Form 8-K - Current report

March 05 2024 - 8:30AM

Edgar (US Regulatory)

0001601712false00016017122024-03-052024-03-050001601712us-gaap:CommonStockMember2024-03-052024-03-050001601712us-gaap:SeriesAPreferredStockMember2024-03-052024-03-050001601712us-gaap:SeriesBPreferredStockMember2024-03-052024-03-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

March 5, 2024

Date of Report

(Date of earliest event reported)

SYNCHRONY FINANCIAL

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-36560 | | 51-0483352 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (I.R.S. Employer

Identification No.) |

| | | | | | | | | | | |

| 777 Long Ridge Road | | |

| Stamford, | Connecticut | | 06902 |

| (Address of principal executive offices) | | (Zip Code) |

(203) 585-2400

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities Registered Pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common stock, par value $0.001 per share | SYF | New York Stock Exchange |

| Depositary Shares Each Representing a 1/40th Interest in a Share of 5.625% Fixed Rate Non-Cumulative Perpetual Preferred Stock, Series A | SYFPrA | New York Stock Exchange |

| Depositary Shares Each Representing a 1/40th Interest in a Share of 8.250% Fixed Rate Non-Cumulative Perpetual Preferred Stock, Series B | SYFPrB | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| | | | | |

| Item 7.01 | Regulation FD Disclosure. |

On March 5, 2024, the Consumer Financial Protection Bureau (“CFPB”) issued a final rule amending Regulation Z, which implements the Truth in Lending Act, relating to the assessment of late fees on credit card accounts. The key elements of the CFPB’s final rule and certain of the current anticipated implications to Synchrony Financial are summarized in Exhibit 99.1 hereto.

The information contained in this Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.1, are furnished pursuant to Item 7.01 of Form 8-K and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, nor shall they be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except as shall be expressly stated by specific reference in such filing.

Cautionary Statement Regarding Forward-Looking Statements

This Current Report, including Exhibit 99.1 hereto, includes certain forward-looking statements as defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which are subject to the “safe harbor” created by those sections. Forward-looking statements may be identified by words such as “anticipate,” “expect,” “outlook,” “continue,” or words of similar meaning. The forward-looking statements convey our expectations, intentions, or forecasts about future events, circumstances, or results regarding the implications of the CFPB’s final rule on our business, results of operation and financial performance. Forward-looking statements in this Current Report are based on management’s assumptions and estimates, and are subject to inherent uncertainties, risks and changes that are difficult to predict, may change over time and many of which are beyond our control. These uncertainties and risks, include, but are not limited to: (i) the timing of implementation of the CFPB’s final rule; (ii) the impact of the final rule on the competitiveness of our credit products, as well as our ability to offer or continue to offer certain products; and (iii) our ability to successfully execute strategic actions to mitigate the impacts of the rule on our business, which is dependent on, among other things, partner, customer and other stakeholder acceptance. As a result, actual results could differ materially from those indicated in these forward-looking statements. For the reasons described above, we caution you against relying on any forward-looking statements, which should also be read in conjunction with our public filings, including under the heading “Risk Factors Relating to Our Business” and “Risk Factors Relating to Regulation” in the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2023, as filed on February 8, 2024. Any forward-looking statement speaks only as of the date on which it is made and we undertake no obligation to update any forward-looking statement, except as otherwise may be required by law.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

The following exhibits are being furnished as part of this report:

| | | | | | | | |

| | |

| Number | | Description |

| |

| | |

| 104 | | The cover page from this Current Report on Form 8-K, formatted in Inline XBRL |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | SYNCHRONY FINANCIAL |

| | | |

Date: March 5, 2024 | | | | By: | | /s/ Jonathan Mothner |

| | | | Name: | | Jonathan Mothner |

| | | | Title: | | Executive Vice President, Chief Risk and Legal Officer |

1 Impact of Late Fee Regulation Key Elements • Amended Safe Harbor from $30/$41 to single $8 amount and eliminated inflation adjustment • Effective date 60 days after rule published in the Federal Register • Detailed analysis of rule on-going Litigation • Anticipate litigation being filed with broad industry support • Expect request for preliminary injunction to delay effective date / pause rule implementation • Outcome of injunction request and litigation uncertain Strategic Implications • Commencing implementation of product, policy and pricing changes, to be executed over the next 3-4 months • Changes in Cardholder Terms (“CITs”) will include increases to APRs, implementation of fees, other product changes • CITs will continue beyond initial implementation period for inactive accounts and accounts which may have been initially ineligible Financial Implications • Reduction in late fees occurs upon effective date of rule • Impact from CITs will occur ~90 days from CIT notification • Certain changes in terms have more immediate impact; APR changes build over time given protected balances under the Card Act • Combined net effects of the rule and mitigants generally flow through RSAs 2024 Outlook • January 23, 2024 Financial Outlook with key driver quantitative ranges is withdrawn • Revised FY2024 Outlook, including EPS Range (excluding final Late Fee impact) provided on page 2 • Financial impacts of Late Fee Rule on key drivers and EPS disclosed on page 3 Exhibit 99.1

2 2024 Revised Outlook, excluding the Impact of Final Late Fee Rule Key Drivers Trends Loan Receivables Growth • Broad-based purchase volume growth • Payment rate moderation expected to continue, but remain above pre-pandemic levels throughout 2024 Net Interest Income • Follow normal seasonal trends adjusted for the following items: • increase in Interest-bearing liabilities cost driven by the lagged impact of higher benchmark rates as fixed rate retail deposits reprice • competition for retail deposits and the pace of deposit repricing in response to potential rate cuts • higher Interest & Fee Income partially offset by higher reversals Net Charge Offs • Expected to peak during 1H before returning to pre-pandemic seasonal trends for the remainder of 2024 • Outlook assumes stable macro environment RSA / Average Loan Receivables • Moderation reflects impact of continued credit normalization, higher interest expense, and portfolio mix partially offset by higher purchase volume Efficiency Ratio • Continue to drive positive operating leverage • Stabilization in operational losses EPS Range • Excluding Pets Best gain and impact of Late Fee rule: $5.70 – $6.00 Baseline Macroeconomic Assumptions (excludes effects of qualitative overlays) U/E Rate (YE’24) Fed Funds (YE’24) Deposit Betas (FY’24) 4.0% 4.75% Sav/CDs: ~30% Additional Assumptions • Pets Best sale & Ally Lending purchase close in 1Q’24 GDP Growth (FY’24) 1.7% (comments and trends in comparison to 2023, except where noted)

3 Financial Impacts of Late Fee Rule for 2024(a) Key Driver Trends Interest & Fees • Benefit from product, policy and pricing changes will build through the year, generally beginning in Q2 • (~$800MM) reduction of Late Fees in Q4, partially offset by moderately lower waivers and reversals Other Income • Benefit from product, policy and pricing changes will build through the year, generally beginning in Q2 Consumer Behavior Changes • Slightly lower new accounts, active accounts and purchase volume resulting from consumer behavioral changes from product, policy and pricing modifications • Expect impact to be recognized in 2H’24 Provision • Slightly lower with majority of decrease occurring in 2H’24, resulting from slower growth • Impact on a dollar basis and should not impact reserve coverage ratio Total Other Expense • Slightly higher in Q1, Q2 and Q3 related to CIT execution • Slightly lower in Q4, reflecting impact of consumer behavior changes RSA • Contracts are expected to function as agreed upon; no modifications to sharing agreements to date • Generally expected to be slightly lower on a full year basis • Slightly higher in Q2 and Q3, resulting from offsets recognized in both Interest & Fees and Other Income • Moderately lower in Q4, reflecting the net impact of the Late Fee reduction EPS Impact • Impact from change in Late Fee regulation on 2024 diluted EPS is ($0.15) – ($0.25), which assumes: October implementation date; (~$800MM) pre-tax impact; and offsets ranging from ~$650MM – $700MM pre-tax (comments and trends in comparison to previously disclosed guidance from January 2024, except where noted) (a) Assumes Late Fee rule implementation date of October 1, 2024, which incorporates our assumption that the anticipated litigation challenge will, at a minimum, delay the implementation date. The Company expects to provide an update to the above information once the impacts of anticipated litigation challenge are clearer. The above also assumes estimated impacts associated with potential changes in consumer behavior in response to the product, policy and pricing changes being implemented. Consumer behavior changes could diverge from the assumptions incorporated above.

4 Cautionary Statement Regarding Forward-Looking Statements This presentation includes certain forward-looking statements as defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which are subject to the “safe harbor” created by those sections. Forward-looking statements may be identified by words such as “anticipate,” “expect, ” “outlook,” “continue,” or words of similar meaning. The forward-looking statements convey our expectations, intentions, or forecasts about future events, circumstances, or results, regarding the implications of the CFPB’s final rule on our business, results of operation and financial performance. Forward-looking statements in this presentation are based on management’s assumptions and estimates, and are subject to inherent uncertainties, risks and changes that are difficult to predict, may change over time and many of which are beyond our control. These uncertainties and risks, include, but are not limited to: (i) the timing of implementation of the CFPB’s final rule; (ii) the impact of the final rule on the competitiveness of our credit products, as well as our ability to offer or continue to offer certain products; and (iii) our ability to successfully execute strategic actions to mitigate the impacts of the rule on our business, which is dependent on, among other things, partner, customer and other stakeholder acceptance. As a result, actual results could differ materially from those indicated in these forward-looking statements. For the reasons described above, we caution you against relying on any forward-looking statements, which should also be read in conjunction with our public filings, including under the heading “Risk Factors Relating to Our Business” and “Risk Factors Relating to Regulation” in the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2023, as filed on February 8, 2024. Any forward-looking statement speaks only as of the date on which it is made and we undertake no obligation to update any forward-looking statement, except as otherwise may be required by law.

v3.24.0.1

Cover

|

Mar. 05, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Mar. 05, 2024

|

| Entity Registrant Name |

SYNCHRONY FINANCIAL

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-36560

|

| Entity Tax Identification Number |

51-0483352

|

| Entity Address, Address Line One |

777 Long Ridge Road

|

| Entity Address, Postal Zip Code |

06902

|

| Entity Address, State or Province |

CT

|

| Entity Address, City or Town |

Stamford,

|

| City Area Code |

203

|

| Local Phone Number |

585-2400

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001601712

|

| Amendment Flag |

false

|

| Common Stock |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common stock, par value $0.001 per share

|

| Trading Symbol |

SYF

|

| Security Exchange Name |

NYSE

|

| Series A Preferred Stock |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Depositary Shares Each Representing a 1/40th Interest in a Share of 5.625% Fixed Rate Non-Cumulative Perpetual Preferred Stock, Series A

|

| Trading Symbol |

SYFPrA

|

| Security Exchange Name |

NYSE

|

| Series B Preferred Stock |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Depositary Shares Each Representing a 1/40th Interest in a Share of 8.250% Fixed Rate Non-Cumulative Perpetual Preferred Stock, Series B

|

| Trading Symbol |

SYFPrB

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesAPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesBPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

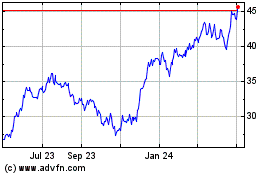

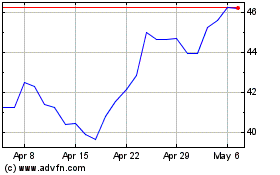

Synchrony Financiall (NYSE:SYF)

Historical Stock Chart

From Mar 2024 to Apr 2024

Synchrony Financiall (NYSE:SYF)

Historical Stock Chart

From Apr 2023 to Apr 2024