Form 8-K - Current report

February 26 2024 - 4:03PM

Edgar (US Regulatory)

0000811532falseFebruary 26, 202400008115322024-02-262024-02-26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 26, 2024

CEDAR FAIR, L.P.

(Exact name of Registrant as specified in its charter)

| | | | | | | | | | | | | | | | | | | | |

| Delaware | | 1-9444 | | 34-1560655 |

(State or other jurisdiction

of incorporation) | | (Commission File No.) | | (I.R.S. Employer

Identification No.) |

One Cedar Point Drive,

Sandusky, Ohio 44870-5259

(Address of principal executive offices) (Zip Code)

(419) 626-0830

(Registrant's telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

| | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Depositary Units (Representing Limited Partner Interests) | FUN | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01. Regulation FD Disclosure.

On February 26, 2024, Cedar Fair, L.P. posted a slide presentation on its investor relations website. The presentation may be used, in whole or in part, or with modifications, in connection with presentations to investors, analysts and others. A copy of the presentation is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

This information shall not be deemed to be "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise be subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, except as expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits:

| | | | | |

| Exhibit No. | Description |

| |

| 104 | Cover Page Interactive Data File (embedded with the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | CEDAR FAIR, L.P. |

| | | By Cedar Fair Management, Inc., General Partner |

| | | |

| Date: | February 26, 2024 | By: | /s/ Brian C. Witherow |

| | | Brian C. Witherow

Executive Vice President and Chief Financial Officer |

Investor Presentation February 2024

Some of the information in this presentation that is not historical in nature constitute “forward‐looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, including statements as to the Company's expectations, beliefs, goals, and strategies regarding the future. These forward‐looking statements may involve risks and uncertainties that are difficult to predict, may be beyond our control and could cause actual results to differ materially from those described in such statements. Although the Company believes that the expectations reflected in such forward‐looking statements are reasonable, it can give no assurance that such expectations will prove to be correct or that the Company's growth strategies will achieve the target results. Important factors, including general economic conditions, the impacts of public health concerns, adverse weather conditions, competition for consumer leisure time and spending, unanticipated construction delays, changes in the Company’s capital investment plans and projects and other factors discussed from time to time by the Company in its reports filed with the Securities and Exchange Commission (the “SEC”) could affect attendance at the Company’s parks and the Company's growth strategies, and cause actual results to differ materially from the Company's expectations or otherwise to fluctuate or decrease. Additional information on risk factors that may affect the business and financial results of the Company can be found in the Company's Annual Report on Form 10‐K and in the filings of the Company made from time to time with the SEC. The Company undertakes no obligation to publicly update or revise any forward‐looking statements, whether a result of new information, future events, information, circumstances or otherwise that arise after the publication of this document. Forward‐Looking Statements 2

Cedar Fair Well Positioned for Growth and Value Creation • Demand remains strong for our parks and resort properties in the highly competitive leisure space • Reliable, recurring and growing revenue streams underpin the business model • Ongoing investments to continue around the guest and associate experience • Data‐driven pricing and product decisions support market segmentation strategy • Balance sheet strong and getting stronger • High return business model supports capital allocation priorities of reinvesting in the business, reducing debt, and returning capital to investors 3

2023 STATISTICS 26.7M guests entertained 2.9M season passes sold $1.80B in Net Revenues $528M of Adjusted EBITDA(a) PORTFOLIO OF PROPERTIES 11 amusement parks 4 separately gated outdoor water parks 1 indoor water park 7 hotels and other resort properties with 2,300+ rooms 4 campgrounds with 600+ cabins / sites 4 Attractive Portfolio of Parks and Resorts “The Park of Locals” – Historic North America Landmarks Within Easy Driving Distance from Home Adjusted EBITDA is a non-GAAP measure (See Appendix for reconciliation of Adjusted EBITDA) (a)

Recession Resilient Business Model Acquisitions: 1992 – Dorney Park 1995 – Worlds of Fun 1997 – Knott’s Berry Farm 2001 – Michigan’s Adventure 2006 – Paramount Parks (five parks) 2019 – Schlitterbahn (two water parks) 2019 – Sawmill Creek Resort & Conference Center $0 $100 $200 $300 $400 $500 $600 ($ in m illi on s) Adjusted EBITDA Financial Crisis 2001 = (6.1%) 2002 = 11.4% 2009 = (11.0%) 2010 = 13.2%Early 2000’s Recession Early 1990’s Recession Impact of COVID-19 (b) (a) 5 (c) Strong operating performance through various economic cycles (b) FY2020 Adjusted EBITDA totaled a loss of $302M (a) Adjusted EBITDA is a non-GAAP measure (See Appendix for reconciliation of Adjusted EBITDA) (c) FY2022 Adjusted EBITDA totaled a record of $552M

Solid Capital Structure in Place Amounts in $MM $300 $1,000 $500 $300 $500 0 300 600 900 1200 2024 2025 2026 2027 2028 2029 2030 Revolver Capacity Senior Notes 6 5.500% Secured May-2025 5.375% Unsecured Apr-2027 5.250% Unsecured Jul-2029 6.500% Unsecured Oct-2028 S + 350 bps Feb-2028 (a) (a) Revolving credit facility maturity is subject to restrictions on the amount of certain notes outstanding.

2023 Recap and 2024 Outlook

Recapping 2023….. • We produced our second‐best EBITDA year ever, despite exogenous macro factors disrupting operations and demand during the first half of the year • Outstanding second‐half performance underscores the resiliency of our business model and the ongoing strong demand of consumers • Second‐half performance was capped off by a record 4th quarter, include new highs in attendance, net revenues and Adjusted EBITDA(a) • Mid‐year adjustments to our marketing and pricing strategies proved very successful, driving a meaningful lift in attendance (~600,000 visits) over the second half of the year • Cost efficiency efforts are taking hold, driving cost savings and Adjusted EBITDA margin(b) expansion of 210 bps over the second half of the year 8 (a) Adjusted EBITDA is a non-GAAP measure. See Appendix for reconciliation of Adjusted EBITDA. (b) Adjusted EBITDA margin is a non-GAAP measure. See Appendix for reconciliation of Adjusted EBITDA margin

3% 4% Strategy Shift Nets Solid 2023 1% Net Revenues $1.80B Adjusted EBITDA(b) $528M Attendance 26.7M In‐Park Per Capita Spending(a) $61.05 Out‐of‐Park Revenues(a) $223M 9 2023 Results (2,365 operating days) 2022 Results (2,302 operating days) $61.65 $213M $552M Yellow font represents record performance (b) Adjusted EBITDA is a non-GAAP measure. See Appendix for reconciliation of Adjusted EBITDA. (a) In-park per capita is calculated as in-park revenues divided by total attendance. In-park per capita spending and out-of-park revenues are non-GAAP measures. See Appendix for reconciliation of these measures. 26.9M $1.82B

3% 4% Record 2023 Second Half 1% Net Revenues $1.21B Adjusted EBITDA(b) $477M Attendance 18.2M In‐Park Per Capita Spending (a) $60.69 Out‐of‐Park Revenues (a) $142M 10 2H‐2023 Results (1,468 operating days) 2H‐2022 Results (1,464 operating days) $1.21B 17.6M $62.83 $137M $450M Yellow numbers represent record performance (b) Adjusted EBITDA is a non-GAAP measure. See Appendix for reconciliation of Adjusted EBITDA. (a) In-park per capita spending is calculated as in-park revenues divided by total attendance. In-park per capita spending and out-of-park revenues are non-GAAP measures. See Appendix for reconciliation of these measures.

Looking to 2024….. • Consumer demand for amusement park entertainment in the highly competitive leisure space remains strong and is pacing to soon surpass pre‐ pandemic levels • Demand momentum supported by consumer research, as well as our second half performance in 2023 and strong early trends in long‐lead indicators • Outstanding start to the 2024 season pass program with unit sales up 20% through January • Group bookings and resort reservations are pacing well and in line with expectations • Unveiling of one of our most compelling and broadest reaching capital programs ever, highlighted by the debut of Top Thrill 2 at Cedar Point • Incremental initiatives focused on reducing costs and improving margins, while still delivering a park experience that meets guest demands 11

2024 Technology Initiatives

2024 Technology Initiatives – Making FUN Easy….. • Roll out of a next generation guest mobile app to be completed across all parks by the end of April 2024 • New mobile app for associates with tools and functionality to improve operating efficiencies already fully rolled out and in use at all parks in 2024 • Improved and expanded WiFi coverage across the portfolio, with our 6 largest parks to be completed by Fall 2024 • Major redesign of our ticketing system with a focus on a more guest friendly, unified shopping cart experience 13 Continued investment in scalable technologies aimed at enhancing the guest experience, driving revenue growth, and improving operational efficiencies for our associates Associate Tools Guest Experience Technology & Infrastructure

Next Gen Guest Mobile App 14 Next Gen Guest Mobile App • Single‐Use Fast Lane • Digital entitlement wallet • Payment with Apple and Google Pay • Mobile food ordering • Improved maps and wayfinding • Enhanced and scalable messaging • Incremental functionality being developed and added with each new park release The next generation guest mobile app is designed to offer the guest a personalized experience throughout, with their passes and favorites readily accessible, along with improved wayfinding and the convenience of a digital wallet to store everything from daily tickets to passes and dining plans in one convenient location

Mobile App Release LAUNCHED LAUNCHED LAUNCHED LAUNCHED LAUNCHED 2/27/2024 3/8/2024 3/20/2024 4/1/2024 4/11/2024 4/15/2024 15

New Associate Mobile App 16 Associate Mobile App • Operational Checklists • Wait Time Management • Ride Status • Park Attendance • Park Hours • User‐Based Permissions A new associate mobile app, which is designed to simplify administrative tasks, reduce paperwork, improve training and communication, and enhance the ability to serve the guest, has been deployed to all parks and is in full use for 2024

17 • The next evolution of our Fast Lane, front‐of‐the‐line product, will now allow for the incremental sale of Single‐Use Fast Lane passes as part of the digital experience within the next generation guest mobile app • The first rollout of Single‐Use Fast Lane at Knott’s Berry Farm is completed, with positive initial feedback from both guests and associates Fast Lane Technology Deployment

18 Testing Additional Technologies We continue to test additional technologies aimed at creating convenient, frictionless experiences for our guests, while expanding revenue opportunities and delivering maximum return for Cedar Fair Leveraging our relationship with Coca‐Cola and other technology partners, planning and construction of a contactless retail location is being piloted at Knott’s Berry Farm in 2024

Appendix

Adjusted EBITDA Reconciliation 20

Table of Key Operational Measures 21

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

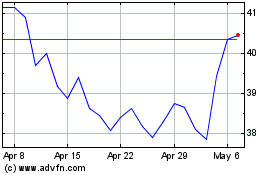

Cedar Fair (NYSE:FUN)

Historical Stock Chart

From Apr 2024 to May 2024

Cedar Fair (NYSE:FUN)

Historical Stock Chart

From May 2023 to May 2024