UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14D-9

SOLICITATION/RECOMMENDATION STATEMENT

UNDER SECTION 14(d)(4) OF THE SECURITIES EXCHANGE

ACT OF 1934

(Amendment No. 1)

Science 37 Holdings, Inc.

(Name of Subject Company)

Science 37 Holdings, Inc.

(Name of Persons Filing Statement)

Common Stock, par value $0.0001 per share

(Title of Class of Securities)

808644207

(CUSIP Number of Class of Securities)

Christine Pellizzari

Chief Legal and Human Resources Officer

Science 37 Holdings, Inc.

800 Park Offices Drive, Suite 3606

Research Triangle Park, North Carolina 27709

(984) 377-3737

(Name, address, and telephone numbers of person

authorized to receive notices and communications on behalf of the persons filing statement)

With copies to:

Jurgita Ashley

David Neuhardt

Thompson Hine LLP

3900 Key Center

127 Public Square

Cleveland, Ohio 44114

(216) 566-5500

| ¨ | Check the box if the filing relates

solely to preliminary communications made before the commencement of a tender offer. |

This Amendment No. 1 (this “Amendment No.

1”) amends and supplements the Solicitation/ Recommendation Statement on Schedule 14D-9 (as further amended or supplemented from

time to time, the “Schedule 14D-9”) previously filed by Science 37 Holdings, Inc., a Delaware corporation (the “Company”

or “Science 37”), with the Securities and Exchange Commission on February 12, 2024, relating to the tender offer on Schedule

TO filed with the Securities and Exchange Commission on February 12, 2024, by eMed, LLC, a Delaware limited liability company (“eMed”),

and Marlin Merger Sub Corporation, a Delaware corporation and wholly owned subsidiary of eMed (“Purchaser”), pursuant to the

terms and subject to the conditions of the Agreement and Plan of Merger, dated January 28, 2024 (as it may be amended or supplemented,

the “Merger Agreement”), by and among Science 37, eMed and Purchaser to acquire all of the issued and outstanding shares of

common stock of Science 37, par value $0.0001 per share (the “Shares”), in exchange for $5.75 per Share, net to the seller

in cash, without interest and less any required withholding taxes (the “Offer Price”), upon the terms and subject to the conditions

set forth in the Offer to Purchase, dated February 12, 2024, and the related Letter of Transmittal, as each may be amended or supplemented

from time to time. Any capitalized term used and not otherwise defined herein shall have the meaning ascribed to such term in the Schedule

14D-9.

Following the announcement of the Merger and as

of the filing of this amendment, various demands were received by Science 37, and three lawsuits were filed by purported stockholders

of Science 37 (captioned Ballard v. Science 37 Holdings, Inc., et al., No. 1:24-cv-00200-UNA (D. Del., filed Feb. 14, 2024); McDaniel

v. Science 37 Holdings, Inc., et al, No. 1:24-cv-01090 (S.D.N.Y., filed Feb. 14, 2024); and Lane v. Science 37 Holdings, Inc.,

et al, No. 1:24-cv-01194 (S.D.N.Y., filed Feb. 14, 2024), challenging the disclosures in the Schedule 14D-9 and the Merger. The complaints

and demands assert claims against Science 37 and the Science 37 Board.

Science 37 believes that the allegations in the

complaints and demands lack merit, that no supplemental disclosure is required under applicable laws and that the Schedule 14D-9 disclosed

all material information required to be disclosed therein. However, in order to moot certain of the disclosure claims and to avoid the

risk that lawsuits may delay or otherwise adversely affect the Offer and/or the Merger, and to minimize the expense of defending such

actions, Science 37 determined voluntarily to supplement certain disclosures in the Schedule 14D-9 related to the claims in the complaints

and demands with the supplemental disclosures set forth below (the “Supplemental Disclosures”), all of which should be read

in conjunction with the Schedule 14D-9 in its entirety. Nothing in the Supplemental Disclosures shall be deemed an admission of the legal

merit, necessity or materiality under applicable laws of any of the disclosures set forth herein. To the contrary, Science 37 specifically

denies all allegations in the demands and complaints described above that any additional disclosure was or is required or material.

Except as otherwise set forth below, the information

set forth in the Schedule 14D-9 remains unchanged and is incorporated herein by reference as relevant to the items in this Amendment No.

1. All paragraph headings and page references used herein refer to the headings and pages in the Schedule 14D-9 before any additions or

deletions resulting from the Supplemental Disclosures or any other amendments. To the extent that information in this Amendment No. 1

differs from or updates information contained in the Schedule 14D-9, this Amendment No. 1 shall supersede or supplement the information

in the Statement.

Item 3. Past Contacts, Transactions, Negotiations and Agreements

Item 3 “Past Contacts, Transactions,

Negotiations and Agreements” of the Schedule 14D-9 is hereby amended and supplemented as follows:

1. By deleting the second paragraph under the section

titled “Arrangements Between Science 37 and its Executive Officers, Directors and Affiliates—Employment Agreements—David

Coman Offer Letter” on page 9 and replacing it with the following paragraph:

“Mr. Coman’s offer letter provides

for his participation in Science 37’s Amended Severance Policy (as defined below). Mr. Coman will become entitled to severance benefits

under the Amended Severance Policy if his employment is terminated by Science 37 without “cause” (as

defined in the Amended Severance Policy) or if Mr. Coman resigns for “good reason” (as defined in the Amended Severance Policy).

Pursuant to the Amended Severance Policy, if Mr. Coman becomes entitled to severance under both his offer letter and the Amended Severance

Policy, he will receive the greater of the severance under his offer letter or the severance under the Amended Severance Policy. For a

description of the Amended Severance Policy, see the section below entitled “Severance and Change in Control Benefit Agreements”.”

2. By deleting the second paragraph under the section

titled “Arrangements Between Science 37 and its Executive Officers, Directors and Affiliates—Employment Agreements—Michael

Shipton Employment Agreement” on page 10 and replacing it with the following paragraph

“Mr. Shipton’s employment agreement

provides for his participation in Science 37’s Amended Severance Policy. Mr. Shipton will become entitled to severance benefits

under the Amended Severance Policy if his employment is terminated by Science 37 without “cause” (as

defined in the Amended Severance Policy) or if Mr. Shipton resigns for “good reason” (as defined in the Amended Severance

Policy). Pursuant to the Amended Severance Policy, if Mr. Shipton becomes entitled to severance under both his employment agreement and

the Amended Severance Policy, he will receive the greater of the severance under his employment agreement or the severance under the Amended

Severance Policy. For a description of the Amended Severance Policy, see the section below entitled “Severance and Change in Control

Benefit Agreements”.”

3. By adding the bold and underlined text to

the below paragraph under the section titled “Arrangements Between Science 37 and its Executive Officers, Directors and Affiliates—Future

Arrangements” on page 12 as follows:

“It is possible that Science 37’s executive

officers or directors will enter into new compensation arrangements with eMed or its affiliates. Such arrangements may include agreements

regarding future terms of employment, the right to receive equity or equity-based awards of eMed or retention awards. As of the date of

this Schedule 14D-9, no employment or compensation arrangements between such persons and eMed and/or its affiliates following

the consummation of the Merger have been negotiated or established. Any such arrangements with Science 37’s

executive officers are currently expected to be entered into after the completion of the Offer and will not become effective until after

the Merger is consummated, if at all.”

Item 4. The Solicitation or Recommendation

Item 4 “The Solicitation or Recommendation”

of the Schedule 14D-9 is hereby amended and supplemented as follows:

1. By adding the bold and underlined text to the below

table regarding the January 2024 Projections under the section titled “Certain Unaudited Prospective Information—Important

Information Concerning the Science 37 Management Forecasts and Liquidation Analysis—Forecasts” on page 36 as follows:

| ($ in millions) |

| 2023E | |

| 2024E | |

| 2025E | |

| 2026E | |

| 2027E | |

| 2028E | |

| Revenue |

$ | 59.3 | |

$ | 51.5 | |

$ | 63.7 | |

$ | 77.8 | |

$ | 95.6 | |

$ | 117.6 | |

| YoY % |

| (15.4% | ) |

| (13.1% | ) |

| 23.6% | |

| 22.1% | |

| 22.8% | |

| 23.0% | |

| Adjusted Gross Profit(1) |

$ | 20.4 | |

$ | 21.4 | |

$ | 28.5 | |

$ | 34.9 | |

$ | 43.0 | |

$ | 53.2 | |

| % Margin |

| 34.3% | |

| 41.5% | |

| 44.7% | |

| 44.9% | |

| 45.0% | |

| 45.2% | |

| Adjusted EBIDTA(2) |

$ | (30.4 | ) |

$ | (6.0 | ) |

$ | 0.5 | |

$ | 3.3 | |

$ | 7.0 | |

$ | 10.7 | |

| % Margin |

| N/A | |

| N/A | |

| 0.9% | |

| 4.2% | |

| 7.3% | |

| 9.1% | |

| Capital Expenditures |

$ | 19.7 | |

$ | 4.6 | |

$ | 6.1 | |

$ | 6.1 | |

$ | 6.1 | |

$ | 6.9 | |

| % of Revenue |

| 33.3% | |

| 9.0% | |

| 9.6% | |

| 7.9% | |

| 6.4% | |

| 5.9% | |

| Change in Net Working Capital |

$ | (4.1 | ) |

$ | 0.6 | |

$ | 4.0 | |

$ | 5.6 | |

$ | 0.7 | |

$ | 1.2 | |

| (1) | “Adjusted Gross Profit” is a non-GAAP measure defined as gross profit excluding stock-based compensation expense. |

| (2) | “Adjusted EBITDA” is a non-GAAP measure defined as earnings before interest, taxes, depreciation, and amortization, further

adjusted to exclude expenses and transactions that Science 37 believes are not representative of its core operations, namely: restructuring

and other costs; transaction and integration-related expenses; stock-based compensation expense; impairment losses; other income (expense),

net; and gain or loss on extinguishment of debt. See below a reconciliation of Adjusted EBITDA to net loss. |

| ($ in millions) |

| 2023E | |

| 2024E | |

| 2025E | |

| 2026E | |

| 2027E | |

| 2028E | |

| Net Loss |

$ | (68.8 | ) |

$ | (20.2 | ) |

$ | (11.5 | ) |

$ | (8.8 | ) |

$ | (10.6 | ) |

$ | (12.0 | ) |

| Other (Income) Expense |

$ | — | |

$ | — | |

$ | — | |

$ | — | |

$ | — | |

$ | 2.9 | |

| Change in Fair Value of Earn-Out Liability |

$ | (2.6 | ) |

$ | — | |

$ | — | |

$ | — | |

$ | — | |

$ | — | |

| Impairment of Long-Lived Assets |

$ | 21.1 | |

$ | — | |

$ | — | |

$ | — | |

$ | — | |

$ | — | |

| Depreciation and Amortization |

$ | 0.6 | |

$ | — | |

$ | 3.3 | |

$ | 3.3 | |

$ | 3.3 | |

$ | 3.7 | |

| Restructuring Costs |

$ | 3.6 | |

$ | 1.2 | |

$ | — | |

$ | — | |

$ | — | |

$ | — | |

| Stock-Based Compensation Expense |

$ | 15.6 | |

$ | 13.0 | |

$ | 8.7 | |

$ | 8.8 | |

$ | 14.3 | |

$ | 16.2 | |

| Adjusted EBIDTA |

$ | (30.4 | ) |

$ | (6.0 | ) |

$ | 0.5 | |

$ | 3.3 | |

$ | 7.0 | |

$ | 10.7 | |

2. By adding the bold and underlined text to the below

paragraphs under the section titled “Opinion of William Blair & Company, L.L.C.—Discounted Cash Flow Analysis” on

pages 41 and 42 as follows:

“William Blair utilized the January 2024

Projections to perform a discounted cash flow analysis of Science 37’s projected future free cash flows for the fiscal years ending

December 31, 2024 through December 31, 2028. Using the discounted cash flow methodology, William Blair calculated the present values of

the projected after-tax unlevered free cash flows for Science 37. Unlevered free cash flows were calculated as net operating profit

after tax net of stock-based compensation expense, plus depreciation and amortization, minus capital expenditures, and adjusted for changes

in net working capital. In this analysis, William Blair exercised its professional judgment, based on its experience and expertise,

and calculated the assumed terminal value of Science 37 by utilizing terminal revenue multiples ranging from 0.50x-1.50x calendar year

2028 expected revenue. To discount the projected unlevered free cash flows and assumed terminal value to present value, William Blair

exercised its professional judgment, based on its experience and expertise, and used discount rates ranging from 22.0% to

24.0%. The discount rate range was derived based upon a weighted average cost of capital using the capital asset pricing model.

William Blair aggregated the present value of the

after-tax unlevered free cash flows over the applicable January 2024 Projection period, the present value of the potential tax savings

expected to result from the utilization of Science 37’s federal net operating losses ($1 million), and the present value of the

assumed terminal value. William Blair then derived a range of implied equity values per share by adding Science 37’s net cash of

$51.2 million as of December 31, 2023 and dividing such amount by Science 37’s total diluted Shares outstanding as of January

23, 2024 (consisting of 6,028,167 shares of common stock, 545,971 restricted stock units, 413,024 options, and 625,000 earn-out

shares), as adjusted to take into account the impact of dilutive securities based on the treasury stock method at the implied

share price. This analysis resulted in a range of implied equity values of $4.62 to $11.10 per Share, as compared to the Offer Price.”

3. By adding the bold and underlined text to the below

paragraph under the section titled “Opinion of William Blair & Company, L.L.C.—General” on page 43 as follows:

“William Blair has been engaged in the investment

banking business since 1935. William Blair continually undertakes the valuation of investment securities in connection with public offerings,

private placements, business combinations, estate and gift tax valuations and similar transactions. In the ordinary course of its business,

William Blair may from time to time trade the securities of Science 37 or other parties involved in the Transactions for its own account

and for the accounts of its customers, and accordingly may at any time hold a long or short position in such securities. William Blair

is familiar with Science 37, having provided certain investment banking services to Science 37 from time to time, including as a capital

markets advisor to Science 37. In the two years prior to the date of its written opinion, except for William Blair’s current

engagement, William Blair has not been engaged to provide financial advisory or other services to the Company, and William Blair did not

receive any compensation from the Company during such period. In the two years prior to the date of its written opinion, William Blair

has not been engaged to provide investment banking services to eMed. The Science 37 Board hired William Blair based on its deep

understanding of Science 37’s business, and that William Blair had a significant wealth of experience in both the clinical research

industry and in transactions of this type.”

4. By adding the bold and underlined text to the below

paragraph under the section titled “Opinion of William Blair & Company, L.L.C.—Fees” on page 43 as follows:

“Pursuant to a letter agreement dated March

31, 2023, a fairness opinion fee of $1,500,000 became payable to William Blair promptly after delivery of its fairness opinion. A fee

of approximately $3,500,000, less the $1,500,000 fairness opinion fee previously paid to William Blair, will become payable to William

Blair upon the consummation of the Merger. The Merger Agreement contains a representation of the Company that William Blair had

delivered a favorable fairness opinion with respect to the Merger. No portion of the fees payable to William Blair were contingent

on the conclusions reached by William Blair in William Blair’s fairness opinion. In addition, Science 37 agreed to reimburse William

Blair for certain of its out-of-pocket expenses (including fees and expenses of its counsel and any other independent experts retained

by William Blair) reasonably incurred by it in connection with its services and to indemnify William Blair against certain potential liabilities

arising out of its engagement, including certain liabilities under the U.S. federal securities laws.”

Item 5. Persons/Assets Retained, Employed, Compensated or Used

Item 5 “Persons/Assets Retained, Employed,

Compensated or Used” of the Schedule 14D-9 is hereby amended and supplemented as follows:

1. By adding the bold and underlined text to the below

paragraph on page 43 as follows:

“Science 37 has retained William Blair to

act as its financial advisor in connection with the Transactions. Science 37 selected William Blair based on, among other factors, its

qualifications, professional reputation and industry expertise as well as its deep understanding of Science 37’s business. In connection

with William Blair’s services as a financial advisor to Science 37, Science 37 has agreed to pay William Blair an aggregate fee

of approximately $3,500,000, $1,500,000 of which was payable promptly after the rendering of William Blair’s opinion and the remainder

of which is payable contingent upon consummation of the Transactions. The Merger Agreement contains a representation of the Company

that William Blair had delivered a favorable fairness opinion with respect to the Merger. In addition, Science 37 has agreed to

reimburse William Blair for certain of its expenses arising, and to indemnify William Blair against certain liabilities that may arise,

out of William Blair’s engagement. The Company and eMed may not have elected to proceed with the transaction without a fairness

opinion from William Blair. Additional information pertaining to the retention of William Blair by Science 37 in “Item 4.

The Solicitation or Recommendation — Opinion of William Blair & Company, L.L.C.” is hereby incorporated

by reference in this Item 5.”

Item 8. Additional Information

Item 8 “Additional Information” of

the Schedule 14D-9 is hereby amended and supplemented as follows:

1. By deleting the paragraph under the section titled

“Legal Proceedings” on page 40 and replacing it with the following paragraphs:

“As of this filing, three purported stockholders

of Science 37 have filed complaints in federal court regarding the Transactions. The first complaint was filed on February 14, 2024 in

the United States District Court for the District of Delaware and is captioned Ballard v. Science 37 Holdings, Inc., et al., No.

1:24-cv-00200-UNA. The second and third complaints were filed on February 14, 2024 and February 16, 2024, respectively, in the United

States District Court for the Southern District of New York and are captioned McDaniel v. Science 37 Holdings, Inc., et al, No.

1:24-cv-01090 and Lane v. Science 37 Holdings, Inc., et al, No. 1:24-cv-01194. The aforementioned three complaints are collectively

referred to as the “Complaints.” The Complaints name as defendants Science 37 and each member of the Science 37 Board (collectively,

the “Science 37 Defendants”). The Complaints allege violations of Section 14(d) and Section 14(e) of the Exchange Act, as

well as Rule 14d-9 promulgated thereunder, against all Science 37 Defendants and assert violations of Section 20(a) of the Exchange Act

against the members of the Science 37 Board. The Complaints collectively seek, among other relief, (i) injunctive relief preventing the

consummation of the Transactions; (ii) rescission and/or rescissory damages in the event the Transactions are consummated; (iii) an award

of plaintiffs’ expenses and attorneys’ fees; and (iv) disclosure of certain information requested by the plaintiffs.

In addition, as of this filing, Science 37 had

received 11 demand letters from purported stockholders of the Company, which generally seek that certain allegedly omitted information

in the Schedule 14D-9 be disclosed.

Additional complaints or demand letters may be

filed against or received by Science 37, the Science 37 Board, eMed and/or Purchaser in connection with the Transactions, the Schedule

TO and the Schedule 14D-9. If additional similar complaints are filed or demand letters received, absent new or different allegations

that are material, Science 37 and eMed will not necessarily announce such additional filings.”

SIGNATURE

After due inquiry and to the best of my knowledge

and belief, I certify that the information set forth in this statement is true, complete and correct.

Dated: March 4, 2024

| SCIENCE 37 HOLDINGS, INC. |

| |

|

| By: |

|

/s/ David Coman |

| Name: |

|

David Coman |

| Title: |

|

Chief Executive Officer and Director |

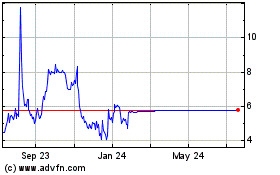

Science 37 (NASDAQ:SNCE)

Historical Stock Chart

From Apr 2024 to May 2024

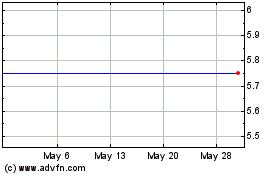

Science 37 (NASDAQ:SNCE)

Historical Stock Chart

From May 2023 to May 2024