0001418121false00014181212024-02-292024-02-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): February 29, 2024 |

APPLE HOSPITALITY REIT, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Virginia |

001-37389 |

26-1379210 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

814 East Main Street |

|

Richmond, Virginia |

|

23219 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 804 344-8121 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Shares, no par value |

|

APLE |

|

The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Apple Hospitality REIT, Inc. (which is referred to below as the “Company”) is filing this report in accordance with Items 7.01 and 9.01 of Form 8-K.

Item 7.01 Regulation FD Disclosure.

On February 29, 2024, the Company made available on its website an updated investor presentation for use at various conferences and meetings in the coming weeks containing, among other things, certain operating statistics for January and February 2024. A copy of the investor presentation is furnished as Exhibit 99.1 to this current report on Form 8-K and is incorporated herein solely for purposes of this Item 7.01 disclosure.

The information contained in this Current Report on Form 8-K, including Exhibit 99.1, shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall such information be deemed incorporated by reference into any filing made by the Company under the Exchange Act or Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

Apple Hospitality REIT, Inc. |

|

|

|

By: |

|

/s/ Justin G. Knight |

|

|

Justin G. Knight |

|

|

Chief Executive Officer |

|

|

|

|

|

February 29, 2024 |

INVESTOR PRESENTATION FEBRUARY 2024 • NYSE: APLE Exhibit 99.1

FORWARD-LOOKING STATEMENTS Certain statements made in this presentation are forward-looking statements. These forward-looking statements include statements regarding our intent, belief or current expectations and are based on various assumptions. These statements involve substantial risks and uncertainties. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements that we make. Forward-looking statements may include, but are not limited to, statements regarding net asset value and potential trading prices. Words such as “anticipates,” “believes,” “expects,” “estimates,” “projects,” “plans,” “intends,” “may,” “will,” “would,“ “outlook,” “strategy,” “targets,” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. Actual results or outcomes may differ materially from those contemplated by the forward-looking statement. Further, forward-looking statements speak only as of the date they are made, and we undertake no obligation to update or revise any forward-looking statement to reflect changed assumptions or the occurrence of unanticipated events or changes to future operating results, unless required to do so by law. Such factors include, but are not limited to, the ability of Apple Hospitality REIT, Inc. (the “Company,” “Apple Hospitality,” “Apple” or “APLE”) to effectively acquire and dispose of properties and redeploy proceeds; the anticipated timing and frequency of shareholder distributions; the ability of the Company to fund capital obligations; the ability of the Company to successfully integrate pending transactions and implement its operating strategy; changes in general political, economic and competitive conditions and specific market conditions (including the potential effects of inflation or a recessionary environment); reduced business and leisure travel due to geopolitical uncertainty, including terrorism and acts of war; travel-related health concerns, including widespread outbreaks of infectious or contagious diseases in the U.S.; inclement weather conditions, including natural disasters such as hurricanes, earthquakes and wildfires; government shutdowns, airline strikes or equipment failures or other disruptions; adverse changes in the real estate and real estate capital markets; financing risks; changes in interest rates; litigation risks; regulatory proceedings or inquiries; changes in laws or regulations or interpretations of current laws and regulations that impact the Company’s business, assets or classification as a real estate investment trust; or other risks detailed in filings made by Apple Hospitality with the Securities and Exchange Commission (“SEC”). Although the Company believes that the assumptions underlying the forward-looking statements contained herein are reasonable, any of the assumptions could be inaccurate, and therefore there can be no assurance that such statements included in this presentation will prove to be accurate. In light of the significant uncertainties inherent in the forward-looking statements included herein, the inclusion of such information should not be regarded as a representation by the Company or any other person that the results or conditions described in such statements or the objectives and plans of the Company will be achieved. COVER PHOTO: HYATT HOUSE AND HYATT PLACE TEMPE / PHOENIX / UNIVERSITY HILTON GARDEN INN MEMPHIS DOWNTOWN BEALE STREET

Note: Hotel portfolio statistics as of February 22, 2024. The Company’s portfolio also includes one non-hotel property leased to third parties. Market categorization based on STR designation. Average Effective Age represents years since hotels were built or last renovated. Average actual age of hotels is 16 years. The Tripadvisor® rating is based on lifetime scores for the Apple Hospitality portfolio of hotels through December 31, 2023. Net Total Debt to Total Capitalization calculation based on (as of December 31, 2023) total debt outstanding, net of cash and cash equivalents (“net total debt outstanding”), divided by net total debt outstanding plus equity market capitalization based on the Company’s closing share price of $16.61 and outstanding common shares. Based on hotels owned as of December 31, 2023. Scale Ownership of Upscale, Rooms-Focused Hotels Industry-Leading Brands and Operators Broad Geographic Diversification Consistent Reinvestment(1) Strong, Flexible Balance Sheet(2) 223 HOTELS 15 BRANDS 37 STATES 5 yrs AVERAGE EFFECTIVE AGE 25% NET TOTAL DEBT TO TOTAL CAPITALIZATION 29,652 GUEST ROOMS 89% OUTSTANDING DEBT EFFECTIVELY FIXED 99% ROOMS-FOCUSED 16 MANAGEMENT COMPANIES 87 MARKETS 4.3 AVERAGE TRIPADVISOR® RATING 210 HOTELS UNENCUMBERED COMPANY PROFILE AND PROVEN INVESTMENT STRATEGY Apple Hospitality is a publicly traded real estate investment trust that owns one of the largest and most diverse portfolios of upscale, rooms-focused hotels in the United States.

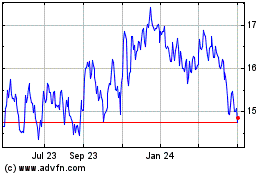

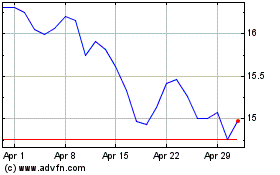

See following pages for reconciliation to actual revenue and net income. Note: Statistics above compare the Company's performance with the performance of specific industry indices using total shareholder return ("TSR"). Net Total Debt to Total Capitalization calculation based on (as of December 31, 2023) total debt outstanding, net of cash and cash equivalents (“net total debt outstanding”), divided by net total debt outstanding plus equity market capitalization based on the Company’s closing share price of $16.61 and outstanding common shares. #1 HOTEL REIT PERFORMER MSCI US REIT Index for 2022 Top 10% OF ALL REITS 2022 TSR performance; #8 overall in the MSCI for 2022 #1 PERFORMER Nareit Lodging/Resorts Index for 2022 +26.0% Outperformance vs. MSCI US REIT Index in 2022 Positive TSR Only positive 2022 TSR of all Nareit Lodging/Resorts Index Constituents +16.8% Outperformance vs. Nareit Lodging/Resorts Index in 2022 EXCHANGE: TICKER NYSE: APLE DIVIDEND YIELD at 1/31/2024 6.0% annual yield, annual rate of $0.96 per share, paid monthly AVERAGE TRADING VOLUME TTM 1/31/2024 2.2 Million shares per day EQUITY MARKET CAP at 12/31/2023 $4.0 Billion NET DEBT at 12/31/2023 $1.4 Billion, 25% net total debt outstanding to total capitalization TOTAL ENTERPRISE VALUE at 12/31/2023 $5.4 Billion COMPARABLE HOTELS REVENUE(1) TTM 12/31/2023 $1.4 Billion COMPARABLE HOTELS ADJUSTED HOTEL EBITDA MARGIN(1) TTM 12/31/2023 36.4% 2024 ESTIMATED CAPEX $75 Million to $85 Million EXECUTIVE TARGET COMPENSATION STRUCTURE 78% executive target compensation incentive based COMPANY OVERVIEW

VALUES Hospitality – We are thoughtful in our interactions with others and know that strong, caring relationships are the core of our industry. Resolve – We are passionate about the work we do and are steadfast in our commitment to our shareholders. Excellence – We are driven to succeed and improve through innovation and perseverance. Integrity – We are trustworthy and accountable. Teamwork – We support and empower one another, embracing diversity of opinion and background. We are a leading real estate investment company committed to increasing shareholder value through the distribution of attractive dividends and long-term capital appreciation. MISSION Average executive tenure with the Apple REIT Companies is 17 years Established and operated 8 public hospitality REITs Raised and invested approximately $7.4 billion of equity in hotel assets Purchased 454 hotels Purchased as many as 74 hotels in a single year through individual hotel and small portfolio transactions Managed over $1.1 billion in CapEx and renovation spending Sold 4 REITs in 3 transactions totaling $2.7 billion Merged 3 REITs and listed Company on NYSE Completed $1.3 billion Apple REIT Ten merger Representation on over 30 brand and industry advisory boards and councils MANAGEMENT TEAM WITH DEEP INDUSTRY EXPERIENCE OVER MULTIPLE HOTEL CYCLES SPRINGHILL SUITES LOS ANGELES BURBANK/DOWNTOWN

PROVEN INVESTMENT STRATEGY Concentrate on Upscale, rooms-focused hotels Efficient operating model yields higher margins Resilient group business Scale ownership minimizes relative G&A load and provides fixed cost efficiencies Unparalleled access to data and operational expertise Align with the best brands in the rooms-focused category Invested in Marriott®, Hilton® and Hyatt® branded hotels with broad consumer appeal which benefit from strong reservation systems and loyalty programs Hire industry-leading operators and maximize performance through benchmarking and asset management Strong regional and national operators with unique management structure align owner and operator to maximize performance in all market environments Analytical data-driven asset management maximizes property-level results Strategic revenue management optimizes mix of business and maximizes bottom-line performance Pursue broad geographic diversification Broad geographic diversification reduces portfolio volatility and provides exposure to a wide variety of demand generators Enhance portfolio through accretive acquisitions, opportunistic dispositions and strategic reinvestment Well-maintained portfolio with average effective age of 5 years ensures competitiveness Strategic acquisitions and dispositions optimize portfolio for long-term growth Prudent capital allocation preserves balance sheet capacity for investments at optimal point in cycle Maintain a strong, flexible balance sheet Strong balance sheet provides security through cycles Positioned to pursue accretive opportunities Conservative capital structure with staggered maturities lowers capital costs and preserves equity value

KEY TAKEAWAYS Meaningful year-over-year topline growth driven by resilient leisure demand and improving business travel 2023 Comparable Hotels RevPAR up 7% to 2022 and up 8% to 2019 Midweek occupancy continues to improve and forward booking trends remain strong January 2024 Comparable Hotels ADR and Occupancy up to January 2023 Fundamentals strong with more than 50% of our hotels not having any new supply under construction within a five-mile radius Utilized ATM during Q4 to raise net proceeds of $216 million used to fund five acquisitions during Q4 at nearly a 1.5x spread based on year end 2023 results and reset balance sheet positioning the company for additional acquisitions 14 hotels acquired since start of pandemic and owned for at least one full year yielding nearly 9% after CapEx on a TTM basis, contributing to overall portfolio performance Annualized distribution of $0.96 per common share represents an annual yield of 6.0%, based on February 26, 2024 closing price of $15.98 HOMEWOOD SUITES NEW ORLEANS

YEAR-OVER-YEAR PERFORMANCE Three Months Ended December 31, Year Ended December 31, 2023 2022 % CHANGE to 2022 2023 2022 % CHANGE to 2022 Comparable Hotels RevPAR $105.01 $102.56 2.4% $116.23 $108.67 7.0% Comparable Hotels Total Revenue $314,913 $306,561 2.7% $1,374,694 $1,280,379 7.4% Comparable Hotels Adjusted Hotel EBITDA $103,667 $105,639 (1.9%) $500,079 $477,876 4.6% Comparable Hotels Adjusted Hotel EBITDA Margin % 32.9% 34.5% (160 bps) 36.4% 37.3% (90 bps) Modified Funds From Operations (MFFO) $72,387 $74,534 (2.9%) $366,884 $351,424 4.4% MFFO per share $0.31 $0.33 (6.1%) $1.60 $1.53 4.6% ($ in thousands except statistical data and per share amounts) Fourth Quarter and Full Year 2023 Performance at a Glance HOMEWOOD SUITES MIAMI-AIRPORT/BLUE LAGOON Note: Comparable Hotels is defined as the 223 hotels owned and held for use by the Company as of December 31, 2023, and excludes one non-hotel property leased to third parties. For hotels acquired during the periods noted, the Company has included, as applicable, results of those hotels for periods prior to the Company's ownership, and for dispositions and assets held for sale, results have been excluded for the Company's period of ownership. Results for periods prior to the Company's ownership have not been included in the Company's actual Consolidated Financial Statements and are included only for comparison purposes. Results included for periods prior to the Company's ownership are based on information from the prior owner of each hotel and have not been audited or adjusted. Reconciliation of net income to non-GAAP financial measures is included in the following pages.

Upscale/Rooms-Focused 2023 Hotel EBITDA Margin and RevPAR Comparison Upper Upscale/Full-Service EFFICIENT OPERATIONS ALOFT PORTLAND DOWNTOWN WATERFRONT ME Source: Company filings. Assumptions may vary by company. See explanation and reconciliation of Adjusted Hotel EBITDA to net income included in subsequent pages. Upscale & Upper Upscale Combined Rooms-focused operating model produces strong margins (1)

+25% +22% +14% +5% +6% +5% +3% +3% +3% +3% +3% +2% % Change in RevPAR Compared to Same Period of 2022 COMPARABLE HOTELS OPERATING TRENDS Q4 2023 produced highest Comparable Hotels RevPAR growth relative to 2019 since start of pandemic, with continued room for growth in occupancy Note: Comparable Hotels is defined as the 223 hotels owned and held for use by the Company as of December 31, 2023, and excludes one non-hotel property leased to third parties. For hotels acquired during the periods noted, the Company has included, as applicable, results of those hotels for periods prior to the Company's ownership, and for dispositions and assets held for sale, results have been excluded for the Company's period of ownership. Results for periods prior to the Company's ownership have not been included in the Company's actual Consolidated Financial Statements and are included only for comparison purposes. Results included for periods prior to the Company's ownership are based on information from the prior owner of each hotel and have not been audited or adjusted. The Omicron variant impacted performance during Q1 2022, boosting Q1 2023 YOY growth

Occupancy COMPARABLE HOTELS OCCUPANCY TRENDS Note: Comparable Hotels is defined as the 223 hotels owned and held for use by the Company as of December 31, 2023, and excludes one non-hotel property leased to third parties. For hotels acquired during the periods noted, the Company has included, as applicable, results of those hotels for periods prior to the Company's ownership, and for dispositions and assets held for sale, results have been excluded for the Company's period of ownership. Results for periods prior to the Company's ownership have not been included in the Company's actual Consolidated Financial Statements and are included only for comparison purposes. Results included for periods prior to the Company's ownership are based on information from the prior owner of each hotel and have not been audited or adjusted. Source: Weekly data provided by STR for hotels owned by the Company and may differ from actual results achieved. Week ended Strength in Comparable Hotels Occupancy with continued upside opportunity +13% +6% +4% - +1% +1% +1% +2% +3% -1% - - +2% -1% -2% +2% +3% -1% - - % Change in Occupancy Compared to Same Period of 2022

Source: Data provided by STR for hotels owned by the Company for the periods noted and may differ from actual results achieved. Weekday occupancy includes Sunday through Thursday nights and weekend occupancy includes Friday and Saturday nights. Leisure travel strength continues Weekday occupancy shows improvement of business demand WEEKDAY VS. WEEKEND OCCUPANCY Occupancy Quarterly Data Monthly Data Weekly Data

PORTFOLIO POISED FOR CONTINUED OUTPERFORMANCE Well positioned to benefit from increasing business transient demand Select-service hotels franchised with industry-leading brands provide strong value proposition and have proven appeal with broadest group of customers Broad geographic diversification provides exposure to wide variety of markets and demand generators Limited near-term portfolio impact from new supply Positioned to benefit from market compression as large group business returns Strong rate growth and operational efficiencies create partial offset to inflationary pressures Data-driven asset management team and industry-leading operators maximize property-level performance Scale ownership of rooms-focused hotels minimizes G&A load per key and provides fixed cost efficiencies Well-maintained, institutional-quality portfolio with substantial long-term value Acquisition and disposition activity since start of pandemic has lowered the average age of assets, reduced near-term CapEx and increased exposure to markets anticipated to outperform over the next cycle while maintaining a strong and flexible balance sheet Balance sheet strength and liquidity position the Company to continue to pursue accretive acquisitions and optimize portfolio HILTON GARDEN INN BOCA RATON

POSITIONED FOR OUTPERFORMANCE ACROSS CYCLES Embedded upside potential Inherent downside protection Outperformance across cycles Limited near-term portfolio impact from new supply High margins drive profitability Business transient demand continues to improve Balance sheet strength and liquidity for opportunistic transactions In Q4 2023, approximately 30% of the Company’s hotels had not achieved RevPAR that met or exceeded Q4 2019 RevPAR Select-service hotels franchised with industry-leading brands provide a strong value proposition and have proven appeal with the broadest group of customers Broad geographic diversification with wide variety of demand generators Efficient buildings and operating model mitigate volatility in cash flows Low debt Well-maintained, institutional-quality portfolio with substantial long-term value

BENEFITS OF BRANDED SELECT-SERVICE HOTELS Total revenue primarily derived from rooms sold Ability to cross-utilize associates to maximize efficiencies High margins Fewer outlets to manage Less public space to maintain Resilient group business Efficient Operating Model Broad Consumer Appeal Maximize Shareholder Value High-quality hotels with strong value proposition for guests Product attractive to business and leisure travelers Award-winning service, innovative design and modern amenities Strong reservation systems and loyalty programs Global distribution creates strong consumer awareness Ability to optimize mix of business to drive RevPAR and EBITDA Lower downside risk with meaningful upside High margins drive overall profitability Lower long-term capital needs Institutional brands foster strong resale market, financing flexibility and investor confidence HILTON GARDEN INN MADISON DOWNTOWN

Rooms-focused hotels with industry-leading brands have broad consumer appeal BROAD CONSUMER APPEAL HOMEWOOD SUITES PHOENIX NORTH-HAPPY VALLEY COURTYARD SEATTLE KIRKLAND HAMPTON INN & SUITES PORTLAND-PEARL DISTRICT Note: Hotel portfolio statistics as of February 22, 2024. Based on number of guest rooms.

MODERN ACCOMMODATIONS AND AMENITIES�WITH BROAD CONSUMER APPEAL

BROAD GEOGRAPHIC DIVERSIFICATION Broad geographic diversification provides exposure to wide variety of demand generators Markets benefit from a mix of business and leisure demand Portfolio benefits from both large corporate negotiated and small and midmarket local negotiated business demand Low dependence on inbound international travel Unparalleled exposure to business-friendly markets leading the recovery and benefitting from population shifts Diversification across 87 markets helps drive strong, consistent performance Note: Hotel locations as of February 22, 2024. Highlighted markets represent largest markets in Apple Hospitality’s portfolio based on Comparable Hotels Adjusted Hotel EBITDA contribution for the year ended December 31, 2023. Comparable Hotels Adjusted Hotel EBITDA contribution by location type based on the year ended December 31, 2023. Market and location categorizations based on STR designations. 3% 6% 5% 4% 6% 3% Adjusted Hotel EBITDA contribution by location type 3% 4% 3% 3%

MARKET STRATEGY SPRINGHILL SUITES LAS VEGAS CONVENTION CENTER HIGH-DENSITY SUBURBAN Properties ideally located in upscale submarkets with attractive cost structures that benefit from a broad mix of business and leisure demand generators and resilient group business. With proximity to an array of guest amenities and conveniences, these locations help drive strong, consistent performance. RESIDENCE INN SEATTLE SOUTH/RENTON SPRINGHILL SUITES LOS ANGELES BURBANK/DOWNTOWN EMBASSY SUITES SOUTH JORDAN SALT LAKE CITY HOMEWOOD SUITES AUSTIN/ROUND ROCK, TX

MARKET STRATEGY AC HOTEL PITTSBURGH DOWNTOWN URBAN Properties located in business-friendly cities leading the recovery. Beneficiaries of demographic shifts and economic development, these urban locations are home to numerous demand generators, not heavily dependent on inbound international travel and poised for continued growth. ALOFT PORTLAND DOWNTOWN WATERFRONT ME HILTON GARDEN INN MEMPHIS DOWNTOWN BEALE STREET HYATT HOUSE SALT LAKE CITY/DOWNTOWN COURTYARD CLEVELAND UNIVERSITY CIRCLE

STRONG OPERATING MARGINS APLE has a proven record of maximizing operating margins across economic cycles. APLE is well positioned to maximize efficiencies and drive profitability: Broad consumer appeal allows for optimization of business mix as recovery continues to drive ADR and RevPAR growth Rooms-focused hotels are inherently efficient Higher margins amplify bottom-line impact of top-line growth Unparalleled access to performance data allows benchmarking to identify and share best practices Flexible labor and in place labor management systems (with centralized reporting) provide opportunity to increase productivity as operations stabilize Investments in hotel associates and training lower turnover and reduce reliance on contract labor over time AC HOTEL LOUISVILLE DOWNTOWN

LIMITED NEAR-TERM IMPACT FROM NEW SUPPLY New construction starts have meaningfully decreased since onset of pandemic with anticipated delays in completion More than 50% of our hotels do not have any exposure to new projects currently under construction within a five-mile radius National supply growth over the next four quarters of 0.7%, more than 46% below long run average(1) RESIDENCE INN TUSTIN ORANGE COUNTY Note: Supply growth as defined by the Company. Graph represents percentage of Apple Hospitality REIT portfolio of hotels with one or more upper midscale, upscale or upper upscale new construction projects underway within a five-mile radius. (1) Source: Hotel Horizons National Forecast Q4 2023 Edition/CBRE Hotels Research, Q4 2023 Supply growth well below historical average for our portfolio Portfolio Exposure to New Supply

INDUSTRY-LEADING ASSET MANAGEMENT Analytical, data-driven asset management to maximize property-level performance Scale to negotiate attractive national contracts Strategic revenue management to optimize mix of business and maximize bottom-line performance Strong regional and national third-party operators with readily terminable contracts and flexibility to align performance goals HOMEWOOD SUITES AUSTIN/ROUND ROCK, TX Strategic Asset Management Approach Best-in-Class Operators 100% of Apple Hospitality’s portfolio operated by third-party property managers 94% of hotels independent of brand management 16 operating companies provide a platform for comparative analytics and shared best practices 24% of operators’ portfolios represented by Apple Hospitality on average, excluding brands Note: Management company information as of December 31, 2023.

PROPRIETARY MANAGEMENT AGREEMENT STRUCTURE COURTYARD HOUSTON NASA/CLEAR LAKE Our unique management company contract structure better aligns owner and operator to maximize performance in all market environments. APLE’s Management Company Contract Structure Industry Standard Structure Variable Management Fee 2.5% - 3.5% of revenues based on property’s balanced scorecard performance Balanced Scorecard Metrics: Gross operating profit budget variance STR market target index growth and target rank Guest satisfaction/online review scores Flex/flow percent versus budgeted gross operating profit Approximately 85% of our hotels operate under this structure. Contract terms average two years and are terminable upon sale. APLE originally implemented this contract structure in 2016. Base Management Fee Typically 3% of revenues + Incentive Management Fee % of operating profit above an owner’s priority return AC HOTEL PITTSBURGH DOWNTOWN HILTON GARDEN INN MEMPHIS DOWNTOWN BEALE STREET With steady recovery in our business and more stabilized operations, we returned to a variable rate management fee structure for 2023 with payments based on a balanced scorecard to optimize performance

BALANCE SHEET POISED FOR FUTURE GROWTH Positive corporate cash flow early in the recovery preserved strength of balance sheet and equity value Conservative capital structure with staggered maturities lowers capital costs Amended and restated existing $850 million credit facility, increasing borrowing capacity to approximately $1.2 billion, extending maturity dates and achieving improved pricing Through the amended credit agreement, the Company has greater access to liquidity for strategic growth and the opportunity to reduce its already conservative secured debt exposure During Q4 2023, the Company sold approximately 12.8 million shares under its ATM Program at a weighted-average market sales price of approximately $17.05 per common share and received net proceeds of approximately $216 million, positioning the Company to continue to pursue accretive acquisitions As of December 31, 2023, 89% of outstanding debt fixed or hedged and 210 hotels unencumbered Poised to be acquisitive and optimize portfolio through opportunistic transactions HYATT PLACE GREENVILLE DOWNTOWN

Debt Composition(1) STRONG BALANCE SHEET & LIQUIDITY POSITION Based on balances and hotels owned as of December 31, 2023, excluding unamortized fair value adjustment of assumed debt and unamortized debt issuance costs. Excludes yearly amortization. Interest rate includes effect of interest rate swaps and SOFR rate in effect at December 31, 2023, plus a 10 bps SOFR spread adjustment. Debt Maturity Schedule (1) ($ in millions) 210 Hotels Unencumbered Hotels: 2 Keys: 325 Rate: 3.9% Term loan Rate: 4.7%(2) Hotels: 1 Keys: 166 Rate 4.4% Term loan Rate: 3.3%(2) Hotels: 4 Keys: 649 Rate: 4.4% Term loan Rate: 5.3%(2) Low debt and staggered maturities facilitate agile balance sheet strategy Strong liquidity position for opportunistic growth and after Total Liquidity (1) ($ in millions) Total Available Revolver Capacity Cash and Cash Equivalents on Hand Total Liquidity Term loan Rate: 3.7%(2) Hotels: 4 Keys: 798 Rate: 3.8% Revolver Rate: 6.85%(2) Term loan Rate: 4.2%(2) Hotels: 4 Keys: 529 Rate: 3.7% Term loan Rate: 3.6%(2)

EFFECTIVE PORTFOLIO MANAGEMENT & �STRATEGIC GROWTH SPRINGHILL SUITES LOS ANGELES BURBANK/DOWNTOWN Opportunistic Dispositions Strategic Growth Reduce exposure to lower growth markets Dispose of hotels where strong operating efficiencies are harder to achieve Optimize capital reinvestment program through dispositions that effectively manage near- and long-term CapEx needs based on return on investment Invest in hotels and markets with greater growth potential Acquire assets in strong RevPAR markets with attractive cost structures that further enhance operating margins and long-term return on investment Grow portfolio when conditions are right Accretive Acquisitions Earnings growth through portfolio optimization enhances long-term shareholder returns

20 hotels purchased for approximately $848 million(1) 13 acquisitions not open or stabilized in 2019 Our acquisition and disposition activity since the start of the pandemic has optimized our portfolio by lowering the average age of our assets, reducing near-term CapEx and increasing exposure to markets we anticipate will outperform over the next cycle while maintaining the strength and flexibility of our balance sheet. 8%+ TTM yield after CapEx 27 hotels sold for approximately $287 million 4 yrs average age at time of acquisition ALOFT PORTLAND DOWNTOWN WATERFRONT ME HILTON GARDEN INN MEMPHIS DOWNTOWN BEALE STREET HILTON GARDEN INN FORT WORTH MEDICAL CENTER AC HOTEL LOUISVILLE DOWNTOWN AC HOTEL PITTSBURGH DOWNTOWN HILTON GARDEN INN MADISON DOWNTOWN AC HOTEL PORTLAND DOWNTOWN/WATERFRONT, ME HAMPTON INN & SUITES PORTLAND-PEARL DISTRICT HYATT HOUSE AND HYATT PLACE TEMPE / PHOENIX / UNIVERSITY HAMPTON INN & SUITES AND HOME2 SUITES CAPE CANAVERAL CRUISE PORT HYATT PLACE GREENVILLE DOWNTOWN HOMEWOOD SUITES FORT WORTH- MEDICAL CENTER, TX NET ACQUIRER SINCE ONSET OF PANDEMIC COURTYARD CLEVELAND UNIVERSITY CIRCLE HYATT HOUSE SALT LAKE CITY/ DOWNTOWN COURTYARD SALT LAKE CITY DOWNTOWN RESIDENCE INN SEATTLE SOUTH/ RENTON Includes the purchase of a parking garage for approximately $9.1 million which serves the Hyatt House Salt Lake City/Downtown, the Courtyard Salt Lake City Downtown and the surrounding area. EMBASSY SUITES SOUTH JORDAN SALT LAKE CITY SPRINGHILL SUITES LAS VEGAS CONVENTION CENTER

20 Hotels Acquired 2020 - 2023 Brand Location Rooms Date Opened Date Acquired Purchase Price Hampton Inn & Suites(1)(2) Cape Canaveral, FL 116 April 2020 April 2020 $46.7 million Home2 Suites(1)(2) Cape Canaveral, FL 108 April 2020 April 2020 Hyatt House(1)(2) Tempe, AZ 105 August 2020 August 2020 $64.6 million Hyatt Place(1)(2) Tempe, AZ 154 August 2020 August 2020 Hilton Garden Inn(2) Madison, WI 176 February 2021 February 2021 $49.6 million AC Hotels Portland, ME 178 July 2018 August 2021 $66.8 million Hyatt Place Greenville, SC 130 December 2018 September 2021 $30.0 million Aloft Portland, ME 157 September 2021 September 2021 $51.2 million Hilton Garden Inn Memphis, TN 150 January 2019 October 2021 $38.0 million Hilton Garden Inn Fort Worth, TX 157 April 2012 November 2021 $29.5 million Homewood Suites Fort Worth, TX 112 June 2013 November 2021 $21.5 million Hampton Inn & Suites Portland, OR 243 September 2017 November 2021 $75.0 million AC Hotels Louisville, KY 156 April 2018 October 2022 $51.0 million AC Hotels Pittsburgh, PA 134 July 2018 October 2022 $34.0 million Courtyard Cleveland, OH 154 April 2013 June 2023 $31.0 million Courtyard Salt Lake City, UT 175 October 2015 October 2023 $48.1 million Hyatt House Salt Lake City, UT 159 January 2015 October 2023 $34.3 million Parking Garage Salt Lake City, UT October 2023 $9.1 million Residence Inn Renton, WA 146 August 2019 October 2023 $55.5 million Embassy Suites South Jordan, UT 192 March 2018 November 2023 $36.8 million SpringHill Suites Las Vegas, NV 299 October 2009 December 2023 $75.0 million Total 3,201 $847.7 million These two hotels comprise a dual-branded property at one location. Contract entered into prior to 2020. There are a number of conditions to closing that have not yet been satisfied and there can be no assurance that closings on these hotels will occur under the outstanding purchase agreements. Number of rooms represents number of rooms expected upon completion. Hotels Under Contract for Purchase(3) Brand Location Rooms Date Opened Anticipated Acquisition Date Purchase Price Embassy Suites(4) Madison, WI 262 Under Development Mid 2024 $79.3 million Motto(4) Nashville, TN 260 To Be Developed Late 2025 $98.2 million Total 522 $177.5 million 29 Hotels sold since January 2020 for combined total sales price of $332 million RECENT ACQUISITION & DISPOSITION ACTIVITY

RECENT ACQUISITIONS Acquired June 2023 154-room Courtyard by Marriott® Cleveland University Circle Hotel opened in April 2013 and underwent a complete renovation of guest rooms and interior public spaces prior to acquisition Total price: $31.0 million or approximately $201,000 per key Location type: Urban Primary demand generators: Health Care and Bio Health Academic Professional Sporting Events Manufacturing Aerospace and Aviation Automotive Information Technology COURTYARD CLEVELAND UNIVERSITY CIRCLE

RECENT ACQUISITIONS Acquired October 2023 175-room Courtyard by Marriott® Salt Lake City Downtown Hotel opened in October 2015 Total price: $48.1 million or approximately $275,000 per key Location type: Urban Primary demand generators: Technology Defense Oil and Gas Transportation Health Care Financial Services Leisure and Tourism Sporting Events Conventions COURTYARD SALT LAKE CITY DOWNTOWN

RECENT ACQUISITIONS Acquired October 2023 159-room Hyatt House® Salt Lake City/Downtown Hotel opened in January 2015 and underwent a full soft-goods renovation prior to acquisition Total price: $34.3 million or approximately $215,000 per key Location type: Urban Primary demand generators: Technology Defense Oil and Gas Transportation Health Care Financial Services Leisure and Tourism Sporting Events Conventions HYATT HOUSE SALT LAKE CITY/DOWNTOWN

RECENT ACQUISITIONS Acquired October 2023 146-room Residence Inn by Marriott® Seattle South/Renton Hotel opened in August 2019 Total price: $55.5 million or approximately $380,000 per key Location type: Suburban Primary demand generators: Aviation Aerospace Manufacturing Technology Life Science Health Care Leisure RESIDENCE INN SEATTLE SOUTH/RENTON

RECENT ACQUISITIONS Acquired November 2023 192-room Embassy Suites by Hilton® South Jordan Salt Lake City Hotel opened in March 2018 Total price: $36.8 million or approximately $191,000 per key Location type: Suburban Primary demand generators: Health Care Technology Distribution Recreational Sports Outdoor Recreation EMBASSY SUITES SOUTH JORDAN SALT LAKE CITY

RECENT ACQUISITIONS Acquired December 2023 299-room SpringHill Suites by Marriott® Las Vegas Convention Center Hotel opened in October 2009 Total price: $75.0 million, or approximately $251,000 per key Location type: Suburban Primary demand generators: Leisure Conventions Professional Sporting Events Entertainment SPRINGHILL SUITES LAS VEGAS CONVENTION CENTER

Hotel under development with anticipated completion of construction in mid-2024 262 rooms(2) Anticipated gross purchase price: $79.3 million or approximately $303,000 per key Forward commitment with trusted developer Location type: Urban Primary demand generators: University of Wisconsin Government Insurance Biotech Manufacturing Telecommunications Technology Conventions Leisure EMBASSY SUITES MADISON, WI(1) There are a number of conditions to closing that have not yet been satisfied and there can be no assurance that a closing on this hotel will occur under the outstanding purchase agreement. Hotel is under development. Number of rooms represents number of rooms expected upon completion. ACQUISITIONS UNDER CONTRACT rendering

Hotel to be developed with anticipated completion of construction in late 2025 260 rooms(2) Anticipated gross purchase price: $98.2 million or approximately $378,000 per key Forward commitment with trusted developer Ideally located in downtown Nashville within walking distance of well-known music and entertainment venues, Bridgestone Arena, popular attractions along Broadway, and Riverfront Park Location type: Urban Primary demand generators: Leisure Music and Entertainment Sporting Events Conventions Health Care Manufacturing Technology Academic MOTTO NASHVILLE, TN (1) There are a number of conditions to closing that have not yet been satisfied and there can be no assurance that a closing on this hotel will occur under the outstanding purchase agreement. Hotel is to be developed. Number of rooms represents number of rooms expected upon completion. ACQUISITIONS UNDER CONTRACT Renderings

Apple REIT Companies Transaction History 1999 – February 22, 2024 454 TOTAL HOTELS ACQUIRED 230 TOTAL HOTELS SOLD 223 CURRENT HOTEL PORTFOLIO(1) 4 REITS SOLD IN 3 TRANSACTIONS 4 REITS MERGED TO FORM CURRENT APLE OVER 20-YEAR TRACK RECORD OF �HOTEL TRANSACTIONS Note: Hotel transactions by the various Apple REIT Companies since the first hospitality REIT in 1999. In 2014, Apple REIT Seven, Inc. and Apple REIT Eight, Inc. merged into Apple REIT Nine, Inc. and the company was renamed Apple Hospitality REIT, Inc. In 2016, Apple REIT Ten, Inc. merged into Apple Hospitality REIT, Inc. (1) The Company’s portfolio also includes one non-hotel property leased to third parties. HAMPTON INN & SUITES ATLANTA-DOWNTOWN Having purchased as many as 74 hotels in a single year through individual hotel and small portfolio transactions, Apple has the experience to meaningfully grow the portfolio

WELL-MAINTAINED PORTFOLIO COURTYARD SAN DIEGO RANCHO BERNARDO The Tripadvisor® rating is based on lifetime scores for the Apple Hospitality portfolio of hotels through December 31, 2023. Average Effective Age represents years since hotels were built or last renovated. Average actual age of hotels is 16 years. Statistics based on all Upscale and Upper Midscale hotels owned by the Company, Apple REIT Seven, Inc., Apple REIT Eight, Inc., or Apple REIT Ten, Inc. for the period owned. Statistics based on the period 2011 – 2023. 5 Years Quality portfolio with average effective age of 5 years.(2) 85% of APLE’s hotels were built or renovated in the last 8 years. Upscale and Upper Midscale Reinvestment Statistics(3) Average Annual Spend as % of Revenue 5.3% Average % of Hotels Renovated Annually 10.0% Average % of Room Nights Out of Service for Renovations < 1.0% Cumulative Spend $704 million WELL-MAINTAINED, INSTUTIONAL QUALITY PORTFOLIO 4.3 out of 5.00 weighted average Tripadvisor® rating(1) Consistent reinvestment enhances long-term value and leads to traveler satisfaction outperformance Experienced team utilizes advantages of scale ownership to control costs and maximize impact of dollars spent Projects are implemented during periods of seasonally lower demand to minimize revenue displacement End results maximize competitiveness within our markets and further drive EBITDA growth

U.S. HOTEL FORECAST U.S. Hotel Forecast 2023 Actual 2024 Forecast 2025 Forecast 2026 Forecast Occupancy 63.0% 63.6% 64.0% 64.1% ADR Change +4.3% +3.1% +2.8% +3.1% RevPAR Change +4.9% +4.1% +3.5% +3.2% HAMPTONN INN & SUITES PHOENIX DOWNTOWN Source: STR. © 2024 CoStar Group. Published January 2024.

AC HOTEL LOUISVILLE DOWNTOWN CORPORATE RESPONSIBILITY INITIATIVES We own one of the largest and most geographically diverse portfolios of rooms-focused hotels in the United States and are dedicated to making a positive impact on the many communities our hotels serve. We are mindful of our environmental footprint and committed to reducing our impact over time. We have always worked to uphold high environmental, social and governance (“ESG”) standards and believe these key areas of focus are an integral part of driving long-term value for our shareholders. We are committed to continuous improvement, and it is our expectation that we will continue to enhance and expand our ESG-related disclosures as our progress deepens and industry-wide standards evolve. Our Corporate Responsibility Report details our ESG performance, strategy and initiatives and features our commitment to environmental sustainability, corporate employees, hotel associates and guests, communities, and other stakeholders. The Company’s 2023 Corporate Responsibility Report utilizes both the Global Reporting Initiative (“GRI”) Standards and Task Force on Climate-related Financial Disclosures (“TCFD”) to provide a comprehensive overview of the Company’s corporate responsibility performance and climate-related risk management. Apple Hospitality’s enhanced disclosures are intended to provide stakeholders with a better understanding of the Company’s strategy, policies, programs, procedures, performance and initiatives related to environmental stewardship, social responsibility, and corporate governance and resiliency. The Company’s 2023 Corporate Responsibility Report and other ESG-related materials can be found within the Corporate Responsibility section of our website.

ENVIRONMENTAL STEWARDSHIP Apple Hospitality is committed to enhancing and incorporating sustainability opportunities into our investment and asset management strategies, with a focus on minimizing our environmental impact through reductions in energy and water usage and through improvements in waste management. RESIDENCE INN SEATTLE SOUTH/RENTON Approximately 19 Million Square Feet 380,000 MWh Total Energy Consumption 20.18 Total kWh per Square Foot 100% Portfolio Enrolled in ENERGY STAR® Program 923,000 kgal Water Withdrawal 14% Diversion Rate(2) With 19.37 total kWh per square foot in 2021 as compared to an average of 23.83 total kWh per square foot reported by full-service REITs for 2021, the rooms-focused hotels we invest in are more operationally and environmentally efficient than full-service hotels.(3) Additionally, Apple Hospitality’s 2022 average total utility cost of $5.90 per occupied room highlights both the Company’s efforts to operate its hotels effectively and the inherent efficiency of the buildings. Statistics are based on the Company’s portfolio of hotels owned in 2022 for period of ownership. Based on measured waste data (measured waste data is representative of 59% of the total portfolio). Includes average of total kWh per square foot as reported for 2021 by DRH, HST, PK, PEB, SHO and XHR. Full-Service Hotels and Limited-Service Hotels based on 2022 data published by STR in 2023. APLE data based on 2022 actual results for all hotels owned in 2022. Average Upscale and Upper-Midscale Class. Average utility costs per occupied room Full-Service Hotels(4) $11.62 Limited-Service Hotels(4)(5) $5.90 APLE(4) $5.90 Apple Hospitality Key Metrics for 2022(1) The Company has in place an Environmental Policy and a Vendor Code of Conduct. A formal energy management program was established in 2018 to ensure that energy, water and waste management are a priority not only within the Company, but also with our management companies and brands.

SOCIAL RESPONSIBILITY Apple Hospitality REIT has always been firmly committed to strengthening communities through charitable giving, by volunteering our time and talents, and by participating in the many philanthropic programs important to our employees and leaders within our industry, including our brands, the American Hotel & Lodging Association (AHLA) and our third-party management companies. We are dedicated to making a positive impact throughout our Company, the hotel industry, our local community and the many communities our hotels serve. Key Metrics for Apple Hospitality since 2017 We are thoughtful in our interactions with others and know that strong, caring relationships are the core of our industry. Apple Gives, an employee-led charitable organization, was formed in 2017 to expand our impact and further advance the achievement of our corporate philanthropic goals. 690+ HOURS volunteered BY APPLE HOSPITALITY EMPLOYEES 140+ Nonprofit organizations helped BY APPLE HOSPITALITY Local Community Outreach Management Companies Brand Initiatives Industry Involvement The Company has in place a Health, Safety and Well-Being Policy, a Human Rights Policy and a Vendor Code of Conduct. Apple Hospitality is committed to diversity, equity and inclusion and our CEO has taken the CEO Action for Diversity & Inclusion™ pledge. HOMEWOOD SUITES JACKSONVILLE-SOUTH/ST. JOHNS CTR.

Board of Directors with Effective Experience Glade M. Knight – Executive Chairman Founder, Apple Hospitality REIT; Former Chairman/CEO, Cornerstone Realty NYSE: TCR Justin G. Knight – Director Chief Executive Officer, Apple Hospitality REIT Glenn W. Bunting – Director President, GB Corporation Jon A. Fosheim – Lead Independent Director Co-founder, Green Street Advisors Kristian M. Gathright – Director Former Executive Vice President & Chief Operating Officer, Apple Hospitality REIT Carolyn B. Handlon – Director Former Executive Vice President, Finance & Global Treasurer, Marriott International, Inc. Blythe J. McGarvie – Director Founder and Former Chief Executive Officer, Leadership for International Finance L. Hugh Redd – Director Former Senior Vice President & Chief Financial Officer, General Dynamics Howard E. Woolley – Director President, Howard Woolley Group, LLC GOVERNANCE Corporate Governance Aligns with Shareholders Audit, Compensation and Corporate Governance Committees are independent Regular executive sessions of independent directors De-staggered Board allows for annual elections of directors Required resignation of an incumbent director not receiving majority of votes cast in election 78% of executive target compensation is incentive based, with 50% based on shareholder returns Required share ownership of: 5 times base salary for CEO, 3 times base salary for other executive officers, and 4 times base cash compensation for directors Opted out of Virginia law requiring super majority vote for specified transactions Alignment with the best interests of our shareholders is at the forefront of our values. AC HOTEL PITTSBURGH DOWNTOWN

APPENDIX COURTYARD AND RESIDENCE INN RICHMOND DOWNTOWN

Hotels Sold 2020 – February 2024 Brand Location Rooms Age at Time of Sale Date Sold Sales Price SpringHill Suites Sanford, FL 105 20 yrs January 2020 $13.0 million SpringHill Suites Boise, ID 230 25 yrs February 2020 $32.0 million Hampton Inn & Suites Tulare, CA 86 12 yrs December 2020 $10.3 million Homewood Suites Charlotte, NC 118 30 yrs February 2021 $10.3 million Homewood Suites Memphis, TN 140 31 yrs March 2021 $8.0 million SpringHill Suites Overland Park, KS 102 23 yrs April 2021 $5.3 million Hilton Garden Inn Montgomery, AL 97 18 yrs July 2021 $211.0 million Homewood Suites Montgomery, AL 91 17 yrs Residence Inn Rogers, AR 88 18 yrs Courtyard Phoenix, AZ 127 13 yrs Courtyard Lakeland, FL 78 21 yrs Fairfield Inn & Suites Albany, GA 87 11 yrs Hilton Garden Inn Schaumburg, IL 166 13 yrs SpringHill Suites Andover, MA 136 20 yrs Residence Inn Fayetteville, NC 92 15 yrs Residence Inn Greenville, SC 78 23 yrs Hampton Inn & Suites Jackson, TN 85 14 yrs Courtyard Johnson City, TN 90 12 yrs Hampton Inn & Suites Allen, TX 103 15 yrs Hilton Garden Inn Allen, TX 150 19 yrs Residence Inn Beaumont, TX 133 13 yrs Hampton Inn & Suites Burleson/Fort Worth, TX 88 13 yrs Hilton Garden Inn El Paso, TX 145 10 yrs Homewood Suites Irving, TX 77 15 yrs SpringHill Suites Richmond, VA 103 13 yrs SpringHill Suites Vancouver, WA 119 14 yrs Independent Richmond, VA 55 34 yrs September 2022 $8.5 million Homewood Suites Rogers, AR 126 17 yrs February 2024 $33.5 million Hampton Inn Rogers, AR 122 25 yrs Total 3,217 Avg age 18 yrs $331.9 million RECENT DISPOSITIONS 20-hotel portfolio sale

COMPARABLE HOTELS QUARTERLY OPERATING METRICS Comparable Hotels Quarterly Operating Metrics and Statistical Data (Unaudited) (in thousands, except statistical data) 2022 2023 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Operating income (Actual) $32,835 $80,745 $75,410 $17,488 $49,247 $83,029 $76,295 $38,910 Operating margin % (Actual) 12.6% 23.9% 22.1% 5.8% 15.8% 23.0% 21.3% 12.5% Comparable Hotels Total Revenue $271,328 $349,791 $352,699 $306,561 $321,939 $370,801 $367,041 $314,913 Comparable Hotels Total Operating Expenses 177,579 206,527 217,475 200,922 208,370 224,755 230,244 211,246 Comparable Hotels Adjusted Hotel EBITDA $93,749 $143,264 $135,224 $105,639 $113,569 $146,046 $136,797 $103,667 Comparable Hotels Adjusted Hotel EBITDA Margin % 34.6% 41.0% 38.3% 34.5% 35.3% 39.4% 37.3% 32.9% ADR (Comparable Hotels) $137.77 $153.90 $158.01 $146.99 $153.39 $161.24 $159.99 $150.72 Occupancy (Comparable Hotels) 67.3% 77.7% 75.7% 69.8% 72.1% 78.1% 77.2% 69.7% RevPAR (Comparable Hotels) $92.68 $119.64 $119.57 $102.56 $110.60 $125.87 $123.44 $105.01 ADR (Actual) $137.03 $153.35 $157.91 $147.30 $152.01 $160.98 $159.36 $149.88 Occupancy (Actual) 67.1% 77.9% 75.7% 69.7% 72.0% 78.2% 77.1% 69.6% RevPAR (Actual) $91.98 $119.41 $119.52 $102.71 $109.46 $125.96 $122.91 $104.27 Reconciliation to Actual Results Total Revenue (Actual) $260,478 $337,668 $341,150 $299,121 $311,454 $361,630 $358,260 $312,456 Revenue from acquisitions prior to ownership 14,445 18,982 18,696 14,790 15,037 14,856 13,589 6,826 Revenue from dispositions/assets held for sale (1,650) (3,065) (2,938) (1,964) (1,709) (2,805) (2,796) (2,242) Revenue from non-hotel property (1,945) (3,794) (4,209) (5,386) (2,843) (2,880) (2,012) (2,127) Comparable Hotels Total Revenue $271,328 $349,791 $352,699 $306,561 $321,939 $370,801 $367,041 $314,913 Adjusted Hotel EBITDA (AHEBITDA) (Actual) (1) $87,936 $136,515 $129,166 $101,962 $106,749 $141,244 $132,161 $101,738 AHEBITDA from acquisitions prior to ownership 5,228 8,347 7,861 6,036 6,493 6,286 5,846 2,711 AHEBITDA from dispositions/assets held for sale (336) (1,276) (1,186) (808) (469) (1,262) (1,210) (782) AHEBITDA from non-hotel property (2) 921 (322) (617) (1,551) 796 (222) - - Comparable Hotels AHEBITDA $93,749 $143,264 $135,224 $105,639 $113,569 $146,046 $136,797 $103,667 Represents the Company's actual Adjusted Hotel EBITDA which excludes Adjusted EBITDAre from its non-hotel property, the Company's independent boutique hotel in New York, New York, for the second half of 2023, subsequent to its lease to a third-party hotel operator for all hotel operations. Represents Adjusted Hotel EBITDA from the Company's independent boutique hotel in New York, New York prior to its lease to a third-party hotel operator for all hotel operations in the first half of 2023. Note: Comparable Hotels is defined as the 223 hotels owned and held for use by the Company as of December 31, 2023, and excludes one non-hotel property leased to third parties. For hotels acquired during the periods noted, the Company has included, as applicable, results of those hotels for periods prior to the Company's ownership, and for dispositions and assets held for sale, results have been excluded for the Company's period of ownership. Results for periods prior to the Company's ownership have not been included in the Company's actual Consolidated Financial Statements and are included only for comparison purposes. Results included for periods prior to the Company's ownership are based on information from the prior owner of each hotel and have not been audited or adjusted. Reconciliation of net income to non-GAAP financial measures is included in the following pages.

SAME STORE HOTELS QUARTERLY OPERATING METRICS SAME STORE Hotels Quarterly Operating Metrics and Statistical Data (Unaudited) (in thousands, except statistical data) Represents the Company's actual Adjusted Hotel EBITDA which excludes Adjusted EBITDAre from its non-hotel property, the Company's independent boutique hotel in New York, New York, for the second half of 2023, subsequent to its lease to a third-party hotel operator for all hotel operations. Represents Adjusted Hotel EBITDA from the Company's independent boutique hotel in New York, New York prior to its lease to a third-party hotel operator for all hotel operations in the first half of 2023. Note: Same Store Hotels is defined as the 215 hotels owned and held for use by the Company as of January 1, 2022, and during the entirety of the periods being compared, and excludes one non-hotel property leased to third parties. This information has not been audited. Reconciliation of net income to non-GAAP financial measures is included in the following pages. 2022 2023 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Operating income (Actual) $32,835 $80,745 $75,410 $17,488 $49,247 $83,029 $76,295 $38,910 Operating margin % (Actual) 12.6% 23.9% 22.1% 5.8% 15.8% 23.0% 21.3% 12.5% Same Store Hotels Total Revenue $256,883 $330,809 $334,003 $289,404 $303,611 $350,676 $346,723 $296,579 Same Store Hotels Total Operating Expenses 168,362 195,892 206,640 190,987 197,594 213,608 218,781 200,717 Same Store Hotels Adjusted Hotel EBITDA $88,521 $134,917 $127,363 $98,417 $106,017 $137,068 $127,942 $95,862 Same Store Hotels Adjusted Hotel EBITDA Margin % 34.5% 40.8% 38.1% 34.0% 34.9% 39.1% 36.9% 32.3% ADR (Same Store Hotels) $137.33 $153.21 $157.58 $146.17 $152.32 $160.25 $159.05 $149.27 Occupancy (Same Store Hotels) 67.3% 77.8% 75.6% 69.7% 72.1% 78.2% 77.1% 69.7% RevPAR (Same Store Hotels) $92.40 $119.17 $119.18 $101.91 $109.81 $125.26 $122.66 $104.03 ADR (Actual) $137.03 $153.35 $157.91 $147.30 $152.01 $160.98 $159.36 $149.88 Occupancy (Actual) 67.1% 77.9% 75.7% 69.7% 72.0% 78.2% 77.1% 69.6% RevPAR (Actual) $91.98 $119.41 $119.52 $102.71 $109.46 $125.96 $122.91 $104.27 Reconciliation to Actual Results Total Revenue (Actual) $260,478 $337,668 $341,150 $299,121 $311,454 $361,630 $358,260 $312,456 Revenue from acquisitions - - - (2,367) (3,291) (5,269) (6,729) (11,508) Revenue from dispositions/assets held for sale (1,650) (3,065) (2,938) (1,964) (1,709) (2,805) (2,796) (2,242) Revenue from non-hotel property (1,945) (3,794) (4,209) (5,386) (2,843) (2,880) (2,012) (2,127) Same Store Hotels Total Revenue $256,883 $330,809 $334,003 $289,404 $303,611 $350,676 $346,723 $296,579 Adjusted Hotel EBITDA (AHEBITDA) (Actual) (1) $87,936 $136,515 $129,166 $101,962 $106,749 $141,244 $132,161 $101,738 AHEBITDA from acquisitions - - - (1,186) (1,059) (2,692) (3,009) (5,094) AHEBITDA from dispositions/assets held for sale (336) (1,276) (1,186) (808) (469) (1,262) (1,210) (782) AHEBITDA from non-hotel property (2) 921 (322) (617) (1,551) 796 (222) - - Same Store Hotels AHEBITDA $88,521 $134,917 $127,363 $98,417 $106,017 $137,068 $127,942 $95,862

RECONCILIATION OF NET INCOME TO EBITDA, EBITDAre, ADJUSTED EBITDAre AND ADJUSTED HOTEL EBITDA THE FOLLOWING TABLE RECONCILES THE COMPANY’S GAAP NET INCOME TO EBITDA, EBITDAre, ADJUSTED EBITDAre AND �ADJUSTED HOTEL EBITDA ON A QUARTERLY BASIS FOR 2022 AND 2023�(Unaudited) (in thousands) 2022 2023 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Net income $18,002 $65,345 $59,146 $2,312 $32,923 $65,289 $58,512 $20,765 Depreciation and amortization 45,324 45,322 45,135 45,916 45,906 45,994 45,498 45,844 Amortization of favorable and unfavorable operating leases, net 99 103 97 97 97 85 99 102 Interest and other expense, net 14,654 15,198 14,933 14,948 16,004 17,499 17,470 17,884 Income tax expense 179 202 1,331 228 320 241 313 261 EBITDA 78,258 126,170 120,642 63,501 95,250 129,108 121,892 84,856 Gain on sale of real estate - - (1,785) - - - - - Loss on impairment of depreciable real estate assets - - - 26,175 - - - 5,644 EBITDAre 78,258 126,170 118,857 89,676 95,250 129,108 121,892 90,500 Non-cash straight-line operating ground lease expense 40 38 38 38 38 36 35 36 Adjusted EBITDAre 78,298 126,208 118,895 89,714 95,288 129,144 121,927 90,536 General and administrative expense 9,638 10,307 10,271 12,248 11,461 12,100 11,079 12,761 Adjusted EBITDAre from non-hotel property (1) - - - - - - (845) (1,559) Adjusted Hotel EBITDA $87,936 $136,515 $129,166 $101,962 $106,749 $141,244 $132,161 $101,738 Non-hotel property only includes the results of one hotel in New York, New York that is leased to a third-party hotel operator. This property's Adjusted EBITDAre results are not included in Adjusted Hotel EBITDA starting in the second half of 2023. Note: The Consolidated Statements of Operations and Comprehensive Income and corresponding footnotes can be found in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023.

RECONCILIATION OF NET INCOME TO FFO AND MFFO THE FOLLOWING TABLE RECONCILES THE COMPANY’S GAAP NET INCOME TO FFO and MFFO ON A QUARTERLY BASIS FOR 2022 AND 2023�(Unaudited) (in thousands, except per share amounts) Note: The Consolidated Statements of Operations and Comprehensive Income and corresponding footnotes can be found in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023. 2022 2023 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Net income $18,002 $65,345 $59,146 $2,312 $32,923 $65,289 $58,512 $20,765 Depreciation of real estate owned 44,560 44,557 44,372 45,152 45,142 45,229 44,734 45,080 Gain on sale of real estate - - (1,785) - - - - - Loss on impairment of depreciable real estate assets - - - 26,175 - - - 5,644 Funds from operations 62,562 109,902 101,733 73,639 78,065 110,518 103,246 71,489 Amortization of finance ground lease assets 759 760 759 760 759 760 759 760 Amortization of favorable and unfavorable operating leases, net 99 103 97 97 97 85 99 102 Non-cash straight-line operating ground lease expense 40 38 38 38 38 36 35 36 Modified funds from operations $63,460 $110,803 $102,627 $74,534 $78,959 $111,399 $104,139 $72,387 Modified funds from operations per common share $0.28 $0.48 $0.45 $0.33 $0.34 $0.49 $0.45 $0.31 Weighted average common shares outstanding – basic and diluted 228,986 228,998 228,991 228,811 229,398 229,041 228,877 230,000

DEFINITIONS HYATT PLACE JACKSONVILLE AIRPORT Non-GAAP Financial Measures The Company considers the following non-GAAP financial measures useful to investors as key supplemental measures of its operating performance: Funds from Operations (“FFO”); Modified FFO (“MFFO”); Earnings Before Interest, Income Taxes, Depreciation and Amortization (“EBITDA”); Earnings Before Interest, Income Taxes, Depreciation and Amortization for Real Estate (“EBITDAre”); Adjusted EBITDAre; Adjusted Hotel EBITDA; Comparable Hotels Adjusted Hotel EBITDA; and Same Store Hotels Adjusted Hotel EBITDA. These non-GAAP financial measures should be considered along with, but not as alternatives to, net income (loss), cash flow from operations or any other operating GAAP measure. FFO, MFFO, EBITDA, EBITDAre, Adjusted EBITDAre, Adjusted Hotel EBITDA, Comparable Hotels Adjusted Hotel EBITDA and Same Store Hotels Adjusted Hotel EBITDA are not necessarily indicative of funds available to fund the Company’s cash needs, including its ability to make cash distributions. Although FFO, MFFO, EBITDA, EBITDAre, Adjusted EBITDAre, Adjusted Hotel EBITDA, Comparable Hotels Adjusted Hotel EBITDA and Same Store Hotels Adjusted Hotel EBITDA, as calculated by the Company, may not be comparable to FFO, MFFO, EBITDA, EBITDAre, Adjusted EBITDAre, Adjusted Hotel EBITDA, Comparable Hotels Adjusted Hotel EBITDA and Same Store Hotels Adjusted Hotel EBITDA, as reported by other companies that do not define such terms exactly as the Company defines such terms, the Company believes these supplemental measures are useful to investors when comparing the Company’s results between periods and with other REITs. EBITDA, EBITDAre, Adjusted EBITDAre and Adjusted Hotel EBITDA EBITDA is a commonly used measure of performance in many industries and is defined as net income (loss) excluding interest, income taxes, depreciation and amortization. The Company believes EBITDA is useful to investors because it helps the Company and its investors evaluate the ongoing operating performance of the Company by removing the impact of its capital structure (primarily interest expense) and its asset base (primarily depreciation and amortization). In addition, certain covenants included in the agreements governing the Company’s indebtedness use EBITDA, as defined in the specific credit agreement, as a measure of financial compliance. In addition to EBITDA, the Company also calculates and presents EBITDAre in accordance with standards established by the National Association of Real Estate Investment Trusts (“Nareit”), which defines EBITDAre as EBITDA, excluding gains and losses from the sale of certain real estate assets (including gains and losses from change in control), plus real estate related impairments, and adjustments to reflect the entity’s share of EBITDAre of unconsolidated affiliates. The Company presents EBITDAre because it believes that it provides further useful information to investors in comparing its operating performance between periods and between REITs that report EBITDAre using the Nareit definition. The Company also considers the exclusion of non-cash straight-line operating ground lease expense from EBITDAre useful, as this expense does not reflect the underlying performance of the related hotels (Adjusted EBITDAre). The Company further excludes actual corporate-level general and administrative expense for the Company as well as Adjusted EBITDAre from its non-hotel property from Adjusted EBITDAre (Adjusted Hotel EBITDA) to isolate property-level operational performance over which the Company’s hotel operators have direct control. The Company believes Adjusted Hotel EBITDA provides useful supplemental information to investors regarding operating performance and is used by management to measure the performance of the Company’s hotels and effectiveness of the operators of the hotels.

DEFINITIONS CONTINUED RESIDENCE INN LOS ANGELES BURBANK/DOWNTOWN FFO and MFFO The Company calculates and presents FFO in accordance with standards established by Nareit, which defines FFO as net income (loss) (computed in accordance with generally accepted accounting principles (“GAAP”)), excluding gains and losses from the sale of certain real estate assets (including gains and losses from change in control), extraordinary items as defined by GAAP, and the cumulative effect of changes in accounting principles, plus real estate related depreciation, amortization and impairments, and adjustments for unconsolidated affiliates. Historical cost accounting for real estate assets implicitly assumes that the value of real estate assets diminishes predictably over time. Since real estate values instead have historically risen or fallen with market conditions, most real estate industry investors consider FFO to be helpful in evaluating a real estate company’s operations. The Company further believes that by excluding the effects of these items, FFO is useful to investors in comparing its operating performance between periods and between REITs that report FFO using the Nareit definition. FFO as presented by the Company is applicable only to its common shareholders, but does not represent an amount that accrues directly to common shareholders. The Company calculates MFFO by further adjusting FFO for the exclusion of amortization of finance ground lease assets, amortization of favorable and unfavorable operating leases, net and non-cash straight-line operating ground lease expense, as these expenses do not reflect the underlying performance of the related hotels. The Company presents MFFO when evaluating its performance because it believes that it provides further useful supplemental information to investors regarding its ongoing operating performance. COMPARABLE HOTELS Comparable Hotels is defined as the 223 hotels owned and held for use by the Company as of December 31, 2023, and excludes one non-hotel property leased to third parties. For hotels acquired during the periods noted, the Company has included, as applicable, results of those hotels for periods prior to the Company's ownership, and for dispositions and assets held for sale, results have been excluded for the Company's period of ownership. Results for periods prior to the Company's ownership have not been included in the Company's actual Consolidated Financial Statements and are included only for comparison purposes. Results included for periods prior to the Company's ownership are based on information from the prior owner of each hotel and have not been audited or adjusted. SAME STORE HOTELS Same Store Hotels is defined as the 215 hotels owned and held for use by the Company as of January 1, 2022, and during the entirety of the periods being compared, and excludes one non-hotel property leased to third parties. This information has not been audited.

TRADEMARK INFORMATION “AC Hotels by Marriott®,” “Aloft Hotels®,” “Courtyard by Marriott®,” “Fairfield by Marriott®,” “Fairfield Inn by Marriott®,” “Fairfield Inn & Suites by Marriott®,” “Marriott® Hotels,” “Residence Inn by Marriott®,” “SpringHill Suites by Marriott®,” and “TownePlace Suites by Marriott®” are each a registered trademark of Marriott International, Inc. or one of its affiliates. All references to “Marriott®” mean Marriott International, Inc. and all of its affiliates and subsidiaries, and their respective officers, directors, agents, employees, accountants and attorneys. Marriott® is not responsible for the content of this presentation, whether relating to hotel information, operating information, financial information, Marriott®’s relationship with Apple Hospitality REIT, Inc., or otherwise. Marriott® was not involved in any way, whether as an “issuer” or “underwriter” or otherwise, in any Apple Hospitality REIT offering and received no proceeds from any offering. Marriott® has not expressed any approval or disapproval regarding this presentation, and the grant by Marriott® of any franchise or other rights to Apple Hospitality REIT shall not be construed as any expression of approval or disapproval. Marriott® has not assumed and shall not have any liability in connection with this presentation. “Embassy Suites by Hilton®,” “Hampton by Hilton®,” “Hampton Inn by Hilton®,” “Hampton Inn & Suites by Hilton®,” “Hilton Garden Inn®,” “Home2 Suites by Hilton®,” “Motto by Hilton®” and “Homewood Suites by Hilton®” are each a registered trademark of Hilton Worldwide Holdings Inc. or one of its affiliates. All references to “Hilton®” mean Hilton Worldwide Holdings Inc. and all of its affiliates and subsidiaries, and their respective officers, directors, agents, employees, accountants and attorneys. Hilton® is not responsible for the content of this presentation, whether relating to hotel information, operating information, financial information, Hilton®’s relationship with Apple Hospitality REIT, Inc., or otherwise. Hilton® was not involved in any way, whether as an “issuer” or “underwriter” or otherwise, in any Apple Hospitality REIT offering and received no proceeds from any offering. Hilton® has not expressed any approval or disapproval regarding this presentation, and the grant by Hilton® of any franchise or other rights to Apple Hospitality REIT shall not be construed as any expression of approval or disapproval. Hilton® has not assumed and shall not have any liability in connection with this presentation. “Hyatt Place®” and “Hyatt House®” are each a registered trademark of Hyatt Hotels Corporation or one of its affiliates. All references to “Hyatt®” mean Hyatt Hotels Corporation and all of its affiliates and subsidiaries, and their respective officers, directors, agents, employees, accountants and attorneys. Hyatt® is not responsible for the content of this presentation, whether relating to hotel information, operating information, financial information, Hyatt®’s relationship with Apple Hospitality REIT, Inc., or otherwise. Hyatt® was not involved in any way, whether as an “issuer” or “underwriter” or otherwise, in any Apple Hospitality REIT offering and received no proceeds from any offering. Hyatt® has not expressed any approval or disapproval regarding this presentation, and the grant by Hyatt® of any franchise or other rights to Apple Hospitality REIT shall not be construed as any expression of approval or disapproval. Hyatt® has not assumed and shall not have any liability in connection with this presentation. HOMEWOOD SUITES OMAHA-DOWNTOWN

CONTACT INFORMATION 814 East Main Street Richmond, VA 23219 (804) 344-8121 info@applehospitalityreit.com www.applehospitalityreit.com COURTYARD AND RESIDENCE INN RICHMOND DOWNTOWN

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |