 (the “Second Amendment Effective Date”), is entered into by and among OPTINOSE US, INC., a Delaware corporation (the “Issuer”), OPTINOSE, INC., a Delaware corporation (the “Parent”), the Purchasers (as defined in the Note Purchase Agreement) party to the Note Purchase Agreement as of the Second Amendment Effective Date, and BIOPHARMA CREDIT PLC, a public limited company incorporated under the laws of England and Wales, as Collateral Agent.

RECITALS

WHEREAS, the Issuer, the Purchasers from time to time party thereto and the other parties from time to time party thereto are parties to that certain Amended and Restated Note Purchase Agreement dated as of November 21, 2022, as amended by that certain First Amendment and Waiver to the Note Purchase Agreement dated as of March 4, 2024 (the “Note Purchase Agreement”);

WHEREAS, in accordance with Section 12.01 of the Note Purchase Agreement, the Collateral Agent and each of the Purchasers desire to amend the Note Purchase Agreement on the terms and conditions set forth herein.

AGREEMENT

NOW, THEREFORE, in consideration of the mutual covenants and premises herein contained and intending to be legally bound by this Amendment, each of the undersigned hereby agrees and declares as follows:

SECTION 1. Definitions; Interpretation. All capitalized terms used in this Amendment (including in the recitals hereof) and not otherwise defined herein shall have the meanings assigned to them in the Note Purchase Agreement. The rules of interpretation set forth in Section 1.02 of the Note Purchase Agreement shall be applicable to this Amendment and are incorporated herein by this reference.

SECTION 2. Amendments to Note Purchase Agreement. Subject to the satisfaction of the conditions precedent to effectiveness set forth in Section 5 below and the other terms and conditions hereof, as of the Second Amendment Effective Date:

(a) the Note Purchase Agreement is hereby amended by deleting in its entirety the definition of “Make-Whole Amount” set forth in Section 1.01 of the Note Purchase Agreement and replacing it as follows:

““Make-Whole Amount” means, on any date of determination, as and to the extent applicable, individually, collectively or in any combination, as appropriate, with respect to any amount of the Notes that is prepaid or required to be prepaid before the 42nd-month anniversary of the Effective Date, an amount equal to: (a) for any prepayment date occurring up to and including the 24th-month anniversary of the Effective Date, the sum of all interest that would have accrued on the principal amount of the Notes prepaid or required to be prepaid from the date of prepayment through and including the 18th-month anniversary of such prepayment date; and (b) for any prepayment date occurring after the 24th-month anniversary of the Effective Date but prior to the 42nd-month anniversary of the Effective Date, the sum of all interest that would have accrued on the principal amount of the Notes prepaid or required to be prepaid from the date of prepayment through and including the 42nd-month anniversary of the Effective Date; provided, however, that in no event shall all Make-Whole Amounts payable by the Issuer to the Purchasers hereunder exceed $24,000,000 in the aggregate.”

(b) The Note Purchase Agreement is hereby amended by deleting in its entirety the table set forth in Section 8.16(a) of the Note Purchase Agreement and replacing it with the following

| | | | | |

| (c) Twelve Month Period Ending | Net Sales Threshold |

| March 31, 2024 | $70,000,000 |

| June 30, 2024 | $70,000,000 |

| September 30, 2024 | $72,500,000 |

| December 31, 2024 | $75,000,000 |

| March 31, 2025 | $80,000,000 |

| June 30, 2025 | $87,500,000 |

| September 30, 2025 | $95,000,000 |

| December 31, 2025 | $102,500,000 |

| March 31, 2026 | $120,000,000 |

| June 30, 2026 | $130,000,000 |

| September 30, 2026 | $145,000,000 |

| December 31, 2026 | $150,000,000 |

| March 31, 2027 | $155,000,000 |

| June 30, 2027 | $160,000,000 |

SECTION 3. Conditions Precedent. This Amendment shall become effective on the Second Amendment Effective Date whereupon this Amendment shall become effective as to the Purchasers and all Note Parties in accordance with Section 12.01 of the Note Purchase Agreement; provided, however, that the amendments set forth in Section 2 above shall become effective only after all of the following conditions precedent have been satisfied (or waived by the Purchasers):

(a) the Collateral Agent shall have received counterparts of this Amendment that, when taken together, bear the signatures of (i) each Note Party, (ii) the Collateral Agent, and (iii) the Purchasers; and

(b) the representations and warranties set forth in Section 4 of this Amendment shall be true and correct on and as of the Second Amendment Effective Date.

SECTION 4. Representations and Warranties; Ratifications; No Novation.

(a) Each Note Party, jointly and severally with each other Note Party, hereby represents and warrants to each Purchaser and the Collateral Agent as follows:

(i) Such Note Party has all requisite power and authority to enter into this Amendment and to perform its obligations hereunder.

(ii) This Amendment has been duly executed and delivered by such Note Party and is the legally valid and binding obligation of such Note Party, enforceable against such Note Party in accordance with its terms, subject to applicable Debtor Relief Laws or other Laws affecting creditors’ rights generally and subject to general principles of equity.

(iii) The execution and delivery by such Note Party of, and the performance by such Note Party of its obligations under, this Amendment have been duly authorized and do not and will not: (A) contravene the terms of any of such Note Party’s Organization Documents; (B) violate in any material respect any Law or regulation; (C) conflict with in any material respect, or result in any material breach or contravention of, or require any material payment to be made under, any material order, judgment, injunction, writ, decree, determination or award of any Governmental Authority or any arbitral award to which such Note Party is a party or affecting

such Note Party or any of its properties or assets; (D) require any approval, consent, exemption, authorization, or other action by, or notice to, or filing with, any Governmental Authority or any other Person, other than those that have been obtained before the Second Amendment Effective Date and are in full force and effect; or (E) conflict with in any material respect or result in any material breach or contravention of, or the creation of any Lien under, or require any payment to be made under, any material Contractual Obligation to which such Note Party is a party or affecting such Note Party or the properties of such Note Party or any of its Subsidiaries.

(iv) As of the Second Amendment Effective Date, no Default exists, or would result from the execution and delivery by such Note Party of, and the performance by such Note Party of any of its obligations under, this Amendment.

(b) All of the terms and conditions of the Note Purchase Agreement and the other Note Documents remain in full force and effect and none of such terms and conditions are, or shall be construed as, otherwise amended, waived, or modified, except as specifically set forth herein. Without limiting the generality of the foregoing, the Collateral Documents and all of the Collateral described therein shall continue to secure the payment of all Obligations of the Note Parties, as amended by this Amendment. Without limiting the generality of the releases contained herein (including, without limitation, Section 10 hereof), the parties hereto hereby expressly acknowledge, ratify and reaffirm all of the exculpatory provisions in favor of the Collateral Agent contained in the Note Purchase Agreement and any other Note Document, including, without limitation, Article XI of the Note Purchase Agreement.

(c) Each Note Party hereby ratifies, confirms, reaffirms, and acknowledges its obligations under the Note Documents to which it is a party and agrees that the Note Documents remain in full force and effect, undiminished by this Amendment, except as expressly provided herein. By executing this Amendment, each Note Party acknowledges that it has read, consulted with its attorneys regarding, and understands, this Amendment.

(d) Without limitation to clauses (b) and (c) above, and notwithstanding anything in the Note Purchase Agreement to the contrary, each Note Party hereby ratifies, confirms, reaffirms, agrees and acknowledges that each of (i) the Amendment Fee, as such term is defined in that certain First Amendment to Note Purchase Agreement dated as of March 2, 2021, which has accrued in full as of such date, (ii) the Third Amendment Fee, as such term is defined in that certain Third Amendment to Note Purchase Agreement dated as of August 10, 2022, which has accrued in full as of such date, (iii) the Waiver Fee, as such term is defined in that certain Waiver to Note Purchase Agreement dated as of November 9, 2022, which has accrued in full as of such date, and (iv) the Amendment Fee, as such term is defined in the Note Purchase Agreement, which has accrued in full as of November 21, 2022 is due and payable on the earliest to occur of (x) the date on which the maturity of the Notes is accelerated pursuant to Section 9.02(b) of the Note Purchase Agreement, (y) the date of any prepayment of the Notes pursuant to Section 2.07 or Section 9.02 of the Note Purchase Agreement (including, for the avoidance of doubt, upon the occurrence of a Change of Control) and (z) the Maturity Date.

(e) The execution, delivery and effectiveness of this Amendment shall not, except as expressly provided herein, operate as a waiver of any right, power or remedy of any Purchaser or the Collateral Agent under any of the Note Documents, nor constitute a waiver of any provision of any of the Note Documents. On and after the effectiveness of this Amendment, this Amendment shall for all purposes constitute a Note Document.

SECTION 5. References to and Effect on Note Purchase Agreement. Except as specifically set forth herein, this Amendment shall not modify or in any way affect any of the provisions of the Note Purchase Agreement, which shall remain in full force and effect and is

hereby ratified and confirmed in all respects. On and after the Second Amendment Effective Date all references in the Note Purchase Agreement to “this Agreement,” “hereto,” “hereof,” “hereunder,” or words of like import shall mean the Note Purchase Agreement as amended by this Amendment. The parties hereto hereby acknowledge and agree that this Amendment constitutes a Note Document.

SECTION 6. Successors and Assigns. The provisions of this Amendment shall be binding upon and inure to the benefit of the parties hereto and their respective successors and assigns.

SECTION 7. Governing Law; Jurisdiction, Etc. Section 12.14 of the Note Purchase Agreement is hereby incorporated by reference, mutatis mutandis.

SECTION 8. Counterparts. This Amendment may be executed in counterparts (and by different parties hereto in different counterparts), each of which shall constitute an original, but all of which when taken together shall constitute a single contract. Delivery of an executed counterpart of a signature page of this Amendment by facsimile or other electronic imaging means (e.g. “pdf” or “tif”) shall be effective as delivery of a manually executed counterpart of this Amendment.

SECTION 9. Electronic Execution of Certain Other Documents. The words “execution,” “execute”, “signed,” “signature,” and words of like import in or related to any document to be signed in connection with this Amendment and the transactions contemplated hereby (including without limitation assignments, assumptions, amendments, waivers and consents) shall be deemed to include electronic signatures, the electronic matching of assignment terms and contract formations on electronic platforms approved by the Collateral Agent, or the keeping of records in electronic form, each of which shall be of the same legal effect, validity or enforceability as a manually executed signature or the use of a paper-based recordkeeping system, as the case may be, to the extent and as provided for in any applicable law, including the Federal Electronic Signatures in Global and National Commerce Act, the New York State Electronic Signatures and Records Act, or any other similar state laws based on the Uniform Electronic Transactions Act.

SECTION 10. General Release. IN CONSIDERATION OF, AMONG OTHER THINGS, THE COLLATERAL AGENT’S AND PURCHASERS’ EXECUTION AND DELIVERY OF (OR CONSENT TO DELIVERY AND EXECUTION OF) THIS AMENDMENT, EACH OF THE RELEASORS HEREBY FOREVER AGREES AND COVENANTS NOT TO SUE OR PROSECUTE AGAINST ANY RELEASEE AND HEREBY FOREVER WAIVES, RELEASES AND DISCHARGES, TO THE FULLEST EXTENT PERMITTED BY LAW, EACH RELEASEE FROM ANY AND ALL CLAIMS THAT SUCH RELEASOR NOW HAS OR HEREAFTER MAY HAVE, OF WHATEVER NATURE AND KIND, WHETHER KNOWN OR UNKNOWN, WHETHER NOW EXISTING OR HEREAFTER ARISING, WHETHER ARISING AT LAW OR IN EQUITY, AGAINST THE RELEASEES, BASED IN WHOLE OR IN PART ON FACTS, WHETHER OR NOT NOW KNOWN, EXISTING ON OR BEFORE THE SECOND AMENDMENT EFFECTIVE DATE, THAT RELATE TO, ARISE OUT OF OR OTHERWISE ARE IN CONNECTION WITH: (I) ANY OR ALL OF THE NOTE DOCUMENTS OR TRANSACTIONS CONTEMPLATED THEREBY OR ANY ACTIONS OR OMISSIONS IN CONNECTION THEREWITH OR (II)

ANY ASPECT OF THE DEALINGS OR RELATIONSHIPS BETWEEN OR AMONG THE NOTE PARTIES, ON THE ONE HAND, AND ANY OR ALL OF THE PURCHASERS AND THE COLLATERAL AGENT, ON THE OTHER HAND, RELATING TO ANY OR ALL OF THE DOCUMENTS, TRANSACTIONS, ACTIONS OR OMISSIONS REFERENCED IN CLAUSE (I) ABOVE. WITHOUT LIMITING THE EFFECT OF THE FOREGOING, THE RECEIPT BY ANY NOTE PARTY OF ANY PROCEEDS OR OTHER BENEFITS OF ANY NOTE OR OTHER FINANCIAL INSTRUMENT HELD BY ANY PURCHASER AFTER THE SECOND AMENDMENT EFFECTIVE DATE SHALL CONSTITUTE A RATIFICATION, ADOPTION, AND CONFIRMATION BY SUCH PARTY OF THE FOREGOING GENERAL RELEASE OF ALL CLAIMS AGAINST THE RELEASEES WHICH ARE BASED IN WHOLE OR IN PART ON FACTS, WHETHER OR NOT NOW KNOWN OR UNKNOWN, EXISTING ON OR PRIOR TO THE DATE OF ISSUANCE OF ANY SUCH NOTES OR OTHER FINANCIAL INSTRUMENT. IN ENTERING INTO THIS AMENDMENT, EACH NOTE PARTY CONSULTED WITH, AND HAS BEEN REPRESENTED BY, LEGAL COUNSEL AND EXPRESSLY DISCLAIMS ANY RELIANCE ON ANY REPRESENTATIONS, ACTS OR OMISSIONS BY ANY OF THE RELEASEES AND HEREBY AGREES AND ACKNOWLEDGES THAT THE VALIDITY AND EFFECTIVENESS OF THE RELEASES SET FORTH ABOVE DO NOT DEPEND IN ANY WAY ON ANY SUCH REPRESENTATIONS, ACTS OR OMISSIONS OR THE ACCURACY, COMPLETENESS OR VALIDITY HEREOF. THE PROVISIONS OF THIS SECTION 10 SHALL SURVIVE THE TERMINATION OF THIS AMENDMENT, ANY OTHER NOTE DOCUMENT, AND PAYMENT IN FULL OF THE OBLIGATIONS UNDER THE NOTE DOCUMENTS.

IN WITNESS WHEREOF, each of the undersigned has caused this Amendment to be duly executed and delivered as of the date first above written.

ISSUER: OPTINOSE US, INC.,

a Delaware corporation

By: /s/ Ramy Mahmoud

Name: Ramy Mahmud

Title: CEO

GUARANTORS:

OPTINOSE, INC.,

a Delaware corporation

By: /s/ Ramy Mahmoud

Name: Ramy Mahmoud

Title: CEO

PURCHASERS: BPCR LIMITED PARTNERSHIP,

a limited partnership established under the laws of England and

Wales

By: Pharmakon Advisors, LP,

its Investment Manager

By: Pharmakon Management I, LLC

its General Partner

By: /s/ Pedro Gonzalez de Cosio

Name: Pedro Gonzalez de Cosio

Title: Managing Member

BIOPHARMA CREDIT INVESTMENTS V (MASTERS) LP,,

a Cayman Islands exempted limited partnership

By: BioPharma Credit Investments V GP LLC,

its General Partner

By: Pharmakon Advisors, LP,

its Investment Manager

By: /s/ Pedro Gonzalez de Cosio

Name: Pedro Gonzalez de Cosio

Title: Managing Member

COLLATERAL AGENT: BIOPHARMA CREDIT PLC,,

a PUBLIC limited partnership established under the laws of

England and Wales

By: Pharmakon Advisors, LP,

its Investment Manager

By: Pharmakon Management I, LLC

its General Partner

By: /s/ Pedro Gonzalez de Cosio

Name: Pedro Gonzalez de Cosio

Title: Managing Member

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

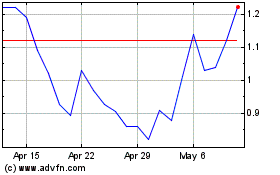

OptiNose (NASDAQ:OPTN)

Historical Stock Chart

From Mar 2024 to Apr 2024

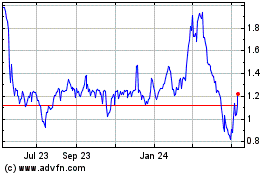

OptiNose (NASDAQ:OPTN)

Historical Stock Chart

From Apr 2023 to Apr 2024