false

0001007019

0001007019

2024-03-07

2024-03-07

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES

EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): March 7, 2024

COFFEE

HOLDING CO., INC.

(Exact

Name of Registrant as Specified in its Charter)

| Nevada |

|

001-32491 |

|

11-2238111 |

| (State

or Other |

|

(Commission |

|

(IRS

Employer |

| Jurisdiction

of Incorporation) |

|

File

Number) |

|

Identification

No.) |

| 3475

Victory Boulevard, Staten Island, New York |

|

10314 |

| (Address

of Principal Executive Offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code (718) 832-0800

Not

Applicable

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☒ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange where registered |

| Common

Stock, par value $0.001 per share |

|

JVA |

|

Nasdaq

Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act ☐

Introductory

Note

As

previously disclosed, on September 29, 2022, Coffee Holding Co., Inc, a Nevada corporation (the “Company,” or “JVA”),

entered into a Merger and Share Exchange Agreement, by and among JVA, Delta Corp Holdings Limited, a Cayman Islands exempted company

(“Pubco”), Delta Corp Holdings Limited, a company incorporated in England and Wales (“Delta”), CHC Merger Sub

Inc., a Nevada corporation and wholly owned subsidiary of Pubco, and each of the holders of ordinary shares of Delta as named therein,

which is referred to herein as the “proposed business combination.”

Item

7.01 Regulation FD Disclosure.

On

March 7, 2024, the Company issued a press release (the “Press Release”) announcing that the registration statement on Form

F-4 relating to the Company and Delta’s proposed business combination was declared effective by the Securities and Exchange Commission

(“SEC”) on March 6, 2024. The Company will hold a special meeting at 12:00 p.m., Eastern Time, on Thursday, March

28, 2024, for consideration and voting on the approval of the business combination and its merger and share exchange agreement, dated

September 29, 2022, as amended (the “definitive agreement”), and related proposals described in the registration statement’s

proxy statement/prospectus.

A

copy of the Press Release is furnished as Exhibit 99.1 to this Current Report on Form 8-K. The Press Release is intended to be furnished

and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing

under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as expressly set forth by

specific reference in such filing.

Important

Information for Investors and Stockholders

This

current report on Form 8-K is provided for informational purposes only and contains information with respect to the proposed business

combination. This report does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation

of any vote or approval nor shall there be any sale of securities in any state or jurisdiction in which such offer, solicitation, or

sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction. This report

does not constitute a proxy statement, prospectus or any equivalent document. No offering of securities shall be made except by means

of a prospectus meeting the requirements of Section 10 of the Securities Act, as amended, or an exemption therefrom.

In

connection with the proposed business combination, Pubco (named Delta Corp Holdings Limited or Delta Corp Holdings Ltd) has filed a registration

statement on Form F-4 to the SEC (as amended, the “Registration Statement”), which has been declared effective and which

includes a prospectus with respect to Pubco’s securities to be issued in connection with the proposed business combination and

a proxy statement to be distributed to holders of the Company’s common stock in connection with the Company’s

solicitation of proxies for the vote by the Company’s stockholders with respect to the proposed business combination and

other matters described in the Registration Statement. The definitive proxy statement/prospectus will be mailed to the Company’s

stockholders as of the record date beginning on or about March 7, 2024.

INVESTORS

AND SECURITY HOLDERS OF THE COMPANY’S, PUBCO

AND OTHER INTERESTED PERSONS ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS AND OTHER DOCUMENTS THAT HAVE BEEN OR WILL BE FILED WITH

THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION. Security

holders and other interested persons may obtain free copies of the Registration Statement, definitive proxy statement/prospectus, and

other relevant material (in each case when available) at the website maintained by the SEC at www.sec.gov.

or by directing a request to: Coffee Holding Co., Inc. 3475 Victory Boulevard, Staten Island, New York 10314, Attn: Andrew Gordon, Chief

Executive Officer.

Certain

Information Regarding Participants in the Solicitation

JVA,

Delta, Pubco and each of their directors, executive

officers and certain other members of management and employees may, under SEC rules, be deemed to be participants in the solicitation

of proxies from the stockholders of JVA with respect to the proposed transaction and related matters. Information about the directors

and executive officers of JVA, including their ownership of shares of JVA common stock, is included in the Registration

Statement and the JVA’s Annual Report on Form 10-K for the year ended October 31, 2023, which was filed with the SEC on

February 9, 2024. Additional information regarding the persons or entities who may be deemed participants in the solicitation of proxies

from JVA stockholders, including a description of their interests in the proposed business combination by security holdings or

otherwise, is included in the Registration Statement’s proxy statement/prospectus and other relevant documents filed or to be filed

with the SEC by Pubco, or Coffee, when they become available. You may obtain free copies of these documents as described above.

Cautionary

Note Regarding Forward-Looking Statements

This

report contains forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation

Reform Act of 1995 and other U.S. federal securities laws. All statements other than statements of historical facts contained in this

report, including statements regarding JVA, Pubco or Delta’s future results of operations and financial position, JVA, Pubco and

Delta’s business strategy, prospective costs, timing and likelihood of success, plans and objectives of management for future operations,

future results of current and anticipated operations of JVA, Pubco and Delta, and the expected value of the combined company after the

transactions, are forward-looking statements. These forward-looking statements generally are identified by the words “believe,”

“project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,”

“future,” “opportunity,” “plan,” “may,” “should,” “will,” “would,”

“will be,” “will continue,” “will likely result,” and similar expressions. These forward-looking

statements are subject to a number of risks, uncertainties and assumptions, including, but not limited to, the following risks relating

to the proposed transaction: the occurrence of any event, change or other circumstances that could give rise to the termination of the

transaction agreement; the risk that the transaction may not be completed in a timely manner or at all, which may adversely affect the

price of JVA’s securities; the occurrence of any event, change or other circumstances that could give rise to the termination of

the transaction agreement; the inability to complete the transactions contemplated by the transaction agreement, including due to failure

to obtain approval of the stockholders of JVA or other conditions to closing in the transaction agreement; the inability to obtain or

maintain the listing of Pubco ordinary shares on Nasdaq following the transaction; the risk that the transactions disrupt current plans

and operations of JVA as a result of the announcement and consummation of the transactions; the ability to recognize the anticipated

benefits of the transactions, which may be affected by, among other things, competition, the ability of the combined company to grow

and manage growth economically and hire and retain key employees; costs related to the transactions; changes in applicable laws or regulations;

the possibility that JVA, Pubco or Delta may be adversely affected by other economic, business, and/or competitive factors; and other

risks and uncertainties to be identified in the proxy statement/prospectus (when available) relating to the transactions, including those

under “Risk Factors” therein, and in other filings with the SEC made by JVA and Pubco. Moreover, JVA, Pubco, and Delta operate

in very competitive and rapidly changing environments. Because forward-looking statements are inherently subject to risks and uncertainties,

some of which cannot be predicted or quantified and some of which are beyond JVA’s, Pubco’s or Delta’s control, you

should not rely on these forward-looking statements as predictions of future events. Forward-looking statements speak only as of the

date they are made. For these reasons, investors and other interested persons are cautioned not to put undue reliance on forward-looking

statements. Neither JVA, Pubco, nor Delta undertake any obligation to update or revise these forward-looking statements, to reflect information,

events, or otherwise after the date of this report, except as required by applicable law.

Item

9.01. Financial Statements and Exhibits.

(d)

Exhibits.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

COFFEE

HOLDING CO., INC. |

| |

|

|

| |

By: |

/s/

Andrew Gordon |

| |

Name: |

Andrew

Gordon |

| |

Title: |

President

and Chief Executive Officer |

| |

|

|

| Date:

March 7, 2024 |

|

|

Exhibit

99.1

COFFEE

HOLDING CO., INC. ANNOUNCES SPECIAL MEETING OF STOCKHOLDERS TO VOTE ON PROPOSED BUSINESS COMBINATION WITH DELTA CORP HOLDINGS LIMITED;

FORM F-4 DECLARED EFFECTIVE

STATEN

ISLAND, N.Y., March 7, 2024—(GLOBENEWSWIRE)—Coffee Holding Co., Inc. (Nasdaq:JVA) (“Coffee Holding” or the “Company”),

a publicly traded integrated wholesale coffee roaster and dealer located in the United States, and Delta Corp Holdings Limited (“Delta”),

a fully integrated global business engaged in logistics, fuel supply and asset management primarily servicing the international supply

chains, today jointly announced that the registration statement on Form F-4 relating to their proposed business combination was declared

effective by the Securities and Exchange Commission (“SEC”) on March 6, 2024. Coffee Holding will hold a special meeting

at 12:00 p.m., Eastern Time, on Thursday, March 28, 2024, for consideration and voting on the approval of the business combination and

its merger and share exchange agreement, dated September 29, 2022, as amended (the “definitive agreement”), and related proposals

described in the registration statement’s proxy statement/prospectus. As previously announced, the proposed business combination

provides that Coffee Holding and Delta will each become wholly owned subsidiaries of a newly created holding company incorporated under

the laws of the Cayman Islands (“Pubco”).

Coffee

Holding’s board of directors unanimously recommends that Coffee Holding stockholders vote “FOR” all of the proposals

to be voted upon at the special meeting, including approval of the proposed business combination and definitive agreement.

Coffee

Holding stockholders of record at the close of business on February 20, 2024 will be entitled to vote at the special meeting. Coffee

Holding will commence mailing the definitive proxy statement/prospectus and related materials to its stockholders of record on or about

March 7, 2024.

The

registration statement on Form F-4 of Pubco, declared effective by the SEC on March 6, 2024, serves as both a proxy statement of Coffee

Holdings (for the meeting of Coffee Holding stockholders) and as a prospectus (registering Pubco shares to be issued to Coffee Holding

stockholders under the definitive agreement). A copy of the registration statement and its definitive proxy statement/prospectus is accessible

on the SEC’s website at www.sec.gov.

Coffee

Holding stockholders who need assistance in completing the proxy card, need additional copies of the proxy materials or have questions

regarding the special meeting may contact Coffee Holding’s proxy solicitor, Alliance Advisors, LLC, by calling toll-free at 833-945-2702.

About

Coffee Holding

Founded

in 1971, Coffee Holding is a leading integrated wholesale coffee roaster and dealer in the United States and one of the few coffee companies

that offers a broad array of coffee products across the entire spectrum of consumer tastes, preferences and price points. Coffee Holding’s

product offerings consist of eight proprietary brands, each targeting a different segment of the consumer coffee market as well as roasting

and blending coffees for major wholesalers and retailers throughout the United States who want to have products under their own names

to compete with national brands. In addition to selling roasted coffee, Coffee Holding also imports green coffee beans from around the

world which it resells to smaller regional roasters and coffee shops throughout the United States and Canada.

About

Delta

Delta

is a fully integrated global business engaged in logistics, fuel supply and asset management related services, primarily servicing the

international supply chains of commodity, energy, and capital goods producers. Delta operates its business through three segments: Bulk

Logistics, Energy Logistics and Asset Management. Delta’s Bulk Logistics division is an asset-light third-party logistics provider

of freight forwarding, ocean transportation, mine-to-port, and related services connecting producers of commodities, agriculture products,

capital goods and energy to end users. Delta’s Energy Logistics operations provides its customers with industry leading fuels,

lubricants and carbon offset products with a focus on environmental impact. Delta also offers Asset Management services to the marine

transportation and offshore oil and gas industries. Delta’s business model is asset-light, and its service offerings facilitate

the global trade of energy, raw materials, intermediate goods, and agricultural products. Delta is a multinational business with offices

throughout Europe, the Middle East, Africa and Asia. For more information, please see Delta’s website at www.wearedelta.com.

Additional

Information and Where to Find It

In

connection with the proposed business combination, Pubco (named Delta Corp Holdings Limited or Delta Corp Holdings Ltd) has filed a registration

statement on Form F-4 to the SEC (as amended, the “Registration Statement”), which has been declared effective and which

includes a prospectus with respect to Pubco’s securities to be issued in connection with the proposed business combination and

a proxy statement to be distributed to holders of Coffee Holding’s common stock in connection with Coffee Holding’s solicitation

of proxies for the vote by Coffee Holding’s stockholders with respect to the proposed business combination and other matters described

in the Registration Statement. The definitive proxy statement/prospectus will be mailed to Coffee Holding’s stockholders as of

the record date beginning on or about March 7, 2024.

INVESTORS

AND SECURITY HOLDERS OF COFFEE HOLDING, PUBCO AND OTHER INTERESTED PERSONS ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS AND OTHER

DOCUMENTS THAT HAVE BEEN OR WILL BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY CONTAIN

OR WILL CONTAIN IMPORTANT INFORMATION. Security holders and other interested persons may obtain free copies of the Registration Statement,

definitive proxy statement/prospectus, and other relevant material (in each case when available) at the website maintained by the SEC

at www.sec.gov. or by directing a request to: Coffee Holding Co., Inc. 3475 Victory Boulevard, Staten Island, New York 10314,

Attn: Andrew Gordon, Chief Executive Officer.

Participants

in the Solicitation

Coffee

Holding, Delta, Pubco and each of their directors, executive officers and certain other members of management and employees may, under

SEC rules, be deemed to be participants in the solicitation of proxies from the stockholders of Coffee Holding with respect to the proposed

transaction and related matters. Information about the directors and executive officers of Coffee Holding, including their ownership

of shares of Coffee Holding common stock, is included in the Registration Statement and the Coffee Holding’s Annual Report on Form

10-K for the year ended October 31, 2023, which was filed with the SEC on February 9, 2024. Additional information regarding the persons

or entities who may be deemed participants in the solicitation of proxies from Coffee Holding stockholders, including a description of

their interests in the proposed business combination by security holdings or otherwise, is included in the Registration Statement’s

proxy statement/prospectus and other relevant documents filed or to be filed with the SEC by Pubco, or Coffee, when they become available.

You may obtain free copies of these documents as described above.

No

Offer or Solicitation

This

communication is for informational purposes only and does not constitute an offer to sell or the solicitation of an offer to buy any

securities or a solicitation of any vote or approval, nor shall there be any sale of any securities in any state or jurisdiction in which

such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of such other jurisdiction.

No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act

of 1933, as amended.

Forward-Looking

Statements

This

press release contains certain forward-looking statements within the meaning of the federal securities laws with respect to the proposed

transaction between Pubco, Coffee Holding and Delta. All statements other than statements of historical facts contained in this press

release, including statements regarding Pubco’s, Coffee Holding’s or Delta’s future results of operations and financial

position, Pubco’s, Coffee Holding’s and Delta’s business strategy, prospective costs, timing and likelihood of success,

plans and objectives of management for future operations, future results of current and anticipated operations of Pubco, Coffee Holding

and Delta, and the expected value of the combined company after the transactions, are forward-looking statements. These forward-looking

statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,”

“estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,”

“may,” “should,” “will,” “would,” “will be,” “will continue,”

“will likely result,” and similar expressions. These forward-looking statements are subject to a number of risks, uncertainties

and assumptions, including, but not limited to, the following risks relating to the proposed transaction: the occurrence of any event,

change or other circumstances that could give rise to the termination of the transaction agreement; the risk that the transaction may

not be completed in a timely manner or at all, which may adversely affect the price of Coffee Holding’s securities; the occurrence

of any event, change or other circumstances that could give rise to the termination of the transaction agreement; the inability to complete

the transactions contemplated by the transaction agreement, including due to failure to obtain approval of the stockholders of Coffee

Holding or other conditions to closing in the definitive agreement; the inability to obtain or maintain the listing of Pubco ordinary

shares on Nasdaq following the proposed transaction; the risk that the proposed transaction disrupts current plans and operations of

Coffee Holding as a result of the announcement and consummation of the proposed transaction; the ability to recognize the anticipated

benefits of the proposed transaction, which may be affected by, among other things, competition, the ability of the combined company

to grow and manage growth economically and hire and retain key employees; costs related to the proposed transaction; changes in applicable

laws or regulations; the possibility that Pubco, Delta or Coffee Holding may be adversely affected by other economic, business, and/or

competitive factors; and other risks and uncertainties identified in the proxy statement/prospectus (when available) relating to the

proposed transaction, including those under “Risk Factors” therein, and in other filings with the SEC made by Pubco and Coffee

Holding. There can be no assurance of the completion of the proposed business combination, nor subject to and following such completion,

the realization of potential benefits of the proposed business combination. Moreover, Pubco, Delta and Coffee Holding operate in very

competitive and rapidly changing environments. Because forward-looking statements are inherently subject to risks and uncertainties,

some of which cannot be predicted or quantified and some of which are beyond Pubco’s, Delta’s and Coffee Holding’s

control, you should not rely on these forward-looking statements as predictions of future events. Forward-looking statements speak only

as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and, except as required

by law, Pubco, Delta and Coffee Holding assume no obligation and do not intend to update or revise these forward-looking statements,

whether as a result of new information, future events, or otherwise. None of Pubco, Delta or Coffee Holding gives any assurance that

either Delta or Coffee Holding or Pubco will achieve its expectations.

For

further information, contact:

Coffee

Holding Co., Inc.

Andrew

Gordon

President

& CEO

(718)

832-0800

Delta

Corp Holdings Limited

Joseph

Nelson

Chief

Financial Officer

Phone:

+44 0203 753 5598

Email:

ir@wearedelta.com

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

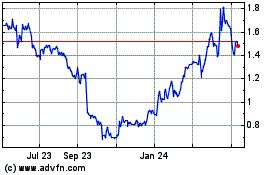

Coffee (NASDAQ:JVA)

Historical Stock Chart

From Mar 2024 to Apr 2024

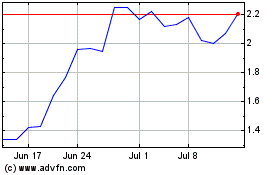

Coffee (NASDAQ:JVA)

Historical Stock Chart

From Apr 2023 to Apr 2024