FRONTLINE PLC REPORTS RESULTS FOR THE

FOURTH QUARTER ENDED DECEMBER 31, 2023

Frontline plc (the “Company” or “Frontline”),

today reported unaudited results for the three and twelve months

ended December 31, 2023:

Highlights

- Profit of $118.4 million, or $0.53 per share for the fourth

quarter of 2023.

- Adjusted profit of $102.2 million, or $0.46 per share for the

fourth quarter of 2023.

- Declared a cash dividend of $0.37 per share for the fourth

quarter of 2023.

- Reported revenues of $415.0 million for the fourth quarter of

2023.

- Took delivery of 11 VLCCs from Euronav NV (“Euronav”) as part

of the acquisition of 24 VLCCs (“the Acquisition”) in the fourth

quarter of 2023 and delivery of a further 12 vessels in January

2024 with the last VLCC expected to be delivered within the first

quarter of 2024.

- Entered into agreements to sell its five oldest VLCCs, built in

2009 and 2010 and one of its oldest Suezmax tankers, built in 2010,

for an aggregate net sales price of $335.0 million in January 2024.

After repayment of existing debt on the vessels the transactions

are expected to generate net cash proceeds of approximately $238.0

million.

- In the process of refinancing eight Suezmax tankers and 16 LR2

tankers expected to generate net cash proceeds of approximately

$408.0 million.

- The net cash proceeds of approximately $646.0 million expected

to be generated from sale and refinancing of vessels, will enable

Frontline to fully repay the Hemen shareholder loan and the amount

drawn under the $275.0 million senior unsecured revolving credit

facility with an affiliate of Hemen in relation to the

Acquisition.

Lars H. Barstad, Chief Executive Officer

of Frontline Management AS, commented:

“Frontline delivered its strongest full year

result in fifteen years, despite muted markets in the fourth

quarter. The year has been exceptional for the tanker industry and

the asset classes we deploy, however, it’s the Suezmax, Aframax and

product markets that have offered volatility. During the fourth

quarter, Frontline started taking delivery of the 24 modern VLCCs

acquired from Euronav, and it’s a testament to Frontline’s scalable

business platform that within a few months Frontline has doubled

its exposure in the VLCC market, by increasing its overall earnings

capacity by more than one-third, with minimal impact on its

operational setup. The continuous disruption in the Red Sea has

caused West / East trading lanes to widen, which we believe

benefits the larger vessel classes, offering economies of scale as

oil and products move around the Cape of Good Hope.”

Inger M. Klemp, Chief Financial Officer

of Frontline Management AS, added:

"When we entered into agreements with Euronav to

acquire a high-quality ECO fleet of 24 VLCCs on October 9, 2023, we

communicated that the Hemen shareholder loan may not be fully drawn

as the Company was exploring other alternatives to free up capital,

including re-leveraging part of the existing Frontline fleet and/or

sale of older non-eco vessels. In January and February 2024, we

executed on this with the agreement to sell six, older non-eco

vessels and the ongoing process of refinancing 24 vessels, on, what

we believe are, attractive terms, expected to generate net cash

proceeds of approximately $646.0 million. This will enable us to

fully repay the Hemen shareholder loan and the amount drawn under

the $275.0 million senior unsecured revolving credit facility with

an affiliate of Hemen in relation to the Acquisition and maintain

our competitive cash breakeven rates.”

Average daily time charter equivalents

("TCEs")1

|

($ per day) |

Spot TCE |

Spot TCE estimates |

% Covered |

Estimated average daily cash breakeven rates |

|

|

2023 |

Q4 2023 |

Q3 2023 |

Q2 2023 |

Q1 2023 |

2022 |

Q1 2024 |

2024 |

|

VLCC |

50,300 |

42,300 |

42,500 |

64,000 |

52,500 |

31,300 |

55,100 |

81% |

28,800 |

|

Suezmax |

52,600 |

45,700 |

37,600 |

61,700 |

64,000 |

37,100 |

52,800 |

72% |

23,700 |

|

LR2 / Aframax |

46,800 |

42,900 |

33,900 |

52,900 |

56,300 |

38,500 |

67,800 |

69% |

21,200 |

In December 2023, the Company took delivery of

11 VLCCs as part of the Acquisition. These vessels contributed 184

trading days net of offhire, of which 150 were ballast days. This

negatively impacted the overall VLCC spot rate by $3,100 per day as

limited revenues were recorded in relation to these vessels,

whereas the Company includes all trading days in the VLCC spot

rate. The spot TCEs presented for the fourth quarter of 2023 in the

table above exclude the impact of the vessels delivered as a result

of the Acquisition.

The spot TCEs estimates in the first quarter of

2024 include the impact of the vessels delivered as a result of the

Acquisition. We expect the spot TCEs for the full first quarter of

2024 to be lower than the TCEs currently contracted, due to the

impact of ballast days at the end of the fourth quarter. The number

of ballast days at the end of the fourth quarter was 570 days for

VLCCs, 384 days for Suezmax tankers and 138 days for LR2/Aframax

tankers.

The Board of DirectorsFrontline plcLimassol,

CyprusFebruary 28, 2024

Ola Lorentzon - Chairman and DirectorJohn

Fredriksen - DirectorOle B. Hjertaker - Director

James O'Shaughnessy - Director Steen Jakobsen - DirectorMarios

Demetriades - DirectorCato Stonex - Director

Questions should be directed to:

Lars H. Barstad: Chief Executive Officer,

Frontline Management AS+47 23 11 40 00

Inger M. Klemp: Chief Financial Officer,

Frontline Management AS+47 23 11 40 00

Forward-Looking Statements

Matters discussed in this report may constitute

forward-looking statements. The Private Securities Litigation

Reform Act of 1995 provides safe harbor protections for

forward-looking statements, which include statements concerning

plans, objectives, goals, strategies, future events or performance,

and underlying assumptions and other statements, which are other

than statements of historical facts.

Frontline plc and its subsidiaries, or the

Company, desires to take advantage of the safe harbor provisions of

the Private Securities Litigation Reform Act of 1995 and is

including this cautionary statement in connection with this safe

harbor legislation. This report and any other written or oral

statements made by us or on our behalf may include forward-looking

statements, which reflect our current views with respect to future

events and financial performance and are not intended to give any

assurance as to future results. When used in this document, the

words "believe," "anticipate," "intend," "estimate," "forecast,"

"project," "plan," "potential," "will," "may," "should," "expect"

and similar expressions, terms or phrases may identify

forward-looking statements.

The forward-looking statements in this report

are based upon various assumptions, including without limitation,

management's examination of historical operating trends, data

contained in our records and data available from third parties.

Although we believe that these assumptions were reasonable when

made, because these assumptions are inherently subject to

significant uncertainties and contingencies which are difficult or

impossible to predict and are beyond our control, we cannot assure

you that we will achieve or accomplish these expectations, beliefs

or projections. We undertake no obligation to update any

forward-looking statements, whether as a result of new information,

future events or otherwise.

In addition to these important factors and

matters discussed elsewhere herein, important factors that, in our

view, could cause actual results to differ materially from those

discussed in the forward-looking statements include:

- the strength of world economies;

- fluctuations in currencies and interest rates, including

inflationary pressures and central bank policies intended to combat

overall inflation and rising interest rates and foreign exchange

rates;

- general market conditions, including fluctuations in charter

hire rates and vessel values;

- changes in the supply and demand for vessels comparable to ours

and the number of newbuildings under construction;

- the highly cyclical nature of the industry that we operate

in;

- the loss of a large customer or significant business

relationship;

- changes in worldwide oil production and consumption and

storage;

- changes in the Company's operating expenses, including bunker

prices, dry docking, crew costs and insurance costs;

- planned, pending or recent acquisitions, business strategy and

expected capital spending or operating expenses, including dry

docking, surveys and upgrades;

- risks associated with any future vessel construction;

- our expectations regarding the availability of vessel

acquisitions and our ability to complete vessel acquisition

transactions as planned;

- our ability to successfully compete for and enter into new time

charters or other employment arrangements for our existing vessels

after our current time charters expire and our ability to earn

income in the spot market;

- availability of financing and refinancing, our ability to

obtain financing and comply with the restrictions and other

covenants in our financing arrangements;

- availability of skilled crew members and other employees and

the related labor costs;

- work stoppages or other labor disruptions by our employees or

the employees of other companies in related industries;

- compliance with governmental, tax, environmental and safety

regulation, any non-compliance with U.S. regulations;

- the impact of increasing scrutiny and changing expectations

from investors, lenders and other market participants with respect

to our ESG policies;

- Foreign Corrupt Practices Act of 1977 or other applicable

regulations relating to bribery;

- general economic conditions and conditions in the oil

industry;

- effects of new products and new technology in our industry,

including the potential for technological innovation to reduce the

value of our vessels and charter income derived therefrom;

- new environmental regulations and restrictions, whether at a

global level stipulated by the International Maritime Organization,

and/or imposed by regional or national authorities such as the

European Union or individual countries;

- vessel breakdowns and instances of off-hire;

- the impact of an interruption in or failure of our information

technology and communications systems, including the impact of

cyber-attacks upon our ability to operate;

- potential conflicts of interest involving members of our board

of directors and senior management;

- the failure of counter parties to fully perform their contracts

with us;

- changes in credit risk with respect to our counterparties on

contracts;

- our dependence on key personnel and our ability to attract,

retain and motivate key employees;

- adequacy of insurance coverage;

- our ability to obtain indemnities from customers;

- changes in laws, treaties or regulations;

- the volatility of the price of our ordinary shares;

- our incorporation under the laws of Cyprus and the different

rights to relief that may be available compared to other countries,

including the United States;

- changes in governmental rules and regulations or actions taken

by regulatory authorities;

- government requisition of our vessels during a period of war or

emergency;

- potential liability from pending or future litigation and

potential costs due to environmental damage and vessel

collisions;

- the arrest of our vessels by maritime claimants;

- general domestic and international political conditions or

events, including “trade wars”;

- any further changes in U.S. trade policy that could trigger

retaliatory actions by the affected countries;

- potential disruption of shipping routes due to accidents,

environmental factors, political events, public health threats,

international hostilities including the ongoing developments in the

Ukraine region and the developments in the Middle East, including

the armed conflict in Israel and the Gaza Strip, acts by terrorists

or acts of piracy on ocean-going vessels;

- the impact of adverse weather and natural disasters;

- the length and severity of epidemics and pandemics and their

impacts on the demand for seaborne transportation of crude oil and

refined products;

- the impact of port or canal congestion;

- the ability of the Company to complete the acquisition of 24

VLCCs from Euronav;

- business disruptions due to natural disasters or other

disasters outside our control; and

- other important factors described from time to time in the

reports filed by the Company with the Securities and Exchange

Commission.

We caution readers of this report not to place

undue reliance on these forward-looking statements, which speak

only as of their dates. These forward-looking statements are no

guarantee of our future performance, and actual results and future

developments may vary materially from those projected in the

forward-looking statements.

This information is subject to the disclosure requirements

pursuant to Section 5-12 the Norwegian Securities Trading Act.

1 This press release describes Time Charter Equivalent earnings

and related per day amounts, which are not measures prepared in

accordance with IFRS (“non-GAAP”). See Appendix 1 for a full

description of the measures and reconciliation to the nearest IFRS

measure.

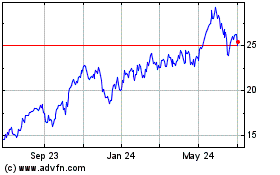

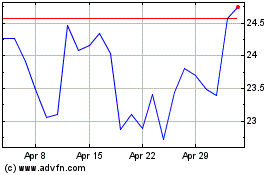

Frontline (NYSE:FRO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Frontline (NYSE:FRO)

Historical Stock Chart

From Apr 2023 to Apr 2024