0001743881false00017438812024-02-222024-02-22

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): February 22, 2024 |

BridgeBio Pharma, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-38959 |

84-1850815 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

3160 Porter Dr., Suite 250 |

|

Palo Alto, CA |

|

94304 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (650) 391-9740 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

|

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

|

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

|

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, par value $0.001 per share |

|

BBIO |

|

The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On February 22, 2024, BridgeBio Pharma, Inc. reported recent business updates and its financial results for the fourth quarter and full year ended December 31, 2023. The full text of the press release issued in connection with the announcement is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information in Item 2.02 of this Form 8-K (including Exhibit 99.1) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference under the Securities Act of 1933, as amended, except as expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

BridgeBio Pharma, Inc. |

|

|

|

|

Date: |

February 22, 2024 |

By: |

/s/ Brian C. Stephenson |

|

|

|

Brian C. Stephenson, Ph.D., CFA

Chief Financial Officer |

BridgeBio Pharma Reports Fourth Quarter and Full Year 2023 Financial Results and Business Update

- Submitted New Drug Application (NDA) to US Food and Drug Administration (FDA) for acoramidis for the treatment of transthyretin amyloid cardiomyopathy (ATTR-CM) based on positive results of Phase 3 ATTRibute-CM trial, which were published in the New England Journal of Medicine; NDA has been accepted for review with a PDUFA date of November 29, 2024; Marketing Authorization Application (MAA) for acoramidis has also been accepted by the European Medicines Agency (EMA)

- Presented additional data from ATTRibute-CM at the American Heart Association Scientific Sessions, demonstrating separation at Month 3 of the placebo and acoramidis time-to-first-event Kaplan-Meier curves for a composite of all-cause mortality (ACM) and cardiovascular-related hospitalization (CVH); separation was sustained through Month 30 and represents the most rapid clinical benefit on the composite endpoint of ACM and CVH in ATTR-CM patients to the Company’s knowledge

- Shared positive results of single-arm Phase 3 study of acoramidis in Japanese ATTR-CM patients, including no mortality reported over the 30 month acoramidis treatment period

- PROPEL 3, the Company's Phase 3 study of infigratinib for achondroplasia continues to enroll with full enrollment expected in 2024; the Company has also announced a partnership granting Kyowa Kirin exclusive license on infigratinib for skeletal dysplasias in Japan in exchange for an upfront payment of $100 million, royalties up to the high twenties percent, and additional milestone-based payments

- FORTIFY, the Company's Phase 3 study BBP-418 for limb-girdle muscular dystrophy type 2I (LMGD2I), continues to enroll, with full enrollment of interim analysis population expected in 2024

- CALIBRATE, the Company's Phase 3 study of encaleret for autosomal dominant hypocalcemia type 1 (ADH1) continues to enroll, with full enrollment expected in 2024 and topline data expected in 2025

- Secured up to $1.25 billion of capital from Blue Owl and CPP investments, including $500 million in cash in exchange for a 5% royalty on future global net sales of acoramidis and a $450 million credit facility from Blue Owl that refinanced existing senior secured credit, extending maturity from 2026 to 2029 subject to certain conditions

- Ended the quarter with $393 million in cash, cash equivalents, and short-term restricted cash, and $59 million of investments in equity securities

Palo Alto, CA – February 22, 2024 – BridgeBio Pharma, Inc. (Nasdaq: BBIO) (BridgeBio or the Company), a commercial-stage biopharmaceutical company focused on genetic diseases and cancers, today reported its financial results for the fourth quarter and full year ended December 31, 2023, and provided an update on the Company’s operations.

“Our focus this year is executing on the launch of acoramidis for patients with ATTR cardiomyopathy,” said Neil Kumar, Ph.D., founder and CEO of BridgeBio. “At the same time, we are also focused on fully enrolling three ongoing Phase 3 clinical trials by the end of 2024. Finally, we hope that reading out potentially exciting data from our Phase 1/2 trial in congenital adrenal hyperplasia later this year will let us take the next step in serving that patient community.”

BridgeBio’s key programs:

•Acoramidis (AG10) – Transthyretin (TTR) stabilizer for transthyretin amyloid cardiomyopathy (ATTR-CM):

oThe Company filed an NDA for acoramidis for the treatment of ATTR-CM with the US FDA; the NDA was accepted for review with a PDUFA date of November 29, 2024. The Company has also filed a Marketing Authorization Application for acoramidis with the EMA, which has been accepted for review.

oThe regulatory filings were based on data from the Phase 3 ATTRibute-CM study, which met its primary endpoint (Win Ratio of 1.8) with a highly statistically significant p-value (p<0.0001). Additional results from ATTRibute-CM include:

▪An 81% survival rate on acoramidis, which approaches the survival rate in the age-matched U.S. database (~85%), and a 0.29 mean annual CVH rate on acoramidis, which approaches the annual hospitalization rate observed in the broader U.S. Medicare population (~0.26);

▪Improvements from baseline observed for a large proportion of participants treated with acoramidis on laboratory and functional measures including n-terminal prohormone of brain natriuiretic peptide (NT-proBNP) and 6-minute walk distance;

▪Rapid clinical benefit on the composite endpoint of ACM and CVH in participants treated with acoramidis, demonstrated by placebo and acoramidis time-to-first event Kaplan-Meier curves for a composite of ACM and CVH that separated at Month 3 and continued to diverge steadily through Month 30 as presented at the American Heart Association Scientific Sessions in November 2023; and

▪Acoramidis was well-tolerated with no safety signals of potential clinical concern identified.

oThe Company also shared positive results of an open-label, single-arm Phase 3 study conducted in Japan by licensing partner Alexion, AstraZeneca Rare Disease, including that no mortality was reported over the 30 month acoramidis treatment period.

oAdditional detailed results of ATTRibute-CM are planned for presentation at 2024 medical meetings.

•Low-dose infigratinib – FGFR1-3 inhibitor for achondroplasia and hypochondroplasia:

oIn December 2023, the Company announced the dosing of the first child in PROPEL 3, its global Phase 3 registrational study of infigratinib in achondroplasia.

oIn February 2024, the Company announced a partnership with Kyowa Kirin wherein the Company grants Kyowa Kirin an exclusive license to develop and commercialize infigratinib for achondroplasia, hypochondroplasia, and other skeletal dysplasias in Japan; in exchange, the Company will receive an upfront payment of $100 million as well as royalties up to the high-twenties percent on sales of infigratinib in Japan, with the potential for additional milestone-based payments.

oThe Company is committed to exploring the potential of infigratinib on the wider medical and functional impacts of achondroplasia, hypochondroplasia and other skeletal dysplasias, and anticipates initiating its clinical program for hypochondroplasia in 2024.

•BBP-418 – Glycosylation substrate for limb-girdle muscular dystrophy type 2I/R9 (LGMD2I/R9):

oFORTIFY, the global Phase 3 registrational trial of BBP-418, continues to enroll in the U.S. with clinical trial sites planned for Europe and Australia. Full enrollment of the interim analysis population is expected in 2024. The Company believes there is potential to pursue Accelerated Approval for BBP-418 based on recent interactions with the FDA on the use of glycosylated αDG levels as a surrogate endpoint.

•Encaleret – Calcium-sensing receptor (CaSR) inhibitor for autosomal dominant hypocalcemia type 1 (ADH1):

oCALIBRATE, the Phase 3 clinical trial of encaleret, continues to enroll; the Company anticipates sharing topline data from CALIBRATE in 2025.

Recent Corporate Updates:

•Secured up to $1.25 billion of capital from Blue Owl and CPP Investments: The raise includes $500 million in cash from Blue Owl and CPP Investments available upon FDA approval of acoramidis in exchange for a 5% royalty on future global net sales of acoramidis, as well as a $450 million credit facility from Blue Owl that refinanced existing senior secured credit, extending maturity from 2026 to 2029 subject to certain conditions.

Fourth Quarter and Full Year 2023 Financial Results:

Cash, Cash Equivalents, Marketable Securities and Short-term Restricted Cash

Cash, cash equivalents and short-term restricted cash, totaled $392.6 million as of December 31, 2023, compared to cash, cash equivalents, marketable securities and short-term restricted cash of $466.2 million as of December 31, 2022. The net decrease of $73.6 million in cash, cash equivalents, marketable securities and short-term restricted cash was primarily attributable to net cash used in operating activities of $527.7 million and $6.9 million in repurchase of shares to satisfy tax withholdings, primarily offset by net proceeds received of $449.8 million from various equity financings, $6.0 million from stock option exercises, and $3.4 million from common stock issuances under our employee stock purchase plan during the year ended December 31, 2023.

Revenue

Revenue for the three months and year ended December 31, 2023 were $1.7 million and $9.3 million, respectively, as compared to $1.9 million and $77.6 million for the same periods in the prior year, respectively. The net decreases of $0.2 million and $68.3 million for the three months and year ended December 31, 2023, respectively, compared to the same periods in the prior year, were primarily due to license revenue recognized in 2022 upon the transfer of the license in accordance with the Navire-BMS License Agreement which was entered into in May 2022.

Operating Costs and Expenses

Operating costs and expenses for the three months and year ended December 31, 2023 were $179.2 million and $616.7 million, respectively, compared to $131.1 million and $589.9 million, for the same periods in the prior year, respectively.

The overall increase of $48.1 million in operating costs and expenses for the three months ended December 31, 2023, compared to the same period in the prior year, was primarily due to an increase of $39.3 million in research and development and other expenses (R&D) to advance the Company's pipeline of development programs, an increase of $15.7 million in selling, general and administrative (SG&A) expenses to support commercialization readiness efforts, offset by a decrease of $6.9 million in restructuring, impairment and related charges given that the majority of the restructuring initiatives occurred in the prior year.

The overall increase of $26.8 million in operating costs and expenses for the year ended December 31, 2023 , compared to the same period in the prior year, was primarily due to an increase of $55.2 million in R&D expenses to advance the Company's pipeline of development programs, an increase of $7.4 million in SG&A expenses to support commercialization readiness efforts, offset by a decrease of $35.8 million in restructuring, impairment and related charges given that the majority of the restructuring initiatives occurred in the prior year.

Restructuring, impairment and related charges for the three months and year ended December 31, 2023, amounted to $0.8 million and $7.9 million, respectively. These charges primarily consisted of winding down, exit costs, and severance and employee-related costs. Restructuring, impairment and related charges for the same periods in the prior year were $7.7 million and $43.8 million, respectively. These charges primarily consisted of impairments and write-offs of long-lived assets, severance and employee-related costs, and exit and other related costs.

Stock-based compensation expenses included in operating costs and expenses for the three months ended December 31, 2023 were $37.1 million, of which $22.5 million is included in R&D expenses, and $14.6 million is included in SG&A expenses. Stock-based compensation expenses included in operating costs and expenses for the same period in the prior year were $22.6 million, of which $8.9 million is included in R&D expenses, and $13.6 million is included in SG&A expenses.

Stock-based compensation expenses included in operating costs and expenses for the year ended December 31, 2023 were $115.0 million, of which $61.6 million is included in R&D expenses, and $53.4 million is included in SG&A expenses. Stock-based compensation expenses included in operating costs and expenses for the same period in the prior year were $93.8 million, of which $38.0 million is included in R&D expenses, $54.7 million is included in SG&A expenses, and $1.2 million is included in restructuring, impairment and related charges.

“Coming off of our recent royalty financing, we find ourselves well capitalized to launch acoramidis this year alongside strong new partners who share our confidence in acoramidis’ potential in the ATTR-CM market,” said Brian Stephenson, Ph.D., CFA, Chief Financial Officer of BridgeBio. “We are excited for this launch, as well as for the continued advancement of our late stage pipeline, which we hope will allow us to serve patients with genetic diseases both directly with the advancement of those medicines towards the market as well as by diversifying our top line revenue and enabling reinvestment into the R&D and business development opportunities that will allow us to be sustainable in the long term.”

BRIDGEBIO PHARMA, INC.

Condensed Consolidated Statements of Operations

(in thousands, except shares and per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended December 31, |

|

|

Year Ended December 31, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

|

(Unaudited) |

|

|

(Unaudited) |

|

|

(1) |

|

Revenue |

|

$ |

1,745 |

|

|

$ |

1,870 |

|

|

$ |

9,303 |

|

|

$ |

77,648 |

|

Operating costs and expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Research, development and other expenses |

|

|

130,824 |

|

|

|

91,549 |

|

|

|

458,157 |

|

|

|

402,896 |

|

Selling, general and administrative |

|

|

47,583 |

|

|

|

31,862 |

|

|

|

150,590 |

|

|

|

143,189 |

|

Restructuring, impairment and related charges |

|

|

754 |

|

|

|

7,691 |

|

|

|

7,926 |

|

|

|

43,765 |

|

Total operating costs and expenses |

|

|

179,161 |

|

|

|

131,102 |

|

|

|

616,673 |

|

|

|

589,850 |

|

Loss from operations |

|

|

(177,416 |

) |

|

|

(129,232 |

) |

|

|

(607,370 |

) |

|

|

(512,202 |

) |

Other income (expense), net: |

|

|

|

|

|

|

|

|

|

|

|

|

Interest income |

|

|

5,578 |

|

|

|

4,092 |

|

|

|

18,038 |

|

|

|

7,542 |

|

Interest expense |

|

|

(20,268 |

) |

|

|

(19,990 |

) |

|

|

(81,289 |

) |

|

|

(80,438 |

) |

Gain from sale of priority review voucher, net |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

107,946 |

|

Other income (expense), net |

|

|

21,778 |

|

|

|

4,560 |

|

|

|

17,370 |

|

|

|

(7,500 |

) |

Total other income (expense), net |

|

|

7,088 |

|

|

|

(11,338 |

) |

|

|

(45,881 |

) |

|

|

27,550 |

|

Net loss |

|

|

(170,328 |

) |

|

|

(140,570 |

) |

|

|

(653,251 |

) |

|

|

(484,652 |

) |

Net loss attributable to redeemable convertible

noncontrolling interests and noncontrolling interests |

|

|

2,180 |

|

|

|

2,979 |

|

|

|

10,049 |

|

|

|

3,469 |

|

Net loss attributable to common stockholders

of BridgeBio |

|

$ |

(168,148 |

) |

|

$ |

(137,591 |

) |

|

$ |

(643,202 |

) |

|

$ |

(481,183 |

) |

Net loss per share, basic and diluted |

|

$ |

(0.96 |

) |

|

$ |

(0.92 |

) |

|

$ |

(3.95 |

) |

|

$ |

(3.26 |

) |

Weighted-average shares used in computing net

loss per share, basic and diluted |

|

|

174,462,332 |

|

|

|

149,344,380 |

|

|

|

162,791,511 |

|

|

|

147,473,076 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended December 31, |

|

|

Year Ended December 31, |

|

Stock-based Compensation |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

|

(Unaudited) |

|

|

(Unaudited) |

|

|

(1) |

|

Research, development and others |

|

$ |

22,495 |

|

|

$ |

8,941 |

|

|

$ |

61,647 |

|

|

$ |

37,987 |

|

Selling, general and administrative |

|

|

14,638 |

|

|

|

13,643 |

|

|

|

53,369 |

|

|

|

54,669 |

|

Restructuring, impairment and related charges |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1,172 |

|

Total stock-based compensation |

|

$ |

37,133 |

|

|

$ |

22,584 |

|

|

$ |

115,016 |

|

|

$ |

93,828 |

|

|

|

(1) |

The condensed consolidated financial statements as of and for the year ended December 31, 2022 are derived from the audited consolidated financial statements as of that date. |

BRIDGEBIO PHARMA, INC.

Condensed Consolidated Balance Sheets

(In thousands)

|

|

|

|

|

|

|

|

|

|

|

December 31, |

|

|

December 31, |

|

|

|

2023 |

|

|

2022 |

|

|

|

(Unaudited) |

|

|

(1) |

|

Assets |

|

|

|

|

|

|

Cash, cash equivalents and marketable securities |

|

$ |

375,935 |

|

|

$ |

428,269 |

|

Investment in equity securities |

|

|

58,949 |

|

|

|

43,653 |

|

Receivable from licensing and collaboration agreements |

|

|

1,751 |

|

|

|

17,079 |

|

Short-term restricted cash |

|

|

16,653 |

|

|

|

37,930 |

|

Prepaid expenses and other current assets |

|

|

24,305 |

|

|

|

21,922 |

|

Property and equipment, net |

|

|

11,816 |

|

|

|

14,569 |

|

Operating lease right-of-use assets |

|

|

8,027 |

|

|

|

10,678 |

|

Intangible assets, net |

|

|

26,319 |

|

|

|

28,712 |

|

Other assets |

|

|

22,625 |

|

|

|

20,224 |

|

Total assets |

|

$ |

546,380 |

|

|

$ |

623,036 |

|

Liabilities, Redeemable Convertible Noncontrolling Interests and Stockholders’ Deficit |

|

|

|

|

|

|

Accounts payable |

|

$ |

10,655 |

|

|

$ |

11,558 |

|

Accrued and other liabilities |

|

|

129,061 |

|

|

|

106,195 |

|

Operating lease liabilities |

|

|

13,109 |

|

|

|

15,949 |

|

2029 Notes, net |

|

|

736,905 |

|

|

|

734,988 |

|

2027 Notes, net |

|

|

543,379 |

|

|

|

541,634 |

|

Term loan, net |

|

|

446,445 |

|

|

|

430,993 |

|

Other long-term liabilities |

|

|

9,361 |

|

|

|

26,643 |

|

Redeemable convertible noncontrolling interests |

|

|

478 |

|

|

|

(1,589 |

) |

Total BridgeBio stockholders' deficit |

|

|

(1,354,257 |

) |

|

|

(1,254,617 |

) |

Noncontrolling interests |

|

|

11,244 |

|

|

|

11,282 |

|

Total liabilities, redeemable convertible noncontrolling interests and stockholders’ deficit |

|

$ |

546,380 |

|

|

$ |

623,036 |

|

|

|

(1) |

The condensed consolidated financial statements as of and for the year ended December 31, 2022 are derived from the audited consolidated financial statements as of that date. |

BRIDGEBIO PHARMA, INC.

Condensed Consolidated Statements of Cash Flows

(In thousands)

|

|

|

|

|

|

|

|

|

|

|

Year Ended December 31, |

|

|

|

2023 |

|

|

2022 |

|

|

|

(Unaudited) |

|

|

(1) |

|

Operating activities: |

|

|

|

|

|

|

Net loss |

|

$ |

(653,251 |

) |

|

$ |

(484,652 |

) |

Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

|

|

|

Stock-based compensation |

|

|

108,710 |

|

|

|

91,559 |

|

Depreciation and amortization |

|

|

6,494 |

|

|

|

6,771 |

|

Noncash lease expense |

|

|

4,032 |

|

|

|

5,172 |

|

Accrual of payment-in-kind interest on term loan |

|

|

10,207 |

|

|

|

13,562 |

|

Loss on deconsolidation of PellePharm |

|

|

1,241 |

|

|

|

— |

|

(Gain) loss from investment in equity securities, net |

|

|

(18,314 |

) |

|

|

8,222 |

|

Fair value of shares issued under a license agreement |

|

|

— |

|

|

|

4,567 |

|

Accretion of debt |

|

|

8,907 |

|

|

|

8,570 |

|

Fair value adjustment of warrants |

|

|

(984 |

) |

|

|

1,571 |

|

Loss on sale of certain assets |

|

|

— |

|

|

|

6,261 |

|

Impairment of long-lived assets |

|

|

— |

|

|

|

12,720 |

|

Gain from sale of priority review voucher, excluding transaction costs |

|

|

— |

|

|

|

(110,000 |

) |

Gain from recognition of receivable from licensing and collaboration agreement |

|

|

— |

|

|

|

(12,500 |

) |

Other noncash adjustments |

|

|

181 |

|

|

|

604 |

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

Receivable from licensing and collaboration agreements |

|

|

15,328 |

|

|

|

15,169 |

|

Prepaid expenses and other current assets |

|

|

(2,702 |

) |

|

|

7,671 |

|

Other assets |

|

|

(1,546 |

) |

|

|

10,971 |

|

Accounts payable |

|

|

2,780 |

|

|

|

(349 |

) |

Accrued compensation and benefits |

|

|

7,802 |

|

|

|

(2,362 |

) |

Accrued research and development liabilities |

|

|

(9,855 |

) |

|

|

(4,309 |

) |

Operating lease liabilities |

|

|

(4,829 |

) |

|

|

(6,245 |

) |

Deferred revenue |

|

|

(5,438 |

) |

|

|

15,262 |

|

Accrued professional and other liabilities |

|

|

3,517 |

|

|

|

(7,729 |

) |

Net cash used in operating activities |

|

|

(527,720 |

) |

|

|

(419,494 |

) |

Investing activities: |

|

|

|

|

|

|

Purchases of marketable securities |

|

|

(29,726 |

) |

|

|

(137,493 |

) |

Maturities of marketable securities |

|

|

82,550 |

|

|

|

479,688 |

|

Purchases of investment in equity securities |

|

|

(107,538 |

) |

|

|

(55,562 |

) |

Sales of investment in equity securities |

|

|

110,556 |

|

|

|

52,835 |

|

Decrease in cash and cash equivalents resulting from deconsolidation of PellePharm |

|

|

(503 |

) |

|

|

— |

|

Payment for intangible asset |

|

|

— |

|

|

|

(1,500 |

) |

Proceeds from sale of priority review voucher |

|

|

— |

|

|

|

110,000 |

|

Proceeds from sale of certain assets |

|

|

— |

|

|

|

10,000 |

|

Purchases of property and equipment |

|

|

(1,306 |

) |

|

|

(4,821 |

) |

Net cash provided by investing activities |

|

|

54,033 |

|

|

|

453,147 |

|

Financing activities: |

|

|

|

|

|

|

Proceeds from issuance of common stock through Private Placement offering, net |

|

|

240,796 |

|

|

|

— |

|

Proceeds from issuance of common stock through Follow-on offering, net |

|

|

144,049 |

|

|

|

— |

|

Proceeds from issuance of common stock through ATM offering, net |

|

|

64,965 |

|

|

|

4,852 |

|

Transactions with noncontrolling interests |

|

|

(801 |

) |

|

|

— |

|

Repayment of term loan |

|

|

— |

|

|

|

(20,486 |

) |

Proceeds from BridgeBio common stock issuances under ESPP |

|

|

3,398 |

|

|

|

2,558 |

|

Repurchase of RSU shares to satisfy tax withholding |

|

|

(6,880 |

) |

|

|

(1,561 |

) |

Proceeds from stock option exercises, net of repurchases |

|

|

6,008 |

|

|

|

666 |

|

Other financing activities |

|

|

— |

|

|

|

837 |

|

Net cash provided by (used in) financing activities |

|

|

451,535 |

|

|

|

(13,134 |

) |

Net increase (decrease) in cash, cash equivalents and restricted cash |

|

|

(22,152 |

) |

|

|

20,519 |

|

Cash, cash equivalents and restricted cash at beginning of period |

|

|

416,884 |

|

|

|

396,365 |

|

Cash, cash equivalents and restricted cash at end of period |

|

$ |

394,732 |

|

|

$ |

416,884 |

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended December 31, |

|

|

|

2023 |

|

|

2022 |

|

|

|

(Unaudited) |

|

|

(1) |

|

Supplemental Disclosure of Cash Flow Information: |

|

|

|

|

|

|

Cash paid for interest |

|

$ |

61,108 |

|

|

$ |

54,443 |

|

Supplemental Disclosures of Noncash Investing and Financing Information: |

|

|

|

|

|

|

Unpaid property and equipment |

|

$ |

100 |

|

|

$ |

47 |

|

Recognized intangible asset recorded in “Other accrued and other long-term liabilities” |

|

$ |

— |

|

|

$ |

11,000 |

|

Transfers (to) from noncontrolling interests |

|

$ |

(10,534 |

) |

|

$ |

(3,512 |

) |

Payment-in-kind interest added to principal of term loan |

|

$ |

— |

|

|

$ |

1,763 |

|

Reconciliation of Cash, Cash Equivalents and Restricted Cash: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

375,935 |

|

|

$ |

376,689 |

|

Short-term restricted cash |

|

|

16,653 |

|

|

|

37,930 |

|

Restricted cash — Included in “Other assets” |

|

|

2,144 |

|

|

|

2,265 |

|

Total cash, cash equivalents and restricted cash at end of periods |

|

$ |

394,732 |

|

|

$ |

416,884 |

|

|

|

(1) |

The condensed consolidated financial statements as of and for the year ended December 31, 2022 are derived from the audited consolidated financial statements as of that date. |

About BridgeBio Pharma, Inc.

BridgeBio Pharma, Inc. (BridgeBio) is a commercial-stage biopharmaceutical company founded to discover, create, test, and deliver transformative medicines to treat patients who suffer from genetic diseases and cancers with clear genetic drivers. BridgeBio’s pipeline of development programs ranges from early science to advanced clinical trials. BridgeBio was founded in 2015 and its team of experienced drug discoverers, developers and innovators are committed to applying advances in genetic medicine to help patients as quickly as possible. For more information visit bridgebio.com and follow us on LinkedIn and Twitter.

BridgeBio Pharma, Inc. Forward-Looking Statements

This press release contains forward-looking statements. Statements in this press release may include statements that are not historical facts and are considered forward-looking within the meaning of Section 27A of the Securities Act of 1933, as amended (the Securities Act), and Section 21E of the Securities Exchange Act of 1934, as amended (the Exchange Act), which are usually identified by the use of words such as “anticipates,” “believes,” “continues,” “estimates,” “expects,” “hopes,” “intends,” “may,” “plans,” “projects,” “remains,” “seeks,” “should,” “will,” and variations of such words or similar expressions. We intend these forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in Section 27A of the Securities Act and Section 21E of the Exchange Act. These forward-looking statements, including statements relating to the clinical and therapeutic, market potential of our programs and product candidates, including the statements in Dr. Kumar’s and Dr. Stephenson's quotes regarding the potential commercial launch of acoramidis (if approved), continued advancement in our pipeline, including enrollments in clinical trials and anticipated readout, and other benefits resulting from recent financing; the statements related to the FDA's planned actions regarding our NDA for acoramidis for the treatment of ATTR-CM; the potential outcomes of regulatory reviews by the FDA and the EMA; the timing and success of our clinical development programs, including the progress of our clinical development program for acoramidis for patients with ATTR-CM, and our plan for, and the expected timing of, presenting additional detailed results of ATTRibute-CM study at medical meetings; the potential success of our partnership granting Kyowa Kirin an exclusive license on infigratinib for skeletal dysplasias in Japan and the potential payments we may receive under the license; the continuation of PROPEL 3, our Phase 3 study of infigratinib for achondroplasia and the

expected timing for full enrollment in the study; our commitment to exploring the potential of infigratinib and the expectation and timing of the initiation of our clinical program for hypochondroplasia; the continuation and progress of FORTIFY, the Phase 3 trial of BBP-418 for LGMD2I, including the ongoing enrollment in the United States, the expectation to enroll in clinical trial sites planned in Europe and Australia, the expectation and timing of full enrollment of the interim analysis population, and the potential to pursue Accelerated Approval for BBP-418 based on recent interactions with the FDA; the continued enrollment in CALIBRATE, the Phase 3 clinical trial of encaleret, and the expectation and timing of full enrollment and sharing topline data from CALIBRATE; the Company’s financial performance, capitalization status, strategy, business plans and goals reflect our current views about our plans, intentions, expectations and strategies, which are based on the information currently available to us and on assumptions we have made. Although we believe that our plans, intentions, expectations and strategies as reflected in or suggested by those forward-looking statements are reasonable, we can give no assurance that the plans, intentions, expectations or strategies will be attained or achieved. Furthermore, actual results may differ materially from those described in the forward-looking statements and will be affected by a number of risks, uncertainties and assumptions, including, but not limited to, initial and ongoing data from our preclinical studies and clinical trials not being indicative of final data, the potential size of the target patient populations our product candidates are designed to treat not being as large as anticipated, the design and success of ongoing and planned clinical trials, future regulatory filings, approvals and/or sales, despite having ongoing and future interactions with the FDA or other regulatory agencies to discuss potential paths to registration for our product candidates, the FDA or such other regulatory agencies not agreeing with our regulatory approval strategies, components of our filings, such as clinical trial designs, conduct and methodologies, or the sufficiency of data submitted, the continuing success of our collaborations, the Company’s ability to obtain additional funding, including through less dilutive sources of capital than equity financings, potential volatility in our share price, uncertainty regarding any impacts due to global health emergencies such as COVID-19, including delays in regulatory review, manufacturing and supply chain interruptions, adverse effects on healthcare systems and disruption of the global economy, the impacts of current macroeconomic and geopolitical events, including changing conditions from hostilities in Ukraine and in Israel and the Gaza Strip, increasing rates of inflation and rising interest rates, on business operations and expectations, as well as those risks set forth in the Risk Factors section of our most recent Annual Report on Form 10-K and our other filings with the U.S. Securities and Exchange Commission. Moreover, we operate in a very competitive and rapidly changing environment in which new risks emerge from time to time. These forward-looking statements are based upon the current expectations and beliefs of our management as of the date of this press release, and are subject to certain risks and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements. Except as required by applicable law, we assume no obligation to update publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

BridgeBio Contact:

Vikram Bali

contact@bridgebio.com

(650)-789-8220

v3.24.0.1

Document and Entity Information

|

Feb. 22, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 22, 2024

|

| Entity File Number |

001-38959

|

| Entity Registrant Name |

BridgeBio Pharma, Inc.

|

| Entity Central Index Key |

0001743881

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

84-1850815

|

| Entity Address, Address Line One |

3160 Porter Dr.

|

| Entity Address, Address Line Two |

Suite 250

|

| Entity Address, City or Town |

Palo Alto

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94304

|

| City Area Code |

650

|

| Local Phone Number |

391-9740

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

BBIO

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

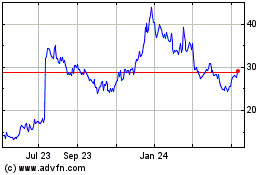

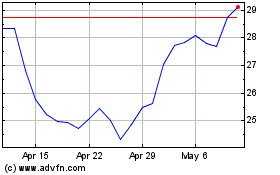

BridgeBio Pharma (NASDAQ:BBIO)

Historical Stock Chart

From Apr 2024 to May 2024

BridgeBio Pharma (NASDAQ:BBIO)

Historical Stock Chart

From May 2023 to May 2024