Form SC TO-T/A - Tender offer statement by Third Party: [Amend]

March 04 2024 - 6:18AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE TO

Tender Offer Statement under Section 14(d)(1) or

13(e)(1)

of the Securities Exchange Act of 1934

(Amendment No. 1)

SCIENCE 37 HOLDINGS, INC.

(Name of Subject Company (Issuer))

MARLIN MERGER SUB CORPORATION

a wholly-owned subsidiary of

eMED, LLC

(Name of Filing Persons (Offerors))

Common Stock, $0.0001 Par Value

(Title of Class of Securities)

808644207

(CUSIP Number of Class of Securities)

Jeffrey M. Schumm

General Counsel

eMed, LLC

900 Biscayne Blvd., Suite 1501

Miami, FL 33132

Telephone: 866-955-1173

(Name, Address, and Telephone Numbers of Person

Authorized to Receive Notices and Communications on Behalf of Filing Persons)

Copies to:

Joseph E. Gilligan

Brian C. O’Fahey

Hogan Lovells US LLP

555 13th Street, NW

Washington, DC 20004

Telephone: +1 (202) 637-5600

| ¨ |

Check the box if the filing relates

solely to preliminary communications made before the commencement of a tender offer. |

| |

|

| Check the appropriate boxes below to designate

any transactions to which the statement relates: |

| |

|

| x |

Third-party tender offer subject to Rule 14d-1. |

| ¨ |

Issuer tender offer subject to Rule 13e-4. |

| ¨ |

Going-private transaction subject to Rule 13e-3. |

| ¨ |

Amendment to Schedule 13D under Rule 13d-2. |

| |

|

| Check the following box if the filing is

a final amendment reporting the results of the tender offer. ¨ |

| |

| If applicable, check the appropriate box(es)

below to designate the appropriate rule provision(s) relied upon: |

| |

|

| ¨ |

Rule 13e-4(i) (Cross-Border Issuer Tender

Offer) |

| ¨ |

Rule 14d-1(d) (Cross-Border Third-Party Tender

Offer) |

This

Amendment No. 1 (this "Amendment") amends and supplements the Tender Offer Statement on Schedule TO (together with any

amendments and supplements hereto, the “Schedule TO”), filed with the Securities and Exchange Commission on February 12,

2024 by (i) Marlin Merger Sub Corporation, a Delaware corporation (“Purchaser”) and a wholly-owned subsidiary of eMed,

LLC, a limited liability company organized under the laws of the State of Delaware (“Parent”), and (ii) Parent. The

Schedule TO relates to the offer by Purchaser to purchase all of the outstanding shares of common stock, par value $0.0001 per share

(the “Shares”), of Science 37 Holdings, Inc., a Delaware corporation (“Science 37”), at a purchase price

of $5.75 per Share, net to the seller in cash, without interest, less any withholding that may be applicable, upon the terms and

subject to the conditions set forth in the Offer to Purchase attached to the Schedule TO as Exhibit (a)(1)(A) (together with

any amendments and supplements thereto, the “Offer to Purchase”) and in the related Letter of Transmittal attached hereto

as Exhibit (a)(1)(B).

Except as otherwise set forth in this Amendment,

the information set forth in the Schedule TO remains unchanged and is incorporated herein by reference to the extent relevant to the

items in this Amendment. Capitalized terms used and not defined herein shall have the meanings assigned to such terms in the Offer to

Purchase.

Schedule TO.

The Schedule TO is hereby amended as follows:

Items 1 through 9 and Item 11.

The information set forth in the Offer to Purchase

under “The Offer – Section 15 – Certain Legal Matters” and Items 1 through 9 and 11 of the Schedule TO,

to the extent such Items incorporate by reference the information contained in the Offer to Purchase, is hereby amended and supplemented

by adding at the end of the section captioned “The Offer – Section 15 – Certain Legal Matters” the following

paragraph:

“Certain Litigation

As of the date of this filing, three purported

stockholders of the Company have filed complaints in federal court regarding the Transactions. The first complaint was filed on February 14,

2024 in the United States District Court for the District of Delaware and is captioned Ballard v. Science 37 Holdings, Inc.,

et al., No. 1:24- cv-00200-UNA. The second and third complaints were filed on February 14, 2024 and February 16, 2024,

respectively, in the United States District Court for the Southern District of New York and are captioned McDaniel v. Science 37 Holdings, Inc.,

et al, No. 1:24-cv-01090 and Lane v. Science 37 Holdings, Inc., et al, No. 1:24-cv-01194. The aforementioned

three complaints are collectively referred to as the “Complaints.” The Complaints name as defendants the Company and each

member of the Company’s board of directors (the “Board”) (collectively, the “Science 37 Defendants”). The

Complaints allege violations of Section 14(d) and Section 14(e) of the Exchange Act, as well as Rule 14d-9 promulgated

thereunder, against all Science 37 Defendants and assert violations of Section 20(a) of the Exchange Act against the members

of the Board. The Complaints collectively seek, among other relief, (i) injunctive relief preventing the consummation of the Transactions;

(ii) rescission and/or rescissory damages in the event the Transactions are consummated; (iii) an award of plaintiffs’

expenses and attorneys’ fees; and (iv) disclosure of certain information requested by the plaintiffs.

In addition, as of this filing, the Company had

received 11 demand letters from purported stockholders of the Company, which generally seek that certain allegedly omitted information

in the Company’s Schedule 14D-9 be disclosed.

Additional complaints or demand letters may be

filed against or received by the Company, the Board, Parent and/or Purchaser in connection with the Transactions, the Schedule TO and

the Company’s Schedule 14D-9. If such additional similar complaints are filed or demand letters received, absent new or different

allegations that are material, the Company, Parent and Purchaser will not necessarily announce such additional filings.”

SIGNATURE

After due inquiry and to the best of my knowledge and belief, I

certify that the information set forth in this statement is true, complete and correct.

Dated: March 4, 2024

| |

eMED, LLC |

| |

|

|

| |

|

|

| |

By |

/s/ Michael

Cole |

| |

Name: |

Michael Cole |

| |

Title: |

President and Chief Financial Officer |

| |

|

|

| |

|

|

| |

MARLIN MERGER SUB CORPORATION |

| |

|

| |

|

| |

By |

/s/ Michael

Cole |

| |

Name: |

Michael Cole |

| |

Title: |

President |

[Signature

Page to Schedule TO]

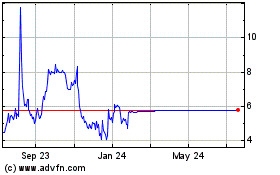

Science 37 (NASDAQ:SNCE)

Historical Stock Chart

From Apr 2024 to May 2024

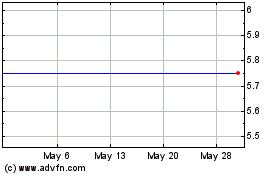

Science 37 (NASDAQ:SNCE)

Historical Stock Chart

From May 2023 to May 2024