false

0001464790

0001464790

2024-02-29

2024-02-29

0001464790

RILY:CommonStockParValue0.0001PerShareMember

2024-02-29

2024-02-29

0001464790

RILY:DepositarySharesEachRepresenting11000thInterestIn6.875SeriesCumulativePerpetualPreferredShareParValue0.0001PerShareMember

2024-02-29

2024-02-29

0001464790

RILY:DepositarySharesEachRepresenting11000thFractionalInterestIn7.375ShareOfSeriesBCumulativePerpetualPreferredStockMember

2024-02-29

2024-02-29

0001464790

RILY:Sec6.75SeniorNotesDue2024Member

2024-02-29

2024-02-29

0001464790

RILY:Sec6.375SeniorNotesDue2025Member

2024-02-29

2024-02-29

0001464790

RILY:Sec5.00SeniorNotesDue2026Member

2024-02-29

2024-02-29

0001464790

RILY:Sec5.50SeniorNotesDue2026Member

2024-02-29

2024-02-29

0001464790

RILY:Sec6.50SeniorNotesDue2026Member

2024-02-29

2024-02-29

0001464790

RILY:Sec5.25SeniorNotesDue2028Member

2024-02-29

2024-02-29

0001464790

RILY:Sec6.00SeniorNotesDue2028Member

2024-02-29

2024-02-29

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 8-K

CURRENT

REPORT

Pursuant

to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): February 29, 2024

B.

RILEY FINANCIAL, INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-37503 |

|

27-0223495 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

11100

Santa Monica Blvd., Suite 800

Los

Angeles, CA 90025

310-966-1444

(Address,

Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which

registered |

| Common

Stock, par value $0.0001 per share |

|

RILY |

|

Nasdaq

Global Market |

| Depositary Shares (each

representing a 1/1000th interest in a 6.875% Series A Cumulative Perpetual Preferred Share, par value $0.0001 per share) |

|

RILYP |

|

Nasdaq

Global Market |

| Depositary Shares, each

representing a 1/1000th fractional interest in a 7.375% share of Series B Cumulative Perpetual Preferred Stock |

|

RILYL |

|

Nasdaq Global Market |

| 6.75% Senior Notes due

2024 |

|

RILYO |

|

Nasdaq Global Market |

| 6.375% Senior Notes due

2025 |

|

RILYM |

|

Nasdaq Global Market |

| 5.00% Senior Notes due

2026 |

|

RILYG |

|

Nasdaq Global Market |

| 5.50% Senior Notes due

2026 |

|

RILYK |

|

Nasdaq Global Market |

| 6.50% Senior Notes due

2026 |

|

RILYN |

|

Nasdaq Global Market |

| 5.25% Senior Notes due

2028 |

|

RILYZ |

|

Nasdaq Global Market |

| 6.00% Senior Notes due

2028 |

|

RILYT |

|

Nasdaq Global Market |

Not

Applicable

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

2.02. Results of Operations and Financial Condition.

On

February 29, 2024, B. Riley Financial, Inc. (the “Company”) issued a press release reporting its preliminary unaudited financial

results for the three and twelve-month periods ending December 31, 2023. A copy of the press release is attached hereto as Exhibit 99.1.

The

information set forth in this Current Report, including Exhibit 99.1 attached hereto, is being furnished and shall not be deemed “filed”

for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject

to the liabilities of such section. The information in this Current Report, including Exhibit 99.1 attached hereto, shall not be incorporated

by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific

reference in such a filing to this Current Report.

Item

9.01. Financial Statements and Exhibits.

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

B. Riley Financial, Inc. |

| |

|

| |

By: |

/s/

Phillip J. Ahn |

| |

Name: |

Phillip J. Ahn |

| |

Title: |

CFO & COO |

Date:

February 29, 2024

-2-

Exhibit 99.1

B. Riley Financial Reports Preliminary Unaudited

Fourth Quarter and Full Year 2023 Results; Declares Quarterly Dividend of $0.50 per share

LOS ANGELES, February 29, 2024 –

B. Riley Financial, Inc. (NASDAQ: RILY) (“B. Riley” or the “Company”), a diversified financial services platform,

today released preliminary unaudited financial results for the three and twelve-month periods ending December 31, 2023. These financial

results are subject to completion of the ongoing audit of the Company’s annual financial statements.

Financial Highlights – Preliminary Unaudited

Fourth quarter ended December 31, 2023:

| ● | Total

revenues were $347 million compared to $382 million for the fourth quarter of 2022 |

| ● | Net

loss available to common shareholders was $70 million, or $2.32 diluted loss per share |

| ● | Operating

revenues(2) of $395 million compared to $449 million in the prior year quarter |

| ● | Operating

adjusted EBITDA(3) of $79 million compared to $110 million in the prior year quarter |

Full year ended December 31, 2023:

| ● | Total

revenues increased 52% to $1.65 billion in 2023, up from $1.08 billion in 2022 |

| ● | Net

loss of $86 million for the full year driven primarily by non-cash impairment charge of $71 million |

| ● | Operating

revenues (2) increased 25% to $1.63 billion in 2023, up from $1.31 billion in 2022 |

| ● | Operating

adjusted EBITDA (3) of $368 million compared to $394 million in the prior year |

| ● | Total

adjusted EBITDA(1) increased to $240 million in 2023, up from $32 million in 2022 |

Bryant Riley, Chairman and Co-Chief Executive

Officer of B. Riley Financial, commented: “Since our founding as a fundamental stock research firm over 27 years ago, we have

invested opportunistically to build our platform and to enable our clients’ success. This has been our stated strategy from the

beginning – and with tailwinds in small caps, we believe B. Riley is poised to gain market share. This is our core business, and

where we will continue to invest. We have reduced our dividend by 50 percent to focus on the many opportunities we have to invest in our

own business, including potentially repurchasing our debt at attractive prices. As we look ahead, our focus remains on charting the best

path forward for our business, employees, and shareholders.”

Tom Kelleher, Co-Chief Executive Officer of

B. Riley Financial, added: “2023 saw notable progress across the majority of our subsidiaries. Non-cash investment losses and

an impairment charge masked what was otherwise a strong year for our core businesses. During 2023, financial consulting revenues and operating

income grew 36% and 86%, respectively; segment income from our communications portfolio increased by 15%; and our wealth management business

returned to profitability. Over the last 10 years, we have diversified our company by investing in and acquiring businesses that can benefit

from and grow on our platform. On balance, each of our core financial services businesses have performed better than prior to our acquisition

and involvement in these businesses. Our team continues to demonstrate complete focus and dedication, and this is truly what has been

paramount to both our and our clients’ collective success.”

Declaration of Common Dividend

The Company’s Board of Directors has approved

a quarterly dividend of $0.50 per common share which will be payable on or about March 22, 2024 to common shareholders of record as of

March 11, 2024.

| |

| www.brileyfin.com | NASDAQ: RILY | 1 |

Notice of Late Filing

The Company will file a Form 12b-25 with the SEC

to provide notice of the late filing of its Annual Report on Form 10-K for the year ended December 31, 2023. The Company notes that it

is unable, without unreasonable effort or expense, to file its Annual Report on Form 10-K for the year ended December 31, 2023 by February

29, 2024, the required filing date, due to delays experienced in finalizing the Company’s financial statements. This delay resulted

from the dedication of time and resources expended by the Company related to the review by the Audit Committee of the Company’s

Board of Directors, with the assistance of outside counsel, of the Company’s transactions with Brian Kahn. The Company is compiling

the required information to complete its Annual Report and it does not anticipate any significant changes to the financial results for

the fourth quarter and year ended December 31, 2023 as disclosed.

Review of Strategic Alternatives

The Company announced separately today that it

has retained Moelis & Company as an independent financial advisor to commence a review of strategic alternatives for the appraisal

and asset disposition businesses, collectively formerly known as Great American Group. There is no guarantee any potential transaction

will result from this strategic review.

Preliminary Unaudited Financial Results for the Fourth Quarter and

Full Year 2023

| Preliminary (Unaudited)

| |

Three Months Ended

December 31, | | |

Twelve Months Ended

December 31, | |

| (Dollars in thousands, except for share data) | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

| | |

| | |

| | |

| |

| Net loss available to common shareholders | |

$ | (70,042 | ) | |

$ | (59,447 | ) | |

$ | (86,371 | ) | |

$ | (167,837 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Basic loss per common share | |

$ | (2.32 | ) | |

$ | (2.08 | ) | |

$ | (2.95 | ) | |

$ | (5.95 | ) |

| Diluted loss per common share | |

$ | (2.32 | ) | |

$ | (2.08 | ) | |

$ | (2.95 | ) | |

$ | (5.95 | ) |

Preliminary

(Unaudited) | |

Three Months Ended

December 31, | | |

Twelve Months Ended

December 31, | |

| (Dollars in thousands) | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

| | |

| | |

| | |

| |

| Operating Revenues (2) | |

$ | 395,026 | | |

$ | 448,831 | | |

$ | 1,633,275 | | |

$ | 1,310,425 | |

| Investment (Loss) Gains (4) | |

| (48,521 | ) | |

| (66,739 | ) | |

| 13,910 | | |

| (229,755 | ) |

| Total Revenues | |

$ | 346,505 | | |

$ | 382,092 | | |

$ | 1,647,185 | | |

$ | 1,080,670 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating Adjusted EBITDA (3) | |

$ | 78,855 | | |

$ | 109,876 | | |

$ | 367,604 | | |

$ | 393,585 | |

| Investment Adjusted EBITDA (5) | |

| (101,821 | ) | |

| (123,916 | ) | |

| (127,727 | ) | |

| (361,303 | ) |

| Total Adjusted EBITDA (1) | |

$ | (22,966 | ) | |

$ | (14,040 | ) | |

$ | 239,877 | | |

$ | 32,282 | |

Certain of the information set forth herein,

including Adjusted EBITDA(1), Operating Revenues(2), and Operating Adjusted EBITDA(3), may be considered

non-GAAP financial measures. Information about B. Riley Financial’s use of non-GAAP financial measures is provided below under

“Use of Non-GAAP Financial Measures.”

For the fourth quarter ended December 31, 2023

| ● | Total

revenues were $347 million compared to $382 million in the fourth quarter of 2022. |

| ● | Net

loss attributable to common shareholders of $70 million, or $2.32 diluted loss per share, was primarily due to non-cash goodwill and

tradename impairment charges of $34 million related to Targus, and unrealized investment losses. |

| ● | Operating

revenues(2) were $395 million for the fourth quarter of 2023, compared to $449 million in the prior year quarter. |

| ● | Operating

adjusted EBITDA (3) of $79 million compared to $110 million for the fourth quarter of 2022. |

| |

| www.brileyfin.com | NASDAQ: RILY | 2 |

For the full year ended December 31, 2023

| ● | Total

revenues increased 52% to $1.65 billion, up from $1.08 billion in 2022. |

| ● | Net

loss of $86 million for 2023 primarily related non-cash goodwill and tradename impairment charges of $71 million related to Targus, and

unrealized investment losses. |

| ● | Operating

revenues (2) increased 25% to $1.63 billion in 2023, up from $1.31 billion in 2022. |

| ● | Operating

adjusted EBITDA (3) decreased to $368 million in 2023 compared to $394 million in 2022. |

| ● | Total

adjusted EBITDA(1) increased to $240 million in 2023, up from $32 million in 2022. |

Investment gains and losses(4) include

realized and unrealized gains and losses on our investments, whether realized from dispositions or unrealized due to changes in mark-to-market

prices. These investment gains and losses have caused, and will continue to cause, volatility in our periodic earnings. For this reason,

the Company generally discusses its financial performance in the context of operating revenues(2) and operating adjusted EBITDA(3)

which may be considered non-GAAP financial measures. During the fourth quarter, the Company recast its operating metrics to include revenues

from fixed income trading. This adjustment is reflected in the reconciliation for operating revenues and operating adjusted EBITDA.

Preliminary Unaudited Segment Financial Summary for the Fourth Quarter

of 2023:

| |

|

Segment Revenues |

|

|

Segment Income (Loss) |

|

| |

|

Three Months Ended December 31, |

|

|

Three Months Ended December 31, |

|

| (Dollars in thousands) |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

| Capital Markets |

|

$ |

87,558 |

|

|

$ |

72,304 |

|

|

$ |

(2,668 |

) |

|

$ |

(8,007 |

) |

| Wealth Management |

|

|

49,350 |

|

|

|

46,217 |

|

|

|

683 |

|

|

|

(7,414 |

) |

| Auction and Liquidation |

|

|

9,439 |

|

|

|

59,778 |

|

|

|

(1,147 |

) |

|

|

12,372 |

|

| Financial Consulting |

|

|

40,123 |

|

|

|

25,427 |

|

|

|

7,816 |

|

|

|

4,412 |

|

| Communications |

|

|

82,021 |

|

|

|

87,944 |

|

|

|

6,468 |

|

|

|

11,205 |

|

| Consumer Products |

|

|

54,046 |

|

|

|

77,821 |

|

|

|

(35,146 |

) |

|

|

8,188 |

|

| |

|

Segment Revenues |

|

|

Segment Income (Loss) |

|

| (Dollars in thousands) |

|

Three Months Ended December 31, |

|

|

Three Months Ended December 31, |

|

| Capital Markets | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Operating | |

$ | 137,363 | | |

$ | 138,346 | | |

$ | 47,137 | | |

$ | 55,520 | |

| Investment | |

| (49,805 | ) | |

| (66,042 | ) | |

| (49,805 | ) | |

| (63,527 | ) |

| Total | |

$ | 87,558 | | |

$ | 72,304 | | |

$ | (2,668 | ) | |

$ | (8,007 | ) |

| |

| www.brileyfin.com | NASDAQ: RILY | 3 |

Preliminary Unaudited Segment Financial Summary for the Full Year

2023:

| | |

Segment Revenues | | |

Segment Income (Loss) | |

| | |

Twelve Months Ended

December 31, | | |

Twelve Months Ended

December 31, | |

| (Dollars in thousands) | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Capital Markets | |

$ | 574,587 | | |

$ | 327,596 | | |

$ | 198,428 | | |

$ | 81,602 | |

| Wealth Management | |

| 198,245 | | |

| 234,257 | | |

| 3,097 | | |

| (34,320 | ) |

| Auction and Liquidation | |

| 103,265 | | |

| 74,096 | | |

| 21,371 | | |

| 12,600 | |

| Financial Consulting | |

| 133,705 | | |

| 98,508 | | |

| 30,420 | | |

| 16,312 | |

| Communications | |

| 337,689 | | |

| 235,655 | | |

| 34,725 | | |

| 30,320 | |

| Consumer Products | |

| 233,202 | | |

| 77,821 | | |

| (75,318 | ) | |

| 8,188 | |

| | |

Segment Revenues | | |

Segment Income (Loss) | |

| (Dollars in thousands) | |

Twelve Months Ended

December 31, | | |

Twelve Months Ended

December 31, | |

| Capital Markets | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Operating | |

$ | 561,789 | | |

$ | 556,511 | | |

$ | 198,512 | | |

$ | 246,998 | |

| Investment | |

| 12,798 | | |

| (228,915 | ) | |

| (84 | ) | |

| (165,396 | ) |

| Total | |

$ | 574,587 | | |

$ | 327,596 | | |

$ | 198,428 | | |

$ | 81,602 | |

Segment Highlights

| ● | Capital

Markets segment revenues increased 75% to $575 million in 2023, up from $328 million in 2022. Segment income increased 143% to $198

million in 2023, up from $82 million in 2022. Excluding investment gains and losses,(4) segment operating revenues(2)

increased to $562 million, up from $557 million in 2022 primarily driven by investment banking and institutional brokerage activities

at B. Riley Securities. Despite relatively subdued equity capital markets activity during the quarter, investment banking benefitted

from an uptick in M&A and recently gained significant market share in debt capital markets. Sales and trading demonstrated sequential

improvement, supported by increased contribution from fixed income trading. Investment banking restructuring has continued to see an

uptick in activity. |

| ● | Wealth

Management returned to profitability in 2023 following the operational realignment of this business throughout 2021 and 2022. Segment

revenues were $198 million in 2023. For the fourth quarter, revenues and fee-based assets increased year-over-year, compared to the fourth

quarter of 2022. Assets under management totaled $25.4 billion at December 31, 2023. |

| ● | Auction

and Liquidation revenues increased 39% to $103 million in 2023, up from $74 million in 2022 driven by a significant uptick in retail

liquidation activity in the U.S. and Canada during 2023, and continued levels of retail liquidation activity in Europe. Segment income

increased 70% to $21 million, up from $13 million in the prior year. Results for this segment vary quarter-to-quarter and year-to-year

due to the episodic impact of large retail liquidation engagements. |

| ● | Financial

Consulting maintained strong steady growth throughout 2023. Segment revenues increased 36% to $134 million in 2023, up from $99 million

in 2022 primarily driven by an increase of bankruptcy and litigation consulting assignments and appraisal engagements, and real estate

restructuring projects. Segment income increased 86% to $30 million, up from $16 million in the prior year. The fourth quarter saw another

record revenue period for our consulting division, along with increased revenues from the appraisal division. |

| ● | Communications

segment revenues increased 43% to $338 million in 2023, up from $236 million primarily due to acquisitions completed during late

2022. On a combined basis, segment income from communications businesses increased 15% to $35 million in 2023 from $30 million in the

prior year. |

| ● | Consumer

Products segment revenues include the sale of goods from Targus, which was impacted by continued softness in the global PC and tablet

marketplace throughout 2023. This resulted in non-cash goodwill and tradename impairment charges of approximately $71 million in 2023.

As global sales improve, the Company believes Targus is well positioned to gain market share as the worldwide leader in its category. |

Dividend income related to securities owned and

our Brand investments increased 33% to $48 million in 2023, up from $36 million in 2022.

| |

| www.brileyfin.com | NASDAQ: RILY | 4 |

Realignment of Segment Reporting

The Company re-aligned its segment reporting during

the fourth quarter of 2023. These changes resulted in Targus’s operations being reported on a standalone basis in the Consumer Products

segment and the operations related to brand licensing that was previously reported in the Consumer segment being reported in the All Other

Category that is reported with Corporate and Other. The Company has recast the financial data for the Consumer Products segment and reporting

of the All Other Category for all periods presented.

Balance Sheet Summary

At December 31, 2023, cash and investments(6)

totaled $1.90 billion, including $232 million of cash and cash equivalents; $1.11 billion in net securities and other investments owned,

at fair value; and $532 million of loans receivable. Total debt, net of cash and investments,(6) was $457 million at quarter-end.

Total debt was $2.36 billion as of December 31, 2023.

Earnings Call Details

B. Riley Financial will hold an investor call

today, February 29, beginning at 4:30 PM ET (1:30 PM PT) to discuss its business and preliminary unaudited financial results for the fourth

quarter and full year 2023. Investors may access the live audio webcast and archived recording at https://ir.brileyfin.com/events-and-presentations.

A web recording will be made available for replay until March 14.

About B. Riley Financial

B. Riley Financial is a diversified financial

services platform that delivers tailored solutions to meet the strategic, operational, and capital needs of its clients and partners.

B. Riley leverages cross-platform expertise to provide clients with full service, collaborative solutions at every stage of the business

life cycle. Through its affiliated subsidiaries, B. Riley provides end-to-end financial services across investment banking, institutional

brokerage, private wealth and investment management, financial consulting, corporate restructuring, operations management, risk and compliance,

due diligence, forensic accounting, litigation support, appraisal and valuation, auction, and liquidation services. B. Riley opportunistically

invests to benefit its shareholders, and certain affiliates originate and underwrite senior secured loans for asset-rich companies. B.

Riley refers to B. Riley Financial, Inc. and/or one or more of its subsidiaries or affiliates. For more information, please visit www.brileyfin.com.

Footnotes (See “Note Regarding Use

of Non-GAAP Financial Measures” for further discussion of these non-GAAP terms. For a reconciliation of Adjusted EBITDA, Operating

Revenue, Operating Adjusted EBITDA, and Investment Adjusted EBITDA to the comparable GAAP financial measures, please see the Appendix

hereto.)

(1) Adjusted EBITDA includes earnings before interest,

taxes, depreciation, amortization, restructuring charge, share-based payments, gain/loss on extinguishment of loans, gain on bargain purchase,

impairment of goodwill and tradenames, and transaction related and other costs.

(2) Operating Revenues is defined as the sum of

revenues from (i) Service and Fees, (ii) Interest Income - Loans and Securities Lending and (iii) Sales of Goods. During the fourth quarter

of 2023, the Company recast its operating metrics to include revenues from fixed income trading. Operating Revenues has been adjusted

to include fixed income trading revenue for the periods presented.

(3) Operating Adjusted EBITDA is defined as Adjusted

EBITDA excluding (i) Trading Income (Loss) and Fair Value Adjustments on Loans, (ii) Realized and Unrealized Gains (Losses) on Investments,

and (iii) other investment related expenses. During the fourth quarter of 2023, the Company recast its operating metrics to include revenues

from fixed income trading. Operating Adjusted EBITDA has been adjusted to include fixed income trading revenue for the periods presented.

(4) Investment Gains (Loss) is defined as Trading

Income (Loss) and Fair Value Adjustments on Loans less fixed income trading revenue.

(5) Investment Adjusted EBITDA is defined as the

sum of (i) Trading Income (Loss) and Fair Value Adjustments on Loans and (ii) Realized and Unrealized Gains (Losses) on Investments, less

fixed income trading revenue and other investment related expenses.

(6) Total cash and investments is defined as the

sum of cash and cash equivalents, net of noncontrolling interest, restricted cash, due from clearing brokers net of due to clearing brokers,

securities and other investments owned, at fair value net of (i) securities sold not yet purchased and (ii) noncontrolling interest related

to investments, advances against customer contracts, loans receivable, at fair value net of loan participations sold, and other investments

reported in prepaid and other assets.

(7) Segment Operating Income (Loss) is defined

as segment income (loss) including fixed income trading revenues and excluding trading income (loss) and fair value adjustments on loans

and other investment related operating expenses.

| |

| www.brileyfin.com | NASDAQ: RILY | 5 |

Note Regarding Use of Non-GAAP Financial Measures

Certain of the information set forth herein, including

operating revenues, adjusted EBITDA, operating adjusted EBITDA, and investment adjusted EBITDA, may be considered non-GAAP financial measures.

B. Riley Financial believes this information is useful to investors because it provides a basis for measuring the Company’s available

capital resources, the operating performance of its business and its revenues and cash flow, (i) excluding in the case of operating revenues,

trading income (losses) and fair value adjustments on loans, (ii) excluding in the case of adjusted EBITDA, net interest expense, provisions

for or benefit from income taxes, depreciation, amortization, fair value adjustment, restructuring charge, gain on extinguishment of loans,

gain on bargain purchase, impairment of goodwill and trade names, stock-based compensation and transaction and other expenses, (iii) excluding

in the case of operating adjusted EBITDA, the aforementioned adjustments for adjusted EBITDA as well as trading income (losses) and fair

value adjustments on loans, and other investment related expenses and including fixed income trading revenue, (iv) including in the case

of investment adjusted EBITDA, trading income (losses) and fair value adjustments on loans, net of other investment related expenses,

and excluding fixed income trading revenue and (v) including in the case of total cash and investments, cash and cash equivalents, restricted

cash, due from clearing brokers net of due to clearing brokers, securities and other investments owned, at fair value net of (a) securities

sold not yet purchased and (b) noncontrolling interest related to investments, advances against customer contracts, loans receivable,

at fair value net of loan participations sold, and other investments reported in prepaid and other assets, that would normally be included

in the most directly comparable measures calculated and presented in accordance with Generally Accepted Accounting Principles (“GAAP”).

In addition, the Company’s management uses these non-GAAP financial measures along with the most directly comparable GAAP financial measures

in evaluating the Company’s operating performance, management compensation, capital resources, and cash flow. Non-GAAP financial measures

should not be considered in isolation from, or as a substitute for, financial information presented in compliance with GAAP, and non-financial

measures as reported by the Company may not be comparable to similarly titled amounts reported by other companies.

Forward-Looking Statements

Statements in this press release that are not

descriptions of historical facts are forward-looking statements that are based on management’s current expectations and assumptions and

are subject to risks and uncertainties. If such risks or uncertainties materialize or such assumptions prove incorrect, our business,

operating results, financial condition, and stock price could be materially negatively affected. You should not place undue reliance on

such forward-looking statements, which are based on the information currently available to us and speak only as of the date of this press

release. Such forward-looking statements include, but are not limited to, statements regarding our excitement and the expected growth

of our business segments. Factors that could cause such actual results to differ materially from those contemplated or implied by such

forward-looking statements include, without limitation, the risks described from time to time in B. Riley Financial, Inc.’s periodic filings

with the SEC, including, without limitation, the risks described in B. Riley Financial, Inc.’s 2022 Annual Report on Form 10-K under

the captions “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations”

(as applicable). Additional information will be set forth in B. Riley Financial, Inc.’s Annual Report on Form 10-K for the year

ended 2023. These factors should be considered carefully, and readers are cautioned not to place undue reliance on such forward-looking

statements. All information is current as of the date this press release is issued, and B. Riley Financial undertakes no duty to update

this information.

| |

| www.brileyfin.com | NASDAQ: RILY | 6 |

B. RILEY FINANCIAL, INC. AND SUBSIDIARIES

Preliminary Unaudited Condensed Consolidated

Balance Sheets

(Dollars in thousands)

| | |

December 31, | | |

December 31, | |

| | |

2023 | | |

2022 | |

| Assets | |

| | |

| |

| Assets | |

| | |

| |

| Cash and cash

equivalents | |

$ | 231,964 | | |

$ | 268,618 | |

| Restricted cash | |

| 1,875 | | |

| 2,308 | |

| Due from clearing brokers | |

| 51,334 | | |

| 48,737 | |

| Securities and other investments

owned, at fair value | |

| 1,117,430 | | |

| 1,129,268 | |

| Securities borrowed | |

| 2,870,939 | | |

| 2,343,327 | |

| Accounts receivable, net | |

| 115,496 | | |

| 149,110 | |

| Due from related parties | |

| 2,510 | | |

| 1,081 | |

| Loans receivable, at fair

value (includes $73,502 and $98,729 from related parties as of December 31, 2023 and December 31, 2022, respectively) | |

| 532,419 | | |

| 701,652 | |

| Prepaid expenses and other

assets | |

| 239,572 | | |

| 460,696 | |

| Operating lease right-of-use

asset, net | |

| 87,605 | | |

| 88,593 | |

| Property and equipment, net | |

| 25,206 | | |

| 27,141 | |

| Goodwill | |

| 471,866 | | |

| 512,595 | |

| Other intangible assets,

net | |

| 322,014 | | |

| 374,098 | |

| Deferred

income taxes | |

| 25,411 | | |

| 3,978 | |

| Total

assets | |

$ | 6,095,641 | | |

$ | 6,111,202 | |

| Liabilities and Equity | |

| | | |

| | |

| Liabilities | |

| | | |

| | |

| Accounts payable | |

$ | 44,550 | | |

$ | 81,384 | |

| Accrued expenses and other

liabilities | |

| 272,586 | | |

| 322,974 | |

| Deferred revenue | |

| 71,504 | | |

| 85,441 | |

| Due to related parties and

partners | |

| 2,731 | | |

| 2,210 | |

| Due to clearing brokers | |

| — | | |

| 19,307 | |

| Securities sold not yet purchased | |

| 8,601 | | |

| 5,897 | |

| Securities loaned | |

| 2,859,306 | | |

| 2,334,031 | |

| Operating lease liabilities | |

| 98,563 | | |

| 99,124 | |

| Deferred income taxes | |

| — | | |

| 29,548 | |

| Notes payable | |

| 19,391 | | |

| 25,263 | |

| Revolving credit facility | |

| 43,801 | | |

| 127,678 | |

| Term loan | |

| 625,151 | | |

| 572,079 | |

| Senior

notes payable, net | |

| 1,668,021 | | |

| 1,721,751 | |

| Total

liabilities | |

| 5,714,205 | | |

| 5,426,687 | |

| | |

| | | |

| | |

| Redeemable noncontrolling

interests in equity of subsidiaries | |

| — | | |

| 178,622 | |

| Total B. Riley Financial,

Inc. stockholders’ equity | |

| 312,713 | | |

| 446,514 | |

| Noncontrolling

interests | |

| 68,723 | | |

| 59,379 | |

| Total

equity | |

| 381,436 | | |

| 505,893 | |

| Total

liabilities and equity | |

$ | 6,095,641 | | |

$ | 6,111,202 | |

| |

| www.brileyfin.com | NASDAQ: RILY | 7 |

B. RILEY FINANCIAL, INC. AND SUBSIDIARIES

Preliminary Unaudited Condensed Consolidated

Statement of Operations

(Dollars in thousands, except share data)

| | |

| Three

Months Ended

| | |

| Twelve

Months Ended

| |

| | |

| December 31,

| | |

| December

31,

| |

| | |

| 2023 | | |

| 2022 | | |

| 2023 | | |

| 2022 | |

| Revenues: | |

| | | |

| | | |

| | | |

| | |

| Services and fees | |

$ | 260,799 | | |

$ | 243,837 | | |

$ | 1,004,708 | | |

$ | 895,623 | |

| Trading (loss) income and fair value adjustments on loans | |

| (40,271 | ) | |

| (58,670 | ) | |

| 43,075 | | |

| (202,628 | ) |

| Interest income - Loans and securities lending | |

| 62,781 | | |

| 62,545 | | |

| 284,896 | | |

| 245,400 | |

| Sale of goods | |

| 63,196 | | |

| 134,380 | | |

| 314,506 | | |

| 142,275 | |

| Total revenues | |

| 346,505 | | |

| 382,092 | | |

| 1,647,185 | | |

| 1,080,670 | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| Direct cost of services | |

| 60,606 | | |

| 68,496 | | |

| 238,794 | | |

| 142,455 | |

| Cost of goods sold | |

| 45,110 | | |

| 71,313 | | |

| 211,106 | | |

| 78,647 | |

| Selling, general and administrative expenses | |

| 205,096 | | |

| 208,552 | | |

| 828,296 | | |

| 714,614 | |

| Restructuring charge | |

| 1,182 | | |

| 995 | | |

| 2,131 | | |

| 9,011 | |

| Impairment of goodwill and tradenames | |

| 33,560 | | |

| — | | |

| 70,793 | | |

| — | |

| Interest expense - Securities lending and loan participations sold | |

| 38,863 | | |

| 22,738 | | |

| 145,435 | | |

| 66,495 | |

| Total operating expenses | |

| 384,417 | | |

| 372,094 | | |

| 1,496,555 | | |

| 1,011,222 | |

| Operating (loss) income | |

| (37,912 | ) | |

| 9,998 | | |

| 150,630 | | |

| 69,448 | |

| Other income (expense): | |

| | | |

| | | |

| | | |

| | |

| Interest income | |

| 420 | | |

| 1,482 | | |

| 3,875 | | |

| 2,735 | |

| Dividend income | |

| 12,141 | | |

| 9,595 | | |

| 47,776 | | |

| 35,874 | |

| Realized and unrealized gains (losses) on investments | |

| (53,552 | ) | |

| (64,874 | ) | |

| (138,512 | ) | |

| (201,079 | ) |

| Change in fair value of financial instruments and other | |

| (750 | ) | |

| 460 | | |

| (4,748 | ) | |

| 10,188 | |

| Gain on bargain purchase | |

| 15,903 | | |

| — | | |

| 15,903 | | |

| — | |

| (Loss) income from equity investments | |

| (6 | ) | |

| 285 | | |

| (181 | ) | |

| 3,570 | |

| Interest expense | |

| (46,891 | ) | |

| (44,399 | ) | |

| (187,013 | ) | |

| (141,186 | ) |

| Loss before income taxes | |

| (110,647 | ) | |

| (87,453 | ) | |

| (112,270 | ) | |

| (220,450 | ) |

| Benefit from income taxes | |

| 42,853 | | |

| 23,998 | | |

| 28,509 | | |

| 63,856 | |

| Net loss | |

| (67,794 | ) | |

| (63,455 | ) | |

| (83,761 | ) | |

| (156,594 | ) |

| Net income (loss) attributable to noncontrolling interests and redeemable

noncontrolling interests | |

| 233 | | |

| (6,010 | ) | |

| (5,447 | ) | |

| 3,235 | |

| Net loss attributable to B. Riley Financial, Inc. | |

| (68,027 | ) | |

| (57,445 | ) | |

| (78,314 | ) | |

| (159,829 | ) |

| Preferred stock dividends | |

| 2,015 | | |

| 2,002 | | |

| 8,057 | | |

| 8,008 | |

| Net loss available to common shareholders | |

$ | (70,042 | ) | |

$ | (59,447 | ) | |

$ | (86,371 | ) | |

$ | (167,837 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Basic loss per common share | |

$ | (2.32 | ) | |

$ | (2.08 | ) | |

$ | (2.95 | ) | |

$ | (5.95 | ) |

| Diluted loss per common share | |

$ | (2.32 | ) | |

$ | (2.08 | ) | |

$ | (2.95 | ) | |

$ | (5.95 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average basic common shares outstanding | |

| 30,248,946 | | |

| 28,545,714 | | |

| 29,265,099 | | |

| 28,188,530 | |

| Weighted average diluted common shares outstanding | |

| 30,248,946 | | |

| 28,545,714 | | |

| 29,265,099 | | |

| 28,188,530 | |

| |

| www.brileyfin.com | NASDAQ: RILY | 8 |

B. RILEY FINANCIAL, INC. AND SUBSIDIARIES

Preliminary Unaudited Adjusted EBITDA(1)

and Operating Adjusted EBITDA(3) Reconciliations

(Dollars in thousands)

| | |

Three Months Ended | | |

Twelve Months Ended | |

| | |

December 31, | | |

December 31, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Net loss attributable to B. Riley Financial, Inc. | |

$ | (68,027 | ) | |

$ | (57,445 | ) | |

$ | (78,314 | ) | |

$ | (159,829 | ) |

| Adjustments: | |

| | | |

| | | |

| | | |

| | |

| Benefit from income taxes | |

| (42,853 | ) | |

| (23,998 | ) | |

| (28,509 | ) | |

| (63,856 | ) |

| Interest expense | |

| 46,891 | | |

| 44,399 | | |

| 187,013 | | |

| 141,186 | |

| Interest income | |

| (420 | ) | |

| (1,482 | ) | |

| (3,875 | ) | |

| (2,735 | ) |

| Share based payments | |

| 9,845 | | |

| 15,312 | | |

| 45,109 | | |

| 61,140 | |

| Depreciation and amortization | |

| 11,502 | | |

| 13,443 | | |

| 49,604 | | |

| 39,969 | |

| Restructuring charge | |

| 1,182 | | |

| 995 | | |

| 2,131 | | |

| 9,011 | |

| Gain on bargain purchase | |

| (15,903 | ) | |

| — | | |

| (15,903 | ) | |

| — | |

| Loss (gain) on extinguishment of loans | |

| — | | |

| — | | |

| 5,409 | | |

| (1,102 | ) |

| Impairment of goodwill and tradenames | |

| 33,560 | | |

| — | | |

| 70,793 | | |

| — | |

| Transactions related costs and other | |

| 1,257 | | |

| (5,264 | ) | |

| 6,419 | | |

| 8,498 | |

| Total EBITDA adjustments | |

| 45,061 | | |

| 43,405 | | |

| 318,191 | | |

| 192,111 | |

| Adjusted EBITDA | |

$ | (22,966 | ) | |

$ | (14,040 | ) | |

$ | 239,877 | | |

$ | 32,282 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating EBITDA Adjustments: | |

| | | |

| | | |

| | | |

| | |

| Trading loss (income) and fair value adjustments on loans | |

| 40,271 | | |

| 58,670 | | |

| (43,075 | ) | |

| 202,628 | |

| Realized and unrealized (gains) losses on investments | |

| 53,552 | | |

| 64,874 | | |

| 138,512 | | |

| 201,079 | |

| Fixed Income Spread | |

| 8,250 | | |

| 8,069 | | |

| 29,165 | | |

| 27,127 | |

| Other investment related expenses | |

| (252 | ) | |

| (7,697 | ) | |

| 3,125 | | |

| (69,531 | ) |

| Total Operating EBITDA Adjustments | |

| 101,821 | | |

| 123,916 | | |

| 127,727 | | |

| 361,303 | |

| Operating Adjusted EBITDA | |

$ | 78,855 | | |

$ | 109,876 | | |

$ | 367,604 | | |

$ | 393,585 | |

| |

| www.brileyfin.com | NASDAQ: RILY | 9 |

B. RILEY FINANCIAL, INC. AND SUBSIDIARIES

Preliminary Unaudited Revenues Reconciliation

(Dollars in thousands)

| | |

Three Months Ended | | |

Twelve Months Ended | |

| | |

December 31, | | |

December 31, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Revenues: | |

| | |

| | |

| | |

| |

| Capital Markets | |

$ | 87,558 | | |

| 72,304 | | |

$ | 574,587 | | |

| 327,596 | |

| Wealth Management | |

| 49,350 | | |

| 46,217 | | |

| 198,245 | | |

| 234,257 | |

| Auction and Liquidation | |

| 9,439 | | |

| 59,778 | | |

| 103,265 | | |

| 74,096 | |

| Financial Consulting | |

| 40,123 | | |

| 25,427 | | |

| 133,705 | | |

| 98,508 | |

| Communications | |

| 82,021 | | |

| 87,944 | | |

| 337,689 | | |

| 235,655 | |

| Consumer Products | |

| 54,046 | | |

| 77,821 | | |

| 233,202 | | |

| 77,821 | |

| All Other | |

| 23,968 | | |

| 12,601 | | |

| 66,492 | | |

| 32,737 | |

| Total Revenues | |

$ | 346,505 | | |

$ | 382,092 | | |

$ | 1,647,185 | | |

$ | 1,080,670 | |

B. RILEY FINANCIAL, INC. AND SUBSIDIARIES

Preliminary Unaudited Operating (Loss) Income

Reconciliation

(Dollars in thousands)

| | |

Three Months Ended | | |

Twelve Months Ended | |

| | |

December 31, | | |

December 31, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Operating (Loss) Income: | |

| | |

| | |

| | |

| |

| Capital Markets | |

$ | (2,668 | ) | |

| (8,007 | ) | |

$ | 198,428 | | |

| 81,602 | |

| Wealth Management | |

| 683 | | |

| (7,414 | ) | |

| 3,097 | | |

| (34,320 | ) |

| Auction and Liquidation | |

| (1,147 | ) | |

| 12,372 | | |

| 21,371 | | |

| 12,600 | |

| Financial Consulting | |

| 7,816 | | |

| 4,412 | | |

| 30,420 | | |

| 16,312 | |

| Communications | |

| 6,468 | | |

| 11,205 | | |

| 34,725 | | |

| 30,320 | |

| Consumer Products | |

| (35,146 | ) | |

| 8,188 | | |

| (75,318 | ) | |

| 8,188 | |

| All Other | |

| (13,918 | ) | |

| (10,758 | ) | |

| (62,093 | ) | |

| (45,254 | ) |

| Total Operating (Loss) Income | |

$ | (37,912 | ) | |

$ | 9,998 | | |

$ | 150,630 | | |

$ | 69,448 | |

| |

| www.brileyfin.com | NASDAQ: RILY | 10 |

B. RILEY FINANCIAL, INC. AND SUBSIDIARIES

Preliminary Unaudited Operating Revenues(2)

Reconciliation

(Dollars in thousands)

| | |

Three Months Ended | | |

Twelve Months Ended | |

| | |

December 31, | | |

December 31, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Total Revenues | |

$ | 346,505 | | |

$ | 382,092 | | |

$ | 1,647,185 | | |

$ | 1,080,670 | |

| Operating Revenues Adjustments: | |

| | | |

| | | |

| | | |

| | |

| Trading loss (income) and fair value adjustments on loans | |

| 40,271 | | |

| 58,670 | | |

| (43,075 | ) | |

| 202,628 | |

| Fixed Income Spread | |

| 8,250 | | |

| 8,069 | | |

| 29,165 | | |

| 27,127 | |

| Total Revenues Adjustments | |

| 48,521 | | |

| 66,739 | | |

| (13,910 | ) | |

| 229,755 | |

| Operating Revenues | |

$ | 395,026 | | |

$ | 448,831 | | |

$ | 1,633,275 | | |

$ | 1,310,425 | |

B. RILEY FINANCIAL, INC. AND SUBSIDIARIES

Preliminary Unaudited Capital Markets Operating

Revenues(2) Reconciliation

(Dollars in thousands)

| | |

Three Months Ended | | |

Twelve Months Ended | |

| | |

December 31, | | |

December 31, | |

| Capital Markets | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Total Revenues | |

$ | 87,558 | | |

$ | 72,304 | | |

$ | 574,587 | | |

$ | 327,596 | |

| Operating Revenues Adjustments: | |

| | | |

| | | |

| | | |

| | |

| Trading loss (income) and fair value adjustments on loans | |

| 42,794 | | |

| 59,115 | | |

| (38,317 | ) | |

| 206,150 | |

| Fixed Income Spread | |

| 7,011 | | |

| 6,927 | | |

| 25,519 | | |

| 22,765 | |

| Total Revenues Adjustments | |

| 49,805 | | |

| 66,042 | | |

| (12,798 | ) | |

| 228,915 | |

| Operating Revenues | |

$ | 137,363 | | |

$ | 138,346 | | |

$ | 561,789 | | |

$ | 556,511 | |

B. RILEY FINANCIAL, INC. AND SUBSIDIARIES

Preliminary Unaudited Capital Markets Segment

Operating Income(7) Reconciliation

(Dollars in thousands

| | |

Three Months Ended | | |

Twelve Months Ended | |

| | |

December 31, | | |

December 31, | |

| Capital Markets | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Segment (Loss) Income | |

$ | (2,668 | ) | |

$ | (8,007 | ) | |

$ | 198,428 | | |

$ | 81,602 | |

| Operating Revenues Adjustments: | |

| | | |

| | | |

| | | |

| | |

| Trading loss (income) and fair value adjustments on loans | |

| 42,794 | | |

| 59,115 | | |

| (38,317 | ) | |

| 206,150 | |

| Fixed Income Spread | |

| 7,011 | | |

| 6,927 | | |

| 25,519 | | |

| 22,765 | |

| Other investment related expenses | |

| — | | |

| (2,515 | ) | |

| 12,882 | | |

| (63,519 | ) |

| Total Operating Income Adjustments | |

| 49,805 | | |

| 63,527 | | |

| 84 | | |

| 165,396 | |

| Segment Operating Income | |

$ | 47,137 | | |

$ | 55,520 | | |

$ | 198,512 | | |

$ | 246,998 | |

# # #

Contacts

| Investors |

Media |

| Mike Frank |

Jo Anne McCusker |

| ir@brileyfin.com |

jmccusker@brileyfin.com |

| (212) 409-2424 |

(646) 885-5425 |

| |

|

| Source: B. Riley Financial, Inc. |

|

| |

| www.brileyfin.com | NASDAQ: RILY |

11 |

v3.24.0.1

Cover

|

Feb. 29, 2024 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 29, 2024

|

| Entity File Number |

001-37503

|

| Entity Registrant Name |

B.

RILEY FINANCIAL, INC.

|

| Entity Central Index Key |

0001464790

|

| Entity Tax Identification Number |

27-0223495

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

11100

Santa Monica Blvd.

|

| Entity Address, Address Line Two |

Suite 800

|

| Entity Address, City or Town |

Los

Angeles

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

90025

|

| City Area Code |

310-

|

| Local Phone Number |

966-1444

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock, par value $0.0001 per share |

|

| Title of 12(b) Security |

Common

Stock, par value $0.0001 per share

|

| Trading Symbol |

RILY

|

| Security Exchange Name |

NASDAQ

|

| Depositary Shares (each representing a 1/1000th interest in a 6.875% Series A Cumulative Perpetual Preferred Share, par value $0.0001 per share) |

|

| Title of 12(b) Security |

Depositary Shares (each

representing a 1/1000th interest in a 6.875% Series A Cumulative Perpetual Preferred Share, par value $0.0001 per share)

|

| Trading Symbol |

RILYP

|

| Security Exchange Name |

NASDAQ

|

| Depositary Shares, each representing a 1/1000th fractional interest in a 7.375% share of Series B Cumulative Perpetual Preferred Stock |

|

| Title of 12(b) Security |

Depositary Shares, each

representing a 1/1000th fractional interest in a 7.375% share of Series B Cumulative Perpetual Preferred Stock

|

| Trading Symbol |

RILYL

|

| Security Exchange Name |

NASDAQ

|

| 6.75% Senior Notes due 2024 |

|

| Title of 12(b) Security |

6.75% Senior Notes due

2024

|

| Trading Symbol |

RILYO

|

| Security Exchange Name |

NASDAQ

|

| 6.375% Senior Notes due 2025 |

|

| Title of 12(b) Security |

6.375% Senior Notes due

2025

|

| Trading Symbol |

RILYM

|

| Security Exchange Name |

NASDAQ

|

| 5.00% Senior Notes due 2026 |

|

| Title of 12(b) Security |

5.00% Senior Notes due

2026

|

| Trading Symbol |

RILYG

|

| Security Exchange Name |

NASDAQ

|

| 5.50% Senior Notes due 2026 |

|

| Title of 12(b) Security |

5.50% Senior Notes due

2026

|

| Trading Symbol |

RILYK

|

| Security Exchange Name |

NASDAQ

|

| 6.50% Senior Notes due 2026 |

|

| Title of 12(b) Security |

6.50% Senior Notes due

2026

|

| Trading Symbol |

RILYN

|

| Security Exchange Name |

NASDAQ

|

| 5.25% Senior Notes due 2028 |

|

| Title of 12(b) Security |

5.25% Senior Notes due

2028

|

| Trading Symbol |

RILYZ

|

| Security Exchange Name |

NASDAQ

|

| 6.00% Senior Notes due 2028 |

|

| Title of 12(b) Security |

6.00% Senior Notes due

2028

|

| Trading Symbol |

RILYT

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=RILY_CommonStockParValue0.0001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=RILY_DepositarySharesEachRepresenting11000thInterestIn6.875SeriesCumulativePerpetualPreferredShareParValue0.0001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=RILY_DepositarySharesEachRepresenting11000thFractionalInterestIn7.375ShareOfSeriesBCumulativePerpetualPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=RILY_Sec6.75SeniorNotesDue2024Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=RILY_Sec6.375SeniorNotesDue2025Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=RILY_Sec5.00SeniorNotesDue2026Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=RILY_Sec5.50SeniorNotesDue2026Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=RILY_Sec6.50SeniorNotesDue2026Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=RILY_Sec5.25SeniorNotesDue2028Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=RILY_Sec6.00SeniorNotesDue2028Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

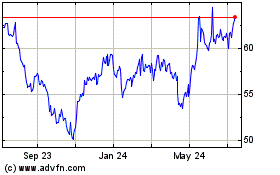

Amplify Video Game Tech ... (AMEX:GAMR)

Historical Stock Chart

From Mar 2024 to Apr 2024

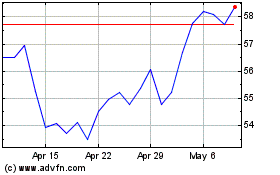

Amplify Video Game Tech ... (AMEX:GAMR)

Historical Stock Chart

From Apr 2023 to Apr 2024