false

0001822928

0001822928

2023-12-31

2023-12-31

0001822928

hlly:CommonStockParValue00001PerShareCustomMember

2023-12-31

2023-12-31

0001822928

hlly:WarrantsEachExercisableForOneShareOfCommonStockAtAnExercisePriceOf1150PerShareCustomMember

2023-12-31

2023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): February 28, 2024

HOLLEY INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

001-39599

|

87-1727560

|

|

(State or other jurisdiction

of incorporation)

|

(Commission

File Number)

|

(IRS Employer

Identification No.)

|

|

1801 Russellville Road, Bowling Green, KY

|

|

42101

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

(270) 782-2900

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange

on which registered

|

|

Common stock, par value $0.0001 per share

|

|

HLLY

|

|

New York Stock Exchange

|

|

Warrants, each exercisable for one share of common stock at an exercise price of $11.50 per share

|

|

HLLY WS

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 2.02

|

Results of Operations and Financial Condition.

|

On February 28, 2024, Holley Inc. (the “Company”) issued a press release announcing its financial results and operational highlights for the Company’s quarter and full year ended December 31, 2023 and providing outlook and guidance for the first quarter and full year 2024. A copy of the press release is furnished herewith as Exhibit 99.1 and incorporated herein by reference.

The information under Item 2.02 of this Report, including Exhibit 99.1, attached hereto, is furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Exchange Act or Securities Act of 1933, as amended, expect as expressly set forth by specific reference in such a filing.

|

Item 9.01

|

Financial Statements and Exhibits.

|

(d) Exhibits

|

Exhibit

No.

|

|

Description

|

|

99.1

|

|

|

|

104

|

|

Cover Page Interactive Data File (formatted as Inline XBRL).

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

|

| |

HOLLEY INC.

|

| |

|

|

| |

By:

|

/s/ Jesse Weaver

|

| |

|

Name: Jesse Weaver

|

|

Date: February 28, 2024

|

|

Title: Chief Financial Officer

|

Exhibit 99.1

PRESS RELEASE

|

|

1801 Russellville Road

Bowling Green, Kentucky 42101

Holley.com

|

HOLLEY REPORTS FOURTH QUARTER AND FULL YEAR 2023 RESULTS; EARLY STAGES OF TRANSFORMATION YIELDING POSITIVE YEAR-OVER-YEAR IMPROVEMENT IN Q4 PROFITABILITY

Year Over Year Fourth Quarter Net Income Improvement of $16.4 Million and Adjusted EBITDA Growth of 89%

Continued strong cash generation and debt paydown further reduces net leverage

Provides outlook and guidance for Q1 and full year 2024

BOWLING GREEN, Ky. – February 28, 2024 – Holley Inc. (NYSE: HLLY), a leader in automotive aftermarket performance solutions, today announced financial results for its fourth quarter and full year ended December 31, 2023.

Fourth Quarter Highlights vs. Prior Year Period

Full Year 2023 Highlights vs. Prior Year Period

1See “Use and Reconciliation of Non-GAAP Financial Measures” below.

“In 2023, Holley achieved many accomplishments as we focused on fueling our teammates, supercharging our customers, and accelerating profitable growth," said Matthew Stevenson, President and Chief Executive Officer of Holley. "We are in the early stages of an organizational transformation, and I am encouraged by the progress we made in 2023 to position ourselves for long-term success. We made significant strides in streamlining our organization and directing our sales, marketing, and R&D efforts towards high-impact areas. We have implemented new processes designed to improve all key aspects of Holley's operations, including a more targeted product development and R&D approach, disciplined inventory and SKU management processes, and a more informed innovation and product launch pipeline. While these transformative efforts are still in their early stages, they have already benefited our operational and financial performance in 2023, and I am confident that this positive momentum will continue as these programs gain traction.”

Key Operating Metrics and Strategic Highlights

| |

● |

Reduced past due orders sequentially by $4.8 million during the fourth quarter, $17.9 million in 2023 |

| |

●

|

Reduced inventory sequentially by $13.7 million during the fourth quarter, $40.1 million in 2023 |

| |

●

|

$5.0 million of year-over-year savings in the fourth quarter and $35.6 million for the full year driven by operational improvements and cost savings initiatives |

| |

●

|

Completed additional $25 million in early debt paydown against the Company’s first lien term loan facility in Q4 |

| |

●

|

Holley’s bank-adjusted EBITDA leverage ratio at quarter end of 4.21x was well below the amended covenant ceiling of 5.75x for Q4 of 2023 and below the original covenant level of 5.0x |

| |

● |

Record-setting attendance at consumer-focused Holley events in 2023, encompassing 7 multi-day festivals |

| |

● |

Implemented a new organizational design, including seven distinct product category teams, to drive growth through expansion of Holley’s portfolio of brands and products into additional consumer verticals |

Stevenson continued, “As we look to 2024, we will maintain our focus on transforming Holley’s growth engine, despite a potentially challenging macro-economic environment. We will put in the fundamental talent, resources, and processes to unlock its full potential. While we work on revving up Holley’s top-line growth engine, we will also simultaneously work on improving our distribution processes and cost to serve. We will also reduce complexity in product offerings, optimize our cost structure, and drive improved profitability.

Our operating model has exhibited increasingly strong cash flow, and we are confident that we will continue paying down debt and improving the company’s financial flexibility this year. Our focused strategy, disciplined culture, and dedicated team will guide us going forward as we drive toward our long-term financial goals.”

Holley's CFO, Jesse Weaver, said, "We anticipate a soft Q1 due to the lower than expected out the door consumer demand experienced by our resellers in late 2023 that led to high inventory levels at key distribution partners. However, we are confident in the overall strength of the automotive performance enthusiast aftermarket. We think that our product and launch strategy will lead to growth in the second half of the year and our actions to simplify and focus the organization will support our long-term goal of delivering at least 20% EBITDA margin.”

Outlook

Holley is providing the following outlook for the first quarter and full-year 2024:

|

Metric

|

First Quarter 2024 Outlook

|

Full Year 2024 Outlook

|

|

Net Sales

|

$150 - $160 million

|

$640 - $680 million

|

|

Adjusted EBITDA

|

$27 - $33 million

|

$125 - $145 million

|

|

Capital Expenditures

|

|

$8 - $12 million

|

|

Depreciation and Amortization Expense

|

|

$24 - $26 million

|

|

Interest Expense

|

|

$50 - $55 million

|

|

Bank-adjusted EBITDA Leverage Ratio

|

|

4.0x - 3.5x

|

Conference Call

A conference call and audio webcast has been scheduled for 8:30 a.m. Eastern Time today to discuss these results. Investors, analysts, and members of the media interested in listening to the live presentation are encouraged to join a webcast of the call available on the investor relations portion of the Company’s website at investor.holley.com. For those that cannot join the webcast, you can participate by dialing 877-407-4019 (Toll Free) or 201-689-8337 (Toll) using the access code of 13744257.

For those unable to participate, a telephone replay recording will be available until Wednesday, March 6, 2024. To access the replay, please call 877-660-6853 (Toll Free) or 201-612-7415 (Toll) and enter confirmation code 13741890. A web-based archive of the conference call will also be available on the Company’s website.

Additional Financial Information

The Investor Relations page of Holley’s website, investor.holley.com contains a significant amount of financial information about Holley, including our earnings presentation, which can be found under Events & Presentations. Holley encourages investors to visit this website regularly, as information is updated, and new information is posted.

About Holley Inc.

Holley Inc. (NYSE: HLLY) is a leading designer, marketer, and manufacturer of high-performance products for car and truck enthusiasts. Holley offers a leading portfolio of iconic brands that deliver innovation and inspiration to a large and diverse community of millions of avid automotive enthusiasts who are passionate about the performance and personalization of their classic and modern cars. Holley has disrupted the performance category by putting the enthusiast consumer first, developing innovative new products, and building a robust M&A process that has added meaningful scale and diversity to its platform. For more information on Holley, visit https://www.holley.com.

Forward-Looking Statements

Certain statements in this press release may be considered “forward-looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements generally relate to future events or Holley’s future financial or operating performance. For example, projections of future revenue and adjusted EBITDA and other metrics, along with statements regarding the impact of organizational changes, are forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “may,” “should,” “expect,” “intend,” “will,” “estimate,” “anticipate,” “believe,” “predict,” “or” or the negatives of these terms or variations of them or similar terminology. Such forward-looking statements are subject to risks, uncertainties, and other factors which could cause actual results to differ materially from those expressed or implied by such forward-looking statements. These forward-looking statements are based upon estimates and assumptions that, while considered reasonable by Holley and its management, are inherently uncertain. Factors that may cause actual results to differ materially from current expectations include, but are not limited to: 1) the ability of Holley to grow and manage growth profitably which may be affected by, among other things, competition; to maintain relationships with customers and suppliers; and to retain its management and key employees; 2) costs related to Holley being a public company; 3) disruptions to Holley’s operations, including as a result of cybersecurity incidents; 4) changes in applicable laws or regulations; 5) the outcome of any legal proceedings that have been or may be instituted against Holley; 6) general economic and political conditions, including the current macroeconomic environment, political tensions, and war (including the conflict in Ukraine, the conflict in Israel and surrounding areas, and the possible expansion of such conflicts and potential geopolitical consequences); 7) the possibility that Holley may be adversely affected by other economic, business, and/or competitive factors, including recent events affecting the financial services industry (such as the closures of certain regional banks); 8) Holley’s estimates of its financial performance; 9) Holley’s ability to anticipate and manage through disruptions and higher costs in manufacturing, supply chain, logistical operations, and shortages of certain company products in distribution channels; and 10) other risks and uncertainties set forth in the section entitled “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” in the Annual Report on Form 10-K for the year ended December 31, 2022 filed with the U.S. Securities and Exchange Commission (“SEC”) on March 15, 2023, and/or disclosed in any subsequent filings with the SEC. Although Holley believes the expectations reflected in the forward-looking statements are reasonable, nothing in this press release should be regarded as a representation by any person that the forward-looking statements or projections set forth herein will be achieved or that any of the contemplated results of such forward looking statements or projections will be achieved. There may be additional risks that Holley presently does not know or that Holley currently believes are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. You should not place undue reliance on forward-looking statements, which speak only as of the date they are made. Holley undertakes no duty to update these forward-looking statements, except as otherwise required by law.

Investor Relations:

Ross Collins / Stephen Poe

Alpha IR Group

312-445-2870

HLLY@alpha-ir.com

Media Relations Contacts:

Paul Oakley, poakley@tinymightyco.com / Rachel Withers, rwithers@tinymightyco.com

Tiny Mighty Communications

615-454-2913

[Financial Tables to Follow]

|

HOLLEY INC. and SUBSIDIARIES

|

|

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

|

|

(In thousands)

|

|

(Unaudited)

|

| |

|

For the thirteen weeks ended

|

|

|

For the year ended

|

|

| |

|

December 31, |

|

|

December 31, |

|

|

Variance |

|

|

Variance |

|

|

December 31, |

|

|

December 31, |

|

|

Variance |

|

|

Variance |

|

| |

|

2023

|

|

|

2022

|

|

|

($)

|

|

|

(%)

|

|

|

2023

|

|

|

2022

|

|

|

($)

|

|

|

(%)

|

|

|

Net Sales

|

|

$ |

155,707 |

|

|

$ |

154,165 |

|

|

$ |

1,542 |

|

|

|

1.0 |

% |

|

$ |

659,704 |

|

|

$ |

688,415 |

|

|

$ |

(28,711 |

) |

|

|

-4.2 |

% |

|

Cost of Goods Sold

|

|

|

95,453 |

|

|

|

106,908 |

|

|

|

(11,455 |

) |

|

|

-10.7 |

% |

|

|

403,615 |

|

|

|

434,757 |

|

|

|

(31,142 |

) |

|

|

-7.2 |

% |

|

Gross Profit

|

|

|

60,254 |

|

|

|

47,257 |

|

|

|

12,997 |

|

|

|

27.5 |

% |

|

|

256,089 |

|

|

|

253,658 |

|

|

|

2,431 |

|

|

|

1.0 |

% |

|

Selling, General, and Administrative

|

|

|

32,246 |

|

|

|

48,196 |

|

|

|

(15,950 |

) |

|

|

-33.1 |

% |

|

|

120,244 |

|

|

|

150,728 |

|

|

|

(30,484 |

) |

|

|

-20.2 |

% |

|

Research and Development Costs

|

|

|

4,909 |

|

|

|

6,687 |

|

|

|

(1,778 |

) |

|

|

-26.6 |

% |

|

|

23,844 |

|

|

|

29,083 |

|

|

|

(5,239 |

) |

|

|

-18.0 |

% |

|

Amortization of Intangible Assets

|

|

|

3,517 |

|

|

|

3,698 |

|

|

|

(181 |

) |

|

|

-4.9 |

% |

|

|

14,557 |

|

|

|

14,683 |

|

|

|

(126 |

) |

|

|

-0.9 |

% |

|

Impairment of Indefinite-Lived Intangible Assets

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

nm |

|

|

|

— |

|

|

|

2,395 |

|

|

|

(2,395 |

) |

|

|

-100.0 |

% |

|

Acquisition and Restructuring Costs

|

|

|

535 |

|

|

|

1,266 |

|

|

|

(731 |

) |

|

|

-57.7 |

% |

|

|

2,641 |

|

|

|

4,513 |

|

|

|

(1,872 |

) |

|

|

-41.5 |

% |

|

Other Operating Expense (Benefit)

|

|

|

257 |

|

|

|

920 |

|

|

|

(663 |

) |

|

|

-72.1 |

% |

|

|

765 |

|

|

|

1,514 |

|

|

|

(749 |

) |

|

|

-49.5 |

% |

|

Operating Expense

|

|

|

41,464 |

|

|

|

60,767 |

|

|

|

(19,303 |

) |

|

|

-31.8 |

% |

|

|

162,051 |

|

|

|

202,916 |

|

|

|

(40,865 |

) |

|

|

-20.1 |

% |

|

Operating Income (Loss)

|

|

|

18,790 |

|

|

|

(13,510 |

) |

|

|

32,300 |

|

|

|

nm |

|

|

|

94,038 |

|

|

|

50,742 |

|

|

|

43,296 |

|

|

|

85.3 |

% |

|

Change in Fair Value of Warrant Liability

|

|

|

(1,405 |

) |

|

|

(5,909 |

) |

|

|

4,504 |

|

|

|

-76.2 |

% |

|

|

4,111 |

|

|

|

(57,021 |

) |

|

|

61,132 |

|

|

|

nm |

|

|

Change in Fair Value of Earn-Out Liability

|

|

|

214 |

|

|

|

(1,449 |

) |

|

|

1,663 |

|

|

|

nm |

|

|

|

2,303 |

|

|

|

(10,731 |

) |

|

|

13,034 |

|

|

|

nm |

|

|

Gain on Early Extinguishment of Debt

|

|

|

(701 |

) |

|

|

— |

|

|

|

(701 |

) |

|

|

nm |

|

|

|

(701 |

) |

|

|

— |

|

|

|

(701 |

) |

|

|

nm |

|

|

Interest Expense, Net

|

|

|

18,837 |

|

|

|

13,447 |

|

|

|

5,390 |

|

|

|

40.1 |

% |

|

|

60,746 |

|

|

|

40,227 |

|

|

|

20,519 |

|

|

|

51.0 |

% |

|

Non-Operating Expense (Income)

|

|

|

16,945 |

|

|

|

6,089 |

|

|

|

10,856 |

|

|

|

178.3 |

% |

|

|

66,459 |

|

|

|

(27,525 |

) |

|

|

93,984 |

|

|

|

nm |

|

|

Income (Loss) Before Income Taxes

|

|

|

1,845 |

|

|

|

(19,599 |

) |

|

|

21,444 |

|

|

|

nm |

|

|

|

27,579 |

|

|

|

78,267 |

|

|

|

(50,688 |

) |

|

|

-64.8 |

% |

|

Income Tax Expense (Benefit)

|

|

|

643 |

|

|

|

(4,373 |

) |

|

|

5,016 |

|

|

|

nm |

|

|

|

8,399 |

|

|

|

4,493 |

|

|

|

3,906 |

|

|

|

86.9 |

% |

|

Net Income (Loss)

|

|

$ |

1,202 |

|

|

$ |

(15,226 |

) |

|

$ |

16,428 |

|

|

|

nm |

|

|

$ |

19,180 |

|

|

$ |

73,774 |

|

|

$ |

(54,594 |

) |

|

|

-74.0 |

% |

|

Comprehensive Income (Loss):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign Currency Translation Adjustment

|

|

|

337 |

|

|

|

(2,248 |

) |

|

|

2,585 |

|

|

|

nm |

|

|

|

234 |

|

|

|

(990 |

) |

|

|

1,224 |

|

|

|

nm |

|

|

Pension Liability Gain

|

|

|

— |

|

|

|

302 |

|

|

|

(302 |

) |

|

|

-100.0 |

% |

|

|

— |

|

|

|

302 |

|

|

|

(302 |

) |

|

|

-100.0 |

% |

|

Total Comprehensive Income (Loss)

|

|

$ |

1,539 |

|

|

$ |

(17,172 |

) |

|

$ |

18,711 |

|

|

|

nm |

|

|

$ |

19,414 |

|

|

$ |

73,086 |

|

|

$ |

(53,672 |

) |

|

|

-73.4 |

% |

|

Common Share Data:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic Net Income (Loss) per Share

|

|

$ |

0.01 |

|

|

$ |

(0.13 |

) |

|

$ |

0.14 |

|

|

|

nm |

|

|

$ |

0.16 |

|

|

$ |

0.63 |

|

|

$ |

(0.47 |

) |

|

|

-74.6 |

% |

|

Diluted Net Income (Loss) per Share

|

|

$ |

0.01 |

|

|

$ |

(0.13 |

) |

|

$ |

0.14 |

|

|

|

nm |

|

|

$ |

0.16 |

|

|

$ |

0.14 |

|

|

$ |

0.02 |

|

|

|

14.3 |

% |

|

Weighted Average Common Shares Outstanding - Basic

|

|

|

117,707 |

|

|

|

117,148 |

|

|

|

559 |

|

|

|

0.5 |

% |

|

|

117,379 |

|

|

|

116,763 |

|

|

|

616 |

|

|

|

0.5 |

% |

|

Weighted Average Common Shares Outstanding - Diluted

|

|

|

119,573 |

|

|

|

117,179 |

|

|

|

2,394 |

|

|

|

2.0 |

% |

|

|

118,511 |

|

|

|

117,248 |

|

|

|

1,263 |

|

|

|

1.1 |

% |

|

nm - not meaningful

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

HOLLEY INC. and SUBSIDIARIES

|

|

CONDENSED CONSOLIDATED BALANCE SHEET

|

|

(In thousands)

|

|

(Unaudited)

|

| |

|

As of |

|

| |

|

December 31, |

|

|

December 31, |

|

| |

|

2023

|

|

|

2022

|

|

|

Assets

|

|

|

|

|

|

|

|

|

|

Total Current Assets

|

|

$ |

297,366 |

|

|

$ |

324,963 |

|

|

Property, Plant and Equipment, Net

|

|

|

47,206 |

|

|

|

52,181 |

|

|

Goodwill

|

|

|

419,056 |

|

|

|

418,121 |

|

|

Other Intangibles, Net

|

|

|

410,465 |

|

|

|

424,855 |

|

|

Other Noncurrent Assets

|

|

|

29,250 |

|

|

|

29,522 |

|

|

Total Assets

|

|

$ |

1,203,343 |

|

|

$ |

1,249,642 |

|

| |

|

|

|

|

|

|

|

|

|

Liabilities and Stockholders’ Equity

|

|

|

|

|

|

|

|

|

|

Total Current Liabilities

|

|

$ |

92,847 |

|

|

$ |

101,259 |

|

|

Long-Term Debt, Net of Current Portion

|

|

|

577,600 |

|

|

|

643,563 |

|

|

Deferred Taxes

|

|

|

53,542 |

|

|

|

58,390 |

|

|

Other Noncurrent Liabilities

|

|

|

38,203 |

|

|

|

30,440 |

|

|

Total Liabilities

|

|

|

762,192 |

|

|

|

833,652 |

|

| |

|

|

|

|

|

|

|

|

|

Common Stock

|

|

|

12 |

|

|

|

12 |

|

|

Additional Paid-In Capital

|

|

|

373,869 |

|

|

|

368,122 |

|

|

Accumulated Other Comprehensive Loss

|

|

|

(710 |

) |

|

|

(944 |

) |

|

Retained Earnings

|

|

|

67,980 |

|

|

|

48,800 |

|

|

Total Stockholders’ Equity

|

|

|

441,151 |

|

|

|

415,990 |

|

|

Total Liabilities and Stockholders’ Equity

|

|

$ |

1,203,343 |

|

|

$ |

1,249,642 |

|

|

HOLLEY INC. and SUBSIDIARIES

|

|

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

|

|

(In thousands)

|

|

(Unaudited)

|

| |

|

For the thirteen weeks ended

|

|

|

For the year ended

|

|

| |

|

December 31,

|

|

|

December 31,

|

|

|

December 31,

|

|

|

December 31,

|

|

| |

|

2023

|

|

|

2022

|

|

|

2023

|

|

|

2022

|

|

|

Operating Activities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Income (Loss)

|

|

$ |

1,202 |

|

|

$ |

(15,226 |

) |

|

$ |

19,180 |

|

|

$ |

73,774 |

|

|

Adjustments to Reconcile to Net Cash

|

|

|

14,625 |

|

|

|

17,465 |

|

|

|

44,071 |

|

|

|

(5,155 |

) |

|

Changes in Operating Assets and Liabilities

|

|

|

15,402 |

|

|

|

(2,091 |

) |

|

|

24,841 |

|

|

|

(56,307 |

) |

|

Net Cash Provided by Operating Activities

|

|

|

31,229 |

|

|

|

148 |

|

|

|

88,092 |

|

|

|

12,312 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investing Activities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Capital Expenditures, Net of Dispositions

|

|

|

(1,328 |

) |

|

|

(1,430 |

) |

|

|

(4,453 |

) |

|

|

(12,702 |

) |

|

Acquisitions / Divestitures, net

|

|

|

— |

|

|

|

1,742 |

|

|

|

— |

|

|

|

(12,335 |

) |

|

Net Cash Provided by (Used in) Investing Activities

|

|

|

(1,328 |

) |

|

|

312 |

|

|

|

(4,453 |

) |

|

|

(25,037 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Financing Activities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Change in Debt

|

|

|

(25,601 |

) |

|

|

8,307 |

|

|

|

(66,038 |

) |

|

|

3,517 |

|

|

Deferred financing fees

|

|

|

— |

|

|

|

— |

|

|

|

(1,427 |

) |

|

|

— |

|

|

Payments from Stock-Based Award Activities

|

|

|

(409 |

) |

|

|

— |

|

|

|

(1,543 |

) |

|

|

(1,050 |

) |

|

Proceeds from Issuance of Common Stock Due to Exercise of Warrants

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

383 |

|

|

Net Cash Provided by (Used in) Financing Activities

|

|

|

(26,010 |

) |

|

|

8,307 |

|

|

|

(69,008 |

) |

|

|

2,850 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Effect of Foreign Currency Rate Fluctuations on Cash

|

|

|

357 |

|

|

|

777 |

|

|

|

300 |

|

|

|

(300 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Change in Cash and Cash Equivalents

|

|

|

4,248 |

|

|

|

9,544 |

|

|

|

14,931 |

|

|

|

(10,175 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and Cash Equivalents

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Beginning of Period

|

|

|

36,833 |

|

|

|

16,606 |

|

|

|

26,150 |

|

|

|

36,325 |

|

|

End of Period

|

|

$ |

41,081 |

|

|

$ |

26,150 |

|

|

$ |

41,081 |

|

|

$ |

26,150 |

|

EBITDA, Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Net Income, and Free Cash Flow are not prepared in accordance with accounting principles generally accepted in the United States (“GAAP”) and may be different from non-GAAP and other financial measures used by other companies. These measures should not be considered as measures of financial performance under GAAP, and the items excluded from or included in these metrics are significant components in understanding and assessing Holley’s financial performance. These metrics should not be considered as alternatives to net income, net cash provided by operating activities, or any other performance measures, as applicable, derived in accordance with GAAP.

Holley believes EBITDA, Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Net Income, and Free Cash Flow are useful to investors in evaluating the Company’s financial performance and in comparing the Company’s financial results between periods because they exclude the impact of certain items that we do not consider indicative of our ongoing operating performance. In addition, Holley uses these measures internally to establish forecasts, budgets, and operational goals to manage and monitor its business. Holley believes that these non-GAAP and other financial measures help to depict a more realistic representation of the performance of the underlying business, enabling Holley to evaluate and plan more effectively for the future.

|

HOLLEY INC. and SUBSIDIARIES

|

|

USE AND RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

|

|

(In thousands)

|

|

(Unaudited)

|

| |

|

For the thirteen weeks ended

|

|

|

For the year ended

|

|

| |

|

December 31,

|

|

|

December 31,

|

|

|

December 31,

|

|

|

December 31,

|

|

| |

|

2023

|

|

|

2022

|

|

|

2023

|

|

|

2022

|

|

|

Net Income (Loss)

|

|

$ |

1,202 |

|

|

$ |

(15,226 |

) |

|

$ |

19,180 |

|

|

$ |

73,774 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjustments:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest Expense, Net

|

|

|

18,837 |

|

|

|

13,447 |

|

|

|

60,746 |

|

|

|

40,227 |

|

|

Income Tax Expense (Benefit)

|

|

|

643 |

|

|

|

(4,373 |

) |

|

|

8,399 |

|

|

|

4,493 |

|

|

Depreciation

|

|

|

2,570 |

|

|

|

2,607 |

|

|

|

10,308 |

|

|

|

10,107 |

|

|

Amortization

|

|

|

3,517 |

|

|

|

3,698 |

|

|

|

14,557 |

|

|

|

14,683 |

|

|

EBITDA

|

|

|

26,769 |

|

|

|

153 |

|

|

|

113,190 |

|

|

|

143,284 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Acquisition and Restructuring Costs

|

|

|

535 |

|

|

|

1,266 |

|

|

|

2,641 |

|

|

|

4,513 |

|

|

Change in Fair Value of Warrant Liability

|

|

|

(1,405 |

) |

|

|

(5,909 |

) |

|

|

4,111 |

|

|

|

(57,021 |

) |

|

Change in Fair Value of Earn-Out Liability

|

|

|

214 |

|

|

|

(1,449 |

) |

|

|

2,303 |

|

|

|

(10,731 |

) |

|

Equity-Based Compensation Expense

|

|

|

2,121 |

|

|

|

14,877 |

|

|

|

7,291 |

|

|

|

24,395 |

|

|

Product Rationalization

|

|

|

— |

|

|

|

4,519 |

|

|

|

(800 |

) |

|

|

4,519 |

|

|

Impairment of Indefinite-Lived Intangible Assets

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

2,395 |

|

|

Gain on Early Extinguishment of Debt

|

|

|

(701 |

) |

|

|

— |

|

|

|

(701 |

) |

|

|

— |

|

|

Notable Items

|

|

|

721 |

|

|

|

741 |

|

|

|

1,285 |

|

|

|

1,838 |

|

|

Other Expense

|

|

|

257 |

|

|

|

920 |

|

|

|

765 |

|

|

|

1,514 |

|

|

Adjusted EBITDA

|

|

$ |

28,511 |

|

|

$ |

15,118 |

|

|

$ |

130,085 |

|

|

$ |

114,706 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Revenues

|

|

$ |

155,707 |

|

|

$ |

154,165 |

|

|

$ |

659,704 |

|

|

$ |

688,415 |

|

|

Net Income Margin

|

|

|

0.8 |

% |

|

|

-9.9 |

% |

|

|

2.9 |

% |

|

|

10.7 |

% |

|

Adjusted EBITDA Margin

|

|

|

18.3 |

% |

|

|

9.8 |

% |

|

|

19.7 |

% |

|

|

16.7 |

% |

| |

|

For the thirteen weeks ended

|

|

|

For the year ended

|

|

| |

|

December 31,

|

|

|

December 31,

|

|

|

December 31,

|

|

|

December 31,

|

|

| |

|

2023

|

|

|

2022

|

|

|

2023

|

|

|

2022

|

|

|

Net Income (Loss)

|

|

$ |

1,202 |

|

|

$ |

(15,226 |

) |

|

$ |

19,180 |

|

|

$ |

73,774 |

|

|

Special items:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjust for: Change in Fair Value of Warrant Liability

|

|

|

(1,405 |

) |

|

|

(5,909 |

) |

|

|

4,111 |

|

|

|

(57,021 |

) |

|

Adjust for: Change in Fair Value of Earn-Out Liability

|

|

|

214 |

|

|

|

(1,449 |

) |

|

|

2,303 |

|

|

|

(10,731 |

) |

|

Adjust for: Gain on Early Extinguishment of Debt

|

|

|

(554 |

) |

|

|

— |

|

|

|

(554 |

) |

|

|

— |

|

|

Adjust for: Impairment of Indefinite-Lived Intangible Assets

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1,892 |

|

|

Adjusted Net Income (Loss)

|

|

$ |

(543 |

) |

|

$ |

(22,584 |

) |

|

$ |

25,040 |

|

|

$ |

7,914 |

|

| |

|

For the thirteen weeks ended

|

|

|

For the year ended

|

|

| |

|

December 31,

|

|

|

December 31,

|

|

|

December 31,

|

|

|

December 31,

|

|

| |

|

2023

|

|

|

2022

|

|

|

2023

|

|

|

2022

|

|

|

Net Cash Provided by Operating Activities

|

|

$ |

31,229 |

|

|

$ |

148 |

|

|

$ |

88,092 |

|

|

$ |

12,312 |

|

|

Capital Expenditures, Net of Dispositions

|

|

|

(1,328 |

) |

|

|

(1,430 |

) |

|

|

(4,453 |

) |

|

|

(12,702 |

) |

|

Free Cash Flow

|

|

$ |

29,901 |

|

|

$ |

(1,282 |

) |

|

$ |

83,639 |

|

|

$ |

(390 |

) |

| |

|

First Quarter 2024 Outlook

|

|

|

Full Year 2024 Outlook

|

|

| |

|

Low Range

|

|

|

High Range

|

|

|

Low Range

|

|

|

High Range

|

|

|

Net Sales

|

|

$ |

150,000 |

|

|

$ |

160,000 |

|

|

$ |

640,000 |

|

|

$ |

680,000 |

|

|

Adjusted EBITDA

|

|

|

27,000 |

|

|

|

33,000 |

|

|

|

125,000 |

|

|

|

145,000 |

|

|

Depreciation and Amortization

|

|

|

|

|

|

|

|

|

|

|

24,000 |

|

|

|

26,000 |

|

|

Interest Expense

|

|

|

|

|

|

|

|

|

|

|

50,000 |

|

|

|

55,000 |

|

|

Capital Expenditures

|

|

|

|

|

|

|

|

|

|

|

8,000 |

|

|

|

12,000 |

|

|

Bank-adjusted EBITDA Leverage Ratio

|

|

|

|

|

|

|

|

|

|

4.0x

|

|

|

3.5x

|

|

Holley defines EBITDA as earnings before depreciation, amortization of intangible assets, interest expense, and income tax expense. Holley defines Adjusted EBITDA as EBITDA adjusted to exclude, to the extent applicable, acquisition and restructuring costs, which includes transaction fees and expenses, termination related benefits, facilities relocation, and executive transition costs; changes in the fair value of the warrant liability; changes in the fair value of the earn-out liability; equity-based compensation expense; impairment of intangible assets; gain or loss on the early extinguishment of debt; non-cash charges due to a product rationalization initiative aimed at eliminating unprofitable or slow-moving stock keeping units, for which a partial reversal of the initial reserve was recognized during the year ended December 31, 2023; notable items that we do not believe are reflective of our underlying operating performance, which for the year ended December 31, 2023, includes certain costs incurred for advisory services related to identifying performance initiatives, and for the year ended December 31, 2022, includes a non-cash adjustment related to the adoption of ASC Topic 842, “Leases,” and legal fees and costs related to a settlement; and other expenses or gains, which includes gains or losses from disposal of fixed assets, franchise taxes, and gains or losses from foreign currency transactions. Adjusted EBITDA Margin is calculated as Adjusted EBITDA divided by total revenues.

Holley calculates Adjusted Net Income by excluding the after-tax effect of items considered by management to be special items from the earnings reported under U.S. GAAP. Management uses this measure to focus on on-going operations and believes that it is useful to investors because it enables them to perform meaningful comparisons of past and present consolidated operating results. Holley believes that using this information, along with net income, provides for a more complete analysis of the results of operations.

Holley defines Free Cash Flow as net cash provided by operating activities minus cash payments for capital expenditures, net of dispositions. Management believes providing Free Cash Flow is useful for investors to understand the Company's performance and results of cash generation after making capital investments required to support ongoing business operations.

A forecast for first quarter and full year 2024 Adjusted EBITDA and a forecast for full year 2024 Year-end Bank-adjusted EBITDA Leverage Ratio is provided on a non-GAAP basis only because certain information necessary to calculate the most comparable GAAP measure, net income, is unavailable due to the uncertainty and inherent difficulty of predicting the occurrence and the future financial statement impact of certain items. Therefore, as a result of the uncertainty and variability of the nature and amount of future adjustments, which could be significant, Holley is unable to provide a reconciliation of its forecasted 2024 Adjusted EBITDA and Bank-adjusted EBITDA Leverage Ratio without unreasonable effort.

v3.24.0.1

Document And Entity Information

|

Dec. 31, 2023 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

HOLLEY INC.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Feb. 28, 2024

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-39599

|

| Entity, Tax Identification Number |

87-1727560

|

| Entity, Address, Address Line One |

1801 Russellville Road

|

| Entity, Address, City or Town |

Bowling Green

|

| Entity, Address, State or Province |

KY

|

| Entity, Address, Postal Zip Code |

42101

|

| City Area Code |

270

|

| Local Phone Number |

782-2900

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity, Emerging Growth Company |

true

|

| Entity, Ex Transition Period |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001822928

|

| CommonStockParValue00001PerShare Custom [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common stock, par value $0.0001 per share

|

| Trading Symbol |

HLLY

|

| Security Exchange Name |

NYSE

|

| WarrantsEachExercisableForOneShareOfCommonStockAtAnExercisePriceOf1150PerShare Custom [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Warrants, each exercisable for one share of common stock at an exercise price of $11.50 per share

|

| Trading Symbol |

HLLY WS

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=hlly_CommonStockParValue00001PerShareCustomMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=hlly_WarrantsEachExercisableForOneShareOfCommonStockAtAnExercisePriceOf1150PerShareCustomMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

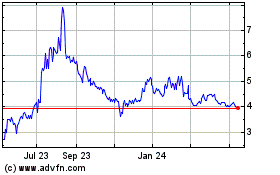

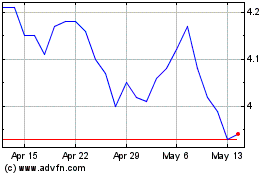

Holley (NYSE:HLLY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Holley (NYSE:HLLY)

Historical Stock Chart

From Apr 2023 to Apr 2024