0001910851falseR1 RCM Inc. /DE00019108512024-02-272024-02-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

________________________

FORM 8-K

________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 27, 2024

____________

R1 RCM Inc.

(Exact Name of Registrant as Specified in Charter)

____________

| | | | | | | | |

| Delaware | 001-41428 | 87-4340782 |

(State or Other Jurisdiction

of Incorporation) | (Commission

File Number) | (IRS Employer

Identification No.) |

| | | | | |

| 433 W. Ascension Way | 84123 |

| Suite 200 |

| Murray |

| Utah |

| (Address of Principal Executive Offices) | (Zip Code) |

Registrant’s telephone number, including area code: (312) 324-7820

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common stock, par value $0.01 per share | RCM | NASDAQ |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition

On February 27, 2024, R1 RCM Inc. (the “Company”) announced its financial results for the fiscal quarter and fiscal year ended December 31, 2023. The full text of the press release issued in connection with the announcement is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

Item 7.01 Regulation FD Disclosure

The Company is hosting an investor conference call on February 27, 2024 regarding its financial results for the fiscal quarter and fiscal year ended December 31, 2023. The slide presentation to be used in conjunction with the investor conference call is furnished as Exhibit 99.2 to this Current Report on Form 8-K and will be posted on the Company’s website.

The information in this Form 8-K (including Exhibits 99.1 and 99.2) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits

| | | | | | | | |

| (d) | Exhibit Number | Description |

| | |

| | |

| 104 | Cover Page Interactive Data File - the cover page iXBRL tags are embedded within the Inline XBRL document |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | R1 RCM INC. |

| | | |

| Date: February 27, 2024 | | |

| | | |

| | By: /s/ Jennifer Williams |

| | Name: Jennifer Williams |

| | Title: Chief Financial Officer |

R1 RCM Reports Fourth Quarter and Full Year 2023 Results

Murray, Utah - February 27, 2024 - R1 RCM Inc. (NASDAQ: RCM) ("R1" or the "Company"), a leading provider of technology-driven solutions that transform the financial performance and patient experience for health systems, hospitals, and physician groups, today announced results for the three months and year ended December 31, 2023.

Fourth Quarter 2023 Results:

•Revenue of $575.1 million, up $41.8 million or 7.8% compared to the same period last year

•GAAP net income of $1.4 million, compared to a net loss of $36.6 million in the same period last year

•Adjusted EBITDA of $167.7 million, up $42.1 million or 33.5% compared to the same period last year

Full Year 2023 Results:

•Revenue of $2,254.2 million, up $447.8 million or 24.8% compared to 2022

•GAAP net income of $3.3 million, compared to net loss of $63.3 million in 2022

•Adjusted EBITDA of $614.3 million, up $190.5 million or 45.0% compared to 2022

“R1 executed on its key objectives in 2023. We established a stronger foundation for growth, stabilized key metrics for several clients and delivered approximately $30 million in synergies from the Cloudmed integration,” stated Lee Rivas, R1's CEO. “In addition, we strengthened our technology platform by driving innovation through generative AI and enhanced our global infrastructure to improve our performance and competitive position in the market.”

Mr. Rivas added, “We enter 2024 with a more diversified business, enhanced technology initiatives and increased global scale. Our strategy is to leverage our best-in-class capabilities to deploy flexible models that meet customers where they are in their revenue cycle journey. We believe R1’s breadth of capabilities and data-driven technology platform, combined with our focus on operational excellence, positions us to drive value for our customers while delivering long-term sustainable growth and improved financial performance for our shareholders.”

2024 Outlook

For 2024, R1 expects to generate:

•Revenue of between $2,625 million and $2,675 million

•GAAP operating income of $105 million to $135 million

•Adjusted EBITDA of $650 million to $670 million

Jennifer Williams, R1’s CFO said, “Our outlook for fiscal 2024 reflects the strength of our platform and our focus on both growth and operating discipline to deliver great value for our customers and shareholders. To further our leadership position in the industry, we will continue improving execution across our business, advancing our new business pipeline and investing in technology, while remaining committed to improving margins and cash flows.”

Supplemental Forward-Looking Information and Assumptions for Fiscal Year 2024

The Company is providing the following supplemental expectations and related assumptions regarding its fiscal year 2024 results, all of which are subject to change, to further provide transparency to investors:

•Revenue of $2,625 to $2,675 million assumes the following:

▪Net operating fees and incentive fees remain consistent with the fourth quarter 2023 run rate (excluding Providence and Acclara contributions), with expected low single digit year-over-year cash collection growth offset by customer attrition and facility divestitures.

▪Modular and Other revenue assumes revenue growth in the low teens.

▪We anticipate Acclara and Providence to contribute revenue of approximately $290 to 295 million, and $45 to 50 million, respectively.

•Capital expenditures of approximately 5% of revenue for the fiscal year.

•Other expenses for the fiscal year of approximately $105 to $125 million, including integration expenses in connection with the Acclara acquisition.

•Interest expense in the range of $160 to $165 million for the fiscal year, including the impact of $575 million in additional Term B Loans and the $80 million draw on the Company’s senior revolving credit facility related to the Acclara acquisition.

•Depreciation and amortization expense of $330 to $350 million.

Conference Call and Webcast Details

R1’s management team will host a conference call today at 8:00 a.m. Eastern Time to discuss its financial results and business outlook. To participate, please dial 888-330-2022 (646-960-0690 outside the U.S. and Canada) using conference code number 5681952. A live webcast and replay of the call will be available at the Investor Relations section of the Company’s website at ir.r1rcm.com.

Non-GAAP Financial Measures

In order to provide a more comprehensive understanding of the information used by R1’s management team in financial and operational decision making, the Company supplements its GAAP consolidated financial statements with certain non-GAAP financial measures, including adjusted EBITDA, non-GAAP cost of services, non-GAAP selling, general and administrative expenses, and net debt. Adjusted EBITDA is defined as GAAP net income (loss) before net interest income/expense, income tax provision/benefit, depreciation and amortization expense, share-based compensation expense, CoyCo 2, L.P. (“CoyCo 2”) share-based compensation expense, and certain other items, including business acquisition costs, integration costs, technology transformation, strategic initiatives, and facility-exit charges. Non-GAAP cost of services is defined as GAAP cost of services less share-based compensation expense, CoyCo 2 share-based compensation expense, and depreciation and amortization expense attributed to cost of services. Non-GAAP selling, general and administrative expenses is defined as GAAP selling, general and administrative expenses less share-based compensation expense, CoyCo 2 share-based compensation expense, and depreciation and amortization expense attributed to selling, general and administrative expenses. Net debt is defined as debt less cash and cash equivalents, inclusive of restricted cash. Adjusted EBITDA guidance is reconciled to operating income guidance, the most closely comparable available GAAP measure.

The Company's board of directors and management team use adjusted EBITDA as (i) one of the primary methods for planning and forecasting overall expectations and for evaluating actual results against such expectations and (ii) a performance evaluation metric in determining achievement of certain executive incentive compensation programs, as well as for incentive compensation programs for employees. Non-GAAP cost of services and non-GAAP selling, general and administrative expenses are used to calculate adjusted EBITDA. Net debt is used as a supplemental measure of the Company's liquidity.

Tables 4 through 9 present a reconciliation of GAAP financial measures to non-GAAP financial measures. Non-GAAP measures should be considered in addition to, but not as a substitute for, the information prepared in accordance with GAAP.

Forward Looking Statements

This press release contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, as amended and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of historical facts, included in this press release are forward-looking statements. The words “anticipate,” “believe,” “contemplate,” “designed,” “estimate,” “expect,” “forecast,” “goal,” “intend,” “may,” “outlook,” “plan,” “predict,” “project,” “see,” “seek,” “target,” “would” and similar expressions or variations or negatives of these words are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. Such forward-looking statements include, among other things, statements about the Company’s strategy, future operations, future financial position, prospects, plans, objectives of management, ability to successfully deliver on commitments to customers, ability to deploy new business as planned, ability to successfully implement new technologies, and expected market growth. Such forward-looking statements are based on management’s current expectations about future events as of the date hereof and involve many risks and uncertainties that could cause the Company’s actual results to differ materially from those expressed or implied in its forward-looking statements. Subsequent events and developments, including actual results or changes in the Company’s assumptions, may cause the Company’s views to change. The Company does not undertake to update its forward-looking statements except to the extent required by applicable law. Readers are cautioned not to place undue reliance on such forward-looking statements. All forward-looking statements included herein are expressly qualified in their entirety by these cautionary statements. The Company’s actual results and outcomes could differ materially from those included in these forward-looking statements as a result of various factors, including, but not limited to, economic downturns and market conditions beyond the Company’s control, including high inflation; the quality of global financial markets; the Company’s ability to timely and successfully achieve the anticipated benefits and potential synergies of the acquisitions of Cloudmed and Acclara; the Company’s ability to retain existing customers or acquire new customers; the development of markets for the Company’s revenue cycle management offering; variability in the lead time of prospective customers; competition within the market; breaches or failures of the Company’s information security measures or unauthorized access to a customer’s data; delayed or unsuccessful implementation of the Company’s technologies or services, or unexpected implementation costs; disruptions

in or damages to the Company’s global business services centers and third-party operated data centers; the volatility of the Company’s stock price; the impact of the recent restatements of the financial statements for the applicable periods on the price of the Company’s common stock, reputation and relationships with its investors, suppliers, customers, employees and other parties; the Company’s substantial indebtedness; and the factors set forth under the heading “Risk Factors” in the Company’s most recent annual report on Form 10-K, and any other periodic reports that the Company may file with the U.S. Securities and Exchange Commission.

About R1 RCM

R1 is a leading provider of technology-driven solutions that transform the patient experience and financial performance of healthcare providers. R1’s proven and scalable operating models seamlessly complement a healthcare organization’s infrastructure, quickly driving sustainable improvements to net patient revenue and cash flows while reducing operating costs and enhancing the patient experience. To learn more, visit: r1rcm.com.

Contact:

R1 RCM Inc.

Investor Relations:

Evan Smith, CFA

516-743-5184

investorrelations@r1rcm.com

Media Relations:

Yancey Casey

Amendola Communications

678-895-9401

ycasey@acmarketingpr.com

| | | | | | | | | | | | | | |

| Table 1 |

| R1 RCM Inc. |

| Consolidated Balance Sheets |

| (In millions) |

| | (Unaudited) | | |

| | | December 31, |

| | | 2023 | | 2022 |

| Assets | | | | |

| Current assets: | | | | |

| Cash and cash equivalents | | $ | 173.6 | | | $ | 110.1 | |

| | | | |

| Accounts receivable, net of $48.2 million and $15.1 million allowance as of December 31, 2023 and 2022, respectively | | 243.3 | | | 235.2 | |

| Accounts receivable - related party, net of $0.1 million allowance as of December 31, 2023 and 2022 | | 26.1 | | | 25.0 | |

| Current portion of contract assets, net | | 94.4 | | | 83.9 | |

| Prepaid expenses and other current assets | | 95.9 | | | 110.3 | |

| Total current assets | | 633.3 | | | 564.5 | |

| Property, equipment and software, net | | 173.7 | | | 164.8 | |

| Operating lease right-of-use assets | | 62.5 | | | 80.5 | |

| Non-current portion of contract assets, net | | 37.7 | | | 32.0 | |

| Non-current portion of deferred contract costs | | 30.4 | | | 26.7 | |

| Intangible assets, net | | 1,310.7 | | | 1,514.5 | |

| Goodwill | | 2,629.4 | | | 2,640.3 | |

| Non-current deferred tax assets | | 10.9 | | | 10.4 | |

| | | | |

| Other assets | | 71.6 | | | 88.1 | |

| Total assets | | $ | 4,960.2 | | | $ | 5,121.8 | |

| | | | |

| Liabilities | | | | |

| Current liabilities: | | | | |

| Accounts payable | | $ | 22.7 | | | $ | 33.4 | |

| Current portion of customer liabilities | | 39.8 | | | 57.5 | |

| Current portion of customer liabilities - related party | | 5.2 | | | 7.4 | |

| Accrued compensation and benefits | | 126.3 | | | 109.0 | |

| Current portion of operating lease liabilities | | 19.3 | | | 18.0 | |

| Current portion of long-term debt | | 67.0 | | | 53.9 | |

| Accrued expenses and other current liabilities | | 65.9 | | | 70.5 | |

| Total current liabilities | | 346.2 | | | 349.7 | |

| Non-current portion of customer liabilities | | 2.7 | | | 5.0 | |

| Non-current portion of customer liabilities - related party | | 11.8 | | | 13.7 | |

| Non-current portion of operating lease liabilities | | 77.8 | | | 94.4 | |

| Long-term debt | | 1,570.5 | | | 1,732.6 | |

| Non-current deferred tax liabilities | | 176.6 | | | 200.8 | |

| Other non-current liabilities | | 23.2 | | | 23.1 | |

| Total liabilities | | 2,208.8 | | | 2,419.3 | |

| | | | |

| | | | |

| Stockholders’ equity: | | | | |

| Common stock | | 4.5 | | | 4.4 | |

| Additional paid-in capital | | 3,197.4 | | | 3,123.3 | |

| Accumulated deficit | | (136.7) | | | (140.0) | |

| Accumulated other comprehensive loss | | (5.9) | | | (3.4) | |

| Treasury stock | | (307.9) | | | (281.8) | |

| Total stockholders’ equity | | 2,751.4 | | | 2,702.5 | |

| Total liabilities and stockholders’ equity | | $ | 4,960.2 | | | $ | 5,121.8 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Table 2 |

| R1 RCM Inc. |

| Consolidated Statements of Operations |

| (In millions, except share and per share data) |

| | | | |

| | (Unaudited) | | (Unaudited) | | (Unaudited) | | |

| | | Three Months Ended December 31, | | Year Ended December 31, |

| | | 2023 | | 2022 | | 2023 | | 2022 |

| Net operating fees | | $ | 369.1 | | | $ | 344.9 | | | $ | 1,455.9 | | | $ | 1,309.7 | |

| Incentive fees | | 23.9 | | | 25.9 | | | 108.4 | | | 106.8 | |

| Modular and other | | 182.1 | | | 162.5 | | | 689.9 | | | 389.9 | |

| Net services revenue | | 575.1 | | | 533.3 | | | 2,254.2 | | | 1,806.4 | |

| Operating expenses: | | | | | | | | |

| Cost of services | | 441.6 | | | 435.5 | | | 1,769.7 | | | 1,446.9 | |

| Selling, general and administrative | | 55.7 | | | 54.3 | | | 220.0 | | | 172.5 | |

| Other expenses | | 28.7 | | | 47.3 | | | 116.6 | | | 189.8 | |

| Total operating expenses | | 526.0 | | | 537.1 | | | 2,106.3 | | | 1,809.2 | |

| Income (loss) from operations | | 49.1 | | | (3.8) | | | 147.9 | | | (2.8) | |

| | | | | | | | |

| | | | | | | | |

| Net interest expense | | 31.6 | | | 28.7 | | | 126.9 | | | 64.0 | |

| Income (loss) before income tax provision (benefit) | | 17.5 | | | (32.5) | | | 21.0 | | | (66.8) | |

| Income tax provision (benefit) | | 16.1 | | | 4.1 | | | 17.7 | | | (3.5) | |

| Net income (loss) | | $ | 1.4 | | | $ | (36.6) | | | $ | 3.3 | | | $ | (63.3) | |

| | | | | | | | |

| Net income (loss) per common share: | | | | | | | | |

| Basic | | $ | — | | | $ | (0.09) | | | $ | 0.01 | | | $ | (0.18) | |

| Diluted | | $ | — | | | $ | (0.09) | | | $ | 0.01 | | | $ | (0.18) | |

| Weighted average shares used in calculating net income (loss) per common share: | | | | | | | | |

| Basic | | 419,440,458 | | | 416,680,429 | | | 418,587,390 | | | 352,337,767 | |

| Diluted | | 451,499,913 | | | 416,680,429 | | | 454,094,374 | | | 352,337,767 | |

| | | | | | | | | | | | | | | | |

| Table 3 | | |

| R1 RCM Inc. | | |

| Consolidated Statements of Cash Flows | | |

| (In millions) | | |

| | (Unaudited) | | | | |

| | | Year Ended December 31, | | |

| | | 2023 | | 2022 | | |

| Operating activities | | | | | | |

| Net income (loss) | | $ | 3.3 | | | $ | (63.3) | | | |

| Adjustments to reconcile net income (loss) to net cash provided by (used in) operations: | | | | | | |

| Depreciation and amortization | | 278.3 | | | 172.0 | | | |

| Amortization of debt issuance costs | | 5.7 | | | 3.6 | | | |

| Share-based compensation | | 64.2 | | | 59.8 | | | |

| CoyCo 2 share-based compensation | | 7.3 | | | 5.1 | | | |

| | | | | | |

| Loss/(gain) on disposal and right-of-use asset write-downs | | 10.0 | | | 21.1 | | | |

| | | | | | |

| Provision for credit losses | | 34.6 | | | 11.8 | | | |

| Deferred income taxes | | (14.6) | | | (6.8) | | | |

| Non-cash lease expense | | 11.5 | | | 14.0 | | | |

| Other | | 12.3 | | | 6.5 | | | |

| | | | | | |

| Changes in operating assets and liabilities: | | | | | | |

| Accounts receivable and related party accounts receivable | | (44.0) | | | (51.8) | | | |

| Contract assets | | (15.2) | | | (24.1) | | | |

| Prepaid expenses and other assets | | 3.9 | | | (40.5) | | | |

| Accounts payable | | (10.9) | | | (16.0) | | | |

| Accrued compensation and benefits | | 17.4 | | | (69.5) | | | |

| Operating lease liabilities | | (18.0) | | | (18.9) | | | |

| Other liabilities | | 17.9 | | | (1.7) | | | |

| Customer liabilities and customer liabilities - related party | | (23.6) | | | (11.2) | | | |

| Net cash provided by (used in) operating activities | | 340.1 | | | (9.9) | | | |

| Investing activities | | | | | | |

| Purchases of property, equipment, and software | | (102.5) | | | (93.5) | | | |

| | | | | | |

| | | | | | |

| Payment for business acquisitions, net of cash acquired | | — | | | (847.7) | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| Other | | (0.3) | | | (8.3) | | | |

| Net cash used in investing activities | | (102.8) | | | (949.5) | | | |

| Financing activities | | | | | | |

| | | | | | |

| Issuance of senior secured debt, net of discount and issuance costs | | — | | | 1,016.6 | | | |

| | | | | | |

| Borrowings on revolver | | 30.0 | | | 50.0 | | | |

| Payment of debt issuance costs | | — | | | (1.0) | | | |

| Repayment of senior secured debt | | (53.9) | | | (25.5) | | | |

| | | | | | |

| Repayments on revolver | | (130.0) | | | (30.0) | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| Payment of equity issuance costs | | — | | | (2.0) | | | |

| Exercise of vested stock options | | 1.3 | | | 4.6 | | | |

| | | | | | |

| Purchase of treasury stock | | — | | | (39.3) | | | |

| Shares withheld for taxes | | (26.5) | | | (30.2) | | | |

| | | | | | |

| Other | | 5.2 | | | (0.2) | | | |

| Net cash (used in) provided by financing activities | | (173.9) | | | 943.0 | | | |

| Effect of exchange rate changes in cash | | 0.1 | | | (3.6) | | | |

| Net increase (decrease) in cash, cash equivalents, and restricted cash | | 63.5 | | | (20.0) | | | |

| Cash, cash equivalents, and restricted cash at beginning of period | | 110.1 | | | 130.1 | | | |

| Cash, cash equivalents, and restricted cash at end of period | | $ | 173.6 | | | $ | 110.1 | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Table 4 |

| R1 RCM Inc. |

| Reconciliation of GAAP Net Income (Loss) to Non-GAAP Adjusted EBITDA (Unaudited) |

| (In millions) |

| | | | | | | | |

| | Three Months Ended December 31, | | 2023 vs. 2022 Change | | Year Ended December 31, | | 2023 vs. 2022 Change |

| | 2023 | | 2022 | | Amount | | % | | 2023 | | 2022 | | Amount | | % |

| Net income (loss) | | $ | 1.4 | | | $ | (36.6) | | | $ | 38.0 | | | (104) | % | | $ | 3.3 | | | $ | (63.3) | | | $ | 66.6 | | | (105) | % |

| Net interest expense | | 31.6 | | | 28.7 | | | 2.9 | | | 10 | % | | 126.9 | | | 64.0 | | | 62.9 | | | 98 | % |

| Income tax provision (benefit) | | 16.1 | | | 4.1 | | | 12.0 | | | (293) | % | | 17.7 | | | (3.5) | | | 21.2 | | | (606) | % |

| Depreciation and amortization expense | | 72.7 | | | 64.2 | | | 8.5 | | | 13 | % | | 278.3 | | | 172.0 | | | 106.3 | | | 62 | % |

| Share-based compensation expense | | 15.3 | | | 15.8 | | | (0.5) | | | (3) | % | | 64.2 | | | 59.7 | | | 4.5 | | | 8 | % |

| CoyCo 2 share-based compensation expense | | 1.9 | | | 2.1 | | | (0.2) | | | — | % | | 7.3 | | | 5.1 | | | 2.2 | | | — | % |

| | | | | | | | | | | | | | | | |

| Other expenses (1) | | 28.7 | | | 47.3 | | | (18.6) | | | (39) | % | | 116.6 | | | 189.8 | | | (73.2) | | | (39) | % |

| Adjusted EBITDA (non-GAAP) | | $ | 167.7 | | | $ | 125.6 | | | $ | 42.1 | | | 34 | % | | $ | 614.3 | | | $ | 423.8 | | | $ | 190.5 | | | 45 | % |

(1) For details see Note 14, Other Expenses, to the Consolidated Financial Statements included in the Company's Annual Report on Form 10-K.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Table 5 |

| R1 RCM Inc. |

| Reconciliation of GAAP Cost of Services to Non-GAAP Cost of Services (Unaudited) |

| (In millions) |

| | | | | | | | |

| | Three Months Ended December 31, | | Year Ended December 31, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Cost of services | | $ | 441.6 | | | $ | 435.5 | | | $ | 1,769.7 | | | $ | 1,446.9 | |

| Less: | | | | | | | | |

| Share-based compensation expense | | 10.9 | | | 7.4 | | | 41.6 | | | 28.1 | |

| CoyCo 2 share-based compensation expense | | 0.4 | | | (0.3) | | | 1.8 | | | 0.7 | |

| Depreciation and amortization expense | | 72.5 | | | 63.8 | | | 277.1 | | | 170.8 | |

| Non-GAAP cost of services | | $ | 357.8 | | | $ | 364.6 | | | $ | 1,449.2 | | | $ | 1,247.3 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Table 6 |

| R1 RCM Inc. |

| Reconciliation of GAAP Selling, General and Administrative to Non-GAAP Selling, General and Administrative (Unaudited) |

| (In millions) |

| | | | | | | | |

| | Three Months Ended December 31, | | Year Ended December 31, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Selling, general and administrative | | $ | 55.7 | | | $ | 54.3 | | | $ | 220.0 | | | $ | 172.5 | |

| Less: | | | | | | | | |

| Share-based compensation expense | | 4.4 | | | 8.4 | | | 22.6 | | | 31.6 | |

| CoyCo 2 share-based compensation expense | | 1.5 | | | 2.4 | | | 5.5 | | | 4.4 | |

| Depreciation and amortization expense | | 0.2 | | | 0.4 | | | 1.2 | | | 1.2 | |

| Non-GAAP selling, general and administrative | | $ | 49.6 | | | $ | 43.1 | | | $ | 190.7 | | | $ | 135.3 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Table 7 |

| R1 RCM Inc. |

| Consolidated Non-GAAP Financial Information (Unaudited) |

| (In millions) |

| | | | | | | | |

| | | Three Months Ended December 31, | | Year Ended December 31, |

| | | 2023 | | 2022 | | 2023 | | 2022 |

| Net operating fees | | $ | 369.1 | | | $ | 344.9 | | | $ | 1,455.9 | | | $ | 1,309.7 | |

| Incentive fees | | 23.9 | | | 25.9 | | | 108.4 | | | 106.8 | |

| Modular and other | | 182.1 | | | 162.5 | | | 689.9 | | | 389.9 | |

| Net services revenue | | 575.1 | | | 533.3 | | | 2,254.2 | | | 1,806.4 | |

| | | | | | | | |

| Operating expenses: | | | | | | | | |

| Cost of services (non-GAAP) | | 357.8 | | | 364.6 | | | 1,449.2 | | | 1,247.3 | |

| Selling, general and administrative (non-GAAP) | | 49.6 | | | 43.1 | | | 190.7 | | | 135.3 | |

| Sub-total (non-GAAP) | | 407.4 | | | 407.7 | | | 1,639.9 | | | 1,382.6 | |

| | | | | | | | |

| Adjusted EBITDA | | $ | 167.7 | | | $ | 125.6 | | | $ | 614.3 | | | $ | 423.8 | |

| | | | | |

| Table 8 |

| R1 RCM Inc. |

| Reconciliation of GAAP Operating Income Guidance to Non-GAAP Adjusted EBITDA Guidance (Unaudited) |

| (In millions) |

| |

| | 2024E |

| GAAP Operating Income Guidance | $105-135 |

| Plus: | |

| Depreciation and amortization expense | $330-350 |

| Share-based compensation expense | $80-90 |

| |

| Strategic initiatives, severance and other costs | $105-125 |

| Adjusted EBITDA Guidance | $650-670 |

| | | | | | | | | | | | | | |

| Table 9 |

| R1 RCM Inc. |

| Reconciliation of Total Debt to Net Debt (Unaudited) |

| (In millions) |

| | | | |

| | December 31, | | December 31, |

| | | 2023 | | 2022 |

| Senior Revolver | | $ | — | | | $ | 100.0 | |

| Term A Loans | | 1,162.5 | | | 1,211.4 | |

| Term B Loan | | 493.8 | | | 498.7 | |

| Total debt | | 1,656.3 | | | 1,810.1 | |

| | | | |

| Less: | | | | |

| Cash and cash equivalents | | 173.6 | | | 110.1 | |

| | | | |

| | | | |

| Net Debt | | $ | 1,482.7 | | | $ | 1,700.0 | |

11 Nasdaq: RCM • February 27, 2024 Fourth Quarter & Full Year 2023 Earnings Call Exhibit 99.2

22 Forward-Looking Statements This presentation contains “forward-looking statements” made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements generally relate to future events and relationships, plans, future growth and future performance, including, but not limited to, statements about the effects of the acquisition of Acclara and related transactions, the Company's strategic initiatives, the Company's capital plans, the Company's costs, the Company's ability to successfully implement new technologies, the Company's future financial and operational performance, and the Company's liquidity. These statements are often identified by the use of words such as “anticipate,” “believe,” “contemplate,” “designed,” “estimate,” “expect,” “forecast,” “goal,” “intend,” “may,” “outlook,” “plan,” “predict,” “project,” “see,” “seek,” "should,” “target,” “would,” and similar expressions or variations or negatives of these words, although not all forward-looking statements contain these identifying words. These statements are based on various assumptions, whether or not identified in this presentation, and on the current expectations of the Company's management and are not predictions of actual performance. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on by any investor as, a guarantee, assurance, prediction or definitive statement of fact or probability. Actual outcomes and results may differ materially from those contemplated by these forward-looking statements as a result of uncertainties, risks and changes in circumstances, including but not limited to risks and uncertainties related to: (i) economic downturns and market conditions beyond the Company’s control, including high inflation; (ii) the quality of global financial markets; (iii) the Company’s ability to timely and successfully achieve the anticipated benefits and potential synergies of the acquisitions of Cloudmed and Acclara; (iv) the Company’s ability to retain existing customers or acquire new customers; (v) the development of markets for the Company’s revenue cycle management offering; (vi) variability in the lead time of prospective customers; (vii) competition within the market; (viii) breaches or failures of the Company’s information security measures or unauthorized access to a customer’s data; (ix) delayed or unsuccessful implementation of the Company’s technologies or services, or unexpected implementation costs; (x) disruptions in or damages to the Company’s global business services centers and third-party operated data centers; (xi) the volatility of the Company’s stock price; (xii) the impact of the recent restatements of the financial statements for the applicable periods on the price of the Company’s common stock, reputation and relationships with its investors, suppliers, customers, employees and other parties; and (xiii) the Company’s substantial indebtedness. Additional risks and uncertainties that could cause actual outcomes and results to differ materially from those contemplated by the forward-looking statements are included under the heading “Risk Factors” in the Company's annual report on Form 10-K for the year ended December 31, 2023, quarterly reports on Form 10-Q and any other periodic reports that the Company may file with the U.S. Securities and Exchange Commission. The foregoing list of factors is not exhaustive. All forward-looking statements included herein are expressly qualified in their entirety by these cautionary statements as of the date hereof and involve many risks and uncertainties that could cause actual results to differ materially from those expressed or implied in the forward-looking statements. Subsequent events and developments, including actual results or changes in the Company's assumptions, may cause the Company's views to change. The Company assumes no obligation and does not intend to update these forward-looking statements, except as required by law. You are cautioned not to place undue reliance on such forward-looking statements. Non-GAAP Financial Information Some of the financial information and data contained in this presentation, including Adjusted EBITDA (and related measures), have not been prepared in accordance with U.S. generally accepted accounting principles (“GAAP”). These non-GAAP financial measures are calculated differently from, and therefore may not be comparable to, similarly titled measures used by other companies. These non-GAAP financial measures should not be considered in isolation or as a substitute for analysis of our results of operations as reported under GAAP. Please refer to the Appendix located at the end of this presentation for a reconciliation of non-GAAP financial measures to their most directly comparable GAAP financial measure.

33 ($ in millions) 4Q’23 FY’23 Revenue $ 575.1 $ 2,254.2 Adjusted Cost of Services1 $ 357.8 $ 1,449.2 Adjusted SG&A Expense1 $ 49.6 $ 190.7 Adjusted EBITDA1 $ 167.7 $ 614.3 CEO Summary R1 is a registered trademark of R1 RCM Inc. All rights reserved. Proprietary Confidential Information. FINANCIAL RESULTS Q4 & FY’23 • Stabilized key metrics for customers • Achieved ~$30M in synergies from the Cloudmed integration • Accelerated technology through GenerativeAI • Created embedded future growth with Acclara / Providence deal 2023 BUSINESS HIGHLIGHTS • Align Go-To-Market approach with customers • Execute new customer onboarding • Execute against technology roadmap • Focus on operational delivery 2024 BUSINESS PRIORITIES Note1: Adjusted cost of services, adjusted SG&A expense, and adjusted EBITDA are non-GAAP measures; refer to the Appendix for reconciliations of non-GAAP financial measures.

44 Q4’23 Performance R1 is a registered trademark of R1 RCM Inc. All rights reserved. Proprietary Confidential Information. Note1: Adjusted cost of services, adjusted SG&A expense, and adjusted EBITDA are non-GAAP measures; refer to the Appendix for reconciliations of non-GAAP financial measures. ($ in millions) 4Q’23 4Q’22 % Change Revenue $ 575.1 $ 533.3 7.8% Adjusted Cost of Services1 $ 357.8 $ 364.6 -1.9% Adjusted SG&A Expense1 $ 49.6 $ 43.1 15.1% Adjusted EBITDA1 $ 167.7 $ 125.6 33.5% • Revenue growth driven by new customer onboarding and modular solutions • Decline to adjusted cost of services was driven by margin maturity and synergy realization • Adjusted SG&A expense impacted by credit allowances and incremental technology investments offset by synergies • Adjusted EBITDA was positively impacted by revenue growth, continued cost discipline, and Cloudmed integration efforts

55 FY’23 Performance R1 is a registered trademark of R1 RCM Inc. All rights reserved. Proprietary Confidential Information. Note1: Adjusted cost of services, adjusted SG&A expense, and adjusted EBITDA are non-GAAP measures; refer to the Appendix for reconciliations of non-GAAP financial measures. ($ in millions) FY’23 FY’22 % Change Revenue $ 2,254.2 $ 1,806.4 24.8% Adjusted Cost of Services1 $ 1,449.2 $ 1,247.3 16.2% Adjusted SG&A Expense1 $ 190.7 $ 135.3 40.9% Adjusted EBITDA1 $ 614.3 $ 423.8 45.0% • Revenue growth driven by new customer onboarding, annualized Cloudmed revenue, and modular growth • Adjusted cost of services increase was driven by higher revenue and the annualized Cloudmed impact offset by synergy realization • Adjusted SG&A expense includes the full year impact of Cloudmed and credit allowances related to certain customers offset by synergy realization • Adjusted EBITDA was positively impacted by revenue growth, continued cost discipline, and Cloudmed integration efforts

66 $609 $772 4Q’23 and FY’23 Cash Generation and Liquidity LIQUIDITY2 ($M)NET DEBT1 ($M) $1,700 $1,483 FY’22 FY’23 FY’22 FY’23 • Cash and cash equivalents totaled $173.6 million at December 31, 2023 • Full year 2023 cash flow from operating activities was $340.1 million • Fully paid outstanding revolver in fourth quarter; $60 million paid in Q4 and $100 million paid in full year 2023 • Net debt leverage was 2.25x at December 31, 2023 • Total liquidity of $772.4 million reflecting cash and cash equivalents as well as availability under the revolverat December 31, 2023 Note1: Net debt is a non-GAAP financial measure; refer to the Appendix for reconciliations of non-GAAP financial measures. Note2: Includes cash, cash equivalents and availability under our revolver.

77 ($ in millions) FY’24 Revenue $2,625 - $2,675 Net Operating Income $105 - $135 Adjusted EBITDA1 $650 - $670 Full Year 2024 Outlook R1 is a registered trademark of R1 RCM Inc. All rights reserved. Proprietary Confidential Information. FINANCIAL OUTLOOK • Revenue guidance assumptions excluding Providence and Acclara: • Existing customers will be at net operating fee run rate as of 4Q’23 • Low single-digit YoY growth for base net operating fees • Customer attrition related to APP and Pediatrix as well as facility divestitures at other customers • Modular and other revenue growth of low double digits • Mid-teens growth for legacy Cloudmed solutions • Low single-digit growth for legacy R1 modular solutions • Expected Acclara and Providence impacts: • Providence to contribute $45 - $50 million to net operating fees in the second half of 2024 and approximately ($45) million to adj. EBITDA • Acclara to contribute approximately $290 - $295 million to total revenue and approximately $25 million to adj. EBITDA QUALITATIVE OVERVIEW Note1: Adjusted EBITDA and adjusted EBITDA margin are non-GAAP financial measures; refer to the Appendix for reconciliations of non-GAAP financial measures.

88 Other Outlook Assumptions R1 is a registered trademark of R1 RCM Inc. All rights reserved. Proprietary Confidential Information. • Capital expenditures of approximately 5% of revenue • Other expenses of approximately $105 - $125 million • Interest expense in the range of $160 - $165 million including: • Incremental $575 million in term B loans related to the Acclara acquisition • $80 million draw on the revolver related to the Acclara acquisition • Depreciation and amortization of $330 - $350 million

99 Appendix

1010 Use of Non-GAAP Financial Measures Reconciliation of GAAP Operating Income Guidance to Non-GAAP Adjusted EBITDA Guidance $ in millions • In order to provide a more comprehensive understanding of the information used by R1’s management team in financial and operational decision making, the Company supplements its GAAP consolidated financial statements with certain non-GAAP financial performance measures, including adjusted EBITDA, non-GAAP cost of services, non-GAAP selling, general and administrative expenses, and net debt. Adjusted EBITDA is defined as GAAP net income (loss) before net interest income/expense, income tax provision/benefit, depreciation and amortization expense, share- based compensation expense, CoyCo 2, L.P. (“CoyCo 2”) share-based compensation expense, and certain other items, including business acquisition costs, integration costs, technology transformation, strategic initiatives, and facility-related charges. Non-GAAP cost of services is defined as GAAP cost of services less share-based compensation expense, CoyCo 2 share-based compensation expense, and depreciation and amortization expense attributed to cost of services. Non-GAAP selling, general and administrative expenses is defined as GAAP selling, general and administrative expenses less share-based compensation expense, CoyCo 2 share-based compensation expense, and depreciation and amortization expense attributed to selling, general and administrative expenses. Net debt is defined as debt less cash and cash equivalents, inclusive of restricted cash. • Our board of directors and management team use adjusted EBITDA as (i) one of the primary methods for planning and forecasting overall expectations and for evaluating actual results against such expectations and (ii) a performance evaluation metric in determining achievement of certain executive incentive compensation programs, as well as for incentive compensation programs for employees. Non-GAAP cost of services and non-GAAP selling, general and administrative expenses are used to calculate adjusted EBITDA. Net debt is used as a supplemental measure of our liquidity. • Adjusted EBITDA guidance for 2024 is reconciled to operating income guidance, the most closely comparable available GAAP measure. A reconciliation of GAAP operating income guidance to non- GAAP adjusted EBITDA guidance for 2024 is provided below GAAP Operating Income Guidance $105-135 Plus: Depreciation and amortization expense $330-350 Shared-based compensation expense $80-90 Strategic initiatives, severance and other costs $105-125 Adjusted EBITDA guidance $650-670 2024E

1111 Reconciliation of Non-GAAP Financial Measures Note1: For details see Note 14, Other Expenses, to the Consolidated Financial Statements included in the Company’s Annual Report on Form 10-K. Reconciliation of GAAP Cost of Services to Non-GAAP Cost of Services (In millions) Three Months Ended December 31, Year Ended December 31, 2023 2022 2023 2022 Cost of services $ 441.6 $ 435.5 $ 1,769.7 $ 1,446.9 Less: Share-based compensation expense 10.9 7.4 41.6 28.1 CoyCo 2 share-based compensation expense 0.4 (0.3) 1.8 0.7 Depreciation and amortization expense 72.5 63.8 277.1 170.8 Non-GAAP cost of services $ 357.8 $ 364.6 $ 1,449.2 $ 1,247.3 Reconciliation of GAAP Selling, General and Administrative to Non-GAAP Selling, General and Administrative (In millions) Three Months Ended December 31, Year Ended December 31, 2023 2022 2023 2022 Selling, general and administrative $ 55.7 $ 54.3 $ 220.0 $ 172.5 Less: Share-based compensation expense 4.4 8.4 22.6 31.6 CoyCo 2 share-based compensation expense 1.5 2.4 5.5 4.4 Depreciation and amortization expense 0.2 0.4 1.2 1.2 Non-GAAP selling, general and administrative $ 49.6 $ 43.1 $ 190.7 $ 135.3 Reconciliation of Total Debt to Net Debt (In millions) December 31, December 31, 2023 2022 Senior Revolver $ — $ 100.0 Term A Loans 1,162.5 1,211.4 Term B Loan 493.8 498.7 Total debt 1,656.3 1,810.1 Less: Cash and cash equivalents 173.6 110.1 Net Debt $ 1,482.7 $ 1,700.0 Reconciliation of GAAP Net Income (Loss) to Non-GAAP Adjusted EBITDA (In millions) Three Months Ended December 31, Year Ended December 31, 2023 2022 2023 2022 Net income (loss) $ 1.4 $ (36.6) $ 3.3 $ (63.3) Net interest expense 31.6 28.7 126.9 64.0 Income tax provision (benefit) 16.1 4.1 17.7 (3.5) Depreciation and amortization expense 72.7 64.2 278.3 172.0 Share-based compensation expense 15.3 15.8 64.2 59.7 CoyCo 2 share-based compensation expense 1.9 2.1 7.3 5.1 Other expenses1 28.7 47.3 116.6 189.8 Adjusted EBITDA (non-GAAP) $ 167.7 $ 125.6 $ 614.3 $ 423.8

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

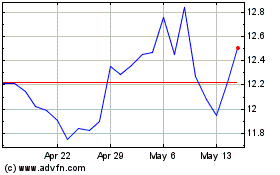

R1 RCM (NASDAQ:RCM)

Historical Stock Chart

From Mar 2024 to Apr 2024

R1 RCM (NASDAQ:RCM)

Historical Stock Chart

From Apr 2023 to Apr 2024