false

0000880631

0000880631

2024-02-27

2024-02-27

0000880631

WT:CommonStock0.01ParValueMember

2024-02-27

2024-02-27

0000880631

WT:PreferredStockPurchaseRightsMember

2024-02-27

2024-02-27

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February

27, 2024

WisdomTree, Inc.

(Exact name of registrant as specified in its charter)

| Delaware |

001-10932 |

13-3487784 |

|

(State or other jurisdiction

of incorporation) |

(Commission

File Number) |

(IRS Employer

Identification No.) |

250

West 34th Street

3rd

Floor

New York, NY 10119

(Address of principal executive offices, including zip code)

(212) 801-2080

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Exchange Act:

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange

on which registered

|

| Common Stock, $0.01 par value |

|

WT |

|

The New York Stock Exchange |

| Preferred Stock Purchase Rights |

|

WT |

|

The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected

not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a)

of the Exchange Act. ¨

On February 27, 2024, WisdomTree, Inc. issued a press release

announcing that it has sent a letter to Graham Tuckwell, chairman of ETFS Capital Limited, from its Board of Directors (“Board”)

in response to a February 20, 2024 letter from Mr. Tuckwell to the Board. A copy of the press release is attached hereto as Exhibit 99.1

and incorporated herein by reference in its entirety.

| Item 9.01. | Financial Statements and Exhibits |

(d) Exhibits:

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act

of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

WisdomTree, Inc. |

| |

|

|

| Date: February 27, 2024 |

By: |

/s/ Marci Frankenthaler

|

| |

|

Marci Frankenthaler |

| |

|

Chief Legal Officer and Secretary |

3

Exhibit 99.1

WisdomTree Board of Directors Sends Letter

to Graham Tuckwell in Response to Mr. Tuckwell’s February 20 Letter to the Board

NEW YORK – February 27, 2024 – WisdomTree, Inc. (NYSE:

WT) (“WisdomTree” or the “Company”), a global financial innovator, today sent a letter to Graham Tuckwell, chairman

of ETFS Capital Limited, from its Board of Directors (“Board”) in response to a February 20, 2024 letter from Mr. Tuckwell

to the Board. Mr. Tuckwell sent the letter to the Board following a meeting Mr. Tuckwell had with two of WisdomTree’s Board members

on February 13, 2024. In an effort to be transparent with all of its stockholders, WisdomTree is publicly disclosing this letter from

the Board. Given the nature of the proposals contained in Mr. Tuckwell’s letter and the Company’s focus on ongoing stockholder

communications and engagement, the Board believes that it is important to make its response to Mr. Tuckwell’s letter publicly available.

No stockholder action is required at this time. A full copy of the

letter follows:

February 27, 2024

Mr. Graham Tuckwell

Chairman

ETFS Capital Limited

Dear Graham,

On behalf of the Board of Directors of WisdomTree, Inc., we are writing

in response to your February 20, 2024 letter to the Board, in which you asked the Board to consider the following proposals: (1) replacing

Jonathan Steinberg, our CEO; (2) raising outside money for WisdomTree Prime; and (3) appointing an investment bank to review strategic

alternatives for the Company. You also proposed that the Board immediately form a special committee of independent directors and publicly

announce an expeditious strategic review of the entire business.

After having carefully reviewed your proposals, we have unanimously

concluded not to implement them as we believe that taking any of these actions would undermine our long-term growth strategy and value-creation

initiatives.

This Board believes that if we were to implement your proposals, it

would jeopardize WisdomTree’s success and harm the Company and its stockholders.

| · | First, Mr. Steinberg has the unanimous support of the Board, and, importantly, our clients, employees and partners have overwhelming

trust and confidence in his abilities and vision for the Company. That confidence has been validated by our stockholders, as evidenced

by the fact that Mr. Steinberg received approximately 86% of the shares voted at the 2023 Annual Meeting of Stockholders, which represented

more votes than nearly all other director nominees. This trust was further evidenced by the Board’s recent unanimous approval of

both the 2024 annual budget and 2023 performance compensation. |

| · | Second, seeking to obtain third-party financing for our digital assets business is unnecessary. We have conviction in our digital

assets strategy and believe it is an appropriate use of capital. Furthermore, the Board and management believe that the digital assets

strategy is highly integrated with the Company’s overall strategy and critical to the Company’s future success. |

| · | Third, given the Company’s current trajectory and the progress demonstrated on various value-creation initiatives, the Board

does not believe that appointing an investment bank to review strategic alternatives, or forming a special committee of independent directors

and publicly announcing an expeditious strategic review of the entire business, is in the best interests of the Company and its stockholders. |

The Board recognizes its fiduciary duties to stockholders and is focused

on stockholder value creation. The Board continually monitors the Company’s business and strategies, as well as developments in

the business environment in which the Company operates. The Board will continue to carefully evaluate any proposals for strategic transactions

that it receives, in line with its fiduciary duties and commitment to acting in the best interests of all of the Company’s stockholders.

We have engaged with you in good faith and accommodated many of your

requests over the past two years: (1) we added two new Board members you proposed, (2) declassified our Board, and (3) formed a special

committee of the Board to review the cost structure, margins and strategy of our entire business, including digital assets. After a thorough

and deliberate review, the special committee found no reason to change our course and our Board unanimously reaffirmed support for our

CEO and our strategy and plan for stockholder value creation.

In 2023, we successfully defended against your proxy contest at our

Annual Meeting of Stockholders, in which you tried to replace three of our Board nominees with three of your own, including yourself.

Our stockholders voted to elect five of our six nominees, while rejecting your own candidacy, and approved a stockholder rights plan to

protect our Company from your activism campaign.

We are highly focused on corporate governance and, over the past three

years, have substantially refreshed our Board, adding key additional experience and perspective, and rotated all committee chair positions.

We have a diverse, independent and highly qualified Board that oversees WisdomTree’s strategy and performance with the best interests

of all stockholders in mind. Currently, two of our nine Board members were nominated by you in connection with your 2022 and 2023 activism

campaigns, respectively. One sits on all three Board committees and chairs the Audit Committee and the other, who joined the Board in

June 2023, is an active member of the Nominating and Governance Committee.

We believe that your letter presents an inaccurate picture of WisdomTree’s

performance, strategy and value proposition.

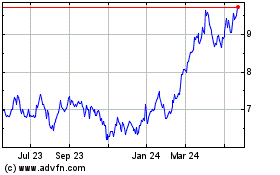

For example, while you claim that we should provide more visibility

into current initiatives, we publicly provide detailed KPIs and set the highest standard for shareholder transparency. Your claim that

management’s approach to shareholder communications does not resonate with investors is contradicted by the fact that, as the chart

attached illustrates, WisdomTree’s total stockholder return (TSR) has significantly outperformed its relevant peers over each of

the most recent 1, 2, 3 and 4-year time periods. WisdomTree’s stock price also has surpassed its 52-week high, and nears its 5-year

high.

In addition, you claim in your letter that value has been destroyed

since the Company acquired ETF Securities in 2018, which is inaccurate. We acquired the European ETP business of ETF Securities to diversify

our products, expand our markets and increase our scale and profitability. The acquisition has been very beneficial for WisdomTree, as

it boosted our earnings and cash flow and added value to our stockholders. We also used WisdomTree stock as a portion of the consideration

in the transaction when the shares were trading at a premium, which was a smart and strategic use of our capital that benefitted all other

WisdomTree stockholders.

We continue to demonstrate strong financial and operational performance,

outperforming our peers and the market in terms of organic AUM growth, margin expansion and stock price. We also have invested in innovation

and technology, launching new products and services that leverage our expertise in tokenization and blockchain-enabled finance. These

initiatives have enhanced our competitive advantage and position us for future growth.

We have a proven track record of delivering value to our stockholders,

and we have a clear and compelling strategy for the future. The Board continues to unanimously support our strategy and CEO, and recognizes

Mr. Steinberg’s strong performance. We are confident that we have the right leadership, the right vision and the right capabilities

to continue to grow and succeed in the evolving financial services industry. We remain focused on executing our strategy and delivering

superior results for all stockholders.

We urge you to respect the will of our stockholders and the judgment

of our Board. The WisdomTree Board and management are committed to constructive dialogue with our stockholders that furthers our goal

of creating stockholder value, and we remain open to continuing to engage in an open, constructive dialogue with you regarding the Company.

Sincerely,

The Board of Directors of WisdomTree, Inc.

Win Neuger

Chair of the Board

WisdomTree, Inc. Total Stockholder Return

About WisdomTree

WisdomTree is a global financial innovator, offering a well-diversified

suite of exchange-traded products (ETPs), models, solutions and products leveraging blockchain-enabled technology. We empower investors

and consumers to shape their future and support financial professionals to better serve their clients and grow their businesses. WisdomTree

is leveraging the latest financial infrastructure to create products that provide access, transparency and an enhanced user experience.

Building on our heritage of innovation, we are also developing and have launched next-generation digital products, services and structures,

including digital or blockchain-enabled mutual funds and tokenized assets, as well as our blockchain-native digital wallet, WisdomTree

Prime™.*

*The WisdomTree Prime digital wallet and digital asset services are

made available through WisdomTree Digital Movement, Inc. (NMLS ID: 2372500) in select U.S. jurisdictions and may be limited where prohibited

by law. Visit https://www.wisdomtreeprime.com or the WisdomTree Prime mobile app for more information.

WisdomTree currently has approximately $102.3 billion in assets under

management globally.

Total Stockholder Return

(As of 2/25/24; Sorted by 111 TSR1 Over Last: lY 2Y 3y 4Y WY 32.6% 43.1% 58.5% 94.6% ARAM 38.6 27.4 14.2 90.0 BLK 21.3 13.6 25.3 75.5

JH 20.4 0.5 24.1 64.9 VCTR 19.2 23.4 75.3 97.2 VRTS 15.0 (0.4) 0.2 113.2 TROW 4.8 (17.2) (22.9) 1.6 CNS 4.0 (4.3) 24.3 15.6 AMC (1.3)

10.6 12.0 92.1 BEN (4.5) (3.0) 16.1 39.1 FHI (6.2) 13.5 45.5 28.5 AB (7.1) (14.1) 16.2 46.2 BSIC (9.0) (7.1) 25.2 141.6 IVZ (9.3) (23.9)

(24.0) 16.0 Traddional AM Peer Avg. 6.6 1.5 17.8 63.2 Wisdom Tree Ranking #2 #1 #2 #4 Source: FactSet as of 2126/24

For more information about WisdomTree and WisdomTree Prime™,

visit: https://www.wisdomtree.com.

Please visit us on X, formerly known as Twitter, at @WisdomTreeNews.

WisdomTree® is the marketing name for WisdomTree, Inc. and its

subsidiaries worldwide.

Cautionary Statement Regarding Forward-Looking Statements

This press release may contain a number of “forward-looking statements”

as defined in the Private Securities Litigation Reform Act of 1995. These forward-looking statements are based on WisdomTree’s management’s

current expectations, estimates, projections and beliefs, as well as a number of assumptions concerning future events. These forward-looking

statements are not guarantees of future performance, conditions or results, and involve a number of known and unknown risks, uncertainties,

assumptions and other important factors, many of which are outside WisdomTree’s management’s control, that could cause actual

results to differ materially from the results discussed in the forward-looking statements. Forward-looking statements in this press release

may include statements relating to WisdomTree’s strategy, its digital assets business, its value creation initiatives and its overall

trajectory. Forward-looking statements included in this release speak only as of the date of this release. WisdomTree does not undertake

any obligation to update its forward-looking statements to reflect events or circumstances after the date of this release except as may

be required by the federal securities laws.

Investor Relations

WisdomTree, Inc.

Jeremy Campbell

+1.646.522.2602

Jeremy.Campbell@wisdomtree.com

Media Relations

WisdomTree, Inc.

Jessica Zaloom

+1.917.267.3735

jzaloom@wisdomtree.com / wisdomtree@fullyvested.com

H/Advisors Abernathy

Tom Johnson / Dana Gorman

+1.212.371.5999

tom.johnson@h-advisors.global / dana.gorman@h-advisors.global

Category: Business Update

5

v3.24.0.1

Cover

|

Feb. 27, 2024 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 27, 2024

|

| Entity File Number |

001-10932

|

| Entity Registrant Name |

WisdomTree, Inc.

|

| Entity Central Index Key |

0000880631

|

| Entity Tax Identification Number |

13-3487784

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

250

West 34th Street

|

| Entity Address, Address Line Two |

3rd

Floor

|

| Entity Address, City or Town |

New York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10119

|

| City Area Code |

(212)

|

| Local Phone Number |

801-2080

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock, $0.01 par value |

|

| Title of 12(b) Security |

Common Stock, $0.01 par value

|

| Trading Symbol |

WT

|

| Security Exchange Name |

NYSE

|

| Preferred Stock Purchase Rights |

|

| Title of 12(b) Security |

Preferred Stock Purchase Rights

|

| Trading Symbol |

WT

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=WT_CommonStock0.01ParValueMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=WT_PreferredStockPurchaseRightsMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

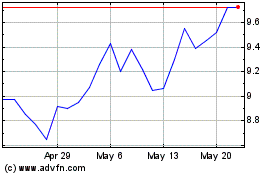

WisdomTree (NYSE:WT)

Historical Stock Chart

From Apr 2024 to May 2024

WisdomTree (NYSE:WT)

Historical Stock Chart

From May 2023 to May 2024